Incremental DLOM Valuation Strategies

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Options Slide Deck Updated Version

www.levelupbootcamps.com 4/4/21 Derivatives Option Strategies 4/4/21 LevelUp, LLC©2021 All rights reserved 1 1 Derivatives & Currency Management Option Strategies 4/4/21 LevelUp, LLC©2021 All rights reserved 2 2 Level Up, LLC©2021 All rights reserved 1 www.levelupbootcamps.com 4/4/21 Risk Management with Options Synthetic Positions • Synthetic Long & Short Forward Option Strategies • Synthetic Puts & Calls Multiple Option Strategies Single Option + Underlying Single Option Directionless Volatility Long U/L Risk Reduction Writing Puts • Long Straddle = LC + LP Covered Call = U/L + SC • Lower purchase cost • Short Straddle = SC + SP • Income enhancement • Fiduciary put = SP + Money Spreads • Reduce at favorable price cash to cover (ftn 13) “Small Moves Up or Down” • Target price realization The Greeks • Bull & Bear Call Spreads • Manza Case 1. Delta + & - • Bear & Bull Put Spreads Protective Put = U/L + LP 2. Gamma + • Insurance Calendar Spreads 3. Theta (time) - Collar = U/L + LP + SC Short “Its all about Theta” 4. Vega (Implied Vol) + • Risk Reversal • Long Calendar Spread Portfolio Mgt • Short Calendar Spread Short U/L Risk Reduction 1. Strategies using • Short U/L + Long Call volatility & market view • Short U/L + Short Put 2. Adjusting risk exposure 4/4/21 LevelUp, LLC©2021 All rights reserved 3 3 Single Option Strategies Refresher . just in case + + X S Long Call – LC S Short Call – SC - - X “writing” Want U/L up – bullish Want U/L down – bearish Right to buy at strike price X Obligated to sell at strike price X Max gain = ∞ when S -

11 Option Payoffs and Option Strategies

11 Option Payoffs and Option Strategies Answers to Questions and Problems 1. Consider a call option with an exercise price of $80 and a cost of $5. Graph the profits and losses at expira- tion for various stock prices. 73 74 CHAPTER 11 OPTION PAYOFFS AND OPTION STRATEGIES 2. Consider a put option with an exercise price of $80 and a cost of $4. Graph the profits and losses at expiration for various stock prices. ANSWERS TO QUESTIONS AND PROBLEMS 75 3. For the call and put in questions 1 and 2, graph the profits and losses at expiration for a straddle comprising these two options. If the stock price is $80 at expiration, what will be the profit or loss? At what stock price (or prices) will the straddle have a zero profit? With a stock price at $80 at expiration, neither the call nor the put can be exercised. Both expire worthless, giving a total loss of $9. The straddle breaks even (has a zero profit) if the stock price is either $71 or $89. 4. A call option has an exercise price of $70 and is at expiration. The option costs $4, and the underlying stock trades for $75. Assuming a perfect market, how would you respond if the call is an American option? State exactly how you might transact. How does your answer differ if the option is European? With these prices, an arbitrage opportunity exists because the call price does not equal the maximum of zero or the stock price minus the exercise price. To exploit this mispricing, a trader should buy the call and exercise it for a total out-of-pocket cost of $74. -

OPTION-BASED EQUITY STRATEGIES Roberto Obregon

MEKETA INVESTMENT GROUP BOSTON MA CHICAGO IL MIAMI FL PORTLAND OR SAN DIEGO CA LONDON UK OPTION-BASED EQUITY STRATEGIES Roberto Obregon MEKETA INVESTMENT GROUP 100 Lowder Brook Drive, Suite 1100 Westwood, MA 02090 meketagroup.com February 2018 MEKETA INVESTMENT GROUP 100 LOWDER BROOK DRIVE SUITE 1100 WESTWOOD MA 02090 781 471 3500 fax 781 471 3411 www.meketagroup.com MEKETA INVESTMENT GROUP OPTION-BASED EQUITY STRATEGIES ABSTRACT Options are derivatives contracts that provide investors the flexibility of constructing expected payoffs for their investment strategies. Option-based equity strategies incorporate the use of options with long positions in equities to achieve objectives such as drawdown protection and higher income. While the range of strategies available is wide, most strategies can be classified as insurance buying (net long options/volatility) or insurance selling (net short options/volatility). The existence of the Volatility Risk Premium, a market anomaly that causes put options to be overpriced relative to what an efficient pricing model expects, has led to an empirical outperformance of insurance selling strategies relative to insurance buying strategies. This paper explores whether, and to what extent, option-based equity strategies should be considered within the long-only equity investing toolkit, given that equity risk is still the main driver of returns for most of these strategies. It is important to note that while option-based strategies seek to design favorable payoffs, all such strategies involve trade-offs between expected payoffs and cost. BACKGROUND Options are derivatives1 contracts that give the holder the right, but not the obligation, to buy or sell an asset at a given point in time and at a pre-determined price. -

Spread Scanner Guide Spread Scanner Guide

Spread Scanner Guide Spread Scanner Guide ..................................................................................................................1 Introduction ...................................................................................................................................2 Structure of this document ...........................................................................................................2 The strategies coverage .................................................................................................................2 Spread Scanner interface..............................................................................................................3 Using the Spread Scanner............................................................................................................3 Profile pane..................................................................................................................................3 Position Selection pane................................................................................................................5 Stock Selection pane....................................................................................................................5 Position Criteria pane ..................................................................................................................7 Additional Parameters pane.........................................................................................................7 Results section .............................................................................................................................8 -

De-Mystifying Derivatives

For institutional investor use only Pacific Investment Management Company LLC, 650 Newport Center Drive, Newport Beach, CA 92660, 949.720.6000 CMR2017-1103-299224 1 Define common derivative instruments used to manage fixed income portfolios Discuss the risks associated with these instruments and how they compare and differ from cash bonds Describe how derivatives are used in an effort to efficiently manage a portfolio’s risk profile and generate excess returns 2 • It’s a contract whereby two parties agree to exchange cashflows or to enter into a type of transaction in the future • A financial instrument that derives its value from movements in an underlying security • Includes futures, options, swaps • It can provide greater flexibility in structuring portfolios and many managers use them – Modify portfolio risk characteristics – Security substitution – Potential for alpha generation – May improve portfolio liquidity • Potential to leverage the portfolio • Inadequate monitoring of derivatives’ effect on portfolio risk characteristics • Counterparty and basis risk Source: PIMCO Refer to Appendix for additional investment strategy and risk information. 3 Cash instruments Risks Derivative instruments Interest Rate Futures / Governments Swaps Interest rate Options Mortgages Credit Volatility Interest Rate Credit Corporates Credit Default Swaps (CDS) Default Sample for illustrative purposes only Refer to Appendix for additional risk information. 4 A futures contract is a highly standardized agreement to exchange cash for an asset at a future date. An obligation to buy or sell a certain asset at a certain price on a certain day. Long position Short position Clearinghouse $ $ Coordinates cashflows and Party A takes the other side of the Party B Asset trade Asset Applications for futures Substitution Hedging Managing duration and curve exposure Sample for illustrative purposes only. -

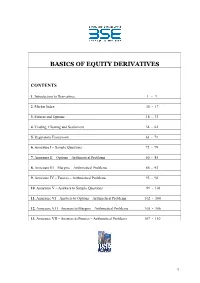

Basics of Equity Derivatives

BASICS OF EQUITY DERIVATIVES CONTENTS 1. Introduction to Derivatives 1 - 9 2. Market Index 10 - 17 3. Futures and Options 18 - 33 4. Trading, Clearing and Settlement 34 - 62 5. Regulatory Framework 63 - 71 6. Annexure I – Sample Questions 72 - 79 7. Annexure II – Options – Arithmetical Problems 80 - 85 8. Annexure III – Margins – Arithmetical Problems 86 - 92 9. Annexure IV – Futures – Arithmetical Problems 93 - 98 10. Annexure V – Answers to Sample Questions 99 - 101 11. Annexure VI – Answers to Options – Arithmetical Problems 102 - 104 12. Annexure VI I– Answers to Margins – Arithmetical Problems 105 - 106 13. Annexure VII – Answers to Futures – Arithmetical Problems 107 - 110 1 CHAPTER I - INTRODUCTION TO DERIVATIVES The emergence of the market for derivative products, most notably forwards, futures and options, can be traced back to the willingness of risk-averse economic agents to guard themselves against uncertainties arising out of fluctuations in asset prices. By their very nature, the financial markets are marked by a very high degree of volatility. Through the use of derivative products, it is possible to partially or fully transfer price risks by locking- in asset prices. As instruments of risk management, these generally do not influence the fluctuations in the underlying asset prices. However, by locking in asset prices, derivative products minimize the impact of fluctuations in asset prices on the profitability and cash flow situation of risk-averse investors. 1.1 DERIVATIVES DEFINED Derivative is a product whose value is derived from the value of one or more basic variables, called bases (underlying asset, index, or reference rate), in a contractual manner. -

Black Swans and Retirement Strategies: Is “Buy and Hold Best”? Barry Doyle University of San Francisco, [email protected]

The University of San Francisco USF Scholarship: a digital repository @ Gleeson Library | Geschke Center Finance School of Management 2010 Black Swans and Retirement Strategies: Is “Buy and Hold Best”? Barry Doyle University of San Francisco, [email protected] Robert Mefford University of San Francisco, [email protected] Nicholas Tay University of San Francisco, [email protected] Follow this and additional works at: http://repository.usfca.edu/fe Part of the Finance and Financial Management Commons Recommended Citation Doyle, Barry; Mefford, Robert; and Tay, Nicholas, "Black Swans and Retirement Strategies: Is “Buy and Hold Best”?" (2010). Finance. Paper 1. http://repository.usfca.edu/fe/1 This Conference Proceeding is brought to you for free and open access by the School of Management at USF Scholarship: a digital repository @ Gleeson Library | Geschke Center. It has been accepted for inclusion in Finance by an authorized administrator of USF Scholarship: a digital repository @ Gleeson Library | Geschke Center. For more information, please contact [email protected]. BLACK SWANS AND RETIREMENT STRATEGIES: IS “BUY AND HOLD BEST”? Barry Doyle, University of San Francisco, [email protected], 415-422-6129 Robert Mefford, University of San Francisco, [email protected], 415-422-6408 Nicholas Tay, University of San Francisco, [email protected], 415-422-6100 ABSTRACT The recent market crash which has led to as much as a 47% drop in the value of the S&P500 index has made some of us wonder if there is a cost effective way for us to hedge our retirement -

The Option Trader Handbook Strategies and Trade Adjustments

The Option Trader Handbook Strategies and Trade Adjustments Second Edition GEORGE VI. JABBOIiR, PhD PHILIP H. BUDWICK, MsF WILEY John Wiley & Sons, Inc. Contents Preface to the First Edition xlli Preface to the Second Edition xvli CHAPTER 1 Trade and Risk Management 1 Introduction 1 The Philosophy of Risk 2 Truth About Reward 5 Risk Management 6 Risk 6 Reward 9 Breakeven Points , 11 Trade Management 11 Trading Theme 11 The Theme of Your Portfolio 14 Diversification and Flexibility 15 Trading as a Business 16 Start-Up Phase 16 Growth Phase 19 Mature Phase 20 Just Business, Nothing Personal 21 SCORE—The Formula for Trading Success 21 Select the Investment 22 Choose the Best Strategy 23 Open the Trade with a Plan v, 24 Remember Your Plan and Stick to It 26 Exit Your Trade 26 Vl CONTENTS CHAPTER 2 Tools of the Trader 29 Introduction 29 Option Value 30 Option Pricing 31 Stock Price 31 Strike Price 32 Time to Expiration 32 Volatility 33 Dividends 33 Interest Rates 33 Option Greeks and Risk Management 34 Time Decay 34 Trading Lessons Learned from Time Decay (Theta). 41 Delta/Gamma 43 Deep-in-the-Money Options 46 Implied Volatility 49 Early Assignment 63 Synthetic Positions 65 Synthetic Stock 66 Long Stock 66 Short Stock 67 Synthetic Call 68 Synthetic Put 70 Basic Strategies 71 Long Call , 71 Short Call . - 72 Long Put .' 73 Short Put 74 Basic Spreads and Combinations 75 Bull Call Spread 75 Bull Put Spread 76 Bear Call Spread 77 Bear Put Spread 78 Long Straddle 78 Long Strangle 79 Short Straddle 80 Short Strangle 81 Advanced Spreads 82 Call Ratio -

OCC: Getting Started with Options -- Strategies and Ideas

T R A N S C R I P T OCC: Getting started with options -- Strategies and ideas Speakers: Allen Helm, Ed Modla, Allen Helm: Well hello everybody, and welcome for the final session of our options series, Getting Started with Options: Strategies and Ideas. My name’s Allen Helm, I’m the Regional Brokerage Consultant for Austin, North Texas, and Oklahoma. My group of about 65 of us nationwide of regional brokerage consultants and brokerage consultants work with clients that own individual securities, whether that’s options, stocks, exchange-traded funds, mutual funds or fixed income, we’re here to help you navigate our brokerage tools to meet goals and objectives, so, if you’d like to attend a session with us, reach out, just give us a call, either to your local financial consultant or call the 800 number and you can reach us there and just ask for some help with some of the tools that we have or what we’re showing today. I’ve been in the brokerage industry now for roughly about 3+ decades. I’m a registered options principal license manager. I also have a money management license, so I have a myriad of different licenses and certifications, and have been in this space for a long, long time. I’m honored to have Ed Modla with us today from the OCC or Option Clearing Corp. He’s going to go over some of the different scenarios. 1 So let me kick it off to Ed, I’ll let Ed introduce himself, and then we’ll go ahead and get started with today’s session. -

Buying Options

GettyImages-1205460059 A Fidelity Investments Webinar Buying Options BROKERAGE: OPTIONS Introduction to Options Get to know the basics of options trading; learn key terms and concepts essential for any new options trader. Buying Options Understand what to expect when buying options; learn the difference between calls and puts. Options Selling Options Understand what to expect when selling options; learn how to navigate Trading the risks associated with selling. Webinar Options Trade Management Now that you’ve placed a trade, learn strategies to manage before, Series during, and after its expiration. Options Pricing Understand how options are priced and learn how you can help get the best returns. 2 BROKERAGE: OPTIONS Review Options Basics Execute a Trade Buy a Call Buy a Protective Put Buy a Put Agenda 3 Review Options Basics BROKERAGE: OPTIONS Review: Anatomy of an Options Symbol Example: Plain English Symbol: SPY Jan 21, 2022 Call 208 SPY220121C208 The symbol of Year of the Month of the Day of the C for a Call, The Strike Price the underlying expiration expiration expiration or P for a Put Holder (buyer) of this call has the right to buy 100 shares of SPY at $208 per share at any time until January 21, 2022. 5 Company trading symbols are provided as examples and for illustrative purposes only and should not be considered an offer to sell, a solicitation of an offer to buy, or a recommendation for the security. BROKERAGE: OPTIONS Review: Premium Components Premium = Intrinsic Value + Extrinsic Value An options contract that has intrinsic -

Equity Options Strategy

EQUITY OPTIONS STRATEGY Long Put DESCRIPTION SUMMARY The investor buys a put contract that is compatible with the expected timing and This strategy consists of buying puts as a means to profit if the stock price size of a downturn. Although a put usually doesn’t appreciate $1 for every $1 that moves lower. It is a candidate for bearish investors who want to participate in the stock declines, the percentage gains can be significant. an anticipated downturn, but without the risk and inconveniences of selling the Exercising a put would result in the sale of the underlying stock. These comments stock short. focus on long puts as a standalone strategy, so exercising the option would The time horizon is limited to the life of the option. result in a short stock position, something not all individuals would choose as a goal. The plan here is to resell the put at a profit before expiration. The investor is MOTIVATION hoping for a dramatic downturn; the sooner, the better. A put buyer has the opportunity to profit from a fall in the stock’s price, without risking an unlimited amount of capital, as a short stock seller does. What’s more, Timing is of the essence. Some put holders set price targets or re-evaluation the leverage involved in a long put strategy can generate attractive percentage dates; others ‘play it by ear.’ Either way, all value must be realized before the put returns if the forecast is right. expires. If the expected results have not materialized as expiration draws near, a careful investor is ready to re-evaluate. -

Reading: Chapter 17

Reading: Chapter 17 An Option In the security market, an option gives the holder the right to buy or sell a stock (or index of stocks) at a specified price (“strike” price) within a specified time period. The value of an option depends in part on the value of the underlying security, so options are often referred to as derivative securities. Two types of options Call options: Options to buy a stock at the strike price within a specified time period. Put options: Options to sell a stock at the strike price within a specified time period. Option is not an obligation. One does not have to exercise the option. If the option is not exercised the original purchase price of the option is lost. 2 Chap. 17. An Introduction to Options 1. Call options 2. Leverage 3. Writing calls 4. Puts 5. The Chicago Board Options Exchanges 6. Stock Index options 7. Currency and interest rate options 8. Warrants 3 4 1. Call Options An example of call option: You pay $15 for an option that gives you the right to buy one share of GM stock for $50 a share by Dec. 31, 200X (one year from today). The current market price of a share of GM stock is $60. Definitions: Expiration date: The date by which the option must be exercised or it is no longer valid. In the example Dec. 31, 200X is the expiration date. Strike price: the price at which the investor may buy the stock through the option. In the example the strike price is $50.