M:\Agendas\Pocatello Testimony.Wpd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Stealth at Work

Stealth at work Marty Trillhaase/Lewiston Tribune JEERS ... to Idaho Senate President Pro Tem Brent Hill, R-Rexburg, and House Speaker Scott Bedke, R-Oakley. You've been left in the dark about a powerful group of lawmakers they've engaged to contemplate whose taxes get cut - and who will pay more. Among the people assigned to this tax working group are the chairmen of the Senate and House tax committees - Sen. Jeff Siddoway, R-Terreton, and Rep. Gary Collins, R-Nampa. Other members include Sens. Jim Guthrie, R-McCammon, Steve Vick, R-Dalton Gardens, Abby Lee, R-Fruitland, Lori Den Hartog, R-Meridian, and Grant Burgoyne, D-Boise, along with Reps. Janet Trujillo, R-Idaho Falls, Dell Raybold, R-Rexburg, Tom Dayley, R-Boise, Robert Anderst, R-Nampa and Mathew Erpelding, D-Boise. Their focus is Utah, where a flat income tax has widened the tax burden between rich and poor. They've met repeatedly this summer. Legislative staffers have been assigned to help them. Representatives of the State Tax Commission, the Division of Financial Management and the Department of Commerce have briefed them. But you will not find this group listed among the 10 interim committees - dealing with everything from broadband access to urban renewal - on the Legislature's web page. Nor has there been any advance word, foiling any pesky citizen who would like to attend one of these sessions. Why the stealth? Could it be they don't want outside voices reminding them how Idaho can't afford any more tax cuts for the well-heeled and the politically connected? If anything, the state will need more taxes to repair the damage done to its schools, public services and higher education. -

2014 Political Corporate Contributions 2-19-2015.Xlsx

2014 POLITICAL CORPORATE CONTRIBUTIONS Last Name First Name Committee Name State Office District Party 2014 Total ($) Alabama 2014 PAC AL Republican 10,000 Free Enterprise PAC AL 10,000 Mainstream PAC AL 10,000 Collins Charles Charlie Collins Campaign Committee AR Representative AR084 Republican 750 Collins‐Smith Linda Linda Collins‐Smith Campaign Committee AR Senator AR019 Democratic 1,050 Davis Andy Andy Davis Campaign Committee AR Representative AR031 Republican 750 Dotson Jim Jim Dotson Campaign Committee AR Representative AR093 Republican 750 Griffin Tim Tim Griffin Campaign Committee AR Lt. Governor AR Republican 2,000 Rapert Jason Jason Rapert Campaign Committee AR Senator AR035 Republican 1,000 Rutledge Leslie Leslie Rutledge Campaign Committee AR Attorney General AR Republican 2,000 Sorvillo Jim Jim Sorvillo Campaign Committee AR Representative AR032 Republican 750 Williams Eddie Joe GoEddieJoePAC AR Senator AR029 Republican 5,000 Growing Arkansas AR Republican 5,000 Senate Victory PAC AZ Republican 2,500 Building Arizona's Future AZ Democratic 5,000 House Victory PAC AZ Republican 2,500 Allen Travis Re‐Elect Travis Allen for Assembly 2014 CA Representative CA072 Republican 1,500 Anderson Joel Tax Fighters for Joel Anderson, Senate 2014 CA Senator CA038 Republican 2,500 Berryhill Tom Tom Berryhill for Senate 2014 CA Senator CA008 Republican 2,500 Bigelow Frank Friends of Frank Bigelow for Assembly 2014 CA Representative CA005 Republican 2,500 Bonin Mike Mike Bonin for City Council 2013 Officeholder Account CA LA City Council -

Idaho Freedom Index 2019 Legislative Session Summary Freedom Index 2019 Idaho District Map

Idaho Freedom Index 2019 legislative session summary Freedom Index Freedom 2019 Idaho district map district Idaho Freedom Index 19 District Sen im Woodard D (68.8%) Sen. Jeff Agenbroad D (60.4%) Sen im Patric D (61.5%) Rep Heather Scott A (98.2%) Rep rent rane B (83.8%) Rep Larie Licey F (56.1%) 1 Rep Sae Dixon B (86.4%) 13 Rep Gar oins B- (81.1%) 25 Rep. Clark Kauffman D (60.1%) Sen Stee Vic C+ (79.2%) Sen Scott Gro D (60.4%) Sen Michee Stennett F (50.0%) Rep Vito arieri A (94.3%) Rep Mie Moe B (83.3%) Rep. Muffy Davis F (53.5%) 2 Rep ohn Green A (94.7%) 14 Rep Gaann DeMordant B- (81.6%) 26 Rep Sa Toone F (50.0%) Sen Don heatham C+ (77.1%) Sen Fred Martin F (56.3%) Sen e Anthon D (68.8%) Rep Ron Mendie A (91.2%) Rep Stee erch F (50.4%) Rep Scott ede C- (70.2%) 3 Rep Ton Wisniesi A (92.1%) 15 Rep ae Eis F (50.9%) 27 Rep Fred Wood F (51.3%) Sen Mar Soa D (67.2%) Sen Grant rgone F (46.4%) Sen im Gthrie F (58.9%) Rep im Addis C (75.0%) Rep ohn Mcrostie F (54.4%) Rep ein Andrs B (84.2%) 4 Rep Pa Amador D (66.7%) 16 Rep Ro Mason F (48.7%) 28 Rep Rand Armstron B+ (87.7%) Sen Daid Neson F (47.9%) Sen Maryanne ordan F (49.0%) Sen Mar Ne F (52.1%) Rep i Goesin D (61.8%) Rep ohn Gannon F (52.6%) Rep hris Aernath F (51.8%) 5 Rep aroine Tro D (64.0%) 17 Rep Se hew F (53.1%) 29 Rep Eaine Smith F (54.4%) Sen Dan ohnson D (62.5%) Sen anie WardEnein F (54.7%) Sen Dean Mortimer D (63.5%) Rep Thra Steenson A (91.2%) Rep Iana Re F (52.2%) Rep Gar Marsha C (76.3%) 6 Rep Mie insey B- (82.9%) 18 Rep rooe Green F (48.7%) 30 Rep Wend Horman C- (71.1%) Sen ar ratree -

Monsanto's Jan 2013

MGGF CONTRIBUTIONS JANUARY 1, 2013 THROUGH JUNE 30, 2013 Name State Candidate Date Amount Party State Total Friends of Frank Bigelow for Assembly 2012CA Assm. Frank Bigelow (R) 3/20/13 $1,000 REP Raul Bocanegra for Assembly 2014 CA Assm. Raul Bocanegra (D) 3/20/13 $1,500 DEM Olsen for Assembly 2014 CA Assm. Kristin Olsen (R) 3/20/13 $1,500 REP Tom Berryhill for Senate 2014 CA Sen. Tom Berryhill (R) 3/27/13 $600 REP Rudy Salas for Assembly 2014 CA Assm. Rudy Salas (D) 3/27/13 $1,500 DEM Galgiani for Senate 2016 CA Sen. Cathleen Galgiani (D) 3/27/13 $2,000 DEM Don Saylor for Supervisor 2014 CA Don Saylor (O) 5/8/13 $500 OTH Leticia Perez for Senate 2013 CA Leticia Perez (U) 5/8/13 $1,000 DEM Alejo for Assembly 2014 CA Assm. Luis A. Alejo (D) 6/24/13 $1,000 DEM Friends of Frank Bigelow for Assembly 2014CA Assm. Frank Bigelow (R) 6/24/13 $1,000 REP Rich Gordon for Assembly 2014 CA Assm. Richard S. Gordon (D) 6/24/13 $1,500 DEM Dr. Richard Pan for Senate 2014 CA Assm. Richard Pan (D) 6/24/13 $1,500 DEM Wilk for Assembly 2014 CA Assm. Scott Thomas Wilk (R) 6/24/13 $1,500 REP California Total $16,100 Friends for Brickwood HI Sen. Brickwood M. Galuteria (D) 4/24/13 $500 DEM Friends of Gil Kahele HI Sen. Gilbert Kahele (D) 4/24/13 $500 DEM Friends of Will Espero HI Sen. -

2013 US Political Contributions & Related Activity Report

2013 U.S. Political Contributions & Related Activity Report Helping People Live Healthier Lives and Helping the Health Care System Work Better for Everyone Letter from the Chairman Our workforce of 165,000 people is dedicated to helping people live healthier lives and helping the health care system work better for everyone by collaborating across the public and private sectors and the entire health care marketplace to deliver transformative solutions. Each day, the men and women of UnitedHealth Group are working to modernize the nation’s health care system and leverage the latest technologies to enhance the consumer experience and improve health outcomes for the more than 85 million individuals we serve. As Federal and State policy-makers continue to look for solutions to modernize the health care system, UnitedHealth Group remains an active participant in the political process. The United for Health PAC continues to be an important component of our overall strategy to engage with elected officials and policy-makers to communicate our perspectives on various priority issues and to share with them our proven solutions and initiatives. The United for Health PAC is a bipartisan Political Action Committee supported by voluntary contributions from eligible employees. The PAC supports Federal and State candidates who champion policies that increase quality, access, and affordability in health care, in accordance with applicable election laws and as overseen by the UnitedHealth Group Board of Directors’ Public Policy Strategies and Responsibility Committee. As key issues of importance to the health care system continue to be debated, UnitedHealth Group remains committed to sharing the insights and solutions we have developed with policy-makers at the Federal and State levels to encourage innovation and sustainable solutions that modernize our nation’s health care system. -

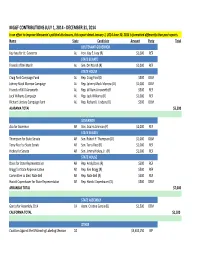

5-21-15 UPDATED FORMAT MGGF Contributions July

MGGF CONTRIBUTIONS JULY 1, 2014 - DECEMBER 31, 2014 In an effort to improve Monsanto's political disclosures, this report dated January 1, 2014-June 30, 2014 is formatted differently than past reports. Name State Candidate Amount Party Total LIEUTENANT GOVERNOR Kay Ivey for Lt. Governor AL Hon. Kay E. Ivey (R) $1,000 REP STATE SENATE Friends of Del Marsh AL Sen. Del Marsh (R) $1,000 REP STATE HOUSE Craig Ford Campaign Fund AL Rep. Craig Ford (D) $500 DEM Johnny Mack Morrow Campaign AL Rep. Johnny Mack Morrow (D) $1,000 DEM Friends of Will Ainsworth AL Rep. William Ainsworth (R) $500 REP Jack Williams Campaign AL Rep. Jack Williams (R) $1,000 REP RIchard Lindsey Campaign Fund AL Rep. Richard J. Lindsey (D) $500 DEM ALABAMA TOTAL $5,500 GOVERNOR Asa for Governor AR Gov. Asa Hutchinson (R) $2,000 REP STATE SENATE Thompson for State Senate AR Sen. Robert F. Thompson (D) $1,000 DEM Terry Rice for State Senate AR Sen. Terry Rice (R) $1,000 REP Hickey for Senate AR Sen. Jimmy Hickey, Jr. (R) $1,000 REP STATE HOUSE Davis for State Representative AR Rep. Andy Davis (R) $500 REP Bragg for State Representative AR Rep. Ken Bragg (R) $500 REP Committee to Elect Nate Bell AR Rep. Nate Bell (R) $500 REP Harold Copenhaver for State Representative AR Rep. Harold Copenhaver (D) $500 DEM ARKANSAS TOTAL $7,000 STATE ASSEMBLY Garcia for Assembly 2014 CA Assm. Cristina Garcia (D) $1,500 DEM CALIFORNIA TOTAL $1,500 OTHER Coalition Against the Misleading Labeling Measure CO $3,404,150 NP Colorado BioScience Political Action Committee CO $550 NP COLORADO TOTAL $3,404,700 AGRICULTURE COMMISSIONER Putnam for AG Commissioner FL Commissioner Adam H. -

Idaho State Legislative Members

IDAHO STATE LEGISLATIVE MEMBERS SESSION BEGINS Legend 62nd IDAHO STATE LEGISLATURE JANUARY 7, 2013 S - Senator FIRST REGULAR SESSION R - Representative (D) Democrat (R) Republican 1 S - Shawn Keough (R) 7 S - Sheryl Nuxoll (R) 18 S - Branden Durst (D) State Legislative District Boundary R - Eric Anderson (R) R - Shannon McMillan (R) R - Janie Ward-Engelking (D) 10 State Legislative District Number R - George Eskridge (R) R - Paul Shepherd (R) R - Phylis K. King (D) 1st Congressional District 2nd Congressional District 2 S - Steve Vick (R) 8 S - Steven Thayn (R) 19 S - Cherie Buckner-Webb (D) County Boundary R - Vito Barbieri (R) R - Terry F. Gestrin (R) R - Mathew Erpelding (D) R - Ed Morse (R) R - Lenore Barrett (R) R - Holli Woodings (D) 3 S - Bob Nonini (R) 9 S - Monty Pearce (R) 20 S - Chuck Winder (R) Boundary R - Ron Mendive (R) R - Lawerence E. Denney (R) R - Joe Palmer (R) R - Frank Henderson (R) R - Judy Boyle (R) R - James Holtzclaw (R) 1 4 S - John W. Goedde (R) 10 S - Jim Rice (R) 21 S - Clifford R. Bayer (R) Bonner R - Luke Malek (R) R - Brandon Hixon (R) R - Steven C. Harris (R) R - Kathleen Sims (R) R - Darrell Bolz (R) R - Thomas E. Dayley (R) 5 S - Dan J. Schmidt (D) 11 S - Patti Anne Lodge (R) 22 S - Russell M. Fulcher (R) R - Cindy Agidius (R) R - Gayle Batt (R) R - John Vander Woude (R) 4 R - Shirley G. Ringo (D) R - Christy Perry (R) R - Jason Monks (R) 2 3 6 S - Dan Johnson (R) 12 S - Todd Lakey (R) 23 S - Bert Brackett (R) Kootenai R - Thyra Stevenson (R) R - Robert Anderst (R) R - Rich Wills (R) Shoshone R - John Rusche (D) R - Rick D. -

State Jurisdiction in Indian Country March 2017

Evaluation report State Jurisdiction in Indian Country March 2017 State Jurisdiction in Indian Country Office of Performance Evaluations Idaho Legislature Promoting confidence and accountability in state government Office of Performance Evaluations Created in 1994, the legislative Office of Performance Evaluations (OPE) operates under the authority of Idaho Code §§ 67-457–464. Its mission is to promote confidence and accountability in state government through independent assessment of state programs and policies. The OPE work is guided by professional standards of evaluation and auditing. Joint Legislative Oversight Committee 2017–2018 The eight-member, equally bipartisan Joint Legislative Oversight Committee (JLOC) selects evaluation topics; OPE staff conduct the evaluations. Reports are released in a public meeting of the committee. The findings, conclusions, and recommendations in OPE reports are not intended to reflect the views of the Oversight Committee or its individual members. Senators Senator Cliff Bayer (R) and Representative Cliff Bayer Mark Harris Michelle Stennett Cherie Buckner-Webb Mat Erpelding (D) cochair the Representatives committee. Mat Erpelding Maxine Bell Caroline Nilsson Troy Elaine Smith 2 State Jurisdiction in Indian Country From the director March 2017 Members Joint Legislative Oversight Committee Idaho Legislature 954 W. Jefferson Street Laws governing jurisdiction in Indian country are incredibly Suite 202 Boise, ID 83702 complex. We found that nearly every stakeholder had a different Ph. 208.332.1470 understanding of some aspects of jurisdiction. Shared legislature.idaho.gov/ope/ jurisdiction has resulted in gaps in law enforcement and difficulty in serving the people of Idaho, both on and off the reservation. Under Public Law 280, the State of Idaho has options to fully or partially retrocede its jurisdiction of Indian country to the federal government. -

MINUTES Approved by Council Legislative Council Friday, June 05, 2020 8:30 A.M. WW02 Lincoln Auditorium Boise, Idaho

MINUTES Approved by Council Legislative Council Friday, June 05, 2020 8:30 A.M. WW02 Lincoln Auditorium Boise, Idaho Speaker Bedke called the meeting to order at 8:30 a.m.; a silent roll call was taken. Legislative Council (Council) members in attendance: Speaker Scott Bedke, Pro Tem Brent Hill, Senators Chuck Winder, Abby Lee, Carl Crabtree, Michelle Stennett, Cherie Buckner-Webb, and Grant Burgoyne; Representatives Mike Moyle, Clark Kauffman, Wendy Horman, Ilana Rubel, John McCrostie, and Sally Toone. Legislative Services Office (LSO) staff present: Director Eric Milstead, Terri Kondeff, and Shelley Sheridan. Other attendees: Mary Sue Jones, Idaho Senate; Mary Lou Molitor and Carrie Maulin, Idaho House of Representatives. Pro Tem Hill called for a motion to approve meeting minutes. Representative Kauffman made a motion to approve the November 8, 2019 minutes; Senator Buckner-Webb seconded the motion. The motion passed by voice vote. DIRECTOR'S REPORT - Eric Milstead, Director, Legislative Services Office (LSO) LSO Performance Survey Director Milstead reported that LSO received close to 50 percent of the surveys and was pleased with the responses. LSO will focus on improving a couple areas as reported by members. Office of Performance Evaluations (OPE) Director Milstead referred to information provided by OPE Director Rakesh Mohan that highlighted four reports OPE will be working on in the upcoming months: (1) State response to Alzheimer's and related dementia, (2) Driver verification cards, (3) Systemic review of tax exemptions and deductions, and (4) Long-term planning postsecondary education. Additionally, OPE plans to release three evaluations in the next few months: (1) Investigating allegations of child neglect, (2) Preparedness of Idahoans to retire, and (3) County revenues. -

Final Bill Status 2018

FINAL BILL STATUS 2018 SECOND REGULAR SESSION SIXTY-FOURTH IDAHO LEGISLATURE January 8, 2018 through March 28, 2018 CONTAINING COMPLETE COMPILATION OF ALL LEGISLATION INTRODUCED Compiled by Legislative Services Research and Legislation with the cooperation of Office of the Secretary of the Senate Office of the Chief Clerk of the House of Representatives WEEKLY BILL STATUS ABBREVIATIONS amen - amended, amendment rec d/p - recommend do pass appt - appointed rec dnp - recommend do not pass apvd - approved recon - reconsidered concur - concurred ref'd - referred engros - engrossing ret'd - returned enrol - enrolling rpt - report, reported Gov - Governor rls - rules intro - introduced sec - secretary Pres - President of the Senate Sp - Speaker of the House ord - order u.c. - unanimous consent prt - printed susp - suspended rdg - reading w/ - with/ rec - recommendation w/o rec - without recommendation rec'd - received SENATE COMMITTEES (10) Agric Aff - Agricultural Affairs Com/HuRes - Commerce & Human Resources Educ - Education Fin - Finance Health/Wel - Health & Welfare Jud - Judiciary & Rules Loc Gov - Local Government & Taxation Res/Env - Resources & Environment St Aff - State Affairs Transp - Transportation HOUSE COMMITTEES (14) Agric Aff - Agricultural Affairs Approp - Appropriations Bus - Business Com/HuRes - Commerce & Human Resources Educ - Education Env - Environment, Energy & Technology Health/Wel - Health & Welfare Jud - Judiciary, Rules & Administration Loc Gov - Local Government Res/Con - Resources & Conservation Rev/Tax - Revenue & Taxation St Aff - State Affairs Transp - Transportation & Defense W/M - Ways & Means ORDER OF BUSINESS SENATE 1. Roll Call 2. Prayer and Pledge of Allegiance 3. Reading and correction of Journal 4. Reading of communications 5. Presentation of petitions, resolutions and memorials 6. Reports of standing committees 7. -

Senate Journal Idaho Legislature

[December 3, 2020 SENATE JOURNAL 1 25 ......................................................................... Jim Patrick (R) SENATE JOURNAL 26 ...............................................................Michelle Stennett (D) OF THE 27 ......................................................... Kelly Arthur Anthon (R) 28 ........................................................................ Jim Guthrie (R) 29 ...........................................................................Mark Nye (D) IDAHO LEGISLATURE 30 ........................................................................Kevin Cook (R) ORGANIZATIONAL SESSION 31 .......................................................................... Steve Bair (R) SIXTY-SIXTH LEGISLATURE 32 ....................................................................... Mark Harris (R) 33 .......................................................................... Dave Lent (R) 34 ........................................................................ Doug Ricks (R) 35 .................................................................Van Burtenshaw (R) FIRST LEGISLATIVE DAY IN TESTIMONY WHEREOF, I have hereunto set my hand THURSDAY, DECEMBER 3, 2020 and affixed the Great Seal of the State of Idaho. Done at Boise, the Capital of Idaho, this Thirtieth day of November, in the year of our Lord, two thousand and twenty, and of the Independence Senate Chamber of the United States of America, the two hundred and forty-fifth. At the hour of 9 a.m. on Thursday, December 3, 2020, the /s/ LAWERENCE DENNEY -

Union Pacific Corporate Political Contributions to Candidates

Union Pacific Corporate Political Contributions to Candidates, Committees, Political Organizations and Ballot Measures for 2012 Committee State Candidate Name Committee Name Amount Committee Party Committee Office Committee District AR Allen, Fred Fred Allen Campaign Committee $1,000.00 D STATE HOUSE 33 AR Altes, Robert Robert Dennis Altes Campaign Committee $100.00 R STATE HOUSE 76 AR Barnett, Jonathan Jonathan Barnett Campaign Committee $100.00 R STATE HOUSE 87 AR Barnett, Jonathan Jonathan Barnett Campaign Committee $500.00 R STATE HOUSE 87 AR Biviano, Mark Mark Biviano for State Representative $100.00 R STATE HOUSE 46 AR Branscum, David David Branscum Campaign Committee $100.00 R STATE HOUSE 83 AR Broadaway, Mary Mary Broadaway for State Representative $100.00 D STATE HOUSE 57 AR Burris, John John Burris Campaign Committee $100.00 R STATE HOUSE 98 AR Caldwell, Ronald Ronald Caldwell for State Senate $1,000.00 R STATE SENATE 23 AR Carter, Davy Committee to Elect Davy Carter $100.00 R STATE HOUSE 43 AR Catlett, John John Catlett Campaign Committee $100.00 D STATE HOUSE 73 AR Chesterfield, Linda Linda Chesterfield Senate Campaign Committee $500.00 D STATE SENATE 30 AR Chesterfield, Linda Linda Chesterfield Senate Campaign Committee $1,000.00 D STATE SENATE 30 AR Clemmer, Ann Ann Clemmer Campaign Committee $100.00 R STATE HOUSE 23 AR Copenhaver, Harold Harold Copenhaver for State Representative $100.00 D STATE HOUSE 58 AR Cozart, Bruce Bruce Cozart Campaign Committee $100.00 R STATE HOUSE 24 AR Dale, Robert Robert E. Dale Campaign Committee