CHOTO Martha R979296O Comprehensive Dissertation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

14% 45Pps 104% 8Pps 467% 46Pps

Performance Outturn: Inflation adjusted financial highlights My commentary is based on inflation adjusted financial statements. The Group’s total income increased by 55% from ZW$524.7m in 2018 to ZW$814.9m in 2019. This was on the back of a significant rise in unrealized credits posted in the income statement. Fair value adjustments moved from a negative of ZW$89.8m in 2018 to a positive of ZW$230.2m in 2019 whilst other income, 14% 104% 467% largely constituted by the revaluation of the Group’s foreign denominated balances, increased by 314% from ZW$35.7m in 2018 to ZW$147.8m in 2019. Total assets Total capital and reserves Net profit/(loss) after taxation Net interest and related income reduced from ZW$199.1m in 2018 to close at ZW$146.6m in 2019, reflecting 2019 - ZW$3 532.5m 2019 - ZW$1 506.3m 2019 - ZW$433.6m the impact of a constrained growth in the underlying business and the application of sub-inflation earning 2018 - ZW$4 105.7m 2018 - ZW$739.1m 2018 - (ZW$118.2m) rates. Loan impairment charges to the income statement increased from ZW$34.6m in 2018 to ZW$75.6m in 2019 in line with the growth in assets exposed to credit risk. Overall credit quality however improved, with non- 45pps 8pps 46pps performing loans as a percentage of total loans reducing from 4.6% in 2018 to 2.2% in 2019. Liquidity ratio (Group) Cost to income ratio Net insurance related earnings increased by 7% from ZW$83.1m to ZW$89.2m. -

Annual Report 2017 Contents

Since 1951 ANNUAL REPORT 2017 CONTENTS 2 Corporate Information Financial Statements 2 Vision, Mission and Values 41 Six Year Financial Review 42 Financial Highlights To Shareholders 43 Report of the Directors 3 Notice to shareholders 46 Directors’ Statement of Responsibility 4 Shareholder Information 47 Extracts from the Report of the Independent Actuary Corporate Governance 49 Independent Auditor’s Report 6 Group Corporate Structure 57 Consolidated Statement of Financial Position 7 Company and Product Profile 58 Company Statement of Financial Position 11 Corporate Revolution Ladder 59 Statements of Profit or Loss and Other Comprehensive 13 Corporate Governance Report Income 19 Directorate 61 Consolidated Statement of Changes in Equity 21 Corporate Social Investment 2017 62 Company Statement of Changes in Equity 25 Acting Chairman’s Statement 63 Statements of Cash Flows 27 Group Chief Executive’s Report 64 Notes to Consolidated and Separate Financial 30 Economic Overview Statements Additional Information 162 Group Footprint 171 Detachable - Form of Proxy 1 Corporate Information ZB FINANCIAL HOLDINGS LIMITED Auditors Registered Office Deloitte & Touche Zimbabwe 21 Natal Road West Block Avondale Borrowdale Office Park Harare Borrowdale Road Telephone: +263 (0) 867 700 2001 Borrowdale E-mail: [email protected] P O Box 267 Facsimile: +263 - 4 - 251029 Harare Web address: www.zb.co.zw Zimbabwe Tel: +263 (0) 867 700 0261 Company Registration Number Fax: +263 - 4 - 852130 1278/89 Web address: www.deloitte.com Date of Incorporation Board of Directors 29 May 1989 Prof C Manyeruke (Chairman) R Mutandagayi (Group Chief Executive) Group Company Secretary F Kapanje (Group Finance Director) H R Nharingo O Akerele T S Bvurere P Chiromo A Z Mangwiro J Mutevedzi P B Nyoni Vision, Mission and Values Our Vision To be a leading global financial services Group. -

Table of Contents

TABLE OF CONTENTS GROUP OVERVIEW Group Salient features 2 How we create value 3 GROUP COMMUNICATION Statements Group Chairman’s Statement 12 Group Chief Executive Officer’s Report 16 CORPORATE PROFILE Business Overview 22 Group Structure 23 Our Success 24 Stakeholder Overview 26 SHAREHOLDER INFORMATION Analysis of Shareholders 30 Share Option Scheme 31 Shareholders’ calendar 32 SUBSIDIARIES COMMUNICATION STATEMENTS Managing Director’s Report - CBZ Bank Limited 34 Managing Director’s Report - CBZ Asset Management (Private) Limited (t/a Datvest) 37 Managing Director’s Report - CBZ Insurance Operations 40 CBZ Insurance (Private) Limited Actuary’s Report 44 CBZ Life (Private) Limited Actuary’s Report 45 CORPORATE SOCIAL RESPONSIBILITY Corporate Social Responsibility Report 48 Group Human Resources 55 Consumer Issues and Fair Operating Practices 56 CORPORATE GOVERNANCE Corporate Governance Framework 60 Report of the Directors 71 Our Directorate 74 FINANCIAL STATEMENTS Statement of Directors’ Responsibility 82 Independent Auditors Report 83 Consolidated Statement of Profit or Loss and Other Comprehensive Income 88 Consolidated Statement of Financial Position 89 Consolidated Statement of Changes In Equity 90 Consolidated Statement of Cash Flows 91 Group Accounting Policies 92 Notes to the Consolidated Financial Statements 110 Company Financial Statements 159 OTHER Notice of Annual General Meeting 172 Group Details 173 Form of Proxy 174 1 CBZ HOLDINGS LIMITED / INTEGRATED ANNUAL REPORT 2017 GROUP SALIENT FEATURES Financial Highlights Total Assets -

ZBFH 2017 Annual Report Final

Since 1951 ANNUAL REPORT 2017 CONTENTS 2 Corporate Information Financial Statements 2 Vision, Mission and Values 41 Six Year Financial Review 42 Financial Highlights To Shareholders 43 Report of the Directors 3 Notice to shareholders 46 Directors’ Statement of Responsibility 4 Shareholder Information 47 Extracts from the Report of the Independent Actuary Corporate Governance 49 Independent Auditor’s Report 6 Group Corporate Structure 57 Consolidated Statement of Financial Position 7 Company and Product Profile 58 Company Statement of Financial Position 11 Corporate Revolution Ladder 59 Statements of Profit or Loss and Other Comprehensive 13 Corporate Governance Report Income 19 Directorate 61 Consolidated Statement of Changes in Equity 21 Corporate Social Investment 2017 62 Company Statement of Changes in Equity 25 Acting Chairman’s Statement 63 Statements of Cash Flows 27 Group Chief Executive’s Report 64 Notes to Consolidated and Separate Financial 30 Economic Overview Statements Additional Information 162 Group Footprint 171 Detachable - Form of Proxy 1 Corporate Information ZB FINANCIAL HOLDINGS LIMITED Auditors Registered Office Deloitte & Touche Zimbabwe 21 Natal Road West Block Avondale Borrowdale Office Park Harare Borrowdale Road Telephone: +263 (0) 867 700 2001 Borrowdale E-mail: [email protected] P O Box 267 Facsimile: +263 - 4 - 251029 Harare Web address: www.zb.co.zw Zimbabwe Tel: +263 (0) 867 700 0261 Company Registration Number Fax: +263 - 4 - 852130 1278/89 Web address: www.deloitte.com Date of Incorporation Board of Directors 29 May 1989 Prof C Manyeruke (Chairman) R Mutandagayi (Group Chief Executive) Group Company Secretary F Kapanje (Group Finance Director) H R Nharingo O Akerele T S Bvurere P Chiromo A Z Mangwiro J Mutevedzi P B Nyoni Vision, Mission and Values Our Vision To be a leading global financial services Group. -

CBZ Bank Upgraded to A

CBZ Bank upgraded to A GCR upgraded CBZ Bank Limited’s (“CBZ”) long-term naional scale US$ rating to A+ (Single A plus), which is one notch up from the previous rating of A (Single A). CBZ is a wholly- owned subsidiary of CBZ Holdings Limited (CBZH), which was incorporated in June 2005. The largest shareholders include the government of Zimbabwe with 16.1%, followed by Libyan Arab Foreign Bank (14.1%), Renaissance Capital (13.6%) and NSSA (10%). CBZ offers a wide range of commercial banking products and services to the retail and corporate markets. CBZ is the largest commercial bank in Zimbabwe, having gained significant market share, with its major competitors continuing to adopt a cautious approach to asset accumulation. Being partly government owned has benefited business flows. The bank enjoys substantial financial flexibility, with its strong brand and local listing supporting its perceived “safe haven” status among depositors. The bank continued to be a major beneficiary of deposits post dollarisation, reflecting a considerable increase in its depositor-funding base during F10. The bank has also benefited from strategic alliances with the corporate sector and its ability to source government deposits through parastatals and ministries. Supplementing depositor funding, CBZ has secured off-shore lines of credit from the African Export-Import Bank and PTA Bank totalling US$70m as at FYE10. On 1 April 2010, the Group announced its plan to merge CBZ Building Society (“CBZ BS”) with the bank as part of a process to rationalise operations and maximise profitability. To date, although the bank and society have been operationally integrated, management are required to maintain separate financial statements pending conclusion of legal & regulatory procedures. -

ZSE in False Start As New Month Commences… in This Weekly

EFE RESEARCH – Weekly Market Review Members of the Zimbabwe Stock Exchange Weekending 04.09.15 In this Weekly ZSE in false start as new month commences… Market Highlights P1 A rallying start to the new month faltered in the penultimate sessions of the week to see the market succumb to yet another loss. Spats of demand largely buoyed by foreign buying emerged earlier in the In the News P4 week to breathe some excitement into the market though it was weathered as the week progressed. Disclaimer P6 Consequently trades subsided to the now common levels of less than $500,000 worth per session and with it the market trended south. The corporate scene was awash with activity this week highlighted by the BNC annual general meeting where all former Mwana Africa proxies on the nickel miner’s board were removed as the new major shareholders in the latter move to have their interests fully represented in the group and subsidiaries. Fellow mining group Zimplats reported a 21% drop in output for its F15 financial year owing to the collapse at its Bimha mine that resulted in loss of production. Meanwhile interest in local investments continued to show from foreigners with Africa’s richest man, Mr Dangote, visiting the country while Tanzanian multi-national Bakhresa Group is reportedly set to acquire the entire shareholding of Blue Ribbon Industries after creditors approved its proposed $40 million capital injection. Losses extend… Contacts: Indices Edgeton Tsanga 0772277153 Previous Current Change (pts) % Change YTD % Industrial 135.53 134.85 0.6800 0.50 17.16 Chris Masendeke 0772135234 Mining 35.34 32.97 2.3700 6.71 54.02 Phenias Mandaza 0772144334 Coreen Madanha 0772144333 Despite the ray of interest by foreign investors in Zimbabwe and the equities market, the selloff prevailed to see the main stream Industrial Index shed 0.5% and settle at 134.85pts. -

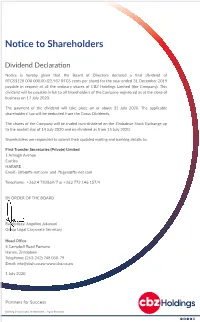

Notice to Shareholders

Notice to Shareholders Dividend Declaration Notice is hereby given that the Board of Directors declared a final dividend of NoticeRTGS$120 000 000.00 to (22.987 Shareholders RTGS cents per share) for the year ended 31 December 2019 payable in respect of allCoronavirus the ordinary shares of CBZ (Covid-19)Holdings Limited (the Company). This Delaydividend in will publication be payable in fullof toAudited all Shareholders Financial of the StatementsCompany registered as at the close of forbusiness year on ended 17 July 312020. AdviceDecember 2019 for the Public CoronavirusWash (Covid-19) your hands frequently The payment of the dividendRegularly willand thoroughlytake place cleanon or your about hands 31 with July an 2020.alcohol-based The applicable The Board of Directors (the “Board”) of CBZ Holdings Limited (the “Company”) wishes to shareholders’Advice tax forwill behand deductedthe rub orPublic fromwash the them Gross with Dividends. soap and water. advise its shareholders that the Company was not able to publish its Audited Financial Wash your hands frequently Statements for the year endedMaintain 31 Decembersocial distancing 2019 (the “Financial Statements” on or beforeRegularlyThe shares 30 and April of thoroughly the2020. Company clean your will handsbe traded with an cum-dividend alcohol-based on the Zimbabwe Stock Exchange up handto the rub market or wash day them of with14Maintain July soap 2020 and at water. leastand ex-dividend 1 metre (3 feet) as from distance 15 July between 2020. yourself and anyone who is coughing or sneezing. TheMaintain Company social is distancing yet to reach an agreement with its External Auditors on the accounting Shareholders are requested to submit their updated mailing and banking details to: forMaintain legacy at debtsleast 1 andmetre this (3 Avoidhasfeet) resulted distance touching inbetween the eyes, delay yourself nose in publication, and and mouthanyone whoof the Financial Statements.is coughing or sneezing. -

2019 Integrated Annual Report Performance Highlights

2019 INTEGRATED ANNUAL REPORT PERFORMANCE HIGHLIGHTS OPERATIONAL PERFORMANCE RATINGS AND ACCREDITATIONS Delivered Externally rated: DBSA foreign currency rating is Baa3 (Moody’s) R37 billion A+ rating from AADFI PSGRS in total infrastructure, unlocked Global Environmental Facility accreditation Green Climate Fund EU 6-pillar accreditation Total disbursements of R9 billion Projects to the value of R6.8 billion ACCOLADES AND AWARDS reached commitment stage African Renewable Energy Programme Award, from Project Finance International for project financing of Funds catalysed to the value of over 14 renewable energy projects in Round Four of the REIPPPP, including the Sirius Solar, Dyasons Klip 1 and 2 photovoltaic projects developed by Scatec Solar. Throughout our 2019 Integrated Annual Report, the following R16.8 billion icons are used to show connectivity between sections. Delivered GOVERNANCE Indicates a page reference for further Indicates a website reference where information which can be found elsewhere R3.5 billion more information can be found. in infrastructure implementation support Unqualified audits received since the in this reporting suite. inception of the DBSA Zero fruitless and wasteful expenditure R0.9 billion during the financial year under review Infrastructure unlocked for under-resourced municipalities A strong, ethical and diverse Board OUR STRATEGIC OBJECTIVES DEVELOPMENT IMPACT 2 Sustained growth in Providing integrated developmental impact infrastructure solutions Maintain financial Sustainability sustainability innovations -

WEEKLY AFRICAN FOOTPRINT TRADING This Week’S Leading Headlines Across the African Capital Markets

SECURITIES AFRICA PAN-AFRICA RESEARCH & CAPITAL MARKETS WEEKLY AFRICAN FOOTPRINT TRADING This Week’s Leading Headlines Across the African Capital Markets We have included summaries for the countries listed below, please click on the country name should you wish to navigate to it directly: Botswana Mauritius Egypt Nigeria Ghana Tanzania Kenya Zambia Malawi Zimbabwe AFRICA STOCK EXCHANGE PERFORMANCE CURRENCIES WTD % Change YTD % Change 25-Apr-14 2-May-14 WTD % YTD % Cur- Country Index 25-Apr-14 2-May-14 Local USD Local USD rency Close Close Change Change Botswana DCI 8890.16 8848.28 -0.47% 0.25% -2.27% -1.84% BWP 8.67 8.61 - 0.72 - 0.43 Egypt CASE 30 8294.88 8308.15 0.16% 0.32% 22.49% 21.55% EGP 6.98 6.97 - 0.16 0.77 Ghana GSE Comp Index 2276.12 2255.27 -0.92% -1.67% 5.13% -11.67% GHS 1.87 2.81 0.77 19.03 Ivory Coast BRVM Composite 239.85 229.85 -4.17% -3.75% -0.94% -0.08% CFA 474.65 472.57 - 0.44 - 0.86 Kenya NSE 20 4956.78 4959.91 0.06% -0.14% 0.67% -0.01% KES 85.49 85.66 0.21 0.68 Malawi Malawi All Share 13087.48 13089.06 0.01% 1.38% 4.45% 11.34% MWK 392.38 387.08 - 1.35 - 6.18 Mauritius SEMDEX 2082.25 2065.18 -0.82% -0.43% -1.46% -1.05% MUR 29.01 28.90 - 0.39 - 0.41 SEM 7 407.35 404.77 -0.63% -0.24% 0.28% 0.69% Namibia Overall Index 1109.87 1123.69 1.25% 2.13% 12.71% 12.58% NAD 10.59 10.50 - 0.86 0.12 Nigeria Nigeria All Share 38898.14 38572.20 -0.84% 0.00% -6.67% -6.25% NGN 160.17 158.82 - 0.84 - 0.45 Swaziland All Share 284.32 284.32 0.00% 0.87% -0.47% -0.59% SZL 10.59 158.82 - 0.86 0.12 Tanzania TSI 2988.22 3012.36 0.81% 0.79% 5.94% -

The Daily Economic and Business News Update, Friday, 14 June 2019

Group Corporate Strategy ZB Financial Holdings Limited 1st Floor, 21 Natal 21 Natal Road, Belgravia, Box 3198, Harare Tel: +263 (0)8677002001 The Daily Economic and Business News Update, Friday, 14 June 2019 Foreign Currency, Money, Equities & Commodities Markets Overview Foreign Currency Markets International Stock Markets Year–On-Year Inflation Rates Currency 14-06-19 13-06-19 Index 13-06-19 12-06-19 Change Country Rate USD/RTGS 6.0000 6.0000 Dow Jones 26,106.77 26,004.83 +0.39% Zimbabwe 75.86%Apr USD/ ZAR 14.8473 14.9121 NASDAQ 7,837.13 7,792.72 +0.57% South Africa 4.4%Apr Apr EUR/ USD 1.1276 1.1298 FTSE All Share 4,022.84 4,024.80 -0.05% Malawi 9.1% GBP/USD 1.2673 1.2681 Nikkei 225 21,101.86 21,014.55 +0.42% Zambia 16 8.0% May USD /BWP 10.9409 10.8932 DAX 12,169.05 12,115.68 +0.44% Botswana 2.5% Apr Old Mutual Implied Exchange Rates Mozambique 2.42%May Currency 13-06-19 12-06-19 May 2019 Apr 2019 Mar 2019 Feb 2019 Namibia 4.1% May USD/ZWL 9.4462 9.4034 9.7191 6.1291 5.4150 4.4057 Kenya 5.49% May ZWL/ZAR 1.5639 1.5914 1.2609 1.2938 1.3073 3.1868 Ghana 9.5% Apr Regional Stock Markets Nigeria 11.37%Apr Index 13-06-19 12-06-19 Change Interest rates 13-06-19 Brazil 4.66%May ZSE Industrial Index 668.49 646.85 +3.35% SARB Prime Rate 10.25% China 2.7%May ZSE Mining Index 248.51 248.51 0.00% BOB Prime Rate 5.00% Canada 2.0%Apr ZSE All Share 200.22 193.81 +3.31% LIBOR One Month 2.411% Germany 1.4%May JSE All Share 58,697.63 58,710.55 -0.02% LIBOR Three Month 2.428% Australia 1.3%Apr Ghana SE-CI 2,414.11 2,422.68 -0.35% LIBOR One Year 2.333% U.K. -

Final Annual Report 28

Annual Report TABLE OF CONTENTS 1. GROUP SALIENT FEATURES 2 2. GROUP STRUCTURE 3 3. CHAIRMAN’S STATEMENT 4 4. GROUP CHIEF EXECUTIVE OFFICER’S REPORT 7 5. MANAGING DIRECTOR’S REPORT – CBZ BANK LIMITED 9 6. MANAGING DIRECTOR’S REPORT – CBZ BUILDING SOCIETY 11 7. MANAGING DIRECTOR’S REPORT – CBZ ASSET MANAGEMENT (PVT) LTD 13 8.MANAGING DIRECTOR’S REPORT – OPTIMAL INSURANCE COMPANY (PVT) LTD 15 9. ANALYSIS OF SHAREHOLDERS 17 10. CORPORATE GOVERNANCE STATEMENT 18 11. STATEMENT OF DIRECTORS’ RESPONSIBILITY 21 12. REPORT OF THE DIRECTORS 24 26 13. REPORT OF THE INDEPENDENT AUDITORS 14. FINANCIAL STATEMENTS: CONSOLIDATED INCOME STATEMENT 28 CONSOLIDATED BALANCE SHEET 29 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY 30 CONSOLIDATED CASH FLOW STATEMENT 31 15. GROUP ACCOUNTING POLICIES 32 16. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 44 17. RISK MANAGEMENT REPORT 61 18. COMPANY BALANCE SHEET 67 19. NOTICE TO MEMBERS 68 20. SHAREHOLDERS’ CALENDAR 69 21. COMPANY DETAILS 70 CBZ Holdings 2008 1 Annual Report GROUP SALIENT FEATURES Historical Cost 2008 2007 2006 $ ‘Quint $ ‘Quint $ ‘Quint Total assets 5 467 558 - - Total net advances 431 124 - - Impairment losses on advances 9 803 - - Gross advances 443 198 - - Total deposits 1 390 280 - - profit after taxation 975 081 - - Capital adequacy (%) – CBZ Bank 22.20 18.60 32.80 Capital adequacy (%) – CBZ Building Society 65.00 51.00 61.00 Headline earnings per share ($’ trillion) 1 426 - - Dividends per share (cents) - - - Dividend cover (times) - - - Return on average assets excluding acceptances (%) 35.67 -

WT/TPR/S/398/Rev.1 30 November 2020 (20-8614) Page

WT/TPR/S/398/Rev.1 30 November 2020 (20-8614) Page: 1/119 Trade Policy Review Body TRADE POLICY REVIEW REPORT BY THE SECRETARIAT ZIMBABWE Revision This report, prepared for the third Trade Policy Review of Zimbabwe, has been drawn up by the WTO Secretariat on its own responsibility. The Secretariat has, as required by the Agreement establishing the Trade Policy Review Mechanism (Annex 3 of the Marrakesh Agreement Establishing the World Trade Organization), sought clarification from Zimbabwe on its trade policies and practices. Any technical questions arising from this report may be addressed to: Mr. Jacques Degbelo (tel.: 022 739 5583), Mr. Thomas Friedheim (tel.: 022 739 5083), and Ms. Catherine Hennis-Pierre (tel.: 022 739 5640). Document WT/TPR/G/398 contains the policy statement submitted by Zimbabwe. Note: This report was drafted in English. WT/TPR/S/398/Rev.1 • Zimbabwe - 2 - CONTENTS SUMMARY ........................................................................................................................ 7 1 ECONOMIC ENVIRONMENT ........................................................................................ 10 1.1 Main Features of the Economy .....................................................................................10 1.2 Recent Economic Developments ...................................................................................10 1.2.1 Monetary and exchange rate policies ..........................................................................14 1.2.2 Fiscal policy ............................................................................................................17