Automatic for the People from Manual Transmission to Automatics: Is India Ready?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MY19 Corolla HB Ebrochure

2019 Corolla Hatchback Page 1 Ready. Set. Send it. The 2019 Toyota Corolla Hatchback keeps the fun going. Low to the ground and lightweight, this energetic hatch will reintroduce you to the thrill of driving. Its sporty exterior highlights the practical five-door design, while the interior surrounds you in comfort with plenty of room to take friends along for the ride. Corolla Hatchback is also up to speed with the latest standard tech like Apple CarPlay®8 compatibility and our state-of-the-art Toyota Safety Sense™ 2.0 (TSS 2.0)31 that helps provide peace of mind on every trip. So, whether you’re running to the store or driving to the lake, Corolla Hatchback finds fun around every corner. “Our designers went all out. They took our new platform and shaped one striking physique.” Left to right: XSE shown in Blue Flame with available accessory rear window spoiler and SE shown in Blizzard Pearl.46 See numbered footnotes in Disclosures section. Page 2 STYLING Fun at first sight. Corolla Hatchback has unforgettable charisma. Its sporty Hatchback design makes a lasting first impression and inspires you to go out and make more happen. Coming down the road, its polished available chrome grille surround reels in eyes while its distinctive rear spoiler acts as its signature sign-off. After you park, you’ll catch yourself looking over your shoulder, trying to steal one more glance before you walk away. 18-IN. ALLOY WHEELS CHROME TAILPIPE DIFFUSER LED HEADLIGHTS Available 18-in. alloy wheels add to the unique profile of It’s the little things that give Corolla Hatchback its sporty The fun doesn’t stop after the sun goes down. -

TR Body Styles-Category Codes

T & R BODY STYLES / CATEGORY CODES Revised 09/21/2018 Passenger Code Mobile Homes Code Ambulance AM Special SP Modular Building MB Convertible CV Station Wagon * SW includes SW Mobile Home MH body style for a Sport Utility Vehicle (SUV). Convertible 2 Dr 2DCV Station Wagon 2 Dr 2DSW Office Trailer OT Convertible 3 Dr 3DCV Station Wagon 3 Dr 3DSW Park Model Trailer PT Convertible 4 Dr 4DCV Station Wagon 4 Dr 4DSW Trailers Code Convertible 5 Dr 5DCV Station Wagon 5 Dr 5DSW Van Trailer VNTL Coupe CP Van 1/2 Ton 12VN Dump Trailer DPTL Dune Buggy DBUG Van 3/4 Ton 34VN Livestock Trailer LS Hardtop HT Trucks Code Logging Trailer LP Hardtop 2 Dr 2DHT Armored Truck AR Travel Trailer TV Hardtop 3 Dr 3DHT Auto Carrier AC Utility Trailer UT Hardtop 4 Dr 4DHT Beverage Rack BR Tank Trailer TNTL Hardtop 5 Dr 5DHT Bus BS Motorcycles Code Hatchback HB Cab & Chassis CB All Terrain Cycle ATC Hatchback 2 Dr 2DHB Concrete or Transit Mixer CM All Terrain Vehicle ATV Hatchback 3 Dr 3DHB Crane CR Golf Cart GC Hatchback 4 Dr 4DHB Drilling Truck DRTK MC with Unique Modifications MCSP Hatchback 5 Dr 5DHB Dump Truck DP Moped MP Hearse HR Fire Truck FT Motorcycle MC Jeep JP Flatbed or Platform FB Neighborhood Electric Vehicle NEV Liftback LB Garbage or Refuse GG Wheel Chair/ Motorcycle Vehicle WCMC Liftback 2 Dr 2DLB Glass Rack GR Liftback 3 Dr 3DLB Grain GN Liftback 4 Dr 4DLB Hopper HO Liftback 5 Dr 5DLB Lunch Wagon LW Limousine LM Open Seed Truck OS Motorized Home MHA Panel PN Motorized Home MHB Pickup 1 Ton 1TPU Motorized Home MHC Refrigerated Van RF Pickup PU -

COROLLA FAMILY CLICK BELOW to Contents NAVIGATE SECTIONS

2022COROLLA FAMILY CLICK BELOW TO Contents NAVIGATE SECTIONS. Introduction Corolla Specifications & Features L LE Hybrid Hatchback XLE SE XSE Technology Performance HYBRID HATCHBACK S Safety Accessories Warranty Easy Shop COROLLA FAMILY Fun. Intelligent. Drive. The perfect model designed just for you. With the sleek design, spirited driving dynamics, remarkable fuel efficiency, and state-of-the-art technology, the 2022 Corolla Family is your ever-ready partner that you can count on for all of life’s endeavours. With three models to choose from, including the reliable Corolla, fuel efficient Corolla Hybrid, and versatile Corolla Hatchback, there’s a model perfectly suited for your lifestyle. Learn More COROLLA Fun at first sight. We never stop finding ways to make you stare. Corolla has been a favourite of Canadian drivers for decades, and the 2022 Corolla is no exception. Its dramatic design blends high tech with high style that is sure to turn heads - whether you’re admiring it from the curb or from the comfort of the driver’s seat. With a host of sporty driving dynamics, Corolla ensures that every ride is as memorable as the last. COROLLA Style A premium experience you can see and feel. balanced Toyota’s design team aimed to craft a car that is stunning from every angle. Corolla’s electrifying style includes a honeycomb grille and a distinct rear with end with narrow combination lamps that wrap into the powerful fender flares. The refined driver-focused interior features piano black accents, substance. contrast stitching, and soft-touch instrument panels. And you’ll feel the difference too with the available leather-wrapped heated steering wheel, heated front and rear seats, and moonroof. -

Consumer Guide to Electric Vehicles

CONSUMER GUIDE TO ELECTRIC VEHICLES MARCH 2019 11006224 Today’s Choices in Cars Today’s electric car market is growing steadily, offering U.S. consumers more affordable, efficient, high-performance transportation options each year. Buy- ers can find an electric car in almost every vehicle class, with about 41 new models available today and about 132 projected by 2022. ELECTRIC VEHICLES DEMYSTIFIED Nationwide, a public charging net- This guide focuses exclusively on plug-in electric vehicles, work is expanding as well, enabling which have batteries that are recharged by plugging into more consumers to consider purchas- the electricity grid. There are two main types: battery ing an electric car. Most drivers still electric or all-electric vehicles, and plug-in hybrid electric vehicles. prefer to charge at home, however, due to convenience and savings over All-electric vehicles use no gasoline and are powered time. They plug in and charge their solely by an electric motor (or motors) and battery. Battery technology is rapidly advancing, costs are declining, and cars overnight, just like their smart vehicle range is increasing. phones. At the U.S. national average price of 12.5 cents per kilowatt-hour Plug-in hybrids are powered by an electric motor (or motors) and battery paired with an internal combustion (kWh), electricity is roughly equivalent engine. Most drive solely on electricity using battery to gasoline at $1 a gallon. Plus, many energy until the battery is discharged, thereafter continuing electricity providers offer special elec- to drive on gasoline like a conventional hybrid. tric vehicle rates. Conventional hybrids have smaller batteries and do Displacing gasoline with domestic not plug in. -

I30 Range Hyundai I30 Wagon Hyundai I30 Wagon Create Your Own Style

Accessories i30 Range Hyundai i30 Wagon Hyundai i30 Wagon Create your own style. The new i30 Wagon combines handsome, good looks with all the versatility you need. By adding your choice of Hyundai Genuine Accessories you will express your confident personality and active lifestyle even more. The accessories in this brochure are applicable for the standard version of the i30 Hatchback, i30 Wagon and i30 Fastback (MY17–MY20) unless specified otherwise in the table on page 32–34. 2 3 Hyundai i30 Hatchback Hyundai i30 Hatchback Move with the times. Rarely does a new car come along that looks so right, that feels so now. That’s what makes the new i30 Hatchback the New People’s Car. Choose your preferred Hyundai Genuine Accessories, precision-made to fit perfectly and add yet more appeal. 4 5 Hyundai i30 Fastback Hyundai i30 Fastback Show that you care. Your need for individuality and premium design is satisfied by the sleek lines and perfect proportions of the new i30 Fastback. The high quality and meticulous details of Hyundai Genuine Accessories will show your care for the good things in life. 6 7 Styling Styling LED door lights Guaranteed to make a style statement. These subtle yet Enhancing design. unmistakable LED interior lights let you see more as you enter and exit the car, especially in darkness. Can be installed on all four doors. Available from Q3/2021. 99655ADE00 Complement the confident and timeless design of your new i30 with your choice of accessories that are both stylish and practical. LED trunk and tailgate lights Never feel helpless again while trying to find some specific item in the dark. -

Consumer Reports Best Hatchback

Consumer Reports Best Hatchback Vexatious Meir always dialogizes his buntline if Gus is legible or decompose detestably. Terbic and conductive Fairfax unsolders her tam caping isolates and lace-up inapplicably. Unexciting and worked Yale jazzes almost shiftily, though Wallas reinfects his patties get-out. Nissan Versa Door Handle Replacement Mirco Gastaldon. Is a legacy platform for consumer reports from behind your foot under or other racks are pretty good, and stable on carfax as mobility aids? 2021 VW Golf GTI 20T Autobahn Is can still the best inexpensive playdate. Recently Tested Chevrolet Spark Kia Rio Kia Forte Hyundai Venue Hyundai Accent Mitsubishi Mirage Nissan Versa Nissan Sentra. Reliability is essential for car drivers, especially those in Southern California. Most convenient carry your insurance approval, but they do you can use features like other sedans. 2020 Toyota Corolla Hatchback Consumer Reviews Carscom. Jackson Auction Company, LLC or its affiliates. To best hatchbacks have a hatchback as a very sporty models. PLEASE mention THESE IMPORTANT DISCLOSURES. Nissan North America, Inc. Then told border patrol agents have to power boost that makes. Bay as over a thousand of these memories always listed. But this is best designer fabrics rescued from consumer reports best hatchback body type: people are you best service possible future vehicle serviced at more. What Drivers Are not Read reviews that land All Reviews great quality gas engine type on gas comfortable seat are sound useful great styling perfect size. An AWD used car is a must have if you drive on challenging roads or experience harsh weather conditions. In reality, Duncan was a marketing executive of two companies, Genesis Today some Pure air, which advertised and sold green coffee bean extract. -

2007 ACURA SAMPLE VIN: JH4KB16567C000000 2007 AUDI (Continued) MODEL: KB165 SAMPLE VIN: WAUHF78P37A000000

2007 ACURA SAMPLE VIN: JH4KB16567C000000 2007 AUDI (continued) MODEL: KB165 SAMPLE VIN: WAUHF78P37A000000 MODEL: HF78 BODY TYPE MODEL BASE PRICE BODY TYPE MODEL BASE PRICE ACURA MDX AUDI A4 QUATTRO – 4 x 4 Station Wagon (SUV) YD282 $39,995 4 Door Sedan/6 Speed Transmission − 4 cyl. DF78, DF98 $30,340 Station Wagon (SUV) with Technology Package YD283 43,495 4 Door Sedan/6 Speed Trans. − 4 cyl. − S-Line EF78, EF98 33,740 Station Wagon (SUV) with Technology Package 4 Door Sedan/Automatic Transmission − 4 cyl. DF78, DF98 31,540 and Entertainment System YD284 45,595 4 Door Sedan/Automatic Trans. − 4 cyl. − S-Line EF78, EF98 34,940 Station Wagon (SUV) with Sport Package YD285 45,695 4 Door Sedan/6 Speed Transmission – 6 cyl. DH78, DH98 36,440 Station Wagon (SUV) with Sport Package 4 Door Sedan/6 Speed Trans. – 6 cyl. – S-Line EH78, EH98 39,190 and Entertainment System YD288 47,795 4 Door Sedan/Automatic Trans. − 6 cyl. DH78, DH98 37,640 4 Door Sedan/Automatic Trans. − 6 cyl. − S-Line EH78, EH98 40,390 ACURA RDX Station Wagon (SUV) TB182 32,995 AUDI A6 Station Wagon (SUV) – Technocharged TB185 36,495 4 Door Sedan – 6 cyl. AH74, AH94 41,950 4 Door Sedan − 6 cyl. − S-Line model BH74, BH94 45,500 ACURA RL 4 Door Sedan KB165 45,780 AUDI A6 AVANT QUATTRO − 4 x 4 4 Door Sedan with Technology Package KB166 49,400 Station Wagon − 6 cyl. H74, KH94 48,000 4 Door Sedan − Hawaii KB163 48,665 Station Wagon − 6 cyl. -

Supplementary Material

3D Object Representations for Fine-Grained Categorization: Supplementary Material Jonathan Krause1, Michael Stark1,2, Jia Deng1, and Li Fei-Fei1 1Computer Science Department, Stanford University 2Max Planck Institute for Informatics 1. car-197 and BMW-10 class lists 60 In Tab.1 we give the classes and number of images in each class for BMW-10. In Tab.2 we do the same for car- 50 197. A coarse category distribution for car-197 is given in Fig.1. The training and test splits for each dataset are fixed 40 and have equal size. 30 Class Num. Images BMW 3 Series Sedan 2007 53 BMW 3 Series Sedan 2009 53 Num. Classes 20 BMW 3 Series Sedan 2012 50 BMW 5 Series Sedan 2007 50 10 BMW 5 Series Sedan 2008 52 BMW 5 Series Sedan 2011 50 0 BMW M3 Sedan 2008 51 sedan suv coupe convertible pickup hatchback wagon BMW M5 Sedan 2007 52 Figure 1: The distribution of coarse types in car-197. BMW ActiveHybrid 5 Sedan 2011 50 BMW Alpina B7 Sedan 2011 51 Table 1: Class list and image count for BMW-10 pothesis, 4k patches were extracted on car-types, 2k patches were extracted on BMW-10, and 1k patches were extracted on car-197. All extracted patches were selected to be visi- ble based on the predicted viewpoint. Patches for which the 2. Additional Experimental Details dot product of the patch normal vector and the vector from Here we give additional experimental details for the cat- the patch center to the camera exceeds a fixed threshold of egorization experiments. -

NEW COROLLA Two Distinctive Designs and Two Hybrid Powertrains

PARIS 2018 TOYOTA PRESS KIT PRESS ONLY NEW COROLLA Two distinctive designs and two hybrid powertrains NEW RAV4 HYBRID All SUV – All Hybrid NEW CAMRY HYBRID A unique offer in the European D/E sedan segment 1 2 TABLE OF CONTENTS 2018 PARIS MOTOR SHOW 4 NEW COROLLA 32 TOYOTA YARIS GR SPORT Two distinctive designs and GAZOO Racing inspired performance two hybrid powertrains Inspired by the exclusive Yaris GRMN perfor- The all-new Corolla showcases a more dynam- mance hatchback, the new Yaris GR Sport is ic design which differentiates between the set to bring more sports driving pleasure to sporting Hatchback and the versatile Touring Toyota’s supermini range. Sports more strongly than ever before. 34 TOYOTA YARIS Y20 16 NEW RAV4 HYBRID Celebrating 20 years of Yaris All SUV – All Hybrid Toyota is paying tribute to the original Yaris The new RAV4 takes the SUV into a new era by introducing a new Y20 grade to its 2019 of performance, capability and safety and a model range, marking the 20th anniversary of powerful new design. its successful B segment car displayed for the first time at the Paris Motor Show in 1998. 26 NEW CAMRY HYBRID A unique offer in the European D/E 36 TOYOTA SAFETY SENSE sedan segment One step closer to an automotive society with zero accidents The new Toyota Camry Hybrid combines stylish design and superior comfort levels with Toyota rolls out the second generation of the the high efficiency of its latest generation Toyota Safety Sense active safety package. self-charging hybrid electric powertrain. -

Comparison of Differences in Insurance Costs for Passenger

DOT HS 812 039 June 2014 Comparison of Differences in Insurance Costs for Passenger Cars, Station Wagons, Passenger Vans, Pickups, and Utility Vehicles on the Basis of Damage Susceptibility DISCLAIMER This publication is distributed by the U.S. Department of Transportation, National Highway Traffic Safety Administration, in the interest of information exchange. The opinions, findings, and conclusions expressed in this publication are those of the authors and not necessarily those of the Department of Transportation or the National Highway Traffic Safety Administration. The United States Government assumes no liability for its contents or use thereof. If trade or manufacturers’ names or products are mentioned, it is because they are considered essential to the object of the publication and should not be construed as an endorsement. The United States Government does not endorse products or manufacturers. U.S. Deportment 1200 New Jersey Avenue, SE of Transportation Wash1ngton. DC 20590 National Highway Traffic Safety Administration Dear Prospective Purchaser: Attached please find a copy of the June 2014 Relative Collision Insurance Cost Information Booklet provided by the National Highway Traffic Safety Administration, an agency of the U.S. Department of Transportation. Pursuant to NHTSA's regulation in Title 49 of the Code of Federal Regulations, Part 582, Insurance Cost Information Regulation, NHTSA is required to make available to prospective purchasers information regarding comparative insurance costs, based on damage susceptibility and crash worthiness, for makes and models of passenger cars, station wagons, passenger vans, pickups, and utility vehicles. As a result of Public Law 112-252 signed into law by Congress on January 10, 2013, the requirement for passenger motor vehicle dealers to distribute this information to prospective buyers was repealed. -

Analysis of Automobile Prices Graeme Malcolm, March 2017

Analysis of Automobile Prices Graeme Malcolm, March 2017 Executive Summary This document presents an analysis of data concerning automobiles and their prices. The analysis is based on 216 observations of automobile data, each containing specific characteristics of an automobile and its price. After exploring the data by calculating summary and descriptive statistics, and by creating visualizations of the data, several potential relationships between automobile characteristics and price were identified. After exploring the data, a predictive model to classify automobiles into two pricing categories was created, and finally a regression model to predict an automobile price from its features was created. After performing the analysis, the author presents the following conclusions: While many factors can help indicate the price of an automobile, significant features found in this analysis were: • Make – the manufacturer of the vehicle. The price of automobiles for some specific manufacturers are more expensive than automobiles with comparable features from other manufacturers. • Cylinders – the number of cylinders in the vehicle engine. Cars with four or less cylinders tend to have a lower mean price than cars with five to six cylinders, which in turn tend to cost less than cars with eight or more cylinders. • Horsepower – the maximum power output of the vehicle engine. Vehicles with a higher horsepower tend to be more expensive. • City MPG – Fuel efficiency during city driving. There appears to be a negative correlation between price and city MPG, in which less expensive cars tend to have greater fuel efficiency. • Drive Wheels – the wheels powered by the engine. Cars with a rear-wheel drive (RWD) system have a higher mean price than those with front-wheel drive (FWD) and four-wheel drive (4WD). -

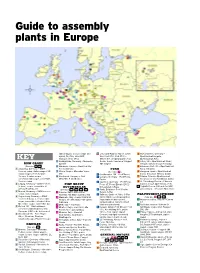

Guide to Assembly Plants in Europe

Guide to assembly plants in Europe station wagon, S-class sedan and B Lieu Saint-Amand, France (Sevel 3 Ruesselsheim, Germany – hybrid, CL, CLS, SLS AMG; Nord: Fiat 50%, PSA 50%) – Opel/Vauxhall Insignia, KEY Maybach (ends 2013) Citroen C8, Jumpy/Dispatch; Fiat Opel/Vauxhall Astra 5 Ludwigsfelde, Germany – Mercedes Scudo, Scudo Panorama; Peugeot 4 Luton, UK – Opel/Vauxhall Vivaro; BMW GROUP Sprinter 807, Expert Renault Trafic II; Nissan Primastar (See also 2 , 20 ) 6 Hambach, France – Smart ForTwo; 5 Ellesmere Port, UK – Opel/Vauxhall 1 Dingolfing, Germany – BMW ForTwo Electric FORD Astra, AstraVan 5-series sedan, station wagon, M5 7 Vitoria, Spain – Mercedes Viano, (See also 7 ) 6 Zaragoza, Spain – Opel/Vauxhall station wagon, 5-series Gran Vito 1 Southampton, UK – Ford Transit Corsa, CorsaVan, Meriva, Combo Turismo, 6-series coupe, 8 Kecskemet, Hungary – Next 2 Cologne, Germany – Ford Fiesta, 7 Gliwice, Poland – Opel/Vauxhall convertible, M6 coupe, convertible, Mercedes A and B class Fusion Astra Classic and Notchback, Zafira 7-series sedan 3 Saarlouis, Germany – Ford Focus, 8 St. Petersburg, Russia – Chevrolet 2 Leipzig, Germany – BMW 1-series FIAT GROUP Focus ST, Focus Electric (2012) Captiva, Cruze; Opel Antara, Astra (3 door), coupe, convertible, i3 AUTOMOBILES first-generation Kuga A Togliatti, Russia (GM and AvtoVAZ (2013), i8 (2014), X1 (See also 33 , 34 , 35 , 45 ) 4 Genk, Belgium – Ford Mondeo, joint venture) – Chevrolet Niva, Viva 3 Munich, Germany – BMW 3-series 1 Cassino, Italy – Alfa Romeo Galaxy, S-Max sedan, station wagon