Local Bodies of West Bengal Full Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Date Wise Details of Covid Vaccination Session Plan

Date wise details of Covid Vaccination session plan Name of the District: Darjeeling Dr Sanyukta Liu Name & Mobile no of the District Nodal Officer: Contact No of District Control Room: 8250237835 7001866136 Sl. Mobile No of CVC Adress of CVC site(name of hospital/ Type of vaccine to be used( Name of CVC Site Name of CVC Manager Remarks No Manager health centre, block/ ward/ village etc) Covishield/ Covaxine) 1 Darjeeling DH 1 Dr. Kumar Sariswal 9851937730 Darjeeling DH COVAXIN 2 Darjeeling DH 2 Dr. Kumar Sariswal 9851937730 Darjeeling DH COVISHIELD 3 Darjeeling UPCH Ghoom Dr. Kumar Sariswal 9851937730 Darjeeling UPCH Ghoom COVISHIELD 4 Kurseong SDH 1 Bijay Sinchury 7063071718 Kurseong SDH COVAXIN 5 Kurseong SDH 2 Bijay Sinchury 7063071718 Kurseong SDH COVISHIELD 6 Siliguri DH1 Koushik Roy 9851235672 Siliguri DH COVAXIN 7 SiliguriDH 2 Koushik Roy 9851235672 SiliguriDH COVISHIELD 8 NBMCH 1 (PSM) Goutam Das 9679230501 NBMCH COVAXIN 9 NBCMCH 2 Goutam Das 9679230501 NBCMCH COVISHIELD 10 Matigara BPHC 1 DR. Sohom Sen 9435389025 Matigara BPHC COVAXIN 11 Matigara BPHC 2 DR. Sohom Sen 9435389025 Matigara BPHC COVISHIELD 12 Kharibari RH 1 Dr. Alam 9804370580 Kharibari RH COVAXIN 13 Kharibari RH 2 Dr. Alam 9804370580 Kharibari RH COVISHIELD 14 Naxalbari RH 1 Dr.Kuntal Ghosh 9832159414 Naxalbari RH COVAXIN 15 Naxalbari RH 2 Dr.Kuntal Ghosh 9832159414 Naxalbari RH COVISHIELD 16 Phansidewa RH 1 Dr. Arunabha Das 7908844346 Phansidewa RH COVAXIN 17 Phansidewa RH 2 Dr. Arunabha Das 7908844346 Phansidewa RH COVISHIELD 18 Matri Sadan Dr. Sanjib Majumder 9434328017 Matri Sadan COVISHIELD 19 SMC UPHC7 1 Dr. Sanjib Majumder 9434328017 SMC UPHC7 COVAXIN 20 SMC UPHC7 2 Dr. -

Anita Mukherjee (1), Somnath Sen (2), and Saikat Kumar Paul

An Approach to Link Water Resource Management with Landscape Art to Enhance its Aesthetic Appeal, Ecological Utility and Social Benefits Authors: Anita Mukherjee (1), Somnath Sen (2), and Saikat Kumar Paul (3) Indian Institute of Technology Kharagpur, Architecture and Regional Planning, Kharagpur, India Email-ID: [email protected] (1), [email protected] (2), [email protected] (3) NEED OF THE STUDY: OBJECTIVE: PROPOSAL-I (Conceptual Layout): PROPOSAL-II (Conceptual Layout): Availability of water with acceptable quality is crucial for the health of the ecosystem, human health Study area-I: Study area-II: and well-being. Freshwater resource management is increasingly becoming challenging with the in- Incorporation of landscape art in developing detention basins and constructed wetlands, creasing quantity of grey water as a result of rapid urbanization coupled with industrialization, world- Kalyani-Gayespur Region of Nadia District of the state of West Bengal, India. West Bengal Singur Region of Hooghly District of West Bengal, India. using less used water-bodies ( paleo-channels, lakes or moribund channels) 21382 wide. 100575 Climate: Humid-Tropical Climate: Humid-Tropical for wastewater treatment and re-use, cases from West Bengal, India. 85503 Optimum reuse of all kind of wastewater is needed to enhance the urban water security and environ- Singur 57648 Annual Rainfall: 1353 mm Annual Rainfall: 1538 mm 19726 19537 mental sustainability. 52158 55048 58998 Average annual temperature: 28°c Average annual temperature: 26°c 1991 2001 2011 Kalyani Gayespur Agricultural Production Agricultural Non-point Source Pollution Increasing 1991 2001 2011 Sources of Secondary Data: Fig.12 Population growth in Singur Grey Water Census of India 2001 and 2011 Fig.6 Population growth in Kalyani and Gayespur Nadia district Increasing Footprints Kalyani Municipality (29.14 sq. -

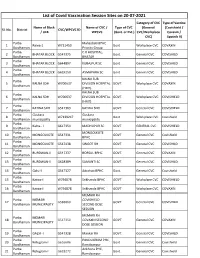

List of Covid Vaccination Session Sites on 20-07-2021 Category of CVC Type of Vaccine Name of Block Name of CVC / Type of CVC (General (Covishield / Sl

List of Covid Vaccination Session Sites on 20-07-2021 Category of CVC Type of Vaccine Name of Block Name of CVC / Type of CVC (General (Covishield / Sl. No. District CVC/WPCVC ID / ULB WPCVC (Govt. or Pvt.) CVC/Workplace Covaxin / CVC) Sputnik V) Purba Mahesbati BPHC 1 Raina-1 W711450 Govt Workplace CVC COVAXIN Bardhaman Priority Group Purba C.R.HOSPITAL, 2 BHATAR BLOCK G547375 Govt. General CVC COVISHILD Bardhaman BHATAR Purba 3 BHATAR BLOCK G644897 KUBAJPUR SC Govt. General CVC COVISHILD Bardhaman Purba 4 BHATAR BLOCK G629250 AYMAPARA SC Govt. General CVC COVISHILD Bardhaman KALNA SUB Purba 5 KALNA SDH W700637 DIVISION HOSPITAL GOVT. Workplace CVC COVAXIN Bardhaman (HMT) KALNA SUB Purba 6 KALNA SDH W700637 DIVISION HOSPITAL GOVT. Workplace CVC COVISHIELD Bardhaman (HMT) Purba 7 KATWA SDH G547363 KATWA SDH GOVT. General CVC COVISHIELD Bardhaman Purba Guskara Guskara 8 W7139247 Govt Workplace CVC Covishield Bardhaman municipality municipality Purba 9 Kalna - I G617354 MADHUPUR SC GOVT GENERAL CVC COVISHIELD Bardhaman Purba MONGOLKOTE 10 MONGOLKOTE G547331 GOVT General CVC Covishield Bardhaman BPHC Purba 11 MONGOLKOTE G547438 SINGOT RH GOVT General CVC COVISHILD Bardhaman Purba 12 BURDWAN-II G547337 BORSUL BPHC GOVT. General CVC COVAXIN Bardhaman Purba 13 BURDWAN-II G628389 SAMANTI SC GOVT. General CVC COVISHILD Bardhaman Purba 14 Galsi-II G547327 Adrahati BPHC Govt. General CVC Covishield Bardhaman Purba 15 Katwa-I W794878 Srikhanda BPHC GOVT Workplace CVC COVISHIELD Bardhaman Purba 16 Katwa-I W794878 Srikhanda BPHC GOVT Workplace CVC COVAXIN Bardhaman MEMARI RH Purba MEMARI COVISHIELD 17 G588860 GOVT General CVC COVISHILD Bardhaman MUNICIPALITY SECOND DOSE SESSION MEMARI RH Purba MEMARI 18 G547350 COVAXIN SECOND GOVT General CVC COVAXIN Bardhaman MUNICIPALITY DOSE SESSION Purba 19 GALSI - I G547328 Mankar RH GOVT. -

List of Rejected Candidate

PASCHIM MEDINIPUR ZILLA PARISHAD Midnapore :: 721101 LIST OF REJECTED CANDIDATE Name of the Post: - District Coordinator (Contractual) of BAY Cell Sl. Name of the Name of the Address No. Applicant Father / Mother 1. Prasenjit Hazra Prafulla Kr. Hazra 243/A/H-52, A.P.C. Road, Kolkata-700006, West Bengal Asoke Kumar Mitra Compound, Near Patwari Bhawan, P.O.- 2. Debjit Dutta Dutta Midnapore, Dist.- Paschim Medinipur, Pin- 721101 Chakra Mohan 39 East Aveneu, Bidhan Nagar, Midnapore, Dist.- 3. Pulak Das Das Paschim Medinipur, Pin- 721101 4. Monalisa Ghosh Kalisadhan Ghosh Vill+P.O.- Baragadra, P.S.- Sarenga, Dist.- Bankura Soumallya Pradip Kr. Uttar Vidyasagarpur, Ward No.- 2, Near Ankush Club, 5. Bhattacharjee Bhattacharjee Inda, Kharagpur, Pin- 721305 Saradapally, Inda, Kharagpur, Paschim Medinipur, West 6. Abhishek Dolui Dipak Dolui Bengal Avishek Ashis Kr. Vill- Parshana, P.O.+P.S.- Beliaberah, Dist.- Paschim 7. Dandapat Dandapat Medinipur, Pin- 721517 Sk. Alamgir At- Hatihalka, P.O.- Ramnagar, Gopinathpur, P.S.- 8. Sk. Safiruddin Ali Hossain Kotwali, Dist.- Paschim Medinipur, Pin- 721305 Vill- Puriha, P.O.- Kaiyar, P.S.- Khanda Ghosh, Dist.- 9. Arindam Roy Anil Kumar Roy Purba Bardhaman, Pin- 713423 Ashif Md. Rafique Vill+P.O.- Kalyanpur, Dist.- Howrah, P.S.- Bagnan, Pin- 10. Chowdhury Chowdhury 711303, West Bengal 443/20, Nayasomaz, P.O.- Kankpul, P.S.- Ashokenagar, 11. Atinta Bose Rabindranath Bose Dist.- North 24 Parganas, Pin- 743272, West Bengal Vill- Amlasuli, P.O.- Amlasuli, P.S.- Goaltore, Dist.- 12. Chiranjit Bisui Swapan Bisui Paschim Medinipur, Pin- 721157, State- West Bengal Vill- Dumurdiha, P.O.- Goaltore, P.S.- Goaltore, Dist.- 13. -

Jbi DEEP (2004-05) ''Ascnim I

I f i i Ife^Pi sb^l| Fi =S, , Wlllflt-Rf "if t f j jb i ><^** miI- al1 ai> '/^>1^1 r Li » iU DEEP (2004-05) ’’ascnim i INDEX Page Chapter Particulars No. Chapter -1 District Profile 1 -6 Chapter - II Educational Scenario of the District 7-22 Challenges, Thrust areas & Strategies for Chapter - III 23-28 Universalis ation o f Elementary Education Chapter - IV Major Interventions 29-70 Chapter - V Budget Paschim Medinipur SSA 2004-05 CHAPTER - 1 DISTRICT PROFILE Midnapore, the largest district of West Bengal was located in the South-Western side of the State. The district has been divided into two parts on 01-01-2002 namely, Purba Medinipur and Paschim Medinipur. In this Plan document the Annual Works Plan & Budget of Paschim Medinipur district has been taken into consideration for the year 2004-2005. Purulia and Bankura district in the North, Hooghly and Purba Medinipur in the East, States of Jharkhand and Orrisa in the West, Orrisa State and Purba Medinipur district in the South bound Paschim Medinipur. Paschim Medinipur district consists of 4 (four) Sub-divisions, 29 (twenty nine) Blocks and 8 (eight) Municipalities. The names of the Blocks and Municipalities (Sub-division wise) are as follows: - Midnapore Sadar Sub-divisiop: Kharagpur Sub-division: Blocks Blocks 1. Midnapore Sadar 1. Kharagpur-I 2. Salboni 2 . Kharagpur-II 3. Keshpur 3. Keshiary 4. Garhbeta-I 4. Debra 5. Garhbeta-II 5. Pingla 6. Garhbeta-III 6. Dantan-I Municipality 7. Dantan-ir' 7. Midnapore Municipality 8 . Sabang 9. Mohanpur 10. Narayangarh Municipality 11. -

Redalyc.A Framework for Assessing the Fiscal Health of Cities: Some

Urban Public Economics Review ISSN: 1697-6223 [email protected] Universidade de Santiago de Compostela España Bandyopadhyay, Simanti A Framework for Assessing the Fiscal Health of Cities: Some Evidence from India Urban Public Economics Review, núm. 19, julio-diciembre, 2013, pp. 12-43 Universidade de Santiago de Compostela Santiago de Compostela, España Available in: http://www.redalyc.org/articulo.oa?id=50430343002 How to cite Complete issue Scientific Information System More information about this article Network of Scientific Journals from Latin America, the Caribbean, Spain and Portugal Journal's homepage in redalyc.org Non-profit academic project, developed under the open access initiative A Framework for Assessing the Fiscal Health of Cities: Some Evidence from India Simanti Bandyopadhyay* The paper considers big urban agglomerations and smaller cities in India to propose a two stage methodology which explains the variations in fiscal health across cities. In the first stage the expenditure need and revenue capacities are estimated. In the second stage an econometric analysis is attempted to identify the determinants of fiscal health. The nature of relationship between the determinants and the fiscal health indicator is defined by the relative strength of the ‘revenue 12 13 effect’ and the ‘expenditure effect’. We find that the role of the higher tiers of the government is important in bigger and smaller cities in their financial management. For bigger cities, own revenues can also play an important role in improving fiscal health. In smaller cities the role of the demand indicators is not that prominent but the cost indicators are found to be more effective while in case of bigger agglomerations, the demand indicators can play a role. -

Report of the Earlier Finance Commissions

FOR OFFICIAL USE ONLY REPORT OF THE FOURTH STATE FINANCE COMMISSION WEST BENGAL PART – I Abhirup Sarkar Professor Indian Statistical Institute, Kolkata Chairman Dilip Ghosh, IAS (Retd.) Ruma Mukherjie Member Member Swapan Kumar Paul, WBCS (Exe.) (Retd.) Member-Secretary FEBRUARY, 2016 BIKASH BHAVAN, SALT LAKE, KOLKATA Preface The Fourth State Finance Commission of West Bengal was set up towards the end of April 2013. However, it was not until October that it got an office space and some minimal support staff to become functional. The five months lying between April and October was spent on informal discussions with academicians and government officials to gather some initial information and form preliminary ideas which helped the Commission in its later deliberations. The Commission had initially started with two members; subsequently the member secretary was appointed in June, 2013 and another member in July, 2014. Apart from commenting on the overall working of local governments in West Bengal and the condition of state finance, the Commission had to undertake three broad exercises. First, the total sum of money to be devolved to the rural and urban bodies that the Commission were to recommend had to be arrived at. Second, given the total recommended sum going to the rural bodies, the Commission had to determine the sharing rule of this sum across the three tiers of Panchayati Raj Institutions, namely the Zilla Parishad, the Panchayat Samiti and the Gram Panchayat. Third, the distribution of devolution within each tier and within the urban bodies had to be decided upon. The Commission’s recommended devolutions to the rural and urban bodies were founded on three basic considerations: (a) the actual amounts devolved in the past as a percentage of the state’s own tax revenue, especially the pattern of devolution made in the recent past; (b) the magnitude and pattern of devolution by the Fourteenth Finance Commission to the local bodies of the state; and (c) the actual requirement of the local bodies for their smooth functioning. -

Phase-V Route Plan/Ghatal/PGE-2019 A

PP lifting plan(05.05.2019)-Phase-V Route Plan/Ghatal/PGE-2019 A. Route Plan to Reach Ghatal D. C. from Different Point of Ghatal Block Registration No. Block & Route Edited No of No of Vehicle Route Details Officers details No. Route PP Vehicle Type 1 49 1 Bus WB 33-A/4872 1 Kuran to Ghatal DC via Kharar, Singhadanga, Borada Chawkan 4 42 1 Bus 2 Lakshmanpur to Ghatal DC via Irhpala bus stand, Kharar bus 29 1 Bus WB 33-C/2442 2 3 stand, Palpukur, Dhalgora, Borada Chawkan 28 1 Bus 5 Sultanpur to Ghatal DC via Kharar bus stand, Palpukur, Borada 38 1 Bus WB 33-C/0195 3 Chawkan Ghatal- Bubai 13 8 1 Bus Mondal, Mob- 8 Manoharpur to Ghatal DC via Konakpur, Maharajpur, Natuk, 10 1 Bus WB 33-C/9578 4 7044609400 10 Radhanagar. 25 1 Bus 11 Dewanchak to Ghatal DC via Gholsai, Kuthighat, Natuk, 50 1 Bus WB 33-D/4098 5 12 Radhanagar 27 1 Bus 6 6 Mansuka to Ghatal DC via Palpukur 20 1 Bus WB 33-A/7547 7 7 Harisingpur to Ghatal DC via Pratappur 12 1 Trekker To be provided by Block 9 8 Panna to Ghatal DC via Borada Chawakan 10 1 Bus WB 33-A/7516 B. Route Plan to Reach Ghatal D. C. from Different Point of Daspur-I Block WB 33/3226 1 1 Kantadarja to Ghatal DC via Supa, Narajole, Jhankra, Kalikapur 8 1 Bus Keshpur to Ghatal DC via Jhalka Bridge, Harirajpur,Narajole, WB 33-A/8173 2 2 36 1 Bus Daspur-I Balipota, Samat, Rajnagar, Bakultala Pradip Bose, 3 3 Khukurda to Ghatal DC via Sonamui, Goura, Daspur 76 2 Bus WB 19-H/5896 Mob- 4 Deleted from Daspur-I and Merged with Route no-2 of Daspur-II 14 1 Bus 9153367613 5 Dhankhal to Ghatal DC via Kankdari, Sarberia, Avirampur, Kalora, 45 1 Bus WB 33-A/7613 4 6 Sultannagar 14 1 Bus 7 5 Sagarpur to Ghatal DC via Hatgachia, Sahabazar, Daspur 10 1 Bus WB 33-A/5989 C. -

Sr. No. Branch ID Branch Name City Branch Address Branch Timing Weekly Off Micrcode Ifsccode

Sr. No. Branch ID Branch Name City Branch Address Branch Timing Weekly Off MICRCode IFSCCode RADHA Bhawan, First Floor, ADRA Raghunathpur Road, PO: ADRA 1 3694 Adra Adra Market, Dist: Purulia, PS: ADRA, Under ARRAH Gram Panchayat, West 9:30 a.m. to 3:30 p.m. 2nd & 4th Saturday and Sunday 723211202 UTIB0003694 Bengal, Pin: 723121. Alipurduar, West Bengal,Alipurduar Chowpothy, Near A/P/D/ Welfare Office,B/F/ Road, 2 729 Alipurduar Alipurduar 9:30 a.m. to 3:30 p.m. 2nd & 4th Saturday and Sunday 736211051 UTIB0000729 Po+Ps: Alipurduar, Dist: Jalpaiguri,Pin 736121, West Bengal Ground Floor, Multipurpose Building, Amta Ranihati Road,PS. Amta, Dist. Howrah, West 3 2782 Amta Amta 9:30 a.m. to 3:30 p.m. 2nd & 4th Saturday and Sunday 700211119 UTIB0002782 Bengal, Pin 711401 Ground Floor, Diamond Harbour Road, P.O. Sukhdevpur, Amtala, Dist. 24 Parganas 4 440 Amtala Amtala 9:30 a.m. to 3:30 p.m. 2nd & 4th Saturday and Sunday 700211032 UTIB0000440 (South), West Bengal Pin 743 503 5 2186 Andal Andal(Gram) Ground Floor, North Bazar, Near Lions Club, Burdwan, West Bengal, Pin 713321 9:30 a.m. to 3:30 p.m. 2nd & 4th Saturday and Sunday 713211801 UTIB0002186 Andul, West Bengal Anandamela, P.O. Andul/ Mouri, Ps. Sankrail, Dist. Howrah, West 6 874 Andul Andul 9:30 a.m. to 3:30 p.m. 2nd & 4th Saturday and Sunday 700211049 UTIB0000874 Bengal, Pin 711302 7 364 Arambagh Arambag Link Road, Arambagh ,Dist/ Hooghly, Pin 712 601,West Bengal 9:30 a.m. -

18Th ALL INDIA LIVESTOCK CENSUS, AGRICULTURE IMPLEMENTS

18th ALL INDIA LIVESTOCK CENSUS, AGRICULTURE IMPLEMENTS AND MACHINERY, FISHERY STATISTICS, WEST BENGAL TOTAL FEMALE CROSS-BRED CATTLE TOTAL FEMALE INDIGENOUS CATTLE TOTAL FEMALE BUFFALO District Name Municipality Name Not calved Total Not calved Total Not calved Total In Milk Dry In Milk Dry In Milk Dry once Breedable once Breedable once Breedable BANKURA BANKURA MUNICIPALITY 276 113 10 399 1,017 790 84 1,891 15 5 2 22 BANKURA BISHNUPUR MUNICIPALITY 493 261 62 816 559 757 120 1,436 34 12 0 46 BANKURA SONAMUKHI MUNICIPALITY 133 34 2 169 435 236 45 716 6107 BARDHAMAN ASANSOL MUNICIPAL CORPORATION 4,276 679 176 5,131 4,817 951 321 6,089 4,878 944 122 5,944 BARDHAMAN BARDHAMAN MUNICIPALITY 1,607 437 63 2,107 1,605 596 191 2,392 219 52 1 272 BARDHAMAN DAINHAT MUNICIPALITY 68 24 13 105 983 270 95 1,348 9 0 1 10 BARDHAMAN DURGAPUR MUNICIPAL CORPORATION 4,949 1,429 655 7,033 7,494 2,390 1,009 10,893 2,819 903 312 4,034 BARDHAMAN GUSKARA MUNICIPALITY 46 10 2 58 1,322 343 179 1,844 47 11 11 69 BARDHAMAN JAMURIA MUNICIPALITY 288 171 21 480 2,936 1,869 377 5,182 268 202 31 501 BARDHAMAN KALNA MUNICIPALITY 1,271 62 4 1,337 78 0 0 78 0000 BARDHAMAN KATOWA MUNICIPALITY 479 37 92 608 583 208 31 822 13 6 2 21 BARDHAMAN KULTI MUNICIPALITY 2,392 557 90 3,039 4,938 783 198 5,919 1,528 296 107 1,931 BARDHAMAN MEMARI MUNICIPALITY 127 55 3 185 431 168 14 613 12 5 0 17 BARDHAMAN RANIGANJ MUNICIPALITY 657 109 0 766 2,603 55 0 2,658 781 216 0 997 BIRBHUM BOLPUR MUNICIPALITY 97 52 1 150 1,574 897 23 2,494 77 57 7 141 BIRBHUM DUBRAJPUR MUNICIPALITY 45 23 0 68 255 -

Paschim Medinipur

District Sl No Name Post Present Place of Posting WM 1 Dr. Jhuma Sutradhar GDMO Ghatal S. D. Hospital WM 2 Dr. Papiya Dutta GDMO Ghatal S. D. Hospital WM 3 Dr. Sudip Kumar Roy GDMO Jhargram District Hospital WM 4 Dr. Susanta Bera GDMO Jhargram District Hospital Midnapore Medical College & WM 5 Dr. Krishanu Bhadra GDMO Hospital WM 6 Dr. Dipak Kr. Agarwal Specialist G & O Keshiary RH DH & FWS, PASCHIM WM 7 Gouri Sankar Das DPC MEDINIPUR DH & FWS, PASCHIM WM 8 Milan Kumar Choudhury, DAM MEDINIPUR DH & FWS, PASCHIM WM 9 Susanta Nath De DSM MEDINIPUR DH & FWS, PASCHIM WM 10 Sumit Pahari AE MEDINIPUR DH & FWS, PASCHIM WM 11 Tanmoy Patra SAE MEDINIPUR DH & FWS, PASCHIM WM 12 Somnath Karmakar SAE MEDINIPUR Computer DH & FWS, PASCHIM WM 13 Guru Pada Garai Assistant, RCH MEDINIPUR DH & FWS, PASCHIM WM 14 Ramkrishna Roy Account Assistant MEDINIPUR Garhbeta Rural WM 15 Anjan Bera BAM Hospital,Garhbeta - I block Kewakole WM 16 Manimay Panda BAM RH under Garhbeta-II block BH&FWS,Garhbeta-III, At- WM 17 Mrinal Kanti Ghosh BAM Dwarigeria B.P.H.C.,Paschim Medinipur. WM 18 Sohini Das BAM Salboni WM 19 Rajendra Kumar Khan BAM Deypara(Chandra)BPHC WM 20 Dev dulal Rana BAM Keshpur BH & FWS WM 21 Ambar Pandey BAM Binpur RH, Binpur-I BELPAHARI R.H. (BINPUR-II WM 22 AMIT SAHU BAM BH&FWS) CHILKIGARH BPHC UNDER WM 23 AMIT DANDAPAT BAM JAMBONI BLOCK Jhargram BH & FWS, at WM 24 Malay Tung BAM Mohanpur BPHC WM 25 Debapratim Goswami BAM Gopiballavpur-R.H. -

Market Survey Report Year : 2011-2012

GOVERNMENT OF WEST BENGAL AGRICULTURAL MARKET DIRECTORY MARKET SURVEY REPORT YEAR : 2011-2012 DISTRICT : NADIA THE DIRECTORATE OF AGRICULTURAL MARKETING P-16, INDIA EXCHANGE PLACE EXTN. CIT BUILDING, 4 T H F L O O R KOLKATA-700073 THE DIRECTORATE OF AGRICULTURAL MARKETING Government of West Bengal LIST OF MARKETS Nadia District Sl. No. Name of Markets Block/Municipality Page No. 1 Alaipur Beltala Market Chakdah 1 2 Anandanagar Bazar - do - 2 3 Balia Hat - do - 3 4 Banamali Kalitala Bazar - do - 4 5 Bela Mitra Nagar Bazar - do - 5 6 Bishnupur Hat - do - 6 7 Chaudanga Hat - do - 7 8 Chaugachha Naya Bazar - do - 8 9 Chaugachha Puratan Bazar - do - 9 10 Chuadanga Hat - do - 10 11 Dakshin Malopara Market - do - 11 12 Ghetugachi Market - do - 12 13 Gora Chand Tala Bazar - do - 13 14 Hingnara Bazar Hat - do - 14 15 Iswaripur Bazar - do - 15 16 Kadambo Gachi Bazar - do - 16 17 Kali Bazar - do - 17 18 Laknath Bazar - do - 18 19 Madanpur Market - do - 19 20 Narikeldanga Joy Bazar - do - 20 21 Netaji Bazar - do - 21 22 Padmavila Thakurbari Market - do - 22 23 Rasullapur Bazar - do - 23 24 Rasullapur Hat - do - 24 25 Rautari Bazar - do - 25 26 Saguna Bazar - do - 26 27 Sahispur Bazar - do - 27 28 Silinda Bazar - do - 28 29 Simurali Chowmatha Bazar - do - 29 30 Simurali Market - do - 30 31 Sing Bagan Market - do - 31 32 South Chandamari Market - do - 32 33 Sutra Hat - do - 33 34 Tangra Hat - do - 34 35 Tarinipur Hat - do - 35 36 Chakdah Bazar Chakdah Municipality 36 37 Sagnna Bazar ( Only Veg ) - do - 37 38 Sagnna Bazar ( Only Fruits ) - do - 38 39 Goyeshpur ( North ) Gayespur Municipality 39 40 Birohi Bazar Haringhata 40 41 Birohi Cattle Hat - do - 41 42 Boikara Hat - do - 42 43 Dakshin Dutta Para Hat - do - 43 44 Hapania Hat - do - 44 45 Haringhata Ganguria Bazar - do - 45 46 Jhikra Hat - do - 46 47 Jhikra Market - do - 47 48 Kalibazar Hat - do - 48 49 Kastodanga Bazar - do - 49 50 Kastodanga Hat - do - 50 51 Khalsia Hat - do - 51 52 Mohanpur Hat ( 7 No ) - do - 52 53 Mohanpur Market - do - 53 54 Nagarukhra Hat - do - 54 55 Nagarukhra Market - do - 55 Sl.