RETAIL VIEW: Super Supermarket Investor Nabs Pathmark and Wild Oats

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Of Counsel: Alden L

IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF COLUMBIA FEDERAL TRADE COMMISSION, ) ) Plaintiff, ) ) v. ) Civ. No. 1:07-cv-01021-PLF ) WHOLE FOODS MARKET, INC., ) REDACTED - PUBLIC VERSION ) And ) ) WILD OATS MARKETS, INC., ) ) Defendants. ) ~~~~~~~~~~~~) JOINT MEMORANDUM OF POINTS AND AUTHORITIES OF WHOLE FOODS MARKET, INC., AND WILD OATS MARKETS, INC. IN OPPOSITION TO MOTION FOR A PRELIMINARY INJUNCTION Paul T. Denis (DC Bar No. 437040) Paul H. Friedman (DC Bar No. 290635) Jeffrey W. Brennan (DC Bar No. 447438) James A. Fishkin (DC Bar No. 478958) Michael Farber (DC Bar No. 449215) Rebecca Dick (DC Bar No. 463197) DECHERTLLP 1775 I Street, N.W. Washington, DC 20006 Telephone: (202) 261-3430 Facsimile: (202) 261-3333 Of Counsel: Alden L. Atkins (DC Bar No. 393922) Neil W. Imus (DC Bar No. 394544) Roberta Lang John D. Taurman (DC Bar No. 133942) Vice-President of Legal Affairs and General Counsel VINSON & ELKINS L.L.P. Whole Foods Market, Inc. The Willard Office Building 550 Bowie Street 1455 Pennsylvania Avenue, N.W., Suite 600 Austin, TX Washington, DC 20004-1008 Telephone (202) 639-6500 Facsimile (202) 639-6604 Attorneys for Whole Foods Market, Inc. Clifford H. Aronson (DC Bar No. 335182) Thomas Pak (Pro Hae Vice) Matthew P. Hendrickson (Pro Hae Vice) SKADDEN, ARPS, SLATE, MEAGHER &FLOMLLP Four Times Square NewYork,NY 10036 Telephone: (212) 735-3000 [email protected] Gary A. MacDonald (DC Bar No. 418378) SKADDEN, ARPS, SLATE, MEAGHER &FlomLLP 1440 New York Avenue, N.W. Washington, DC 20005 Telephone: (202) 371-7000 [email protected] Terrence J. Walleck (Pro Hae Vice) 2224 Pacific Dr. -

Federal Court Rejects Ftc Request to Block Whole Foods — Wild Oats Supermarket Merger

CLIENT MEMORANDUM FEDERAL COURT REJECTS FTC REQUEST TO BLOCK WHOLE FOODS — WILD OATS SUPERMARKET MERGER On August 16, 2007, the United States District Court for the District of Columbia denied the request of the Federal Trade Commission (“FTC”) for a preliminary injunction to block the acquisition of Wild Oats Markets, Inc. by Whole Foods Market, Inc. Judge Paul Friedman’s detailed, 93-page opinion rejected the FTC’s fundamental argument against the merger: That it would lead to a virtual monopoly in a market for “premium natural and organic supermarkets” (“PNOS”) across the United States. The United States Court of Appeals for the District of Columbia Circuit denied the FTC’s motion for an injunction staying the transaction pending the FTC’s appeal, and the parties consummated the merger on August 27, 2007. Whole Foods is the largest operator of PNOS in the United States, having 194 stores. Wild Oats was the second largest PNOS operator in the United States, with 115 stores that were generally smaller in size and higher in price than Whole Foods stores. Both firms concentrated on selling natural and organic food items and emphasizing customer service, but both also carried a variety of non-natural foods items. As is often true in merger analysis, the pivotal question was how to define the relevant market affected by the merger. As Judge Friedman summarized the issue: In this case, if the relevant product market is, as the FTC alleges, a product market of ‘premium natural and organic supermarkets’ consisting only of the two defendants and two other non-national firms, there can be little doubt that the acquisition of the second largest firm in the market by the largest firm in the market will tend to harm competition in that market. -

Schedule 14A

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. __) Filed by the Registrant o Filed by a Party other than the Registrant ☑ Check the appropriate box: o Preliminary Proxy Statement o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) o Definitive Proxy Statement o Definitive Additional Materials ☑ Soliciting Material Pursuant to ss. 240.14a-12 Target Corporation (Name of Registrant as Specified In Its Charter) Pershing Square, L.P. Pershing Square II, L.P. Pershing Square International, Ltd. Pershing Square IV Trade-Co, L.P. Pershing Square IV-I Trade-Co, L.P. Pershing Square International IV Trade-Co, Ltd. Pershing Square International IV-I Trade-Co, Ltd. William A. Ackman Michael L. Ashner James L. Donald Ronald J. Gilson Richard W. Vague (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (check the appropriate box): ☑ No fee required. o Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: o Fee paid previously with preliminary materials. -

FTC V. Whole Foods Market (D.C. Cir.)

PUBLIC COPY - SEALED MATERIAL DELETED ORAL ARGUMENT NOT YET SCHEDULED No. 07-5276 IN THE UNITED STATES COURT OF APPEALS FOR THE DISTRICT OF COLUMBIA CIRCUIT FEDERAL TRADE COMMISSION, Plaintiff-Appellant, v. WHOLE FOODS MARKET, INC., and WILD OATS MARKETS, INC., Defendants-Appellees. Appeal from the United States District Court for the District of Columbia, Civ. No. 07-cv-Ol021-PLF PROOF BRIEF FOR APPELLANT FEDERAL TRADE COMMISSION JEFFREY SCHMIDT WILLIAM BLUMENTHAL Director General Counsel Bureau of Competition JOHN D. GRAUBERT KENNETH L. GLAZER Principal Deputy General Counsel Deputy Director JOHNF.DALY MICHAEL J. BLOOM Deputy General Counsel for Litigation Director of Litigation MARILYN E. KERST THOMAS J. LANG Attorney THOMAS H. BROCK Federal Trade Commission CATHARINE M. MOSCATELLI 600 Pennsylvania Ave., N.W. MICHAEL A. FRANCHAK Washington, D.C. 20580 JOAN L. HElM Ph. (202) 326-2158 Attorneys Fax (202) 326-2477 CERTIFICATE AS TO PARTIES, RULINGS, AND RELATED CASES Pursuant to Circuit Rule 28(1)(1), Appellant Federal Trade Commission certifies as follows: (A) PARTIES FEDERAL TRADE COMMISSION (Plaintiff) WHOLE FOODS MARKET, INC. (Defendant) WILD OATS MARKETS, INC. (Defendant) APOLLO MANAGEMENT HOLDING LP (Intervenor) DELHAIZE AMERICA. INC. (Interested Party) H.E. BUTT GROCERY COMPANY (Intervenor) KROGER CO. (Intervenor) PUBLIX SUPER MARKETS, INC. (Intervenor) SAFEWAY INC. (Intervenor) SUPERVALU INC (Intervenor) TRADER JOE'S COMPANY (Intervenor) TARGET CORPORATION (Movant) WAL-MART STORES, INC. (Intervenor) WINN-DIXIE STORES INC (Intervenor) WEGMANS FOOD MARKETS, INC. (Movant) AMICI CURIAE AMERICAN ANTITRUST INSTITUTE CONSUMER FEDERATION OF AMERICA ORGANIZATION FOR COMPETITIVE MARKETS (B) RULING UNDER REVIEW Federal Trade Commission v. Whole Foods Market, Inc., 502 F. -

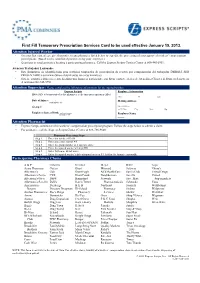

Express Scripts Prescription Form

First Fill Temporary Prescription Services Card to be used effective January 15, 2013. Attention Injured Worker • On your first visit, please give this notice to any pharmacy listed below to expedite the processing of your approved workers’ compensation prescriptions. (Based on the established parameters by your employer.) • Questions or need assistance locating a participating pharmacy: Call the Express Scripts Contact Center at 800-945-5951. Atencion Trabajador Lesionado: • Este formulario de identificación para servicios temporales de prescripción de recetas por compensación del trabajador DEBERÁ SER PRESENTADO a su farmacéutico al surtir su(s) receta(s) inicial(es). • Si tiene cualquier duda o necesita localizar una farmacia participante, por favor contacte al área de Atención a Clientes de Express Scripts, en el teléfono 866-945-5951. Attention Supervisor: Please complete the following information for the injured worker. Express Scripts Employee Information ID #: SSN to be presented to the pharmacy at the time prescription is filled First M Last Date of Injury: / / Mailing Address MM/DD/CCYY Group #: Street Address or PO Box City State Zip Employee Date of Birth: / / Employer Name MM/DD/CCYY Attention Pharmacist • Express Scripts administers this workers’ compensation prescription program. Follow the steps below to submit a claim. • For assistance, call the Express Scripts Contact Center at 888-786-9640. Pharmacy Processing Steps Step 1 Enter bin number 003858 Step 2 Enter processor control A4 Step 3 Enter the group number as it -

View Annual Report

United Natural Foods, Inc. ANNUAL REPORT [2004] Investment in the future a commitment to sustainable growth people • facilities • equipment • technology To be an Mission Statement enduring, To excel in the distribution of natural and organic foods and wellness products by fulfilling successful the highest standards for quality, consistency, product assortments, dependability, value-added and support services and integrity in our business profitable and personal relationships. To exceed the needs and expectations of all our stakeholders: our company. customers, suppliers, employees, shareholders, communities, the environment and the planet. To our customers To create partnering relationships development, and by providing com- of trust, integrity, customer satisfaction petitive, merit based compensation and loyalty. To provide the widest and benefits which rewards their good selection of natural and organic prod- work and dedication. ucts of the highest quality, consistently high in-stock levels, dependable on- To our shareholders time deliveries and highly competitive To exceed the expectations of our pricing, which allow our retailers to shareholders by delivering outstanding compete successfully and prosper. performance and commendable returns on their investments. To our suppliers To build and sustain fair and honest relationships and be a trusted, To our communities To be an outstanding partner in the dependable distribution resource communities where we work, supported by innovative and effective supporting them economically, being -

Former Pathmark & Waldbaums Stores Converted Into New Union

AFL-CIO, CLC RESTORED Former Pathmark & Waldbaums stores converted into new union supermarkets - See pages 6-9 THE OFFICIAL PUBLICATION OF UFCW LOCAL 1500 • MARCH 2016 • VOL. 50 • NO. 1 2 The Register March 2016 The Register 3 THE PRESIDENT’S PERSPECTIVE JUST FOR THE RECORD By Bruce W. Both By Anthony G. Speelman, Secretary-Treasurer @Aspeel1500 New York’sLocal Grocery Workers’1500 Union A COURT CASE TO CHANGE THE LABOR MOVEMENT 2016 CHALLENGES Friedrichs v. California Teachers Association aims to rewrite the rules how public unions operate The A&P bankruptcy is over. We saved nearly This is especially important to our union The company also recently announced it would 2,500 jobs and now it’s time to focus on what after the A&P bankruptcy. One year ago, 27% be purchasing the 70,000 square foot former A monumental case, posed to rewrite a 40-year compete is on the forefront of union-members across According to The New York Times, “A ruling in the challenges we face in 2016. of our members worked at Stop & Shop. Today Pathmark in East Meadow. The idea I’m getting precedent guiding public sector labor relations, will America. If unions are defunded, who then, fights for teachers’ favor would affect millions of government In 2014 we negotiated a three-year contract over 40% of our union works under the Stop & at is there’s a growing number of new grocery be ruled on later this summer by the five Republican- working men and women? workers and culminate a political and legal campaign with ShopRite. -

Supermarkets & Grocery Stores in the US

US INDUSTRY (NAICS) REPORT 44511 Supermarkets & Grocery Stores in the US In the bag: Rising discretionary income is expected to support revenue growth Cecilia Fernandez | November 2020 IBISWorld.com +1-800-330-3772 [email protected] Supermarkets & Grocery Stores in the US 44511 November 2020 Contents About This Industry...........................................5 Competitive Landscape...................................26 Industry Definition..........................................................5 Market Share Concentration....................................... 26 Major Players................................................................. 5 Key Success Factors................................................... 26 Main Activities................................................................5 Cost Structure Benchmarks........................................27 Supply Chain...................................................................6 Basis of Competition...................................................31 Similar Industries........................................................... 6 Barriers to Entry........................................................... 32 Related International Industries....................................6 Industry Globalization..................................................33 Industry at a Glance.......................................... 7 Major Companies............................................34 Executive Summary....................................................... 9 Major Players.............................................................. -

FBI File on Whole Foods Market, Inc

FBI file on Whole Foods Market, Inc. Obtained (via FOIA) and posted by AltGov2 www.altgov2.org U.S. Department of Justice Federal Bureau of Investigation Washington, D.C. 20535 November 30, 2018 MR. RUSS KICK POST OFFICE BOX 36914 TUCSON, AZ 85740 FOIPA Request No.: 1405742-000 Subject: Whole Foods Market Inc (1980 – Present) Dear Mr. Kick: The enclosed documents were reviewed under the Freedom of Information/Privacy Acts (FOIPA), Title 5, United States Code, Section 552/552a. Below you will find check boxes under the appropriate statute headings which indicate the types of exemptions asserted to protect information which is exempt from disclosure. The appropriate exemptions are noted on the enclosed pages next to redacted information. In addition, a deleted page information sheet was inserted to indicate where pages were withheld entirely and identify which exemptions were applied. The checked exemptions boxes used to withhold information are further explained in the enclosed Explanation of Exemptions. Section 552 Section 552a (b)(1) (b)(7)(A) (d)(5) (b)(2) (b)(7)(B) (j)(2) (b)(3) (b)(7)(C) (k)(1) (b)(7)(D) (k)(2) (b)(7)(E) (k)(3) (b)(7)(F) (k)(4) (b)(8) (k)(5) (b)(4) (b)(5) (b)(9) (k)(6) (b)(6) (k)(7) 29 pages were reviewed and 29 pages are being released. Below you will also find additional informational paragraphs about your request. Where applicable, check boxes are used to provide you with more information about the processing of your request. Please read each item carefully. Document(s) were located which originated with, or contained information concerning, other Government Agency [OGA]. -

Attachment a IIAS Standards Interest Group Participating Merchants for 2008

Attachment A IIAS Standards Interest Group Participating Merchants for 2008 Section 1 – Retailers Planning IIAS Standards Interest Group Support by January 1, 2008 Retailer Date Retailer Date ACME - SuperValu 12/1/2007 Longs Drug Stores 1/1/2008 Albertson’s – SuperValu 12/1/2007 Lucky – SuperValu 12/1/2007 A&P Supermarkets 1/1/2008 Macey’s 10/1/2007 Bigg’s – SuperValu 12/1/2007 Meijer 11/19/2007 Big Y Foods 1/1/2008 OSCO – SuperValu 12/1/2007 Brookshires 1/1/2008 Pak’ n Save Foods 1/1/2008 Buehler Food Markets 12/15/2007 Pathmark Stores 12/15/2007 Carrs 1/1/2008 Pavilions 1/1/2008 Cubs – SuperValu 12/1/2007 Price Chopper Supermarkets 1/1/2008 CVS Pharmacy 1/1/2008 Randalls 1/1/2008 Dan’s 10/1/2007 Rosauers/Super 1 Pharmacies 1/1/2008 Dick’s 10/1/2007 Roundy’s 1/1/2008 Dierbergs 1/1/2008 Safeway 1/1/2008 Discount Drug Mart 12/1/2007 Sam’s Club 1/1/2008 Dominick’s 1/1/2008 Sav-A-Center 1/1/2008 Farm Fresh – SuperValu 12/1/2007 Shaws – SuperValu 12/1/2007 Food Basics 1/1/2008 Shop & Save - SuperValu 12/1/2007 Genuardi’s 1/1/2008 ShopKo Stores/ShopKo Express 11/15/2007 Giant Eagle 12/1/2007 Shoppers – SuperValu 12/1/2007 Giant Food 12/31/2007 Star Market – SuperValu 12/1/2007 Hannaford Food and Drug 1/1/2008 Stop & Shop Supermarket Company 12/31/2007 Harris Teeter, Inc 1/1/2008 Super 1 Foods 1/1/2008 H-E-B 1/1/2008 SuperFresh 1/1/2008 Hen House Markets 1/1/2008 Sunflower- SuperValu 12/1/2007 Hornbachers – SuperValu 12/1/2007 Sweetbay Supermarkets 1/1/2008 Hy-Vee Drug Stores 1/1/2008 Target Stores 10/1/2007 Hy-Vee Food Stores 1/1/2008 Tom Thumb 1/1/2008 Jewel – SuperValu 12/1/2007 Vons 1/1/2008 Kerr Drug 1/1/2008 Waldbaum’s 1/1/2008 Kroger 10/1/2007 Wal-Mart Stores 1/1/2008 Lin’s 10/1/2007 Section 2 – Retailers Planning IIAS Standards Interest Group Support during 2008 Retailer Date Retailer Date Duane Reade ¹ 3/31/2008 United Supermarkets ¹ 4/1/2008 Fagen Pharmacy ¹ Q1 2008 Walgreen Co. -

Corrected Brief for Appellee Whole Foods Market, Inc

[Oral Argument Scheduled for April 23, 2008] PUBLIC COPY - PROTECTED INFORMATION REDACTED Case No. 07-5276 IN THE UNITED STATES COURT OF APPEALS FOR THE DISTRICT OF COLUMBIA CIRCUIT FEDERAL TRADE COMMISSION, Appellant, V. WHOLE FOODS MARKET, INC., Appellee. APPEAL FROM THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF COLUMBIA CORRECTED BRIEF FOR APPELLEE WHOLE FOODS MARKET, INC. Of Counsel: Paul T. Denis Paul H. Friedman Jeffrey W. Brennan Roberta Lang James A. Fishkin Vice-President of Legal Affairs Michael D. Farber and General Counsel Nory Miller Whole Foods Market, Inc. Rebecca Dick 550 Bowie Street DECHERTLLP Austin, Texas 78703 1775 I Street, N.W. Washington, DC 20006 Telephone: (202) 261-3430 Facsimile: (202) 261-3333 March 18, 2008 Attorneys for Whole Foods Market, Inc. · . CERTIFICATE OF THE PARTIES, RULINGS, AND RELATED CASES · · The Parties on Appeal · Appellant . Appellees * · ·. Federal Trade Commission Whole Foods Market, Inc . 600 Pennsylvania Ave., N. W. 550 Bowie Street Washington, D.C! . 20580 Austin, Texas 78703 ' . *Wild Oats Markets, Inc~, 1821 30th Street, Boulder, Colorado 80301, an appellee · when this appeal was filed, is now a wholly~owned s-µbsidiary of appellee Whole · · Foods Market, Inc. ... Amicion Appeal - Motion for Stay Pending Appeal . •, . ··. AIDerican Antitrust Institute. Organization for Competitive · 2929. Ellicott Street; Suite 1000 Markets Washington, D.C ~ 20008 1.620 lStreet, NW - Suite 200 · Washington, DC·20006 Consumer Federation of America P.O. Box 6486 · Lincoln, NE 68506 · Amici on Appeal - Merits . American Antitrust Institute* . Organic Trade Association* 2929 ElliCott Street, Suite 1000 POBox547 Washington, D.C. 20008 Greenfield MA .o1302 · .*Has filed amicus.brief o~ ·behalf of. -

Schedule 13D/A

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 13D/A Under the Securities Exchange Act of 1934 (Amendment No. 6)* Target Corporation (Name of Issuer) Common Stock (Title of Class of Securities) 87612E106 (CUSIP Number) Roy J. Katzovicz, Esq. Pershing Square Capital Management, L.P. 888 Seventh Avenue, 42nd Floor New York, NY 10019 212-813-3700 with a copy to: Stephen Fraidin, Esq. Andrew E. Nagel, Esq. Kirkland & Ellis LLP 153 East 53rd Street New York, New York 10022 212-446-4800 March 16, 2009 (Date of Event which Requires Filing of this Statement) If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box. o Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent. * The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).