Henkel Ag & Co. Kgaa

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

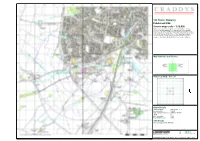

10K Raster Mapping Published 2006 Source Map Scale - 1:10,000 the Historical Maps Shown Were Produced from the Ordnance Survey`S 1:10,000 Colour Raster Mapping

10k Raster Mapping Published 2006 Source map scale - 1:10,000 The historical maps shown were produced from the Ordnance Survey`s 1:10,000 colour raster mapping. These maps are derived from Landplan which replaced the old 1:10,000 maps originally published in 1970. The data is highly detailed showing buildings, fences and field boundaries as well as all roads, tracks and paths. Road names are also included together with the relevant road number and classification. Boundary information depiction includes county, unitary authority, district, civil parish and constituency. dummy Map Name(s) and Date(s) Historical Map - Slice A Order Details Order Number: 186115750_1_1 Customer Ref: 11485 National Grid Reference: 390030, 172040 Slice: A Site Area (Ha): 0.69 Search Buffer (m): 1000 Site Details Site at, Chippenham, Wiltshire Tel: 0844 844 9952 Fax: 0844 844 9951 Web: www.envirocheck.co.uk A Landmark Information Group Service v50.0 14-Nov-2018 Page 13 of 14 VectorMap Local Published 2018 Source map scale - 1:10,000 VectorMap Local (Raster) is Ordnance Survey's highest detailed 'backdrop' mapping product. These maps are produced from OS's VectorMap Local, a simple vector dataset at a nominal scale of 1:10,000, covering the whole of Great Britain, that has been designed for creating graphical mapping. OS VectorMap Local is derived from large-scale information surveyed at 1:1250 scale (covering major towns and cities),1:2500 scale (smaller towns, villages and developed rural areas), and 1:10 000 scale (mountain, moorland and river estuary areas). -

Global Brand List

Global Brand List Over the last ten years Superbrand, Topbrand and Grande status in over 10 countries: Marque status have become recognised as the benchmark for brand success. The organisation has produced over 5000 case DHL, American Express, Audi, AVIS, Sony, studies on brands identified as high achievers. These unique McDonald's, MasterCard, Philips, Pepsi, Nokia, stories and insights have been published in 100 branding bibles, Microsoft, Gillette, Kodak and Heinz. 77 of which were published in Europe, the Middle East and the Indian sub-continent. The following brands have achieved Superbrands ® 1C Aim Trimark Amstel Asuransi Barbie 3 Hutchison Telecom AIMC *Amsterdam AT Kearney Barca Velha 3 Korochki Air Asia Amsterdam Airport Atlas Barclaycard 36,6 Air Canada Amway Atlas Hi-Fi Barclays Bank 3FM Air France An Post Aton Barista 3M Air Liquide Anadin atv BARMER 7-Up Air Miles Anakku Audi Barnes & Noble 8 Marta Air Sahara Anchor Audrey Baron B A Blikle Airbus Ancol Jakarta Baycity Aurinkomatkat Basak¸ Emeklilik A&E Airland Andersen Consulting Australia Olympic Basak¸ Sigorta A-1 Driving Airtel Andersen Windows Committee BASF AA2000 AIS Andrex Australia Post Basildon Bond AAJ TAK Aiwa Angel Face Austrian Airlines Baskin Robins AARP Aji Ichiban Anlene Auto & General Baso Malang AB VASSILOPOULOS Ak Emekliik Ann Summers Auto Bild Bassat Ogilvy ABBA Akari Annum Automibile Association Bata abbey Akbank Ansell AV Jennings Batchelors ABC Al Ansari Exchange Ansett Avance Bates Abenson Inc Al Ghurair Retail City Antagin JRG AVE Battery ABN Amro -

Fund Focus 2018 Issue

PENSIONER EDITION From the Trustees of the PENSIONER EDITION Unilever UK Pension Fund FUND FOCUS 2018 ISSUE 1 Some of this issue’s features… Your Trustee Board – meet our new arrivals Noticeboard – a round-up of recent pension to the Board, and find out more about the developments. training we undertake. Finding out more – a guide to the online Facts and figures – our regular summary help and support available, both from of the latest membership, accounts, funding Unilever and other helpful services. and investment information. 2 | FUND FOCUS PENSIONER EDITION Welcome... to the latest edition of Fund Focus. As usual, this year’s issue includes all the key facts from the 2018 annual Report and Financial Statements, together with recent news about the Fund and pensions in general. Remember that wherever you see the laptop icon, you can find more information about that TONY ASHFORD >> subject online (www.uukpf.co.uk). This has been another busy year for the Fund and your Trustees… We have reviewed our investment strategy… those proposals in early October 2018. As Trustees, During the year, we started a review of our investment we are responsible for monitoring how proposals like strategy for the defined benefit Final salary and Career this might affect the strength of Unilever’s support for average plans. The plans’ funding level had increased the Fund. Knowing how far we can rely on Unilever’s from 89% to an estimated 98% at 31 March 2018, support helps us, among other things, to decide on our significantly ahead of our targets, and so it was a good investment approach – the returns we need to aim for, time to consider a more ‘de-risked’ strategy – that is, and the investment risk the Fund can carry – and it helps to focus more on investing in assets that match our us to set the statutory funding target. -

1959 Annual Report

REPORT & ACCOUNTS I959 U Nt I L E V E R REPORT & ACCOUNTS UNILEVER N.V. F. J. TEMPEL - CHAIRMAN SIDNEY J. VAN DEN BERGH -VICE-CHAIRMAN THE LORD HEYWORTH -VICE-CHAIRMAN COLIN BAXTER G. D. A. KLIJNSTRA J. P. VAN DEN BERGH J. F. KNIGHT A. F. H. BLAAUW ANDREW M. KNOX A. D. BONHAM CARTER D. J. MANN A. W. J. CARON J. F. VAN MOORSEL GEORGE COLE F. D. MORRELL J. A. CONNEL F. J. PEDLER HAROLD HARTOG R. H. SIDDONS M. M. VAN HENGEL A. H. SMITH RUDOLF G. JURGENS J. P. STUBBS E. G. WOODROOFE A H. M. HIRSCHFELD J. M. HONIG K. P. VAN DER MANDELE PAUL RIJKENS JHR. J. A. G. SANDBERG H. L. WOLTERSOM E. A. HOFMAN AU s PRICE WATERHOUSE & Co. COOPER BROTHERS & Co. This is a translation of the original Dutch refjort. AllJTgures relate to the J~.F'. and LLWTED Groups combined 1958 1959 F1. F1. 18,388,000,000 TURNOVER............ 19,O 16,000,000 976,000,000 TRADINGPROFIT .......... 1,207,000,000 490,000,000 TAXATIONFORTHEYEAR...... 594,000,000 32,000,000 EXCEPTIONALPROFITS ....... 43,000,000 503,000,000 CONSOLIDATEDNET PROFIT ..... 640,000,000 105,000,000 ORDINARYDIVIDENDS ........ 146,000,000 * 18 "3 "0 N.V.. ............ 20 "lo * 4s. 2.4d. LIMITED (PER E 1 OF CAPITAL) ... 4s. 6.5d." 360,000,000 PROFITRETAINED IN THE BUSINESS ... 454,000,000 5,598,000,000 CAPITALEMPLOYED ........ 6,140,000,000 429,000,000 EXPENDITUREON FIXED ASSETS (NET). 439,000,000 244,000,000 DEPRECIATION.......... 271,000,000 %. %. On increased capital. -

Consumer Goods 118 Oil & Gas Thought Leadership Content to Inspire 44 Consumer Services 122 Technology 68 Financials 126 Telecoms

Issuer services Sponsorsed by Issuer services 1 1 CONTENTS Issuer Services Connectivity for the benefit of our issuers FOREWORDS FTSE 100 OVERVIEW 4 FTSE 100: London’s 8 Welcome to global benchmark FTSE 100 Companies COMPANY PROFILE LSEG SERVICES Nikhil Rathi CEO, London Stock Exchange Plc 10 FTSE 100 – did you know? Personalise your Our services 6 Supporting Enterprise 11 A truly international index LSE profile page in one place and Growth in the UK Jes Staley, Group Chief Executive, 12 FTSE 100 Companies in 1984 Barclays MARKETPLACE DATA 13 FTSE 100 Companies in 2018 Vetted third party Connecting you services for issuers to your data SECTORS 14 Basic Materials 100 Industrials SPARK 28 Consumer Goods 118 Oil & Gas Thought leadership content to inspire 44 Consumer Services 122 Technology 68 Financials 126 Telecoms To find out more please contact 92 Healthcare 130 Utilities us at [email protected] INDEX 138 Index of Companies 142 Index of Brands An official publication of London Stock Exchange Group © London Stock Exchange Group March 2018. All rights reserved 10 Paternoster Square, London EC4M 7LS 2 3 FTSE 100: LONDON’S GLOBAL BENCHMARK The UK has always been at the forefront of financial innovation, bringing UK and international companies and investors together to raise and invest capital efficiently. Firms from 100 countries are listed on London Stock Exchange and the FTSE 100 index is seen as the global benchmark for blue-chip firms listed on our markets. An index tracks the performance of a basket of securities and is increasingly used by investors to issue investment products, such as exchange traded funds (ETFs), and to measure performance. -

Unilever Annual Report and Accounts 2018 Consolidated Cash Flow Statement

UNILEVER ANNUAL REPORT CONTENTS AND ACCOUNTS 2018 Strategic Report ............................................................................... 1 This document is made up of the Strategic Report, the Governance About us .................................................................................................... 1 Report, the Financial Statements and Notes, and Additional Chairman’s statement .............................................................................. 2 Information for US Listing Purposes. Board of Directors .................................................................................... 3 The Unilever Group consists of Unilever N.V. (NV) and Unilever PLC Chief Executive Officer’s review ............................................................... 4 (PLC) together with the companies they control. The terms “Unilever”, the “Group”, “we”, “our” and “us” refer to the Unilever Group. Unilever Leadership Executive (ULE) ...................................................... 5 Our performance ...................................................................................... 6 Our Strategic Report, pages 1 to 35, contains information about us, how we create value and how we run our business. It includes Financial performance .......................................................................... 6 our strategy, business model, market outlook and key performance Unilever Sustainable Living Plan .......................................................... 7 indicators, as well as our approach to sustainability -

The Uk's Top Brands According to 18

REPORT 2014 THE UK’S TOP BRANDS ACCORDING TO 18 24s Youth Communications Partner Sponsored by 6 INTRODUCTION 7 METHODOLOGY 8 FINDINGS 10 MEET THE CONTRIBUTORS 16 YOUTH 100 RESULTS 18 ALCOHOLIC DRINKS 20 APPS 22 BEAUTY & PERSONAL CARE SHOW US YOUR BRIEFS 24 CHARITIES & CAMPAIGNS 26 EDUCATION 28 FASHION 30 FAST FOOD & RESTAURANTS 34 GRADUATE EMPLOYERS 36 GROCERY 38 HAIRCARE 40 HOME & STATIONERY 42 INTERNET 44 LIFESTYLE & ENTERTAINMENT 46 LUXURY 48 MEDIA 50 MOBILE & ISPS 52 MONEY & FINANCE 54 ONLINE SHOPPING 56 RETAIL 58 SNACKS & CONFECTIONERY 60 SOFT DRINKS 62 SUPERMARKETS 64 TECHNOLOGY THE YOUTH COMMUNICATIONS AGENCY 66 TRAVEL T: WWW.THINKHOUSE.CO.UK TWITTER.COMTHINKHOUSEUK FACEBOOK.COMLOVETHINKHOUSE 3 Youth 100 A5.indd 1 09/10/2014 11:48 you want to reach The digital student card of young helping hundreds of people each month? retailers drive sales There are endless campaigns we can build together... Talk to us about increasing your student If you want to become a friend of Do Something, conversion by up to 50% say hello @DoSomethingUK or pay us a visit at uk.dosomething.org email [email protected] or phone 020 3095 1492 vInspired registered charity no. 1113255 Introduction This is the third year of the Youth 100: The UK’s Top Brands According To 18-24s. Already in its short life this research has Talking about the appeal of the Youth 100 grown to become a must-read among recently, one marketer said: “All brands marketers interested in the youth audience. are self-obsessed! They’re desperate to INTRODUCTIONIt has brought insight and raised eyebrows. -

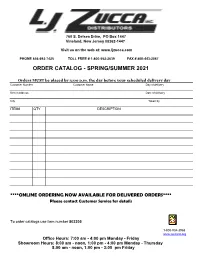

Spring/Summer 2021

760 S. Delsea Drive, PO Box 1447 Vineland, New Jersey 08362-1447 Visit us on the web at: www.ljzucca.com PHONE 856-692-7425 TOLL FREE # 1-800-552-2639 FAX # 800-443-2067 ORDER CATALOG - SPRING/SUMMER 2021 Orders MUST be placed by 3:00 p.m. the day before your scheduled delivery day Customer Number Customer Name Day of delivery Street Address Date of delivery City Taken by ITEM# QTY DESCRIPTION ****ONLINE ORDERING NOW AVAILABLE FOR DELIVERED ORDERS**** Please contact Customer Service for details X 0 A To order catalogs use item number 803205 1-800-934-3968 www.wecard.org Office Hours: 7:00 am - 4:00 pm Monday - Friday Showroom Hours: 8:00 am - noon, 1:00 pm - 4:00 pm Monday - Thursday 8:00 am - noon, 1:00 pm - 3:00 pm Friday RETURN POLICY If an item is received with LESS than the guaranteed shelf life and you believe you will not sell it before the expiration date: Contact our office within 72 hours with the invoice number, item number, quantity, and the code on the received item. The following items may be returned for credit ONLY IF PURCHASED FROM L J ZUCCA in the last 14 days and in original packaging, un-opened, and never stickered. BATTERIES GROCERIES (Case) and (Each) CANDY, GUM, MINTS FULL BOXES PAPER PRODUCTS CIGARETTE PAPERS PLAYING CARDS CIGARETTE TUBES PIPES GLOVES SPORT & TRADING CARDS Credit for the following product categories is divided into four sections FULL CREDIT RESTRICTIONS ANY "NEW" CANDY, NOVELTY, GUM, SNACK ITEM Within 60 days of our initial release CIGARS PACKS KETTLE CHIPS MEAT SNACKS NABISCO CRACKERS & COOKIES TOBACCO CREDIT WITH RESTRICTIONS RESTRICTIONS: BEVERAGE'S If received with LESS than 30 days shelf life CANDY, GUM, CRACKERS OR COOKIES If received with LESS than 30 days shelf life CANDY - HOLIDAY If returned 30 days BEFORE the Holiday CIGAR FULL BOXES Full Boxes, original packaging, un-opened, and never stickered. -

Seminar Nasional Kewirausahaan Dan Inovasi Bisnis IV 2014 Universitas Tarumanagara Jakarta, 8 Mei 2014 ISSN NO: 2089-1040

Seminar Nasional Kewirausahaan dan Inovasi Bisnis IV 2014 Universitas Tarumanagara Jakarta, 8 Mei 2014 ISSN NO: 2089-1040 KATA PENGANTAR Seminar Nasional Kewirausahaan dan Inovasi Bisnis keempat pada tahun 2014 diselenggarakan oleh Fakultas Ekonomi bekerjasama dengan Mata Kuliah Umum (MKU) dan Magister Manajemen (MM) Universitas Tarumanagara. Seminar ini merupakan salah satu upaya untuk terus mendorong berkembangnya semangat kewirausahaan, khususnya pada generasi muda, serta mengembangkan wawasan dan pengetahuan di bidang kewirausahaan secara luas dan menyeluruh. Pada beberapa tahun terakhir, terjadi peningkatan GDP negara-negara Asia khususnya Indonesia yang meningkatkan daya beli masyarakat. Peningkatan daya beli ini seharusnya diikuti peningkatan konsumsi produk khususnya produk lokal. Berdasarkan hal tersebut, maka seminar kali ini mengusung tema “Pemberdayaan UMKM untuk Memperkuat Daya Saing Produk Lokal”. Diharapkan, seminar ini dapat memberikan kajian tentang pentingnya pengembangan produk lokal melalui UMKM untuk meningkatkan daya saing Indonesia dalam perekonomian global. Prosiding ini berisi semua presentasi oral yang dibawakan pada Seminar Nasional Kewirausahaan dan Inovasi Bisnis keempat di Jakarta, pada tanggal 8 Mei 2014. Subtema meliputi Kewirausahaan, Keuangan, Pemasaran dan Operasional. Atas nama Panitia Seminar Nasional Kewirausahaan dan Inovasi Bisnis keempat , kami ucapkan terima kasih kepada semua penulis, reviewer, tim editorial, pimpinan universitas dan fakultas, anggota panitia, dan para sponsor atas kontribusi -

Britain's 100 Biggest Brands Risers, Fallers & Basket Cases

Britain’s 100 Biggest Brands Risers, fallers & basket cases BBB16_01_cover.indd 3 11/03/2016 16:39 in association with nielsen britain’s biggest brands leader “In a climate of brutal rivalry, creative advertising has never been more important for Britain’s brands” ver the next 42 pages there’s a lot of discussion about the price of groceries. We are in the midst of a price war, after all. Sixty one of Britain’s top O100 brands have seen their average prices per unit fall in the past year. What’s more, SKUs are Britain’s 100 being jettisoned as the major mults fight to maximise the profit- ability of their shelves. Biggest Brands What you’ll also find in this year’s report is proof of the value of targeted, creative, effective and well invested marketing; Risers, fallers proof that when done properly, advertising can be so much more than just hot air; that it can help fuel a brand’s rise above the & basket cases deflation that has grounded so many of Britain’s biggest brands in the past year. It all starts with the product, of course. But with shelf space Where to find Britain’s 100 Biggest Brands squeezed and shoppers holding the purse strings ever more tightly, effective marketing of those products has never been Activia 31 Lindt 38 Air Wick 35 Lucozade 14 more important. Indeed, it’s crucial if retailers are to be per- Alpro 33 Lurpak 17 suaded that a brand is worthy of shelf space and, ultimately, AnchorBBB16_01_cover.indd 3 34 Magnum 11/03/2016 3016:39 Andrex 14 Maltesers 28 shoppers are to be convinced it’s worth paying more for. -

What a Line Up

MATCH DAY DEALS WHAT A LINE UP RRP £4.99 450g £3 RRP £1.89/ £2.05/ £1.99 £1 150g/ 300g/ 175g ($&+ .50 RRP £5.95 £3 10x330ml £9 RRP £10.61/ £12/£11 12x330ml/ 12x300ml/ 10x440ml ($&+ 8QOHVVRWKHUZLVHVWDWHGDOORƨHUVDYDLODEOHIURPWK0D\WK-XQH 32SWLRQ+-HPSVRQśV Doritos Cool Original/ Nacho Cheese Dip/ Walkers Ready Salted Sharing Pack: 150g/ 300g/ 175g Equiv to 66.6p/ 33.4p/ 57.2p/100g; Mars & Team: 450g Equiv to 66.7p/100g; Diet Coke: 10x330ml Equiv to 10.6p/100ml; Coors Light/ Amstel/ Bud Light: 12x330ml/ 12x300ml/ 10x440ml Equiv to £2.27/ltr. of Making a Difference Locally www.jempsons.com see inside for more... FATHER’S DAY MAKE DAD’S DAY SUNDAY 17TH JUNE BREAKFAST DEALS 60p £1 £1 ($&+ +HULWDJH)UHH5DQJH(JJV +HULWDJH9LQH7RPDWRHV)ODW0XVKURRPV RRP 79p RRP £1.15 RRP £1.19/£1.45 415g 6pk 400g/250g £3 2 FOR £2 £3 £3 £3.50 ($&+ 7URSLFDQD&RSHOOD 5LFKPRQG7KLFN6DXVDJHV 'DQLVK6L]]OLQJ%DFRQ our price £2 each 681g 2x200g 850ml/ 900ml Heinz Beanz: 415g Equiv to 14.4p/100g; Heritage Free Range Medium Eggs: 6pk Equiv to 17.0p/Each; Heritage Vine Tomatoes/Flat Mushrooms: 400g/250g Equiv to £2.50/£4.00/kg; Richmond Thick Pork Sausages: 681g Equiv to £2.94/kg; Danish Sizzling Smoked/Unsmoked Bacon Twin Pack: 2x200g Equiv to £7.50/kg; Tropicana Smooth Orange/ Copella Cloudy Apple: 850ml/ 900ml Equiv to 20.6p/ 19.4p/100ml. GIFTING £3 £7.99 £19.99 ($&+ RRP £12.99 RRP £29.99 360g/380g/ 290g/ 189g 75cl 70cl Maltesers Box/Mars Celebrations/ Cadbury Heroes/ Thorntons Father’s Day Box/ Toblerone Father’s Day Bar: 360g/380g/ 290g/ 189g Equiv to 83.3p/78.9p/£1.03/ £1.59/ 100g; Cockburn’s Special Reserve Fine Ruby Port: 75cl Equiv to £7.99/75cl; Glen Keith Single Malt Scotch Whisky Equiv to £28.56/ltr. -

Top 100 Global Consumer Packaged Goods Companies

Top 100 global consumer packaged goods companies (non food/beverage**) Company Name Headquarters 2008 Sales 1. Procter & Gamble Cincinnati, OH $65 Billion 2. Unilever United Kingdom $27.3 Billion 3. L'Oréal Clichy, France $25.8 Billion 4. Kimberly-Clark Corp. Dallas, TX $19.4 Billion 5. Colgate-Palmolive New York, NY $15.33 Billion 6. Reckitt Benckiser Berkshire, United Kingdom $11.2 Billion 7. Avon Products, Inc. New York, NY $10.69 Billion 8. Henkel Düsseldorf, Germany $10.5 Billion 9. Kao Tokyo, Japan $10.5 Billion 10. S.C. Johnson Racine, WI $8 Billion 11. Estee Lauder New York, NY $7.91 Billion 12. Beiersdorf Hamburg, Germany $7.5 Billion 13. Johnson & Johnson New Brunswick, NJ $7.2 Billion 14. Shiseido Tokyo, Japan $6.9 Billion 15. Amway Ada, MI $6.5 Billion 16. Alcon Laboratories, Inc. Huneberg, Switzerland $6.29 Billion 17. Ecolab St. Paul, MN $6.14 Billion 18. Allergan Irvine, CA $4.33 Billion 19. LVMH Paris, France $4.2 Billion 20. Coty New York, NY $4 Billion 21. Liz Claiborne New York, NY $4* Billion 22. Wyeth Consumer Healthcare Madison, NJ $4* Billion 23. Bayer Consumer Health Morristown, NJ $3.95 Billion 24. Nestle Health Care Nutrition Glendale, CA $3.9 Billion 25. Chanel Neuilly sur Seine, France $3.3 Billion 26. Johnson Diversey Sturtevant, WI $3.3 Billion 27. Novartis Consumer Healthcare-OTC Parsippany, NJ $3 Billion 28. Scotts Miracle-Gro Co. Marysville, OH $2.98 Billion 29. Bausch & Lomb Rochester, NY $2.92 Billion Return to List Top 100 global consumer packaged goods companies (non food/beverage**) Company Name Headquarters 2008 Sales 30.