Australian Office Investment Review & Outlook 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Renewal Ultimo Historical Walking Tour

historical walking tours RENEWAL ULTIMO Historical Walking Tour Front Cover Image: Tram passing Sydney Technical College, 1950s (Photograph: City of Sydney Archives) ultimo Then the landscape was remade by sandstone ntil 1850, Ultimo was semi-rural, quarrying on Ultimo’s western edge and by the with cornfields and cow paddocks. construction of a railway and goods yard on its Members of the Gadigal people still eastern shoreline. The suburb became crowded harvested cockles on its foreshores. with factories, woolstores and workers’ housing. Today it has a new identity as a cultural precinct as industrial sites are adapted for entertainment and education. This tour of Ultimo starts in greyness and ends in the technicolour of Darling Harbour. Sydney’s PLEASE ALLOW 1½ – 2 hours for this tour. WHY ULTIMO? history Begin the walk at The story of Ultimo began with a court case is all around us. Railway Square outside the and a joke. In the 1800s, Governor King was Our walking tours will lead you Marcus Clark Building (1). engaged in a power struggle with officers on a journey of discovery from of the NSW Corps. Surgeon John Harris early Aboriginal life through to of the Corps supported him, and became contemporary Sydney. so unpopular with his colleagues that he was court-martialled in 1803. But Harris escaped conviction because the charge stated he had committed an offence on the “19th ultimo” (last month) instead of “19th instant” (this month). When Governor King rewarded Harris with land grants, he Clover Moore MP celebrated the technicality by calling his Lord Mayor of Sydney estate Ultimo. -

Shelter NSW Submission Rapid Assessment Framework NSW Department of Planning, Industry, and Environment Date 12.2.2021

Shelter NSW Submission Rapid Assessment Framework NSW Department of Planning, Industry, and Environment Date 12.2.2021 Introduction Shelter NSW appreciates the opportunity to comment on the Department of Planning, Industry, and Environment (DPIE), proposed Rapid Assessment Framework. Shelter NSW supports the Government’s objective to provide clear guidance and increase the efficiency and transparency of the assessment process for a major project while also improving community engagement standards. Shelter NSW’s submission responds to the growing demand for the NSW planning system to deliver on its promise of a more equitable city, and this includes the capacity to deliver affordable rental housing in one of the most expensive housing markets in the world. An objective of the Environmental Planning and Assessment Act 1979 (d) is to promote the delivery and maintenance of affordable housing. However, there is a growing acknowledgment that a key barrier in meeting this objective and addressing both housing need and affordability is the expanding complexities of the planning system, various legislation, policy and public authorities. Shelter NSW has provided feedback on the proposed changes and associated documentation in the Rapid Assessment Framework package. This feedback is informed by Shelter NSW's involvement with community organisations who are engaged with several ‘State Significant Development’ (SSD) housing projects and associated community engagement initiatives which do not support the delivery of an equitable and sustainable city. We hope these insights help the Government in meeting its overall goals, while also addressing some of the current system failures. About Shelter NSW Shelter NSW has operated since 1975 as the NSW State peak housing policy and advocacy body. -

Charter Hall Property Portfolio

CHARTER HALL PROPERTY PORTFOLIO Charter Hall Property Portfolio Period ending 30 June 2019 2 Market Street, Sydney NSW 10 Shelley Street, Sydney NSW CHARTER HALL 1 PROPERTY PORTFOLIO $30.4 b Funds Under Management 844 3.4% Number of Weighted Average Properties Rent Review (WARR) 97.9% 8.2 years Occupancy Weighted Average Lease Expiry (WALE) Richlands Distribution Facility, QLD CHARTER HALL 2 PROPERTY PORTFOLIO CONTENTS CHARTER HALL GROUP 3 OUR FUNDS, PARTNERSHIPS & MANDATES 5 OFFICE 7 CHARTER HALL PRIME OFFICE FUND (CPOF) 8 CHARTER HALL OFFICE TRUST (CHOT) 24 OFFICE MANDATES AND PARTNERSHIPS 32 CHARTER HALL DIRECT OFFICE FUND (DOF) 36 CHARTER HALL DIRECT PFA FUND (PFA) 47 INDUSTRIAL 57 CHARTER HALL PRIME INDUSTRIAL FUND (CPIF) 58 CORE LOGISTICS PARTNERSHIP (CLP) 95 CHARTER HALL DIRECT INDUSTRIAL FUND NO.2 (DIF2) 98 CHARTER HALL DIRECT INDUSTRIAL FUND NO.3 (DIF3) 106 CHARTER HALL DIRECT INDUSTRIAL FUND NO.4 (DIF4) 114 CHARTER HALL DIRECT CDC TRUST (CHIF12) 121 RETAIL 123 CHARTER HALL PRIME RETAIL FUND (CPRF) 124 CHARTER HALL RETAIL REIT (CQR) 127 RETAIL PARTNERSHIP NO.1 (RP1) 137 RETAIL PARTNERSHIP NO.2 (RP2) 141 RETAIL PARTNERSHIP NO.6 (RP6) 143 LONG WALE HARDWARE PARTNERSHIP (LWHP) 145 LONG WALE INVESTMENT PARTNERSHIP (LWIP) 150 LONG WALE INVESTMENT PARTNERSHIP NO.2 (LWIP2) 152 CHARTER HALL DIRECT BW TRUST (CHIF11) 153 CHARTER HALL DIRECT AUTOMOTIVE TRUST (DAT) 154 CHARTER HALL DIRECT AUTOMOTIVE TRUST NO.2 (DAT2) 157 DIVERSIFIED 161 CHARTER HALL LONG WALE REIT (CLW) 162 DVP 184 DIVERSIFIED CONSUMER STAPLES FUND (DCSF) 185 SOCIAL INFRASTRUCTURE 194 CHARTER HALL EDUCATION TRUST (CQE) 195 CHARTER HALL CIB FUND (CIB) 215 INDEX 216 FURTHER INFORMATION 228 Gateway Plaza, VIC CHARTER HALL 3 PROPERTY PORTFOLIO Charter Hall Group (ASX:CHC) With over 28 years’ experience in property investment and funds management, we’re one of Australia’s leading fully integrated property groups. -

Space For: Going Places

Space for: going places CITY WEST OFFICE PARK 33–35 SAUNDERS STREET, PYRMONT, NSW OVERVIEW 2 Premium office space in a prime location Position your business in premium office space, among high profile brands in the thriving Pyrmont precinct. Centrally located on Saunders Street, City West Office Park offers the unique combination of high quality, modern office space within close proximity to a range of entertainment and dining options. The estate is the location of choice for high profile brands, including Network Ten, Nova 96.9, 9Radio, UNICEF, National Film and Restaurant Brands Australia. Pyrmont has emerged as a thriving media and technology hub, attracting leading brands, including Google, OMD Worldwide, BMF Australia and IBM. VIEW FROM ABOVE 3 Sydney CBD North Sydney Barangaroo King Street Wharf The Star City West Office Park Western Distributor FISH MARKET LIGHT RAIL STATION Sydney Fish Market Anzac Bridge LOCATION 4 Superior connectivity City West Office Park offers convenient access to the CBD, Sydney Airport and local amenities, with major bus routes, Sydney Light Rail and Sydney ferry terminals within walking distance of the estate. Vehicles accessing the estate will benefit from close proximity to City West Link and the Western Distributor, offering convenient Light Rail, buses and connections to greater Sydney. motorways offer superior connections to the CBD and greater Sydney CENTR ALLY CONNECTED 200M 900M 14.7KM to light rail to City West to Sydney 100M 900M Link 2.6KM Airport to bus stop to ferry terminal to Sydney CBD -

Pyrmont Peninsula Place Strategy

Pyrmont Peninsula Place Strategy December 2020 Acknowledgement of Country The Department of Planning, Industry and Environment acknowledges the traditional custodians of the land and pays respect to Elders past, present and future. We recognise Australian Aboriginal and Torres Strait Islander peoples’ unique cultural and spiritual relationships to place and their rich contribution to society. Aboriginal people take a holistic view of land, water and culture and see them as one, not in isolation to each other. The Pyrmont Peninsula Place Strategy is based on the premise upheld by Aboriginal people that if we care for Country, it will care for us. Published by NSW Department of Planning, Industry and Environment dpie.nsw.gov.au Pyrmont Peninsula Place Strategy December 2020 ISBN: 978-1-76058-406-1 Cover image sources: Destination NSW and Shutterstock Artwork (left) by Nikita Ridgeway © State of New South Wales through Department of Planning, Industry and Environment 2020. You may copy, distribute, display, download and otherwise freely deal with this publication for any purpose, provided that you attribute the Department of Planning, Industry and Environment as the owner. However, you must obtain permission if you wish to charge others for access to the publication (other than at cost); include the publication in advertising or a product for sale; modify the publication; or republish the publication on a website. You may freely link to the publication on a departmental website. Disclaimer: The information contained in this publication is based on knowledge and understanding at the time of writing (December 2020) and may not be accurate, current or complete. -

Dexus (ASX: DXS) ASX Release

Dexus (ASX: DXS) ASX release 25 October 2017 Bank of America Merrill Lynch Australian Real Estate Conference presentation Dexus today provides the attached presentation to be used as a basis of discussion with institutional investors at the 2017 Bank of America Merrill Lynch Australian Real Estate Conference. The conference is being held at the offices of Bank of America Merrill Lynch in Sydney. For further information please contact: Investor Relations Media Relations Melanie Bourke Louise Murray +61 2 9017 1168 +61 2 9017 1446 +61 405 130 824 +61 403 260 754 [email protected] [email protected] About Dexus Dexus is one of Australia’s leading real estate groups, proudly managing a high quality Australian property portfolio valued at $24.9 billion. We believe that the strength and quality of our relationships will always be central to our success, and are deeply committed to working with our customers to provide spaces that engage and inspire. We invest only in Australia, and directly own $12.2 billion of office and industrial properties. We manage a further $12.7 billion of office, retail, industrial and healthcare properties for third party clients. The group’s $4.3 billion development pipeline provides the opportunity to grow both portfolios and enhance future returns. With 1.8 million square metres of office workspace across 54 properties, we are Australia’s preferred office partner. Dexus is a Top 50 entity by market capitalisation listed on the Australian Securities Exchange (trading code: DXS) and is supported by 28,000 investors from 20 countries. With more than 30 years of expertise in property investment, development and asset management, we have a proven track record in capital and risk management, providing service excellence to tenants and delivering superior risk-adjusted returns for investors. -

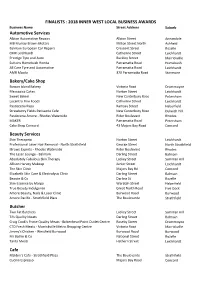

2018 05 Finalists

FINALISTS : 2018 INNER WEST LOCAL BUSINESS AWARDS Business Name Street Address Suburb Automotive Services Albion Automotive Repairs Albion Street Annandale MB Murray Brown Motors Milton Street North Ashfield Balmain European Car Repairs Crescent Street Rozelle CMR Leichhardt Catherine Street Leichhardt Prestige Tyre and Auto Buckley Street Marrickville Suttons Homebush Honda Parramatta Road Homebush All Care Tyre and Automotive Parramatta Road Leichhardt AMR Mazda 370 Parramatta Road Stanmore Bakery/Cake Shop Bowan Island Bakery Victoria Road Drummoyne Mezzapica Cakes Norton Street Leichhardt Sweet Belem New Canterbury Road Petersham Locantro Fine Foods Catherine Street Leichhardt Pasticceria Papa Ramsay Street Haberfield Strawberry Fields Patisserie Cafe New Canterbury Road Dulwich Hill Pasticceria Amore - Rhodes Waterside Rider Boulevard Rhodes MAKER Parramatta Road Petersham Cake Shop Concord 43 Majors Bay Road Concord Beauty Services Skin Therapeia Norton Street Leichhardt Professional Laser Hair Removal - North Strathfield George Street North Strathfield IBrows Experts - Rhodes Waterside Rider Boulevard Rhodes The Laser Lounge - Balmain Darling Street Balmain Absolutely Fabulous Skin Therapy Lackey Street Summer Hill Allison Harvey Makeup Junior Street Leichhardt The Skin Clinic Majors Bay Rd Concord Elizabeth Skin Care & Electrolysis Clinic Darling Street Balmain Beaute & Co Darling St Rozelle Skin Essence by Margo Waratah Street Haberfield True Beauty Indulgence Great North Road Five Dock Amore Beauty, Nails & Laser Clinic Burwood -

Adec Preview Generated PDF File

ARCHAEOLOGICAL INVESTIGATION 732 HARRIS STREET ULTIMO 2007 CULTURAL RESOURCES MANAGEMENT ARCHAEOLOGICAL INVESTIGATION 732 HARRIS STREET ULTIMO 2007 A Project Funded by Spurbest pty Ltd CULTURAL RESOURCES MANAGEMENT CONTENTS 1.0 EXECUTIVE SUMMARY ........................................................................................ 01 1. 1 The Project.............................................................................................................. 02 1.2 The Pre-Settlement Environment ........................................................................... 02 1.3 On the Fringe of Settlement. ................................................................................... 02 1.4 Ultimo Estate ........................................................................................................... 03 1.5 Samuel Blackman's House ..................................................................................... 03 1.6 The Lamb Inn .......................................................................................................... 03 1.7 859-869 George Street ........................................................................................... 04 1.8 857 George Street .................................................................................................. 04 1.9 851-855 George Street ........................................................................................... 04 1.10 849 George Street ................................................................................................. -

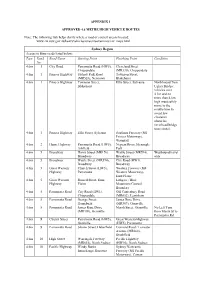

APPENDIX 1 APPROVED 4.6 METRE HIGH VEHICLE ROUTES Note: The

APPENDIX 1 APPROVED 4.6 METRE HIGH VEHICLE ROUTES Note: The following link helps clarify where a road or council area is located: www.rta.nsw.gov.au/heavyvehicles/oversizeovermass/rav_maps.html Sydney Region Access to State roads listed below: Type Road Road Name Starting Point Finishing Point Condition No 4.6m 1 City Road Parramatta Road (HW5), Cleveland Street Chippendale (MR330), Chippendale 4.6m 1 Princes Highway Sydney Park Road Townson Street, (MR528), Newtown Blakehurst 4.6m 1 Princes Highway Townson Street, Ellis Street, Sylvania Northbound Tom Blakehurst Ugly's Bridge: vehicles over 4.3m and no more than 4.6m high must safely move to the middle lane to avoid low clearance obstacles (overhead bridge truss struts). 4.6m 1 Princes Highway Ellis Street, Sylvania Southern Freeway (M1 Princes Motorway), Waterfall 4.6m 2 Hume Highway Parramatta Road (HW5), Nepean River, Menangle Ashfield Park 4.6m 5 Broadway Harris Street (MR170), Wattle Street (MR594), Westbound travel Broadway Broadway only 4.6m 5 Broadway Wattle Street (MR594), City Road (HW1), Broadway Broadway 4.6m 5 Great Western Church Street (HW5), Western Freeway (M4 Highway Parramatta Western Motorway), Emu Plains 4.6m 5 Great Western Russell Street, Emu Lithgow / Blue Highway Plains Mountains Council Boundary 4.6m 5 Parramatta Road City Road (HW1), Old Canterbury Road Chippendale (MR652), Lewisham 4.6m 5 Parramatta Road George Street, James Ruse Drive Homebush (MR309), Granville 4.6m 5 Parramatta Road James Ruse Drive Marsh Street, Granville No Left Turn (MR309), Granville -

Property Synopsis

Property Synopsis 2018 years being listed as Dexus Dexus 2018 Property Synopsis About Total funds under management IN THIS REPORT About Dexus 01 Office Portfolio 02 $27.2bn Industrial Portfolio 36 Directory 75 Square metres across Market the group Capitalisation www. dexus2018. reportonline. com.au 4.5m 9.9 bn ABOUT THIS REPORT Dexus’s 2018 Property Synopsis forms part of Dexus’s 2018 Annual Reporting Suite which Properties Engaged employees includes: 1. 2018 Dexus Annual Report 2. 2018 Dexus Combined Financial Statements 148 427 3. 2018 Dexus Sustainability Performance Pack 4. 2018 Dexus Annual Results Presentation Customers Entity on ASX 4,962 Top 50 years being listed as Dexus All data as at 30 June 2018. 01 Dexus is one of Australia’s leading real estate groups, About Dexus managing a high quality Australian property portfolio valued at $27.2 billion. We believe the strength and quality of our relationships will be central to our success, and are deeply committed to working with our customers to provide spaces that engage and inspire. The creation of sustained value is underpinned by our quality property portfolio, located across Australia’s major cities. We are committed to playing a leading role in shaping Australian cities for the future as desirable places to live, work and play. We invest only in Australia, and directly own $13.3 billion of office and industrial properties. We manage a further $13.9 billion of office, retail, industrial and healthcare properties for third party clients. The group’s $4.2 billion development pipeline provides the opportunity to grow both portfolios and enhance future returns. -

Finalists - 2019 Inner West Local Business Awards

FINALISTS - 2019 INNER WEST LOCAL BUSINESS AWARDS Business Name Unit/Suite/Shop Street Number Street Address Suburb Automotive Services Leichhardt Automotive Specialists 689 Parramatta Road Leichhardt Jay Lee Motors 27-31 Milton Street North Ashfield Marrickville Prestige Smash Repairs 33-43 Shepherd Street Marrickville Mastertouch Automotive 24 Lords Road Leichhardt CMR Leichhardt 54 Catherine Street Leichhardt Prestige Tyre and Auto Unit B 44-50 Buckley Street Marrickville All Care Tyre and Automotive 625 Parramatta Road Leichhardt Auto Outsource Victoria Road Drummoyne AMR Mazda 370-380 Parramatta Road Stanmore BT Smash Repairs 18 Barker Street Lewisham Bakery/Cake Shop Tre Punte Cafe 101 Great North Road Five Dock Locantro Fine Foods Shop 9 11 Catherine Street Leichhardt Pasticceria Papa 145 Ramsay Street Haberfield The Last Course Sydney Ground Floor 175 Enmore Road Enmore Cavallaro Leichhardt Shop 21 55 Norton St Leichhardt L'Oven Craft Bakery - Burwood Plaza Shop 36/42 50 Railway Parade Burwood 85 Degrees Bakery - Ashfield Mall Shop 61 260A Liverpool Road Ashfield Beauty Services HoneyTusk Eyebrow Studio 748 Darling Street Rozelle Laser Clinic Australia - Norton Plaza Shop T6-7 55 Norton Street Leichhardt Absolutely Fabulous Skin Therapy 10 Lackey Street Summer Hill The Skin Clinic Shop 11 103 Majors Bay Road Concord Skinessence by Margo 61 Waratah Street Haberfield Amore Beauty, Nails & Laser Clinic 89 Burwood Road Burwood Elite Body Contouring Leichhardt 10 Norton Street Leichhardt Urban Spa - Rhodes Waterside Shopping Centre -

Business Business Service COVID-19 Services Special Offer for Address Phone Website Name Rosebank Families

Business Business Service COVID-19 Services Special Offer for Address Phone Website Name Rosebank Families A Stitch N Auto upholstery, furniture All services 7 Goodlet Street, 0416 119 224 Time upholstery, marine upholstery Ashbury and also handyman work We are continuing to Anesti conduct demolition Excavation services during Covid-19 If you mention your child and following NSW Health goes to Rosebank College www.anesti.com.au Demolition Residential Demolition and compliance for all we can offer a reduced 1/466 Burwood Rd, Pty Ltd Excavation services. employees and customers. quotation price. Belmore 02 9011 6599 Aquatic Blue Swimming pool builds, All services Lidcombe 0414 849 265 https://www.instagram.com/a Pools Pty Ltd renovation & pool equipment quaticbluepools/ Avante Bathroom, kitchen, Laundry All renovation services, Harvey Norman 0418 673 893 avantebathrooms.com.au Bathrooms and home renovations. maintenance work and Flagship store consulting clients for Auburn: 250, future renovations. Parramatta Rd, Auburn Business promotion and community connects and www.baytalk.com.au promotes local business in Three months free as a Rowe Street, Five BayTalk Sydney's Inner West All services Bronze member Dock 0434 395 770 Bellevue Restaurant Take away menu 55 Leichhardt St, 9552 6493 www.bellevuecottage.com.au Cottage by Glebe Antoine Belmore Automotive Service and Free Pick-up and Drop- 39 King Street, 9716 6188 www.BelmoreMotorWorks.c Motor Repairs Off within 6km radius Ashbury om.au Works from Rosebank College for service bookings Free Vehicle Disinfectant Treatment with any service booking Bettinas New kitchen or Kitchen On site measure & Leichhardt 0400 729 011 Designs refurbish remote design & quote Big Bite on Hot breakfast , coffee and All our food is take away 3/250 Pitt Street, 9283 4700 Bigbiteonpitt.com.au Pitt sandwiches.