Interest Rate Conversion

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Calculating Interest Rates

Calculating interest rates A reading prepared by Pamela Peterson Drake O U T L I N E 1. Introduction 2. Annual percentage rate 3. Effective annual rate 1. Introduction The basis of the time value of money is that an investor is compensated for the time value of money and risk. Situations arise often in which we wish to determine the interest rate that is implied from an advertised, or stated rate. There are also cases in which we wish to determine the rate of interest implied from a set of payments in a loan arrangement. 2. The annual percentage rate A common problem in finance is comparing alternative financing or investment opportunities when the interest rates are specified in a way that makes it difficult to compare terms. One lending source 1 may offer terms that specify 9 /4 percent annual interest with interest compounded annually, whereas another lending source may offer terms of 9 percent interest with interest compounded continuously. How do you begin to compare these rates to determine which is a lower cost of borrowing? Ideally, we would like to translate these interest rates into some comparable form. One obvious way to represent rates stated in various time intervals on a common basis is to express them in the same unit of time -- so we annualize them. The annualized rate is the product of the stated rate of interest per compounding period and the number of compounding periods in a year. Let i be the rate of interest per period and let n be the number of compounding periods in a year. -

Measuring the Natural Rate of Interest: International Trends and Determinants

FEDERAL RESERVE BANK OF SAN FRANCISCO WORKING PAPER SERIES Measuring the Natural Rate of Interest: International Trends and Determinants Kathryn Holston and Thomas Laubach Board of Governors of the Federal Reserve System John C. Williams Federal Reserve Bank of San Francisco December 2016 Working Paper 2016-11 http://www.frbsf.org/economic-research/publications/working-papers/wp2016-11.pdf Suggested citation: Holston, Kathryn, Thomas Laubach, John C. Williams. 2016. “Measuring the Natural Rate of Interest: International Trends and Determinants.” Federal Reserve Bank of San Francisco Working Paper 2016-11. http://www.frbsf.org/economic-research/publications/working- papers/wp2016-11.pdf The views in this paper are solely the responsibility of the authors and should not be interpreted as reflecting the views of the Federal Reserve Bank of San Francisco or the Board of Governors of the Federal Reserve System. Measuring the Natural Rate of Interest: International Trends and Determinants∗ Kathryn Holston Thomas Laubach John C. Williams December 15, 2016 Abstract U.S. estimates of the natural rate of interest { the real short-term interest rate that would prevail absent transitory disturbances { have declined dramatically since the start of the global financial crisis. For example, estimates using the Laubach-Williams (2003) model indicate the natural rate in the United States fell to close to zero during the crisis and has remained there into 2016. Explanations for this decline include shifts in demographics, a slowdown in trend productivity growth, and global factors affecting real interest rates. This paper applies the Laubach-Williams methodology to the United States and three other advanced economies { Canada, the Euro Area, and the United Kingdom. -

Inflation, Income Taxes, and the Rate of Interest: a Theoretical Analysis

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: Inflation, Tax Rules, and Capital Formation Volume Author/Editor: Martin Feldstein Volume Publisher: University of Chicago Press Volume ISBN: 0-226-24085-1 Volume URL: http://www.nber.org/books/feld83-1 Publication Date: 1983 Chapter Title: Inflation, Income Taxes, and the Rate of Interest: A Theoretical Analysis Chapter Author: Martin Feldstein Chapter URL: http://www.nber.org/chapters/c11328 Chapter pages in book: (p. 28 - 43) Inflation, Income Taxes, and the Rate of Interest: A Theoretical Analysis Income taxes are a central feature of economic life but not of the growth models that we use to study the long-run effects of monetary and fiscal policies. The taxes in current monetary growth models are lump sum transfers that alter disposable income but do not directly affect factor rewards or the cost of capital. In contrast, the actual personal and corporate income taxes do influence the cost of capital to firms and the net rate of return to savers. The existence of such taxes also in general changes the effect of inflation on the rate of interest and on the process of capital accumulation.1 The current paper presents a neoclassical monetary growth model in which the influence of such taxes can be studied. The model is then used in sections 3.2 and 3.3 to study the effect of inflation on the capital intensity of the economy. James Tobin's (1955, 1965) early result that inflation increases capital intensity appears as a possible special case. -

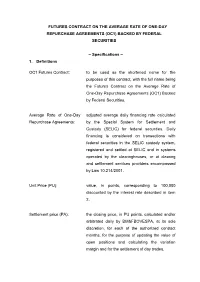

Futures Contract on the Average Rate of One-Day Repurchase Agreements (Oc1) Backed by Federal Securities

FUTURES CONTRACT ON THE AVERAGE RATE OF ONE-DAY REPURCHASE AGREEMENTS (OC1) BACKED BY FEDERAL SECURITIES – Specifications – 1. Definitions OC1 Futures Contract: to be used as the shortened name for the purposes of this contract, with the full name being the Futures Contract on the Average Rate of One-Day Repurchase Agreements (OC1) Backed by Federal Securities. Average Rate of One-Day adjusted average daily financing rate calculated Repurchase Agreements: by the Special System for Settlement and Custody (SELIC) for federal securities. Daily financing is considered on transactions with federal securities in the SELIC custody system, registered and settled at SELIC and in systems operated by the clearinghouses, or at clearing and settlement services providers encompassed by Law 10.214/2001. Unit Price (PU): value, in points, corresponding to 100,000 discounted by the interest rate described in item 2. Settlement price (PA): the closing price, in PU points, calculated and/or arbitrated daily by BM&FBOVESPA, at its sole discretion, for each of the authorized contract months, for the purpose of updating the value of open positions and calculating the variation margin and for the settlement of day trades. Reserve-day: business day for the purposes of financial market transactions, as established by the National Monetary Council. BM&FBOVESPA: BM&FBOVESPA S.A. – Bolsa de Valores, Mercadorias e Futuros. BCB: Central Bank of Brazil 2. Underlying asset The effective interest rate until the contract’s expiration date, defined for these purposes by the accumulation of the daily rates of repurchase agreements in the period as of and including the transaction’s date up to and including the contract’s expiration date. -

Interest Rates and Expected Inflation: a Selective Summary of Recent Research

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: Explorations in Economic Research, Volume 3, number 3 Volume Author/Editor: NBER Volume Publisher: NBER Volume URL: http://www.nber.org/books/sarg76-1 Publication Date: 1976 Chapter Title: Interest Rates and Expected Inflation: A Selective Summary of Recent Research Chapter Author: Thomas J. Sargent Chapter URL: http://www.nber.org/chapters/c9082 Chapter pages in book: (p. 1 - 23) 1 THOMAS J. SARGENT University of Minnesota Interest Rates and Expected Inflation: A Selective Summary of Recent Research ABSTRACT: This paper summarizes the macroeconomics underlying Irving Fisher's theory about tile impact of expected inflation on nomi nal interest rates. Two sets of restrictions on a standard macroeconomic model are considered, each of which is sufficient to iniplv Fisher's theory. The first is a set of restrictions on the slopes of the IS and LM curves, while the second is a restriction on the way expectations are formed. Selected recent empirical work is also reviewed, and its implications for the effect of inflation on interest rates and other macroeconomic issues are discussed. INTRODUCTION This article is designed to pull together and summarize recent work by a few others and myself on the relationship between nominal interest rates and expected inflation.' The topic has received much attention in recent years, no doubt as a consequence of the high inflation rates and high interest rates experienced by Western economies since the mid-1960s. NOTE: In this paper I Summarize the results of research 1 conducted as part of the National Bureaus study of the effects of inflation, for which financing has been provided by a grait from the American life Insurance Association Heiptul coinrnents on earlier eriiins of 'his p,irx'r serv marIe ti PhillipCagan arid l)y the mnibrirs Ut the stall reading Committee: Michael R. -

Decision on the Effective Interest Rate

Pursuant to Article 304, item (1) of the Credit Institutions Act (Official Gazette 159/2013, 19/2015 and 102/2015) and in connection with Article 17 of the Act on Consumer Housing Loans (Official Gazette 101/2017), Article 13, paragraph (3) of the Credit Unions Act (Official Gazette 141/2006, 25/2009 and 90/2011) and Article 43, paragraph (2), item (9) of the Act on the Croatian National Bank (Official Gazette 75/2008 and 54/2013), the Governor of the Croatian National Bank hereby issues the Decision on the effective interest rate I GENERAL PROVISIONS Subject matter Article 1 (1) This Decision prescribes the calculation methodology and elements for the purposes of the uniform calculation of the effective interest rate (hereinafter referred to as 'EIR'). (2) This Decision transposes into the legal system of the Republic of Croatia Directive 2014/17/EU of the European Parliament and of the Council of 4 February 2014 on credit agreements for consumers relating to residential immovable property and amending Directives 2008/48/EC and 2013/36/EU and Regulation (EU) No 1093/2010 (OJ L 60, 28.2.2014). Entities subject to the Decision Article 2 (1) Entities subject to this Decision shall be the following entities that provide services to consumers: 1. credit institutions with head offices in the Republic of Croatia that have been authorised by the Croatian National Bank; 2. credit institutions of the Member States that have established branches within the territory of the Republic of Croatia in accordance with the law governing the operation of credit institutions or that have been authorised to provide mutually recognised services directly within the territory of the Republic of Croatia; 3. -

March 21, 2018

Guaranteed Home Loan Program March 21, 2018 USDA Rural Development Guaranteed Home Loan Program Requires Itemization of Loan Discount Points and Origination Fees USDA Rural Development’s guaranteed home loan program requires that loan discount points and loan origination fees be itemized separately on the settlement statement so the amount of the loan used for loan discount points can be accurately identified. Also, loan discount points, other than to reduce the effective interest rate, cannot be financed as part of the loan. Discount points must be reasonable and customary for the area and cannot be more than those charged other applicants for comparable transactions. Permissible discount points financed may not exceed two percentage points of the loan amount for a non-streamlined refinance. Loan discount points representing fees other than to reduce the effective interest rate, such as to compensate for a low credit score or low loan amount, are ineligible loan purposes. Lenders must begin with an eligible interest rate prior to reducing the effective interest rate. Last year 2,100 rural Iowa families and individuals purchased homes by accessing more than $230 million in USDA Rural Development guaranteed loans. Please call (515) 284-4667, email [email protected] or visit www.rd.usda.gov/ia for more information. USDA Guaranteed Home Loan Program - Additional Information and Resources Stay informed of guaranteed home loan program changes by signing up for alerts at https://public.govdelivery.com/accounts/USDARD/subscriber/new?qsp=USDARD_25 USDA Rural Development's current 3555 Lender Handbook can be found at http://www.rd.usda.gov/publications/regulations-guidelines/handbooks. -

ADM-505 How to Determine Interest Rates

How to Determine Pre- & Post- Judgment Interest Rates in 2021 1. Is there a contract that sets the interest rate? If not, go to #2. 2. Is there a statute other than AS 09.30.070 that sets the interest rate? 1 If not, go to #3. 3. When did the cause of action accrue? 2 a. Before August 7, 1997: Both the pre- & post- judgment interest rates are 10.5%3 b. On or After August 7, 1997: Both pre- & post- judgment interest rates will be the interest rate for the year in which the judgment is entered.4 For judgments entered in 2021, this rate is 3.25%.5 Note: After the interest rate on a particular judgment is established, it does not later change, even though the interest rate changes. For example: The post-judgment interest rate on a judgment entered in 2001 is 9%. That rate will stay 9% until the judgment is paid. It is not affected by the fact that new judgments entered in 2021 will have a 3.25% interest rate. 1 Examples of other statutes that set interest rates: • AS 25.27.025 – child support arrearages • AS 06.05.473(h) – claims upon liquidation of a state bank • AS 09.55.440(a) – compensation for property taken in eminent domain proceeding • AS 13.16.475(d) – claims against decedent’s estate 2 Accrue. In general, a cause of action “accrues” when a suit may be maintained thereon, that is, when sufficient events have occurred to support a valid lawsuit (for example, when injury or damage occurs or when a contract is breached). -

Fact Sheet on Interest Rate Restrictions

Federal Deposit Insurance Corporation FACT SHEET Interest Rate Restrictions The Federal Deposit Insurance Corporation (FDIC) published a final rule to revise its regulations relating to interest rate restrictions on banks that are less than well capitalized. PROMOTES FLEXIBILITY AND RESPONSIVENESS ACROSS ECONOMIC CYCLES – The final rule promotes flexibility for institutions subject to the interest rate restrictions and ensures that those institutions will be able to compete for deposits regardless of the interest rate environment. • The final rule defines the “National Rate Cap” as the higher of (1) the national rate plus 75 basis points; or (2) for maturity deposits, 120 percent of the current yield on similar maturity U.S. Treasury obligations and, for nonmaturity deposits, the federal funds rate, plus 75 basis points. • By establishing two methods for calculating the national rate cap, the FDIC ensures that deposit interest rate caps are durable under both high-rate or rising-rate environments and low-rate or falling-rate environments. MORE COMPREHENSIVE NATIONAL RATE – The final rule defines the National Rate to include credit union rates for the first time. • “National Rate” is defined as the weighted average of rates paid by all IDIs and credit unions on a given deposit product, for which data are available, where the weights are each institution’s market share of domestic deposits. PROMOTES TRANSPARENCY – The final rule calculates the National Rate Cap based on similar maturity U.S. Treasury obligations and the federal funds rate, which are both publicly available, and thus, represent a more transparent calculation for bankers and the public. REDUCES REGULATORY BURDEN – The final rule provides a new simplified process, as opposed to the current two-step process, for institutions that seek to offer a competitive rate when the prevailing rate in an institution’s local market area exceeds the national rate cap. -

The-Great-Depression-Glossary.Pdf

The Great Depression | Glossary of Terms Glossary of Terms Balanced budget – Government revenues equal expenditures on an annual basis. (Lesson 5) Bank failure – When a bank’s liabilities (mainly deposits) exceed the value of its assets. (Lesson 3) Bank panic – When a bank run begins at one bank and spreads to others, causing people to lose confidence in banks. (Lesson 3) Bank reserves – The sum of cash that banks hold in their vaults and the deposits they maintain with Federal Reserve banks. (Lesson 3) Bank run – When many depositors rush to the bank to withdraw their money at the same time. (Lesson 3) Bank suspensions – Comprises all banks closed to the public, either temporarily or permanently, by supervisory authorities or by the banks’ boards of directors because of financial difficulties. Banks that close under a special holiday declaration and remained closed only during the designated holiday are not counted as suspensions. (Lesson 4) Banks – Businesses that accept deposits and make loans. (Lesson 2) Budget deficit – When government expenditures exceed revenues. (Lesson 4) Budget surplus – When government revenues exceed expenditures. (Lesson 4) Consumer confidence – The relationship between how consumers feel about the economy and their spending and saving decisions. (Lesson 5) Consumer Price Index (CPI) – A measure of the prices paid by urban consumers for a market basket of consumer goods and services. (Lesson 1) Deflation – A general downward movement of prices for goods and services in an economy. (Lessons 1, 3 and 6) Depression – A very severe recession; a period of severely declining economic activity spread across the economy (not limited to particular sectors or regions) normally visible in a decline in real GDP, real income, employment, industrial production, wholesale-retail credit and the loss of overall confidence in the economy. -

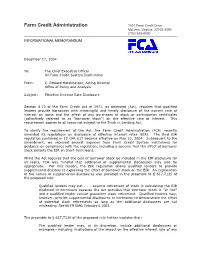

Effective Interest Rate Disclosure

Farm Credit Administration 1501 Farm Credit Drive McLean, Virginia 22102-5090 (703) 883-4000 INFORMATIONAL MEMORANDUM December 17, 2004 To: The Chief Executive Officer All Farm Credit System Institutions From: C. Edward Harshbarger, Acting Director Office of Policy and Analysis Subject: Effective Interest Rate Disclosure Section 4.13 of the Farm Credit Act of 1971, as amended (Act), requires that qualified lenders provide borrowers with meaningful and timely disclosure of the current rate of interest on loans and the effect of any purchases of stock or participation certificates (collectively referred to as "borrower stock") on the effective rate of interest. This requirement applies to all loans not subject to the Truth in Lending Act. To clarify the requirement of the Act, the Farm Credit Administration (FCA) recently amended its regulations on disclosure of effective interest rates (EIR). The final EIR regulation contained in 12 CFR 617 became effective on May 10, 2004. Subsequent to the amendment, we received several inquiries from Farm Credit System institutions for guidance on compliance with the regulation, including a concern that the effect of borrower stock distorts the EIR on short-term loans. While the Act requires that the cost of borrower stock be included in the EIR disclosure for all loans, FCA was mindful that additional or supplemental disclosures may also be appropriate. For this reason, the EIR regulation allows qualified lenders to provide supplemental disclosures explaining the effect of borrower stock on the EIR. An explanation of the nature of supplemental disclosures was provided in the preamble to § 617.7125 of the proposed rule: Qualified lenders may not . -

Effective Rates of Interest: Beware of Inconsistencies

I I I I "kI bN 4:)* 61 Rewards ISSUE 58 AUGUST 2011 EFFECTIVE RATES OF INTEREST: BEWARE OF INCONSISTENCIES By Stevens A. Carey* Synopsis: Current introductory textbooks on the mathematics offinance inconsistently define an "effective rate of interest ". Many, if not most, of these definitions are general and cover not only compound interest but also simple interest. These general definitions yield the same results onlyfor interest accumulation functions, such as continuous compound interest at a constant rate, which satisfy any one of three equivalent regularity conditions known as Markov accumulation, the consistency principle and the transitivity of the corresponding time value relation. Simple interest, as it is generally known, does not satisfy these conditions. Outside the context of compound interest, care must be taken to ensure that there is a common understanding of an effective rate of interest. * STEVENS A. CAREYis a transa ctional partner with Pircher, Nichols & Meeks, a real estate law firm with offices in Los Angeles and Chicago. This article is a condensed version of an article previously published by the author: Carey, "Effective Rates ofInterest", The Real Estate Finance Journal (JVinter 2011) © 2010 Thompson/West. Please refer to the prior article for more detail (including acknowledgments, citations, quotes of effective rate definitionsfrom various textbooks, and proofs). 1 INTRODUCTION - MUCH ADO ABOUT NOTHING? What is an effective rate of interest? Isn't the definition relatively standard? As the word "effective" suggests, the effective rate for a particular time period seems to be nothing more than the rate that reflects the actual economic "effect" of the interest during that period, namely: the actual percentage increase by which a unit investment would grow during the applicable period.