FRCC Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pipeline Transportation and Underground

Docket No. RP16-___-000 Exhibit No. ANR-012 Page 1 of 17 Additions to Capacity on the U.S. Natural Gas Pipeline Network: 2005 This report examines the amount of new natural gas pipeline capacity added to the U.S. natural gas pipeline system during 2005 and the areas of the country where those additions were concentrated. In addition, it discusses and analyzes proposed natural gas pipeline projects that may be developed between 2006 and 2008 and the market factors supporting these initiatives. Questions or comments on the contents of this article should be directed to James Tobin at [email protected] or (202) 586-4835. The addition to natural gas pipeline capacity in 2005 It appears, however, that 2004 and 2005 may be the bottom exceeded that of 2004 (Figure 1) although fewer miles of of a temporary trough in the natural gas pipeline development pipeline were installed (Figure 2). Miles of new natural gas activity cycle. The current inventory of announced or pipeline (1,152) were 21 percent less than in 2004, even approved natural gas pipeline projects indicates that natural though pipeline capacity grew by 8.2 billion cubic feet per gas pipeline capacity additions could increase significantly day (Bcf/d), a 7-percent increase in capacity additions (see between 2006 and 2008 (Figure 1). Several factors are Box, “Capacity Measures,” p. 4). Indeed, less new natural driving this anticipated growth, particularly the expanding gas pipeline mileage was added in 2005 than in any year development of natural gas production in the Fort Worth during the past decade.1 Basin of east Texas and the Piceance/Unita Basins of western Colorado and eastern Utah, and the need for natural gas Figure 1. -

154 Ferc ¶ 61080 United States

154 FERC ¶ 61,080 UNITED STATES OF AMERICA FEDERAL ENERGY REGULATORY COMMISSION Before Commissioners: Norman C. Bay, Chairman; Cheryl A. LaFleur, Tony Clark, and Colette D. Honorable. Florida Southeast Connection, LLC Docket Nos. CP14-554-000 Transcontinental Gas Pipe Line Company, LLC CP15-16-000 Sabal Trail Transmission, LLC CP15-17-000 ORDER ISSUING CERTIFICATES AND APPROVING ABANDONMENT (Issued February 2, 2016) 1. On September 26, 2014, Florida Southeast Connection, LLC (Florida Southeast) filed an application in Docket No. CP14-554-000, pursuant to section 7(c) of the Natural Gas Act1 (NGA) and Part 157 of the Commission’s regulations,2 for authorization to construct and operate the Florida Southeast Connection Project (Florida Southeast Project), a new 126-mile natural gas pipeline and related facilities.3 The Florida Southeast Project will provide up to 640,000 dekatherms per day (Dth/d) of firm transportation service. Florida Southeast also requests a blanket certificate under Part 157, Subpart F of the Commission's regulations to perform certain routine construction activities and operations, and a blanket certificate under Part 284, Subpart G of the Commission's regulations to provide open access transportation services. 2. On November 18, 2014, Transcontinental Gas Pipe Line Company, LLC (Transco) filed an application in Docket No. CP15-16-000 under sections 7(b) and 7(c) of the NGA and Part 157 of the Commission’s regulations, requesting authorization to 1 15 U.S.C. § 717f(c) (2012). 2 18 C.F.R. Pt. 157 (2015). 3 Commission staff’s draft and final Environmental Impact Statement for this proceeding refer to Florida Southeast as “FSC” and the Florida Southeast Project as “FSC Project.” Docket Nos. -

Transporting Natural Gas

About U.S. Natural Gas Pipelines – Transporting Natural Gas The U.S. natural gas pipeline network is a highly U.S. Natural Gas Pipeline Network integrated transmission and distribution grid that can transport natural gas to and from nearly any location in the lower 48 States. The natural gas pipeline grid comprises: • More than 210 natural gas pipeline systems. • 300,000 miles of interstate and intrastate transmission pipelines (see mileage table). • More than 1,400 compressor stations that maintain pressure on the natural gas pipeline network and assure continuous forward movement of supplies (see map). • More than 11,000 delivery points, 5,000 click to enlarge receipt points, and 1,400 interconnection See Appendix A: Combined ‘Natural Gas points that provide for the transfer of natural Transportation’ maps gas throughout the United States. • 29 hubs or market centers that provide See Appendix B: Tables additional interconnections (see map). • 394 underground natural gas storage facilities (see map). Geographic Coverage of Pipeline Companies • 55 locations where natural gas can be United States - links to companies listed A-Z with U.S. map imported/exported via pipelines (see map). showing regional breakout detail • 5 LNG (liquefied natural gas) import facilities and 100 LNG peaking facilities. Northeast - CT, DE, MA, MD, ME, NH, NJ, NY, PA, RI, VA, VT, WV Learn more about the natural gas Midwest - IL, IN, MI, MN, OH, WI Southeast - AL, FL, GA, KY, MS, NC, SC, TN pipeline network: Southwest - AR, LA, NM, OK, TX Central - CO, IA, KS, -

FERC NGA GAS TARIFF Fifth Revised Volume No. 1

FERC NGA GAS TARIFF Fifth Revised Volume No. 1 (Supersedes Fourth Revised Volume No. 1) Of FLORIDA GAS TRANSMISSION COMPANY, LLC Filed with FEDERAL ENERGY REGULATORY COMMISSION Communications concerning this Tariff should be addressed to: Michael T. Langston Vice President Chief Regulatory Officer Florida Gas Transmission Company, LLC 1300 Main Street Houston, Texas 77002 Phone: (713) 989-7610 Fax: (713) 989-1205 [email protected] Florida Gas Transmission Company, LLC FERC NGA Gas Tariff Part I Table of Contents Fifth Revised Volume No. 1 Version 9.0.0 PART I TABLE OF CONTENTS Part II Preliminary Statement Part III Tariff Map System Map Western Division Map Market Area Map Part IV Currently Effective Rates Rate Schedule FTS-1 Currently Effective Rates Rate Schedule FTS-2Cancel Currently Effective Rates Rate Schedule FTS-3 Currently Effective Rates Rate Schedule SFTS Currently Effective Rates Rate Schedule NNTS Currently Effective Rates Rate Schedule FTS-WD Currently Effective Rates Rate Schedule FTS-WD-2 Currently Effective Rates Rate Schedule ITS-1 Currently Effective Rates Rate Schedule ITS-WD Currently Effective Rates Rate Schedule PNR Currently Effective Rates Negotiated Rates Currently Effective Rates Part V Rate Schedules Rate Schedule FTS-1 Firm Transportation Service Rate Schedule FTS-2Cancel Firm Transportation Service Rate Schedule FTS-3 Firm Transportation Service Rate Schedule SFTS Small Customer Firm Transportation Service Rate Schedule NNTS No Notice Transportation Service Rate Schedule FTS-WD Firm Transportation Service Rate Schedule FTS-WD-2 Firm Transportation Service Rate Schedule ITS-1 Interruptible Transportation Service Rate Schedule ITS-WD Interruptible Transportation Service Rate Schedule PNR Interruptible Park ‘N Ride Service Rate Schedule IPS In-Line Pooling Transportation Service Rate Schedule TSS Transporter Sales Service - Cancelled Page 1 of 3 Filed: August 4, 2021 Effective: September 4, 2021 Florida Gas Transmission Company, LLC FERC NGA Gas Tariff Part I Table of Contents Fifth Revised Volume No. -

RP19-402-000 FERC Form 501-G Filing

December 6, 2018 Via eFiling Ms. Kimberly D. Bose, Secretary Federal Energy Regulatory Commission 888 First Street, NE Washington, DC 20426 Re: Docket No. RP19-____ Florida Gas Transmission Company, LLC Form No. 501-G Dear Ms. Bose: In compliance with Order No. 849 (Final Rule) and Section 260.402 of the Commission’s Regulations under the Natural Gas Act, Florida Gas Transmission Company, LLC (Florida Gas) submits herewith its FERC Form No. 501-G, One-time Report on Rate Effect of the Tax Cuts and Jobs Act, established in Docket No. RM18-11-000, for the twelve months ending December 31, 2017. As further detailed below, pursuant to Option 3 of the Final Rule, Florida Gas does not believe an adjustment is warranted at this time. Paragraph 216 of the Final Rule stated that under Option 3, a pipeline may explain why an adjustment in its rates is not warranted. As such, Florida Gas submits an Addendum to its Form No. 501-G, which reflects certain adjustments that Florida Gas believes are necessary to properly reflect its situation. In addition, pursuant to the Stipulation and Agreement entered into as a settlement of the last Florida Gas rate case in Docket No. RP15-101-000, Florida Gas has agreed to reduce its existing tariff rates effective February 1, 2019, and a filing to reflect such reduction will be made by the end of December, 2018. Such rate reductions are not reflected in the attached 501-G forms. In addition, Florida Gas has an obligation to file the next rate case on February 1, 2020, and has agreed to a rate moratorium until that time. -

Subchapter I—Other Regulations Under the Natural Gas Policy Act of 1978 and Related Authorities

SUBCHAPTER I—OTHER REGULATIONS UNDER THE NATURAL GAS POLICY ACT OF 1978 AND RELATED AUTHORITIES PART 280—GENERAL PROVISIONS 281.303 Definitions. 281.304 Computation of alternative fuel vol- APPLICABLE TO SUBCHAPTER I ume. 281.305 General rule. AUTHORITY: Natural Gas Policy Act of 1978, APPENDIX A TO PART 281—COMPARISON OF SE- Pub. L. 95–621; 92 Stat. 3350, 15 U.S.C. 3301– LECTED FUEL PRICE DATA, FPC FORM NO. 3432; Outer Continental Shelf Lands Act 423 VERSUS MONTHLY ENERGY REVIEW, Amendment of 1978, Pub. L. 95–372, 43 U.S.C. 1976—JANUARY 1980 1862. AUTHORITY: 15 U.S.C. 717–717w, 3301–3432; 16 U.S.C. 2601–2645; 42 U.S.C. 7101–7352. § 280.101 Definitions. SOURCE: Order 10–B, 44 FR 13470, Mar. 12, (a) NGPA definitions. Terms defined in 1979, unless otherwise noted. the NGPA shall have the same meaning for purposes of this subchapter as they Subpart A Reserved have under the NGPA, unless further [ ] defined in this subpart. (b) Other definitions. For purposes of Subpart B—Permanent this subchapter: Curtailment Rule (1) NGPA means the Natural Gas Pol- icy Act of 1978. § 281.201 Purpose. (2) OCS means the Outer Continental The purpose of this subpart is to im- Shelf as defined in section 2(35) of the plement section 401 of the NGPA in NGPA. order to provide that effective Novem- ber 1, 1979, the curtailment plans of [44 FR 12409, Mar. 7, 1979, as amended by Order 92, 45 FR 49252, July 24, 1980] interstate pipelines protect, to the maximum extent practicable, deliv- eries of natural gas for essential agri- PART 281—NATURAL GAS CURTAIL- cultural uses and for high-priority uses MENT UNDER THE NATURAL GAS in accordance with the provisions of POLICY ACT OF 1978 this subpart. -

Methodology and Specifications Guide Global M2M Gas Quantitatively Modeled Forward Curves

Methodology and Specifications Guide Global M2M Gas Quantitatively Modeled Forward Curves Latest update: June 2021 Introduction 2 Part VI: Requests for clarifications of data and How this methodology statement is organized 2 complaints 4 Part I: Data quality and data submission 2 Part VII: Definitions of the North American locations for General principles applicable to all derivative or forward which Platts publishes forward curves 5 markets 2 Northeast 7 Gulf Coast Region 10 Part II: Security and confidentiality 3 Mid-Continent 13 Upper Midwest 14 Rockies and West 15 Part III: Calculating forward curves 3 National Package 17 Shaping 3 GPCM and 20 year curves 3 Important disclosure 18 Part IV: Platts standards 4 Revision history 19 Part V: Corrections 4 www.spglobal.com/platts Methodology and Specifications Guide Global M2M Gas Quantitatively Modeled Forward Curves: June 2021 INTRODUCTION be used for independent valuation, mark-to-market validation How this methodology statement is organized processes, strategic decision support, or other portfolio risk Platts’ methodologies are designed to produce forward curves This description of methodology for forward curves is divided management processes. The product also provides a valuable that are representative of market value, and of the particular into seven major parts (I-VII) that parallel the entire process of source of information for evaluating and verifying internally markets to which they relate. Methodology documents describe producing the forward curves. generated values for marking forward positions. the specifications for various products reflected by Platts’ Market Data, the processes and standards Platts adheres to ■■ Part I describes what goes into Platts forward curves, Platts maintains comprehensive historical data on spot and in collecting data, and the methods by which Platts arrives at including details on what market data is used. -

Gas Debit/Credit Calculations for Fy 2014

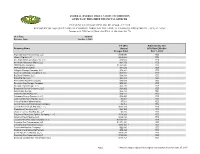

FEDERAL ENERGY REGULATORY COMMISSION OFFICE OF THE CHIEF FINANCIAL OFFICER GAS DEBIT/CREDIT CALCULATIONS FOR FY 2014 Act Program Cost: 59,235,000 Adj Tot DTherms: 42,469,337,988 Adj Chg Factor: 0.0013947710 Original Adjusted Company 2014 Company Name Annual Annual Total Debit/Credit Charge Charge Algonquin Gas Transmission, LLC (310) 604,036,582 851,643 842,493 -9,150 Alliance Pipeline L.P. (493) 677,855,934 955,723 945,454 -10,269 American Midstream (AlaTenn) LLC (199) 18,291,164 25,789 25,512 -277 American Midstream (Midla) LLC (12451) 53,265,698 75,100 74,293 -807 ANR Pipeline Company (12442) 1,415,820,336 1,996,194 1,974,745 -21,449 ANR Storage Company (36155) 30,396,543 42,857 42,396 -461 Arlington Storage Company, LLC (604) 42,338,384 59,694 59,052 -642 Bear Creek Storage Company, L.L.C. (1332) 41,379,795 58,342 57,715 -627 Big Sandy Pipeline, LLC (002443) 35,321,584 49,801 49,266 -535 Bison Pipeline LLC (302) 12,881,040 18,161 17,966 -195 Black Marlin Pipeline Company (1772) 8,892,244 12,537 12,403 -134 Blue Lake Gas Storage Company (1901) 35,788,906 50,460 49,917 -543 Bluewater Gas Storage, LLC (001154) 48,182,237 67,933 67,203 -730 Boardwalk Storage Company, LLC (14444) 10,433,076 14,710 14,552 -158 Bobcat Gas Storage (11144) 43,230,913 60,952 60,297 -655 Caledonia Energy Partners, L.L.C. (726) 11,613,012 16,373 16,197 -176 Cameron Interstate Pipeline, LLC (740) 1,064,108 1,500 1,484 -16 Carolina Gas Transmission Corporation (187) 135,519,468 191,072 189,019 -2,053 Centra Pipelines Minnesota Inc. -

OSRADP Report # 02-006

OSRADP Report # Research and Development of a GIS of Oil and Gas Transmission Pipelines In the Lafayette, Louisiana Vicinity By Louisiana State University Louisiana Geological Survey For Louisiana Oil Spill Coordinator’s Office/Office of the Governor Oil Spill Research and Development Program Research and Development of a GIS of Oil and Gas Transmission Pipelines In the Lafayette, Louisiana Vicinity Submitted to the Louisiana Oil Spill Coordinator’s Office/Office of the Governor Oil Spill Research and Development Program By Louisiana State University Louisiana Geological Survey Robert Paulsell and Weiwen Feng Louisiana Geological Survey Disclaimer This report was prepared under a contract between Louisiana State University and the Louisiana Applied Oil Spill Research and Development Program (OSRADP). The contents of this document do not necessarily reflect the views and policies of the Louisiana Oil Spill Coordinator’s Office—Office of the Governor or that of the Louisiana Applied Oil Spill Research and Development Program, nor does mention of trade names or commercial products constitute endorsement or recommendation for use by the state of Louisiana. Report Availability Additional copies of this report may be obtained by writing to: The Louisiana Applied Oil Spill Research and Development Program 2003 Deliverables Room 258 A Military Science Building Baton Rouge, Louisiana 70803 Telephone number: (225) 578-3477 • FAX number (225) 578-0403 Or from The Louisiana Oil Spill Coordinator’s Office/Office of the Governor Natural Resources Building 625 N 4th Street, Room 800 Baton Rouge, Louisiana 70804 Telephone number: (225) 219-5800 • FAX number (225) 219-5802 Citation Suggested Citation: Paulsell, R.L. -

Ehron Documents 1993

Ehron Documents 1993 S-F-1325.12 CORRESPONDENCE CONTROL FORM (11-90) OFFICE OF THE EXECLTIVE SECRETARIAT ACTIVITY ADD DO NOT DETACH FROM ORIGINAL CORRESPONDENCE 01/19/93 10:17 SOURCE CODE pM PUBLIC MAIL SPEC INT: _ CONTROL N( S93-000578 DATE CORR: 01/13/93 DATERECD: 01/19/93 DATECNTRL: 01/19/93 -DATE DUE: LETTER: MEMO: TWX: _OTHER: MOTION TO:SECY: X DEPSEC: UN SEC: OTHER: ROM:FLOWERS,G PATRICK TX O REMARKS: ENRON CORP. UB J : LEGAL -=--_- LITIGATION FOR USE fY ACT N OFFICE ONLY MOTION FOR LEAVE TO INTERVENE ACTION REFERRED TO DATE RETURN TO DUE OF NORTHERN NATURAL GAS CO., DATE TRANSWESTERN PIPELINE CO., 2 FLORIDA GAS TRANSMISSION CO... _3-_ ACTION TO: rr - TYPE ACTION: Appropriate action SIG OF: 3NCURRENCE: i NFORMATION:DS US EP FE ES1 D02 FILE CODE:PMFLOWFRS-ES930'00578 CONTROL ANALYST: B ATCHERSON 6-2255 ALL DOCUNfENTS FOR THE OFFICE OF THE SECRETARY MUST BE FORWARDED TO THE OFFICE OF THE EXECUTIVE SECRETARIAT FOR FINAL PROCESSING Vvcj-. ^. -, i IN THE UNITED STATES COURT OF APPEALS FOR THE DISTRICT OF COLUMBIA CIRCUIT Virginia Electric and Power Company, § Petitioner, §-- § v. § No. 92-1644 § (Not Consolidated) Federal Energy Regulatory Commission, § Respondent. § Northern-Indiana Public § Service Company, § Petitioner, § v. § No. 93-1002 § (Not Consolidated) Federal Energy Regulatory Commission, § Respondent. Northern States Power Company § (Minnesota) and § Northern States Power Company § (Wisconsin), § Petitioners, § § v. § No. 93-1003 § (Not Consolidated) Federal Energy Regulatory § Commission, Respondent. § Midland Cogeneration Venture § Limited Partnership, § § v. § No. 93-1006 § (Not Consolidated) Federal Energy Regulatory § .Commission, § Respondent. SNR\1014.jwz MOTION FOR LEAVE TO INTERVENE OF NORTHERN NATURAL GAS COMPANY, TRANSWESTERN. -

Payment Status of Pipeline Billings

FEDERAL ENERGY REGULATORY COMMISSION OFFICE OF THE CHIEF FINANCIAL OFFICER PAYMENT STATUS OF PIPELINE BILLINGS - FY 2015 RECOVERY OF ASSESSED ANNUAL CHARGES THROUGH THE ANNUAL CHARGES ADJUSTMENT (ACA) CLAUSE Pursuant to 18 CFR Part 154 Docket No. RM12-14-000; Order No. 776 ACA Rate: $0.0014 Effective Date: October 1, 2015 FY 2015 Authorized to Use Company Name Annual ACA Rate Effective Charges Paid Oct. 1, 2015 Algonquin Gas Transmission, LLC $919,070 YES Alliance Pipeline L.P. $959,856 YES American Midstream (AlaTenn), LLC $26,516 YES American Midstream (Midla), LLC $64,759 YES ANR Pipeline Company $1,961,486 YES ANR Storage Company $64,524 YES Arlington Storage Company, LLC $56,341 YES Bear Creek Storage Company, L.L.C. $58,801 YES Big Sandy Pipeline, LLC $48,338 YES Bison Pipeline LLC $86,368 YES Black Marlin Pipeline Company $16,047 YES Blue Lake Gas Storage Company $50,345 YES Bluewater Gas Storage, LLC $42,239 YES Boardwalk Storage Company, LLC $23,662 YES Bobcat Gas Storage $54,732 YES Cadeville Gas Storage LLC $26,811 YES Caledonia Energy Partners, L.L.C. $14,867 YES Cameron Interstate Pipeline, LLC $1,461 YES Centra Pipelines Minnesota Inc. $7,011 YES Central Kentucky Transmission Company $6,769 YES Central New York Oil And Gas, L.L.C. $732,325 YES Chandeleur Pipe Line, LLC $21,169 YES Cheniere Creole Trail Pipeline, L.P. $3,206 YES Cheyenne Plains Gas Pipeline Company, L.L.C. $131,138 YES Cimarron River Pipeline, LLC $149,725 YES Colorado Interstate Gas Company, L.L.C. -

Natural Gas Latest Update: May 2020

Methodology and specifications guide US and Canada natural gas Latest update: May 2020 Introduction 2 Part VI: Requests for clarifications of data and Daily CGPR Symbols (USD/MMBtu) 37 How this methodology statement is organized 2 complaints 8 Monthly CGPR Symbols (CAD/Gj) 38 Monthly CGPR Symbols (USD/MMBtu) 39 CGPR Daily & Monthly Indices Methodology 40 Part I: Data quality and data submission 2 Part VII: Definitions of the trading locations for Gas Indices Americas (GIA) Daily Indices Methodology 40 which Platts publishes daily and monthly indices or What to report 3 GIA Symbols 41 How to report 3 assessments 9 Northeast 9 Revision history 42 Part II: Security and confidentiality 3 Appalachia 10 Midcontinent 11 Upper Midwest 12 Part III: Calculating indices and making assessments 3 East Texas 13 Price assessment and index guidelines 4 Louisiana/Southeast 14 Daily market 4 Rockies/Northwest 15 Monthly market 5 Southwest 17 Outliers 7 Platts locations daily symbols 18 Regional and national averages 7 Platts locations monthly symbols 22 Platts Canadian OTC Indices daily symbols 25 Part IV: Platts editorial standards 7 Platts Canadian OTC Indices monthly symbols 25 ICE locations daily symbols 26 ICE locations monthly symbols 30 Part V: Corrections 8 Daily CGPR Symbols (CAD/Gj) 36 www.spglobal.com/platts Methodology and specifications guide US and Canada natural gas: May 2020 INTRODUCTION stakeholders aimed at gaining market acceptance for any ■■ Part V lays out the verification and correction process for proposed introduction or changes to methodology. For more revising published prices and the criteria Platts uses to S&P Global Platts methodologies are designed to produce price information on the review and approval procedures, please determine when it publishes a correction.