Sustainable Investment Report 3 Q1 2021 SUSTAINABILITY INSIGHTS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Report & Accounts 2018

Report & Accounts 2018 Report & Accounts Derwent London plc Report & Accounts 2018 CONTENTS STRATEGIC REPORT GOVERNANCE 2018 summary ......................................................................................... 04 Introduction from the Chairman ........................................................... 84 Chairman’s statement ............................................................................ 07 Governance at a glance .......................................................................... 86 Chief Executive’s statement .................................................................. 08 Board of Directors ................................................................................... 88 CEO succession ........................................................................................11 Senior management ............................................................................... 90 London: Open for business .....................................................................12 Corporate governance statement ........................................................ 92 Central London office market ................................................................14 Nominations Committee report ......................................................... 100 A well-placed portfolio ............................................................................16 Audit Committee report ....................................................................... 104 Our stakeholders ......................................................................................18 -

XINT F UK Real Estate P GBP Index

As of December 30, 2020 XINT F UK Real Estate P GBP Index DE000A13PXZ5 GBP The XINT F UK Real Estate P GBP Index is a free-float adjusted index, designed to track the performance of real estate companies and REITS listed on the London Stock Exchange. INDEX PERFORMANCE - PRICE RETURN 120 115 110 105 100 95 90 85 80 75 70 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sep-20 Returns (p.a) Standard Deviation (p.a) Maximum Drawdown 3M 69.43% 3M 23.80% From 14.02.2020 6M 21.90% 6M 21.90% To 19.03.2020 1Y -17.08% 1Y -17.08% Return -38.63% Index Intelligence GmbH - Grosser Hirschgraben 15 - 60311 Frankfurt am Main Tel.: +49 69 247 5583 50 - [email protected] www.index-int.com Top 10 Constituents FFMV (GBPm) Weight % Industry Sector Segro PLC 11,298 19.84 Real Estate Land Securities Group PLC 4,910 8.62 Real Estate British Land Company PLC 4,630 8.13 Real Estate Unite Group PLC 3,341 5.87 Real Estate Derwent London PLC 3,136 5.51 Real Estate Tritax Big Box REIT Plc 2,866 5.03 Real Estate LondonMetric Property PLC 2,059 3.61 Real Estate Assura PLC 2,021 3.55 Real Estate Primary Health Properties PLC 1,989 3.49 Real Estate Grainger PLC 1,900 3.34 Real Estate Total 38,151 66.99 This information has been prepared by Index Intelligence GmbH (“IIG”). All information is provided "as is" and IIG makes no express or implied warranties, and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to any data included herein. -

COVERAGE LIST GEO Group, Inc

UNITED STATES: REIT/REOC cont’d. UNITED STATES: REIT/REOC cont’d. UNITED STATES: NON-TRADED REITS cont’d. COVERAGE LIST GEO Group, Inc. GEO Sabra Health Care REIT, Inc. SBRA KBS Strategic Opportunity REIT, Inc. Getty Realty Corp. GTY Saul Centers, Inc. BFS Landmark Apartment Trust, Inc. Gladstone Commercial Corporation GOOD Select Income REIT SIR Lightstone Value Plus Real Estate Investment Trust II, Inc. Gladstone Land Corporation LAND Senior Housing Properties Trust SNH Lightstone Value Plus Real Estate Investment Trust III, Inc. WINTER 2015/2016 • DEVELOPED & EMERGING MARKETS Global Healthcare REIT, Inc. GBCS Seritage Growth Properties SRG Lightstone Value Plus Real Estate Investment Trust, Inc. Global Net Lease, Inc. GNL Silver Bay Realty Trust Corp. SBY Moody National REIT I, Inc. Government Properties Income Trust GOV Simon Property Group, Inc. SPG Moody National REIT II, Inc. EUROPE | AFRICA | ASIA-PACIFIC | MIDDLE EAST | SOUTH AMERICA | NORTH AMERICA Gramercy Property Trust Inc. GPT SL Green Realty Corp. SLG MVP REIT, Inc. Gyrodyne, LLC GYRO SoTHERLY Hotels Inc. SOHO NetREIT, Inc. HCP, Inc. HCP Sovran Self Storage, Inc. SSS NorthStar Healthcare Income, Inc. UNITED KINGDOM cont’d. Healthcare Realty Trust Incorporated HR Spirit Realty Capital, Inc. SRC O’Donnell Strategic Industrial REIT, Inc. EUROPE Healthcare Trust of America, Inc. HTA St. Joe Company JOE Phillips Edison Grocery Center REIT I, Inc. GREECE: Athens Stock Exchange (ATH) AFI Development Plc AFRB Hersha Hospitality Trust HT STAG Industrial, Inc. STAG Phillips Edison Grocery Center REIT II, Inc. AUSTRIA: Vienna Stock Exchange (WBO) Babis Vovos International Construction S.A. VOVOS Alpha Pyrenees Trust Limited ALPH Highwoods Properties, Inc. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

Report & Accounts 2018

Report & Accounts 2018 Report & Accounts Derwent London plc Report & Accounts 2018 01 DERWENT LONDON CONTENTS Who we are We are the largest London-focused real estate investment trust (REIT), owning a 5.4 million sq ft portfolio of mainly commercial real estate in 13 ‘villages’ across central London. Our purpose Our purpose is to help improve and upgrade the stock of office space in central London, providing above average long-term returns to our shareholders while bringing social and economic benefits to all our stakeholders. By setting an open and progressive corporate culture and promoting values that include building lasting relationships, our design-led ethos has created a brand of well-designed, flexible and efficient buildings at affordable rents. These not only help our occupiers attract talent but also revitalise neighbourhoods and benefit local communities. Our approach contributes to workforce well-being and will help to maintain London’s place as a leading global business hub. What we do The majority of our portfolio is income producing. STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS We aim for a balance between properties with potential to add further value through regeneration and those 2018 summary ......................................................................................... 04 Introduction from the Chairman ........................................................... 84 Statement of Directors’ responsibilities ........................................... 138 which have already been improved but where our asset -

The London Office Crane Survey – Summer 2017 Development Table

The London Office Crane Survey – Summer 2017 Development table Scheme Crane Survey Completion Total space Space Status Market Scheme name Postcode Developer Tenant number status date sq ft available sq ft 1 Under Construction City Bloomberg Place EC4 Bloomberg/Stanhope Bloomberg Q2 2017 669,000 - 2 Under Construction City 1 London Wall Place EC2 Brookfield/Oxford Properties Schroders Q2 2017 309,000 - 3 Under Construction City 20 Old Bailey EC4 Blackstone Barings Q2 2017 240,410 127,585 4 Under Construction City 2 London Wall Place EC2 Brookfield/Oxford Properties Cleary Gottlieb Steen Q2 2017 177,000 129,000 & Hamilton 5 Under Construction City 45 Cannon Street EC4 Morgan Capital Partners LLP Q2 2017 88,500 88,500 6 Under Construction City The Hallmark Building, EC3 TH Real Estate Q2 2017 88,000 88,000 56 Leadenahll Street 7 Under Construction City The Epworth, 25 City Road EC1 London and Regional Properties Q2 2017 66,000 66,000 8 Under Construction City 15 Bishopsgate EC2 Tower Partnership WeWork Q2 2017 52,000 - 9 Under Construction City 33 Queen Street EC4 Beltane Asset Management Q2 2017 50,000 50,000 10 Under Construction City 1 Aylesbury Street EC1 Meritcape Alexander McQueen Q2 2017 28,500 - 11 Under Construction City 25-39 Eastcheap EC3 Thackeray Estates Q2 2017 25,000 25,000 12 Under Construction City 19-28 Watling Street EC4 Morgan Capital Partners LLP Q2 2017 21,000 21,000 13 Under Construction City 181 Queen Victoria Street EC4V City Bridge Trust Q2 2017 17,000 17,000 14 Under Construction City 33 Central, 33 King William -

View Annual Report

MITIE Group PLC Annual Report and Accounts 2012 The strategic outsourcing and energy services company 25 years… never stop looking forward. Over the last 25 years our entrepreneurial spirit and passionate people have been a constant force driving us forward. We’ve certainly adapted and changed over the years, and will continue to do so for years to come. Keeping in-step with To mark the 25th year of MITIE, we asked what our customers need, photographer Ed Robinson to document how far we’ve come and what we stand for today through a series of 25 images… and delivering beyond You can keep up to date with all things MITIE during our milestone year by following us across our social media channels. their expectations is what facebook.com/mitiepeople twitter.com/mitie_group_plc youtube.com/user/MITIEGroupPLC makes us special… #25mitie it’s what makes us MITIE. MITIE Group PLC Annual Report and Accounts 2012 Introduction This year… Overview More on our Business review work with Essex 20 County Council Accounts Independent auditor’s report to the members of MITIE Group PLC 74 Consolidated income statement 75 Consolidated statement of comprehensive income 76 Governance Consolidated balance sheet 77 Consolidated statement of changes in equity 79 Consolidated statement of cash flows 80 Notes to the consolidated financial statements 82 Independent auditor’s report to the members of MITIE Group PLC 121 Accounts Company balance sheet 122 Notes to the Company Overview More on financial statements 123 our work Shareholder information IBC MITIE at a glance -

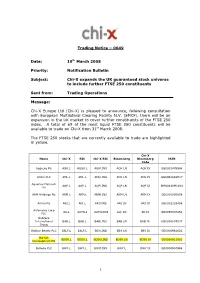

20080319 Trading Notice Functional 0049

Trading Notice – 0049 Date: 19 th March 2008 Priority: Notification Bulletin Subject: Chi-X expands the UK guaranteed stock universe to include further FTSE 250 constituents Sent from: Trading Operations Message: Chi-X Europe Ltd (Chi-X) is pleased to announce, following consultation with European Multilateral Clearing Facility N.V. (EMCF), there will be an expansion in the UK market to cover further constituents of the FTSE 250 index. A total of 69 of the most liquid FTSE 250 constituents will be available to trade on Chi-X from 31 st March 2008. The FTSE 250 stocks that are currently available to trade are highlighted in yellow. Chi-X Name Chi-X RIC Chi-X RIC Bloomberg Bloomberg ISIN Code Aggreko Plc AGK.L AGGK.L AGKl.INS AGK LN AGK IX GB0001478998 Amlin PLC AML.L AML.L AMLl.INS AML LN AML IX GB00B2988H17 Aquarius Platinum AQP.L AQP.L AQPl.INS AQP LN AQP IX BMG0440M1284 Ltd ARM Holdings Plc ARM.L ARM.L ARMl.INS ARM LN ARM IX GB0000595859 Arriva Plc ARI.L ARI.L ARIl.INS ARI LN ARI IX GB0002303468 Autonomy Corp AU.L AUTN.L AUTNl.INS AU/ LN AU IX GB0055007982 PLC Babcock International BAB.L BAB.L BABl.INS BAB LN BAB IX GB0009697037 Group Balfour Beatty PLC BALF.L BALF.L BBYl.INS BBY LN BBY IX GB0000961622 Barratt BDEV.L BDEV.L BDEVl.INS BDEV LN BDEV IX GB0000811801 Development Plc Bellway PLC BWY.L BWY.L BWYl.INS BWY.L BWY IX GB0000904986 1 Biffa PLC BIFF.L BIFF.L BIFFl.INS BIFF LN BIFF IX GB00B129PL77 Bradford & Bingley BB.L BB.L BBl.INS BB/ LN BB IX GB0002228152 PLC Bunzl PLC BNZL.L BNZL.L BNZLl.INS BNZL LN BNZL IX GB00B0744B38 Burberry -

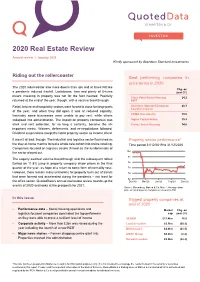

2020 Real Estate Review

2020 Real Estate Review Annual review | January 2021 Kindly sponsored by Aberdeen Standard Investments Riding out the rollercoaster Best performing companies in price terms in 2020 The 2020 rollercoaster saw more downs than ups and at times felt like Chg. on a pandemic induced freefall. Lockdowns, tiers and plenty of U-turns year (%) meant investing in property was not for the faint hearted. Positivity Triple Point Social Housing 24.2 returned at the end of the year, though, with a vaccine breakthrough. REIT Retail, leisure and hospitality sectors were forced to close for large parts Aberdeen Standard European 20.3 Logistics Income of the year, and when they did open it was at reduced capacity. Inevitably some businesses were unable to pay rent, while others CEIBA Investments 19.0 collapsed into administration. The impact on property companies was Sigma Capital Group 15.9 stark and rent collection, for so long a certainty, became the all- Civitas Social Housing 14.8 important metric. Waivers, deferments, and re-negotiations followed. Dividend suspensions swept the listed property sector as income dived. It wasn’t all bad, though. The industrial and logistics sector flourished as Property sector performance* the stay-at-home mantra forced a whole new cohort into online retailing. Time period 31/12/2019 to 31/12/2020 Companies focused on logistics assets thrived as the fundamentals of the sector played out. 102 94 The eagerly awaited vaccine breakthrough and the subsequent rollout fuelled an 11.8% jump in property company share prices in the final 86 quarter of the year, as hope of a return to some form of normality rose. -

Morning Meeting 7 August 2020

Morning Meeting 7 August 2020 Index +/- % change Currencies +/- 12 month range FTSE 100 6026.9 -77.8 -1.3 £:$ 1.314 0.00 1.15 1.33 FTSE All-Share 3358.5 -40.4 -1.2 Y:$ 105.525 -0.04 102.55 112.09 DJ Industrial Average 27387.0 185.5 0.7 E:£ 1.110 0.00 1.07 1.20 S&P 500 3349.2 21.4 0.6 E:$ 1.184 0.00 1.07 1.19 NASDAQ Composite Index 11108.1 109.7 1.0 10 Yr Bond Yld % +/- -3 months -12 months Nikkei Japan 1000 Index 1854.6 -5.5 -0.3 UK 0.09 -0.03 0.24 0.62 Hang Seng Index 24930.6 -172.0 -0.7 US 0.54 -0.01 0.71 1.74 EURO STOXX 50 (EUR) 3240.4 -28.0 -0.9 Germany -0.55 -0.04 -0.51 -0.54 Switzerland SMI (PR) 10067.1 -30.8 -0.3 Price (p) +/- 12 month range France CAC 40 4885.1 -48.2 -1.0 Germany DAX (TR) 12591.7 -68.6 -0.5 Investec plc 148 -2.09999 128.8 498.0 Matrix Winners Price +/- % change Sector Winners % change Mkt Wt Pearson PLC 605.0 44.0 7.8 FTSE All-Share / Leisure Goods - SEC 2.0 0.2 Aviva plc 297.5 13.2 4.6 FTSE All-Share / Media - SEC 0.82 0.2 Ascential Plc 283.0 11.2 4.1 FTSE All-Share / Electronic & Electrical Equipment - SEC 0.56 0.8 Smart Metering Systems PLC 643.0 25.0 4.0 FTSE All-Share / Life Insurance - SEC 0.5 3.4 ITV PLC 63.3 2.4 3.9 FTSE All-Share / Food & Drug Retailers - SEC 0.3 2.1 Matrix Losers Price +/- % change Sector Losers % change Mkt Wt Cairn Energy PLC 131.0 -7.4 -5.3 FTSE All-Share / Industrial Metals & Mining - SEC -2.9 0.1 IMI plc 1027.0 -55 -5.1 FTSE All-Share / Oil & Gas Producers - SEC -2.6 7.9 Land Securities Group PLC 579.8 -30.2 -5.0 FTSE All-Share / Aerospace & Defense - SEC -2.4 1.6 Rio Tinto plc 4720.0 -238 -4.8 FTSE All-Share / Technology Hardware & Equipment - SEC -1.9 0.1 Ibstock Plc 160.1 -8 -4.8 FTSE All-Share / Household Goods & Home Construction - SEC -1.9 4.1 Stocks Hitting Relative High Stocks Hitting Relative Low Bunzl plc HSBC Holdings Plc BHP Group Plc Hurricane Energy Plc Dechra Pharmaceuticals PLC Imperial Brands PLC Dunelm Group plc - Flutter Entertainment Plc - Keywords Studios plc - Kingfisher Plc - LondonMetric Property Plc - Ocado Group PLC - Renishaw plc - St. -

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Derwent London DLN Real Estate Investment Trusts — GBP 34.58 at close 30 September 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 30-Sep-2021 30-Sep-2021 30-Sep-2021 40 125 130 1D WTD MTD YTD Absolute -0.9 -3.8 -8.8 11.7 38 125 Rel.Sector 0.2 -0.4 -1.8 -1.4 120 Rel.Market -0.5 -3.7 -7.7 1.1 36 120 34 115 VALUATION 32 115 Trailing Relative Price Relative Relative Price Relative 110 30 110 PE -ve Absolute Price (local (local currency) AbsolutePrice 28 EV/EBITDA 42.8 105 105 PB 1.0 26 PCF 48.0 24 100 100 Div Yield 1.1 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Price/Sales +ve Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.3 100 100 90 Div Payout 0.0 90 90 80 ROE -ve 80 80 70 Share Index) Share Share Sector) Share - - 70 70 60 DESCRIPTION 60 60 50 50 The Company is a real estate investment trust (REIT) 50 40 RSI RSI (Absolute) 40 with a focus on the central London commercial, residential and office development market. -

Real Estate Quarterly Report

Real estate quarterly report Third quarter 2020 | October 2020 Kindly sponsored by Aberdeen Standard Investments Toughing it out Best performing companies in price terms in Q3 2020 It has been another challenging quarter for the real Chg. on estate sector as the COVID-19 pandemic continues to quarter (%) take its toll. Sigma Capital Group 43.3 The economy bounced back in the early part of the quarter after the CLS Holdings 15.1 national lockdown was lifted, while government schemes such as ‘Eat UK Commercial Property REIT 14.0 Out to Help Out’ stimulated activity. However, towards the end of the Macau Property Opportunities 13.4 quarter a rise in COVID-19 cases heightened fears of a second AEW UK REIT 12.9 lockdown and new restrictions were placed on the hospitality sector. Tough trading conditions meant the ability of tenants to pay rent in the most affected sectors – retail, leisure and hospitality – continued to be diminished, impacting the rent collection rates of property companies Property sector performance* that hold these assets in their portfolios. An uncertain future for offices, Time period 31/12/19 to 30/09/20 with a long-term trend for working from home now prevalent, also took 102 its toll. 94 The logistics sector, however, continued to benefit from increased 86 online consumer spending, while sectors with resilient income streams, 78 such as social housing, proved popular with investors. 70 62 Dec/19 Feb/20 Apr/20 Jun/20 Aug/20 In this issue Source: Bloomberg, Marten & Co. Note *: Average share price of listed property companies rebased to 100 • Performance data – There was an eclectic mix of property Biggest property companies at companies to see share price gains, while few surprises in end of Q3 2020 share price falls.