C O N G R E S S O F the U N I T E D S T a T E S . Washington, DC 20515

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CONGRESSIONAL RECORD—HOUSE March 29, 2001

March 29, 2001 CONGRESSIONAL RECORD—HOUSE 4995 Hoeffel, Peter Hoekstra, Tim Holden, Rush Thomas G. Tancredo, John S. Tanner, Ellen transmitting a copy of the annual report in D. Holt, Michael M. Honda, Darlene Hooley, O. Tauscher, W. J. (Billy) Tauzin, Charles H. compliance with the Government in the Sun- Stephen Horn, John N. Hostettler, Amo Taylor, Gene Taylor, Lee Terry, William M. shine Act during the calendar year 2000, pur- Houghton, Steny H. Hoyer, Kenny C. Thomas, Bennie G. Thompson, Mike Thomp- suant to 5 U.S.C. 552b(j); to the Committee Hulshof, Duncan Hunter, Asa Hutchinson, son, Mac Thornberry, John R. Thune, Karen on Government Reform. Henry J. Hyde, Jay Inslee, Johnny Isakson, L. Thurman, Todd Tiahrt, Patrick J. Tiberi, f Steve Israel, Darrell E. Issa, Ernest J. John F. Tierney, Patrick J. Toomey, James Istook, Jr., Jesse L. Jackson, Jr., Sheila A. Traficant, Jr., Jim Turner, Mark Udall, PUBLIC BILLS AND RESOLUTIONS Jackson-Lee, William J. Jefferson, William Robert A. Underwood, Fred Upton, Nydia M. Under clause 2 of rule XII, public ´ L. Jenkins, Christopher John, Eddie Bernice Velazquez, Peter J. Visclosky, David Vitter, bills and resolutions of the following Johnson, Nancy L. Johnson, Sam Johnson, Greg Walden, James T. Walsh, Zach Wamp, Timothy V. Johnson, Stephanie Tubbs Maxine Waters, Wes Watkins, Melvin L. titles were introduced and severally re- Jones, Walter B. Jones, Paul E. Kanjorski, Watt, J.C. Watts, Jr., Henry A. Waxman, An- ferred, as follows: Marcy Kaptur, Ric Keller, Sue W. Kelly, thony D. Weiner, Curt Weldon, Dave Weldon, By Mr. WATTS of Oklahoma (for him- Mark R. -

STANDING COMMITTEES of the HOUSE Agriculture

STANDING COMMITTEES OF THE HOUSE [Democrats in roman; Republicans in italic; Resident Commissioner and Delegates in boldface] [Room numbers beginning with H are in the Capitol, with CHOB in the Cannon House Office Building, with LHOB in the Longworth House Office Building, with RHOB in the Rayburn House Office Building, with H1 in O’Neill House Office Building, and with H2 in the Ford House Office Building] Agriculture 1301 Longworth House Office Building, phone 225–2171, fax 225–8510 http://agriculture.house.gov meets first Wednesday of each month Collin C. Peterson, of Minnesota, Chair Tim Holden, of Pennsylvania. Bob Goodlatte, of Virginia. Mike McIntyre, of North Carolina. Terry Everett, of Alabama. Bob Etheridge, of North Carolina. Frank D. Lucas, of Oklahoma. Leonard L. Boswell, of Iowa. Jerry Moran, of Kansas. Joe Baca, of California. Robin Hayes, of North Carolina. Dennis A. Cardoza, of California. Timothy V. Johnson, of Illinois. David Scott, of Georgia. Sam Graves, of Missouri. Jim Marshall, of Georgia. Jo Bonner, of Alabama. Stephanie Herseth Sandlin, of South Dakota. Mike Rogers, of Alabama. Henry Cuellar, of Texas. Steve King, of Iowa. Jim Costa, of California. Marilyn N. Musgrave, of Colorado. John T. Salazar, of Colorado. Randy Neugebauer, of Texas. Brad Ellsworth, of Indiana. Charles W. Boustany, Jr., of Louisiana. Nancy E. Boyda, of Kansas. John R. ‘‘Randy’’ Kuhl, Jr., of New York. Zachary T. Space, of Ohio. Virginia Foxx, of North Carolina. Timothy J. Walz, of Minnesota. K. Michael Conaway, of Texas. Kirsten E. Gillibrand, of New York. Jeff Fortenberry, of Nebraska. Steve Kagen, of Wisconsin. Jean Schmidt, of Ohio. -

Fact Sheet: the House Health Repeal Bill's Impact on Pennsylvania

Fact Sheet: The House Health Repeal Bill’s Impact on Pennsylvania A year ago, a majority of the House of Representatives, including Representatives Mike Kelly, Scott Perry, Glenn Thompson, Bill Shuster, Tom Marino, Lou Barletta, Keith Rothfus, Lloyd Smucker, and Tim Murphy, voted for and passed the so-called “American Health Care Act,” or AHCA, a health repeal bill that would have cut coverage, increased costs, and eliminated protections for hundreds of thousands of Pennsylvanians. The bill would have imposed an “age tax,” letting insurers charge people over 50 five times more for coverage, and put the health of one in five Americans on Medicaid in jeopardy, including seniors, children, and people with disabilities. While Pennsylvanians would have lost out, the wealthy and insurance and drug companies would have gotten $600 billion in new tax breaks. AHCA Meant Pennsylvanians Would Have Lost Coverage 777,000 Pennsylvanians Would Have Lost Coverage. In 2026, 777,000 Pennsylvanians would have lost coverage under this bill. 371,800 With Medicaid Would Have Lost Coverage. Under the American Health Care Act, 371,800 Pennsylvanians with Medicaid would have lost their coverage. 10,800 Veterans in Pennsylvania Would Have Lost Coverage. Under the American Health Care Act, 10,800 veterans in Pennsylvania would have lost their Medicaid coverage. AHCA Meant Pennsylvanians Would Have Paid Higher Costs, Especially Older Pennsylvanians Raise Premiums By Double Digits. The nonpartisan Congressional Budget Office found that a key part of the American Health Care Act, repealing the requirement that most people have health insurance, will premiums 10 percent next year. Though the AHCA never became law, Congressional Republicans managed to enact these changes through the GOP tax bill. -

Congressional Committees Roster

HOUSE AND SENATE COMMITTEE MEMBERSHIP Provided below are House and Senate Committee membership rosters with jurisdiction over health programs as of Friday, November 17, 2006. At the time of this printing, only the Senate Democrats have released their Committee assignments. Assignments for the House Committees will not take place until December when Congress reconvenes in the lame-duck session. However, most Members of Congress who were on the Committees before the election will continue to serve. Members whose names are crossed out will not be returning in the 110th Congress. Members whose names are underlined, indicates that they have been added to the Committee. Senate Appropriations Committee Majority Minority Robert C. Byrd, WV - Chair Thad Cochran, MS - Rnk. Mbr. Daniel K. Inouye, HI Ted Stevens, AK Patrick J. Leahy, VT Arlen Specter, PA Tom Harkin, IA Pete V. Domenici, NM Barbara A. Mikulski, MD Christopher S. Bond, MO Harry Reid, NV Mitch McConnell, KY Herbert H. Kohl, WI Conrad Burns, MT Patty Murray, WA Richard C. Shelby, AL Byron L. Dorgan, ND Judd Gregg, NH Dianne Feinstein, CA Robert F. Bennett, UT Richard J. Durbin, IL Larry Craig, ID Tim P. Johnson, SD Kay Bailey Hutchison, TX Mary L. Landrieu, LA Mike DeWine, OH Jack Reed, RI Sam Brownback, KS Frank Lautenberg NJ Wayne A. Allard, CO Ben Nelson, NE Senate Budget Committee Majority Minority Kent Conrad, ND - Chair Judd Gregg, NH - Rnk. Mbr. Paul S. Sarbanes, MD Pete V. Domenici, NM Patty Murray, WA Charles E. Grassley, IA Ron Wyden, OR Wayne A. Allard, CO Russ Feingold, WI Michael B. -

LEG REG REVIEW 2012, 30Th Issue November 7, 2012

LEG REG REVIEW 2012, 30th Issue November 7, 2012 LEG REG REVIEW is a periodic newsletter produced by PHILLIPS ASSOCIATES, a professional lobbying and consultant firm located near the State Capitol. It contains news on the legislative and regulatory scene in Pennsylvania that may be of interest to the Insurance and Business Communities. It is a free member benefit for those who are members of the Pennsylvania Association of Health Underwriters (PAHU) or Manufacturers Association of South Central PA (MASCPA). Subscription information may be obtained by contacting PHILLIPS ASSOCIATES at 717/728-1217 FAX 717/728-1164 or e-mail to [email protected]. Please email [email protected] supplying both your name and e-mail address if you wish to be removed from this list. DEMOCRATS TAKE TOP OFFICES In addition to winning the state for Barack Obama, Pennsylvania Democrats carried the day in the other top races. Senator Bob Casey, Jr. won with 53.6% over Tom Smith (44.7%). Kathleen Kane triumphed over David Freed 56.1% to 41.6% in the race for Attorney General. A Democrat has never held the office of Attorney General. State Treasurer Rob McCord won re-election 52.5% to 44% over Diana Irey Vaughan. The closest race pitted two incumbent House members against each other but ultimately Democrat Eugene DePasquale from York overpowered Republican John Maher (Allegheny/Washington) 49.7% to 46.5%. In this race, the Libertarian candidate Betsy Elizabeth Summers drew 3.8% of the vote, potentially enough to swing the decision. REPUBLICAN CONSOLATION PRIZE: The PA Congressional Delegation In one of the hottest races nationally, Republican Keith Rothfus took incumbent Mark Critz’ western and southwestern PA congressional seat with 51.5% of the vote. -

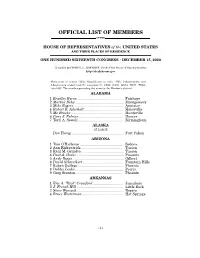

Official List of Members

OFFICIAL LIST OF MEMBERS OF THE HOUSE OF REPRESENTATIVES of the UNITED STATES AND THEIR PLACES OF RESIDENCE ONE HUNDRED SIXTEENTH CONGRESS • DECEMBER 15, 2020 Compiled by CHERYL L. JOHNSON, Clerk of the House of Representatives http://clerk.house.gov Democrats in roman (233); Republicans in italic (195); Independents and Libertarians underlined (2); vacancies (5) CA08, CA50, GA14, NC11, TX04; total 435. The number preceding the name is the Member's district. ALABAMA 1 Bradley Byrne .............................................. Fairhope 2 Martha Roby ................................................ Montgomery 3 Mike Rogers ................................................. Anniston 4 Robert B. Aderholt ....................................... Haleyville 5 Mo Brooks .................................................... Huntsville 6 Gary J. Palmer ............................................ Hoover 7 Terri A. Sewell ............................................. Birmingham ALASKA AT LARGE Don Young .................................................... Fort Yukon ARIZONA 1 Tom O'Halleran ........................................... Sedona 2 Ann Kirkpatrick .......................................... Tucson 3 Raúl M. Grijalva .......................................... Tucson 4 Paul A. Gosar ............................................... Prescott 5 Andy Biggs ................................................... Gilbert 6 David Schweikert ........................................ Fountain Hills 7 Ruben Gallego ............................................ -

Union Calendar No. 603

Union Calendar No. 603 110TH CONGRESS " ! REPORT 2d Session HOUSE OF REPRESENTATIVES 110–930 ACTIVITIES OF THE COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM ONE HUNDRED TENTH CONGRESS FIRST AND SECOND SESSIONS 2007–2008 Available via the World Wide Web: http://www.gpoaccess.gov/congress/ index.html http://www.house.gov/reform JANUARY 2, 2009.—Committed to the Committee of the Whole House on the State of the Union and ordered to be printed VerDate Aug 31 2005 01:57 Jan 03, 2009 Jkt 046108 PO 00000 Frm 00001 Fmt 6012 Sfmt 6012 E:\HR\OC\HR930.XXX HR930 smartinez on PROD1PC64 with REPORTS congress.#13 ACTIVITIES REPORT OF THE HOUSE COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM VerDate Aug 31 2005 01:57 Jan 03, 2009 Jkt 046108 PO 00000 Frm 00002 Fmt 6019 Sfmt 6019 E:\HR\OC\HR930.XXX HR930 smartinez on PROD1PC64 with REPORTS with PROD1PC64 on smartinez 1 Union Calendar No. 603 110TH CONGRESS " ! REPORT 2d Session HOUSE OF REPRESENTATIVES 110–930 ACTIVITIES OF THE COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM ONE HUNDRED TENTH CONGRESS FIRST AND SECOND SESSIONS 2007–2008 Available via the World Wide Web: http://www.gpoaccess.gov/congress/ index.html http://www.house.gov/reform JANUARY 2, 2009.—Committed to the Committee of the Whole House on the State of the Union and ordered to be printed U.S. GOVERNMENT PRINTING OFFICE 46–108 WASHINGTON : 2009 VerDate Aug 31 2005 01:57 Jan 03, 2009 Jkt 046108 PO 00000 Frm 00003 Fmt 4012 Sfmt 4012 E:\HR\OC\HR930.XXX HR930 smartinez on PROD1PC64 with REPORTS congress.#13 COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM HENRY A. -

LRI's Rev Up! Philadelphia 2018 Booklet

Register, Educate, Vote, Use Your Power Full political participation for Americans with disabilities is a right. AAPD works with state and national coalitions on effective, non- partisan campaigns to eliminate barriers to voting, promoting accessible voting technology and polling places; educate voters about issues and candidates; promote turnout of voters with disabilities across the country; protect eligible voters’ right to participate in elections; and engage candidates and elected officials to recognize the disability community. 1 Pennsylvania 2018 Midterm Election Dates 2018 Pennsylvania Midterm Election Registrations Date: Tuesday, October 9, 2018 – DEADLINE!! 2018 Pennsylvania Midterm Elections Date: Tuesday, November 6, 2018, 7 am – 8 pm Pennsylvania Voter Services https://www.pavoterservices.pa.gov • Register to Vote • Apply for An Absentee Ballot • Check Voter Registration Status • Check Voter Application Status • Find Your Polling Place 2 Table of Contents Pennsylvania 2018 Midterm Election Dates ............................ 2 2018 Pennsylvania Midterm Election Registrations ................. 2 2018 Pennsylvania Midterm Elections .................................. 2 Table of Contents ................................................................ 3 Voting Accommodations ....................................................... 7 Voter Registration ............................................................ 7 Language Access ................................................................ 8 Issues that Affect People with Disabilities -

IN the UNITED STATES DISTRICT COURT for the MIDDLE DISTRICT of PENNSYLVANIA JACOB CORMAN, in His Official Capacity As Majority L

Case 1:18-cv-00443-CCC-KAJ-JBS Document 50 Filed 02/28/18 Page 1 of 14 IN THE UNITED STATES DISTRICT COURT FOR THE MIDDLE DISTRICT OF PENNSYLVANIA JACOB CORMAN, in his official capacity as ) Majority Leader of the Pennsylvania Senate, ) MICHAEL FOLMER, in his official capacity ) as Chairman of the Pennsylvania Senate ) State Government Committee, LOU ) BARLETTA, RYAN COSTELLO, MIKE ) KELLY, TOM MARINO, SCOTT PERRY, ) KEITH ROTHFUS, LLOYD SMUCKER, ) and GLENN THOMPSON, ) Plaintiffs, ) v. ) ) ROBERT TORRES, in his official capacity ) as Acting Secretary of the Commonwealth, ) and JONATHAN M. MARKS, in his official ) Civil Action No. 1:18-cv-00443 capacity as Commissioner of the Bureau of ) Commissions, Elections, and Legislation, ) Judge Jordan Defendants, ) Chief Judge Conner and ) Judge Simandle ) LEAGUE OF WOMEN VOTERS OF ) ELECTRONICALLY FILED PENNSYLVANIA; CARMEN FEBO SAN ) MIGUEL; JAMES SOLOMON; JOHN ) GREINER; JOHN CAPOWSKI; ) GRETCHEN BRANDT; THOMAS ) RENTSCHLER; MARY ELIZABETH ) LAWN; LISA ISAACS; DON ) LANCASTER; JORDI COMAS; ROBERT ) SMITH; WILLIAM MARX; RICHARD ) MANTELL; PRISCILLA MCNULTY; ) THOMAS ULRICH; ROBERT ) MCKINSTRY; MARK LICHTY; and ) LORRAINE PETROSKY, ) (Proposed) Intervenor- ) Defendants. PROPOSED INTERVENORS’ REPLY BRIEF IN SUPPORT OF MOTION TO INTERVENE AS DEFENDANTS Case 1:18-cv-00443-CCC-KAJ-JBS Document 50 Filed 02/28/18 Page 2 of 14 TABLE OF CONTENTS Page TABLE OF AUTHORITIES .................................................................................... ii I. Proposed Intervenors Are Entitled To Intervene as of Right .......................... 1 A. Proposed Intervenors’ Interest in this Action Is Overwhelming and the Requested Remedy Would Direct Impact Their Rights .................. 1 B. Proposed Intervenors’ Interests Are Not Adequately Represented ...... 2 II. Alternatively, the Court Should Grant Permissive Intervention ..................... 8 CONCLUSION ......................................................................................................... -

Is an Effective Alzheimer's Treatment at Hand?

Memorypreserving your Summer 2008 The Magazine of Health and Hope 10 Outdoor Activities to Enhance Your Loved One’s Summer Learn about the Benefits of Gardening from Is an Effective HGTV Host Justin Cave Alzheimer’s Treatment at Hand? MetLife Foundation Awards Scientists An Expert Speaks for Research in Alzheimer’s Disease (Page 34, Exercise Your Memory) +1* )'!&+ )', $!.!+ + + ', +'$0 !%)1* &!&'-)/',) +1*. /')'-)/)* +! ',&+!'& **,((')+)*) '&+ !*!** '/ .)()',+' '&'))+ +)''() &!-)*!+/',-&& &*+!+,+ $!,% ')+**) ')+ .*+)&&!-)*!+/ !'& !$!( '& ' &* '(#!&* &!-)*!+/ ''$ ' !!& $+!%') / "'!& )'.!& $!*+ ' *!&+!*+* *) !&'),) '+ +'&/ $0 !%)1*.'&1+'$$'.!&&/'/1*''+*+(* A1082_MetLife.indd 1 3/5/08 9:35:38 AM #$ !=*2*5&7.32) : : : "(.*2(* 3852&03+*) "**.67 3852&03+*8536(.*2(* &785* *8532 *7-9&26 &5/<5&77; &85*28<;/ &1*63<;5& *7*5*5'61&2 01& 854-; #$* -!)+$*!%!&+()!()! .',&",$% *7.+* #$ #$ "! *0 37"&9*) 58.<( 587.,*5 .,-72 587.,*5 2 587.,*5 30) 587.,*530)2 8785&30) *09*7.(& *09*7.(&*8*30)32) *09*7.(&*8* 32)*26*) # & %*7.+ 0&(/ Features Is an Effective Alzheimer’s Treatment at Hand? An Expert Speaks Dr. Paul Greengard, Nobel Prize recipient, answers today’s most pressing questions on the causes and treatments of Alzheimer’s disease. 8 MetLife Foundation Awards Scientists for Research in Alzheimer’s Disease MetLife Foundation honored three scientists who have made significant contributions to the understanding of 14 Alzheimer’s. 10 Outdoor Activities to Enhance Your Loved One’s Summer Discover tips to help preserve memories— and create new ones. 20 Easy Summer Gardening Soothes the Soul Learn about the benefits of gardening from HGTV 26 host Justin Cave. summer 2008 www.ALZinfo.org 3 Contents 5 From the Editor’s Desk Summer is a season for memories. 6 News Briefs Read the latest news on Alzheimer’s disease and brain health. -

2 PH It: ~Nltld Stjtcs Smarr REGIONAL HEARING CLERK ("F/',;, .R

,c/' RECEIVED 2012 APR -2 PH It: ~nltLd StJtcs Smarr REGIONAL HEARING CLERK ("F/',;, .r. ,; EPA REGION 1II. PHI LA. PA March 22, 2012 Shawn Garvin Re: Docket No.s Administrator CWA-03-20l2-0092 U.S. EPA REGION 3 CWA-03-2012-0093 1650 Arch Street CWA-03-2012-0094 Philadelphia, PA I')\ 03-2029 CWA-OJ-2012-0095 Dear Administrator Garvin, 1 write to you again to echo the many concerns army constituents regarding EPA's actions against several central Pennsylvania municipalities. Since our last correspondence regarding the city of Lebanon, it has come to my attention that EPA is fining three additional municipalities (York. Manor Township, and Swatara Township) tor allegedly failing to comply with their National Pollutant Discharge Elimination System (NPDES) permits issued by the Pennsylvania Department of Environmental Protection (PA OFP). This raises total EPA fines pending against Pennsylvania municipalities to $128,608. It is my hope that we can lind a compromisc that allows thcse fines to bc waived. I appreeiatc EPA's letter of March, 13 2012 commenting on the fine EPA levicd against the city of Lebanon. That said. I feci this letter was an incomplete explanation as to why EPA is taking such aggressive action against Lebanon and did not adequately explain EPA's rationale for assessing such a large penalty. 1 also appreciate EPA's stated commitment to keeping PA DEI' infonned ofall enforcement activities, though I remain disappointed that EPA failed to provide PA DEP with official copies of enforccment documents until more than 30 days after they had been issued. -

Crony Capitalism Has Consequences: Opioid Distribution, Destruction and Death

Crony Capitalism Has Consequences: Opioid Distribution, Destruction and Death DAVID W. JOHNSON October 25, 2017 Market Corner Commentary | Special Edition Talk about bombshells. On October 15th, the Washington Post and 60 Minutes released a detailed and damning investigative report titled “The Drug Industry’s Triumph Over the DEA (Drug Enforcement Agency).” The report chronicles how Big Pharma and its Congressional allies orchestrated passage of legislation that has severely weakened the DEA’s ability to curtail illegal distribution of opioid drugs. The “2016 Ensuring Patient Access and Effective Drug Enforcement Act” gutted the DEA’s ability to halt questionable sales of prescription pain pills. As a result, the DEA’s number CRONY CAPITALISM FUELS ADDICTION of “immediate suspension orders” against suspect doctors, pharmacies Opioid addiction usually starts when individuals take painkilling drugs prescribed and drug companies plummeted from for themselves or experiment with drugs prescribed for someone they know. Big 65 in 2011 to just 8 in 2016. Pharma provides that initial fix and feeds the addiction by flooding American communities with oxycodone, hydrocodone, fentanyl and other opioid-based drugs. Passage of the Drug Enforcement Act capped a multi-faceted, multi- A December 2016 article in the Charleston Gazette-Mail reported that drug year effort by the pharmaceutical distributers delivered 780 million oxycodone and hydrocodone pills to West Virginia industry to diminish the DEA’s ability pharmacies between 2007 and 2012. That translates into 433 opioid pills for every to interfere with their commercial man, woman and child in the state. During that period, 1,728 West Virginians died interests. Big Pharma’s goal was from over-dosing on those drugs.