Prospectus-Microsoft-Stock-Plan.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

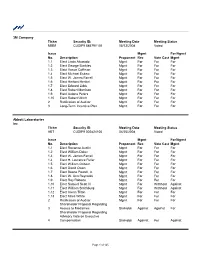

Proxy Voting Record

Proxy Voting Report July 1, 2012 to November 5, 2012 Fund Name : Tech Leaders Income Fund Cisco Systems, Inc. Ticker Security ID: Meeting Date Meeting Status CSCO CUSIP 17275R102 11/15/2012 Voted Meeting Type Annual Issue No. Description Proponent Mgmt Rec Vote Cast For/Agnst Mgmt 1 Elect Carol Bartz Mgmt For For For 2 Elect Marc Benioff Mgmt For For For 3 Elect M. Michele Burns Mgmt For For For 4 Elect Michael Capellas Mgmt For For For 5 Elect Larry Carter Mgmt For For For 6 Elect John Chambers Mgmt For For For 7 Elect Brian Halla Mgmt For For For 8 Elect John Hennessy Mgmt For Against Against 9 Elect Kristina Johnson Mgmt For For For 10 Elect Richard Kovacevich Mgmt For For For 11 Elect Roderick McGeary Mgmt For For For 12 Elect Arun Sarin Mgmt For For For 13 Elect Steven West Mgmt For For For 14 Amendment to the Executive Mgmt For For For Incentive Plan 15 Advisory Vote on Executive Mgmt For For For Compensation 16 Ratification of Auditor Mgmt For For For 17 Shareholder Proposal Regarding ShrHoldr Against For Against Independent Board Chairman 18 Shareholder Proposal Regarding ShrHoldr Against Against For Report on Conflict Minerals Dell Inc. Ticker Security ID: Meeting Date Meeting Status DELL CUSIP 24702R101 07/13/2012 Voted Meeting Type Annual Issue No. Description Proponent Mgmt Rec Vote Cast For/Agnst Mgmt 1 Elect James Breyer Mgmt For For For 2 Elect Donald Carty Mgmt For For For 3 Elect Janet Clark Mgmt For For For 4 Elect Laura Conigliaro Mgmt For For For 5 Elect Michael Dell Mgmt For For For 6 Elect Kenneth Duberstein Mgmt For For For 7 Elect William Gray, III Mgmt For For For 8 Elect Gerard Kleisterlee Mgmt For For For 9 Elect Klaus Luft Mgmt For For For 10 Elect Alex Mandl Mgmt For For For 11 Elect Shantanu Narayen Mgmt For For For 12 Elect H. -

Vote Summary Report Reporting Period: 07/01/2017 to 06/30/2018 Location(S): All Locations

Vote Summary Report Reporting Period: 07/01/2017 to 06/30/2018 Location(s): All Locations BGP Holdings Plc Meeting Date: 07/03/2017 Country: Malta Primary Security ID: Record Date: 05/25/2017 Meeting Type: Special Ticker: N/A Proposal Vote Number Proposal Text Proponent Mgmt Rec Instruction 1 Approve Reduction of Share Premium Account Mgmt For For 2 Approve Distribution of EUR 5 Million to Mgmt For For Directors 3 Approve Distribution of EUR 1.5 Million to Mgmt For For Directors Red Rock Resorts, Inc. Meeting Date: 07/06/2017 Country: USA Primary Security ID: 75700L108 Record Date: 05/08/2017 Meeting Type: Annual Ticker: RRR Proposal Vote Number Proposal Text Proponent Mgmt Rec Instruction 1.1 Elect Director Frank J. Fertitta, III Mgmt For For 1.2 Elect Director Lorenzo J. Fertitta Mgmt For For 1.3 Elect Director Robert A. Cashell, Jr. Mgmt For For 1.4 Elect Director Robert E. Lewis Mgmt For For 1.5 Elect Director James E. Nave Mgmt For For 2 Advisory Vote to Ratify Named Executive Mgmt For For Officers' Compensation 3 Advisory Vote on Say on Pay Frequency Mgmt One Year One Year 4 Ratify Ernst & Young LLP as Auditors Mgmt For For LondonMetric Property Plc Meeting Date: 07/11/2017 Country: United Kingdom Primary Security ID: G5689W109 Record Date: 07/07/2017 Meeting Type: Annual Ticker: LMP Vote Summary Report Reporting Period: 07/01/2017 to 06/30/2018 Location(s): All Locations LondonMetric Property Plc Proposal Vote Number Proposal Text Proponent Mgmt Rec Instruction 1 Accept Financial Statements and Statutory Mgmt For For Reports 2 -

Downloadable Content, and Peripherals

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended June 30, 2013 OR ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period From to Commission File Number 0-14278 MICROSOFT CORPORATION WASHINGTON 91-1144442 (STATE OF INCORPORATION) (I.R.S. ID) ONE MICROSOFT WAY, REDMOND, WASHINGTON 98052-6399 (425) 882-8080 www.microsoft.com/investor Securities registered pursuant to Section 12(b) of the Act: COMMON STOCK, $0.00000625 par value per share NASDAQ Securities registered pursuant to Section 12(g) of the Act: NONE Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨ Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). -

Microsoft Corporation One Microsoft Way Redmond, Washington 98052, U.S.A

Microsoft Corporation One Microsoft Way Redmond, Washington 98052, U.S.A. MICROSOFT CORPORATION 2003 EMPLOYEE STOCK PURCHASE PLAN, AS AMENDED, EFFECTIVE JANUARY 1, 2013 (THE "ESPP") Prospectus for the employees of certain European Economic Area ("EEA") subsidiaries of Microsoft Corporation, subject to the applicable legislation in each country Pursuant to articles L. 412-1 and L. 621-8 of the Code Monétaire et Financier and its General Regulation, in particular articles 211-1 to 216-1 thereof, the Autorité des marchés financiers has attached visa number 14-333 dated June 26, 2014 onto this prospectus. This prospectus was established by the issuer and incurs the responsibility of its signatories. The visa, pursuant to the provisions of Article L. 621-8-1-I of the Code Monétaire et Financier, was granted after the AMF has verified that the document is complete and comprehensible, and that the information it contains is consistent. The visa represents neither the approval of the worthiness of the operation nor the authentication of the financial and accounting information presented. This prospectus will be made available in printed form to employees of the EEA subsidiaries of Microsoft Corporation based in states in which offerings under the plan listed above are considered public offerings, subject to the applicable legislation in each country, at the respective head offices of their employers. In addition, this prospectus along with summary translations (as applicable) will be posted on Microsoft Corporation’s intranet, and free copies will be available to the employees upon request by contacting the human resources department of their employer. This prospectus, together with the French translation of its summary, will also be available on the website of the AMF, www.amf-france.org. -

EXHIBIT a Case 2:14-Cv-00540-JCC Document 1-1 Filed 04/11/14 Page 2 of 6

Case 2:14-cv-00540-JCC Document 1-1 Filed 04/11/14 Page 1 of 6 EXHIBIT A Case 2:14-cv-00540-JCC Document 1-1 Filed 04/11/14 Page 2 of 6 THE WEISER LAW FIRM WWW .WEISERLAWFIRM.COM PENNSYLVANIA CALIFORNIA 22 CASSATT AvE. 12707 HIGH BLUFF DRIVE, SUITE 200 BERWYN, PA 19312 SAN DIEGO, CA 92130 TELEPHONE: (610) 225-2677 TELEPHONE : (858) 794-1441 FACSIMILE : (610) 408-8062 FACSIMILE : (858) 794-1450 March 22, 2013 VIA CERTIFIED MAIL RETURN RECEIPT REQUESTED William H. Gates III Chairman of the Board of Directors Microsoft Corporation One Microsoft Way Redmond, WA 98052-6399 Re: Shareholder Demand Pursuant to Washington Law Dear Mr. Gates: The undersigned firms represent Kim Barovic (the "Stockholder"), a current stockholder of Microsoft Corporation ("Microsoft" or the "Company"). Pursuant to Washington law, we write on behalf of the Stockholder to demand that the Company's Board of Directors (the "Board") take action to remedy breaches of fiduciary duties by certain current and/or former directors and executive officers of the Company, including yourself ("Gates"), Steve Ballmer ("Ballmer"), Dina Dublon ("Dublon"), Maria M. Klawe ("Klawe"), Stephen J. Luczo ("Luczo"), David F. Marquardt ("Marquardt"), Charles H. Noski (''Noski"), Helmut Panke ("Panke"), John W. Thompson ("Thompson"), Peter Klein ("Klein"), Andrew Lees ("Lees"), Eric Rudder ("Rudder"), Brad Smith ("Smith") and B. Kevin Turner ("Turner"). Collectively, the foregoing executive officers and/or directors of the Company will be referred to herein as "Management." As you are aware, by reason of their positions as officers and/or directors of Microsoft and because of their ability to control the business and corporate affairs of Microsoft, members of Management owed and owe Microsoft and its shareholders the fiduciary obligations of good faith, loyalty, and due care. -

Microsoft Corporation

A Progressive Digital Media business COMPANY PROFILE Microsoft Corporation REFERENCE CODE: 8ABE78BB-0732-4ACA-A41D-3012EBB1334D PUBLICATION DATE: 25 Jul 2017 www.marketline.com COPYRIGHT MARKETLINE. THIS CONTENT IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED OR DISTRIBUTED Microsoft Corporation TABLE OF CONTENTS TABLE OF CONTENTS Company Overview ........................................................................................................3 Key Facts.........................................................................................................................3 Business Description .....................................................................................................4 History .............................................................................................................................5 Key Employees .............................................................................................................26 Key Employee Biographies .........................................................................................28 Major Products & Services ..........................................................................................35 SWOT Analysis .............................................................................................................36 Top Competitors ...........................................................................................................44 Company View ..............................................................................................................45 -

Microsoft from Wikipedia, the Free Encyclopedia Jump To: Navigation, Search

Microsoft From Wikipedia, the free encyclopedia Jump to: navigation, search Coordinates: 47°38′22.55″N 122°7′42.42″W / 47.6395972°N 122.12845°W / 47.6395972; -122.12845 Microsoft Corporation Public (NASDAQ: MSFT) Dow Jones Industrial Average Type Component S&P 500 Component Computer software Consumer electronics Digital distribution Computer hardware Industry Video games IT consulting Online advertising Retail stores Automotive software Albuquerque, New Mexico Founded April 4, 1975 Bill Gates Founder(s) Paul Allen One Microsoft Way Headquarters Redmond, Washington, United States Area served Worldwide Key people Steve Ballmer (CEO) Brian Kevin Turner (COO) Bill Gates (Chairman) Ray Ozzie (CSA) Craig Mundie (CRSO) Products See products listing Services See services listing Revenue $62.484 billion (2010) Operating income $24.098 billion (2010) Profit $18.760 billion (2010) Total assets $86.113 billion (2010) Total equity $46.175 billion (2010) Employees 89,000 (2010) Subsidiaries List of acquisitions Website microsoft.com Microsoft Corporation is an American public multinational corporation headquartered in Redmond, Washington, USA that develops, manufactures, licenses, and supports a wide range of products and services predominantly related to computing through its various product divisions. Established on April 4, 1975 to develop and sell BASIC interpreters for the Altair 8800, Microsoft rose to dominate the home computer operating system (OS) market with MS-DOS in the mid-1980s, followed by the Microsoft Windows line of OSes. Microsoft would also come to dominate the office suite market with Microsoft Office. The company has diversified in recent years into the video game industry with the Xbox and its successor, the Xbox 360 as well as into the consumer electronics market with Zune and the Windows Phone OS. -

Microsoft Corporation One Microsoft Way Redmond, Washington 98052, U.S.A

Microsoft Corporation One Microsoft Way Redmond, Washington 98052, U.S.A. MICROSOFT CORPORATION EMPLOYEE STOCK PURCHASE PLAN, AS AMENDED, EFFECTIVE JANUARY 1, 2013 (THE "ESPP") Prospectus for the employees of certain European Economic Area ("EEA") subsidiaries of Microsoft Corporation, subject to the applicable legislation in each country Pursuant to articles L. 412-1 and L. 621-8 of the Code Monétaire et Financier and its General Regulation, in particular articles 211-1 to 216-1 thereof, the Autorité des marchés financiers has attached visa number 17-291 dated June 22, 2017 onto this prospectus. This prospectus was established by the issuer and incurs the responsibility of its signatories. The visa, pursuant to the provisions of Article L. 621-8-1-I of the Code Monétaire et Financier, was granted after the AMF has verified that the document is complete and comprehensible, and that the information it contains is consistent. The visa represents neither the approval of the worthiness of the operation nor the authentication of the financial and accounting information presented. This prospectus will be made available in printed form to employees of the EEA subsidiaries of Microsoft Corporation based in states in which offerings under the plan listed above are considered public offerings, subject to the applicable legislation in each country, at the respective head offices of their employers. In addition, this prospectus along with summary translations (as applicable) will be posted on Microsoft Corporation’s intranet, and free copies will be available to the employees upon request by contacting the human resources department of their employer. This prospectus, together with the French translation of its summary, will also be available on the website of the AMF, www.amf-france.org. -

Microsoft Modern Slavery and Human Trafficking Statement

Microsoft Modern Slavery and Human Trafficking Statement Fiscal Year 2018 Contents Highlights of FY18 improvements 4 Introduction 5 Approach to human rights, modern slavery and human trafficking 6 Preventing modern slavery and human trafficking in the Microsoft business and supply chain 11 SEA strategy 11 Hardware and packaging audits and due diligence process 12 Remediation 13 Findings 13 Giving workers a voice 15 Responsible sourcing of raw materials 15 Building supplier capabilities 17 Governance 18 Addressing the root causes of modern slavery and human trafficking 18 An ongoing commitment 21 Microsoft Modern Slavery and Human Trafficking Statement – Fiscal Year 2018 Pursuant to the UK Modern Slavery Act of 2015, this Statement describes the actions taken by the Microsoft Corporation and its subsidiaries during Fiscal Year 2018 (FY18) to prevent modern slavery and human trafficking in our business and supply chain. Our FY18 fiscal year ended on June 30, 2018. The Microsoft Board of Directors delegated authority to approve this Statement to its Regulatory and Public Policy Committee, which provided approval at its November 26, 2018 meeting. The statement is signed by the Chair of the Committee, Dr. Helmut Panke. Dr. Helmut Panke Chair of the Regulatory and Public Policy Committee Microsoft Corporation Board of Directors 3 Microsoft Modern Slavery and Human Trafficking Statement – Fiscal Year 2018 Highlights of FY18 improvements Due Diligence: 168 factories were audited in the devices hardware and packaging supply chain with 24 major findings in the Freely Chosen Employment category; and 15 factories were audited for the data center hardware supply chain, with 5 major findings in the same category. -

3M Company Ticker Security ID: MMM CUSIP9 88579Y101 Issue No

3M Company Ticker Security ID: Meeting Date Meeting Status MMM CUSIP9 88579Y101 05/13/2008 Voted Issue Mgmt For/Agnst No. Description Proponent Rec Vote Cast Mgmt 1.1 Elect Linda Alvarado Mgmt For For For 1.2 Elect George Buckley Mgmt For For For 1.3 Elect Vance Coffman Mgmt For For For 1.4 Elect Michael Eskew Mgmt For For For 1.5 Elect W. James Farrell Mgmt For For For 1.6 Elect Herbert Henkel Mgmt For For For 1.7 Elect Edward Liddy Mgmt For For For 1.8 Elect Robert Morrison Mgmt For For For 1.9 Elect Aulana Peters Mgmt For For For 1.10 Elect Robert Ulrich Mgmt For For For 2 Ratification of Auditor Mgmt For For For 3 Long-Term Incentive Plan Mgmt For For For Abbott Laboratories Inc Ticker Security ID: Meeting Date Meeting Status ABT CUSIP9 002824100 04/25/2008 Voted Issue Mgmt For/Agnst No. Description Proponent Rec Vote Cast Mgmt 1.1 Elect Roxanne Austin Mgmt For For For 1.2 Elect William Daley Mgmt For For For 1.3 Elect W. James Farrell Mgmt For For For 1.4 Elect H. Laurance Fuller Mgmt For For For 1.5 Elect William Osborn Mgmt For For For 1.6 Elect David Owen Mgmt For For For 1.7 Elect Boone Powell, Jr. Mgmt For For For 1.8 Elect W. Ann Reynolds Mgmt For For For 1.9 Elect Roy Roberts Mgmt For For For 1.10 Elect Samuel Scott III Mgmt For Withhold Against 1.11 Elect William Smithburg Mgmt For Withhold Against 1.12 Elect Glenn Tilton Mgmt For For For 1.13 Elect Miles White Mgmt For For For 2 Ratification of Auditor Mgmt For For For Shareholder Proposal Regarding 3 Access to Medicines ShrHoldr Against Against For Shareholder Proposal Regarding Advisory Vote on Executive 4 Compensation ShrHoldr Against For Against Page 1 of 125 Accenture Limited Ticker Security ID: Meeting Date Meeting Status ACN CUSIP9 G1150G111 02/07/2008 Voted Issue Mgmt For/Agnst No. -

Microsoft Corporation and Its Consolidated Subsidiaries, Unless Otherwise Stated Or the Context Otherwise Requires

Prospectus Supplement (To Prospectus dated November 2, 2012)CALCULATION OF REGISTRATION FEE Maximum Amount of Title of Each Class of Amount to be Maximum Offering Aggregate Offering Registration Securities to be Registered Registered (1) Price Per Unit Price Fee (2) (3) 2.125% Notes due 2021 ........... $2,378,425,000€3,500,000,000 99.629% $2,369,601,043 $305,205 3.125% Notes due 2028 ...........Microsoft$2,378,425,000 Corporation 99.223% $2,359,944,638 $303,961 (1) €1,750,000,000 aggregate€1,750,000,000 principal amount 2.125% of 2.125% Notes Notes due due 2021 2021 and €1,750,000,000 aggregate principal amount of 3.125%€1,750,000,000 Notes due 2028 3.125% will be Notes issued. due The 2028 Amount to be Registered is based on We arethe offering December€1,750,000,000 3, 2013 euro/U.S.$ aggregate exchange principal rate amount of €1/U.S.$1.3591, of 2.125% Notes as reported due 2021 by (theBloomberg. “2021 Notes”) and €1,750,000,000(2) Calculated aggregate in accordance principal with amount Rule of 457(r) 3.125% under Notes the due Securities 2028 (the Act “2028 of 1933, Notes” as amended. and, together The totalwith the 2021 Notes, theregistration “notes”). Thefee for 2021 this Notes offering will is mature $609,166. on December 6, 2021 and the 2028 Notes will mature on December(3) 6, 2028. Paid herewith. Interest on the notes will accrue from December 6, 2013 and be payable on December 6 of each year, commencing on December 6, 2014. -

Form: N-PX, Filing Date: 08/27/2010

SECURITIES AND EXCHANGE COMMISSION FORM N-PX Annual report of proxy voting record of registered management investment companies filed on Form N-PX Filing Date: 2010-08-27 | Period of Report: 2010-06-30 SEC Accession No. 0000900092-10-000893 (HTML Version on secdatabase.com) FILER BLACKROCK GLOBAL ALLOCATION FUND, INC. Mailing Address Business Address 100 BELLEVUE PARKWAY 100 BELLEVUE PARKWAY CIK:834237| IRS No.: 222937779 | State of Incorp.:MD | Fiscal Year End: 1031 WILMINGTON DE 19809 WILMINGTON DE 19809 Type: N-PX | Act: 40 | File No.: 811-05576 | Film No.: 101043000 800-441-7762 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document ******************************* FORM N-Px REPORT ******************************* ICA File Number: 811-05576 Reporting Period: 07/01/2009 - 06/30/2010 BlackRock Global Allocation Fund, Inc. ==================== BLACKROCK GLOBAL ALLOCATION FUND, INC. ==================== 3COM CORP. Ticker: COMS Security ID: 885535104 Meeting Date: SEP 23, 2009 Meeting Type: Annual Record Date: JUL 27, 2009 # Proposal Mgt Rec Vote Cast Sponsor 1.1 Elect Director Kathleen A. Cote For For Management 1.2 Elect Director David H.Y. Ho For For Management 1.3 Elect Director Robert Y.L. Mao For For Management 1.4 Elect Director J. Donald Sherman For For Management 1.5 Elect Director Dominique Trempont For For Management 2 Declassify the Board of Directors For For Management 3 Ratify Auditors For For Management -------------------------------------------------------------------------------- 3COM CORP. Ticker: COMS Security ID: 885535104 Meeting Date: JAN 26, 2010 Meeting Type: Special Record Date: DEC 9, 2009 # Proposal Mgt Rec Vote Cast Sponsor 1 Approve Merger Agreement For For Management 2 Adjourn Meeting For For Management -------------------------------------------------------------------------------- 3M COMPANY Copyright © 2012 www.secdatabase.com.