Spotlight Marylebone and Fitzrovia Autumn 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Full Brochure

CONTENTS 04 Introduction 08 The History 20 The Building 38 The Materials 40 The Neighbourhood 55 Floor Plans 61 The Team 66 Contact 1 The scale of a full city block With its full city block setting, Marylebone Square is a rare chance to develop a bold and beautiful building on a piece of prime, storied real estate in a district rich in culture and history. Bound by Aybrook, Moxon, Cramer and St. Vincent Streets, Marylebone Square is reintroducing a long-lost local street pattern to the area. MARYLEBONE SQUARE INTRODUCTION A Rare London Find What is it about Marylebone? Perhaps it’s the elegance of its architecture and the charm of its boutiques and eateries – or the surprising tranquillity of its tree-lined streets, a world away from the bustle of nearby Oxford Street. In the end, it might be the sense of community and leisurely pace of life that sets this neighbourhood apart. As the city buzzes with its busy schedules, Marylebone takes its time – savouring sit-down coffees in local cafés and loungy lunches in the park. It’s easy to forget you’re just a short stroll away from transport hubs, tourist attractions and all the trappings of big city life. As you find yourself “Marylebone Square idling around the shops on chic Chiltern Street, exchanging hellos with the butcher at the Ginger Pig or sunbathing in a quiet corner of Paddington Square is a collection Gardens, you quickly realise that this is a place where people actually live – of 54 high-end not just commute to, pass through, or visit for a few hours a day. -

St Marylebone Parish Church Records of Burials in the Crypt 1817-1853

Record of Bodies Interred in the Crypt of St Marylebone Parish Church 1817-1853 This list of 863 names has been collated from the merger of two paper documents held in the parish office of St Marylebone Church in July 2011. The large vaulted crypt beneath St Marylebone Church was used as place of burial from 1817, the year the church was consecrated, until it was full in 1853, when the entrance to the crypt was bricked up. The first, most comprehensive document is a handwritten list of names, addresses, date of interment, ages and vault numbers, thought to be written in the latter half of the 20th century. This was copied from an earlier, original document, which is now held by London Metropolitan Archives and copies on microfilm at London Metropolitan and Westminster Archives. The second document is a typed list from undertakers Farebrother Funeral Services who removed the coffins from the crypt in 1980 and took them for reburial at Brookwood cemetery, Woking in Surrey. This list provides information taken from details on the coffin and states the name, date of death and age. Many of the coffins were unidentifiable and marked “unknown”. On others the date of death was illegible and only the year has been recorded. Brookwood cemetery records indicate that the reburials took place on 22nd October 1982. There is now a memorial stone to mark the area. Whilst merging the documents as much information as possible from both lists has been recorded. Additional information from the Farebrother Funeral Service lists, not on the original list, including date of death has been recorded in italics under date of interment. -

Character Overview Westminster Has 56 Designated Conservation Areas

Westminster’s Conservation Areas - Character Overview Westminster has 56 designated conservation areas which cover over 76% of the City. These cover a diverse range of townscapes from all periods of the City’s development and their distinctive character reflects Westminster’s differing roles at the heart of national life and government, as a business and commercial centre, and as home to diverse residential communities. A significant number are more residential areas often dominated by Georgian and Victorian terraced housing but there are also conservation areas which are focused on enclaves of later housing development, including innovative post-war housing estates. Some of the conservation areas in south Westminster are dominated by government and institutional uses and in mixed central areas such as Soho and Marylebone, it is the historic layout and the dense urban character combined with the mix of uses which creates distinctive local character. Despite its dense urban character, however, more than a third of the City is open space and our Royal Parks are also designated conservation areas. Many of Westminster’s conservation areas have a high proportion of listed buildings and some contain townscape of more than local significance. Below provides a brief summary overview of the character of each of these areas and their designation dates. The conservation area audits and other documentation listed should be referred to for more detail on individual areas. 1. Adelphi The Adelphi takes its name from the 18th Century development of residential terraces by the Adam brothers and is located immediately to the south of the Strand. The southern boundary of the conservation area is the former shoreline of the Thames. -

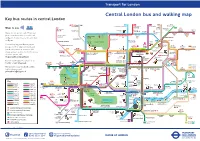

Central London Bus and Walking Map Key Bus Routes in Central London

General A3 Leaflet v2 23/07/2015 10:49 Page 1 Transport for London Central London bus and walking map Key bus routes in central London Stoke West 139 24 C2 390 43 Hampstead to Hampstead Heath to Parliament to Archway to Newington Ways to pay 23 Hill Fields Friern 73 Westbourne Barnet Newington Kentish Green Dalston Clapton Park Abbey Road Camden Lock Pond Market Town York Way Junction The Zoo Agar Grove Caledonian Buses do not accept cash. Please use Road Mildmay Hackney 38 Camden Park Central your contactless debit or credit card Ladbroke Grove ZSL Camden Town Road SainsburyÕs LordÕs Cricket London Ground Zoo Essex Road or Oyster. Contactless is the same fare Lisson Grove Albany Street for The Zoo Mornington 274 Islington Angel as Oyster. Ladbroke Grove Sherlock London Holmes RegentÕs Park Crescent Canal Museum Museum You can top up your Oyster pay as Westbourne Grove Madame St John KingÕs TussaudÕs Street Bethnal 8 to Bow you go credit or buy Travelcards and Euston Cross SadlerÕs Wells Old Street Church 205 Telecom Theatre Green bus & tram passes at around 4,000 Marylebone Tower 14 Charles Dickens Old Ford Paddington Museum shops across London. For the locations Great Warren Street 10 Barbican Shoreditch 453 74 Baker Street and and Euston Square St Pancras Portland International 59 Centre High Street of these, please visit Gloucester Place Street Edgware Road Moorgate 11 PollockÕs 188 TheobaldÕs 23 tfl.gov.uk/ticketstopfinder Toy Museum 159 Russell Road Marble Museum Goodge Street Square For live travel updates, follow us on Arch British -

Charlotte Street Fitzrovia, London W1T 2LX

14 Charlotte Street Fitzrovia, London W1T 2LX Mixed Use Freehold Building FOR SALE - with Planning Consent for an Additional Floor www.rib.co.uk 14 Charlotte Street, Fitzrovia www.rib.co.uk Location Russell Goodge Charlotte Street lies in the heart of Square Station vibrant Fitzrovia and is widely known Street Station for its array of restaurants and cafés. Bounded by Euston Road to the north, Tottenham Court Road to the east, Oxford Street to the south and Portland ROKA Place to the west, Fitzrovia sits in the Charlotte British Bedford core of London’s West End. Street Museum Square Fitzrovia continues to attract many of the world’s leading occupiers including 14 Architectural Sony, Facebook, BBC, Freemantle CHARLOTTE Media, Estee Lauder, and BT. STREET Association Tottenham Court Road and Goodge Street Underground stations are both within a few minutes walking distance to the property. The property falls within The London Borough of Camden, and the Tottenham Charlotte Street Conservation Area. Facebook Court Road UK HQ Station 14 Charlotte Street, Fitzrovia www.rib.co.uk Description Comprises a prominent corner building with restaurant accommodation on ground and lower ground floor with three floors of residential use above in shell and core condition. Planning permission has been granted and implemented for the erection of a mansard roof extension at fourth floor level, including new roof terrace and installation of rooflights; and conversion from 3 x flats to 2 self-contained flats (2 x 2 beds) between the 1st and 4th floor levels; and installation of extraction flue (ducting). The newly created duplex flats will have a total Net Saleable Area of approximately 1,640 sq ft Planning reference: 2016/4651/P. -

St Giles: a Renewed London Quarter Emerges

St Giles: A Renewed London Quarter Emerges § £2 billion regeneration § 60,000 sq ft of dining space § 58% Tech & Media occupation 08 September, London, United Kingdom - The redevelopment of the iconic London landmark, Centre Point, together with an influx of new retail brands, dining and leisure operators, plus the anticipated arrival of the Elizabeth line at Tottenham Court Road has triggered the rejuvenation of the area around the eastern end of Oxford Street and St Giles in the capital’s West End. The area is poised for great growth, driven by the imminent arrival (2018) of the Elizabeth line and the redevelopment of the station at Tottenham Court Road at the eastern end of Oxford Street, which will see more than 100m passengers pass through it each year – three times more than the current volume. This, together with an influx of new retail brands, dining and leisure operators, residential development and high profile tech and media businesses – the ever-growing interest in the area has been supported by more than £2 billion of regeneration. A comprehensive report launching today – A renewed London quarter emerges – has been produced by leading property consultants, Colliers International, in partnership with New West End Company, The Fitzrovia Partnership and Midtown Business Improvement Districts. It charts the intense activity in the St Giles area and its transformation since 2008 from what was previously a little known area of London, into an exciting hub of commercial and private investment developments, including unique dining destinations, to become a vibrant location that puts St Giles firmly on the map. -

St John's Wood

St John’s Wood Area Guide St John’s Wood lies within the City of Westminster in the North West London. Once part of the Great Middlesex Forest, the area was one of the first London suburbs to be developed from the early 19th century onwards, mainly with low density “villa” type housing. St. John’s Wood was once part of the Great Forest of Middlesex, its name derived from its mediaeval owners, the Knights of the Order of St John of Jerusalem. After the Reformation and the Dissolution of monastic orders, St John’s Wood became Crown land, and Henry VIII established Royal Hunting Grounds in what became known as Marylebone Park, to the north of which lay St John’s Wood. The area remained in agricultural use until the end of the eighteenth century, when plans for residential development first appeared. Building began in 1809 in Alpha Road, on the southern boundary of St John’s Wood. One of the first London suburbs to be developed, it was a unique pattern of development and mainly planned with a large amount of low density, semi-detached villas, abandoning the familiar terraced house. Although many of the original houses and gardens disappeared during the twentieth century, through bomb damage and the building of new roads, railways and schools, much of the original character of the area remains. In the 1960s, most of St John’s Wood was designated a Conservation Area and its houses listed by English Heritage. It remains a highly desirable residential location, and one of the most expensive areas of London. -

KIMA-Architecture-Interiors-Booklet

kima-uk.com Architecture & Interiors Ltd. +44 (0) 20 7487 0761 [email protected] 18 Cleveland Street London W1T 4HZ United Kingdom © kima-uk.com kima-uk.com KIMA ARCHITECTURE & INTERIORS Unparalleled attention to detail, quality & beauty. This is KIMA. Our team consists of highly experienced and talented architects and interior designers who work to the highest international standards. KIMA designs are executed with unparalleled attention to detail and quality, making sure our projects stand the test of time and last for centuries to come. © kima-uk.com kima-uk.com KARINA GONCHAROVA Director I’m thrilled to be part of Kima as their interiors director. I have worked extensively across Europe to cement myself as one of the region’s most creative interior advisers. I was fortunate to graduate from the esteemed International Design school in Moscow and delighted to bring my love, passion and dedication to interior design to the CLAUDIO ROCCHETTI team at KIMA Founding Director Coming from an Italian background I grew Karina up immersed in classical architecture and a culture of design and craftsmanship. I consider myself lucky that I managed to create a business where I strive to put this into practice. Claudio © kima-uk.com kima-uk.com KIMA believes that durability is central to architecture and interior design that is superior, and relevant for life today. We believe in buildings and designs that outlast trends and that are made of quality materials that will endure the test of time. © kima-uk.com kima-uk.com BELGRAVIA CONSERVATION AREA | SW1X Eaton Place Size: 790 sq.m / 8500 sq.ft Grade II Listed Building The showstopper of this project, which took an incredible amount of detailing and coordination, was the new stair required to connect the two levels of this very large amalgamated apartment. -

Westminster Abbey

Westminster Abbey Civic Service attended in Civic State by The Lord Mayor of Westminster Councillor Audrey Lewis and Councillors of the City of Westminster Sunday 6 th July 2014 11.00 am THE CITY OF WESTMINSTER Westminster first achieved the status of a city in 1540 when, for only ten years, it became a bishopric. Its first recorded civic administration dates from 1585, in the reign of Queen Elizabeth I, when an Act authorised the establishment of a Court of Burgesses ‘for the good government of the City of Westminster’. While Queen Elizabeth I was creating mayors elsewhere in England, she was concerned that a mayor in Westminster might challenge the authority of the monarch in her own capital city, and she therefore appointed instead the High Steward of Westminster Abbey as Chairman of her newly created Court of Burgesses. The first High Steward to chair the new Court of Burgesses was the Queen’s First Minister, William Cecil, Lord Burleigh. The Court of Burgesses was an administrative body which dealt with public health and morality, planning permissions, the prevention and punishment of crime, and the regulation of weights and measures. It comprised twelve Burgesses appointed by the Dean—one for each ward. However, when the London Government Act of 1899 created twenty-eight Metropolitan Borough Councils, each having an elected Mayor, Aldermen, and Councillors, the authority of the Dean and the High Steward in secular affairs ceased. The last High Steward who was also effectively Mayor was Lord Salisbury, who was then also Prime Minister. The Duke of Norfolk was the first Mayor of Westminster. -

London Residential the Proximity Premium London Residential 2–3 the Proximity Premium

London residential The proximity premium London Residential 2–3 The proximity premium The proximity premium Every home buyer is Our clients have wide ranging demands The highest premium occurred for properties when it comes to buying a home. Whether it close to hotels. Our analysis included unique. Each has their be to live in or as a rental investment, our Claridge’s, the Dorchester and The Ritz. buyers often have a clear idea of where they The average prices of properties within own motivation and want to buy; geographical location is 500 metres of hotels was £3.2 million, important. And this can impact on the price, more than double the borough average of preferences, one might with higher prices in the prime areas of £1.68 million. Proximity to well known Knightsbridge and Mayfair. However, even department stores, such as Harrods and like to live close to a within areas prices vary. Harvey Nichols, also added nearly double to property values. Being within 500 metres university, for others To determine whether the price varies of a world class university adds around depending on the local amenity offer, we 25% to property values. restaurants may be have identified the average price of properties in central London within 500 key. But whatever the metres of an amenity, such as a university, Michelin starred restaurant, hotel or motivation, this is well-known department store. We compared this with wider borough prices to identify reflected in the price; any price differential (see the back page for a fuller description of our methodology). properties in central Our research shows that living close to amenities can add around 50% to central London close to world London property prices. -

25-27 Lorne Close Marylebone London, Nw8 7Jj

25-27 LORNE CLOSE MARYLEBONE LONDON, NW8 7JJ RARE LONG-LEASEHOLD OFFICE BUILDING FOR SALE MARYLEBONE / ST JOHN’S WOOD (POTENTIALLY SUITABLE FOR OTHER USES) 5,806 SQ FT / 539.39 SQ M LOCATION Lorne Close is linked to the northern end of Park Road, close to the entrance of Regent’s Park (Hanover Gate Entrance). The property is located on the northern side of Lorne Close and is the only office building on the street. The property is situated within a 10 minute walk (0.5 miles) of Baker Street Underground Station (Bakerloo, Circle, Hammersmith & City, Jubilee & Metropolitan Lines), Marylebone Stations (Bakerloo & Chiltern Railways), and St John’s Wood Underground Station (Jubilee Line) As well as excellent transport links, the immediate area benefits from superb amenities with a wide range of café’s, restaurants and boutique retailers located in the nearby St John’s Wood High Street. Lord’s Cricket Ground is within a 5 minute walk and Regents Park is virtually opposite Lorne Close, on the east side of Park Road. 25-27 LORNE CLOSE MARYLEBONE LONDON, NW8 7JJ DESCRIPTION Most of the space is located on the ground floor, benefitting exposed ceilings and beams throughout the property. The premises benefit from very good natural light and the accommodation has recently been comprehensively refurbished by our client to provide high quality, essentially open plan office space. There are currently 5 meeting rooms in the building and an office / meeting room located on the 1st floor which totals 465 sq ft. The WCs are located towards the entrance of the building with the kitchen / break out area located towards the rear of the space. -

The London Gazette, 23 September, 1938 6015

THE LONDON GAZETTE, 23 SEPTEMBER, 1938 6015 of the aforesaid London Traffic Act to make Kensington High Street, Kensington, from the London Traffic (Miscellaneous Provisions) Kensington Gardens eastwards to Kensington 'Regulations, 1938:— Road, and from Hornton Street westwards to (i) restricting the waiting, loading and un- Kensington Road. loading of vehicles and prohibiting the sale Kensington Road, Kensington and West- of goods from vehicles except where the minster. goods are delivered to premises in close Kentish Town Road, St. Pancras, between proximity to the vehicle from which they High Street, Camden Town and Leighton are sold in the streets specified in the Road. Schedule hereto and in the first 120 feet of Kilburn High Road, Hampstead. every street which joins each of those streets King's Cross Road, Finsbury and St. measured from its junction with such street, Pancras. and King Street, Hammersmith, between Stud- (ii) prohibiting between the hours of land Street and Chiswick High Road. 10 a.m. and 6 p.m. the delivery of coal, King's Road, Chelsea. coke and other solid fuels, certain hydro- Knightsbridge, Westminster, between Charles carbon oils and beer in the streets specified Street and Kensington Road. in Part I of the said Schedule. Maida Vale, Hampstead, Paddington and St. Marylebone. Marylebone Road, St. Marylebone, between SCHEDULE. Edgware Road and Chapel Street. New King's Road, Fulham. PART I. Parliament Square, Westminster (West Side). Bayswater Road, Paddington and Kensing- Pentonville Road, Finsbury, Islington and ton. St. Pancras, between Northdown Street and Bloomsbury Square, Holborn (South Side). City Road. Brompton Road, Chelsea, Kensington and Piccadilly Circus, Westminster.