2017 Insights

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Conference Presentation Q2 / 2017 the Road Ahead – Expanding Our Strenghts

LANXESS – Conference Presentation Q2 / 2017 The road ahead – expanding our strenghts Investor Relations Safe harbor statement The information included in this presentation is being provided for informational purposes only and does not constitute an offer to sell, or a solicitation of an offer to purchase, securities of LANXESS AG. No public market exists for the securities of LANXESS AG in the United States. This presentation contains certain forward-looking statements, including assumptions, opinions, expectations and views of the company or cited from third party sources. Various known and unknown risks, uncertainties and other factors could cause the actual results, financial position, development or performance of LANXESS AG to differ materially from the estimations expressed or implied herein. LANXESS AG does not guarantee that the assumptions underlying such forward-looking statements are free from errors nor does it accept any responsibility for the future accuracy of the opinions expressed in this presentation or the actual occurrence of the forecast developments. No representation or warranty (expressed or implied) is made as to, and no reliance should be placed on, any information, estimates, targets and opinions, contained herein, and no liability whatsoever is accepted as to any errors, omissions or misstatements contained herein, and accordingly, no representative of LANXESS AG or any of its affiliated companies or any of such person's officers, directors or employees accept any liability whatsoever arising directly or indirectly -

Gowanus Canal Superfund Site

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK In re: Chapter 11 CHEMTURA CORPORATION, et al., Case No. 09-11233 (REG) Debtors. Jointly Administered SETTLEMENT AGREEMENT BETWEEN THE DEBTORS AND THE UNITED STATES RELATING TO THE GOWANUS CANAL SUPERFUND SITE I. RECITALS WHEREAS, Chemtura Corporation (“Chemtura”) and those of its affiliates listed in Exhibit A (collectively, as debtors, debtors-in-possession, or in any new or reorganized form as a result of the above-captioned bankruptcy proceeding, “Debtors”) filed with the United States Bankruptcy Court for the Southern District of New York (the “Bankruptcy Court” or “Court”) voluntary petitions for relief under Title 11 of the United States Code (the “Bankruptcy Code”) on March 18, 2009 (the “Petition Date”), which have been consolidated for procedural purposes and are being administered jointly as Case No. 09-11233 (REG) (the “Bankruptcy Cases”); WHEREAS, the United States, on behalf of the United States Environmental Protection Agency (along with any legal successor thereto, “EPA”), has filed a proof of claim (Claim No. 11672) (the “U.S. Proof of Claim”) against Chemtura, contending, inter alia, that Chemtura is liable under the Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA”), 42 U.S.C. § 9601 et seq., for costs incurred and to be incurred by the United States in response to releases and threats of releases of hazardous substances at or in connection with the Gowanus Canal Superfund Site in New York (the “Gowanus Site”); WHEREAS, on January -

Chemtura Corporation Frequently Asked Question Faqs

Chemtura Corporation Frequently Asked Question FAQs What is the ticker symbol for Chemtura Corporation? New York Stock Exchange: CEM Who will be the registrar / transfer agent for Chemtura Corporation? Mellon Investor Services Telephone number: (866) 233-4822 Web site address: www.melloninvestor.com When will replacement stock certificates be issued? Mellon Investor Services will send share exchange transmittal instructions to all Great Lakes Chemical Corporation shareholders within two weeks of the closing date. Existing Crompton Corporation shareholders who may wish to exchange Crompton certificates for Chemtura certificates should contact Mellon Investor Services for instructions. Where can investors get up-to-date financial information and relevant historical financial data and public announcements? All current financial information for Chemtura Corporation and all historical financial information for both Crompton Corporation and Great Lakes Chemical Corporation can be found at www.chemtura.com by selecting the “Investor Relations site” option near the bottom of the screen. In the coming months, all such information will be incorporated within a newly designed Web site for Chemtura Corporation. Which Wall Street analysts will be covering Chemtura? See listing under the Analyst Coverage Section of the investor relations section of this Web site. Any views or predictions made in these independently researched reports are those of the authors…and are not expressly endorsed by the company. What are the earnings expectations for Chemtura? The company does not provide explicit earnings guidance. But it does routinely comment on business performance and directional trends during its quarterly earnings conference calls and at various chemical industry conference presentations. Transcripts of such comments are archived in the investor relations section of our Web site. -

Chemtura Corporation Case No. 09-11233 SOFA 3B Payments to Creditors

In re: Chemtura Corporation Case No. 09-11233 SOFA 3b Payments to creditors Name of creditor Address 1 Address 2 City State Zip Country Payment date Amount paid ABRAMS & LASTER, LLP 20 MONTCHANIN ROAD, SUITE 200 WILMINGTON DE 19807 01/26/09 $21,780.55 ABRAMS & LASTER, LLP 20 MONTCHANIN ROAD, SUITE 200 WILMINGTON DE 19807 01/26/09 $68,144.55 ABSORBTECH LLC PO BOX 88396 MILWAUKEE WI 53288-0396 01/20/09 $2,964.80 ABSORBTECH LLC PO BOX 88396 MILWAUKEE WI 53288-0396 02/20/09 $2,964.80 ABU GHAZALEH INTELLECTUAL PROPERTY QUEEN NOOR STREET, SHMEISANI PO BOX 921100 AMMAN 11192 Jordan 01/07/09 $7,586.86 ACID CHEM (USA) INC. 201 W. PASSAIC STREET SUITE 100 ROCHELLE PARK NJ 07662 03/04/09 $63,952.00 ACID CHEM (USA) INC. 201 W. PASSAIC STREET SUITE 100 ROCHELLE PARK NJ 07662 03/06/09 $64,120.00 ACME HARDESTY PO BOX 201477 DALLAS TX 75320-1477 01/26/09 $9,600.00 ADM ARCHER DANIELS MIDLAND PO BOX 92572 CHICAGO IL 60675-2572 01/07/09 $2,750.00 ADM ARCHER DANIELS MIDLAND PO BOX 92572 CHICAGO IL 60675-2572 03/06/09 $60,482.72 ADPEN LABORATORIES INC. 11757 CENTRAL PARKWAY JACKSONVILLE FL 32224 01/26/09 $22,800.00 AG CONTAINER RECYCLING COUNCIL 223 SOUTH MAIN STREET LEXINGTON VA 24450 03/10/09 $31,344.00 AG PROCESSING, INC. PO BOX 3480 OMAHA NE 68103-0480 12/29/08 $286,795.66 AG PRODUCTION CO. PO BOX K TURLOCK CA 95381 01/15/09 $34,638.62 AG RX PO BOX 2008 OXNARD CA 93034 01/15/09 $34,523.00 AGGREKO LLC PO BOX 972562 DALLAS TX 75397-2562 01/14/09 $3,560.05 AGGREKO LLC PO BOX 972562 DALLAS TX 75397-2562 01/14/09 $3,264.55 AIR LIQUIDE INDUSTRIAL U.S. -

United States Bankruptcy Court Southern District of New York

Richard M. Cieri M. Natasha Labovitz Craig A. Bruens Brian E. Schartz KIRKLAND & ELLIS LLP 601 Lexington Avenue New York, New York 10022-4611 Telephone: (212) 446-4800 Facsimile: (212) 446-4900 Counsel to the Debtors and Debtors in Possession UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK ) In re: ) Chapter 11 ) CHEMTURA CORPORATION, et al.,1 ) Case No. 09-11233 (REG) ) Debtors. ) Jointly Administered ) DISCLOSURE STATEMENT FOR THE JOINT CHAPTER 11 PLAN OF CHEMTURA CORPORATION, ET AL. THIS IS NOT A SOLICITATION OF AN ACCEPTANCE, OR REJECTION OF THE PLAN WITHIN THE MEANING OF SECTION 1125 OF THE BANKRUPTCY CODE. ACCEPTANCES OR REJECTIONS MAY NOT BE SOLICITED UNTIL A DISCLOSURE STATEMENT HAS BEEN APPROVED BY THE BANKRUPTCY COURT. THIS DISCLOSURE STATEMENT IS BEING SUBMITTED FOR APPROVAL, BUT HAS NOT BEEN APPROVED BY THE BANKRUPTCY COURT. Dated: June 17, 2010 1 The Debtors in these chapter 11 cases, along with the last four digits of each Debtor’s federal taxpayer identification number, are: Chemtura Corporation (3153); A&M Cleaning Products, LLC (4712); Aqua Clear Industries, LLC (1394); ASCK, Inc. (4489); ASEPSIS, Inc. (6270); BioLab Company Store, LLC (0131); BioLab Franchise Company, LLC (6709); Bio-Lab, Inc. (8754); BioLab Textile Additives, LLC (4348); CNK Chemical Realty Corporation (5340); Crompton Colors Incorporated (3341); Crompton Holding Corporation (3342); Crompton Monochem, Inc. (3574); GLCC Laurel, LLC (5687); Great Lakes Chemical Corporation (5035); Great Lakes Chemical Global, Inc. (4486); GT Seed Treatment, Inc. (5292); HomeCare Labs, Inc. (5038); ISCI, Inc. (7696); Kem Manufacturing Corporation (0603); Laurel Industries Holdings, Inc. (3635); Monochem, Inc. (5612); Naugatuck Treatment Company (2035); Recreational Water Products, Inc. -

STLE Philadelphia Section Members 2015

STLE Philadelphia Section Members 2015 First Name Last Name Company Phone Email Adedamola Adedeji Solvay (215) 781-6250 [email protected] Nick Ariano Harry Miller Corporation (215) 324-4000 [email protected] Petro-Canada America Gaston Arseneault (973) 673-3164 [email protected] Lubricants, Inc. James Atkinson Reit Lubricants Co. (610) 932-2200 [email protected] ExxonMobil Research & Steven Avis (856) 224-2966 [email protected] Engineering Jonathan Ayutsede Chevron Oronite (215) 622-4082 [email protected] Mark Bair Voith Turbo Inc (717) 767-3254 [email protected] John Ballinger O F Zurn Company (215) 229-5268 [email protected] Dinesh Bansal Infineum USA L.P. (908) 474-3489 [email protected] Harry Baumbach Ultrachem Inc. (302) 571-8520 Brianne Bentivegna Ultrachem Inc. (302) 325-9880 [email protected] Joseph Berquist Quaker Chemical (610) 832-8589 [email protected] Jillian Beyer (302) 429-5443 [email protected] William Black Wedeven Associates, Inc. (610) 356-7161 [email protected] Robert Blithe Houghton International Inc. (610) 666-4150 [email protected] ExxonMobil Research & Michael Blumenfeld (856) 224-2865 [email protected] Engineering Thomas Blunt Krytox Performance Lubricants (302) 695-8338 [email protected] Cecile Bonnet Arkema (702) 497-2170 [email protected] David Boyer BP Castrol (610) 225-0751 [email protected] Schaeffer Manufacturing Alan Bradley (314) 865-4100 [email protected] Company Joseph Braza Boulden Company (610) 825-1515 [email protected] Walter Brostow Exelon (609) 971-4836 [email protected] Ed Brutsch Colonial Specialty Chemical (609) 870-7597 [email protected] (413) 525-0660 Darren Burn US Fluids Inc. -

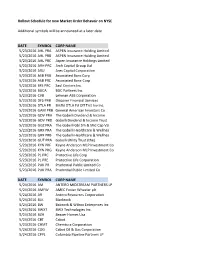

Rollout Schedule for New Market Order Behavoir on NYSE Additional

Rollout Schedule for new Market Order Behavoir on NYSE Additional symbols will be announced at a later date DATE SYMBOL CORP NAME 5/23/2016 AHL PRA ASPEN Insurance Holding Limited 5/23/2016 AHL PRB ASPEN Insurance Holding Limited 5/23/2016 AHL PRC Aspen Insurance Holdings Limited 5/23/2016 ARH PRC Arch Capital Group Ltd 5/23/2016 ARU Ares Capital Corporation 5/23/2016 ASB PRB Associated Banc Corp 5/23/2016 ASB PRC Associated Banc-Corp 5/23/2016 BFS PRC Saul Centers Inc. 5/23/2016 BGCA BGC Partners Inc. 5/23/2016 CVB Lehman ABS Corporation 5/23/2016 DFS PRB Discover Financial Services 5/23/2016 DTLA PR Brkfld DTLA Fd Off Trst Inv Inc. 5/23/2016 GAM PRB General American Investors Co 5/23/2016 GDV PRA The Gabelli Dividend & Income 5/23/2016 GDV PRD Gabelli Dividend & Income Trust 5/23/2016 GGZ PRA The Gabelli Gbl Sm & Mid Cap Val 5/23/2016 GRX PRA The Gabelli Healthcare & Wellnes 5/23/2016 GRX PRB The Gabelli Healthcare & Wellnes 5/23/2016 GUT PRA Gabelli Utility Trust (the) 5/23/2016 KYN PRF Kayne Anderson MLP Investment Co 5/23/2016 KYN PRG Kayne Anderson MLP Investment Co 5/23/2016 PL PRC Protective Life Corp 5/23/2016 PL PRE Protective Life Corporation 5/23/2016 PUK PR Prudential Public Limited Co 5/23/2016 PUK PRA Prudrntial Public Limited Co DATE SYMBOL CORP NAME 5/24/2016 AM ANTERO MIDSTREAM PARTNERS LP 5/24/2016 AMFW AMEC Foster Wheeler plc 5/24/2016 AR Antero Resources Corporation 5/24/2016 BLK Blackrock 5/24/2016 BW Babcock & Wilcox Enterprises Inc 5/24/2016 BWXT BWX Technologies Inc. -

An Economist's View of Market Evidence in Valuation and Bankruptcy Litigation

22 May 2014 An Economist’s View of Market Evidence in Valuation and Bankruptcy Litigation By Faten Sabry and Courts often face many challenges when assessing the solvency of a company whether public or William P. Hrycay privately held. Examples of difficult valuation questions include: would a company with a market capitalization of several hundred million dollars possibly be insolvent? Or, would publicly-traded debt at or near par be conclusive evidence that the issuer is solvent at the time? Or, would a company’s inability to raise funds or maintain its investment grade rating at a given time be sufficient to rule on solvency? It is common in valuation and solvency disputes to have qualified experts with very different opinions on the fair market value of a company, often using the same standard approaches of discounted cash flows and comparables. How would the courts or the arbitrators decide and what is the role of contemporaneous market evidence in such disputes? In this article, we discuss the role of market evidence and possible misinterpretations of such evidence and highlight recent court decisions in the United States. We start with a few basic definitions. The fair market value is defined as the price at which an asset would change hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, both parties having reasonable knowledge of relevant facts. The three standard valuation approaches are the discounted cash flow approach, the market comparables approach, and the asset approach. -

Case M.8261 — Lanxess/Chemtura) (Text with EEA Relevance) (2017/C 67/11)

C 67/20 EN Official Journal of the European Union 3.3.2017 PROCEDURES RELATING TO THE IMPLEMENTATION OF COMPETITION POLICY EUROPEAN COMMISSION Prior notification of a concentration (Case M.8261 — Lanxess/Chemtura) (Text with EEA relevance) (2017/C 67/11) 1. On 24 February 2017, the Commission received notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 (1) by which the undertaking Lanxess AG (Germany) acquires within the meaning of Article 3(1)(b) of the Merger Regulation control of the whole of the undertakings Chemtura Corporation (United States of America) by way of purchase of shares. 2. The business activities of the undertakings concerned are: — for Lanxess: Lanxess is a s pecialty chemicals group based in Cologne, Germany. Lanxess’ core business is the devel opment, manufacturing and marketing of plastics, rubber, intermediates and specialty chemicals, including flame retardants and lubricant additives, — for Chemtura: Chemtura is a global specialty chemicals company, headquartered in Philadelphia, Pennsylvania (United States), with its other principal executive office in Middlebury, Connecticut (United States). 3. On preliminary examination, the Commission finds that the notified transaction could fall within the scope of the Merger Regulation. However, the final decision on this point is reserved. 4. The Commission invites interested third parties to submit their possible observations on the proposed operation to the Commission. Observations must reach the Commission not later than 10 days following the date of this publication. Observations can be sent to the Commission by fax (+32 22964301), by email to [email protected] or by post, under reference M.8261 — Lanxess/Chemtura, to the following address: European Commission Directorate-General for Competition Merger Registry 1049 Bruxelles/Brussel BELGIQUE/BELGIË (1) OJ L 24, 29.1.2004, p. -

Case M.8261 - LANXESS / CHEMTURA

EUROPEAN COMMISSION DG Competition Case M.8261 - LANXESS / CHEMTURA Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 6(1)(b) NON-OPPOSITION Date: 31/03/2017 In electronic form on the EUR-Lex website under document number 32017M8261 EUROPEAN COMMISSION Brussels, 31.3.2017 C(2017) 2232 final In the published version of this decision, some information has been omitted pursuant to Article PUBLIC VERSION 17(2) of Council Regulation (EC) No 139/2004 concerning non-disclosure of business secrets and other confidential information. The omissions are shown thus […]. Where possible the information omitted has been replaced by ranges of figures or a general description. To the notifying party: Subject: Case M.8261 – LANXESS / CHEMTURA Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2 Dear Sir or Madam, (1) On 24 February 2017 the European Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/20043 by which Lanxess AG ("Lanxess" or the "Notifying Party") acquires within the meaning of Article 3(1)(b) of the Merger Regulation control of the whole of Chemtura Corporation ("Chemtura", and together with Lanxess, the "Parties") by way of purchase of shares. 1. THE PARTIES AND THE OPERATION (2) Lanxess is a German corporation listed on the Frankfurt Stock Exchange and based in Cologne, Germany. The core business of Lanxess is the development, manufacturing and marketing of chemical components, specialty chemicals and plastics. -

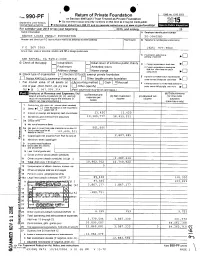

Return of Private Foundation

4 • Return of Private Foundation OMB No 1545 0052 F." 990-PF or Section 4947(a)(1) Trust Treated as Private Foundation Do not enter social security numbers on this form as may made 2015 Department of the Treasury ► it be public Internal Revenue Service ► Information about Form 990 PF and its separate instructions is at tinny vs gov/form990pf W11311111-fliNiffignitill go For calendar y ear 2015 or tax y ear be g innin g , 2015 , and endin g 1 20 Name of foundation A Employer Identification number GEORGE LUCAS FAMI LY FOUNDATION 20-3940983 Number and street (or P O box number if mail Is not delivered to street address ) Room/ suite B Telephone number ( see instructions) P 0 BOX 2009 (925) 977-9060 City or town state or province country and ZIP or foreign postal code C If e.empuan appl i cation is pending check here ► SAN RAFAEL, CA 94912-2009 G Check all that apply Initial return Initial return of a former public charity q D I Fore , gnu'ganoaaons d,ecknere ► Final return Amended return 2 Foreign orgsncatens meelv,g the ehece here and Address change Name change 85% hi auam computeion ► H Check type of organization X Section 501(c)(3) exempt private foundation E u private foundehon slaws was here led Section 4947(a ) (1 ) nonexem pt charitable trust Other taxable p rivate foundation section q u nder 507(n)Ol(n) check here ► I Fair market value of all assets at J Accounting method L_J Cash X Accrual F u lna foundation ^ . -

Investment Portfolio 2016

INVESTMENT PORTFOLIOS June 30, 2016 Teachers’ Retirement System of the City of New York Contents Introduction . .1 Statement of Total Investments for the Pension Fund . .3 Statement of Total Investments for the Diversified Equity Fund . .7 Statement of Total Investments for the Bond Fund . .103 Statement of Total Investments for the International Equity Fund . .111 Statement of Total Investments for the Inflation Protection Fund . .137 Statement of Total Investments for the Socially Responsive Equity Fund . .141 Summar y of Investment Managers . .145 Introduction The Teachers’ Retirement System of the City of New York (TRS) is pleased to present you with our Investment Portfolios publication for the fiscal year ended June 30, 2016. This publication lists the name and value of each investment that TRS held in its six investment programs at the closing of the fiscal year. Cash, receivables, and collateral from securities-lending transactions are assets of TRS but not of the investment programs; therefore, they are not included in this report. TRS’ investments are described briefly below: The Pension Fund consists of U.S. and international equities and fixed-income instruments, with smaller allocations made to private equity and real estate investments. It contains the City’s contributions toward TRS members’ retirement allowances (pension reserves) and members’ contributions to the Qualified Pension Plan (QPP). It also includes the assets of the Fixed Return Fund, an investment option for members that provides a fixed rate of return, determined by the New York State Legislature in accordance with applicable laws. The Diversified Equity Fund invests primarily in the stocks of U.S.