2021 QUARTER 1 (January–March)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sector Study Logistics South Africa

SECTOR STUDY: LOGISTICS - SOUTH AFRICA Commissioned by the Netherlands Enterprise Agency SECTOR STUDY: LOGISTICS Final Report 30 March 2020 1 GAIN Group (Pty) Ltd Executive Summary The South African logistics sector supports the second-largest economy on the continent, and is relatively sophisticated. Local and international companies use South Africa as gateway for their operations into Africa. However, under-investment in maintenance and infrastructure development has created challenges for the efficiency of the logistics system. While hampering efficiency, this aspect at the same time presents opportunity for improvement and investment. This document summarises the results of an investigation into opportunities for Dutch companies to do business in South Africa. It is based on a review of knowledge of the sector, as well as interviews with Dutch and South African stakeholders. The study focused on industry-level interviews to gain the best possible perspective within the scope and time frame of the project. While it does not outline firm-to-firm opportunities, the study summarises needs in the logistics sector as expressed by South African stakeholders, as well as opportunities or current initiatives identified by Dutch role players. Some key findings are as follows: South Africa's logistics landscape is the most sophisticated on the continent. However, logistics takes place in an environment of neglected maintenance and accompanying infrastructure degradation, and relatively high logistics costs. This inefficient environment provides inherent opportunities for improvement and optimisation. At present, many organisations in South Africa do not have the skills to utilise digital technologies effectively. This represents a significant opportunity for digital skills development and knowledge transfer regarding the benefits of these technologies across the logistics sector. -

Annual Report for the YEAR ENDED 31 MARCH 2009 Acknowledgements

SOUTH AFRICAN HERITAGE RESOURCES AGENCY Annual Report FOR THE YEAR ENDED 31 MARCH 2009 Acknowledgements It would have been impossible for the South African Heritage Resources Agency (SAHRA) to achieve what has been reported in the proceeding pages without the cooperation of various State Departments, associations, organizations and many interested individuals. This continued support and guidelines are appreciated by the Council of SAHRA and its staff. Finally, the Council would like to thank its dedicated staff at the Head Office and Provincial offices for their enthusiasm and initiative during the year. Contents COUNCIL MEMBERSHIP 4 APPLICABLE ACTS & OTHER INFORMATION 4 LETTER FROM THE CHAIRPERSON 5 CHIEF EXECUTIVE OFFICER’S MESSAGE 6 CORPORATE AFFAIRS 10 • Information and Auxilliary Services Unit 11 • Information Communication Technology Unit 14 • Human Resources Management 18 HERITAGE RESOURCES MANAGEMENT 26 HEAD OFFICE UNITS 26 • Archaeology, Palaeontology and Meteorite Unit 26 • Maritime Unit 34 • Architectural Heritage Landscape Unit 40 • Grading & Declarations Unit 42 • Heritage Objects Unit 46 • Burial Grounds & Graves Unit 54 PROVINCIAL OFFICES 60 • Eastern Cape 60 • Free State 66 • Gauteng 74 • KwaZulu Natal 78 • Limpopo 80 • Mpumalanga 84 • Northern Cape 88 • North West 96 • Western Cape 100 LEGAL UNIT 114 FINANCIAL STATEMENTS 118 Council Membership NAME STATUS 1. MR PHILL MASHABANE Chairperson 2. MS LAURA ROBINSON National 3. TBA National 4. DR AMANDA BETH ESTERHUYSEN National 5. MR EDGAR NELUVHALANI National 6. MR HENK SMITH National PHRAs 7. DR MTHOBELI PHILLIP GUMA Western Cape 8. ADV. JUSTICE BEKEBEKE Northern Cape 9. TBA Eastern Cape 10. TBA Free State 11. TBA KwaZulu-Natal 12. TBA Gauteng 13. -

Chapter 12: Coastal Emergency Plans

Chapter 12: Coastal Emergency Plans 1. Shipping Incident Disaster Risk Management Plan 2. Cape Zone Coastal Oil Spill Contingency Plan RESTRICTED & CONFIDENTIAL RESTRICTED AND CONFIDENTIAL DISTRIBUTION The Shipping Incident Disaster Risk Management Plan is produced by the City of Cape Town’s Disaster Risk Management Centre (DRMC) as part of its responsibility in terms of the Disaster Management Act, 57 of 2002. This document is intended for the internal use of the Entities and Organisations concerned and should therefore be treated as restricted and confidential and must not be displayed in whole or in part in any public place or to the Media. The Role-players will be advised by the DRMC when the DRM Plan is amended or updated. Amendments and updates must then be incorporated into each Organisation’s / Discipline’s own Plan copy and into any relevant SOP’s, as applicable. DRM PLAN DISTRIBUTION LIST Copy Date of Name of Organisation Number Distribution 1 February 2014 City Manager - CoCT 2 February 2014 Executive Director: Safety & Security - CoCT 3 February 2014 CoCT Disaster Risk Management Centre 4 February 2014 CoCT Fire & Rescue Service 5 February 2014 107 Public Emergency Communications Centre 6 February 2014 CoCT Metropolitan Police Department (MPD) 7 February 2014 CoCT Traffic Services 8 February 2014 CoCT Law Enforcement & Security Services 9 February 2014 CoCT Communications 10 February 2014 CoCT Environmental Resource Management Department (ERMD) 11 February 2014 CoCT Solid Waste Management 12 February 2014 CoCT Sport, Recreation & Amenities 13 February 2014 CoCT Legal Services 14 February 2014 WCG Emergency Medical Services (EMS) 15 February 2014 WCG Forensic Pathology Services 16 February 2014 WCG Disaster Management (WC DMC) 17 February 2014 South African Police Service (SAPS) 18 February 2014 SASAR – Maritime Rescue Co-ordination Centre (MRCC) 19 February 2014 South African Maritime Safety Authority (SAMSA) 20 February 2014 National Department of Transport (DoT) 21 February 2014 South African National Defence Force (SANDF) – J Tac HQ. -

City of Cape Town Profile

2 PROFILE: CITY OF CAPETOWN PROFILE: CITY OF CAPETOWN 3 Contents 1. Executive Summary ........................................................................................... 4 2. Introduction: Brief Overview ............................................................................. 8 2.1 Location ................................................................................................................................. 8 2.2 Historical Perspective ............................................................................................................ 9 2.3 Spatial Status ....................................................................................................................... 11 3. Social Development Profile ............................................................................. 12 3.1 Key Social Demographics ..................................................................................................... 12 3.1.1 Population ............................................................................................................................ 12 3.1.2 Gender Age and Race ........................................................................................................... 13 3.1.3 Households ........................................................................................................................... 14 3.2 Health Profile ....................................................................................................................... 15 3.3 COVID-19 ............................................................................................................................ -

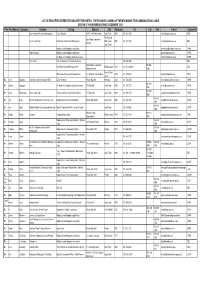

MTN Main Table.Xlsx

LIST OF REGISTERED INTERESTED AND AFFECTED PARTIES - THE PROPOSED LANDING OF THE MTN MARINE TELECOMMUNICATIONS CABLE SYSTEM AT VAN RIEBEECKSTRAND (DECEMBER 2016) Title First Names Surname Position Co/Org Address City Postcode Tel Fax Cell E-mail CategoryID Environmental Resource Management City of Beaches 7th Floor, 44 Wale Street Cape Town 8001 021 487 2284 [email protected] ENVI 7th Floor, 44 Good Hope Subcouncil City of Cape Town Environmental Resource Management Wale Street, 8001 021 487 2284 [email protected] DEL building Cape Town Melkbosstrand Neighbourhood Watch [email protected] OTHR Public Relations Melkbosstrand Neighbourhood Watch [email protected] OTHR SA Deep Sea Trawling Industry Association [email protected] OTHR Port Control Transnet National Ports Authority House 021 449 2805 DEL Drommedaris Street,Van 021 553 Van Riebeeckstrand Primary School Melkbosstrand 7441 021 553 3409/10 DEL Riebeeckstrand 4396 Atlantis, West West Coast Environmental Cooperative Cnr Annalaan & Arion Drive 7353 021 572 0272 [email protected] ENVI Coast Mrs. Carin Adriaanse Secretary to Senior Manager -NPM Eskom Koeberg Private Bag X10 Kernkrag 7440 021 550 5050 [email protected] OTHR 021 419 Mr. Johann Augustyn SA Deep Sea Trawling Industry Association PO Box 2066 Cape Town 8000 021 425 2727 [email protected] ORGB 0785 021 449 Mr. Coen Birkenstock Port of Cape Town Transnet National Ports Authority House P O Box 4245 Cape Town 8001 021 449 3107 [email protected] OTHR 2665 083 412 Mr Alan Boyd Director: Biodivercity Oceans and Coast Department of Environmental Affairs Private Bag X4390 Cape Town 8000 021 402 3070 [email protected] GOVN 3965 083 412 Dr Alan Boyd Director: Biodiversity and Coastal Research Dept.Environmental Affairs: Ocean & Coasts Cape Town 021 819 5006 [email protected] GOVP 3965 Merchant Walk, 021 553 Ms. -

Strategic Environmental Assessment (Sea) for the Port of Cape Town and Environmental Impact Assessment (Eia) for the Expansion O

Strategic Environmental Assessment (Sea) For The Port Of Cape Town And Environmental Impact Assessment (Eia) For The Expansion Of The Container Terminal Stacking Area: Specialist Study On Maritime Archaeology Item Type Working Paper Authors Werz, Bruno E.J.S. Citation SEA/EIA Port of Cape Town Download date 26/09/2021 21:33:13 Link to Item http://hdl.handle.net/1834/391 STRATEGIC ENVIRONMENTAL ASSESSMENT (SEA) FOR THE PORT OF CAPE TOWN AND ENVIRONMENTAL IMPACT ASSESSMENT (EIA) FOR THE EXPANSION OF THE CONTAINER TERMINAL STACKING AREA SPECIALIST STUDY ON MARITIME ARCHAEOLOGY BRUNO E.J.S. WERZ CAPE TOWN, MAY 2003 Maritime archaeology and the port of Cape Town SUMMARY The following specialist report forms part of the larger Strategic Environmental Assessment (SEA) for the Port of Cape Town, the Environmental Impact Assessment (EIA) for the extension of the container terminal in that port, and the related sourcing of fill material. The development and management of these assessments, as well as the monitoring and guiding of specialist studies, is being undertaken jointly by Sakaza Communications and the Council for Scientific and Industrial Research (CSIR), and specifically the Council’s environmental department (Environmentek). The project is commissioned by the National Ports Authority (NPA), Port of Cape Town. The project was set in motion towards the end of the 1990s, whereby the emphasis initially lay with the EIA for the proposed expansion of the container terminal in Cape Town harbour. During the orientation phase for this, that included a public participation process, a number of key issues were identified. These vary considerably and range from planning, traffic management, visual and noise effects, to potential impacts on the marine ecology and cultural resources in the area. -

Cvs of Esia Project Team

TOTAL E & P South Africa B.V. SLR Project No. 720.20047.00005 ESIA for Additional Exploration Activities in Block 11B/12B: Draft Scoping Report June 2020 APPENDIX 2: CVS OF ESIA PROJECT TEAM CURRICULUM VITAE CURRICULUM VITAE JEREMY BLOOD Windhoek PEL28 BV - EIA for the drilling of up to two exploration wells in Petroleum Exploration Licence 83 JEREMY BLOOD Exploration well drilling in (PEL83) in the Orange Basin off the coast of Namibia . Jeremy’s role i ncluded managing Petroleum Exploration the EIA process and public participation process, specialist report review and EIA report SENIOR ENVIRONMENTAL CONSULTANT Licence 83, Namibia (2019) writing. Environmental Management, Planning & Approvals, Shell Namibia Upstream BV EIA for the drilling of up to two deep water exploration wells in Petroleum Exploration South Africa - Exploration well drilling in Licence 39 off the coast of southern Namibia . Jeremy’s role included managing the EIA Petroleum Exploration process and public participation process, specialist report review and EIA report Licence 39, Namibia (2017- writing. QUALIFICATIONS 2018) MSc 2006 Masters in Conservation Ecology (Stell enbosch University). Cum Laude . BHP Billiton Petroleum Application for a Closure Certificate and consolidated Environmental Risk Report and BSc (Hons) 1995 HonoursThesis: Monitoring in Botany (Rhodesrehabilitation University). success Academic on Namakwa colours Sands. heavy minerals mining (South Africa 3B/4B) Closure Plan for the relinquishment of Licence Block 3B/4B (ER 12/3/23) off the West BSc 1994 Majors in Botany and Zoology (Rhodes University) . Limited - Relinquishment Coast of South Africa. Jeremy’s role included managing the relinquishment process, z of Licence Block 3B/4B, report writing and liaison with the competent authority. -

2.1.2 South Africa Port of Cape Town

2.1.2 South Africa Port of Cape Town Port Overview Port Picture Description and Contacts of Key Companies Cape Town Services Dry dock/ship repair facilities Robinson Dry Dock Sturrock Dry Dock Bunkering Chandlers Port Performance Discharge Rates and Terminal Handling Charges Berthing Specifications General Cargo Handling Berths Port Handling Equipment Container Facilities Customs Guidance Terminal Information Multipurpose Terminal Grain and Bulk Handling Main Storage Terminal Stevedoring Hinterland Information Port Security Port Overview The Port of Cape Town is the premier port for the Western Cape region, providing a wide range of round-the-clock port operations. With a land area of 253 ha and a water area of 9163 ha, the port provides port services to a variety of sectors, including containers, general cargo, fresh produce and fishing (including international operations and exports), as well as the burgeoning offshore oil and gas industry. Local and international demand for bunkering and ship repair is growing rapidly, and Cape Town has 3 ship repair facilities, one of which includes the largest dry dock in Southern Africa. The port also provides comprehensive marine services: navigation, towage, pilotage, berthing, and pollution control. Cape Town is positioned as a hub linking the Americas and Europe with Asia, Southeast Asia, and Australia. As a result, a large percentage of cargo handled is transhipment cargo for onward transit. South Africa’s growing exports, particularly fresh fruit, perishables and frozen produce, travel to global destinations via the Port of Cape Town. Cargoes fall into four clusters: containers, liquid bulk, dry bulk and break-bulk. The port has facilities and infrastructure for container, multi-purpose and fresh produce terminals. -

Legal-Consumer Protection Act Consumer Protection Act – Industry Alternative Dispute Resolution Scheme

Legal-Consumer Protection Act Consumer Protection Act – Industry Alternative Dispute Resolution Scheme Your right to redress Certificate of registration certificate Pledge Consumer Protection Act, 68 of 2008 INTRODUCTION The Consumer Protection Act intends to regulate the marketing of goods and services to consumers, as well as the relationships, transactions and/or agreements between the consumers and the producers, suppliers, distributors, importers, retailers, service providers and intermediaries of those goods and services. The purpose of the Act is to ‘promote and advance the social and economic welfare of consumers in South Africa’. It therefore intends; • To improve access to, as well as the quality of, information that is necessary for consumers to make informed choices, • To protect consumers from health and safety hazards, • To promote consumer education, • To establish a legal framework for the achievement of a consumer market that is fair, accessible, efficient, sustainable and responsible, • To promote fair business practices, • To protect consumers from unfair, unreasonable and/or improper trade practices, • To protect consumers from misleading, deceptive, unfair or fraudulent conduct • To provide for systems of dispute resolution and enforcement. DISCLOSURES REQUIRED IN TERMS OF SECTION 27 OF THE CONSUMER PROTECTION ACT, 68 OF 2008 • Full name: Maersk South Africa (Pty) Ltd • Registration Number: 1992/005770/07 • Vessel Agent Registration Certificate Number: VA 047 issued by Transnet National Ports Authority for the Port -

Port of Cape Town Information

Port of Cape Town Information LOCATION Latitude 33.54S | Longitude 18.26E PILOTAGE Pilot is compulsory. Rendezvous point is 1.6 nautical miles SE of the port entrance on the leading lights. Pilot transfer is by pilot boat, unless otherwise advised. When pilot is embarking by pilot boat, ladders must comply with SOLAS regulations. Cape Town has two fast pilot boats equipped with radar and VHF telephone. WATER DENSITY Seawater density in the harbour is 1025g/cm3. PILOT BOARDING POSITION Pilot station | Longitude 18.423300 DMS Long | 18° 25' 23.8800'' E PORT LIMITS The entrance channel has a depth of 17m and Chart Datum, is 15.4m and a channel width of 180m. Diamond Shipping Services, South Africa ~ 1 ~ Updated: October 2017 Port of Cape Town Information APPROACHES Vessels report to Cape Town Port Control at 12 Nautical Miles and at 6 Nautical Miles from the pilot station. TIDE Tide fall at Cape Town is 1.2m. WEATHER THE Cape Town region enjoys a Mediterranean climate, but also subject to special factors of its southern latitude. During the winter months, April to September, north and northwest winds backing to southwest are frequent. West gales can occur particular during winter, which can result in heavy range action at the berths (average temp. 10-18deg). During summer months October to March, the prevailing winds are southeast. They reach gale force. (average temp. 18-26deg). BALLAST Vessels must be adequately ballasted to permit safe navigation within the port. Only clean, locally loaded ballast water, may be discharged within the port. RADIO The Port of Durban port control and the signal station are manned 24 hours a day, seven days a week. -

Risk Profile of Port Congestion

Risk Profile of Port Congestion: Cape Town Container Terminal Case study Lilian Potgieter Thesis presented in fulfilment of the requirements for the degree of Masters of Commerce in Logistics Management in the Faculty of Economics and Management Sciences at Stellenbosch University Supervisor: Dr Leila Goedhals-Gerber Co-Supervisor: Prof Jan Havenga March 2016 Stellenbosch University https://scholar.sun.ac.za Declaration of Originality By submitting this thesis electronically, I declare that the entirety of the work contained therein is my own, original work, that I am the sole author thereof (save to the extent explicitly otherwise stated), that reproduction and publication thereof by Stellenbosch University will not infringe any third party rights and that I have not previously in its entirely or in part submitted it for obtaining any qualification. Lilian Potgieter Date: ……………………. Copyright © 2016 Stellenbosch University All rights reserved i Stellenbosch University https://scholar.sun.ac.za Abstract Supply chains, both complex and simple, are often exposed to various levels of risk stemming from different sources. These risks, whether minor or critical, require a certain level of management to mitigate and control frequency and overall impact. The South African maritime industry suffers from a number of risks, with the most prominent source of risk stemming from vessel and vehicle congestion within port terminals. In most cases, this is due to a lack of port capacity, lack of operator productivity, severe weather conditions and/or system-related challenges. In South Africa, one of the most important ports – the Port of Cape Town – faces two risks associated with port congestion, namely, severe weather and system delays. -

A Maritime Icon: "Smit Amandla"

17th Volume, Special Dated 21 May 2016 BUYING, SALES, NEW BUILDING, RENAMING AND OTHER TUGS TOWING & OFFSHORE INDUSTRY NEWS TUGS TOWING & OFFSHORE NEWS SPECIAL 40 YEARS IN SERVICE A MARITIME ICON: ’SMIT AMANDLA’ The ocean-going salvage tug ‘Smit Amandla’ returned to the Port of Cape Town in February after a safe and successful 2361 nautical mile (4400 km) round trip tow from Limbe, Cameroon, towing the ‘Zenith Explorer’. Unlike the majority of its jobs which involve emergency callout and response to high risk maritime emergencies, this was a measured voyage easily within the capacity of the salvage tug, which was custom designed for effective use in the most extreme conditions. Still fabulous at the age of 40, the tug is a maritime icon. On contract to the Department of Transport to respond to maritime emergencies on the South African coast, and a key part of the State’s pollution prevention strategy, the tug is on standby 24/7/365, ready to respond to a callout within 30 minutes. This means that the crew onboard devote their attention to proactive preventative and 1/10 17TH VOLUME, SPECIAL DATED 21 MAY 2016 planned maintenance, ensuring that she can deliver an effective response in the most hazardous conditions the South African coast displays, which are well known to be some of the worst in the world. It’s not called the Cape of Storms for nothing! As an essential training platform, the ‘Smit Amandla’ has been home to many seafarers who have gone on to become leaders in this field; providing opportunities Masters, Officers, Chief Engineers and specialist shore-based experts have moved through the ranks on the ‘Smit Amandla’ and her sister tug over the years, and she has been a platform for the training and development of seafarers.