Poland – IHS Country Risk Insight

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download=47:Poland-Germany-Partnership-For-Europe

BRIEF POLICY AFTER TUSK: POLAND IN EUROPE Piotr Buras SUMMARY The departures of Donald Tusk and Radoslaw Sikorski Poland has just experienced the most mark the end of an era in Polish politics. Tusk will take successful decade in its modern history. It took office as president of the European Council on 1 December, advantage of the opportunities presented by EU integration and has enjoyed stable political and Sikorski left the Ministry of Foreign Affairs after the and economic development. Not hit by the government reshuffle in September to become Marshal of economic crisis and led by the tandem of Tusk the Sejm (chair of the Polish parliament). Together, the and Sikorski, Warsaw won the confidence of former prime minister and the former foreign minister its main EU partners, most notably Berlin, emblematise Poland’s success in recent years in achieving and earned a strong position within the bloc. The nomination of Tusk for the post of the clear economic gains and making a splash in foreign and president of the European Council marked the European affairs. Against a backdrop of financial and end of this unprecedented era. The next decade economic crisis, Poland emerged as an important player on may be more difficult and a continuation of the European stage. Poland’s successful run is by no means certain. The country needs a new economic model As the only country in Europe not to experience an economic to sustain its impressive growth. It faces political dilemmas with regard to accession slump, Warsaw benefited politically from the crisis – and to the eurozone as well as to its eastern and became an important ally to Berlin. -

Tackling Labour Exploitation in Poland, Bulgaria and Romania

March 2019 Tackling labour exploitation in Poland, Bulgaria and Romania Author: Suzanne Hoff (La Strada International) RIGHTS AT WORK TACKLING LABOUR EXPLOITATION IN POLAND, BULGARIA AND ROMANIA Colophon Rights at Work Tackling labour exploitation in Poland, Bulgaria and Romania March 2019 This publication has been made possible Author Suzanne Hoff with the financial support of the Dutch (La Strada International) Ministry of Foreign Affairs (Small Human Copy editor Stephanie Ross Rights Fund). It was developed within the Cover photo Shutterstock framework of the project Rights at Work – Layout Frans Schupp Tackling labour exploitaiton in all economic sectors in Poland, Bulgaria and Romania. Acknowledgements La Strada International would like to thank all the organisations that partnered in this project, including: the Centre for Research on Multinational Corporations (SOMO), FairWork, La Strada Foundation against Trafficking in Persons and Slavery (La Strada Poland), the Association for Legal Intervention (SIP) in Poland, AIDRom in Romania and Animus Association Foundation in Bulgaria. The following people contributed by providing and collecting information and/or reviewing specific sections of this publication. Their input, comments and additions were invaluable: Ilona Hartlief, Katrin Mc Gauran, Joanna Garnier, Irena Dawid, Antoaneta Vassileva, Nadia Kozhouharova, Dobryana Petkova, Katarzyna Slubik, Elena Timofticiuc, Louis Ulrich and Julia Muraszkiewicz. Further special thanks go to those who supported the implementation of the Rights at Work project, including Esther de Haan, Karin Burgerhout and Eline Willemsen, all participants of the final conference of the project held on 28 September 2018 in Amsterdam, the Netherlands, as well as all those in Poland, Bulgaria and Romania who attended project activities and were ready to be interviewed during the fact-finding missions in 2017. -

Studia Politica 32014

www.ssoar.info The 2014 European Elections. The Case of Poland Sula, Piotr Veröffentlichungsversion / Published Version Zeitschriftenartikel / journal article Empfohlene Zitierung / Suggested Citation: Sula, P. (2014). The 2014 European Elections. The Case of Poland. Studia Politica: Romanian Political Science Review, 14(3), 395-406. https://nbn-resolving.org/urn:nbn:de:0168-ssoar-445354 Nutzungsbedingungen: Terms of use: Dieser Text wird unter einer CC BY-NC-ND Lizenz This document is made available under a CC BY-NC-ND Licence (Namensnennung-Nicht-kommerziell-Keine Bearbeitung) zur (Attribution-Non Comercial-NoDerivatives). For more Information Verfügung gestellt. Nähere Auskünfte zu den CC-Lizenzen finden see: Sie hier: https://creativecommons.org/licenses/by-nc-nd/4.0 https://creativecommons.org/licenses/by-nc-nd/4.0/deed.de The 2014 European Elections The Case of Poland PIOTR SULA Introduction This article presents the conduct and consequence of the election to the European Parliament held in Poland on 25 May 2014. It is a commonly accepted view that elections are inherent in the democratic order. Members of the European Parliament are elected following a similar procedure to that governing the elections to national Parliaments. Probably as widespread is the opinion that, since they do not result in the election of the executive branch of government, European elections are of less significance to the competing parties – which appear to prioritise their participation in the future government – than the competition for seats in the national parliament. As a consequence, the lesser impact of the decisions made at the ballot box is also translated into a less intense interest in the European elections expressed by the electorate. -

Poland's 2019 Parliamentary Election

— SPECIAL REPORT — 11/05/2019 POLAND’S 2019 PARLIAMENTARY ELECTION Tomasz Grzegorz Grosse Warsaw Institute POLAND’S 2019 PARLIAMENTARY ELECTION Held on October 13, 2019, Poland’s general election is first and foremost a success of democracy, as exemplified by crowds rushing to polling stations and a massive rise in voter turnout. Those that claimed victory were the govern- ment groups that attracted a considerable electorate, winning in more constitu- encies across the country they ruled for the past four years. Opposition parties have earned a majority in the Senate, the upper house of the Polish parliament. A fierce political clash turned into deep chasms throughout the country, and Poland’s political stage reveals polarization between voters that lend support to the incumbent government and those that question the authorities by manifest- ing either left-liberal or far-right sentiments. Election results Poland’s parliamentary election in 2019 attrac- try’s 100-seat Senate, the upper house of the ted the attention of Polish voters both at home parliament, it is the Sejm where the incum- and abroad while drawing media interest all bents have earned a majority of five that has over the world. At stake were the next four a pivotal role in enacting legislation and years in power for Poland’s ruling coalition forming the country’s government2. United Right, led by the Law and Justice party (PiS)1. The ruling coalition won the election, The electoral success of the United Right taking 235 seats in Poland’s 460-seat Sejm, the consisted in mobilizing its supporters to a lower house of the parliament. -

Re-Branding a Nation Online: Discourses on Polish Nationalism and Patriotism

Re-Branding a Nation Online Re-Branding a Nation Online Discourses on Polish Nationalism and Patriotism Magdalena Kania-Lundholm Dissertation presented at Uppsala University to be publicly examined in Sal IX, Universitets- huset, Uppsala, Friday, October 26, 2012 at 10:15 for the degree of Doctor of Philosophy. The examination will be conducted in English. Abstract Kania-Lundholm, M. 2012. Re-Branding A Nation Online: Discourses on Polish Nationalism and Patriotism. Sociologiska institutionen. 258 pp. Uppsala. ISBN 978-91-506-2302-4. The aim of this dissertation is two-fold. First, the discussion seeks to understand the concepts of nationalism and patriotism and how they relate to one another. In respect to the more criti- cal literature concerning nationalism, it asks whether these two concepts are as different as is sometimes assumed. Furthermore, by problematizing nation-branding as an “updated” form of nationalism, it seeks to understand whether we are facing the possible emergence of a new type of nationalism. Second, the study endeavors to discursively analyze the ”bottom-up” processes of national reproduction and re-definition in an online, post-socialist context through an empirical examination of the online debate and polemic about the new Polish patriotism. The dissertation argues that approaching nationalism as a broad phenomenon and ideology which operates discursively is helpful for understanding patriotism as an element of the na- tionalist rhetoric that can be employed to study national unity, sameness, and difference. Emphasizing patriotism within the Central European context as neither an alternative to nor as a type of nationalism may make it possible to explain the popularity and continuous endur- ance of nationalism and of practices of national identification in different and changing con- texts. -

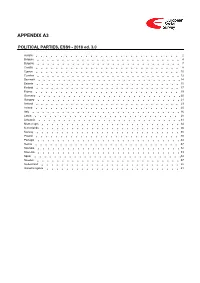

ESS9 Appendix A3 Political Parties Ed

APPENDIX A3 POLITICAL PARTIES, ESS9 - 2018 ed. 3.0 Austria 2 Belgium 4 Bulgaria 7 Croatia 8 Cyprus 10 Czechia 12 Denmark 14 Estonia 15 Finland 17 France 19 Germany 20 Hungary 21 Iceland 23 Ireland 25 Italy 26 Latvia 28 Lithuania 31 Montenegro 34 Netherlands 36 Norway 38 Poland 40 Portugal 44 Serbia 47 Slovakia 52 Slovenia 53 Spain 54 Sweden 57 Switzerland 58 United Kingdom 61 Version Notes, ESS9 Appendix A3 POLITICAL PARTIES ESS9 edition 3.0 (published 10.12.20): Changes from previous edition: Additional countries: Denmark, Iceland. ESS9 edition 2.0 (published 15.06.20): Changes from previous edition: Additional countries: Croatia, Latvia, Lithuania, Montenegro, Portugal, Slovakia, Spain, Sweden. Austria 1. Political parties Language used in data file: German Year of last election: 2017 Official party names, English 1. Sozialdemokratische Partei Österreichs (SPÖ) - Social Democratic Party of Austria - 26.9 % names/translation, and size in last 2. Österreichische Volkspartei (ÖVP) - Austrian People's Party - 31.5 % election: 3. Freiheitliche Partei Österreichs (FPÖ) - Freedom Party of Austria - 26.0 % 4. Liste Peter Pilz (PILZ) - PILZ - 4.4 % 5. Die Grünen – Die Grüne Alternative (Grüne) - The Greens – The Green Alternative - 3.8 % 6. Kommunistische Partei Österreichs (KPÖ) - Communist Party of Austria - 0.8 % 7. NEOS – Das Neue Österreich und Liberales Forum (NEOS) - NEOS – The New Austria and Liberal Forum - 5.3 % 8. G!LT - Verein zur Förderung der Offenen Demokratie (GILT) - My Vote Counts! - 1.0 % Description of political parties listed 1. The Social Democratic Party (Sozialdemokratische Partei Österreichs, or SPÖ) is a social above democratic/center-left political party that was founded in 1888 as the Social Democratic Worker's Party (Sozialdemokratische Arbeiterpartei, or SDAP), when Victor Adler managed to unite the various opposing factions. -

PARLIAMENTARY ELECTIONS in POLAND 25Th October 2015

PARLIAMENTARY ELECTIONS IN POLAND 25th October 2015 European Elections monitor The Law and Justice Party win the parliamentary elections and the absolute majority Corinne Deloy Abstract: Five months after having been elected Andrzej Duda (PiS) as President of the Republic on 24th May last (with 51.55% of the vote) the Law and Justice Party (PiS) won the parlia- mentary elections that took place in Poland on 25th October. It won the absolute majority Results and should therefore be able to govern Poland alone over the next four years – a first in the country’s history since the fall of communism in 1989. The conservative and eurosceptic party, also who were disappointed with the PO. The People’s extremely attached to Poland’s Catholic identity Party (PSL), a centrist, agrarian party chaired by led by Jaroslaw Kaczynski, won 37.58% of the vote outgoing Prime Minister Janusz Piechocinski, won and 242 seats (+85 in comparison with the last 5.13% of the vote and 18 seats (- 10). parliamentary elections on 9th October 2011) in the Diet, the Lower Chamber of Parliament. It drew The left has disappeared from Parliament. The United ahead of Civic Platform (PO), the party of outgoing Left Coalition (ZL, Zjednoczona Lewica), formed of Prime Minister Eva Kopacz, which won 24.09% of the the Alliance between the Democratic Left (SLD) led vote and 133 seats (- 74). by Leszek Miller, Your Movement (TR, Twoj Ruch) Pawel Kukiz – a rock singer and protest candidate led by Janusz Palikot, the Socialist Party, the Greens who won 20.8% of the vote in the first round of the and the Labour Union (UP), won 7.55% of the vote presidential election on 10th May 2015 took third i.e. -

The October 2015 Polish Parliamentary Election

An anti-establishment backlash that shook up the party system? The october 2015 Polish parliamentary election Article (Accepted Version) Szczerbiak, Aleks (2016) An anti-establishment backlash that shook up the party system? The october 2015 Polish parliamentary election. Perspectives on European Politics and Society, 18 (4). pp. 404-427. ISSN 1570-5854 This version is available from Sussex Research Online: http://sro.sussex.ac.uk/id/eprint/63809/ This document is made available in accordance with publisher policies and may differ from the published version or from the version of record. If you wish to cite this item you are advised to consult the publisher’s version. Please see the URL above for details on accessing the published version. Copyright and reuse: Sussex Research Online is a digital repository of the research output of the University. Copyright and all moral rights to the version of the paper presented here belong to the individual author(s) and/or other copyright owners. To the extent reasonable and practicable, the material made available in SRO has been checked for eligibility before being made available. Copies of full text items generally can be reproduced, displayed or performed and given to third parties in any format or medium for personal research or study, educational, or not-for-profit purposes without prior permission or charge, provided that the authors, title and full bibliographic details are credited, a hyperlink and/or URL is given for the original metadata page and the content is not changed in any way. http://sro.sussex.ac.uk An anti-establishment backlash that shook up the party system? The October 2015 Polish parliamentary election Abstract The October 2015 Polish parliamentary election saw the stunning victory of the right-wing opposition Law and Justice party which became the first in post-communist Poland to secure an outright parliamentary majority, and equally comprehensive defeat of the incumbent centrist Civic Platform. -

Domestic Aspects of Polish Membership in the European Union

Iowa State University Capstones, Theses and Retrospective Theses and Dissertations Dissertations 1-1-2002 Domestic aspects of Polish membership in the European Union Aurelia Wiktoria Trywianska Iowa State University Follow this and additional works at: https://lib.dr.iastate.edu/rtd Recommended Citation Trywianska, Aurelia Wiktoria, "Domestic aspects of Polish membership in the European Union" (2002). Retrospective Theses and Dissertations. 21337. https://lib.dr.iastate.edu/rtd/21337 This Thesis is brought to you for free and open access by the Iowa State University Capstones, Theses and Dissertations at Iowa State University Digital Repository. It has been accepted for inclusion in Retrospective Theses and Dissertations by an authorized administrator of Iowa State University Digital Repository. For more information, please contact [email protected]. Domestic aspects of Polish membership in the European Union by Aurelia Wiktoria Trywianska A thesis submitted to the graduate faculty in partial fulfillment of the requirements for the degree of MASTER OF ARTS Major: Political Science Program of Study Committ~e: Matthias Kaelberer, Major Professor Joel Moses Andrejs Plakans Iowa State University Ames, Iowa 2002 ii Graduate College Iowa State University This is to certify that the master's thesis of Aurelia Wiktoria Trywianska has met the thesis requirements of Iowa State University Signatures have been redacted for privacy iii Dia Najukochatiszych Rodzicow z nadziejq o lepszq Polskf iv TABLE OF CONTENTS DEDICATION iii LIST OF FIGURES v1 LIST OF TABLES vii ACKNOWLEDGEMENTS vm CHAPTER 1. INTRODUCTION 1 CHAPTER 2. IDSTORICAL CONTEXT 3 Cooperation and Trade Agreements as a first step toward integration process 3 Association agreements and public opinion responses 9 Benefits of the European Union membership 15 Mutual advantages between Poland and the European Union CHAPTER 3. -

A Place at the Top Table? Poland and the Euro Crisis

Reinvention of Europe Project A place at the top table? Poland and the euro crisis By Konstanty Gebert If you want to dine at the European Union’s top table it is important to be able to count on powerful friends who can help you pull up a chair. With an economy only one quarter that of Germany’s, and a population half its size, Poland cannot and does not aspire to have a permanent chair at that top table. But neither can it – with a population accounting for half of all the 2004 enlargement states and an economy among the best-performing in a crisis-ridden EU – content itself with merely a seat at the lower table. This is the challenge facing Poland, as it seeks to follow its developing interests and make its voice heard at a time when the most powerful countries in the EU are pulling in very different directions. Poland’s position within the EU is further complicated by its straddling of several dividing lines. For instance, its future is fundamentally tied to the Eurozone club that it does not belong to but very deeply desires to participate in. It managed to assume the rotating EU presidency for the first time just as the deepest crisis to affect the Union was deepening even further. Following on from the Lisbon Treaty, however, the presidency’s influence is now much reduced, and so Poland was relegated to being a mere observer of decisions made by others, mostly over the future of the Eurozone. Poland also straddles the demographic and economic boundaries between the EU’s major players and its smaller ones (the sixth largest in both categories). -

Law and Justice's Stunning Victory in Poland Reflected Widespread

blogs.lse.ac.uk http://blogs.lse.ac.uk/europpblog/2015/11/02/law-and-justices-stunning-victory-in-poland-reflected-widespread-disillusionment-with-the- countrys-ruling-elite/ Law and Justice’s stunning victory in Poland reflected widespread disillusionment with the country’s ruling elite What does the recent parliamentary election in Poland tell us about the country’s politics? Aleks Szczerbiak writes that the victory secured by the right-wing opposition party Law and Justice stemmed from widespread disillusionment with Poland’s ruling elite. He notes that the usual strategy employed by the ruling party, Civic Platform, of trying to mobilise the ‘politics of fear’ against Law and Justice was not successful this time. The election result heralds major changes on the political scene including a leadership challenge in Civic Platform, the emergence of new ‘anti-system’ and liberal political forces in parliament, and a period of soul searching for the marginalised Polish left. Poland’s October 25th parliamentary election saw a stunning victory for the right-wing Law and Justice (PiS) party, previously the main opposition grouping. The party increased its share of the vote by 7.7 per cent – compared with the previous 2011 poll – to 37.6 per cent, securing 235 seats in the 460-member Sejm, the more powerful lower house of the Polish parliament. This made Law and Justice the first political grouping in post-communist Poland to secure an outright parliamentary majority. At the same time, the centrist Civic Platform (PO), the outgoing ruling party led by prime minister Ewa Kopacz, suffered a crushing defeat, seeing its vote share fall by 15.1 per cent to only 24.1 per cent and number of seats drop to 138. -

From Poland with Love

From Poland with Love Monthly Newsletter – May Topic of the month The Indomitable. 40 Days in Sejm On April 18th parents of disabled children started occupation of the halls of the Sejm. The protest lasted for 40 days. On Sunday, May 27th, one day after the Mother’s Day, they left the parliament building and were welcomed by the supporting crowd, like heroes. The government did not meet their demands, but the protesters have accomplished something more - they changed the attitude of Polish people towards the disabled. In Poland people who choose not to work in order to care for a disabled child receive €350 per month from the government. But they can only receive this benefit if they have no other income, which means they cannot take even part-time work. What is more, as soon as the child turns 18, even that meager payment expires and parents are left alone with their children who need constant support and no means for living. Back in 2014, Poland's Constitutional Tribunal deemed the law unconstitutional. But none of the governments - the previous PO-PSL coalition nor the current PiS government - have done much to improve situation of parents of disabled children. It is important to say that the parents of the disabled children also protested for 17 days in the Sejm when Civic Platform led the government. This protest has hit the government hard – it has revealed the declared “pro-social” attitude of PiS so the government politicized the protest, presenting the protesters are tools in hand of the opposition.