Press Release Template F

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

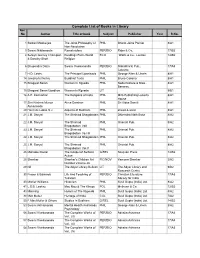

Complete List of Books in Library Acc No Author Title of Book Subject Publisher Year R.No

Complete List of Books in Library Acc No Author Title of book Subject Publisher Year R.No. 1 Satkari Mookerjee The Jaina Philosophy of PHIL Bharat Jaina Parisat 8/A1 Non-Absolutism 3 Swami Nikilananda Ramakrishna PER/BIO Rider & Co. 17/B2 4 Selwyn Gurney Champion Readings From World ECO `Watts & Co., London 14/B2 & Dorothy Short Religion 6 Bhupendra Datta Swami Vivekananda PER/BIO Nababharat Pub., 17/A3 Calcutta 7 H.D. Lewis The Principal Upanisads PHIL George Allen & Unwin 8/A1 14 Jawaherlal Nehru Buddhist Texts PHIL Bruno Cassirer 8/A1 15 Bhagwat Saran Women In Rgveda PHIL Nada Kishore & Bros., 8/A1 Benares. 15 Bhagwat Saran Upadhya Women in Rgveda LIT 9/B1 16 A.P. Karmarkar The Religions of India PHIL Mira Publishing Lonavla 8/A1 House 17 Shri Krishna Menon Atma-Darshan PHIL Sri Vidya Samiti 8/A1 Atmananda 20 Henri de Lubac S.J. Aspects of Budhism PHIL sheed & ward 8/A1 21 J.M. Sanyal The Shrimad Bhagabatam PHIL Dhirendra Nath Bose 8/A2 22 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam VolI 23 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam Vo.l III 24 J.M. Sanyal The Shrimad Bhagabatam PHIL Oriental Pub. 8/A2 25 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam Vol.V 26 Mahadev Desai The Gospel of Selfless G/REL Navijvan Press 14/B2 Action 28 Shankar Shankar's Children Art FIC/NOV Yamuna Shankar 2/A2 Number Volume 28 29 Nil The Adyar Library Bulletin LIT The Adyar Library and 9/B2 Research Centre 30 Fraser & Edwards Life And Teaching of PER/BIO Christian Literature 17/A3 Tukaram Society for India 40 Monier Williams Hinduism PHIL Susil Gupta (India) Ltd. -

Rakesh Mohan: State of the Indian Economy

Rakesh Mohan: State of the Indian economy Inaugural address by Dr Rakesh Mohan, Deputy Governor of the Reserve Bank of India, at the 2nd Annual Indian Securities Infrastructure & Operations Forum 2006, Mumbai, 7 November 2006. * * * It is my great pleasure to be here at the 2nd Annual Indian Securities Infrastructure & Operations Forum 2006. The recent growth momentum of the Indian economy is leading to renewed interest in India’s growth prospects. As the mid-year review of the annual policy is just over I thought instead of giving just a run-down of the current state of the Indian economy let me put the current trends into a broader perspective - both with respect to the longer term trend and as well as the global scenario. Thus, I will proceed as follows: • In order to draw appropriate perspectives for the future of the Indian economy, I will first present an overview of India’s economic progress over the past three decades. • Given the growing integration of the Indian economy with the rest of the world, I will then discuss the prospects of the global economy. • This will be followed by an assessment of the current economic situation in India. • Finally, I will discuss some of the issues necessary to accelerate the current growth momentum. I. Overview of longer-term trends Growth, savings and investment Following the initiation of structural reforms in the early 1990s, the Indian economy has grown at an annual average rate of over 6 per cent per annum. While the 1980s had also witnessed high growth (5.8 per cent per annum), this growth was associated with widening macroeconomic imbalances – growing fiscal deficits, growing current account deficits, falling international reserves and higher inflation – culminating in the balance of payments crisis of 1990-91. -

Monday, July 12, 2021 Tuesday, July 13, 2021

JULY 12-15, 2021 On Zoom every day during 6:30 to 9:30 pm IST and at equivalent times in other zones (time clock) Participation in the India Policy Forum 2021 is by invitation. Invitations are non-transferable. Click here for Biosketches of the participants MONDAY, JULY 12, 2021 All times are IST 6:30–8:00 pm Welcome Remarks Surjit S Bhalla, Executive Director IMF & Governing Body Member, NCAER Introduction to the 18th India Policy Forum Poonam Gupta, NCAER; Barry Bosworth, Brookings Institution; Karthik Muralidharan, University of California, San Diego & NCAER The 3rd T.N. Srinivasan Memorial Lecture “Responding to COVID-19 amidst Market and Government Failures” Speaker: Shanta Devarajan, Georgetown University & NCAER Chair: Rukmini Banerji, Pratham Education Foundation 8:00–9:30 pm Big, Open Data for Development: A Vision for India [Paper] Sam Asher, Johns Hopkins; Aditi Bhowmick, Development Data Lab; Alison Campion, Development Data Lab; Tobias Lunt, Development Data Lab; Paul Novosad, Dartmouth College, Development Data Lab Chair: Suman Bery, Bruegel & former Director General, NCAER Discussants: Robert J. Cull, World Bank Ashwini Deshpande, Ashoka University TUESDAY, JULY 13, 2021 All times are IST Welcome to the 2nd day of the IPF 2021 & general instructions 6:30–8:00 pm Analysing India's Exchange Rate Regime [Paper] Rajeswari Sengupta, IGIDR; Ila Patnaik, NIPFP Chair: Raghuram Rajan, University of Chicago & former RBI Governor Discussants: Poonam Gupta, NCAER Prakash Loungani, IMF 8:00–9:30 pm IPF POLICY ROUNDTABLE ONE The future of economic reforms: 30 years after “बता तेरी रजा �ा है? (What’s your wish?)” Looking Back to Look Ahead Conversations with four Finance Secretaries on the next round of reforms Moderator: K.P. -

Trends and Issues in Tax Policy and Reform in India

M. GOVINDA RAO National Institute of Public Finance and Policy R. KAVITA RAO National Institute of Public Finance and Policy Trends and Issues in Tax Policy and Reform in India ax systems the world over have undergone significant changes during Tthe last twenty years as many countries across the ideological spectrum and with varying levels of development have undertaken reforms. The wave of tax reforms that began in the mid-1980s and accelerated in the 1990s was motivated by a number of factors. In many developing countries, pressing fiscal imbalance was the driving force. Tax policy was employed as a principal instrument to correct severe budgetary pressures.1 In others, the transition from a planned economy to a market economy necessitated wide- ranging tax reforms. Besides efficiency considerations, these tax reforms had to address the issues of replacing public enterprise profits with taxes as a principal source of revenue and of aligning tax policy to change in the development strategy. Another motivation was the internationalization of economic activities arising from increasing globalization. On the one hand, globalization entailed significant reduction in tariffs, and replacements had to be found for this important and relatively easily administered revenue source. On the other, globalization emphasized the need to minimize both efficiency and compliance costs of the tax system. The supply-side tax reforms of the Thatcher-Reagan era also had their impact on the tax reforms in developing countries. The evolution of the Indian tax system was driven by similar concerns and yet, in some ways, it is different and even unique. Unlike most develop- ing countries, which were guided in their tax reforms by multilateral agencies The authors are grateful to Shankar N. -

India's Overall Fiscal Architecture

Flagship Seminar Series on India’s public finances | Part 1: India’s overall fiscal architecture Centre for Social and Economic Progress (CSEP) New Delhi Monday, March 8, 2021 CSEP Research Foundation 6, Dr Jose P Rizal Marg, Chanakyapuri, New Delhi 110021, India Ph: 011 2415 7600 Panelists Mr. N.K. Singh - Chairman, Fifteenth Finance Commission. He has also served as Chairman of the Fiscal Responsibility and Budget Management Review Committee and as Member of Parliament in the Rajya Sabha. Dr. Shankar Acharya - Honorary Professor at the Indian Council for Research on International Economic Relations (ICRIER). Mr. Anoop Singh - Distinguished Fellow, CSEP and Member, Fifteenth Finance Commission. Moderator Rakesh Mohan - President & Distinguished Fellow, CSEP Watch the event video here: https://www.youtube.com/watch?v=zSUEZXnCV1c The following is an edited transcript from the event. PROCEEDINGS Rakesh Mohan: One, it was of course a very special finance commission report in the sense of the current COVID times, so it was a very, very difficult task. And of course, Mr. N.K. Singh chaired. So, given that it's a very complex report with lots of issues in it, even though we will be doing a three-part series, we would still just be touching on the periphery of the report. So, today is this overall architecture of the report, overall view of the report as presented by Mr. N.K. Singh. The second one will be next week, same time, same place, 15th of March. That'll be on Fiscal Federalism and Human Capital. The moderator will be Mr. Montek Singh Ahluwalia. -

Working Paper No. 92 India's Fiscal Situation: Is a Crisis Ahead?

CENTER FOR RESEARCH ON ECONOMIC DEVELOPMENT AND POLICY REFORM Working Paper No. 92 India’s Fiscal Situation: Is a Crisis Ahead? by T. N. Srinivasan* February 2001 Stanford University John A. and Cynthia Fry Gunn Building 366 Galvez Street | Stanford, CA | 94305-6015 * Samuel C. Park, Jr. Professor of Economics, Yale University 2 INDIA’S FISCAL SITUATION: IS A CRISIS AHEAD? T. N. Srinivasan* Samuel C. Park, Jr. Professor of Economics Yale University September 20, 2000—2 Paper presented at the Center for Research on Economic Development and Policy Reform Conference on Indian Economic Prospects: Advancing Policy Reform Abstract Although, on the surface, the achievements of the Indian economy during the past two decades paint a comforting macroeconomic picture, the accompanying rapid expansion in fiscal deficits is unsustainable. The current fiscal problems existing in the states can be attributed to the increasing subsidies on publicly supplied goods and services, inter-state competition in attracting investment through tax incentives, and overstaffing of administrations and public enterprises. The federal structure of India’s fiscal system also implies difficulties in improving the states’ finances. After discussing ways to reform taxes and expenditure, this paper identifies high explicit and implicit subsidies as a major cause of the fiscal problems at the central and state level. Reducing these subsidies requires far-reaching changes in the domestic political economy. The paper also analyzes the fiscal impact of disinvestment. To achieve the goals of development, fiscal sustainability is indispensable. Although there are some positive signs, a political consensus on and commitment to fiscal reform are yet to emerge. -

Roaring Tiger Or Lumbering Elephant?

aUGUST 2006 ANALYSIS MARK THIRLWELL Roaring tiger or Program Director International Economy lumbering elephant? Tel. +61 2 8238 9060 [email protected] Assessing the performance, prospects and problems of India’s development model.1 In the past, there has been plenty of scepticism about India’s economic prospects: for many, Charles De Gaulle’s aphorism regarding Brazil, that it was a country with enormous potential, and always would be, seemed to apply equally well to the South Asian economy. While the ‘tiger’ economies of East Asia were enjoying economic take-off on the back of investment- and export-led growth, the lumbering Indian elephant seemed set to be a perpetual also-ran in the growth stakes. Yet following a series of reform efforts, first tentatively in the 1980s, and then with much more conviction in the 1990s, the Indian economic model has been transformed, and so too India’s growth prospects. High profile successes in the new economy sectors of information technology (IT) and business process outsourcing (BPO), along with faster economic growth, triggered a widespread rethink regarding India’s economic prospects, and a wave of foreign portfolio investment flowed into Indian markets. Perhaps India was set to be a tiger after all. Yet this new-found optimism received a setback in May and June of this year, when there were sharp falls in Indian stock markets. Had the optimism been overdone, and was another re-rating of India’s economic prospects on the cards? Perhaps India was only a lumbering elephant after all? This paper takes a closer look at the new Indian development model. -

India Policy Forum July 13–16, 2020

Authors, Chair, and Discussants India Policy Forum July 13–16, 2020 NCAER | National Council of Applied Economic Research NCAER India Centre, 11 Indraprastha Estate, New Delhi 110002 Tel: +91-11-23452698, www.ncaer.org NCAER | Quality . Relevance . Impact Authors, Chair, and Discussants 2 Shankar Acharya is an Honorary Professor at the Indian Council for Research on International Economic Relations (ICRIER). He has served as a Member on the 12th Finance Commission, the Prime Minister’s Economic Advisory Council, and on the Securities and Exchange Board of India. During his previous assignment as Chief Economic Adviser to the Government of India, he was closely associated with the Government’s programme of economic reforms as well as with the macroeconomic management of the economy. Apart from being the principal author of the World Development Report, 2017, and several World Bank country reports, he has published numerous books and scholarly papers mainly on topics related to macroeconomic policy, growth, international economics, and public finance. Some of his recent books on the Indian economy are Towards Economic Crisis (2012-14) (2015), India and the Global Crisis (2012), and India’s Economy: Performance and Challenges (2010). He has a Bachelor’s degree in Economics from Oxford University and a PhD in Economics from Harvard University. Junaid Ahmad is the India Country Director for the World Bank. He was earlier the Chief of Staff to the President of the World Bank Group,and before that, the Senior Director for the Bank’s Water Global Practice, where he championed the Practice’s focus on water and the economy and resilience in water management. -

Appointment of Director

Dixon® The brand behind brands Dixon Technologies (India) Ltd. 2 °<1 February,2021 To To Secretary Secretary Lis ting Departme nt Listing Department BSE Limited National Stock Exchange of India Limited De partment of Corporate Services Exchange Plaza, Bandra Ku rla Complex Phiroze jeejeebhoy Towe rs, Mumbai - 400 051 Dalal Street, Mumbai - 400 001 Scrip Code - 540699 Scrip Code- DIXON !SIN: INE935N01012 ISIN: INE935N01012 Dear Sir/ Madam, Sub: Intimatio n purs ua nt to the re quirem e nts of the SEBI Circula r No. CIR/ CFD/ CMD / 4 / 2015 date d 9 t h Se pte m ber, 2015 for Appointme nt of Direct or Pursuant to Regulation 30 of the SEBI (LODR) Regulations, 2015 and aforementioned SEBI Circular dated 9th September, 2015, we would like to inform that the Board of Directors, at its meeting held on 2nd February, 2021 have appointed Dr. Rakesh Mo han as Additional Director in the capacity of Non- Executive and Independent Director of the Company with effect from 2nd February, 2021. Brief profile of Dr. Rakesh Mohan is enclosed as Annexure- A along with a derailed announcement in this respect. Further, pursuant to Circular No. LI ST/COMP/14/2018-19 dated 201h June, 2018 we wish to confirm that Dr. Rakesh Mohan is not debarred from holding the office of Director by virtue of any SE BI order or any other such authority. You are kindly requested to take the aforesaid on your records. Thanking You, For DIX N TEC NOLO IY.>11~,!->L"t_ !....""·lrf,,v 'IJYI ED m a r Rcgd. -

India's Macroeconomic Performance and Policies Since 2000

Working Paper No. 225 India’s Macroeconomic Performance and Policies since 2000 Shankar Acharya October 2008 INDIAN COUNCIL FOR RESEARCH ON INTERNATIONAL1 ECONOMIC RELATIONS Contents Foreword.........................................................................................................................i Abstract..........................................................................................................................ii I. Review of Macroeconomic Developments................................................................1 A. Growth .................................................................................................................1 B. Inflation ................................................................................................................3 C. External Balance ..................................................................................................5 D. Domestic Balance: Deficits, Savings and Investment .........................................7 E. Macroeconomic Performance: an overview.........................................................9 II. Major Challenges for Macroeconomic Policy ......................................................10 A. Fiscal Consolidation...........................................................................................11 B. Foreign Capital Surge.........................................................................................13 III. Key Issues for the Future ......................................................................................17 -

70 POLICIES THAT SHAPED INDIA 1947 to 2017, Independence to $2.5 Trillion

Gautam Chikermane POLICIES THAT SHAPED INDIA 70 POLICIES THAT SHAPED INDIA 1947 to 2017, Independence to $2.5 Trillion Gautam Chikermane Foreword by Rakesh Mohan © 2018 by Observer Research Foundation All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means without permission in writing from ORF. ISBN: 978-81-937564-8-5 Printed by: Mohit Enterprises CONTENTS Foreword by Rakesh Mohan vii Introduction x The First Decade Chapter 1: Controller of Capital Issues, 1947 1 Chapter 2: Minimum Wages Act, 1948 3 Chapter 3: Factories Act, 1948 5 Chapter 4: Development Finance Institutions, 1948 7 Chapter 5: Banking Regulation Act, 1949 9 Chapter 6: Planning Commission, 1950 11 Chapter 7: Finance Commissions, 1951 13 Chapter 8: Industries (Development and Regulation) Act, 1951 15 Chapter 9: Indian Standards Institution (Certification Marks) Act, 1952 17 Chapter 10: Nationalisation of Air India, 1953 19 Chapter 11: State Bank of India Act, 1955 21 Chapter 12: Oil and Natural Gas Corporation, 1955 23 Chapter 13: Essential Commodities Act, 1955 25 Chapter 14: Industrial Policy Resolution, 1956 27 Chapter 15: Nationalisation of Life Insurance, 1956 29 The Second Decade Chapter 16: Institutes of Technology Act, 1961 33 Chapter 17: Food Corporation of India, 1965 35 Chapter 18: Agricultural Prices Commission, 1965 37 Chapter 19: Special Economic Zones, 1965 39 iv | 70 Policies that Shaped India The Third Decade Chapter 20: Public Provident Fund, 1968 43 Chapter 21: Nationalisation of Banks, 1969 45 Chapter -

GOVERNMENT of INDIA MINISTRY of FINANCE DEPARTMENT of ECONOMIC AFFAIRS LOK SABHA UNSTARRED QUESTION No.3616 to BE ANSWERED on MO

GOVERNMENT OF INDIA MINISTRY OF FINANCE DEPARTMENT OF ECONOMIC AFFAIRS LOK SABHA UNSTARRED QUESTION No.3616 TO BE ANSWERED ON MONDAY, 15TH JULY, 2019 [Ashadha 24, 1941 (SAKA)] CHANGE OF FINANCIAL YEAR QUESTION US 3616. SHRIMATI JYOTSNA CHARANDAS MAHANT: SHRI P.K. KUNHALIKUTTY: Will the Minister of FINANCE be pleased to state: (a) whether the Government has decided to change the commencement of financial year from January instead of April every year; (b) if so, the details thereof; (c) whether the Government has taken views of the States ahead of implementing the change in financial year; and (d) if not, the reasons therefor? ANSWER MINISTER OF STATE (SHRI ANURAG SINGH THAKUR) (a) & (b) No such decision has been taken by the Government. (c) & (d) Question does not arise. ***** F. No. 8 (2)-B (SD)/2019 Government of India Ministry of Finance Department of Economic Affairs (Budget Division) Subject: Lok Sabha Unstarred Question No 3616 to be answered on 15.07.2019 regarding ‘change of Financial Year-reg. We have received Notice & printed version of Lok Sabha Unstarred Question No 3616 for answering on 15.07.2019 on the subject ‘Change of Financial Year’. The question has been asked by Shrimati Jyotsna Charandas Mahant, MP and Shri. P.K. Kunhalikutty, MP. 2. It may be submitted that the Government had constituted a committee to examine the desirability and feasibility of having a new financial year on 6.7.2016 under the chairmanship of Dr. Shankar Acharya, former CEA. The Committee submitted its report to the Government on 26.12.2016. No decision has been taken on the recommendation of the Committee, as yet.