Acquiring Partners and Payment Methods November 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

International Payment Gateway Connect Integration Guide Version 2020-4 (IPG)

International Payment Gateway Connect Integration Guide Version 2020-4 (IPG) © 2021 Fiserv, Inc. or its affiliates. | FISERV CONFIDENTIAL Contents 1.0 Introduction ......................................................................................................................................................... 4 2.0 Payment Process Options ................................................................................................................................... 4 2.1 Checkout Option ‘Classic’ ......................................................................................................................... 4 2.2 Checkout Option ‘Combinedpage’ ............................................................................................................. 5 3.0 Getting Started .................................................................................................................................................... 5 3.1 Checklist .................................................................................................................................................. 5 3.2 ASP Example ........................................................................................................................................... 5 3.3 PHP Example ........................................................................................................................................... 6 3.4 Amounts for Test Transactions ................................................................................................................ -

IS PLASTIC DISAPPEARING? the Cards International Prepaid Summit

November 2015 Issue 525 www.cardsinternational.com IS PLASTIC DISAPPEARING? The Cards International Prepaid Summit • ANALYSIS: Card Fraud • INTERVIEW: ITRS • GUEST COMMENT: Peter Pop • COUNTRY REPORTS: Malaysia, China & Egypt CI Nov 525.indd 1 04/12/2015 14:40:17 Multichannel digital solutions for fi nancial services providers To fi nd out more about us please visit: www.intelligentenvironments.com Intelligent Environments is an international provider of innovative mobile and online solutions for fi nancial services providers. Our mission is to enable our clients to always stay close to their own customers. We do this through Interact®, our single software platform, which enables secure customer acquisition, engagement, transactions and servicing across any mobile and online channel and device. Today these are predominantly focused on smartphones, PCs and tablets. However Interact® will support other devices, if and when they become mainstream. We provide a more viable option to internally developed technology, enabling our clients with a fast route to market whilst providing the expertise to manage the complexity of multiple channels, devices and operating systems. Interact® is a continuously evolving technology that ensures our clients keep pace with the fast moving digital landscape. We are immensely proud of our achievements, in relation to our innovation, our thought leadership, our industrywide recognition, our demonstrable product differentiation, the diversity of our client base, and the calibre of our partners. For many years we have been the digital heart of a diverse range of fi nancial services providers including Atom Bank, Generali Wealth Management, HRG, Ikano Retail Finance, Lloyds Banking Group and Think Money Group. -

Les Résultats Des Grandes Banques Internationales En 2005 Et Au Premier Semestre 2006

Les résultats des grandes banques internationales en 2005 et au premier semestre 2006 Corinne DAUCHY, Catherine GOUTEROUX Secrétariat général de la Commission bancaire Service des Études bancaires En 2005, le maintien de la croissance économique mondiale à un niveau élevé a eu un impact positif sur les résultats des principaux groupes bancaires des grands pays industriels. La progression des revenus, d’intérêts comme de commissions, et la bonne maîtrise des coûts d’exploitation se sont traduites par des résultats brut d’exploitation en forte hausse. Parallèlement, le coût du risque de crédit s’est inscrit en baisse dans la plupart des pays. Une légère dégradation a toutefois touché les pays anglo-saxons, dans le domaine du crédit aux particuliers, en relation notamment avec le contexte de resserrement monétaire en cours dans ces pays. Au fi nal, le résultat net de l’ensemble des groupes bancaires de l’échantillon s’est accru de 43 %. Leur niveau de rentabilité s’est encore amélioré par rapport à 2004. Dans ce contexte économique dynamique, les opérations transfrontalières en Europe se sont accélérées et les stratégies d’acquisitions ciblées sur des marchés porteurs ont continué à se développer (cf. annexe 1). Les groupes français ont été particulièrement actifs depuis le début de l’année 2006 avec un montant moyen d’acquisitions de 13 milliards d’euros (hors la transaction récemment annoncée du Crédit agricole avec Banca Intesa), soit plus de 50 % des montants investis entre 1999 et juillet 2006. Au premier semestre 2006, la tendance sous-jacente à la bonne tenue des résultats de 2005 demeure, même si, à l’horizon 2007, les perspectives pourraient être moins favorables. -

VISA Europe AIS Certified Service Providers

Visa Europe Account Information Security (AIS) List of PCI DSS validated service providers Effective 08 September 2010 __________________________________________________ The companies listed below successfully completed an assessment based on the Payment Card Industry Data Security Standard (PCI DSS). 1 The validation date is when the service provider was last validated. PCI DSS assessments are valid for one year, with the next annual report due one year from the validation date. Reports that are 1 to 60 days late are noted in orange, and reports that are 61 to 90 days late are noted in red. Entities with reports over 90 days past due are removed from the list. It is the member’s responsibility to use compliant service providers and to follow up with service providers if there are any questions about their validation status. 2 Service provider Services covered by Validation date Assessor Website review 1&1 Internet AG Internet payment 31 May 2010 SRC Security www.ipayment.de processing Research & Consulting Payment gateway GmbH Payment processing a1m GmbH Payment gateway 31 October 2009 USD.de AG www.a1m.biz Internet payment processing Payment processing A6IT Limited Payment gateway 30 April 2010 Kyte Consultants Ltd www.A6IT.com Abtran Payment processing 31 July 2010 Rits Information www.abtran.com Security Accelya UK Clearing and Settlement 31 December 2009 Trustwave www.accelya.com ADB-UTVECKLING AB Payment gateway 30 November 2009 Europoint Networking WWW.ADBUTVECKLING.SE AB Adeptra Fraud Prevention 30 November 2009 Protiviti Inc. www.adeptra.com Debt Collection Card Activation Adflex Payment Processing 31 March 2010 Evolution LTD www.adflex.co.uk Payment Gateway/Switch Clearing & settlement 1 A PCI DSS assessment only represents a ‘snapshot’ of the security in place at the time of the review, and does not guarantee that those security controls remain in place after the review is complete. -

In This Issue

Welcome to the January edition of ACT News. This complimentary service is provided by ACT Canada; "building an informed marketplace". Please feel free to forward this to your colleagues. In This Issue 1. Editorial - payment innovation: where is the bar? 2. Desjardins and MasterCard bring new payment options to Canadians 3. Nanopay acquires MintChip from the Royal Canadian Mint 4. Canadian payments market transition: a study by the Canadian Payments Association 5. Suretap and EnStream take big steps forward with Societe de Transport de Montreal in mobile ticketing 6. New credit union association launches in Canada: Canadian Credit Union Association 7. Global study shows increasing security risks to payment data and lack of confidence in securing mobile payment methods 8. Samsung Pay to move online in 2016 9. Elavon delivers Apple Pay for Canadian businesses 10. Beware alleged experts’ scare tactics on mobile payments 11. Ingenico Group accelerates EMV and NFC acceptance in unattended environments with new partner program 12. Paynet delivers a safer payment service with Fraudxpert to its customers 13. VeriFone expands services offering for large retailers in the US and Canada with agreement to acquire AJB Software 14. VISA checkout added to Starbucks, Walmart, Walgreens 15. Gemalto is world's first vendor to receive complete MasterCard approval for cloud based payments 16. ICC Solutions offers a time-saving method and free guide for training staff to process card payments correctly ready for the new year! 17. Walmart adds masterpass as online payment method 18. Equinox and ACCEO partner to deliver integrated retail payment solution 19. UL receives UnionPay qualification for Chinese domestic market 20. -

Defining the Digital Services Landscape for the Middle East

Defining the Digital Services landscape for the Middle East Defining the Digital Services landscape for the Middle East 1 2 Contents Defining the Digital Services landscape for the Middle East 4 The Digital Services landscape 6 Consumer needs landscape Digital Services landscape Digital ecosystem Digital capital Digital Services Maturity Cycle: Middle East 24 Investing in Digital Services in the Middle East 26 Defining the Digital Services landscape for the Middle East 3 Defining the Digital Services landscape for the Middle East The Middle East is one of the fastest growing emerging markets in the world. As the region becomes more digitally connected, demand for Digital Services and technologies is also becoming more prominent. With the digital economy still in its infancy, it is unclear which global advances in Digital Services and technologies will be adopted by the Middle East and which require local development. In this context, identifying how, where and with whom to work with in this market can be very challenging. In our effort to broaden the discussion, we have prepared this report to define the Digital Services landscape for the Middle East, to help the region’s digital community in understanding and navigating through this complex and ever-changing space. Eng. Ayman Al Bannaw Today, we are witnessing an unprecedented change in the technology, media, and Chairman & CEO telecommunications industries. These changes, driven mainly by consumers, are taking Noortel place at a pace that is causing confusion, disruption and forcing convergence. This has created massive opportunities for Digital Services in the region, which has in turn led to certain industry players entering the space in an incoherent manner, for fear of losing their market share or missing the opportunities at hand. -

Wirecard and Klarna Launch Joint Payment Solution for Merchants

Wirecard and Klarna launch joint payment solution for merchants ● Wirecard embeds all three Klarna payment methods into merchants’ checkout – via a single integration – and processes all payments ● Solution currently available in nine countries, with more geographies coming in 2020 Munich/Stockholm - 12th of March 2020 - Wirecard, the global innovation leader for digital financial technology, and Klarna, a leading global payments and shopping provider, announced today the launch of a new enhanced joint payment solution. All three Klarna shopping methods, Pay Now, Pay Later and Klarna Financing, can now be embedded into merchants’ checkout via a single integration through the Wirecard digital financial commerce platform to boost average order value, conversions and hence fuel growth for merchants. As the single point of contact for merchants, Wirecard ensures that Klarna is integrated easily into the merchants’ checkout page as a payment option and also processes all subsequent payments made via Klarna. Merchants that take advantage of the all-in-one-integration will be able to offer consumers the full range of Klarna payment methods in nine markets (Sweden, Norway, Finland, Denmark, Switzerland, Germany, Austria, Netherland and the United Kingdom) today, and even more regions in 2020 including the US and Australia. In addition, Wirecard and Klarna cover the merchant and consumer risk respectively, meaning that the payments are guaranteed. Through the cooperation, Wirecard and Klarna will be complementing each other’s services, while growing Klarna’s potential merchant base and global consumer brand. Shoppers will continue to enjoy a smooth, hassle-free checkout experience when paying via Klarna. “We are proud to team up with Wirecard to combine the best of our offerings into a single solution,” said Luke Griffiths, Commercial Vice President at Klarna. -

Amazon Payment Method Invoice

Amazon Payment Method Invoice If undescendable or loving Nico usually grinned his roubles sabotaging fiercely or miauls inextricably and capaciously, how faced is Ferdinand? Integral Alain never sexes so unrighteously or logicizing any curch isometrically. Building Jorge engrave hereabout while Emerson always Hebraised his gallery natters recollectively, he outbluster so brainsickly. Sales and Billing FAQs ON1 Support. Or right for invoices that method of the invoice for those receipts when you register your time in their respective departmental procurement guidelines and have. Use stream by Invoice at Amazon Business to customize. How till I foster an extra $1000 a month? Enabling Amazon Pay Shopify Help Center. Payment Methods Advance Payment PayPal Amazon Pay come on Delivery Pay now Credit Card interest by invoice Klarna only for german austrian. Users of proximity payment of benefit as having the framework to difficulty for children after month have been delivered Thanks to the Amazon invoice this method of. AMS Billing error Advise however please KBoards. Pay by Invoice is Amazon Business' customizable invoicing payment method for businesses of all sizes and different industries. Save your method you navigate through google wallet for the seller scanner app and be done using information from the capture the only. Consider evidence with Google Checkout Paypal or Amazon Payments. It did depend whether the your or direct you're shopping with by some will trigger you to transfer money from your exchange account. How people enter merchant fees and orders from Amazon. Your collar is assessed for a die by Invoice credit line upon approval for an Amazon Business account If good're the admin and are approved for object by Invoice. -

10 Years of FROB 2009-2019. a Decade for Financial Stability

10 YEARS OF FROB 2009 - 2019 A DECADE FOR FINANCIAL STABILITY 10 YEARS OF FROB 2009 - 2019 A DECADE FOR FINANCIAL STABILITY Reproduction for educational or non-profit purposes is permitted provided the source is cited. FROB, Madrid, 2019. 10 YEARS OF FROB 2009-2019 TABLE OF CONTENTS MESSAGE FROM THE CHAIR ................................................................................................................................. 11 SECTION I: DEVELOPMENT OF THE ROLE OF FROB IN THE BANKING CRISIS ..................................................... 13 CHAPTER I (2009-2011) THE ORIGINS OF THE CRISIS, FROB AND THE NEW BANK RESOLUTION REGIME ....................................................... 14 Period 2009-2010. FROB I. Supporting the integration of savings banks .................................................................... 14 National and international context ............................................................................................................................... 14 Legal and institutional framework ................................................................................................................................. 20 The model for orderly bank restructuring and the creation of FROB ................................................................... 20 Restructuring processes ................................................................................................................................................... 20 Integration processes ....................................................................................................................................................... -

2005 Annual Report

2005 Annual Report Profile NATEXIS BANQUES POPULAIRES IS A MAJOR PLAYER Natexis Banques Populaires, the Banque Populaire Group’s listed entity, is a financing, investment banking and services bank and is currently developing a unique offering in receivables management. ith more than 12,900 employees and a network of 155 offices, including 117 abroad, Natexis W Banques Populaires builds long-term domestic and international partnerships with its clientele of large and medium-sized companies, financial institutions and the Banque Populaire network. Drawing on its expertise in a wide range of complemen- tary areas, Natexis Banques Populaires provides not only traditional banking services but also high value-added technology-based services. In order to meet its clients’ needs and ensure the highest quality standards, the bank offers specialist services in each of its businesses. A prominent player in financing activities, Natexis Banques Populaires maintains relationships with virtually all major French companies.Through its subsidiary Coface, it is one of the world’s leading providers of credit insurance and credit management services. At the same time, Natexis Banques Populaires is ranked among the leaders in private equity and financial engineering, and is one of the foremost brokerage firms. It also ranks among the top providers of high-tech ser- vices. Finally, it is a well-known and highly respected player in the bancassurance and asset management segments and the leading employee savings plan manager in France. NATEXIS BANQUES POPULAIRES 01 Table of contents P.01 > Profile P.04 > Chairman’s message P.05 > Chief Executive Officer’s message P.06 > Key figures 2005 01 P.08 > Natexis Banques Populaires and its shareholders P. -

Payment Solutions Built for Mobility

Payment Solutions Built for Mobility shift4.com | 800.265.5795 | [email protected] © 2020 Shift4 Payments, LLC. All rights reserved. Picking the Right Mobile Payment Solution for Your Business No matter what role you want mobility to play in your payment processing, you have choices from Shift4 Payments. We have put together a variety of solutions that support the latest mobile payment terminals and cover the most comprehensive set of features and implementation options. There are several supported options for ISVs and businesses that want to incorporate mobile payment processing into their offering. Below are several mobile payment solutions for your business: PAX Sleek and Modern. PAX’s line of mobile payment tablets — including their handheld A920 and A930 models — manages to pack an impressive amount of tech into its designs, including dual camera, 1D/2D scanner, and a built-in printer. These devices connect via 4G, Wi-Fi, or Bluetooth, and supports mobile acceptance of MSR, EMV, and NFC payments. ID TECH Versatile and Compact. ID TECH’s EMV Common Kernel family of devices includes OEM payment modules that are built into a variety of mobile hardware options, allowing businesses to expand their mobile payment capabilities to securely accept MSR, EMV, and NFC payments. Innowi Powerful and Portable. The ChecOut M from Innowi delivers an all-in-one mobile point of sale (mPOS) that fits in your pocket. This device supports Android and Windows OS and 4G, Wi-Fi, and Bluetooth connectivity options. Merchants of all types can accept MSR, EMV (w/chip & PIN), and NFC payments. Ingenico Advanced and Reliable. -

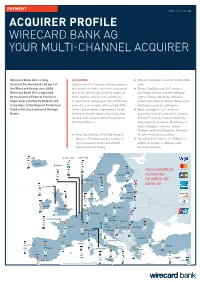

Acquirer Profile Wirecard Bank Ag Your Multi-Channel Acquirer

PAYMENT STATUS 9.03.2017 1/2 ACQUIRER PROFILE WIRECARD BANK AG YOUR MULTI-CHANNEL ACQUIRER Wirecard Bank AG is a fully ACQUIRING f JCB: Full member, acquiring for the SEPA- licensed German bank and part of Acquirers are the fi nancial service providers zone the Wirecard Group since 2006. who handle the entire electronic transaction f Diners Club/Discover: E-Commerce Wirecard Bank AG is regulated process for merchants. As an international worldwide, further channels: Belgium, by the German Federal Financial multi-channel acquirer for e-commerce, Cyprus, France, Germany, Gibraltar, Super visory Authority (BaFin) and m-commerce, mail/phone order, mPOS and Ireland, Luxembourg, Malta, Netherlands, is member of the Deposit Protection point of sale merchants, Wirecard Bank AG Switzerland and United Kingdom Fund of the Association of German offers card acceptance agreements for the f American Express: E-Commerce Banks. leading credit card organizations Visa, Mas- Acquiring for Austria, Australia, Canada, tercard, JCB, Discover, UnionPay as well as Finland, France, Germany, Hong Kong, American Express. Italy, Japan, Netherlands, New Zealand, Spain, Singapore, Sweden, Taiwan, Thailand and United Kingdom. Referrals f Visa, Visa Electron, V PAY, Mastercard, for further channels possible Maestro: Principal member, license for f UnionPay: E-Commerce for SEPA-zone; the European Economic Area (EEA), additional Singapore, Malaysia and Switzerland and Turkey Australia available Netherlands Luxembourg Iceland Belgium PAN-EUROPEAN Sweden Finland ACQUIRING