Taiwan Futures Exchange Principles for Financial Market Infrastructure Disclosure Report (CCP)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

For Additional Information the Information on the Attached Approvals Chart Is Subject to Change at Any Time

April 15, 2020 Attached please find the updated Foreign Listed Stock Index Futures and Options Approvals Chart, current as of April 15, 2020. All prior versions are superseded and should be discarded. Please note the following developments since we last distributed the Approvals Chart: 1. B3 S.A. has certified the Nikkei 225 index futures contract for trading by U.S. persons. 2. Eurex Exchange has certified the following futures contracts for trading by U.S. persons: (i) MSCI Europe ex UK (EUR, NTR) index futures; (ii) MSCI Japan (JPY, NTR) index futures; (iii) MSCI Saudi Arabia (USD, NTR) index futures; (iv) MSCI South Africa (USD, NTR) index futures; (v) MSCI World (GBP, NTR) index futures; (vi) MSCI World Communication Services (USD, NTR) index futures; (vii) MSCI World Consumer Discretionary (USD, NTR) index futures; (viii) MSCI World Consumer Staples (USD, NTR) index futures; (ix) MSCI World Energy (USD, NTR) index futures; (x) MSCI World Financials (USD, NTR) index futures; (xi) MSCI World Health Care (USD, NTR) index futures; (xii) MSCI World Industrials (USD, NTR) index futures; (xiii) MSCI World IT (USD, NTR) index futures; (xiv) MSCI World Materials (USD, NTR) index futures; (xv) MSCI World Real Estate (USD, NTR) index futures; (xvi) MSCI World Utilities (USD, NTR) index futures; and (xvii) STOXX USA 500 ESG-X (USD, price) index futures. 3. Korea Exchange has notified market participants that, as of April 1, 2020, the KOSPI 200 index is deemed a narrow-based security index, and as such, futures on the KOSPI 200 index are now available for trading by U.S. -

Incoming Letter: Taipei Exchange Main Board and Taipei Exchange

New York Paris Northern California Madrid Washington DC Tokyo São Paulo Beijing London Hong Kong James C. Lin Partner Resident Hong Kong Partners Davis Polk & Wardwell 852 2533 3368 tel William F. Barron* Gerhard Radtke* Hong Kong Solicitors 852 2533 1768 fax Bonnie Chan* Martin Rogers † The Hong Kong Club Building [email protected] Karen Chan † Patrick S. Sinclair* 3A Chater Road Paul K. Y. Chow* † Miranda So* Hong Kong James C. Lin* James Wadham † Hong Kong Solicitors * Also Admitted in New York † Also Admitted in England and Wales August 29, 2019 Re: Application for Designation of the Taipei Exchange Main Board and Taipei Exchange Bond Market as a “Designated Offshore Securities Market” Michael Coco, Chief Office of International Corporate Finance Division of Corporation Finance United States Securities and Exchange Commission 450 Fifth Street. N.W. Washington, DC 20549 Dear Mr. Coco: We are writing to the United States Securities and Exchange Commission (the “SEC” or the “Commission”) on behalf of the Taipei Exchange (the “TPEx”) to apply for the classification of a “designated offshore securities market” for purposes of Regulation S (“Regulation S”) under the U.S. Securities Act of 1933, as amended, for (i) the portion of the TPEx known as the Taipei Exchange Main Board (the “TPEx Main Board”) and (ii) the portion of the TPEx known as the Taipei Exchange Bond Market (the “TPEx Bond Market” and together with the TPEx Main Board, the “TPEx Platforms”). Designation is being sought in order to assist market participants to the TPEx Platforms who are eligible for the safe harbor provision provided by Rule 904 of Regulation S to satisfy the requirements specified in that rule when reselling securities “in, on or through the facilities of” the TPEx Platforms. -

Futures Industry Template

China took a big step in the development of both its financial and risk management markets when it officially inaugurated, on Sept. 8, the China Financial Futures Exchange in Shanghai. This exchange will extend into the financial sphere an industry that’s already thriving in commodities. Since the 1990s, the Dalian Commodity Exchange, the Shanghai Futures Exchange, and the Zhengzhou Commodity Exchange have been trading a healthy slate of commodity futures, such as copper and fuel oil at the SFE, soybeans and corn at the DCE, and sugar and wheat at the The Dawning ZCE. Volume should top 200 million contracts this of Financial year, an impressive increase from 27 million in 2000. Some 183 firms provide brokerage and Futures In support services. China To be sure, the launch of the new exchange was a bit of an anti-climax, since it was accompanied By Nick Ronalds by no product launch or even an announcement and Wang Xue Qin of a launch date. Still, the official establishment of a financial futures exchange was a clear sign that financial futures will not be long in coming. And though we did not have a launch date as of late October, when this article was written, much about the new exchange is taking shape. 54 Futures Industry Ownership Structure that cannot afford full clearing member- ship. TCMs may not clear for non-clearing The competition among existing futures Exchange rules are still under discussion, brokers. Minimum capital: RMB 50 mil- and securities exchanges for the right to so the information available is somewhat lion. -

The Price Discovery and Price Leadership of Foreign Investors: Evidence from Taiwan Futures Markets

The price discovery and price leadership of foreign investors: Evidence from Taiwan futures markets Wei-Kuang Chen Professor, Department of Money and Banking, National Chengchi University Ching-Ting Lin* Assistant professor, Department of Money and Banking, National Chengchi University Cheng-Yi Shiu Professor, Department of Finance, National Central University Abstract Using a unique dataset composed of comprehensive transaction data from Taiwan futures markets, we classify all investors into individuals, domestic institutions, and foreigners, and examine the price discovery and price leadership for these three groups. We find that, despite the relatively low trading volume of futures contracts by foreigners, such trades make a significant contribution to price discovery. Moreover, intraday analysis shows that foreigners’ correlated trades can positively predict concurrent and future price movements of futures contracts. The empirical result indicates that foreigners have an information advantage in Taiwan futures markets. In contrast to foreigners, individuals make the least contribution to price discovery and their correlated trades negatively predict the following price movements, suggesting that individuals have an information disadvantage. Keywords: Price discovery; Price leadership; Herding; Foreigners; Information role *Corresponding author. Department of Money and Banking, College of Commerce, National Chengchi University, Taipei, Taiwan, R.O.C., Tel: +886-2-29393091 ext. 81248, Email: [email protected]. 1 1. Introduction Literature on the informational role of foreign investors expresses diverse views. One tranche of literature asserts that domestic investors are more knowledgeable than foreign investors about the local environment or domestic firms. For example, Choe, Kho, and Stulz (2005) analyze all trades in the Korean stock market and find that domestic investors are better able to select winners than foreigners. -

DCE and Palm Oil Futures Contract

DCE and Palm Oil Futures Contract December 2020 Building a Diversified, Open and World-class Derivatives Exchange 1 智舒 CONTENTS 01 Introduction to DCE 02 RBD Palm Olein Futures 03 RBD Palm Olein Delivery 2 Diverse Product Suite 智舒 Futures + Options No.1 Soybean 20 7 Corn LLDPE PVC Soybean Meal FUTURES OPTIONS No.2 Soybean RBD Palm Coking Coke Soybean Oil Olein Coal Fiber Block Polypropy Egg Iron Ore 1 43 board board lene OTC MARKET INDICES Corn Ethylene Ethenyl Rice LPG Starch Glycol benzene 3 Opening-up 智舒 May 4th, 2018 4 Trading Facts 智舒 DCE's Trading Volume and Turnover by Year 1,800 80,000 s 1,600 t 70,000 c Trading Volume Turnover a B r t 1,400 M n 60,000 R o c n o n 1,200 i l o l i 50,000 i l l b i 1,000 , m e , 40,000 u l e 800 a m V u l l 30,000 a o 600 n V o i g t n 20,000 o i 400 d N a r T 200 10,000 - - 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 19 19 19 19 19 19 19 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 2019 ANNUAL TRADING VOLUME ANNUAL TURNOVER AVERAGE DAILY OPEN INTEREST AVERAGE DAILY TRADING VOLUME 1,355 69 6.72 5.56 million contracts trillion CNY million contracts million contracts • Source: Dalian Commodity Exchange 5 World Top Derivatives Exchanges 智舒 2019 Top 20 Derivatives Exchanges Worldwide World Derivatives Exchanges Ranking Rank Exchange Jan – Dec 2019 Vol Jan – Dec 2018 Vol 1 National Stock Exchange of India 5,960,653,879 3,790,090,142 th th th th 12 10 8 8 2 CME Group 4,830,045,369 4,844,857,131 3 B3 3,880,624,283 2,574,073,178 4 Intercontinental Exchange -

Cash Equity Market Cash Equity Market

Cash Equity Market Cash Equity Market Domestic Market Capitalization Value of share trading Number of trades New listings Investment flows Number of listed companies Cash Equity Market % change Q1 2015 Q2 2015 Q3 2015 Q4 2015 2015 2014 to 2015 Domestic Market Capitalization 72 548 800 74 498 795 65 392 815 66 960 858 66 960 858 -1.3% (USD million) Americas 30 335 850 30 236 210 28 058 649 27 943 103 27 943 103 -7.7% Asia Pacific 25 359 012 27 368 840 21 925 007 23 141 192 23 141 192 9.8% EMEA 16 853 938 16 893 746 15 409 159 15 876 563 15 876 563 -3.6% Value of Share Trading 25 160 866 34 098 939 28 561 774 25 897 938 113 719 334 40.6% (USD million) Americas 11 703 385 10 829 829 12 232 090 11 298 256 46 063 560 5.6% Asia Pacific 9 714 428 19 645 172 12 876 712 11 478 610 53 714 739 126.9% EMEA 3 743 053 3 623 937 3 452 973 3 121 072 13 941 035 2.6% Number of trades 4 882 6 633 6 355 5 903 23 772 54.9% (million of trades) Americas 1 569 1 436 1 748 1 711 6 464 10.7% Asia Pacific 2 847 4 761 4 158 3 745 15 510 93.8% EMEA 466 436 450 447 1 798 19.0% Number of listed companies 48 842 49 164 49 324 49 830 49 830 2.7% (full number) Americas 10 273 10 271 10 271 10 203 10 203 -1.3% Asia Pacific 24 640 24 911 25 084 25 401 25 401 4.0% EMEA 13 929 13 982 13 969 14 226 14 226 3.5% Source : WFE % change Q1 2015 Q2 2015 Q3 2015 Q4 2015 2015 2014 to 2015 Number of newly listed comp. -

Exchange Fee Pricing

3/10/2018 eSignal | Exchange Fee Pricing EXCHANGE PRICING CHAT SUBSCRIBERS EXCHANGE FEE PRICING EXCHANGE FEE (US$ / MONTH) (* CLICK TO SEE INFORMATION ON MULTI-UNIT EXCHANGE U.S. STOCKS, OPTIONS AND INDICES FEE PRICING.) Non-Pro Pro NYSE and NYSE Indices 10 50 * NYSE American LLC (fka NYSE MKT LLC) 10 24 (Includes Bid / Ask) NASDAQ Level I and Indices 10 30 OTC Markets Level I (formerly Pink Sheets) 10 40 (You must subscribe to NASDAQ Level I rst.) Options: OPRA and OPRA Indices 10 30.50 OPRA Indices Only 8 28.50 S & P Cash Indices (CME) 10 10 S & P Cash Indices (CME) -- Delayed 4 4 Market Data Indices (CBOE) 10 10 Dow Jones Indices 2 2 North American Index Package (NANX) (includes NYSE, American LLC 12 12 [fka NYSE MKT LLC] and NASDAQ) NYSE Global Index Feed (GIF) 5 17 Russell Indices 7 2 MSCI EOD Indices 2 2 Bloomberg UBS Commodity Indices 2 2 MARKET DEPTH (Requires a monthly surcharge of $25 per month [$32 for LiveCharts] for monthly and annual prepay subscriptions in addition to exchange fees for one or all Market Depth services.) Non-Pro Pro CBOT Level II ** *** 0 0 (You must subscribe to CBOT Level I rst.) https://www.esignal.com/exchange-fee-pricing 1/13 3/10/2018 eSignal | Exchange Fee Pricing EXCHANGE FEE (US$ / MONTH) (* CLICK TO SEE INFORMATION ON MULTI-UNIT EXCHANGE U.S. STOCKS, OPTIONS AND INDICES FEE PRICING.) CME Globex Level II ** *** 0 0 (You must subscribe to CME Level I. Depth not included in CME Fee Waiver service.) COMEX Level II New! 0 0 (You must subscribe to COMEX Level 1 rst.) Forex Depth ** *** 0 0 (You must subscribe to GTIS FOREX rst.) NASDAQ Level II ** 15 76 (You must subscribe to NASDAQ Level I rst.) NASDAQ TotalView (includes Level II, Single Book and Island) ** 18 76 (You must subscribe to NASDAQ Level I rst.) NYMEX Level II New! 0 0 (You must subscribe to NYMEX Level 1 rst.) NYSE ArcaBook ** *** 12 40 NYSE Open Book ** *** 15 60 OTC Markets Level II (formerly Pink Sheets)** *** 17 77 (You must subscribe to OTC Markets [formerly Pink Sheets] Level I rst.) Regional Options ** *** 0 30 (You must subscribe to OPRA rst.) U.S. -

List of Execution Venues Made Available by Societe Generale

List of Execution Venues made available by Societe Generale January 2018 Note that this list of Execution Venues is not exhaustive and will be kept under review and updated in accordance with Societe Generale’s execution practices. Societe Generale reserves the right to use other Execution Venues in addition to those listed below where it deems it appropriate in accordance with execution practices. Where Societe Generale acts as the Execution Venue, it will consider all sources of reasonably available information to obtain the best possible outcome. Fixed Income . The main Execution Venue is Societe Generale SA (and its affiliates) . When the trading obligation for derivatives applies, execution will take place on MiFID trading venues (Regulated Markets, or MTF or OTF or all equivalent venues as SEF) Alternative Venues include: BGC Bloomberg Bloomberg FIET Brokertec GFI Marketaxess MTP MTS TP ICAP Tradeweb Tradition Forex . The main Execution Venue is Societe Generale SA (and its affiliates) Alternative Venues include: 360T Alpha BGC Bloomberg Currenex EBS Equilend FX Connect FX Spotstream FXall Hotpspot ICAP Integral FX inside Reuters Tradertools Cash Equities Abu Dhabi Securities Exchange EDGEA Exchange NYSE Amex Alpha EDGEX Exchange NYSE Arca AlphaY EDGX NYSE Stock Exchange Aquis Equilend Omega ARCA Stocks Euronext Amsterdam OMX Copenhagen ASX Centre Point Euronext Block OMX Helsinki Athens Stock Exchange Euronext Brussels OMX Stockholm ATHEX Euronext Cash Amsterdam OneChicago Australia Securities Exchange Euronext Cash Brussels Oslo -

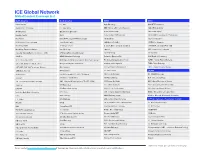

ICE Global Network Global Content Coverage List

ICE Global Network Global Content Coverage List North America North America EMEA APAC Activ Financial ICE TMC Aquis Exchange ASX (NTP Derivatives) Aequitas NEO Exchange ICE Swap Trade BME - Bolsas y Mercados Españoles CXA (CHI-X Australia) ATG Americas IEX (Investors Exchange) Borsa Italiana Group CXJ (CHI-X Japan) Barclays Capital IIROC Börse Stuttgart (SID platform) HKEX (OMD C Securities & D Derivatives) BGC Fenics Itiviti (NYFIX, ULLink PTRMS (Canada)) CBOE Europe ICE Clear Singapore BOX (Boston Stock Exchange) Jane Street Capital CME (BrokerTech EU) ICE Futures Singapore Broadridge (ADP) JP Morgan Chase Deutsche Börse Group (Xetra, Eurex) JPX (TSE Flex Standard/Full, OSE) Broadridge Financial Solutions Lime Brokerage Equiduct KRX - Korea Stock Exchange Canadian Imperial Bank of Commerce - CIBC LTSE (Long Term Stock Exchange) Euronext Group SBI Japanext CBOE US MEMX (Members Exchange) Fastmatch (Euronext FX) SGX (Equities, Derivatives) CBOE FX (Hotspot NY4) MIAX Options, MIAX Pearl Options, Miax Pearl Equities FIS Global (Sungard London-Paris) TAIFEX – Taiwan Futures Exchange CME (CME, NYMEX, COMEX, CBOT) Morgan Stanley Unicast Services Goldman Sachs Sigma-X TPEX – Taipei Exchange CME (BME, DME, MGEX, Indexes, Bitcoin) MSCI Indexes ICE Benchmark Administration TWSE - Taiwan Stock Exchange CME (BrokerTec US) MT Newswires ICE Clear Europe LATAM Credit Suisse NASDAQ Canada (CXC, CX2, CXD, Basic) ICE Clear Netherlands B3 - BM&F & Bovespa Creditex NASDAQ US (All Markets) ICE Futures Europe BCS - Bolsa de Santiago CSE - Canadian Securities -

Doing Data Differently

General Company Overview Doing data differently V.14.9. Company Overview Helping the global financial community make informed decisions through the provision of fast, accurate, timely and affordable reference data services With more than 20 years of experience, we offer comprehensive and complete securities reference and pricing data for equities, fixed income and derivative instruments around the globe. Our customers can rely on our successful track record to efficiently deliver high quality data sets including: § Worldwide Corporate Actions § Worldwide Fixed Income § Security Reference File § Worldwide End-of-Day Prices Exchange Data International has recently expanded its data coverage to include economic data. Currently it has three products: § African Economic Data www.africadata.com § Economic Indicator Service (EIS) § Global Economic Data Our professional sales, support and data/research teams deliver the lowest cost of ownership whilst at the same time being the most responsive to client requests. As a result of our on-going commitment to providing cost effective and innovative data solutions, whilst at the same time ensuring the highest standards, we have been awarded the internationally recognized symbol of quality ISO 9001. Headquartered in United Kingdom, we have staff in Canada, India, Morocco, South Africa and United States. www.exchange-data.com 2 Company Overview Contents Reference Data ............................................................................................................................................ -

If You Are in Any Doubt About the Contents of This

If you are in any doubt about the contents of this Prospectus, the risks involved in investing in the Company or the suitability for you of investment in the Company, you should consult your stock broker, bank manager, solicitor, accountant or other independent financial adviser. Prices of shares in the Company’s Sub-Funds may fall as well as rise. ___________________________ MORI UMBRELLA FUND PLC (An open-ended umbrella investment company with variable capital incorporated with limited liability in Ireland under the Companies Act 2014 with registration number 282792 and established as an undertaking for collective investment in transferable securities pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations, 2011, as amended and with segregated liability between Sub-Funds. ___________________________ Mori Eastern European Fund Mori Ottoman Fund Investment Manager MORI CAPITAL MANAGEMENT LIMITED Dated 22 December 2020 PRELIMINARY THIS PROSPECTUS MAY BE ISSUED WITH ONE OR MORE SUPPLEMENTS EACH CONTAINING SPECIFIC INFORMATION RELATING TO A PARTICULAR SUB-FUND. THIS PROSPECTUS AND ANY RELEVANT SUPPLEMENT SHOULD BE READ AND CONSTRUED AS ONE DOCUMENT. TO THE EXTENT THAT THERE IS ANY INCONSISTENCY BETWEEN THIS PROSPECTUS AND ANY SUPPLEMENT, THE RELEVANT SUPPLEMENT SHALL PREVAIL. This Prospectus does not constitute, and may not be used for the purposes of, an offer or solicitation to anyone in any jurisdiction in which such offer or solicitation is not authorised, or to any person to whom it is unlawful to make such offer or solicitation. The distribution of this Prospectus and the offering of Shares in certain jurisdictions may be restricted and, accordingly, persons into whose possession this Prospectus comes are required to inform themselves about, and to observe, such restrictions. -

Bofa List of Execution Venues

This List of Execution Venues and the associated Bank of America EMEA Order Execution Policy Summary form part of the General Terms & Conditions of Business available on the Bank of America MifID II Website www.bofaml.com/mifid2 The tables below set out the execution venues accessed by entities in the Bank of America Entities List and Associated Companies. These tables are not exhaustive and we may amend them from time to time in accordance with our policies. MLI and BofASE may also use other execution venues from time to time where they deem appropriate but in accordance with their policies (including the Bank of America Order Execution Policy). Asset class Region Regulated Markets of which MLI / BofASE is a direct member and MTFs accessed by MLI / BofASE Equities EMEA Aquis UK Equities EMEA Athex Group Equities EMEA Bloomberg BV Equities EMEA Bloomberg UK Equities EMEA Borsa Italiana Equities EMEA Cboe BV Equities EMEA Cboe UK Equities EMEA Deutsche Borse Xetra Equities EMEA Equiduct Equities EMEA Euronext Amsterdam Equities EMEA Euronext Brussels Equities EMEA Euronext Dublin Equities EMEA Euronext Lisbon Equities EMEA Euronext Oslo Equities EMEA Euronext Paris Equities EMEA ITG Posit Equities EMEA Liquidnet Equities EMEA Liquidnet Europe Equities EMEA London Stock Exchange 1 – ©2020 Bank of America Corporation Asset class Region Regulated Markets of which MLI / BofASE is a direct member and MTFs accessed by MLI / BofASE Equities EMEA NASDAQ OMX Nordic – Helsinki Equities EMEA NASDAQ OMX Nordic – Stockholm Equities EMEA NASDAQ OMX