Budgeting in France

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download the Classification Decision for the Great

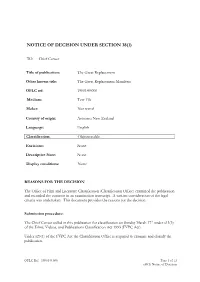

NOTICE OF DECISION UNDER SECTION 38(1) TO: Chief Censor Title of publication: The Great Replacement Other known title: The Great Replacement Manifesto OFLC ref: 1900149.000 Medium: Text File Maker: Not stated Country of origin: Aotearoa New Zealand Language: English Classification: Objectionable. Excisions: None Descriptive Note: None Display conditions: None REASONS FOR THE DECISION The Office of Film and Literature Classification (Classification Office) examined the publication and recorded the contents in an examination transcript. A written consideration of the legal criteria was undertaken. This document provides the reasons for the decision. Submission procedure: The Chief Censor called in this publication for classification on Sunday March 17th under s13(3) of the Films, Videos, and Publications Classification Act 1993 (FVPC Act). Under s23(1) of the FVPC Act the Classification Office is required to examine and classify the publication. OFLC Ref: 1900149.000 Page 1 of 13 s38(1) Notice of Decision Under s23(2) of the FVPC Act the Classification Office must determine whether the publication is to be classified as unrestricted, objectionable, or objectionable except in particular circumstances. Section 23(3) permits the Classification Office to restrict a publication that would otherwise be classified as objectionable so that it can be made available to particular persons or classes of persons for educational, professional, scientific, literary, artistic, or technical purposes. Synopsis of written submission(s): No submissions were required or sought in relation to the classification of the text. Submissions are not required in cases where the Chief Censor has exercised his authority to call in a publication for examination under section 13(3) of the FVPC Act. -

The Principles of Budgetary Governance Public Governance

@OECDgov PUBLIC GOVERNANCE AND TERRITORIAL DEVELOPMENT OECD, Paris www.oecd.org/gov DRAFT RECOMMENDATION OF THE OECD COUNCIL ON THE PRINCIPLES OF OECD Paris BUDGETARY GOVERNANCE 2, rue André-Pascal, 75775 Paris Cedex 16 Tel.: +33 (0) 1 45 24 82 00 OECD PRINCIPLES OF BUDGETARY GOVERNANCE OECD Senior Budget Officials July 2014 Introductory note The objective of these Principles is to draw together the lessons of a decade and more of work by the OECD Working Party of Senior Budget Officials (SBO) and its associated Networks, along with the contributions and insights from other areas of the OECD and of the international budgeting community more generally. The Principles provide a concise overview of good practices across the full spectrum of budget activity, taking account in particular of the lessons of the recent economic crisis, and aim to give practical guidance for designing, implementing and improving budget systems to meet the challenges of the future. The overall intention is to provide a useful reference tool for policy-makers and practitioners around the world, and help ensure that public resources are planned, managed and used effectively to make a positive impact on citizens’ lives. For further information, please visit: http://www.oecd.org/governance/budgeting/ OECD PRINCIPLES OF BUDGETARY GOVERNANCE Introduction: The fundamental national role of the budget and the budgeting process The budget is a central policy document of government, showing how it will prioritise and achieve its annual and multi-annual objectives. Apart from financing new and existing programmes, the budget is the primary instrument for implementing fiscal policy, and thereby influencing the economy as a whole. -

FY2022 Proposed Budget Fiscal Policy and Position Control

FY2022 Annual Budget Fiscal and Budgetary Policy Adopted: September 28, 2021 I. PURPOSE The City of Georgetown is committed to financial management through integrity, prudent stewardship, planning, accountability, transparency and communication. The broad purpose of the Fiscal and Budgetary Policies is to enable the City and its related component units, including the Georgetown Transportation Enhancement Corporation (GTEC) and the Georgetown Economic Development Corporation (GEDCO), to achieve and maintain a long-term stable and positive financial condition, and provide guidelines for the day-to-day planning and operations of the City’s financial affairs. Policy scope generally spans areas of accounting, operational and capital budgeting, revenue and expenditure management, financial reporting, internal controls, investment and asset management, debt management and forecasting. This is done in order to: A. Demonstrate to the residents of Georgetown, the investment community, and the bond rating agencies that the City is committed to a strong fiscal operation; B. Provide precedents for future policy-makers and financial managers on common financial goals and strategies; C. Fairly present and fully disclose the financial position of the City in conformity to generally accepted accounting principles (GAAP); and D. Demonstrate compliance with finance-related legal and contractual issues in accordance with the Texas Local Government Code and other legal mandates. These policies will be reviewed and updated annually as part of the budget preparation process. II. FUND STRUCTURE AND BASIS OF BUDGETING The budgeted funds for the City of Georgetown include: Governmental Funds: General Fund which accounts for all financial resources except those required to be accounted for in another fund, and include basic governmental services, such as Street Maintenance, Planning and Development, Police, Fire, Parks, as well as Solid Waste Management. -

CALENDAR of ARTICLES by EFFECTIVE DATES As of March 27, 2019

CALENDAR OF ARTICLES by EFFECTIVE DATES As of March 27, 2019 Introduction This document organizes MLN Matters® Article by effective date with descriptive information. The calendar represents 12 months (rolling months) of articles that have been posted. It can be used to review upcoming Medicare changes. Since many of the articles are posted and Change Requests (CRs) released months before the effective dates, the calendar can serve as a reminder of pending Medicare changes. Tips on Using the Calendar Review the calendar for upcoming Medicare changes to anticipate where errors may be introduced due to billing changes. Review the calendar for upcoming Medicare changes to assist in anticipating where complex changes may increase the number of calls to Call Centers. This could be due to effective dates of complicated regulation changes that are scheduled. Review the calendar to ensure staff and provider partners (if appropriate) are prepared for the upcoming change (for example, ICD-10). The calendar is updated weekly to reflect the posted MLN articles and CRs. March 2018 CALENDAR OF MEDICARE PROCESSING and BILLING CHANGES Effective Date Article Article Title Providers Affected Description Number 3/16/2018 MM10878 National Coverage Physicians, providers, Informs, effective 3/16/2018, Determination and suppliers billing CMS covers diagnostic (NCD90.2): Next MACs for services laboratory tests using next Generation provided to Medicare generation sequencing when Sequencing (NGS) beneficiaries performed in a CLIA-certified laboratory when -

An SVAR Analysis of Stabilization Policies in Monetary Union

EUROPEAN UNIVERSITY INSTITUTE DEPARTMENT OF ECONOMICS EUI Working Paper ECO No. 2004 /22 Monetary and Budgetary Policy Interaction: An SVAR Analysis of Stabilization Policies in Monetary Union PETER CLAEYS BADIA FIESOLANA, SAN DOMENICO (FI) All rights reserved. No part of this paper may be reproduced in any form Without permission of the author(s). ©2004 Peter Claeys Published in Italy in June 2004 European University Institute Badia Fiesolana I-50016 San Domenico (FI) Italy Monetary and budgetary policy interaction: an SVAR analysis of stabilisation policies in monetary union Peter Claeys∗ European University Institute† Janurary 31st , 2 004 Abstract This paper examines the interaction between monetary and budgetary policy. A comparison of the dynamic responses in different exchange rate regimes offers an assessment of the monetary union case. The analysis proceeds on an SVAR-common trends model. In its current specifica- tion, we can only infer responses to the budgetary policy shock. Its identification is obtained by imposing a (long term) solvency condition on government accounts, exploiting automatic stabilisation responses of government revenues, and the imposition of the Fisher relationship. Two main conclusions emerge. Budgetary policy shocks indirectly lead to monetary tightening. Such effects are significant in countries with flexible exchange rate regimes only. Second, policy regime shifts are important. 1INTRODUCTION With the creation of EMU, a new macroeconomic regime has been installed. The prime aim of the ECB is to maintain price stability and - only in a second line - to support general economic objectives. A multitude of national budgetary authorities is bound by the Stability and Growth Pact (SGP). The rules of the Pact comprise the use of automatic stabilisers around structurally sound fiscal positions, close to balance or in surplus in the medium term. -

United Arab Emirates (Uae)

Library of Congress – Federal Research Division Country Profile: United Arab Emirates, July 2007 COUNTRY PROFILE: UNITED ARAB EMIRATES (UAE) July 2007 COUNTRY اﻟﻌﺮﺑﻴّﺔ اﻟﻤﺘّﺤﺪة (Formal Name: United Arab Emirates (Al Imarat al Arabiyah al Muttahidah Dubai , أﺑﻮ ﻇﺒﻲ (The seven emirates, in order of size, are: Abu Dhabi (Abu Zaby .اﻹﻣﺎرات Al ,ﻋﺠﻤﺎن Ajman , أ مّ اﻟﻘﻴﻮﻳﻦ Umm al Qaywayn , اﻟﺸﺎرﻗﺔ (Sharjah (Ash Shariqah ,دﺑﻲّ (Dubayy) .رأس اﻟﺨﻴﻤﺔ and Ras al Khaymah ,اﻟﻔﺠﻴﺮة Fajayrah Short Form: UAE. اﻣﺮاﺗﻰ .(Term for Citizen(s): Emirati(s أﺑﻮ ﻇﺒﻲ .Capital: Abu Dhabi City Major Cities: Al Ayn, capital of the Eastern Region, and Madinat Zayid, capital of the Western Region, are located in Abu Dhabi Emirate, the largest and most populous emirate. Dubai City is located in Dubai Emirate, the second largest emirate. Sharjah City and Khawr Fakkan are the major cities of the third largest emirate—Sharjah. Independence: The United Kingdom announced in 1968 and reaffirmed in 1971 that it would end its treaty relationships with the seven Trucial Coast states, which had been under British protection since 1892. Following the termination of all existing treaties with Britain, on December 2, 1971, six of the seven sheikhdoms formed the United Arab Emirates (UAE). The seventh sheikhdom, Ras al Khaymah, joined the UAE in 1972. Public holidays: Public holidays other than New Year’s Day and UAE National Day are dependent on the Islamic calendar and vary from year to year. For 2007, the holidays are: New Year’s Day (January 1); Muharram, Islamic New Year (January 20); Mouloud, Birth of Muhammad (March 31); Accession of the Ruler of Abu Dhabi—observed only in Abu Dhabi (August 6); Leilat al Meiraj, Ascension of Muhammad (August 10); first day of Ramadan (September 13); Eid al Fitr, end of Ramadan (October 13); UAE National Day (December 2); Eid al Adha, Feast of the Sacrifice (December 20); and Christmas Day (December 25). -

Thomson Reuters Spreadsheet Link User Guide

THOMSON REUTERS SPREADSHEET LINK USER GUIDE MN-212 Date of issue: 13 July 2011 Legal Information © Thomson Reuters 2011. All Rights Reserved. Thomson Reuters disclaims any and all liability arising from the use of this document and does not guarantee that any information contained herein is accurate or complete. This document contains information proprietary to Thomson Reuters and may not be reproduced, transmitted, or distributed in whole or part without the express written permission of Thomson Reuters. Contents Contents About this Document ...................................................................................................................................... 1 Intended Readership ................................................................................................................................. 1 In this Document........................................................................................................................................ 1 Feedback ................................................................................................................................................... 1 Chapter 1 Thomson Reuters Spreadsheet Link .......................................................................................... 2 Chapter 2 Template Library ........................................................................................................................ 3 View Templates (Template Library) .............................................................................................................................................. -

Cesifo Working Paper No. 3038 Category 1: Public Finance April 2010

Aggressive Oil Extraction and Precautionary Saving: Coping with Volatility Frederick van der Ploeg CESIFO WORKING PAPER NO. 3038 CATEGORY 1: PUBLIC FINANCE APRIL 2010 An electronic version of the paper may be downloaded • from the SSRN website: www.SSRN.com • from the RePEc website: www.RePEc.org • from the CESifo website: www.CESifo-group.org/wpT T CESifo Working Paper No. 3038 Aggressive Oil Extraction and Precautionary Saving: Coping with Volatility Abstract The effects of stochastic oil demand on optimal oil extraction paths and tax, spending and government debt policies are analyzed when the oil demand schedule is linear and preferences quadratic. Without prudence, optimal oil extraction is governed by the Hotelling rule and optimal budgetary policies by the tax and consumption smoothing principle. Volatile oil demand brings forward oil extraction and induces a bigger government surplus. With prudence, the government depletes oil reserves even more aggressively and engages in additional precautionary saving financed by postponing spending and bringing taxes forward, especially if it has substantial monopoly power on the oil market, gives high priority to the public spending target, is very prudent, and future oil demand has high variance. Uncertain economic prospects induce even higher precautionary saving and, if non‐oil revenue shocks and oil revenue shocks are positively correlated, even more aggressive oil extraction. In contrast, prudent governments deliberately underestimate oil reserves which induce less aggressive oil depletion and less government saving, but less so if uncertainty about reserves and oil demand are positively correlated. JEL-Code: D81, E62, H63, Q32. Keywords: Hotelling rule, tax smoothing, prudence, vigorous oil extraction, precautionary saving, taxation and under-spending, oil price volatility, uncertain economic prospects and oil reserves. -

Superstition and Risk-Taking: Evidence from “Zodiac Year” Beliefs in China

Superstition and risk-taking: Evidence from “zodiac year” beliefs in China This version: February 28, 2020 Abstract We show that superstitions –beliefs without scientific grounding – have material conse- quences for Chinese individuals’ risk-taking behavior, using evidence from corporate and in- dividual decisions, exploiting widely held beliefs in bad luck during one’s “zodiac year.” We first provide evidence on individual risk-avoidance. We show that insurance purchases are 4.6 percent higher in a customer’s zodiac year, and using survey data we show that zodiac year respondents are 5 percent more likely to favor no-risk investments. Turning to corpo- rate decision-making, we find that R&D and corporate acquisitions decline substantially in a chairman’s zodiac year by 6 and 21 percent respectively. JEL classification: D14, D22, D91, G22, G41 Keywords: Risk aversion, Innovation, Insurance, Household Finance, Superstition, China, Zodiac Year 1 1 Introduction Many cultures have beliefs or practices – superstitions – that are held to affect outcomes in situations involving uncertainty. Despite having no scientific basis and no obvious function (beyond reducing the stresses of uncertainty), superstitions persist and are widespread in modern societies. It is clear that superstitions have at least superficial impact: for example, buildings often have no thirteenth floor, and airplanes have no thirteenth row, presumably because of Western superstitions surrounding the number 13. Whether these beliefs matter for outcomes with real stakes – and hence with implications for models of decision-making in substantively important economic settings – has only more recently been subject to rigorous empirical evaluation. In our paper we study risk-taking of individuals as a function of birth year, and risk-taking by firms as a function of the birth year of their chairmen. -

Local Economic Protectionism in China's Economic Reform

Local Economic Protectionism in China’s Economic Reform Pak K. Lee* A hallmark of China’s economic reforms since 1979 has been the decentralisation of the use of resources to lower levels of the administrative hierarchy. The central leaders have expected the subnational units, by making greater use of the market, to use the decentralised resources in economically productive areas. Provincial and local authorities are, however, very pragmatic. They miss no opportunity to maximise their control of resources, in order to minimise conflict in their units or localities. In a country with as unfavourable a resource-population ratio as China, local protectionism is not inconceivable, though it is neither inevitable nor desirable. Although it is widely accepted that China’s reforms have achieved notable success in moving towards a market economy, as evidenced in the remarkable reduction in the share of goods allocated through the plan and in the deregulation of price controls (World Bank, 1994: xiii–xiv), progress in the greater integration of the domestic market is less pronounced. Local protectionism or the ‘feudal economy’ principally takes the form of using a restrictive economic blockade by China’s provincial and local governments to prevent the outflow of scarce local raw materials and the sale of non-locally produced goods within their areas. This article addresses the issue of why local economic protectionism has arisen and been sustained in the course of the economic reforms. In the first section of the article, incidents of economic localism in the provinces are presented. The causes of the rise of local economic protectionism will be suggested in section two. -

Djibouti Health Expenditure Profile

Djibouti Health expenditure profile HEALTH SPENDING IN BRIEF WHO PAYS FOR HEALTH? 0.6% Health spending (% of GDP) 3.5 27.8% Health expenditure per capita (US$) 70 Public Out-of-pocket 45.8% Public spending on health per capita (US$) 32 Voluntary prepayment External Other GDP per capita (US$) 2,004 25.8% Life expectancy, both sexes (years) 62 RICHER COUNTRIES SPEND MORE ON HEALTH… …BUT NOT NECESSARILY AS A SHARE OF GDP 10,000 25 20 1,000 15 10 100 Health spending % of GDP 5 Health spending per capita (US$, log scale) 10 0 100 1,000 10,000 100,000 100 1,000 10,000 100,000 GDP per capita (US$, log scale) GDP per capita (US$, log scale) MORE GOVERNMENT SPENDING ON HEALTH IS ASSOCIATED WITH LOWER OUT-OF-POCKET SPENDING DOES GOVERNMENT SPEND ENOUGH ON HEALTH? 100 100 10 80 80 8 60 60 6 % US$ 40 40 4 20 20 2 Out-of-pocket spending % of health 0 0 0 0 2 4 6 8 10 12 14 2006 2008 2010 2012 2014 2016 Public spending on health % of GDP Health spending per capita (US$, bars) Government health spending % of total government spending (line) Djibouti PRIORITY OF HEALTH IN BUDGET ALLOCATION IS A POLITICAL CHOICE 25 20 15 10 5 Government health spending % of total government spending 0 India Egypt Kenya Congo Nigeria Angola Kiribati Ghana Bhutan SudanBoliviaJordan Tunisia Djibouti Vanuatu Armenia Ukraine Zambia Morocco Georgia Eswatini Lao PDRPakistan Myanmar TajikistanMongolia IndonesiaSri LankaViet Nam Honduras Cameroon MauritaniaMicronesia Cambodia Philippines Uzbekistan GuatemalaNicaraguaEl Salvador Timor-LesteBangladesh Côte d'Ivoire Cabo Verde Solomon -

Trends Gross and Net Spending Non-Cash Benefits

8. PUBLIC EXPENDITURE ON PENSIONS Key Results Public spending on cash old-age pensions and survivors’ benefits in the OECD increased from an average of 6.6% of gross domestic product (GDP) to 8.0% between 2000 and 2015. Public pensions are often the largest single item of social expenditure, accounting for 18.4% of total government spending on average in 2015. Greece spent the largest proportion of national income Trends on public pensions among OECD countries in 2015: 16.9% of Public pension spending was fairly stable as a GDP. Other countries with high gross public pension proportion of GDP over the period 1990-2015 in spending are in continental Europe, with Italy at 16.2% and ten countries: Australia, Germany, Iceland, Israel, Lithuania, Austria, France and Portugal at between 13% and 14% of New Zealand, Poland, Slovenia, Sweden and Switzerland. GDP. Public pensions generally account for between one- fourth and one-third of total public expenditure in these Public pension expenditure increased by more than 4 countries. points of GDP between 2000 and 2015 in Finland, Greece, Portugal and Turkey, and between 2 and 3 percentage points Iceland and Mexico spent 2.1% and 2.2% of GDP on in France, Italy, Japan and Spain. public pensions, respectively. Korea is also a low spender at 2.9% of GDP. Mexico has a relative young population, which Gross and net spending is also the case but to a lesser extent in Iceland, where much of retirement income is provided by compulsory The penultimate column of the table shows public occupational schemes (see the next indicator of “Pension- spending in net terms: after taxes and contributions paid on benefit expenditures: Public and private”), leaving a lesser benefits.