Corporate Governance Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cyberagent Way 2020(統合報告書)

CyberAgent CyberAgent, Inc. Way TSE4751 統合報告書 December, 2020 New Normal 2020 年、新型コロナウイルス感染拡大は人々の生活様式、働き方を変え、ニ ューノーマル と 呼ばれる新しい日常が生まれました。サイバーエージェントでも、取引先のみなさま、従業員の安心 安全を最優先に据えながら、強みである変化対応力を活かし色々な取り組みを実施。それにより デジタル 化 支援事業の提供を開始したり、オンラインライブ事業が本格稼働するなど、新たな 事業機会の創出につなげています。企業の成長フェーズにあわせて進化させてきた取締役会の 体制も、さらなるガバナンス強化のため監督と執行を明確に分離する新体制に移行。引き続き、 サイバーエージェントのニューノーマルとともにサステナブルな成長を実現していきます 。 執行役員 副社長 日高 裕介 代表執行役員 社長 藤田 晋 執行役員 副社長 岡本 保朗 専務執行役員 山内 隆裕 専務執行役員 小池 政秀 専務執行役員 中山 豪 専務執行役員 石田 裕子 専務執行役員 飯塚 勇太 常務執行役員 山田 陸 常務執行役員 CHO 曽山 哲人 常務執行役員 技術担当 長瀬 慶重 常務執行役員 内藤 貴仁 常務執行役員 浮田 光樹 上級執行役員 石井 洋之 上級執行役員 小池 英二 執行役員 佐藤 真人 執行役員 佐藤 洋介 執行役員 武田 丈宏 執行役員 谷口 達彦 執行役員 中田 大樹 執行役員 野村 智寿 執行役員 藤井 琢倫 執行役員 宮田 岳 執行役員 横山 祐果 21世 紀を代 表する会社を創 る CEOメッセージ 平素より御高配を賜り、誠にありがとうございます。 サイバーエージェントは1998 年の創業以来、「21世紀を代表する会社 を創る」というビジョンを掲げ、進化の早いインターネット産 業で、 事業拡大を続けてまいりました。 2020年は、広告事業において新型コロナウイルス感染拡大の影響が あったものの、過去最高の売上高を更新。2016年4月に開 局した テレビ&ビデオエンターテインメント「ABEMA」は、何かあったら 「ABEMA」という視聴習慣を構築し、開局 4 年半で 5,900 万ダウン ロードを突破しました。また、コロナ禍においてオンラインライブ 事業を提供するなど周辺事業が多様化し、メディアとしての可 能 性 の 大きさを強く感じています。 引き続き、イン ターネット 広 告 事 業、ゲーム事 業に続き、中長期の柱に すべく「ABEMA」を 中 心 とした メディア 事 業 を 育 て な が ら、次世代の 技術者育成、スポーツ支援など、事業を通じた社会的価値の創造に 取り組み、新たな成長ステージへ向けた持続的な経営を目指して まいります。 代 表取締役 藤田 晋 01 サイバーエージェントのニューノーマル 012 コーポレートガバナンス 016 SDGsへの取り組み 024 02 サステナブルな成長を実現する価値創造モデル 027 成長戦略 0 32 メディア事 業 035 CyberAgent Integrated Report | インターネット広告事業 051 ゲーム事業 059 Way 2020 Way t 03 サステナブルな成長を実現する変化対応力 067 Agen r リスクと機 会 071 Cybe 04 E S G トピックス 090 環境 093 社会への取り組み 096 ガバナンスへの取り組み 109 05 Facts 113 財務情報 115 会社情報 125 01 サイバーエー ジェント の ニューノーマル The New Normal -

Cyberagent Way 2020 (Integrated Report)

04 ESG Topics ESG Topics Environment ESG Topics 0 94 ESG Topics Climate Change Engagement CyberAgent has been working on disclosing information on greenhouse gas emissions from Scope 3 Emissions per Category (%) its business activities since the fiscal year 2020. Due to the nature of our business, which is mainly in the Internet domain, the calculation of Category Scopes* FY2018 FY2019 FY2020 CO2 emissions covers emissions from our main domestic offices, emissions from the data centers for the operation of the internet services we provide, employees' commuting, and 1 Purchased Goods and Services 20% 17% 19% business trips, etc. We will continue to measure the environmental impact of business activities and strive to improve business efficiency and reduce total CO2 emissions at the Fuel- and energyrelated activities same time. 3 (not included in scope 1 or scope 2) 5% 4% 6% 5 Waste generated in operations 1% 1% 0.3% 6 Business travel 66% 71% 59% GHG Emissions [t-CO2] 7 Employee commuting 10% 7% 15% Scopes* FY2018 FY2019 FY2020 Changes in Total GHG Emissions Scope 1 0 0 0 Reduced electricity consumption due to 24,794 the consolidation of the Shibuya-based ( ) 25,000 Scope 2 Location-based 4,866 5,188 4,601 offices between April and September 20,000 19,244 2019, and lower transportation and Scope 3 14,378 19,606 11,219 15,820 travel expenses due to the spread of 15,000 COVID-19. Total GHG Emissions 19,244 24,794 15,820 10,000 * Scopes 5,000 Scope 1 Direct emissions from our owned or controlled sources such as offices and data centers. -

Vote Summary Report

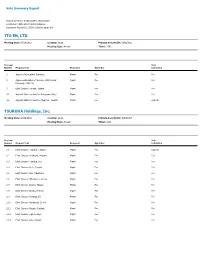

Vote Summary Report Reporting Period: 07/01/2019 to 06/30/2020 Location(s): State Street Global Advisors Institution Account(s): SPDR Solactive Japan ETF ITO EN, LTD. Meeting Date: 07/24/2019 Country: Japan Primary Security ID: J25027103 Meeting Type: Annual Ticker: 2593 Proposal Vote Number Proposal Text Proponent Mgmt Rec Instruction 1 Approve Accounting Transfers Mgmt For For 2 Approve Allocation of Income, With a Final Mgmt For For Dividend of JPY 20 3 Elect Director Tanaka, Yutaka Mgmt For For 4.1 Appoint Statutory Auditor Nakagomi, Shuji Mgmt For For 4.2 Appoint Statutory Auditor Miyajima, Takashi Mgmt For Against TSURUHA Holdings, Inc. Meeting Date: 08/09/2019 Country: Japan Primary Security ID: J9348C105 Meeting Type: Annual Ticker: 3391 Proposal Vote Number Proposal Text Proponent Mgmt Rec Instruction 1.1 Elect Director Tsuruha, Tatsuru Mgmt For Against 1.2 Elect Director Horikawa, Masashi Mgmt For For 1.3 Elect Director Tsuruha, Jun Mgmt For For 1.4 Elect Director Goto, Teruaki Mgmt For For 1.5 Elect Director Abe, Mitsunobu Mgmt For For 1.6 Elect Director Mitsuhashi, Shinya Mgmt For For 1.7 Elect Director Ogawa, Hisaya Mgmt For For 1.8 Elect Director Okada, Motoya Mgmt For For 1.9 Elect Director Yamada, Eiji Mgmt For For 1.10 Elect Director Murakami, Shoichi Mgmt For For 1.11 Elect Director Atsumi, Fumiaki Mgmt For For 1.12 Elect Director Fujii, Fumiyo Mgmt For For 1.13 Elect Director Sato, Harumi Mgmt For For Vote Summary Report Reporting Period: 07/01/2019 to 06/30/2020 Location(s): State Street Global Advisors Institution Account(s): SPDR Solactive Japan ETF TSURUHA Holdings, Inc. -

Cyberagent Way 2019 Integrated Report

04 ESG CyberAgent has been expanding business in the internet domain since its inception, and by drawing on the knowledge and business resources built up over the years, we are committed to helping to realize a society capable of sustainable growth. E SG ESG Environment CyberAgent is making efforts to reduce environmental burdens and maintain optimization in its operations to contribute to preserving the global environment and achieving a sustainable society. 70 ESG Environment Social Governance Our Commitment to Environment Promotion of Digitalization Security Protection and Recycle CyberAgent is working on digitalizing internal documents, including cost calculations, invoices, Documents in the office are destroyed using an exclusive recycling trash bin (Mamoru-kun) (Japan and received faxes to reduce the amount of paper used in the office. By developing and providing Purple Inc.) which maintains confidentiality and recycling. From April 2018 to March 2019, it “GEPPO,” a tool to assess employee conditions and promoting digitalization of various kind of contributed to saving 1,927.49 trees and around 55,531.06kg (8.6% down compared to the same documents related to business transactions, we create an environment where each employee can period previous year) in carbon dioxide emissions annually focus on their primary duties by preparing an internal system. Conversion of Studio Lightsinto LED CyberAgent reduces the environmental burden by saving energy. An example is to adopt LED lights for the studio that "AbemaTV" uses for shooting. LED emits less harmful rays, such as heat rays and UV, and will also lead to cutting down stress found in shooting, like heat factors. -

JHVIT Quarterly Holdings 6.30.2021

John Hancock Variable Insurance Trust Portfolio of Investments — June 30, 2021 (unaudited) (showing percentage of total net assets) 500 Index Trust 500 Index Trust (continued) Shares or Shares or Principal Principal Amount Value Amount Value COMMON STOCKS – 97.6% COMMON STOCKS (continued) Communication services – 10.9% Hotels, restaurants and leisure (continued) Diversified telecommunication services – 1.2% Marriott International, Inc., Class A (A) 55,166 $ 7,531,262 McDonald’s Corp. 155,101 35,826,780 AT&T, Inc. 1,476,336 $ 42,488,950 MGM Resorts International 86,461 3,687,562 Lumen Technologies, Inc. 208,597 2,834,833 Norwegian Cruise Line Holdings, Ltd. (A) 75,206 2,211,808 Verizon Communications, Inc. 858,032 48,075,533 Penn National Gaming, Inc. (A) 30,865 2,360,864 93,399,316 Royal Caribbean Cruises, Ltd. (A) 45,409 3,872,480 Entertainment – 1.9% Starbucks Corp. 244,224 27,306,685 Activision Blizzard, Inc. 160,872 15,353,624 Wynn Resorts, Ltd. (A) 21,994 2,689,866 Electronic Arts, Inc. 60,072 8,640,156 Yum! Brands, Inc. 62,442 7,182,703 Live Nation Entertainment, Inc. (A) 30,014 2,628,926 151,933,613 Netflix, Inc. (A) 91,957 48,572,607 Household durables – 0.4% Take-Two Interactive Software, Inc. (A) 24,146 4,274,325 D.R. Horton, Inc. 68,073 6,151,757 The Walt Disney Company (A) 376,832 66,235,761 Garmin, Ltd. 31,500 4,556,160 145,705,399 Leggett & Platt, Inc. 27,959 1,448,556 Interactive media and services – 6.3% Lennar Corp., A Shares 55,918 5,555,453 Alphabet, Inc., Class A (A) 62,420 152,416,532 Mohawk Industries, Inc. -

Downloaded in Korea, Was Held In

i RETHINKING THE EXPEDIENCY OF THE REGIONAL FLOW OF POP CULTURE: THE CASE OF THE KOREAN WAVE IN JAPAN by SUNYOUNG KWAK B.A., SogAng University, 1999 M.A., SogAng University, 2001 A dissertAtion submitted to the Faculty of the GraduAte School of the University of ColorAdo in pArtiAl fulfillment of the requirement for the degree of Doctor of Philosophy College of MediA, CommunicAtion And Information 2017 ii This thesis entitled: Rethinking the Expediency of the Regional Flow of Pop Culture: The Case of the Korean WAve in Japan written by Sunyoung Kwak has been approved for the College of MediA, CommunicAtion And Information Dr. Shu-Ling Chen Berggreen Dr. Hun Shik Kim Date The finAl copy of this thesis hAs been eXAmined by the signatories, and we find thAt both the content And the form meet AcceptAble presentAtion stAndArds of scholArly work in the Above mentioned discipline. iii AbstrAct KwAk, Sunyoung (Ph.D., CommunicAtion, College of MediA, CommunicAtion And Information) Rethinking the Expediency of the Regional Flow of Pop Culture: The Case of the Korean WAve in Japan DissertAtion directed by AssociAte Professor Shu-Ling Chen Berggreen This dissertAtion study Aims to identify the role of nAtionAl markets in the regional flow of pop culture, focusing on how nAtionAl markets reAct to foreign pop cultures And take advAntAge of them. TAking the internAtionAl populArity of South Korean pop culture, called “Korean Wave,” or “Hallyu” in Japan As the case, this study analyzes the discourse of JApAn’s mainstreAm mediA from 2009 to 2016 in order to find out the national market's role And desire behind the regionAl And transnational flow of pop culture. -

Corporate Governance Report

English Translation This is a translation of the original release in Japanese. In the event of any discrepancy, the original release in Japanese shall prevail. CORPORATE GOVERNANCE Corporate Governance Report CyberAgent, Inc. Latest Revision: December 11, 2020 Company: CyberAgent, Inc. Representative: Susumu Fujita, Representative Director Inquiries: IR&SR Division Securities Code: 4751 URL: https://www.cyberagent.co.jp/en/ The following is an overview of corporate governance at CyberAgent, Inc. I Basic Policy, Capital Structure, Corporate Attributes and Other Basic Information 1. Basic Policy The CyberAgent Group makes efforts to improve its corporate value under our vision of “To create the 21st century's leading company.” While recognizing that thoroughgoing corporate governance is essential for expanding business, the Group takes measures so that its corporate activities comply with laws, regulations, social norms, ethics. In order to respect the positions of stakeholders and fulfill corporate social responsibility, the Group produced the “CyberAgent Mission Statement” for the purposes of not only following laws and regulations, but also establishing corporate ethics, and strives to improve the morals of executives and employees. [Reasons for Not Implementing Principles of Corporate Governance Code] <Medium-term management plan> Principle 4-1-2: CyberAgent (the Company) operate businesses in the Internet industry, which the business environment and technologies are changing rapidly. Therefore, instead of producing medium to long-term management plans, we explain our medium to long-term management strategies continuously through IR activities to promote the understanding of shareholders and investors. [Disclosure Based on the Principles of the Corporate Governance Code] Updated <Strategic-Shareholdings> Principle 1-4: If business tie-ups are expected to be cemented, the Company may hold the Strategic- Shareholdings. -

Computer Graphic Arts Society People Create Culture, and Culture Touches Hearts

About the CG-ARTS Computer Graphic Arts Society People create culture, and culture touches hearts. Since its establishment in 1991, The Computer Graphic Arts Society (CG-ARTS), a Japanese public interest incorporated foundation has played a role in human resource development and cultural promotion for the image information eld using computers, and has been committed to the ad- vancement of these areas. Now more than 29 years after its establishment, many who have studied under the curriculum, or who have won awards in the contest of the CG-ARTS are at the forefront of the academic, art and industry sectors. The use of image information has spread into a variety of industries, and has become indispensable in the daily lives of people. The CG-ARTS is engaged in a variety of activities that support the birth and growth of the attractive culture and industries of Japan related to image information. The Role of the CG-ARTS Industry Human Resource Development ・Creating Curriculums ・Developing / Publishing Teaching Materials ・Conducting Certification Tests ・ Training Teachers and Instructors Cultural Promotion ・Planning and management Festival Academic Art ・Producing Exhibitions / Events ・Creative Support ・ Hosting the CG Contest for Students One of the main pillars of these activities is "Human Resource Development". In an increasingly changing era, the enhancement of this foundation is essential. For the purpose of strengthening the basic abilities of people involved in the image information eld, we conduct educational promotion activities including the creation of education curriculums, the development of teaching materials, the training of teachers and instructors, and the implementation of certication tests. -

Download .Pdf File of Volume 36

Recherche littéraire/Literary Research Automne / Fall 2020 PETER LANG Bruxelles Berlin Bern New York Oxford Recherche littéraire / Literary Research Rédacteur / Editor Marc Maufort, Université Libre de Bruxelles (ULB) Publié avec le concours de /Published with the support of : l’Association internationale de littérature comparée (AILC)/The International Comparative Literature Association (ICLA) Comité consultatif / Advisory Board Dorothy Figueira (University of Georgia, Athens), rédactrice précédente/immediate past editor John Burt Forster (George Mason University), ancien rédacteur/past editor Thomas Oliver Beebee (Penn State University, USA) César Domínguez (Universidade de Santiago de Compostela, España) Eugene C. Eoyang (Indiana University, USA) Massimo Fusillo (Università degli studi dell’Aquila, Italia) Peter Hajdu (Hungarian Academy of Sciences, Hungary) Scott Miller (Brigham Young University, USA) Helga Mitterbauer (Université Libre de Bruxelles, ULB, Belgique) David O’Donnell (Victoria University of Wellington, New Zealand) Randolph Pope (University of Virginia, USA) E.V. Ramakrishnan (Central University of Gujarat, India) Haun Saussy (University of Chicago, USA) Monica Spiridon (Universitatea din Bucureşti, România) Jüri Talvet (University of Tartu, Estonia) Anne Tomiche (Sorbonne Université, France) Hein Viljoen (North-West University, Potchesfstroom, South Africa) Zhang Longxi (City University of Hong Kong, China) Assistants de rréééédaction/editorialdaction/editorial assistants Jessica Maufort (Université Libre de Bruxelles, ULB) Samuel Pauwels (Bruxelles) En tant que publication de l’Association internationale de littérature comparée, la revue bilingue Recherche littéraire / Literary Research a pour but de faire connaître aux comparatistes du monde entier les développements récents de la discipline. Dans ce but, la revue publie des comptes rendus de livres significatifs sur des sujets comparatistes ainsi que des essais critiques dressant l’état des lieux dans un domaine particulier de la littérature comparée. -

Computer Graphic Arts Society 2018

kyoukai_annai_omote_Eng_2018_19.pdf 1 18/05/25 17:13 People create About the CG-ARTS culture, and culture touches hearts. Since its establishment in 1991, The Computer Graphic Arts Society (CG-ARTS), a Japanese public interest incorporated foundation has played a role in human resource development ȱȱȱȱȱȱȱęȱȱǰȱȱȱȱ- Ĵȱȱȱȱȱȱǯ Now more than 28 years after its establishment, many who have studied under the curricu- lum, or who have won awards in the contest of the CG-ARTS are at the forefront of the aca- ǰȱȱȱ¢ȱǯȱȱȱȱȱȱȱȱȱȱ¢ȱȱ ǰȱȱȱȱȱȱȱ¢ȱȱȱǯ The CG-ARTS is engaged in a variety of activities that support the birth and growth of the Ĵȱȱȱȱȱ ȱȱȱȱǯ Computer The Role of the CG-ARTS Industry Graphic Arts Human Resource Development Society ・Creating Curriculums ・Developing / Publishing Teaching Materials 2018/ 2019 ・Conducting Certification Tests ・ Training Teachers and Instructors Cultural Promotion ・Planning and management Festival Academic Art ・Producing Exhibitions / Events ・Creative Support ・ Hosting the CG Contest for Students ȱ ȱ ȱ ȱ ȱ ȱ ȱ ȱ ȱ Ȉ ȱ ȱ Ȉǯȱ ȱ ȱ ¢ȱȱǰȱȱȱȱȱȱȱǯȱȱȱȱȱ ȱ ȱ ȱ ȱ ȱ ȱ ȱ ȱ ȱ ȱ ȱ ęǰȱ ȱ conduct educational promotion activities including the creation of education curriculums, the development of teaching materials, the training of teachers and instructors, and the ȱȱęȱǯȱ¢ȱȱǰȱ ȱȱȱȱ ȱ¢ȱ ȱȱǯȱ ȱǰȱ ȱȱȱȱȱȱȱȱ¢ȱȱ expressions and also a place for academic-industrial exchanges, thereby connecting excellent ȱȱ¢ǯ ȱ ȱ ȱ ȱ Ȉȱ Ȉǯȱ ȱ ȱ ȱ ǰȱ ȱ ȱ ȱ ȱ ȱ evaluate the cultural values of a variety of works born out of the evolution of technology, ȱ ȇȱ -

Annual Report 2015

ANNUAL REPORT 2015 SEGA SAMMY HOLDINGS ANNUAL REPORT 2015 SEGA SAMMY HOLDINGS The entertainment industry is currently facing major structural change as the pastimes of the young generation diversify. In response, the SEGA SAMMY Group has restructured decisively to get back on a trajectory of earnings growth and sustained long- term development. Restructuring has clarified core businesses, restructured unprofitable and underperforming businesses drastically, laid foundations for strengthening business portfolio management, and optimized personnel deployment. + Vision + Strategies + Action 2 SEGA SAMMY HOLDINGS In fiscal 2016, we expect to see some of the benefits of restructuring. However, the SEGA SAMMY Group’s reform is still under way. We will set out a clear target profile for the Group, establish strategies to achieve it, and advance measures based on these strategies steadily. For us, change is constant. ANNUAL REPORT 2015 3 [ INDEX ] the NUMBERS the GROUP Grasp the main points in business Discussion on the Group’s Past and Present result trends and in fiscal 2015 Get to know the Group’s past business results and present Business Results Highlights ......................................... 6 We explain business models and management resources from a Groupwide viewpoint as well as our track record for returns to shareholders. What Makes the SEGA SAMMY Group Tick? .............24 the MANAGEMENT TEAM The SEGA SAMMY Group: The Story So Far ..............26 Learn about the management Management Resources Creating Entertainment Value ...................................................28 team’s approach • Intellectual Properties ..............................................28 Messages from senior executives of SEGA SAMMY HOLDINGS, SEGA Holdings, and Sammy • Human Capital .........................................................30 A Message from the Chairman of • Financial Capital .......................................................34 the Board and CEO .................................................... -

The Vanguard Japan Stock Index Fund ------Issuer: Abc-Mart, Inc

ANNUAL REPORT OF PROXY VOTING RECORD DATE OF REPORTING PERIOD: JULY 1, 2018 - JUNE 30, 2019 FUND: THE VANGUARD JAPAN STOCK INDEX FUND --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ISSUER: ABC-MART, INC. TICKER: 2670 CUSIP: J00056101 MEETING DATE: 5/29/2019 FOR/AGAINST PROPOSAL: PROPOSED BY VOTED? VOTE CAST MGMT PROPOSAL #1: APPROVE ALLOCATION OF INCOME, WITH A ISSUER YES FOR FOR FINAL DIVIDEND OF JPY 105 PROPOSAL #2.1: ELECT DIRECTOR NOGUCHI, MINORU ISSUER YES FOR FOR PROPOSAL #2.2: ELECT DIRECTOR KATSUNUMA, KIYOSHI ISSUER YES FOR FOR PROPOSAL #2.3: ELECT DIRECTOR KOJIMA, JO ISSUER YES FOR FOR PROPOSAL #2.4: ELECT DIRECTOR KIKUCHI, TAKASHI ISSUER YES FOR FOR PROPOSAL #2.5: ELECT DIRECTOR HATTORI, KIICHIRO ISSUER YES FOR FOR PROPOSAL #3.1: ELECT DIRECTOR AND AUDIT COMMITTEE ISSUER YES FOR FOR MEMBER MATSUOKA, TADASHI PROPOSAL #3.2: ELECT DIRECTOR AND AUDIT COMMITTEE ISSUER YES FOR FOR MEMBER SUGAHARA, TAIO PROPOSAL #3.3: ELECT DIRECTOR AND AUDIT COMMITTEE ISSUER YES FOR FOR MEMBER TOYODA, KO --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ISSUER: ACOM Co., Ltd. TICKER: 8572 CUSIP: J00105106 MEETING DATE: 6/21/2019 FOR/AGAINST PROPOSAL: PROPOSED BY VOTED? VOTE CAST MGMT PROPOSAL #1: APPROVE ALLOCATION OF INCOME, WITH A ISSUER YES FOR FOR FINAL DIVIDEND OF JPY 1 PROPOSAL #2.1: ELECT