Introduction to SFR March, 2008

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Executive Summary

Executive summary For more information, visit: www.vodafone.com/investor Highlights Group highlights for the 2010 financial year Revenue Financial highlights ■ Total revenue of £44.5 billion, up 8.4%, with improving trends in most £44.5bn markets through the year. 8.4% growth ■ Adjusted operating profit of £11.5 billion, a 2.5% decrease in a recessionary environment. ■ Data revenue exceeded £4 billion for the first time and is now 10% Adjusted operating profit of service revenue. ■ £1 billion cost reduction programme delivered a year ahead of schedule; £11.5bn further £1 billion programme now underway. 2.5% decrease ■ Final dividend per share of 5.65 pence, resulting in a total for the year of 8.31 pence, up 7%. ■ Higher dividends supported by £7.2 billion of free cash flow, an increase Free cash flow of 26.5%. £7.2bn Operational highlights 26.5% growth ■ We are one of the world’s largest mobile communications companies by revenue with 341.1 million proportionate mobile customers, up 12.7% during the year. Proportionate mobile customers ■ Improved performance in emerging markets with increasing revenue market share in India, Turkey and South Africa during the year. ■ Expanded fixed broadband customer base to 5.6 million, up 1 million 341.1m during the year. 12.7% growth ■ Comprehensive smartphone range, including the iPhone, BlackBerry® Bold and Samsung H1. ■ Launch of Vodafone 360, a new internet service for the mobile and internet. ■ High speed mobile broadband network with peak speeds of up to 28.8 Mbps. Vodafone Group Plc Annual Report 2010 1 Sir John Bond Chairman Chairman’s statement Your Company continues to deliver strong cash generation, is well positioned to benefit from economic recovery and looks to the future with confidence. -

Download Europe Pop

EUROPE LEGEND As built: March 2021. Maps are not to scale. Learn more about our network: teliacarrier.com Point of presence (PoP) Multiple PoPs Telia Carrier fiber Leased network OUR PoPs IN EUROPE Amsterdam Copenhagen Helsinki Milan Prague Tallinn Cessnalaan 50, Interxion 3000 Industriparken 20A, Interxion Iso-Roobertinkatu 21–25, Telia Via Caldera 21, Irideos Nad Elektrarnou 411, CECOLO Söle 14, Telia Johan Huizingalaan 759, Global Switch Horskaetten 3, Global Connect Kansakoulukuja 3, Telia 25 Viale Lombardia, Supernap Kuuse 4, Telia J.W Lucasweg 35, Iron Mountain Metrovej 1, Telia Kiviadankatu 2H, Nebula Via Monzoro 101–105, Data4 Riga 12 Koolhovenlaan, EdgeConnex Sydvestvej 100, Telia Parrukatu 2, Equinix Lielvardes Str. 8a, Telia Timisoara Kuiperbergweg 13, Equinix Sahamyllyntie 4b, Equinix Moscow Zakusalas krastmala 1, Riga TV Tower Calea Torontalului 94, Orange Luttenbergweg 4, Equinix Dresden Sinimäentie 12, Equinix Altufevskaya Shosse 33G, IXcellerate Schepenbergweg 42, Equinix Overbeckstr. 41a, Telia Valimotie 3–5, Telia Butlerova Str. 7, MMTS-9 JSC Rome Udomlya Science Park 120a, Digital Realty Oktyabrskaya Str. 1, Telia Via del Tizii, NAMEX CONSYST-Communication Provider Science Park 121, Interxion Dublin Kiev Viamotornaya Str. 69, DataPro Science Park 610, Equinix Kilcarbery Park, Equinix Gaydara Str. 50, New Telco Ukraine Rotterdam Valencia Science Park 105, NIKHEF Citywest Campus, Equinix Leontovicha Str. B. 9/3, Farlep-Invest Munich Van Nelleweg Rotterdam, 1, Smart DC Calle Villa de Madrid 44, Nixval Tupolevlaan 101, Interxion -

Telecom Operators

March 2007 Telecom Operators Caution – work ahead Accelerating decline in voice to be offset by siginificant take-off in data? Reorganization of the value chain: necessary but not without risk Critical size and agility: has anyony got both? - Renewed ambitions of leaders and intensified pressure on challengers: M&A activity to gather pace Contacts EXANE BNP Paribas Antoine Pradayrol [email protected] Exane BNP Paribas, London: +44 20 7039 9489 ARTHUR D. LITTLE Jean-Luc Cyrot [email protected] Arthur D. Little, Paris: +33 1 55 74 29 11 Executive summary Strategic reorientation: unavoidable, and beneficial in the near term... More than ever, European telecom operators must juggle between shrinking revenues in their traditional businesses on the one hand, and opportunities to capture growth in attractive new markets on the other, driven by the development of fixed and mobile broadband. Against this background, carriers will step up initiatives to cut costs and secure growth. They are gradually acknowledging that they cannot be present at every link in the value chain, and that even on those links that constitute their core business, they can create more value by joining forces with partners. This should result in a variety of ‘innovations’, such as: – outsourcing of passive and even active infrastructures and/or network sharing in both fixed line and mobile; – development of wholesale businesses and virtual operators (MVNOs, MVNEs, FVNOs, CVNOs1, etc.); – partnerships with media groups and increasingly with Internet leaders. These movements will: – enable companies to trim costs and capex: all else being equal, the outsourcing of passive or active infrastructures and network sharing can increase carriers’ operating free cash flow by up to 10%; – stimulate market growth: partnerships with media groups and Internet leaders have demonstrated that they can stimulate usage without incurring a significant risk of cannibalisation in the near term. -

LES CHAÎNES TV by Dans Votre Offre Box Très Haut Débit Ou Box 4K De SFR

LES CHAÎNES TV BY Dans votre offre box Très Haut Débit ou box 4K de SFR TNT NATIONALE INFORMATION MUSIQUE EN LANGUE FRANÇAISE NOTRE SÉLÉCTION POUR VOUS TÉLÉ-ACHAT SPORT INFORMATION INTERNATIONALE MULTIPLEX SPORT & ÉCONOMIQUE EN VF CINÉMA ADULTE SÉRIES ET DIVERTISSEMENT DÉCOUVERTE & STYLE DE VIE RÉGIONALES ET LOCALES SERVICE JEUNESSE INFORMATION INTERNATIONALE CHAÎNES GÉNÉRALISTES NOUVELLE GÉNÉRATION MONDE 0 Mosaïque 34 SFR Sport 3 73 TV Breizh 1 TF1 35 SFR Sport 4K 74 TV5 Monde 2 France 2 36 SFR Sport 5 89 Canal info 3 France 3 37 BFM Sport 95 BFM TV 4 Canal+ en clair 38 BFM Paris 96 BFM Sport 5 France 5 39 Discovery Channel 97 BFM Business 6 M6 40 Discovery Science 98 BFM Paris 7 Arte 42 Discovery ID 99 CNews 8 C8 43 My Cuisine 100 LCI 9 W9 46 BFM Business 101 Franceinfo: 10 TMC 47 Euronews 102 LCP-AN 11 NT1 48 France 24 103 LCP- AN 24/24 12 NRJ12 49 i24 News 104 Public Senat 24/24 13 LCP-AN 50 13ème RUE 105 La chaîne météo 14 France 4 51 Syfy 110 SFR Sport 1 15 BFM TV 52 E! Entertainment 111 SFR Sport 2 16 CNews 53 Discovery ID 112 SFR Sport 3 17 CStar 55 My Cuisine 113 SFR Sport 4K 18 Gulli 56 MTV 114 SFR Sport 5 19 France Ô 57 MCM 115 beIN SPORTS 1 20 HD1 58 AB 1 116 beIN SPORTS 2 21 La chaîne L’Équipe 59 Série Club 117 beIN SPORTS 3 22 6ter 60 Game One 118 Canal+ Sport 23 Numéro 23 61 Game One +1 119 Equidia Live 24 RMC Découverte 62 Vivolta 120 Equidia Life 25 Chérie 25 63 J-One 121 OM TV 26 LCI 64 BET 122 OL TV 27 Franceinfo: 66 Netflix 123 Girondins TV 31 Altice Studio 70 Paris Première 124 Motorsport TV 32 SFR Sport 1 71 Téva 125 AB Moteurs 33 SFR Sport 2 72 RTL 9 126 Golf Channel 127 La chaîne L’Équipe 190 Luxe TV 264 TRACE TOCA 129 BFM Sport 191 Fashion TV 265 TRACE TROPICAL 130 Trace Sport Stars 192 Men’s Up 266 TRACE GOSPEL 139 Barker SFR Play VOD illim. -

Annex 8 Compulsory Licensing of Premium Pay Tv

ANNEX 8 COMPULSORY LICENSING OF PREMIUM PAY TV CHANNELS IN OTHER COUNTRIES 1. Introduction 1.1 Ofcom has sought to portray its proposals to compel Sky to license its premium pay TV channels to other operators as relatively uncontroversial on a number of grounds including that the proposals are a ‘normal’ form of regulation in other countries. For example, Ofcom has stated: “wholesale must-offer obligations have been imposed in a number of other countries, in response to similar concerns to those that we have set out”;1 and “This is not a revolutionary approach… this kind of wholesale must offer has existed in the States for years.”2 1.2 Ofcom’s views on this matter appear impressionistic, rather than being based on a thorough understanding of (a) the nature of compulsory licensing obligations in other countries; or (b) the reasons for those obligations.3 A proper understanding of such matters is required in order to rely on the existence of regulation in other countries as lending support to Ofcom’s own proposals to impose wide-ranging, deterministic and highly intrusive regulation on Sky. 1.3 In this Annex, Sky considers the compulsory licensing obligations that exist in relation to pay TV channels in the countries cited by Ofcom as relevant comparators, namely France, Italy, Spain and the United States.4 We show that the regulation that exists in those countries has little in common either in form or rationale with that which Ofcom proposes. In particular, in spite of the fact that obligations were introduced in France, Italy and Spain in order to remedy demonstrable reductions in competition arising from mergers between pay TV operators, Ofcom’s proposals go far beyond the remedies that were adopted in those countries. -

Numericable / SFR 750 Undrawn RCF at Altice VII 100

“The Future Begins Today” Creating the French Champion in Very High Speed Fixed – Mobile Convergence 7 April 2014 Disclaimer ■ This presentation contains statements about future events, projections, forecasts and expectations that are forward-looking statements. Any statement in this presentation that is not a statement of historical fact is a forward-looking statement that involves known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These risk and uncertainties include those discussed or identified in the Document de Base of Numericable Group filed with the Autorité des Marchés Financiers ("AMF") under number I.13-043 on September 18, 2013 and its Actualisation filed with the AMF under number D.13-0888-A01 on October 25, 2013. In addition, past performance of Numericable Group cannot be relied on as a guide to future performance. Numericable Group makes no representation on the accuracy and completeness of any of the forward-looking statements, and, except as may be required by applicable law, assumes no obligations to supplement, amend, update or revise any such statements or any opinion expressed to reflect actual results, changes in assumptions or in Numericable Group's expectations, or changes in factors affecting these statements. Accordingly, any reliance you place on such forward-looking statements will be at your sole risk. ■ This presentation does not contain or constitute an offer of Numericable Group's or Altice's shares for sale or an invitation or inducement to invest in Numericable Group's or Altice's shares in France, the United States of America or any other jurisdiction. -

THE E-HEALTH OPPORTUNITY for the TELECOMMUNICATION INDUSTRY and PORTUGAL TELECOM – a CASE STUDY Cover

THE E-HEALTH OPPORTUNITY FOR THE TELECOMMUNICATION INDUSTRY AND PORTUGAL TELECOM – A CASE STUDY Cover Francisco Borges d’Almeida Nascimento Master of Science in Business Administration Orientador: Prof. Jorge Lengler, ISCTE Business School, Departamento de Marketing, Operações e Gestão Geral April 2015 THE E-HEALTH OPPORTUNITY FOR THE TELECOMMUNICATION INDUSTRY AND PORTUGAL TELECOM – A CASE STUDY Francisco Borges d’Almeida Nascimento Case Study – E-Health in the telecommunication industry and at PT Abstract Electronic-Health (e-health) is a recent answer to some pressing challenges on health. Aging of western societies and treatments’ rising costs raised doubts about health systems’ sustainability. Individuals, companies and public administration alike are looking for technology to find aid in addressing these challenges. Several industries are tacking those issues offering innovative solutions among which Telecommunication’s. Nonetheless, this industry is facing challenges from over- the-top players menacing its business model. Portugal Telecom shares these challenges and is looking to diversify to guarantee future growth, namely, by developing in e-health solutions. This case study follows two important threads in strategy literature: diversification and the resource-based view, applied Portugal Telecom and the e-health opportunity. As a case study, it aims providing readers a tool to better understand and employ strategic management concepts and frameworks in an applied business context. E-health as an opportunity for growth to Telecommunication companies and Portugal Telecom is described from three points of view: i) an actual market need ii) that may be addressed by Telecommunication companies and iii) should be addressed by those companies as they need to grow. -

Untangling the Web From

Untangling the Web from DNS Michael Walfisha, Hari Balakrishnana, and Scott Shenkerb IRIS Project a{mwalfish, hari}@csail.mit.edu, MIT Computer Science and AI Laboratory (CSAIL), Cambridge, MA [email protected], International Computer Science Institute (ICSI), Berkeley, CA Abstract tably in the URN literature [2, 5, 9, 19, 28, 29], to move the Web away from host-based URLs. The Web relies on the Domain Name System (DNS) to Since the Web has imposed the burden of branding on resolve the hostname portion of URLs into IP addresses. DNS, and DNS has restricted the flexibility of the Web, This marriage-of-convenience enabled the Web’s mete- we believe that both systems would benefit if they were oric rise, but the resulting entanglement is now hinder- disentangled from each other. However, dissolving this ing both infrastructures—the Web is overly constrained mutually unhealthy union would require a new RRS for by the limitations of DNS, and DNS is unduly burdened the Web. What should such an RRS look like? There by the demands of the Web. There has been much com- has been extensive discussion about this topic, largely mentary on this sad state-of-affairs, but dissolving the ill- within the URN community but among many others as fated union between DNS and the Web requires a new well. While we don’t provide a comprehensive review way to resolve Web references. To this end, this paper de- of the commentary, the literature suggests the following scribes the design and implementation of Semantic Free two basic requirements for any such RRS (both of which Referencing (SFR), a reference resolution infrastructure DNS-based URLs do not satisfy): based on distributed hash tables (DHTs). -

Fixed Mobile Convergence

Fixed Mobile Convergence Dr. Stephan Spitz Giesecke & Devrient GmbH Division Telecommunication Fixed Mobile Convergence (FMC) 1. What is FMC ? Technology Status of FMC 2. Existing (U/I)SIM-based FMC security solutions 3. The Future ETSI Security Workshop 2007 Seite 2 Fixed Mobile Convergence (FMC) 1. What is FMC ? Technology Status of FMC 2. Existing (U/I)SIM-based FMC security solutions 3. The Future ETSI Security Workshop 2007 Seite 3 Definition of Fixed Mobile Convergence, … The aim of Fixed Mobile Convergence (FMC) is to provide fixed and mobile services with a single phone or personal device, which could switch between networks ad hoc. Wikipedia ETSI Security Workshop 2007 Seite 4 … but also Network Convergence ETSI Security Workshop 2007 Seite 5 Strong Convergence Drivers TECHNOLOGY COMPETITION Multiplicity of access Disruptive business methods models Multimedia and real- Price pressure time networking Eroding revenue New standards CONVERGENCE Move to IP infrastructure Intersection IT and Telecom USER “Value rich services” PREFERENCES CONSOLIDATION Integrated value rich services Lower costs Personalized and mobile Bigger brands Secure communications Media/entertainment into Telecom/IT ETSI Security Workshop 2007 Seite 6 Standardization Bodies TISPAN (Telecoms & Internet converged Services & Protocols for Advanced Networks ) specifications of 3GPP ensure integration between fixed and mobile solutions based on 3GPP IMS (IP Multimedia Subsystem) http://www.etsi.org/tispan/; WG7 SEC security Fixed Mobile Convergence Alliance (FMCA, http://www.thefmca.com ) WiMAX Forum (http://www.wimaxforum.org ) ETSI Security Workshop 2007 Seite 7 Some FMC Examples TwinTel (http://www.arcor.de/privat/twintel.jsp) in Germany: Arcor offers a mobile GSM handset which can also be used for making calls trough the ADSL line BT Fusion* (http://www.btfusionorder.bt.com/ )in England: British Telecom offers a Vodafone handset also capable of making calls through the ADSL line. -

Telecommunications Operator Excellent Financial Results, the Fruit of Marketing Investments in 2006

Telecommunications operator Excellent financial results, the fruit of marketing investments in 2006 In 2007, Bouygues Telecom continued to offer an attractive line-up for both consumers and businesses. It ensured that it had the resources to meet growing demand for data and converged services from businesses and SMEs. New brand campaign 2007 Operating Net profit att. Employees 2008 sales sales margin to the Group target €4,796m 15.6% €492m 7,700 €4,965m (+6%) (+2.5 points) (+26%)* (+4%) (*) From continuing operations The 9 million customer milestone passed in November Highlights The popular Neo product range confirmed the soundness of Bouygues Telecom’s sales and marketing strategy based on unlimited calling. • Carbon balance Bouygues Telecom continued to emphasise unlimited services in its product measured in 2007. offerings in 2007. • November: 3G+ services Bouygues Telecom rounded out its Neo and Exprima range of consumer call released for businesses and plans with the launch of the Exprima 24/24 plan offering unlimited calls to consumers. fixed-line numbers and the "2 Fois Plus" plan offering double call time to all • September: signing of an numbers from 6.00pm to midnight and at weekends. The prepaid line was agreement with Neuf Cegetel overhauled to boast an unrivalled price per minute as well as recharge cards for the provision of a busi- that include unlimited text messages in certain time slots. ness and consumer DSL ser- The Evolutif Pro Fixe 24/24 and Neo Pro plans offer unlimited calling for vice; new brand campaign on the theme of freeing up businesses and SMEs. -

ITU Operational Bulletin No. 869 – 3

ITU Operational Bulletin No. 869 1.X.2006 (Information received by 25 September 2006) Table of Contents Page General information Lists annexed to the ITU Operational Bulletin: Note from TSB.............................................................. 3 Approval of ITU-T Recommendations................................................................................................... 4 Assignment of Signalling Area/Network Codes (SANC) (ITU-T Recommendation Q.708 (03/1999)): Monaco, Norway.............................................................................................................................. 4 Telephone Service: Burkina Faso (Autorité Nationale de Régulation des Télécommunications (ARTEL), Ouagadougou)........................................................................................................................... 5 Denmark (National IT and Telecom Agency (NITA), Copenhagen) ............................................... 5 United Arab Emirates (Telecommunications Regulatory Authority (TRA), Abu Dhabi).................. 5 Gambia (The Gambia Public Utilities Regulatory Authority (PURA), Kololi) ................................... 7 Guatemala (Superintendencia de Telecomunicaciones, Guatemala)............................................. 8 Guyana (Guyana Telephone & Telegraph Co. Ltd, Georgetown).................................................. 11 Jamaica (Office of Utilities Regulation (OUR), Kingston)............................................................... 12 Serbia (Republic Telecommunication Agency, -

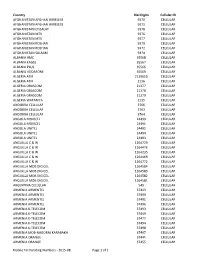

Mobile Terminating Numbers

Country Dial Digits Cellular ID AFGHANISTAN AFGHAN WIRELESS 9370 CELLULAR AFGHANISTAN AFGHAN WIRELESS 9371 CELLULAR AFGHANISTAN ETISALAT 9378 CELLULAR AFGHANISTAN MTN 9376 CELLULAR AFGHANISTAN MTN 9377 CELLULAR AFGHANISTAN ROSHAN 9379 CELLULAR AFGHANISTAN ROSHAN 9372 CELLULAR AFGHANISTAN SALAAM 9374 CELLULAR ALBANIA AMC 35568 CELLULAR ALBANIA EAGLE 35567 CELLULAR ALBANIA PLUS 35566 CELLULAR ALBANIA VODAFONE 35569 CELLULAR ALGERIA ATM 2139619 CELLULAR ALGERIA ATM 2136 CELLULAR ALGERIA ORASCOM 21377 CELLULAR ALGERIA ORASCOM 21378 CELLULAR ALGERIA ORASCOM 21379 CELLULAR ALGERIA WATANIYA 2135 CELLULAR ANDORRA CELLULAR 3766 CELLULAR ANDORRA CELLULAR 3763 CELLULAR ANDORRA CELLULAR 3764 CELLULAR ANGOLA MOVICEL 24499 CELLULAR ANGOLA MOVICEL 24491 CELLULAR ANGOLA UNITEL 24492 CELLULAR ANGOLA UNITEL 24494 CELLULAR ANGOLA UNITEL 24493 CELLULAR ANGUILLA C & W 1264729 CELLULAR ANGUILLA C & W 1264476 CELLULAR ANGUILLA C & W 1264235 CELLULAR ANGUILLA C & W 1264469 CELLULAR ANGUILLA C & W 1264772 CELLULAR ANGUILLA MOB DIGICEL 1264584 CELLULAR ANGUILLA MOB DIGICEL 1264583 CELLULAR ANGUILLA MOB DIGICEL 1264582 CELLULAR ANGUILLA MOB DIGICEL 1264581 CELLULAR ARGENTINA CELLULAR 549 CELLULAR ARMENIA ARMENTEL 37443 CELLULAR ARMENIA ARMENTEL 37499 CELLULAR ARMENIA ARMENTEL 37491 CELLULAR ARMENIA ARMENTEL 37496 CELLULAR ARMENIA K-TELECOM 37493 CELLULAR ARMENIA K-TELECOM 37449 CELLULAR ARMENIA K-TELECOM 37477 CELLULAR ARMENIA K-TELECOM 37494 CELLULAR ARMENIA K-TELECOM 37498 CELLULAR ARMENIA MOB-NAGORNI KARABAKH 37497 CELLULAR ARMENIA ORANGE 37441 CELLULAR ARMENIA