Another Step Forward for the Power Sector As International Investors Bide Their Time

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Africa Les Leaders Économiques De Demain

CLASSEMENT 2O14 AFRICA Les leaders économiques de demain PARTENAIRES Pascal Lorot Président, Institut Choiseul ous assistons aujourd’hui au grand compétences de celles et ceux dont l’action Nréveil de l’ Afrique. Longtemps contribue à façonner le destin de leurs pays considérée comme la grande oubliée de et de l’ ensemble du continent, l’Institut la mondialisation, elle s’installe peu à peu Choiseul a voulu mettre en lumière dans le paysage géoéconomique et s’impose l’action de ces jeunes leaders économiques durablement comme l’un des principaux qui bâtissent l’ Afrique d’aujourd’hui et moteurs de la croissance mondiale. préparent celle de demain. Forte de nouvelles grandes puissances Le Choiseul 100 Africa vise à identifier ces émergentes, d’ entreprises dynamiques femmes et ces hommes de 40 ans et moins, et florissantes, dans tous les secteurs, qui s’ engagent sur le chemin de la réussite dans tous les domaines, l’ Afrique évolue, et dont l’ambition est d’amener l’ Afrique se transforme, se réinvente. Au-delà de au plus haut degré de son développement l’ exploitation de ses ressources en matières économique, social et culturel. Qu’ils soient premières, l’ Afrique se tourne aujourd’hui à la tête de grandes entreprises, dirigeants de vers une économie plus mature et plus PME, investisseurs ou porteurs de projets diversifiée. Ainsi, sur tout le continent, ce personnels structurants, ils ont tous en sont de grands chantiers qui s’ ouvrent, des commun l’ excellence de leur parcours, des projets innovants qui se développent, des réseaux influents, un potentiel hors norme leviers de croissance qui se créent. -

Deep Breathing Is the Order of The

Hof Communications Cape Town 10 December 2017 This editorial is the opinion of the editors of ParlyReport Deep breathing is the order of the day fter having endured so many of President Jacob Zuma’s cabinet reshuffles, most of them in his A own interests, it is painful to think that in all probability there is still one more shuffle to go. In the past, this regular passing of the hat has allowed minister after minister to side-step the truth and report to Parliament on a “it wasn’t me” basis. It has been the bane of Zuma’s presidency and in many cases the cover up for wholesale corruption and the ineptitude of some of those anointed. When the music stops… So, it is with trepidation that Parliament awaits another round of new ministerial faces which will probably coincide with a new round of appointments of chairperson of committees, let alone some new faces in the benches. This is all at a time when the economy sits at tipping point. Once again, the parliamentary telephone directory will be at the mercy of ever-changing power battles within the governing party, a minor matter it may seem, but which somehow represents the country-wide breakdown in communications across of whole section of the governance and political spectrum. It occurs every time cabinet portfolios get switched around. This waiting period for new faces is the same as the usual vacuum before an election. In this case, however, the ordinary Joe has no say in outcome. In an election, one sees a manifesto of beliefs, values, policies and an appeal to the electorate. -

Nigeria: from Goodluck Jonathan to Muhammadu Buhari ______

NNoottee ddee ll’’IIffrrii _______________________ Nigeria: From Goodluck Jonathan to Muhammadu Buhari _______________________ Benjamin Augé December 2015 This study has been realized within the partnership between the French Institute of International Relations (Ifri) and OCP Policy Center The French Institute of International Relations (Ifri) is a research center and a forum for debate on major international political and economic issues. Headed by Thierry de Montbrial since its founding in 1979, Ifri is a non- governmental and a non-profit organization. As an independent think tank, Ifri sets its own research agenda, publishing its findings regularly for a global audience. Using an interdisciplinary approach, Ifri brings together political and economic decision-makers, researchers and internationally renowned experts to animate its debate and research activities. With offices in Paris and Brussels, Ifri stands out as one of the rare French think tanks to have positioned itself at the very heart of European debate. OCP Policy Center is a Moroccan policy-oriented think tank whose mission is to contribute to knowledge sharing and to enrich reflection on key economic and international relations issues, considered as essential to the economic and social development of Morocco, and more broadly to the African continent. For this purpose, the think tank relies on independent research, a network of partners and leading research associates, in the spirit of an open exchange and debate platform. By offering a "Southern perspective" from a middle-income African country, on major international debates and strategic challenges that the developing and emerging countries are facing, OCP Policy Center aims to make a meaningful contribution to four thematic areas: agriculture, environment and food security; economic and social development; commodity economics and finance; and “Global Morocco”, a program dedicated to understanding key strategic regional and global evolutions shaping the future of Morocco. -

UNITED STATES of AMERICA, ) ) Plaintiff, ) VERIFIED COMPLAINT ) - V.- ) ) REAL PROPERTY LOCATED in LOS ) Civil No

Case 4:20-cv-02524 Document 1 Filed on 07/16/20 in TXSD Page 1 of 47 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF TEXAS HOUSTON DIVISION ______________________________________ ) UNITED STATES OF AMERICA, ) ) Plaintiff, ) VERIFIED COMPLAINT ) - v.- ) ) REAL PROPERTY LOCATED IN LOS ) Civil No. 4:20-cv-02524 ANGELES, CALIF., COMMONLY ) KNOWN AS 755 SARBONNE ROAD, LOS ) ANGELES, CALIF. 90077, AND ALL ) APPURTENANCES, IMPROVEMENTS, ) AND ATTACHMENTS LOCATED ) THEREON, AND ANY PROPERTY ) TRACEABLE THERETO, ) ) Defendant In Rem ) _________________________ ) ) Comes now the Plaintiff, the United States of America, through its undersigned attorneys, and alleges, upon information and belief, as follows: I. NATURE OF THE ACTION 1. This is an action in rem to forfeit a parcel of luxury real estate derived from an international conspiracy to obtain lucrative business opportunities in the Nigerian oil and gas sector in return for corruptly offering and giving millions of dollars’ worth of gifts and benefits to the former Nigerian Minister for Petroleum Resources, Diezani Alison-Madueke (“ALISON- Case 4:20-cv-02524 Document 1 Filed on 07/16/20 in TXSD Page 2 of 47 MADUEKE”); and to subsequently launder the proceeds of the illicit business opportunities into and through the United States. 2. From in or about April 2010 until in or about May 2015, ALISON-MADUEKE— who was often referred to as “the Madam” or “Madam D”—was Nigeria’s Minister for Petroleum Resources. In that role, she was responsible for overseeing Nigeria’s state-owned oil company, -

Africa Economic Leaders for Tomorrow

RANKING 2O14 AFRICA Economic Leaders for Tomorrow PA R TNE R S Pascal Lorot President, Institut Choiseul oday, we are witnessing the competences of those whose actions Tawakening of Africa. Considered contribute to shape the destiny of their for so long as the forgotten one of the country and of the all continent, the Institut globalization, it is slowly establishing itself Choiseul wanted to enlighten the action in the geo-economical landscape, imposing of those young economic leaders who are itself on the long term as one of the major building the Africa of today and preparing driving force of the global growth. the one to become. With its new great emergent powers, its The Choiseul 100 Africa aims to identify dynamic and thriving companies, in every those men and women who are 40 years old sector, every field, Africa is evolving, is being and below, who are engaged in the way of transformed, reinventing itself. Beyond the success and have the ambition of lifting exploitation of its raw materials, Africa is Africa to its highest level of economical, turning today toward a more mature and societal and cultural development. At The diversified economy. Therefore, all around head of big companies, managers of a SMB, the continent, great programs are launched, investors or creators of large-scale projects, projects are developed, growth levers are they all have in common the excellence created. of their background, a social influences, a This new paradigm is made possible high potential and a capacity to do without by the flood of financing coming from common measure. -

WINTER 2013 V8:Layout 1.Qxd

WINTER 2013 v8_2-825459627.e$S:Layout 1 15/12/2013 18:29 Page 1 This Contest is aimed at celebrating the Nigerian women in the diaspora and to give a voice to their yearnings and aspirations. Chidera is a young girl that epitomizes beauty and brains and we wish her the best in her reign. Other bumper stories include spotlights on (a) Uzo Udemba, Chairman/CEO of Trend Media Group that plans to recreate urban living through the development of the Trend Media City (b) Folorunsho Alakija- Nigeria's richest woman and how she rose to wealth and fame (c) Flavor Nabannia and the rave music that he It is yet another holiday season and time to creates count all our blessings.. We also have spotlights on the magic of God has been good to us despite all the tra- Kenya, Plateau State, the tourism capital of vails we may have experienced in this outgoing Nigeria and the grand Induction of Umuada ndi year: the struggling economy, the struggle to Igbo in Diaspora Inc. Baltimore Maryland Chapter. balance our budgets, and for those of us from In addition to all these we do have our regu- Nigeria, the reports of insecurity in our country: lar columnists, Dr. Olufemi Saliu on HEALTH the Boko Haram menace, the continued reports and NUTRITION, Pastor Dipo Kalejaiye on RE- of kidnappings, etc... LIGION, Dr. Nicoline Ambe on LIFE'S ISSUES, That is however not the full picture and that Ijeoma Nwawka - YOUTH COLUMN, Grace is not the report we will believe.. Neequaye on GOING HOME FOR CHRISTMAS God has been our strong tower and our and a brand new columnist, Iruka Ndubuizu refuge during life's storms. -

Choiseul 100 Africa

RANKING 2O18 AFRICA Economic Leaders for Tomorrow PARTNERS 2 Pascal Lorot Chairman, Institut Choiseul frica is inserting itself more than and accomplishment. These entrepreneurs Aever in global economic circuits perfectly know the practices and the where it is imposing as a central actor. expectations of an international business After a year of slowing growth in 2016, world in which they integrate with Africa is demonstrating its great resilience brilliance. capacity. According to the African Bank The purpose ofChoiseul 100 Africa – of Development, the GDP growth has the Economic Leaders for Tomorrow is increased in 2017 to reach 3.6%, and to honor those exceptional profiles who will exceed 4% in 2018 and 2019 thanks contribute to the renewing of the African to several factors: the staging of great economic governance. For this fifth infrastructures projects, the growth of edition, the Institut Choiseul called on a sustained domestic demand as well as the best observers of the continent, along the improvement of the international with local actors who make the African economic context. economic actuality. The objective of this Nevertheless, Africa is still facing structural process is to identify the entrepreneurs impediments which stem its development : who will make tomorrow’s Africa and who the lack of infrastructures and equipment, will carry its growth. the dependency on raw materials of many We are proud to introduce in this ranking continental economies among the most the best representatives of this new wave important ones which expose Africa to of successful leaders and entrepreneurs exogenous shocks, the insufficiency of who already are references nationally, human capital… Many characteristics regionally or continentally. -

Download Choiseul 100 Africa 2019

CHOISEUL AFRICA AFRICA Economic Leaders for Tomorrow 2O19 In partnership with SOCIETE GENERALE Brand Block 2L R0-G0-B0 HEXA #000000 File: 18J2953E R233-G4-B30 Date : 23/10/2018 HEXA #E9041E AC/DC validation : Client validation : 2 Pascal Lorot Chairman, Institut Choiseul am delighted to present the newest Always seeking to explore new forms of Iedition of the Choiseul 100 Africa, a economic cooperation between Africa ranking independently carried out by the and France, it is with the enthusiasm of Institut Choiseul in order to honour the early days that the Institut Choiseul has 100 most talented young African economic searched the African continent to identify leaders of their generation. these economic leaders who are both the Created in 2014, the Choiseul 100 Africa guarantors of a unique identity and the showcases the men and women who, builders of a new economic governance. through their dynamism and belief As we have done since the first edition, in what the future holds, are taking this ranking attempts to represent the Africa with them on the path to success. continent in its diversity and complexity in This youth has embraced the values of order to paint the most accurate picture of excellence, abnegation and sharing so that the dynamics at work on the continent. the continent can take advantage of the Whether they are entrepreneurs or unmatched opportunities it holds, and successful start-uppers, whether they which are envied around the world. hold executive positions in institutions, or Close to local realities and open to the have brilliantly taken up the reins of the global issues that they perceive with family business, these conquerors are all uncommon acuteness, these talents references within their ecosystem. -

The High Court of South Africa

THE HIGH COURT OF SOUTH AFRICA (WESTERN CAPE DIVISION) JUDGMENT Case No: 4305/18 In the matter between CENTRAL ENERGY FUND SOC LTD FIRST APPLICANT SSTRATEGIC FUEL FUND ASSOCIATION SECOND APPLICANT NNPC and VENUS RAYS TRADE (PTY) LTD FIRST RESPONDENT GLENCORE ENERGY (UK) LTD SECOND RESPONDENT TALEVERAS PETROLEUM TRADING THIRD RESPONDENT DMCC CONTANGO TRADING SA FOURTH RESPONDENT NATIXIS SA FIFTH RESPONDENT VESQUIN TRADING (PTY) LTD SIXTH RESPONDENT VITOL ENERGY (SA) (PTY) LTD SEVENTH RESPONDENT VITOL SA EIGHTH RESPONDENT MINISTER OF ENERGY NINTH RESPONDENT 2 MINISTER OF FINANCE TENTH RESPONDENT Coram: Rogers J Heard: 14-16 September, 23 October 2020; supplementary submissions on 10 November 2020 Delivered: 20 November 2020 (by email to the parties and same-day release to SAFLII) 3 JUDGMENT _____________________________________________________________________ Rogers J Introduction [1] This case is about the sale, in late 2015/early 2016, of South Africa’s strategic stock of 10 million barrels of crude oil for about $281 million. The seller was the second applicant (‘SFF’), which is a wholly-owned subsidiary of the first applicant (‘CEF). They are public entities listed in Schedule 2 of the Public Finance Management Act 1 of 1999 (‘PFMA’). They seek the review and setting aside of the decisions to sell the oil and of the ensuing transactions. [2] The oil is 5 million barrels of Basrah Light (‘Basrah’, an Iraq oil) and 5 million barrels of Bonny Light (‘Bonny’, a Nigerian oil). Basrah is less valuable than Bonny because it is heavier and has more sulphur. SFF has six underground storage tanks at Saldanha Bay with a combined capacity of 44,4 million barrels. -

Ranking 2O18

RANKING 2O18 AFRICA Economic Leaders for Tomorrow PARTNERS 2 Pascal Lorot Chairman, Institut Choiseul frica is inserting itself more than and accomplishment. These entrepreneurs Aever in global economic circuits perfectly know the practices and the where it is imposing as a central actor. expectations of an international business After a year of slowing growth in 2016, world in which they integrate with Africa is demonstrating its great resilience brilliance. capacity. According to the African Bank The purpose ofChoiseul 100 Africa – of Development, the GDP growth has the Economic Leaders for Tomorrow is increased in 2017 to reach 3.6%, and to honor those exceptional profiles who will exceed 4% in 2018 and 2019 thanks contribute to the renewing of the African to several factors: the staging of great economic governance. For this fifth infrastructures projects, the growth of edition, the Institut Choiseul called on a sustained domestic demand as well as the best observers of the continent, along the improvement of the international with local actors who make the African economic context. economic actuality. The objective of this Nevertheless, Africa is still facing structural process is to identify the entrepreneurs impediments which stem its development : who will make tomorrow’s Africa and who the lack of infrastructures and equipment, will carry its growth. the dependency on raw materials of many We are proud to introduce in this ranking continental economies among the most the best representatives of this new wave important ones which expose Africa to of successful leaders and entrepreneurs exogenous shocks, the insufficiency of who already are references nationally, human capital… Many characteristics regionally or continentally. -

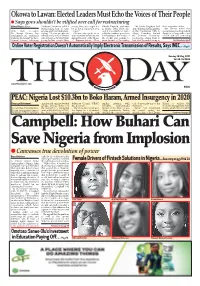

Campbell: How Buhari Can Save Nigeria from Implosion

Okowa to Lawan: Elected Leaders Must Echo the Voices of Their People Says govs shouldn’t be vilified over call for restructuring Udora Orizu in Abuja Southern Governors’ call for voices, then, you ought not Ndudi Elumelu, yesterday The Senate President had their respective states. restructuring, ban on open be in the position that you in Asaba, Delta State, also after observing the Eid prayers But Okowa noted that Delta State Governor, grazing and fiscal federalism, occupy.” said it was utterly wrong to at the Presidential Villa in restructuring has been talked Dr. Ifeanyi Okowa, has saying, “If your people are Okowa, who spoke at an vilify the southern governors Abuja, Thursday, faulted about for so long, with voices condemned the statement talking and you’re an elected empowerment scheme by the for heeding to the voices of the Southern Governors’ of PDP and APC endorsing made by the Senate President, person but you shy away from minority leader of the House the people and seeking to resolutions, asking them to Ahmed Lawan, following giving further voice to their of Representatives, Hon. promote unity in the country. first start the restructuring in Continued on page 5 Online Voter Registration Doesn’t Automatically Imply Electronic Transmission of Results, Says INEC… Page 8 Sunday 16 May, 2021 Vol 26. No 9533 www.thisdaylive.com T N400 RU N TH & REASO PEAC: Nigeria Lost $10.3bn to Boko Haram, Armed Insurgency in 2020 Gboyega Akinsanmi agitation and organised violent Advisory Council (PEAC) regular meeting with cost of insecurity across the Salami to replace the groups, among others, cost has disclosed. -

In the Federal High Court of Nigeria in the Abuja Judicial Division Holding at Abuja on Monday the 21St Day of October, 2019 Before His Lordship, Hon

IN THE FEDERAL HIGH COURT OF NIGERIA IN THE ABUJA JUDICIAL DIVISION HOLDING AT ABUJA ON MONDAY THE 21ST DAY OF OCTOBER, 2019 BEFORE HIS LORDSHIP, HON. JUSTICE B.F.M. NYAKO CAUSE LIST, COURT 2 S/NO SUIT NUMBER PARTIES FOR 1. FHC/ABJ/CR/119/19 INSPECTOR GENEERAL OF POLICE PLEA VS MARYAM AWAISU 2. FHC/ABJ/CR/673/18 REGD. TRUST OF NIGERIA PORTS USERS & MENTION OPERATORS ASSOCIATION & ANOR VS SIR MIKE JUKWE & 2 ORS 3. FHC/ABJ/CS/219/18 INCORP. TRUSTEE OF VOLUNTEER LEGAL MENTION PRACTITIONERS FOUNDATION FOR PROMOTION OF MORALS & VALUES VS ATTORNEY GENERAL OF THE FEDERATION & 4 ORS 4. FHC/ABJ/CS/763/16 KENNETH NNAMDI OBI MENTION VS MIN. OF FOREIGN AFFAIRS & 3 ORS 5. FHC/ABJ/CS/1292/18 RANGER SUBSEA NIG, LTD MENTION VS INSPECTOR GENERAL OF POLICE & 7 ORS 6. FHC/ABJ/CS/668/19 CHIEF (MRS.) MARGARET O. IDISI & 2 ORS MENTION VS ACCESS BANK & 2 ORS 7. FHC/ABJ//CS/123/17 A M C O N MENTION VS CAPITAL ACCOMMODATION SERVICE & APARTMENT & LUXURY ROOMS & ANOR 8. FHC/ABJ/CS/125/19 EMMANUEL CHARLES ANGASIE MENTION VS DEPARTMENT OF STATE SERVICES 9. FHC/ABJ/CS/943/19 A M C O N MENTION VS SNECOU NIG. LTD & ANOR 10. FHC/ABJ/CS/746/17 PAN AFRICAN INT’L NIG. LTD MENTION VS A M C O N & 2 ORS 11. FHC/ABJ/CS/833/2000 CHIEF HARRY AKANDE M/EXPARTE VS PLATEAU STATE GOVT. & ORS 12. FHC/ABJ/CS/1122/19 BOMA EZEKIEL-HART M/EXPARTE FH VS INSPECTOR GENERAL OF POLICE 13.