Taiwan Cooperative Bank

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Taiwan Cooperative Bank, Thanks to the Use of Its Branch Network and Its Advantage As a Local Operator, Again Created Brilliant Operating Results for the Year

Stock No: 5854 TAIWAN COOPERATIVE BANK SINCE 1946 77, KUANCHIEN ROAD, TAIPEI TAIWAN TAIWAN, REPUBLIC OF CHINA COOPERATIVE TEL: +886-2-2311-8811 FAX: +886-2-2375-2954 BANK http://www.tcb-bank.com.tw Spokesperson: Tien Lin / Kuan-Young Huang Executive Vice President / Senior Vice President & General Manager TEL : +886-2-23118811 Ext.210 / +886-2-23118811 Ext.216 E-mail: [email protected] / [email protected] CONTENTS 02 Message to Our Shareholders 06 Financial Highlights 09 Organization Chart 10 Board of Directors & Supervisors & Executive Officers 12 Bank Profile 14 Main Business Plans for 2008 16 Market Analysis 20 Risk Management 25 Statement of Internal Control 28 Supervisors’ Report 29 Independent Auditors’ Report 31 Financial Statement 37 Designated Foreign Exchange Banks 41 Service Network Message to Our Shareholders Message to Our Shareholders Global financial markets were characterized by relative instability in 2007 because of the impact of the continuing high level of oil prices and the subprime crisis in the United States. Figures released by Global Insight Inc. indicate that global economic performance nevertheless remained stable during the year, with the rate of economic growth reaching 3.8%--only marginally lower than the 3.9% recorded in 2006. Following its outbreak last August, the negative influence of the subprime housing loan crisis in the U.S. spread rapidly throughout the world and, despite the threat of inflation, the U.S. Federal Reserve lowered interest rates three times before the end of 2007, bringing the federal funds rate down from 5.25% to 4.25%, in an attempt to avoid a slowdown in economic growth and alleviate the credit crunch. -

Central Bank of the Republic of China (Taiwan)

Central Bank of the Republic of China (Taiwan) Financial Stability Report May 2016 | Issue No. 10 Table of contents About the Financial Stability Report ..................................................................................... I Abstract ..................................................................................................................................... I I. Overview................................................................................................................................ 1 II. Macro environmental factors potentially affecting financial sector ............................ 13 2.1 International economic and financial conditions .......................................................... 13 2.2 Domestic economic conditions ..................................................................................... 29 2.3 Non-financial sectors .................................................................................................... 34 III. Financial sector assessment ............................................................................................ 49 3.1 Financial markets .......................................................................................................... 49 3.2 Financial institutions ..................................................................................................... 58 3.3 Financial infrastructure ................................................................................................. 89 IV. Measures to maintain financial stability -

6-Translation Exercises Unit11-15

6 Translation: For Each Part 189 6. Translation Exercises, Units 11–24: For Each Part (Lesson) Unit 11, Part 1: Translation Exercise NAME ____________________________________________ COURSE ___________________________ DATE ___________________________ Translate the following sentences into Pinyin romanization with correct tone marks. If you have forgot- ten a word, consult the English-Chinese Glossary in the back of your textbook. 1. Relax, there is no problem. 2. Eat faster, we only have half an hour. 3. How long have you been in America? 4. That was terrifying! Drive more slowly, OK? 5. She has been working at the Bank of Taiwan for ten years. IIMCMC SSpeakingpeaking & ListeningListening PB_INT.inddPB_INT.indd 189189 119/10/179/10/17 22:16:16 ppmm 190 6 Translation: For Each Part Unit 11, Part 2 Unit 11, Part 2: Translation Exercise NAME ____________________________________________ COURSE ___________________________ DATE ___________________________ Translate the following sentences into Pinyin romanization with correct tone marks. If you have forgot- ten a word, consult the English-Chinese Glossary in the back of your textbook. 1. How often is there a bus? 2. There’s a bus every fifteen minutes. 3. Strange, she hasn’t come for two weeks. 4. I normally drive a car; I haven’t taken the subway for a long time. 5. That’s embarrassing; the $10 dollar ones are all sold out, only the $15 ones are left. IIMCMC SSpeakingpeaking & ListeningListening PB_INT.inddPB_INT.indd 190190 119/10/179/10/17 22:16:16 ppmm Unit 11, Part 3 6 Translation: For Each Part 191 Unit 11, Part 3: Translation Exercise NAME ____________________________________________ COURSE ___________________________ DATE ___________________________ Translate the following sentences into Pinyin romanization with correct tone marks. -

Website : the Bank Website

Website : http://newmaps.twse.com.tw The Bank Website : http://www.landbank.com.tw Time of Publication : July 2018 Spokesman Name: He,Ying-Ming Title: Executive Vice President Tel: (02)2348-3366 E-Mail: [email protected] First Substitute Spokesman Name: Chu,Yu-Feng Title: Executive Vice President Tel: (02) 2348-3686 E-Mail: [email protected] Second Substitute Spokesman Name: Huang,Cheng-Ching Title: Executive Vice President Tel: (02) 2348-3555 E-Mail: [email protected] Address &Tel of the bank’s head office and Branches(please refer to’’ Directory of Head Office and Branches’’) Credit rating agencies Name: Moody’s Investors Service Address: 24/F One Pacific Place 88 Queensway Admiralty, Hong Kong. Tel: (852)3758-1330 Fax: (852)3758-1631 Web Site: http://www.moodys.com Name: Standard & Poor’s Corp. Address: Unit 6901, level 69, International Commerce Centre 1 Austin Road West Kowloon, Hong Kong Tel: (852)2841-1030 Fax: (852)2537-6005 Web Site: http://www.standardandpoors.com Name: Taiwan Ratings Corporation Address: 49F., No7, Sec.5, Xinyi Rd., Xinyi Dist., Taipei City 11049, Taiwan (R.O.C) Tel: (886)2-8722-5800 Fax: (886)2-8722-5879 Web Site: http://www.taiwanratings.com Stock transfer agency Name: Secretariat land bank of Taiwan Co., Ltd. Address: 3F, No.53, Huaining St. Zhongzheng Dist., Taipei City 10046, Taiwan(R,O,C) Tel: (886)2-2348-3456 Fax: (886)2-2375-7023 Web Site: http://www.landbank.com.tw Certified Publick Accountants of financial statements for the past year Name of attesting CPAs: Gau,Wey-Chuan, Mei,Ynan-Chen Name of Accounting Firm: KPMG Addres: 68F., No.7, Sec.5 ,Xinyi Rd., Xinyi Dist., Taipei City 11049, Taiwan (R.O.C) Tel: (886)2-8101-6666 Fax: (886)2-8101-6667 Web Site: http://www.kpmg.com.tw The Bank’s Website: http://www.landbank.com.tw Website: http://newmaps.twse.com.tw The Bank Website: http://www.landbank.com.tw Time of Publication: July 2018 Land Bank of Taiwan Annual Report 2017 Publisher: Land Bank of Taiwan Co., Ltd. -

Ctbc Financial Holding Co., Ltd. and Subsidiaries

1 Stock Code:2891 CTBC FINANCIAL HOLDING CO., LTD. AND SUBSIDIARIES Consolidated Financial Statements With Independent Auditors’ Report For the Six Months Ended June 30, 2019 and 2018 Address: 27F and 29F, No.168, Jingmao 2nd Rd., Nangang Dist., Taipei City 115, Taiwan, R.O.C. Telephone: 886-2-3327-7777 The independent auditors’ report and the accompanying consolidated financial statements are the English translation of the Chinese version prepared and used in the Republic of China. If there is any conflict between, or any difference in the interpretation of the English and Chinese language independent auditors’ report and consolidated financial statements, the Chinese version shall prevail. 2 Table of contents Contents Page 1. Cover Page 1 2. Table of Contents 2 3. Independent Auditors’ Report 3 4. Consolidated Balance Sheets 4 5. Consolidated Statements of Comprehensive Income 5 6. Consolidated Statements of Changes in Stockholder’s Equity 6 7. Consolidated Statements of Cash Flows 7 8. Notes to the Consolidated Financial Statements (1) History and Organization 8 (2) Approval Date and Procedures of the Consolidated Financial Statements 8 (3) New Standards, Amendments and Interpretations adopted 9~12 (4) Summary of Significant Accounting Policies 12~39 (5) Primary Sources of Significant Accounting Judgments, Estimates and 40 Assumptions Uncertainty (6) Summary of Major Accounts 40~202 (7) Related-Party Transactions 203~215 (8) Pledged Assets 216 (9) Significant Contingent Liabilities and Unrecognized Contract 217~226 Commitment (10) Significant Catastrophic Losses 227 (11) Significant Subsequent Events 227 (12) Other 227~282 (13) Disclosures Required (a) Related information on significant transactions 283~287 (b) Related information on reinvestment 287~289 (c) Information on investment in Mainland China 289~290 (14) Segment Information 291 KPMG 11049 5 7 68 ( 101 ) Telephone + 886 (2) 8101 6666 台北市 信義路 段 號 樓 台北 大樓 68F., TAIPEI 101 TOWER, No. -

The History and Politics of Taiwan's February 28

The History and Politics of Taiwan’s February 28 Incident, 1947- 2008 by Yen-Kuang Kuo BA, National Taiwan Univeristy, Taiwan, 1991 BA, University of Victoria, 2007 MA, University of Victoria, 2009 A Dissertation Submitted in Partial Fulfillment of the Requirements for the Degree of DOCTOR OF PHILOSOPHY in the Department of History © Yen-Kuang Kuo, 2020 University of Victoria All rights reserved. This dissertation may not be reproduced in whole or in part, by photocopy or other means, without the permission of the author. ii Supervisory Committee The History and Politics of Taiwan’s February 28 Incident, 1947- 2008 by Yen-Kuang Kuo BA, National Taiwan Univeristy, Taiwan, 1991 BA, University of Victoria, 2007 MA, University of Victoria, 2009 Supervisory Committee Dr. Zhongping Chen, Supervisor Department of History Dr. Gregory Blue, Departmental Member Department of History Dr. John Price, Departmental Member Department of History Dr. Andrew Marton, Outside Member Department of Pacific and Asian Studies iii Abstract Taiwan’s February 28 Incident happened in 1947 as a set of popular protests against the postwar policies of the Nationalist Party, and it then sparked militant actions and political struggles of Taiwanese but ended with military suppression and political persecution by the Nanjing government. The Nationalist Party first defined the Incident as a rebellion by pro-Japanese forces and communist saboteurs. As the enemy of the Nationalist Party in China’s Civil War (1946-1949), the Chinese Communist Party initially interpreted the Incident as a Taiwanese fight for political autonomy in the party’s wartime propaganda, and then reinterpreted the event as an anti-Nationalist uprising under its own leadership. -

Chbannualreport2006.Pdf

൴֏ˠ Spokesman щ NameĈJames ShihޙؖЩĈ߉ ᖚჍĈઘᓁགྷந TitleĈExecutive Vice President ྖĈ(02)2536-295102)2536-2951)2536-29512536-2951 TelĈ(02) 2536-2951 E-mail [email protected] ̄ฎІܫቐĈ[email protected] Ĉ Acting Spokesman ந൴֏ˠ NameĈJames Y.G.Chen ؖЩĈౘ̯ซ TitleĈExecutive Vice President ᖚჍĈઘᓁགྷந TelĈ(02) 2536-2951 ྖĈ(02)2536-295102)2536-2951)2536-29512536-2951 E-mailĈ[email protected] ̄ฎІܫቐĈ[email protected] Addresses of Chang Hwa Bank Head Office ᓁҖгӬ Ŝ Taichung: 38,Tsu Yu Rd., Sec. 2,Taichung,Taiwan, R.O.C. Ŝ έ̚Ĉέ̚ᦦҋϤྮ˟߱38ཱི Tel: (04) 2222-2001 ྖĈ(04)2222-2001 Ŝ Taipei: 57, Chung Shan N. Rd., Sec. 2,Taipei,Taiwan, Ŝ έΔĈέΔᦦ̋̚Δྮ˟߱57ཱི R.O.C. ྖĈ(02)2536-2951 Tel: (02) 2536-2951 Web Site: http://www.chb.com.tw ᅙҖშӬĈhttp://www.chb.com.tw Stock Registration Offices of Chang Hwa Bank Ᏹந۵ை࿅͗፟ၹ Ŝ Name: Shareholders' Service Section, Secretariat Division .Ŝ ЩჍĈၓ̼ᅙҖ৪३۵ચࡊ Address: 38,Tsu Yu Rd., Sec. 2,Taichung,Taiwan, R.O.C гӬĈέ̚ᦦҋϤྮ˟߱38ཱི Tel: (04) 2222-2001 ྖĈ(04)2222-2001 Ŝ Name:Taipei Service Center of Shareholders' Service Ŝ ЩჍĈၓ̼ᅙҖ৪३۵ચࡊ Section, Secretariat Division ,ચ͕̚ Address: 57, Chung Shan N. Rd., Sec. 2,Taipei,TaiwanڇāāāέΔ гӬĈέΔᦦ̋̚Δྮ˟߱57ཱི R.O.C. ྖĈ(02)2536-2951 Tel: (02) 2536-2951 შӬĈhttp://www.chb.com.tw Web Site: http://www.chb.com.tw Credit Rating Agency ܫϡෞඈ፟ၹ Moody's Taiwan Corporation ϡෞඈ۵Њѣࢨ̳ΦܫЩჍĈ᎗࢚ AddressĈRm. 1813, 18F,333, Keelung Rd., Sec 1, 110 333 18 1813 гӬĈέΔᦦ ૄษྮ˘߱ ཱི ሁ ވ Taipei, 110 Taiwan ྖĈ(02) 2757-7125 Tel: 886-2-2757-7125 ็ৌĈ(02) 2757-7129 Fax: 886-2-2757-7129 ᘪᙋົࢍर CPA-auditor of the Financial Report னЇົࢍर Present CPA ؖЩĈችԈேăਃၷᐌ NameĈHung-Hsiang Tsai, Long-Swei Won ࢍरְચٙ CompanyĈDeloitte & ToucheົܫચٙЩჍĈ๔ຽிְ 3߱156ཱི12ሁ AddressĈ12th Floor, Hung-TaiPlaze 156 MinSheng EastྮڌડϔϠ̋ڗгӬĈέΔξ105 Rd., Sec. -

Directory of Head Office and Branches

Directory of Head Office and Branches I. Domestic Business Units II. Overseas Units BANK OF TAIWAN 14 2009 Annual Report I. Domestic Business Units 120 Sec 1, Chongcing South Road, Jhongjheng District, Taipei City 10007, Taiwan (R.O.C.) P.O. Box 5 or 305, Taipei, Taiwan SWIFT: BKTWTWTP http://www.bot.com.tw TELEX:11201 TAIWANBK CODE OFFICE ADDRESS TELEPHONE FAX Head Office No.120 Sec. 1, Chongcing South Road, Jhongjheng District, 0037 Department of Business 02-23493456 02-23759708 Taipei City 1975 Bao Qing Mini Branch No.35 Baocing Road Taipei City 02-23311141 02-23319444 Department of Public 0059 120, Sec. 1, Gueiyang Street, Taipei 02-23494123 02-23819831 Treasury 6F., No.49, Sec. 1, Wuchang Street, Jhongjheng District, 0082 Department of Trusts 02-23493456 02-23146041 Taipei City Department of 2329 45, Sec. 1, Wuchang Street, Taipei City 02-23493456 02-23832010 Procurement Department of Precious 2330 2-3F., Building B, No.49 Sec. 1, Wuchang St., Taipei City 02-23493456 02-23821047 Metals Department of Government 2352 6F., No. 140, Sec. 3, Sinyi Rd., Taipei City 02-27013411 02-27015622 Employees Insurance Offshore Banking 0691 1st Fl., No.162 Boai Road, Taipei City 02-23493456 02-23894500 Department Northern Area 0071 Guancian Branch No.49 Guancian Road, Jhongjheng District, Taipei City 02-23812949 02-23753800 No.120 Sec. 1, Nanchang Road, Jhongjheng District, Taipei 0336 Nanmen Branch 02-23512121 02-23964281 City No.120 Sec. 4, Roosevelt Road, Jhongjheng District, Taipei 0347 Kungkuan Branch 02-23672581 02-23698237 City 0451 Chengchung Branch No.47 Cingdao East Road, Jhongjheng District, Taipei City 02-23218934 02-23918761 1229 Jenai Branch No.99 Sec. -

Taiwan Cooperative Financial Holding Co., Ltd. Handbook for the 2020 Annual General Shareholders’ Meeting (Summary Translation)

Stock Code:5880 Taiwan Cooperative Financial Holding Co., Ltd. Handbook for the 2020 Annual General Shareholders’ Meeting (Summary Translation) Time: 09:00 A.M., Wednesday, June 24th , 2020 Location: 1st Floor of Building B, No.225, Section 2, Chang’an East Road, Songshan District, Taipei City, Taiwan, R.O.C . (The Grand Auditorium of Taiwan Cooperative Bank Headquarters) This English version handbook is a summary translation of the Chinese version and is for reference only. If there is any discrepancy between the English version and Chinese version, the Chinese version shall prevail. - Table of Contents Matters for Reporting 1. TCFHC 2019 Business Performance………………………………………….. 2 2. TCFHC Audit Committee’s Review Opinions on 2019 Financial 3 Statements ……………………………………………………………………... 3. TCFHC 2019 Remuneration Distribution of Board of Directors and Employees 4 Report……………………………………………………………… Matters for Recognitions 1. Adoption of TCFHC 2019 Annual Business Report and Financial Statements.. 5 2. Adoption of TCFHC 2019 Earnings Appropriation…………………………… 40 Matters for Discussions 1. Proposal for New Shares Issued through Capitalization of 2019 Retained Earnings…………………………………………………………………………. 42 2. Amendment to TCFHC's Articles of Incorporation…………………………… 43 3. Amendment to the Rules for Director Elections………………………………. 58 4. Amendment to the Rules of Procedure for Shareholders’ Meeting……………. 64 Election Matters The 4th Election of Directors………………………………………………….. 81 Other Matters Proposal of Releasing the Prohibition on the 4th Directors from Participating 83 in Competitive Business……………………………………………………….. Appendices Appendix A Audit Committee Report……………………………………………. 6 Appendix B TCFHC 2019 Business Report……………………………………… 7 Appendix C Independent Auditors’ Report and TCFHC 2019 Financial 22 Statements…………………………………………………………… Appendix D TCFHC 2019 Earnings Appropriation Table……………………….. 41 Appendix E Amended TCFHC’s Articles of Incorporation and Comparison 44 Table…………………………………………………………………. -

Annual Report 2020 Central Bank of the Republic of China (Taiwan)

Annual Report 2020 Central Bank of the Republic of China (Taiwan) Taipei, Taiwan Republic of China Foreword Chin-Long Yang, Governor Looking back on 2020, it started with an outbreak of the coronavirus COVID-19 that quickly spread out and wreaked havoc on the global economy and world trade. Hampered by the resulting demand weakness both at home and abroad, Taiwan's economic growth slowed to 0.35% in the second quarter, the lowest since the second quarter of 2016. However, the pace picked up further and further in the latter half of the year amid economic reopening overseas and the introduction of consumption stimulus policies domestically. The annual growth rate of GDP reached 5.09% in the fourth quarter, the highest since the second quarter of 2011. For the year as a whole, the economy expanded by 3.11%, also higher than the past two years. Similarly, domestic inflation was affected by the pandemic as softer international demand for raw materials dragged down energy prices and hospitality services (such as travel and hotels) launched promotional price cuts. The annual growth rate of CPI dropped to -0.23%, the lowest since 2016, while that of the core CPI (excluding fruit, vegetables, and energy) fell to 0.35%, a record low unseen for more than a decade. Faced with the unusual challenges posed by pandemic-induced impacts on the economy and the labor market, the Bank reduced the policy rates by 25 basis points and rolled out a special accommodation facility worth NT$200 billion to help SMEs obtain funding in March, followed by an expansion of the facility to NT$300 billion in September. -

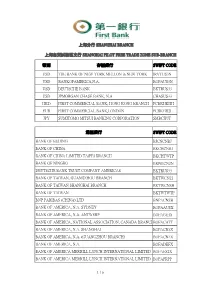

1 / 6 幣別 存匯銀行 Swift Code Usd the Bank of New York

上海分行 SHANGHAI BRANCH 上海自貿試驗區支行 SHANGHAI PILOT FREE TRADE ZONE SUB-BRANCH 幣別 存匯銀行 SWIFT CODE USD THE BANK OF NEW YORK MELLON in NEW YORK IRVTUS3N USD BANK OF AMERICA, N.A. BOFAUS3N USD DEUTSCHE BANK BKTRUS33 USD JPMORGAN CHASE BANK, N.A CHASUS33 HKD FIRST COMMERCIAL BANK, HONG KONG BRANCH FCBKHKHH EUR FIRST COMMERCIAL BANK,LONDON FCBKGB2L JPY SUMITOMO MITSUI BANKING CORPORATION SMBCJPJT 通匯銀行 SWIFT CODE BANK OF BEIJING BJCNCNBJ BANK OF CHINA BKCHCNBJ BANK OF CHINA LIMITED TAIPEI BRANCH BKCHTWTP BANK OF NINGBO BKNBCN2N DEUTSCHE BANK TRUST COMPANY AMERICAS BKTRUS33 BANK OF TAIWAN, GUANGZHOU BRANCH BKTWCN22 BANK OF TAIWAN SHANGHAI BRANCH BKTWCNSH BANK OF TAIWAN BKTWTWTP BNP PARIBAS (CHINA) LTD BNPACNSH BANK OF AMERICA, N.A. SYDNEY BOFAAUSX BANK OF AMERICA, N.A. ANTWERP BOFABE3X BANK OF AMERICA, NATIONAL ASSOCIATION, CANADA BRANCHBOFACATT BANK OF AMERICA, N.A. SHANGHAI BOFACN3X BANK OF AMERICA, N.A. (GUANGZHOU BRANCH) BOFACN4X BANK OF AMERICA, N.A. BOFADEFX BANK OF AMERICA MERRILL LYNCH INTERNATIONAL LIMITED BOFAES2X BANK OF AMERICA MERRILL LYNCH INTERNATIONAL LIMITED BOFAFRPP 1 / 6 通匯銀行 SWIFT CODE BANK OF AMERICA, N.A. LONDON BOFAGB22 BANK OF AMERICA, N.A. ATHENS BOFAGR2X BANK OF AMERICA, N.A. HONG KONG BOFAHKHX BANK OF AMERICA, N.A. JAKARTA BRANCH BOFAID2X BANK OF AMERICA, N.A. MUMBAI BOFAIN4X BANK OF AMERICA, N.A. BOFAIT2X BANK OF AMERICA, TOKYO BOFAJPJX BANK OF AMERICA, N.A. SEOUL BRANCH BOFAKR2X BANK OF AMERICA, MALAYSIA BERHAD BOFAMY2X BANK OF AMERICA, N.A. AMSTERDAM BOFANLNX BANK OF AMERICA, N.A. MANILA BOFAPH2X BANK OF AMERICA, N.A. SINGAPORE BOFASG2X BANK OF AMERICA (SINGAPORE) LTD. -

Taipei,China's Banking Problems: Lessons from the Japanese Experience

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Montgomery, Heather Working Paper Taipei,China's Banking Problems: Lessons from the Japanese Experience ADBI Research Paper Series, No. 42 Provided in Cooperation with: Asian Development Bank Institute (ADBI), Tokyo Suggested Citation: Montgomery, Heather (2002) : Taipei,China's Banking Problems: Lessons from the Japanese Experience, ADBI Research Paper Series, No. 42, Asian Development Bank Institute (ADBI), Tokyo, http://hdl.handle.net/11540/4148 This Version is available at: http://hdl.handle.net/10419/111142 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. https://creativecommons.org/licenses/by/3.0/igo/ www.econstor.eu ADB INSTITUTE RESEARCH PAPER 42 Taipei,China’s Banking Problems: Lessons from the Japanese Experience Heather Montgomery September 2002 Over the past decade, the health of the banking sector in Taipei,China has been in decline.