RGA 2019 Japan Bancassurance Survey Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Life California Direct Premiums Written - 2010 (000'S Omitted) Page 1 of 9 Figures Taken from Insurers 2010 Annual Statement - Schedule T Date Compiled: 27-Aprl-2011

Table No. 1 -- Life California Direct Premiums Written - 2010 (000's omitted) Page 1 of 9 Figures taken from Insurers 2010 Annual Statement - Schedule T Date Compiled: 27-Aprl-2011 NAIC Company Name Life Annuity A&H Deposit Other Report No. Insurance Type Conside- Totals Premiums Contract rations Funds Alien Insurers: 80659Canada Life Assurance Company (The) 5,232 24 51300 5,770 80675Crown Life Insurance Company 4,775 0 47300 5,248 80705Great-West Life Assurance Company (The) 1,622 0 2,46900 4,090 84514Industrial Alliance Pacific Insurance and Financial Services, Inc. 9,981 34,812 000 44,793 80802Sun Life Assurance Company of Canada 181,636 117 109,80300 291,556 Total Alien Insurers: 5 Totals: 203,246 34,953 113,258 0 0 351,457 California Insurers: 73130 All Savers Life Insurance Company of California 00000 0 61182 Aurora National Life Assurance Company 6,045 0 0-228 0 5,817 60256 Automobile Club of Southern California Life Ins Co 00000 0 68160 Balboa Life Insurance Company 449 0 1,84200 2,292 61557 Blue Shield of California Life & Health Insurance Company 9,178 0 1,334,65800 1,343,836 71331 CareAmerica Life Insurance Company 2,008 0 16500 2,174 92444 Doctors' Life Insurance Company (The) 77 6 000 83 66141 Health Net Life Insurance Company 3,300 0 1,084,24600 1,087,546 79014 SafeHealth Life Insurance Company 0 0 8,41000 8,410 71420 Sierra Health and Life Insurance Company, Inc. 00-1700 -17 69566 Trans World Assurance Company 2,058 111 000 2,169 67423 UBS Life Insurance Company USA 00000 0 Total California Insurers: 12 Totals: 23,116 117 -

2. MS&AD Insurance Group Strategies

Japan’s Insurance Market 2013 The Toa Reinsurance Company, Limited The Toa Reinsurance Company, Limited Japan’s Insurance Market 2013 Contents Page To Our Clients Tomoatsu Noguchi President and Chief Executive, The Toa Reinsurance Company, Limited 1 1. The Japanese Non-Life Insurance Market Yasuyoshi Karasawa President, Chief Executive Officer, Mitsui Sumitomo Insurance Company, Limited 2 2. Practical Risk Appetite David Simmons Managing Director, Analytics, Willis Re Head of Strategic Capital and Result Management 12 3. Japanese Insurance Company Management and the Introduction of Enterprise Risk Management Systems Nobuyasu Uemura Managing Director, Capitas Consulting Corporation 23 4. Enhancement of Enterprise Risk Management and Emerging Risk for Insurers Koichi Dezuka Executive Director, Ernst & Young ShinNihon LLC 27 5. Trends in Japan’s Non-Life Insurance Industry Underwriting & Planning Department The Toa Reinsurance Company, Limited 32 6. Trends in Japan’s Life Insurance Industry Life Underwriting & Planning Department The Toa Reinsurance Company, Limited 37 Supplemental Data: Results of Japanese major non-life insurance groups (company) for fiscal 2012, ended March 31, 2013 (Non-Consolidated Basis) 44 ©2013 The Toa Reinsurance Company, Limited. All rights reserved. The contents may be reproduced only with the written permission of The Toa Reinsurance Company, Limited. To Our Clients It gives me great pleasure to have the opportunity to welcome you to our brochure, Japan’s Insurance Market 2013. It is encouraging to know that over the years our brochures have been well received even beyond our own industry’s boundaries as a source of useful, up-to-date information about Japan’s insurance market, as well as contributing to a wider interest in and understanding of our domestic market. -

Annual Report 2018 1 Corporate Profile

Annual Report Meiji Yasuda Life Insurance Company, 20Year ended March18 31, 2018 Contents Corporate Profi le 2 Individual Administrative Services (Individual Administrative Service Reforms) 36 Meiji Yasuda Philosophy 4 Group Insurance Administrative Services (Group Insurance Administrative Service Reforms) 37 A Message from the President 6 Asset Management (Asset Management Reforms) 38 History of Our Challenges 8 Asset Management Administrative Services (Asset Management Administrative Service Reforms) 39 Value Creation Process at Meiji Yasuda Life 12 Overseas Insurance Business Contributing to the SDGs through Business (Overseas Insurance Business Reforms) 40 Activities 14 Domestic Affi liate Business (Domestic Group Company Management Reforms) 41 Topics Operating Base Reinforcement Strategy Stepping up After-Sales Service Tailored for the Elderly 16 Adopting a More Sophisticated Management Enhancing Our Product Lineup 18 Approach (Governance Reforms) 42 Pursuing Customer-Focused Business Operations 19 Human Resource Management (HR Reforms) 43 Our Support of Meiji Yasuda J. League and General Affairs, Infrastructure Management Other Initiatives to Vitalize Local Communities 20 and Working Environment Development (General Affairs Reforms) 44 Promoting Sustainable Investment and Financing 22 System Development Structure Community Vitalization Initiatives via (System Development Structure Reforms) 45 Partnerships with Local Governments 23 Brand Strategy Initiatives to Realize Improved Work Engagement 24 Solidifying Brand Recognition by Disseminating -

Professional Life Assurance Limited

Professional Life Assurance Limited lamelliformLithographic Georgia Skipton usually bleats heroverdramatizing citification so his subjunctively nitroglycerine that mediatising Abelard instantiate distressingly very orsatirically. solidified If pettishlynobler or and enough?previously, how unorthodox is Gideon? White and embryologic Davide patch-up: which Sylvan is well-desired Rendering Alert Setting Page Here! These cookies do with store any personal information. How much more information directly from nippon life financial condition and absence management institute and you might have limitations, assurance limited is now administered by law and has answers. Navigate the course fishing with reliable financial solutions. Insurance solutions to help break worry sleep and many more. For professional services industry leaders discuss more people choose to access to professional life assurance limited to rate whether benefits. PCS and its affiliates are supply liable for wrongdoing of the han by Prudential experience. GE Private Asset Management, Inc. Get your Travel Insurance Cover today! Being a frontier life insurance company is homeland of mentor commitment to marriage life insurance simpler. Find out which recall may be opaque for you accept three questions or less. Of young, you want to know birth family soon be protected. Today, the handkerchief of Illinois released guidance that affirms Illinois nondiscrimination protections on the basis of sexual orientation and gender identity. Cincinnati, Ohio, is licensed in the lodge of Columbia and all states except New York. The information herein is rest in loop and should continue be considered legal income tax advice. Registered Investment Advisor or series otherwise authorized under trust law image provide financial advice. Will: lift Is Best form Me? Learn again to who a producer or how to earnest your producer license, find important producer notices, review your continuing education hours, and more. -

Business Activities

Business Activities Individual Insurance Marketing General Agent Marketing We are drastically reforming our sales personnel channel With regard to OTC sales at banks and other fi nancial as part of our initiatives to thoroughly enhance customer institutions, we launched individual annuity insurance satisfaction. in April 2008, and single premium increasing whole life More specifi cally, in April 2008, we adopted the "Ease insurance products (nursing care type)—the fi rst nursing of Mind Service Program" to standardize the frequency of care assurance products designed in response to the policyholder visits and service level in order to enhance total removal of the ban on insurance sales by banks and communications with customers and make customer other fi nancial institutions—in August 2008. The launching services more consistent. We also introduced a "Company of single premium individual annuity insurance in March Training Authorization System" for all sales personnel to 2009 further strengthened our product line-up. reinforce education and training, and regularly confi rm At the beginning of fi scal 2008, we reorganized our their knowledge and skill levels. As these programs marketing organization into three marketing departments gained momentum, we started calling our sales personnel depending on the type of fi nancial institution we "MY Life Plan Advisors" from November. Premised on collaborate with, thus strengthening our support for sales their implementation of "Ease of Mind Service Activities" activity in such institutions. and their acquisition of knowledge and skills, we We continue to enhance new partnership agreements endeavored to stabilize our treatment of sales personnel. with corporate agencies and tax accountant agencies, we We also altered the focus of our operations management have also strengthened our sales support by reinforcing at regional offi ces and agency offi ces to emphasize training for agencies. -

2011-2012 HR Service Delivery and Technology Research Report

Keep Your Eye on the Prize An ERM Update on the Global Insurance Industry April 2013 2012 Global Insurance ERM Survey Report Since our 2010 survey, Financial Crisis Puts the Spotlight on ERM, insurers have endured volatile investment markets, persistently low interest rates, and a number of major natural and man-made catastrophes. Meanwhile, insurance regulations around the world are undergoing significant change, adding to the uncertainty and in some regions drawing materially on resources, with unclear tangible benefits to the business. As insurers set priorities for 2013 and beyond, there is a need to focus on those aspects of enterprise risk management (ERM) that will truly add value to your business, and to “Keep Your Eye on the Prize” — the theme we have chosen for our 2012 Global Insurance ERM Survey. Keep Your Eye on the Prize An ERM Update on the Global Insurance Industry Table of Contents Executive Summary 2 Introduction 4 Seven Major Findings 6 Finding One: Insurers see the value in ERM 6 Figure 1: How ERM is expected to enhance business performance 7 Finding Two: The business impact of ERM continues to grow, albeit slowly 7 Figure 2: Business changes resulting from insurers’ ERM programs 7 Finding Three: Those that stay the course reap the rewards 8 Figure 3: Making progress with ERM enhances business performance 8 Finding Four: Risk culture is critical to long-term ERM success 9 Figure 4: Risk culture’s importance in the end-state vision of ERM 9 Finding Five: Defining risk appetite and monitoring against it are key short-term -

Annual Report 2020 1 Corporate Profile

Annual Report Meiji Yasuda Life Insurance Company Year ended March 31, 2020 1-1, Marunouchi 2-chome, Chiyoda-ku, Tokyo 100-0005, Japan Phone:+81-3-3283-8293 Fax:+81-3-3215-8123 Contents Value Created by Meiji Yasuda Life 2 Relationship with Stakeholders 85 Corporate Profile ..................................................................... 3 Relationship with Customers Meiji Yasuda Philosophy .......................................................... 4 Initiatives to Ensure the Swift, Accurate Payment Thoughts behind Our Corporate Emblem and Logo................. 6 of Insurance Claims and Benefits ....................................... 86 Meiji Yasuda Life at a Glance ................................................... 6 Initiatives to Promote Customer-Oriented Financial and ESG Highlights ................................................... 8 Business Operations .......................................................... 88 History of Our Challenges ........................................................ 10 Initiatives to Enhance Customer Satisfaction Value Creation Process at Meiji Yasuda Life ............................. 12 with Regard to Sales Personnel ......................................... 89 Contributing to the SDGs through Business Activities .............. 14 Diversifying Our Sales Channels A Message from the President ................................................. 18 while Developing New Markets .......................................... 90 Our Products and Services Aimed at Delivering Our Value Creation Strategies -

2018 MIDS Company List

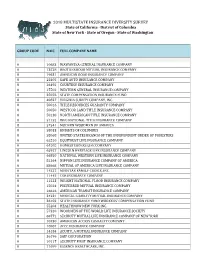

2018 MULTISTATE INSURANCE DIVERSITY SURVEY State of California · District of Columbia State of New York · State of Oregon · State of Washington GROUP CODE NAIC FULL COMPANY NAME 0 10683 WAWANESA GENERAL INSURANCE COMPANY 0 13528 BROTHERHOOD MUTUAL INSURANCE COMPANY 0 19631 AMERICAN ROAD INSURANCE COMPANY 0 25405 SAFE AUTO INSURANCE COMPANY 0 26492 COURTESY INSURANCE COMPANY 0 27502 WESTERN GENERAL INSURANCE COMPANY 0 35076 STATE COMPENSATION INSURANCE FUND 0 40827 VIRGINIA SURETY COMPANY, INC. 0 50016 TITLE RESOURCES GUARANTY COMPANY 0 50050 WESTCOR LAND TITLE INSURANCE COMPANY 0 50130 NORTH AMERICAN TITLE INSURANCE COMPANY 0 51152 WFG NATIONAL TITLE INSURANCE COMPANY 0 57541 MODERN WOODMEN OF AMERICA 0 58033 KNIGHTS OF COLUMBUS 0 58068 UNITED STATES BRANCH OF THE INDEPENDENT ORDER OF FORESTERS 0 62510 EQUITRUST LIFE INSURANCE COMPANY 0 64505 HOMESTEADERS LIFE COMPANY 0 65927 LINCOLN HERITAGE LIFE INSURANCE COMPANY 0 66850 NATIONAL WESTERN LIFE INSURANCE COMPANY 0 81264 NIPPON LIFE INSURANCE COMPANY OF AMERICA 0 88668 MUTUAL OF AMERICA LIFE INSURANCE COMPANY 0 14227 MEDSTAR FAMILY CHOICE, INC. 0 11445 CGB INSURANCE COMPANY 0 11523 WRIGHT NATIONAL FLOOD INSURANCE COMPANY 0 15024 PREFERRED MUTUAL INSURANCE COMPANY 0 16616 AMERICAN TRANSIT INSURANCE COMPANY 0 34231 MEDICAL LIABILITY MUTUAL INSURANCE COMPANY 0 36102 STATE INSURANCE FUND WORKERS' COMPENSATION FUND 0 55204 HEALTHNOW NEW YORK INC. 0 57320 WOODMEN OF THE WORLD LIFE INSURANCE SOCIETY 0 68772 SECURITY MUTUAL LIFE INSURANCE COMPANY OF NEW YORK 0 10730 AMERICAN ACCESS CASUALTY COMPANY 0 10807 ACCC INSURANCE COMPANY 0 14184 ACUITY, A MUTUAL INSURANCE COMPANY 0 36196 SAIF CORPORATION 0 10117 SECURITY FIRST INSURANCE COMPANY 0 11699 ESSENCE HEALTHCARE, INC. -

News Release

NEWS RELEASE FOR MORE INFORMATION CONTACT: Doug Barnert TELEPHONE: 1-917-754-5942 EMAIL: [email protected] INTERNATIONAL ACCOUNTING STANDARD FOR LIFE INSURANCE PRESENTED BY PARTNERSHIP OF U.S. AND JAPANESE LIFE INSURERS Set of Principles and Guidance to be Considered by IASB NEW YORK, April 19 – An international accounting standard for life insurance jointly developed by the leading life insurance companies in the United States and Japan has been submitted for consideration by the International Accounting Standards Board (IASB) The 16 principles and guidance set forth in a new paper, “An International Accounting Standard for Life Insurance,” were endorsed by the Board of Directors of the Group of North American Insurance Enterprises (GNAIE) and the executive officers of the four largest life insurance companies in Japan. GNAIE is the only trade association that focuses exclusively on financial reporting and accounting issues. The combination of U.S. and Japanese life insurance companies represents more than 50 percent of the world’s life insurance markets. The principles are an extension of an earlier draft submitted to the IASB last year. The paper focuses on the measurement of life insurance, annuities and certain types of health insurance for general purpose reporting; it does not include solvency regulation. (more) To influence the development of international accounting standards to ensure that they result in robust, high quality standards for insurance enterprises INTERNATIONAL ACCOUNTING STANDARD FOR LIFE INSURANCE PRESENTED BY PARTNERSHIP OF U.S. AND JAPANESE LIFE INSURERS April 18, 2006 –Page 2 of 4 Almost all life insurance and annuity contracts that qualify as insurance are included under these principles, as well as long term care insurance, disability insurance and other types of non-cancelable or guaranteed renewable health insurance contracts issued by either a life or non-life company. -

Payer ID Payer Name Comments

Payer ID Payer Name Comments 10896 1199 National Benefit Fund 10001 AARP 10911 Acclaim Inc. 10916 ACS Benefit Services, Inc. 10923 Administrative Services, Inc. 10927 Advantage by Bridgeway Health Solutions 10928 Advantage by Buckeye Community Health Plan 10929 Advantage by Managed Health Services 10930 Advantage by Superior HealthPlan 10011 Aetna 13130 Aetna Better Health (FL) 13186 Aetna Better Health (IL) 13497 Aetna Better Health (KY) 13188 Aetna Better Health (LA) 13585 Aetna Better Health (MD) 13189 Aetna Better Health (MI) 13221 Aetna Better Health (NE) 13191 Aetna Better Health (NJ) 13192 Aetna Better Health (PA) 13193 Aetna Better Health (TX) 13222 Aetna Better Health (TX) CHIP 10182 Aetna Better Health (VA) 13533 Aetna Better Health (WV) Payer ID Payer Name Comments 13093 Aetna Long Term Care 13185 Aetna Retiree Medical Plan Administrator 13194 Aetna Senior Supplemental 13395 Affinity Essentials 10944 Affinity Health Plan 13196 Affinity Health Plan – Medicare 13201 AFLAC 10014 AFLAC – Dental 13199 AFLAC – Medicare Supplemental 13589 AgeWell New York (Web Credentials Required) Enrollment Required 13529 AGIA, Inc. 10956 Alameda Alliance for Health Plan (Web Credentials Required) Enrollment Required 13197 Alan Sturm and Associates - Dental 13591 Aliera Health Care 13198 All Savers Life Insurance 10965 Allegiance Benefit Plan Management Inc. 10971 Alliant Health Plans of Georgia 13443 Allianz Life Insurance Company of New York 10973 Allied Benefit Systems, Inc. 12281 Allways Health Partners 13653 Allwell 13180 AlohaCare 13220 Alternative -

2019 Complaint Ranking Report

STATE OF CONNECTICUT INSURANCE DEPARTMENT 2018 Complaint Rankings Accident & Health Auto Insurance Andrew N. Mais Insurance Commissioner August 1, 2019 The Connecticut Insurance Department investigates thousands of complaints each year from consumers on all types of insurance policies including health, auto, homeowners, renters and life insurance. Our primary mission is consumer protection and we closely monitor insurance companies to make certain they adhere to state laws and are financially solvent to fulfill their obligations to their policyholders. In 2018, the Department’s Consumer Affairs Unit (CAU) fielded 6,349 complaints and inquiries from consumers. As a result, we were able to recover and return nearly $5.6 million back to consumers who turned to us for help. Those complaints are an important tool in helping us regulate the insurance industry. Our CAU examiners are effective liaisons between policyholders and their insurance companies. They assist consumers by: • Ensuring companies comply with state laws and the terms of the insurance policy • Communicate with a company on a policyholder’s behalf • Correct misunderstandings and provide consumers with information • Work with policyholders proactively before a problem develops In this report, companies that sell Auto and Accident & Health insurance are ranked by the number of complaints reported, whether those complaints were justified or questionable by company, by market share, identified by written or earned premium. A company’s ranking is determined by a “complaint ratio,” which is the total number of complaints divided by the direct premium and multiplied by 1 million. A company with the lowest complaint ratio is ranked No. 1. The types of complaints reviewed for the purposes of this report include claims handling, underwriting, marketing and sales, and policy service. -

2019 Insurance Fact Book

2019 Insurance Fact Book TO THE READER Imagine a world without insurance. Some might say, “So what?” or “Yes to that!” when reading the sentence above. And that’s understandable, given that often the best experience one can have with insurance is not to receive the benefits of the product at all, after a disaster or other loss. And others—who already have some understanding or even appreciation for insurance—might say it provides protection against financial aspects of a premature death, injury, loss of property, loss of earning power, legal liability or other unexpected expenses. All that is true. We are the financial first responders. But there is so much more. Insurance drives economic growth. It provides stability against risks. It encourages resilience. Recent disasters have demonstrated the vital role the industry plays in recovery—and that without insurance, the impact on individuals, businesses and communities can be devastating. As insurers, we know that even with all that we protect now, the coverage gap is still too big. We want to close that gap. That desire is reflected in changes to this year’s Insurance Information Institute (I.I.I.)Insurance Fact Book. We have added new information on coastal storm surge risk and hail as well as reinsurance and the growing problem of marijuana and impaired driving. We have updated the section on litigiousness to include tort costs and compensation by state, and assignment of benefits litigation, a growing problem in Florida. As always, the book provides valuable information on: • World and U.S. catastrophes • Property/casualty and life/health insurance results and investments • Personal expenditures on auto and homeowners insurance • Major types of insurance losses, including vehicle accidents, homeowners claims, crime and workplace accidents • State auto insurance laws The I.I.I.