Tourism Strategy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Long-Term Population Growth in Regional Queensland

LONG-TERM POPULATION GROWTH IN REGIONAL QUEENSLAND March 2015 LONG-TERM POPULATION GROWTH IN REGIONAL QUEENSLAND 1.0 INTRODUCTION Over a period of time, major changes have been taking place in the distribution of population in regional Queensland outside of the south-east corner of the State. This paper sets out: o This changing pattern and the leading role of Cairns and the Cairns region in this changing pattern; o Why this consistent pattern of change has been happening over a period of time; and o On a continuation of these long-term trends, what regional population in Queensland would look like by 2050. This paper has been prepared by Cummings Economics for the Cairns Regional Council. W S Cummings B Econ 38 Grafton St (PO Box 2148) Cairns Q 4870 Phones 07 4031 2888 / 0418 871 011 Email [email protected] Website www.cummings.net.au CUMMINGS ECONOMICS ABN: 99 734 489 175 Ref: J2806 March 2015 Page /33 2 LONG-TERM POPULATION GROWTH IN REGIONAL QUEENSLAND 2.0 THE QUEENSLAND REGIONS Queensland outside of the south-east corner of the State covers a large area. Realities of distances lead to the area being served by a series of regional capitals with distinct commercial servicing regions. Map 1 shows these regional capitals and the commercial regions they serve. In the case of Cairns, Townsville, Mackay and Toowoomba, the regional capitals and their commercial servicing areas are fairly clear. Although Rockhampton is the regional capital of the Fitzroy and Central West region, unlike Cairns, Townsville and Mackay, the region’s port is not located at the city, but 100km away at Gladstone. -

Region Region

THE MACKAY REGION Visitor Guide 2020 mackayregion.com VISITOR INFORMATION CENTRES Mackay Region Visitor Information Centre CONTENTS Sarina Field of Dreams, Bruce Highway, Sarina P: 07 4837 1228 EXPERIENCES E: [email protected] Open: 9am – 5pm, 7 days (May to October) Wildlife Encounters ...........................................................................................4–5 9am – 5pm Monday to Friday (November to April) Nature Reserved ..................................................................................................6–7 9am – 3pm Saturday Hooked on Mackay ...........................................................................................8–9 9am – 1pm Sunday Family Fun ..............................................................................................................10–11 Melba House Visitor Information Centre Local Flavours & Culture ............................................................................12–13 Melba House, Eungella Road, Marian P: 07 4954 4299 LOCATIONS E: [email protected] Cape Hillsborough & Hibiscus Coast ...............................................14–15 Open: 9am – 3pm, 7 days Eungella & Pioneer Valley .........................................................................16–17 Mackay Visitor Information Centre Mackay City & Marina .................................................................................. 18–19 320 Nebo Road, Mackay (pre-Feb 2020) Northern Beaches .........................................................................................20–21 -

Regional Investment Prospectus (PDF 5MB)

Council has a determined focus on setting and supporting an active economic and industry development agenda. The Mackay region was forged on the back of the sugar Sometimes we forget that a city’s most valuable asset is industry and in recent years has matured and diversified its people. With such diversity and a strong multicultural in to the resource service hub of Australia. We are home population, our sense of community enables us to come to one of the largest coal terminals in the world that together to support people of all culture, beliefs and accounts for over 7% of the total global seaborne coal backgrounds. #MackayPride coveys that message and exports and we also produce over one third of Australia’s cements a culture of inclusiveness, social cohesion, sugar. community pride and opportunity. While we possess this strong and resilient economic As a fifth generation local, I am enormously proud of this foundation, we continue to leverage off our natural region and know that we are well placed to attract new advantages and look for emerging opportunities. investment and develop partnerships to capitalise on the enormous economic opportunities in the years to come. Investment opportunities are ripe throughout the region and council has a determined focus on setting and supporting an active economic and industry development Greg Williamson agenda. This focus is supported by Council’s suite of Mayor – Mackay Regional Council development incentives which measure up to the best in the country. Of equal importance to the strength of our economy is the strength of our lifestyle choices. -

Chapter 2: the Mackay Setting

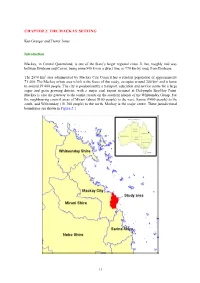

CHAPTER 2: THE MACKAY SETTING Ken Granger and Trevor Jones Introduction Mackay, in Central Queensland, is one of the State’s larger regional cities. It lies, roughly mid way between Brisbane and Cairns, being some 800 km in a direct line, or 970 km by road, from Brisbane. The 2890 km2 area administered by Mackay City Council has a resident population of approximately 71 400. The Mackay urban area which is the focus of this study, occupies around 240 km2 and is home to around 59 000 people. The city is predominantly a transport, education and service centre for a large sugar and grain growing district, with a major coal export terminal at Dalrymple Bay/Hay Point. Mackay is also the gateway to the tourist resorts on the southern islands of the Whitsunday Group. For the neighbouring council areas of Mirani (about 5100 people) to the west, Sarina (9400 people) to the south, and Whitsunday (18 300 people) to the north, Mackay is the major centre. These jurisdictional boundaries are shown in Figure 2.1. 11 Figure 2.1: Mackay study area location The Physical Setting Topography: The entire study area is low-lying, with an average elevation of less than 10 m above the Australian Height Datum (AHD), with the low hills of Mount Bassett (approximately 30 m above AHD) and Mount Pleasant (about 60 m above AHD) as the main features of relief. In the original area of urban development, south of the Pioneer River, the average elevation is around 6 m above AHD and ranges from less than 4 m above AHD at the airport to a little over 11 m above AHD at the Mackay Base Hospital. -

Looking Back & Moving Forward

LOOKING BACK & MOVING FORWARD > A brief history of Mackay Regional Council INSIDE I SUGAR BOOM I HISTORY OF REGIONAL COUNCILS I MILESTONES A new port in Queensland > Potential of the area recognised Prior to European settlement, an At the same time, Henry Bell settled estimated 2000 Indigenous people at Plain Creek (later the township of lived in the Pioneer Valley. Sarina); and Edmund Atherton took European discovery of what is up a selection at Cliftonville. now known as the Pioneer Valley occurred when John Mackay, a A port at Mackay was Scottish pastoralist explorer, led established to service the pastoral a party from northern New South runs of the Pioneer River valley and Wales in search of new grazing its hinterland. The port was superior lands. The group headed out from to that at Broadsound in that there John Mackay Uralla and after a journey of five was sufficient water at low tide to months discovered the Pioneer berth vessels of 100 to 150 tons, The township of Plane Creek River valley in May 1860. and there was a more gradual road (formerly Plain Creek) began to to the inland. develop at Michelmore’s Hill, north of The explorers immediately the present town of Sarina, probably recognised the potential of the The Mackay settlement was in the 1880s and by the time the area and applied for pastoral runs. surveyed in 1863 and on October Plane Creek Sugar Mill was built in Mackay returned to the Pioneer 13 the first sales of Crown lands 1895, a hotel, store and blacksmith Valley region in 1862 with 1200 took place at Bowen. -

Traffic Management Scheme

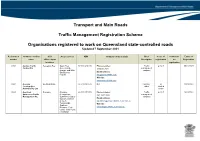

Transport and Main Roads Traffic Management Registration Scheme Organisations registered to work on Queensland state-controlled roads Updated 7 September 2021 Registration Company / trading QLD Areas services ABN Company contact details Brief Scope of Conditions Expiry of number name office / depot Description registration on Registration locations registration 0202 Aaction Traffic Deception Bay South East 37 128 649 445 Phone number: Traffic O, S, D 30/11/2023 Control P/L Queensland, 1300 055 619 management Gympie and Wide company Bay Burnett Email address: regions [email protected] Website: www.aactiontraffic.com 0341 Acciona South Brisbane 66 618 030 872 N/A Industry - D 31/01/2023 Construction other Limited Australia Pty Ltd scope 0043 Acquired Brendale Brisbane 45 831 570 559 Phone number: Traffic O, S, D 15/12/2022 Awareness Traffic Metropolitan, (07) 3881 3008 management Management P/L Sunshine Coast to company Gympie, western Email address: areas to [email protected] Toowoomba, Website: Southern Brisbane, Gold www.acquiredawareness.com.au Coast, Gold Coast Hinterland Registration Company / trading QLD Areas services ABN Company contact details Brief Scope of Conditions Expiry of number name office / depot Description registration on Registration locations registration 0278 Action Control Labrador South East 92 098 736 899 Phone Number: Traffic O, S 31/10/2021 (Aust) P/L Queensland 0403 320 558 management Limited company scope Email address: [email protected] Website: www.actioncontrol.com.au 0271 -

Economic Development Strategy 2020-2025

2020-2025 Mackay Region Economic Development Strategy Mackay Region Economic Development Strategy 2020-2025 Strategy by Lucid Economics Pty Ltd 2 Mackay Region Economic Development Strategy 2020-2025 3 Mayor’s Foreword A message from the Mayor This Economic Development Strategy 2020-2025 Within this strategy, we have set a clear Economic reflects the Mackay region – diverse, innovative, Development Framework designed to support forward thinking and full of exciting opportunities. employment and investment outcomes through advocacy and leadership, investment attraction, The previous edition of the strategy, which set out industry development and workforce and skills. an action plan for 2015-2020, was put in place when the Mackay region was recovering from a downturn Council will support the local economy by in the resources sector. This had placed enormous delivering a range of specific initiatives and actions pressure on our community, both socially to demonstrate economic leadership and instil and economically. confidence in the local market. Attracting investment not only provides a significant economic stimulus, it attracts new technology and innovation, as well as stimulates additional The economic environment of today however, is investment and job creation through supply chains. “much different to the one we found ourselves in five years ago. The Mackay region we all know, We see the region well placed to move forward and and love is back, and our future in terms of capitalise on new opportunities. economic prosperity looks bright. Our strengths are in the METS sector, our underpinning agricultural base, a burgeoning There is still plenty of work to do as we continue tourism industry and a council focussed on building to diversify and evolve to ensure our region is a liveable community. -

Queensland's Tourism Network

Growing Queensland jobs Queensland’s Tourism Network: Information paper March 2018 1 Introduction Queensland’s tourism network is extensive, consisting of government, industry associations, and over 54,000 tourism businesses servicing approximately 24 million visitors . This paper outlines the roles and responsibilities of the various entities contributing to success in Queensland’s tourism network. Clear roles and responsibilities for the various levels within the network are essential. Unclear roles or failure to adhere to them can lead to fragmentation across destinations and the poor use of resources. Current structure Queensland’s tourism industry comprises the state tourism Visitor Markets organisation, Tourism and Events Queensland (TEQ), 13 regional tourism organisations (RTO), numerous local tourism organisations (LTO) and tourism businesses. Leadership is provided by TEQ, the Regional Tourism Organisations & Local Regional Department of Innovation, Tourism Industry Development, and the Commonwealth Games (DITID), Queensland Tourism Industry Council (QTIC) and around 18 industry associations within the Local Government Local Tourism state focused on advancing tourism. and Community Organisations Collectively, these organisations in partnership with all levels of government, tourism and aligned industry and commercial stakeholders, aim to build Queensland’s tourism and events Tourism Operators industry, foster innovation, drive industry growth and boost visitor expenditure. Underpinning the industry structure are the Queensland -

RG Council Highlight Report 2016-17

© Commonwealth of Australia 2017 Published by the Great Barrier Reef Marine Park Authority ISBN 978-0-9953732-9-7 The Reef Guardian Councils: Highlight Reports 2016–2017 is licensed by the Commonwealth of Australia for use under a Creative Commons By Attribution 4.0 International licence with the exception of the Coat of Arms of the Commonwealth of Australia, the logo of th e Great Barrier Reef Marine Park Authority, any other material protected by a trademark, content supplied by third parties and any photographs. Fo r licence conditions see: http://creativecommons.org/licences/by/4.0 This publication should be cited as: Great Barrier Reef Marine Park Authority and Reef Guardian Councils 2017, Reef Guardian Councils: Highlight Reports 2016–2017, GBRMPA, Townsville. A cataloguing record is available for this publication from the National Library of Australia While all efforts have been made to verify facts, the Great Barrier Reef Marine Park Authority takes no responsibility for the accuracy of information supplied in this publication. Aboriginal and Torres Strait Islander readers are advised this publication may contain names and images of deceased persons. Unless otherwise noted all images are © to the Great Barrier Reef Marine Park Authority Front cover inset photograph credits: second left Amy Yates, third left: Douglas Shire Council, forth left: Cairns Regional Council Comments and questions regarding this document are welcome and should be addressed to: 2–68 Flinders Street (PO Box 1379) TOWNSVILLE QLD 4810, A AUSTRALIA Phone: (07) 4750 0700 Fax: (07) 4772 6093 Email: [email protected] www.gbrmpa.gov.au REEF GUARDIAN COUNCILS HIGHLIGHT REPORTS 2016 - 2017 The Reef Guardian Council stewardship program unites 17 councils working together to preserve the health and resilience of the Great Barrier Reef — for today and tomorrow. -

Mackay Region Events Strategy 2020-2025

Mackay Region Event Strategy 2020-2025 Mackay Region Event Strategy 2020-2025 Strategy by Luminair Consulting / © Luminair Pty Ltd 2019 - All Rights Reserved Contents Executive Summary 4 Introduction and Strategic Context 6 Introduction to the Mackay region 7 Document purpose 7 Strategic context 8 The need 9 Policy, Guidelines and processes 9 Partners and acknowledgements 9 Summary of Opportunities 10 The New Direction 18 Where we want to be 19 Our new vision 19 Introducing new strategic priorities 19 Resulting outcomes 19 What does this look like for the Mackay region? 19 What does this new approach require of Council? 20 Why does Council need a ‘Portfolio of Events’? 20 What could the ‘Realignment of Council Event Resources’ look like? 23 Our Future and Roadmap to Success 26 Our future 27 Planning principles 27 Delivery priorities 27 Roadmap to success (implementation plan) 28 3 Executive Summary 4 Mackay Region Event Strategy 2020-2025 Mackay Regional Council (Council) has sought a new The identified gaps and opportunities within the direction, mindset and framework for events. This strategy document itself (i.e. this document) has undertaking is founded on a desire for increased shaped four key delivery priorities, these being: levels of economic, social and environmental Priority one: Set the structures in place. wellbeing and stability. Priority two: Create the environment for success The purpose of this document, the Mackay Region and sustainability. Event Strategy (2020-2025), is to set this new direction, mindset and framework; and in doing Priority three: Develop, acquire and partner. so, maximise the outcomes and benefits that the Priority four: Evaluate and evolve. -

Economic Development and Planning Standing Committee Final Minutes

ECONOMIC DEVELOPMENT AND PLANNING STANDING COMMITTEE FINAL MINUTES 10 May 2017 FINAL MINUTES ECONOMIC DEVELOPMENT AND PLANNING STANDING COMMITTEE WEDNESDAY 10 MAY 2017 Table of Contents Folio Date Particulars 43830 10.05.2017 Economic Development and Planning Standing Committee Minutes 43849 30.04.2017 Development Services Monthly Review - April 2017 43864 07.04.2017 Minutes - Character and Heritage Advisory Committee Meeting Declaration of Potential Conflict of Interest Nil. MIN/10.05.2017 FOLIO 43829 FINAL MINUTES ECONOMIC DEVELOPMENT AND PLANNING STANDING COMMITTEE WEDNESDAY 10 MAY 2017 ECONOMIC DEVELOPMENT AND PLANNING STANDING COMMITTEE MINUTES The Chair welcomed Cr Ellison Sade from the Honiara City Council who was sitting in the Public Gallery for today's meeting. 1. COMMITTEE ATTENDANCE: Crs A J Camm (Chairperson), J F Englert, R C Gee, F A Mann, K L May and Mayor G R Williamson were in attendance at the commencement of the meeting. 2. NON-COMMITTEE ATTENDANCE: Also present were Cr R D Walker, Cr M J Bella, Cr A R Paton, Cr L G Bonaventura, Mr C Doyle (Chief Executive Officer), Mr G Carlyon (Director Development Services) and Mrs M Iliffe (Minute Secretary). The meeting commenced at 1.00 pm. 3. ABSENT ON COUNCIL BUSINESS: Nil 4. APOLOGIES: Nil 5. CONFLICT OF INTEREST: Nil MIN/10.05.2017 FOLIO 43830 FINAL MINUTES ECONOMIC DEVELOPMENT AND PLANNING STANDING COMMITTEE WEDNESDAY 10 MAY 2017 6. CONFIRMATION OF MINUTES: 6.1 ECONOMIC DEVELOPMENT AND PLANNING STANDING COMMITTEE MINUTES - 12 APRIL 2017 THAT the Economic Development and Planning Standing Committee Meeting Minutes held on 12 April 2017 be adopted. -

Download a Copy of the Mackay Regional Profile 2018 (PDF)

DISCLAIMER All figures and data presented in this document are based on data sourced from the Australian Bureau of Statistics (ABS), and other government agencies. Using ABS datasets, the regional economic modelling software ‘REMPLAN Economy’, has been applied to generate industrial economic data estimates. This document is provided in good faith with every effort made to provide accurate data and apply comprehensive knowledge. However, REMPLAN does not guarantee the accuracy of data nor the conclusions drawn from this information. Economic Development Department (07) 5689 1499 / (03) 5444 4788 1300 MACKAY (622 529) www.remplan.com.au [email protected] www.investmackay.com OVERVIEW EMPLOYMENT DEMOGRAPHICS INDUSTRY HOUSING TRENDS TOURISM RESOURCES The region’s expanding employment, investment and development opportunities, buoyant economy and lifestyle attributes are just some of the many positive aspects that encourage people to live, work and play in the Mackay Region. The Mackay Regional Local Government Area is one of the fastest-growing in Queensland, with a population of 118,000. The region’s growth is fuelled by activity in the resources sector, resurgence in agribusiness, and growth in construction, logistics and tourism. The Mackay Region is the gateway to the rich coal deposits in the Bowen and Galilee Basins. It is one of the largest sugar-producing regions in Australia and hosts much of the engineering, manufacturing and mining services industries supporting the wider Mackay-Isaac-Whitsunday economy. Only an hour’s flight from Brisbane, the Mackay Region boasts an enviable lifestyle and a buoyant economy with the benefits of a fast-growing coastal city.