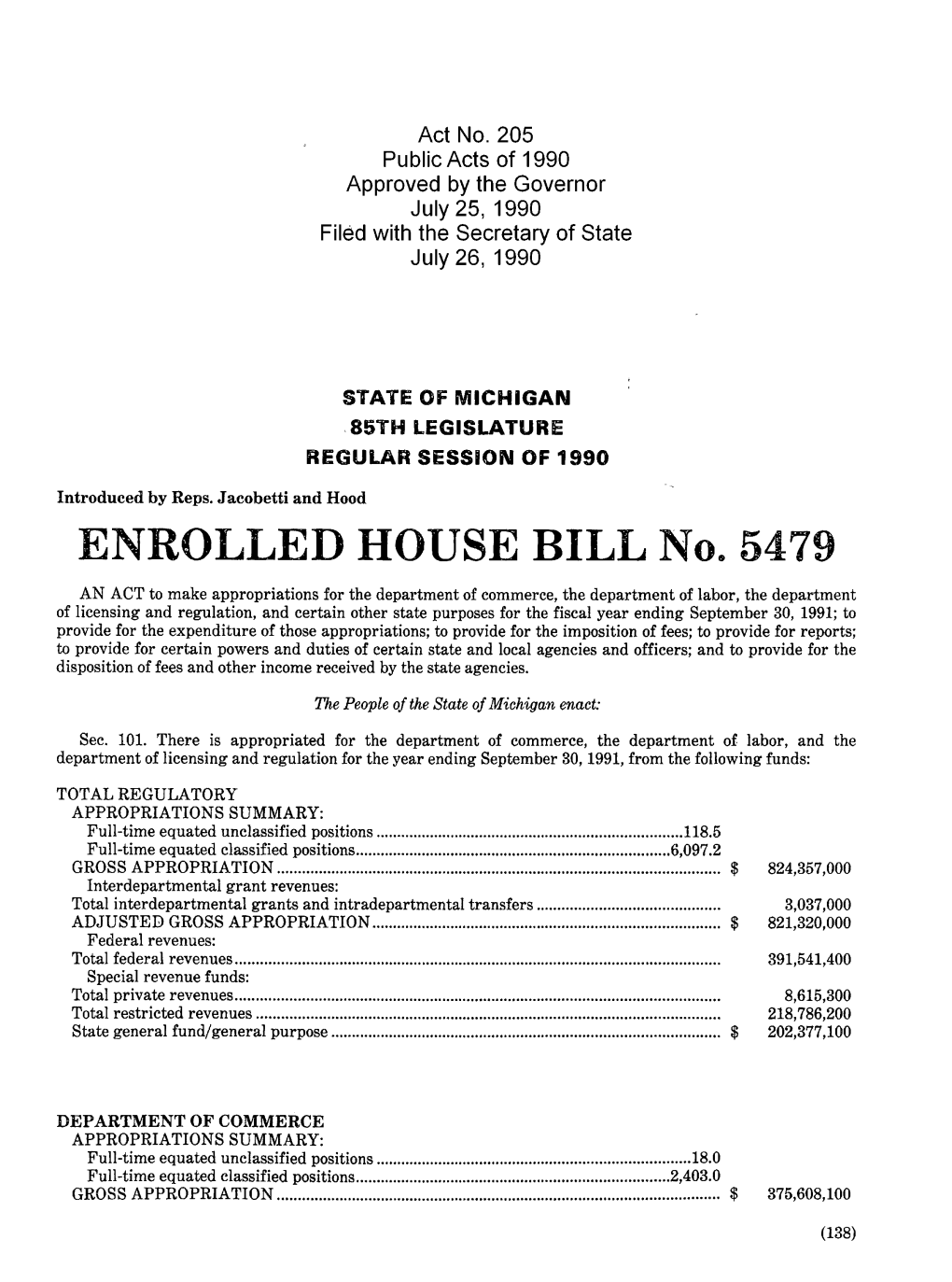

1990 House Enrolled Bill 5479

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The 2020 Tuition Assistance Auction!

Welcome to the 2020 Tuition Assistance Auction! So glad you’re here! I want to personally thank you for your support of this very important event. Your participation helps make it successful and is very much appreciated. No matter what your role, each one is vital to the success of this event. The Tuition Assistance Auction could not be accomplished without your involvement and support. NorthPointe Christian Schools continues to award approximately $500,000 each year in tuition assistance. Nearly one in four students that currently attend NPC receives assistance. The generosity of God’s people makes this possiBle. You play a significant role in giving these families the opportunity to receive an education that is Christ-centered and seeks to honor God. “My husband and I are grateful for tuition assistance at NorthPointe. Without it, our son would not be here. We are happy to be able to lend our support for this year’s auction.“ – A family receiving assistance Once again, we are Blown away By the donations--so many! The new items added to the 2020 auction and the repeat items are all amazing! As we start our evening, remember, we do it for the kids, for the families, and ultimately for Jesus Christ. Be cheerful in your giving! Bid high and Bid often! RememBer that every dollar you spend will go in its entirety to tuition assistance and will Be used to fulfill our mission of “Equipping students to impact their world for Jesus Christ. Have a great night tonight! Many Blessings, Todd N. Tolsma Head of Schools 1 Thank You to Our Sponsors: Platinum Event Sponsors Dermatology Associates of West Michigan, Daniel Dapprich, MD NorthPointe Christian Schools Education Foundation Gold Event Sponsors Discovery Financial, David and Angela MuilenBerg Dynamic Wood Products J.C. -

Annual Report Has Found Its Way to You

Hello! We’re happy our annual report has found its way to you. We hope that the stories and photographs about our community, our grantees and donors are inspiring and make you proud to be part of Grand Rapids Community Foundation. Off and Running! Our Challenge Scholars Head for Success Our Future In May 2014, we introduced our first class of Challenge Scholars—137 sixth graders from Harrison Park School and Westwood Middle School on Grand Rapids’ West Side. The students and their families will be participating in college– readiness programming until the students enroll in college in 2020. And better yet, every class of students after them will be Challenge Scholars too! Good Work This year we awarded $10.7 million in grants to West Michigan nonprofits that are working to make our community better in the areas of education, arts and social engagement, the environment, health, neighborhoods and economic prosperity. We set a record in scholarship awards with $1.1 million going to students working to achieve a college education. The Money This year, generous people made $16.7 million in contributions to Grand Rapids Community Foundation, helping grow our endowment to $329 million at fiscal year ending June 30, 2014. Celebrate! This year, Grand Rapids Community Foundation was honored with the Grand Rapids Area Chamber of Commerce’s Diversity Visionary Award. This award recognized our efforts to create an inclusive organization and our efforts to make Grand Rapids Read more about Challenge Scholars on PAGE 9. a more welcoming and equitable community. Community happens FROM OUR LEADERS 2013/2014 03 here. -

Grand Rapids Fact Sheet

CONTACT: Stephanie Bradley 616-233-3577 [email protected] Grand Rapids Fact Sheet One of The New York Times 52 Places to Go in 2016. The #1 U.S. travel destination in 2014. Beer City USA. Home to one of the globe's top five festivals. Grand Rapids, Michigan is all of this and so much more - a city that will constantly surprise and delight you with authentic and unforgettable world-class experiences made easy, affordable and friendly. Whether you are a meeting planner or a visitor, Grand Rapids exceeds expectations in every way- in the quantity and quality of our activities and attractions, in the warmth of our hospitality and in the power of our innovation. Grand Rapids offers all the big-city excitement with the small-town sense of community pride and closeness which brings all residents together for grand events such as ArtPrize, Restaurant Week, Cool Brews. Hot Eats. and more. LOCATION: Grand Rapids is the second largest city in Michigan with a population of about 192,000 in the city and about a million in the Metro Grand Rapids area. Grand Rapids is located on the banks of the Grand River that winds its way through downtown. Grand Rapids gets its name from the Grand River and the rapids that used to help the local furniture industry with the transport of logs. In the early 1900s flood walls were installed in the river to remove the rapids in order to help manage flooding. The Grand Rapids WhiteWater Project is now in the works to restore the river and the rapids. -

2016 FINANCIAL OVERVIEW Kent County, Michigan

2016 FINANCIAL OVERVIEW Kent County, Michigan Daryl J. Delabbio County Administrator/Controller Stephen W. Duarte Fiscal Services Director Kenneth D. Parrish County Treasurer OFFICE OF THE ADMINISTRATOR Kent County Administration Building 300 Monroe Avenue, N.W. Grand Rapids, Michigan 49503-2206 Phone: (616) 336 - 3512 • Fax: (616) 336 - 2523 Administrator’s Office 300 Monroe Avenue NW Grand Rapids, MI 49503-2221 P: 616.632.7570 April 11, 2005 F: 616.632.7565 Moody’s Investors Service Attn: Jonathan North March 31, 2016 99 Church Street New York, NY 10007 RE: 2005 Kent County Financial Overview The Honorable Board of Commissioners The following document presents a “FinancialKent County Overview” Administration for Kent Building County. The information contained herein provides significant 300economic, Monroe demographic Avenue NW and financial information in summary format. It will provide the readerGrand Rapids,with a comprehensiveMI 49503-2221 report demonstrating the financial strength and stability of Kent County government. The document is intended to serve the informationRE: 2016 Kent needs County of individuals Financial Overview and organizations with a financial interest in Kent County including: The following document presents a “Financial Overview” for Kent County. The information contained • Retail Bond Holders/Institutionalherein Investors/Rating summarizes significant Agencies economic, demographic and financial information. It will provide the reader • County Elected Officials. with a comprehensive report demonstrating the financial strength and sustainability of Kent County’s • The Citizens of Kent County. governmental organization. • Businesses doing business or considering locating new business in Kent County. The document is intended to serve the information needs of individuals and organizations with a financial This is an annual publication, the preparationinterest inof Kentwhich County is a cooperative including: effort of the County Treasurer, Human Resources and Fiscal Services staff. -

Grand Rapids Housing Commission News

Scattered Sites Renovations Campau Commons Hosts HUD GVSU Expands Services at Completed EnVision Center Mount Mercy Clinic The GRHC has completed a total HUD has designated the Campau The GVSU Kirkhof College of of $673,000 in improvements Commons Community Center as Nursing has received a grant to to 20 Scattered Sites units. The the Grand Rapids EnVision Center, support the addition of behavioral renovations were funded through recognizing GRHC programs health services at the GVSU HUD Capital Fund Program that help residents attain self- Health Center at Mount Mercy. grants. Details on page 2! sufficiency. Details on page 3! Details on page 7! GRAND RAPIDS HOUSING COMMISSION AUTUMNWinter 20212018 NEWS Cares Act Funds 75 Additional Mainstream Vouchers The Grand Rapids Housing Commission grateful to have expanded capacity to provide (GRHC) was recently awarded a $495,593 HUD housing stability to some of our most vulnerable Mainstream Voucher program grant authorized applicants,” noted GRHC Interim Executive under the federal Coronavirus Aid, Relief and Director Hattie Tinney Beenen. Economic Security (CARES) Act. The grant will fund an additional 75 Mainstream Vouchers to In addition to a rental housing subsidy, the support the housing needs of non-elderly persons Mainstream program provides supportive who have disabilities; HUD defines “non-elderly” services coordinated by the GRHC’s on-staff as under age 62. This award brings the total social work professionals in collaboration with number of Mainstream Vouchers the GRHC The Salvation Army, Disability Advocates, the administers to 207. Area Agency on Aging of Western Michigan, Cherry Health, Care Resources, local hospitals The Mainstream Voucher program is targeted to and nursing homes, and other community people with disabilities who are transitioning out of partner organizations that serve people who institutional settings, at risk of institutionalization, have disabilities. -

Morris Photo Collection Collection 043

Finding aid for the Morris photo collection Collection 043 This finding aid was produced using ArchivesSpace on February 12, 2021. English Describing Archives: A Content Standard Grand Rapids History and Special Collections 111 Library Street NE Grand Rapids, Michigan 49503 [email protected] URL: https://www.grpl.org/research/history/ Finding aid for the Morris photo collection Collection 043 Table of Contents Summary Information ......................................................................................................................................... 3 Biographical / Historical ...................................................................................................................................... 3 Scope and Contents .............................................................................................................................................. 4 Administrative Information ............................................................................................................................... 6 Controlled Access Headings ............................................................................................................................... 6 Alphabetical Brief Subject Index ...................................................................................................................... 6 Collection Inventory ........................................................................................................................................... 23 Images ................................................................................................................................................................ -

Helen J. Devos, Civic Leader, Wife of Amway Co-Founder, Dies

2017-10-19 - Helen DeVos Family StatementNews Release CONTACT: Kim Bruyn 616-540-7711 Beth Dornan 616-787-6445 Helen J. DeVos, civic leader, wife of Amway co-founder, dies ADA, Mich., October 19, 2017 - Helen J. DeVos, wife of Amway co-founder Rich DeVos and a philanthropic leader in Grand Rapids, Michigan, and Central Florida, died October 18, 2017 of complications from a stroke following a recent diagnosis of myeloid leukemia. She was 90. Her husband, Rich DeVos, often said, “Helen was a wonderful wife and the heart of our family. She blessed my life in countless ways and always was an encourager to our children, grandchildren and great-grandchildren.” Born Helen J. Van Wesep on Feb. 24, 1927, in Grand Rapids, Michigan, Mrs. DeVos graduated from Frankfort High School in Frankfort, Michigan, and earned a degree from Calvin College in Grand Rapids. She married Rich DeVos on Feb. 7, 1953. Mrs. DeVos volunteered her time and leadership to a number of causes and with her husband, Rich, donated generously through the Richard and Helen DeVos Foundation. They always said they were motivated to give because of their Christian faith and their responsibility as stewards of the financial resources God had given to them. They supported scores of Christian churches and ministries along with health organizations, educational institutions and civic projects. The Helen DeVos Children’s Hospital in Grand Rapids is named in recognition of her lifelong advocacy for the health and wellness of families. The hospital provides an impressive depth and breadth of children’s health care and is one of the nation’s premier centers of its kind. -

Live Auction

Live Auction 1. Eight Hour Chartered Fishing Trip for Six People Donated by Tangled Mess Charters Enjoy an eight hour chartered fishing trip for up to six people with Tangled Mess Charters, based out of the Yacht Basin Marina in Holland, MI. Captain Don will share his experience and love of fishing with others as you enjoy a day out on beautiful Lake Michigan. Valued at $850 2. An Evening at the Meyer May House, Dinner Party for 10 Donated by Steelcase Enjoy a gourmet four-course dinner, dessert and wine at the Meyer May House, a local architectural treasure. The Meyer May chefs will provide a variety of selections to assure something for every palate. A docent will be nearby to provide guided tours of Meyer May House and weather permitting, the veranda will be open for a lovely setting of conversation and relaxation. Dinner parties can be accommodated most Friday evenings throughout the year. Donated by Steelcase Inc., a private dinner party evening like this is not available except through local charitable events and less than a handful are given each year to the local community. Don’t miss out on your chance to bid on this exclusive dinner party! Value: Pricless. 3. Chicago Cubs Family Package Donated by Dave & Jane Zylstra, Greg & Lyn Jansen, Shedd Aquarium, & Skydeck Chicago If you love Chicago, you won’t want to miss out on this fun, family-friendly adventure! Enjoy four tickets to the July 18th Cubs vs. Mets game, a $50 gift card to Murphy’s Bleachers, famous neighborhood bar right outside Wrigley Field and a two night stay at the Chicago Marriott-Magnificent Mile hotel with parking. -

FOR IMMEDIATE RELEASE CONTACT Kerri Vanderhoff Grand Rapids Art Museum 616.831.2914 [email protected] GRAND RAPIDS

FOR IMMEDIATE RELEASE CONTACT Kerri VanderHoff Grand Rapids Art Museum 616.831.2914 [email protected] GRAND RAPIDS ART MUSEUM ANNOUNCES FALL SUNDAY CLASSICAL CHAMBER MUSIC SERIES SCHEDULE Twelve-Week Program Features Professional, Collegiate and Youth Ensembles Followed by an Artist Reception in the Museum East Court GRAND RAPIDS, Mich., September 4, 2008 – The Grand Rapids Art Museum (GRAM), a new leading cultural destination, presents the Fall Sunday Classical Chamber Music Series beginning September 14 and continuing through November 30, 2008. Ed Clifford, Music Director for the Grand Rapids Art Museum, organizes the twelve-week classical music series. Clifford is widely known for his work with the Grand Rapids Symphony as flutist, and for artistic programs organized through the Clifford Music Group. The Fall Series is made possible by the National City Bank Endowment Fund and the media sponsor is Blue Lake Public Radio. The concerts are held on Sunday afternoons, from 2:00 to 3:00 pm, and feature a range of regional talent from professionally recognized area musicians to local college faculty and youth ensembles. The concerts are held on Blodgett Balcony, where acoustics allow the music to be heard throughout the galleries. Programs and seating are available in the balcony area for those preferring to watch the musicians perform. A Meet-the-Artists reception will follow each performance. The reception begins at 3:00 pm in the Main Level East Court, where complimentary snacks and a cash bar will be available. During youth concerts, additional soft beverages will be offered. The Museum Café offers a Special Sunday Brunch menu beginning at 11:00 am. -

2018 Annual Report Our Mission

GRAND RAPIDS HOUSING COMMISSION 2018 ANNUAL REPORT OUR MISSION The Grand Rapids Housing Commission provides housing assistance and affordable housing opportunities to lower-income families, the disabled and senior citizens in a manner that is fiscally sound and in ways that support families, neighborhoods and economic self-sufficiency. HISTORY The Grand Rapids Housing Commission (GRHC) was established in 1966 to provide affordable housing for low-income residents and to eliminate substandard housing conditions. Over the years, the Housing Commission has expanded its role in the community, partnering with organizations and individuals to advocate for positive change in local social welfare policy and to offer supportive services families can use to achieve self -sufficiency and a stronger financial future. Funded primarily through the United States Department of Housing and Urban Development (HUD), the GRHC is independently administered and is governed by a five-member board appointed by the City Manager and approved by the City Commission. Visit our website: www.grhousing.org THE GRAND RAPIDS HOUSING COMMISSION From left: Bobbie Butler, President; Betty Zylstra, Vice President; Angela Bunn, Commissioner; Patrick Miles Sr., Commissioner; Monica Steimle, Commissioner GRAND RAPIDS HOUSING COMMISSION BOARDS AND COMMITTEES GRAND RAPIDS CITY OFFICIALS GRAND RAPIDS SCATTERED SITES HOUSING RESIDENT ADVISORY BOARD Mayor: Rosalynn Bliss CORPORATION Angela Bunn, Chairperson City Manager: Mark Washington Ellen James, President Teresa Boileau City -

FOR IMMEDIATE RELEASE CONTACT Kerri Vanderhoff Grand Rapids Art Museum 616.831.2914 [email protected] ART MUSEUM ELECT

FOR IMMEDIATE RELEASE CONTACT Kerri VanderHoff Grand Rapids Art Museum 616.831.2914 [email protected] ART MUSEUM ELECTS NEW BOARD MEMBERS FOR 2008-2009 GRAND RAPIDS, Mich., October 22, 2008 – The Grand Rapids Art Museum (GRAM) elected new board members during the Annual Meeting on October 3, 2008. Election to the Board of Trustees by the Museum Membership includes Patricia Betz, Judy DeLapa, Dirk Hoffius, Chris Stoffel Overvoorde, Jason Pater, Jeff Reuschel, Mitchell Watt, Scott Wierda, and Meg Miller Willit. Michael Ellis, outgoing President of the Board of Trustees, was elected to the Art Museum Foundation Board of Trustees. Election of Board Officers by Trustees included Scott Wierda to the position of President and Michael Love to the position of Vice President of the Board of Trustees. Recognition of service was given to outgoing Trustees Doris Anderson, Kenyatta Brame, Mary Nelson, Pamella DeVos and outgoing President Michael Ellis. Patricia Betz graduated from Western Michigan University in 1959 with a B.A. Degree in Education. She was an educator in the Grand Rapids Public School system. She tutored in the inner city and recently helped establish a tutoring program at Westwood Middle School. She is married to Karl Betz, President of Betz Industries and has three married children and eight grandchildren. Patricia has been a volunteer in the Grand Rapids community for many years. She is a past president of UCOM – the United Church Outreach Ministry Board of Trustees and of the St. John’s United Church of Christ Council and is currently active in the church’s education program. -

Devos Releases Unprecedented Amount of Personal Financial Information

FOR IMMEDIATE RELEASE CONTACT: John Truscott MARCH 31, 2006 (517) 485-8404 DeVos releases unprecedented amount of personal financial information Gubernatorial candidate Dick DeVos today released an unprecedented amount of personal financial information to demonstrate to voters that there clearly are no conflicts of interest or potential conflicts between his business holdings and state government. Today’s released information demonstrates that Dick and Betsy DeVos have paid all taxes in full, have no conflicts of interest and are proven community leaders. IRS data show that the average tax paid on income by Americans is 11.9 percent. The top 1 percent of income earners (those with incomes over $1.05 million) paid an average of 24.31 percent. Included in this document: • In an unprecedented move, Dick DeVos included a list of all the businesses in which he has an interest; • A list of 449 charities to which DeVos has contributed; and • This is a tremendous amount of detail; more than what would be provided in a tax return. #### Paid for by DeVos for Governor | PO Box 22216 | Lansing | MI | 48909 | 517-679-0191 www.DeVosforGovernor.com Dick and Betsy DeVos No Conflict of Interest March 31, 2006 Taxes Paid in Full The most recently filed tax return for Dick and Betsy DeVos is their 2004 return. (They must extend their tax returns each year due to information required from third-parties not being available by April 15.) The tax and income information below is based on their 1997-2004 tax returns: o Dick and Betsy DeVos paid both Federal and Michigan income taxes every year during the past eight years.