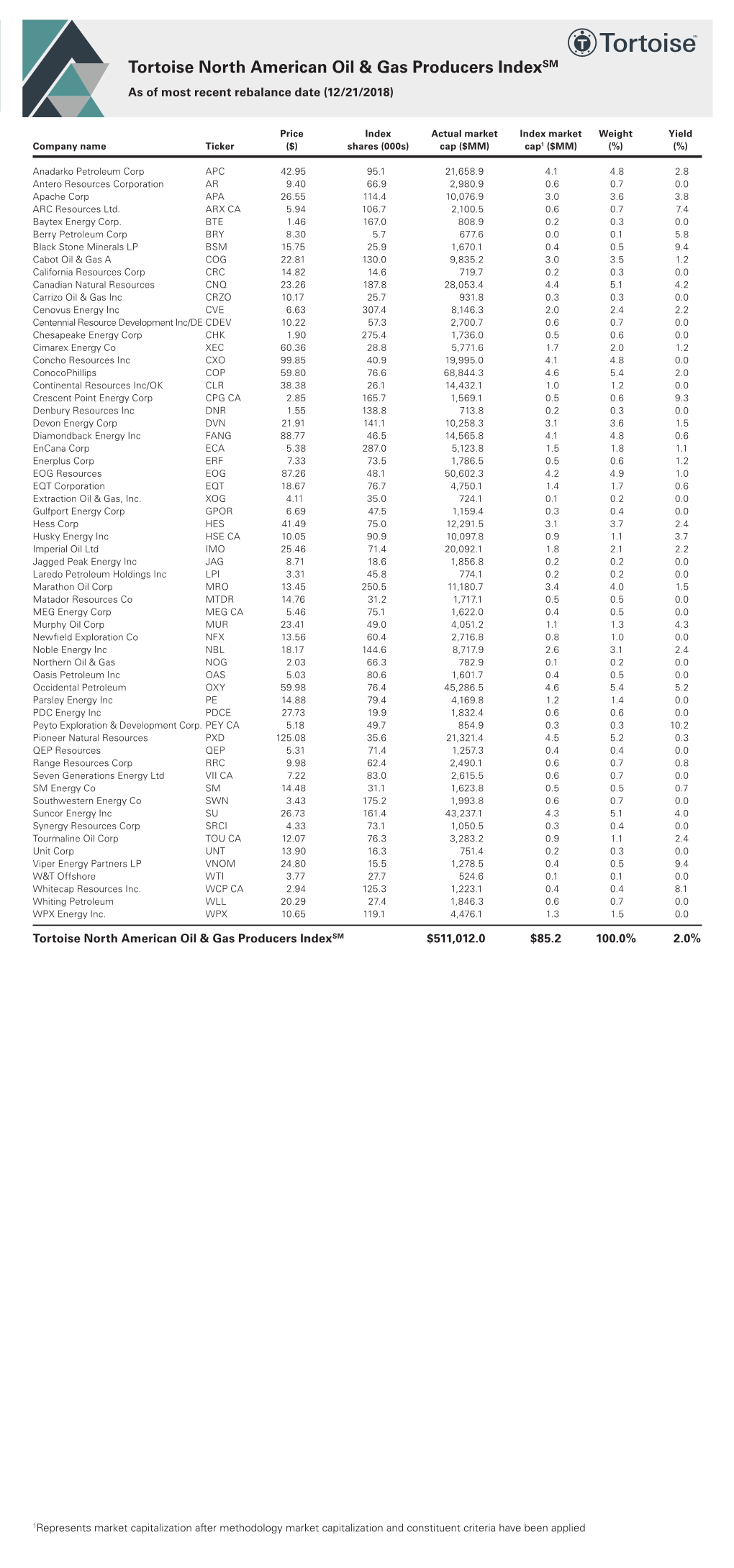

Tortoise North American Oil & Gas Producers Indexsm

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Petroleum News Bakken 121513 Petroleum News 082904

page Statoil hits 14th top IP well 8 in 22 weeks Vol. 2, No. 35 • www.PetroleumNewsBakken.com A weekly newspaper for industry and government Week of December 15, 2013 • $2.50 l NATURAL GAS Producing amid the windrows Finishing touches NDPC flaring task force to submit recommendations to NDIC in January By MAXINE HERR “The nature of this business is that VERN WHITTEN PHOTOGRAPHY For Petroleum News Bakken drillers drill, operators operate, and they he North Dakota Petroleum Council, NDPC, sign a long-term contract with a gas Tflaring task force is putting finishing touch- processing company and they walk es on its recommendations to reduce flaring in the away.” —Department of Mineral Resources Director state. Lynn Helms In September, Gov. Jack Dalrymple requested the development of a task force to study the prob- Wells pumping on a Hess Corporation pad in the Traux field subcommittee has some recommendations that southeast of Williston in southern Williams County, N.D. lem and provide some solid solutions to the North needed further review. Dakota Industrial Commission. The task force “We want to give it a good review and make will present its findings at the Jan. 29 commission sure membership and everyone’s ready,” Dille ND operators increasing well meeting. said. “We want to get it as good as we can. As far Task force Chairman Eric Dille of EOG densities to even higher levels as recommendations on flaring, goals, and crite- Resources told Petroleum News Bakken that the ria, we have developed some targets we think we North Dakota operators continue to increase well densi- task force had hoped to present at the Dec. -

2015 Annual Report Mission

2015 annual report Mission Our mission is to facilitate innovation, collaborative research and technology development, demonstration and deployment for a responsible Canadian hydrocarbon energy industry. 2 Vision Our vision is to help Canada become a global hydrocarbon energy technology leader. PTAC Technology Areas Manage Environmental Impacts • Air Quality • Alternative Energy Improve Oil and Gas Recovery • Ecological • CO2 Enhanced Hydrocarbon Recovery • Emission Reduction / Eco-Efficiency • Coalbed Methane, Shale Gas, Tight Gas, Gas Hydrates, • Energy Efficiency and other Unconventional Gas • Resource Access • Conventional Heavy Oil, Cold Heavy Oil Production with • Soil and Groundwater Sands • Water • Conventional Oil and Gas Recovery • Wellsite Abandonment • Development of Arctic Resources • Development of Remote Resources Additional PTAC Technical Areas • Enhanced Heavy Oil Recovery • e-Business • Enhanced Oil and Gas Recovery • Genomics • Enhanced Oil Sands Recovery • Geomatics • Emerging Technologies to Recover Oil Sands from Deposits • Geosciences with Existing Zero Recovery • Health and Safety • Tight Oil, Shale Oil, and other Unconventional Oil • Instrumentation/Measurement • Nano Technology Reduce Capital, Operating, and G&A Costs • Operations • Automation • Photonics • Capital Cost Optimization • Production Engineering • Cost Reduction Using Emerging Drilling and Completion • Remote Sensing Technologies • Reservoir Engineering • Cost Reduction Using Surface Facilities • Security • Eco-Efficiency and Energy Efficiencyechnologies -

Q3 2020 Husky-MDA

MANAGEMENT’S DISCUSSION AND ANALYSIS October 29, 2020 Table of Contents 1.0 Summary of Quarterly Results 2.0 Business Overview 3.0 Business Environment 4.0 Results of Operations 5.0 Risk Management and Financial Risks 6.0 Liquidity and Capital Resources 7.0 Critical Accounting Estimates and Key Judgments 8.0 Recent Accounting Standards and Changes in Accounting Policies 9.0 Outstanding Share Data 10.0 Reader Advisories 1.0 Summary of Quarterly Results Three months ended Quarterly Summary Sep. 30 Jun. 30 Mar. 31 Dec. 31 Sept. 30 Jun. 30 Mar. 31 Dec. 31 ($ millions, except where indicated) 2020 2020 2020 2019 2019 2019 2019 2018(1) Production (mboe/day) 258.4 246.5 298.9 311.3 294.8 268.4 285.2 304.3 Throughput (mbbls/day) 300.1 281.3 307.8 203.4 356.4 340.3 333.6 286.9 Gross revenues and Marketing and other(1) 3,379 2,408 4,113 4,921 5,373 5,321 4,610 5,042 Net earnings (loss) (7,081) (304) (1,705) (2,341) 273 370 328 216 Per share – Basic (7.05) (0.31) (1.71) (2.34) 0.26 0.36 0.32 0.21 Per share – Diluted (7.06) (0.31) (1.71) (2.34) 0.25 0.36 0.31 0.16 Cash flow – operating activities 79 (10) 355 866 800 760 545 1,313 Funds from operations(2) 148 18 25 469 1,021 802 959 583 Per share – Basic 0.15 0.02 0.02 0.47 1.02 0.80 0.95 0.58 Per share – Diluted 0.15 0.02 0.02 0.47 1.02 0.80 0.95 0.58 (1) Gross revenues and Marketing and other results reported for 2019 have been recast to reflect a change in reclassification of intersegment sales eliminations and a change in presentation of the Integrated Corridor and Offshore business units. -

Suncor Q3 2020 Investor Relations Supplemental Information Package

SUNCOR ENERGY Investor Information SUPPLEMENTAL Published October 28, 2020 SUNCOR ENERGY Table of Contents 1. Energy Sources 2. Processing, Infrastructure & Logistics 3. Consumer Channels 4. Sustainability 5. Technology Development 6. Integrated Model Calculation 7. Glossary SUNCOR ENERGY 2 SUNCOR ENERGY EnergyAppendix Sources 3 202003- 038 Oil Sands Energy Sources *All values net to Suncor In Situ Mining Firebag Base Plant 215,000 bpd capacity 350,000 bpd capacity Suncor WI 100% Suncor WI 100% 2,603 mmbbls 2P reserves1 1,350 mmbbls 2P reserves1 Note: Millennium and North Steepank Mines do not supply full 350,000 bpd of capacity as significant in-situ volumes are sent through Base Plant MacKay River Syncrude 38,000 bpd capacity Syncrude operated Suncor WI 100% 205,600 bpd net coking capacity 501 mmbbls 2P reserves1 Suncor WI 58.74% 1,217 mmbbls 2P reserves1 Future opportunities Fort Hills ES-SAGD Firebag Expansion Suncor operated Lewis (SU WI 100%) 105,000 bpd net capacity Meadow Creek (SU WI 75%) Suncor WI 54.11% 1,365 mmbbls 2P reserves1 First oil achieved in January 2018 SUNCOR ENERGY 1 See Slide Notes and Advisories. 4 1 Regional synergy opportunities for existing assets Crude logistics Upgrader feedstock optionality from multiple oil sands assets Crude feedstock optionality for Edmonton refinery Supply chain Sparing, warehousing & supply chain management Consolidation of regional contracts (lodging, busing, flights, etc.) Operational optimizations Unplanned outage impact mitigations In Situ Turnaround planning optimization Process -

Pride Drillships Awarded Contracts by BP, Petrobras

D EPARTMENTS DRILLING & COMPLETION N EWS BP makes 15th discovery in ultra-deepwater Angola block Rowan jackup moving SONANGOL AND BP have announced west of Luanda, and reached 5,678 m TVD to Middle East to drill the Portia oil discovery in ultra-deepwater below sea level. This is the fourth discovery offshore Saudi Arabia Block 31, offshore Angola. Portia is the 15th in Block 31 where the exploration well has discovery that BP has drilled in Block 31. been drilled through salt to access the oil- ROWAN COMPANIES ’ Bob The well is approximately 7 km north of the bearing sandstone reservoir beneath. W ell Keller jackup has been awarded a Titania discovery . Portia was drilled in a test results confirmed the capacity of the three-year drilling contract, which water depth of 2,012 m, some 386 km north- reservoir to flow in excess of 5,000 bbl/day . includes an option for a fourth year, for work offshore Saudi Arabia. The Bob Keller recently concluded work Pride drillships in the Gulf of Mexico and is en route to the Middle East. It is expected awarded contracts to commence drilling operations during Q2 2008. Rowan re-entered by BP, Petrobras the Middle East market two years ago after a 25-year absence. This PRIDE INTERNATIONAL HAS contract expands its presence in the announced two multi-year contracts for area to nine jackups. two ultra-deepwater drillships. First, a five-year contract with a BP subsidiary Rowan also has announced a multi- will allow Pride to expand its deepwater well contract with McMoRan Oil & drilling operations and geographic reach Gas Corp that includes re-entering in deepwater drilling basins to the US the Blackbeard Prospect. -

Husky Energy Ltd

CLEAN ENERGY FINAL REPORT PACKAGE Project proponents are required to submit a Final Report Package, consisting of a Final Public Report and a Final Financial Report. These reports are to be provided under separate cover at the conclusion of projects for review and approval by Alberta Innovates (AI) Clean Energy Division. Proponents will use the two templates that follow to report key results and outcomes achieved during the project and financial details. The information requested in the templates should be considered the minimum necessary to meet AI reporting requirements; proponents are highly encouraged to include other information that may provide additional value, including more detailed appendices. Proponents must work with the AI Project Advisor during preparation of the Final Report Package to ensure submissions are of the highest possible quality and thus reduce the time and effort necessary to address issues that may emerge through the review and approval process. Final Public Report The Final Public Report shall outline what the project achieved and provide conclusions and recommendations for further research inquiry or technology development, together with an overview of the performance of the project in terms of process, output, outcomes and impact measures. The report must delineate all project knowledge and/or technology developed and must be in sufficient detail to permit readers to use or adapt the results for research and analysis purposes and to understand how conclusions were arrived at. It is incumbent upon the proponent to ensure that the Final Public Report is free of any confidential information or intellectual property requiring protection. The Final Public Report will be released by Alberta Innovates after the confidentiality period has expired as described in the Investment Agreement. -

Environmental Effects Monitoring Design Report

Environmental Effects Monitoring Design Report Appendix A Approach to Baseline WR-HSE-RP-2008, Ver 1 Appendix A Page 1 of 3 Environmental Effects Monitoring Design Report Incorporation of New Drill Centres into the White Rose EEM Program Selection of Station Locations Sampling and statistical analyses of Environmental Effects Monitoring (EEM) data at White Rose occurs at micro- and macro-scales within the nearfield and farfield regions to address zones of influence (ZOI). The nearfield is that region described by the immediate influence of the drill centres. The farfield region is the area further out along transects outside the nearfield area. As such, the design includes a survey grid centered on the FPSO and a second series of stations centered on the location of drill centres. Husky Energy’s approach to sampling drill centre areas in the nearfield has been to sample six stations located 1 km from the proposed location of new drill centres. This approach accommodates a 1.5-km movement of drill centres should the proposed location change. The approach was employed during initial baseline collection in 2000 (Husky Energy 2001) and for sampling around the potential new drill centre at the NN and South White Rose Extension (SWR-X) drill centres in 2004 (Figure 1). With slight variation, this approach was used again in 2006 for the proposed West Alpha and West Bravo drill centres (Figure 1). Once the location of new drill centres is finalized, three or four of the nearest drill centre stations are retained1 depending on projected drilling intensity, and one new station is added 300 m from the drill centre in the following sampling year if drilling has occurred at that drill centre. -

Archrock, Inc. AROC (DB) Baker Hughes BHGE

Abraxas Petr. AXAS (RM) Helix Energy HLX (MWM) Sanchez Engy SN (RM) Anadarko APC (CM) Helmerich/Payne HP (DB) Sanchez Mid. SNMP (GV) Apache APA (CM) Hi-Crush Partners HCLP (MWM) Schlumberger SLB (DB) Archrock, Inc. AROC (DB) HighPoint Res. HPR (BC) Silverbow SBOW (RM) Baker Hughes BHGE (DB) Hornbeck Offsh HOS (DB) Smart Sand SND (MWM) Basic Energy BAS (DB) Independ. Cont. ICD (DB) Solaris Oilfield SOI (MWM) Berry Petrol. BRY (BC) Innospec Inc IOSP (RS) Southwestern SWN (CM) Bristow Grp BRS (DB) Jones Energy JONE (RM) SRC Energy SRCI (BC) Cabot Oil COG (CM) Key Energy Svcs. KEG (DB) Sundance SNDE (BC) Cactus, Inc. WHD (MWM) Kosmos Energy KOS (CM) Superior Engy SPN (DB) Callon Petl. CPE (RM) Lilis Energy Inc. LLEX (RM) TEAM Inc. TISI (MWM) Carrizo Oil CRZO (RM) Lonestar Res. LONE (RM) TechnipFMC plc FTI (MWM) Centennial Rs CDEV (BC) Mammoth Energy TUSK (DB) TETRA TTI (MWM) Chaparral CHAP (RM) Matador Res. MTDR (BC) Thermon Grp THR (MWM) Chart Industr GTLS (MWM) McDermott Intl. MDR (MWM) Tidewater TDW (RS) Chesapeake CHK (CM) Nabors Industries NBR (DB) Transocean RIG (GV) C&J Energy CJ (DB) National Oilwell NOV (MWM) Unit Corp. UNT (BC) CNX Midstr. CNXM (GV) Newfield Expl NFX (RM) US Silica Hld SLCA (MWM) Comstock CRK (RM) Newpark Res. NR (GV) Weatherford WFT (DB) Concho Res. CXO (CM) Noble Energy NBL (CM) Whiting Pet WLL (BC) Contango MCF (RM) Noble Corp. NE (GV) Wildhorse WRD (BC) Continental Rs CLR (BC) Noble Midstream NBLX (GV) WPX Ergy WPX (BC) Covia Holdings CVIA (MWM) Northern Oil NOG (BC) Core Lab. -

BLM Prohibited Holdings List 2021

BLM 2021 Prohibited Holdings Guide All employees of the Bureau of Land Management (BLM) are prohibited from directly or indirectly acquiring interests in Federal lands. This Guide contains information on this prohibition and provides a list of publicly traded stocks that BLM employees, their spouses, and minor or dependent children are prohibited from holding, in the absence of an exception. All BLM employees have a duty to comply with the BLM Organic Act and related ethics regulations. Accordingly, all BLM employees must review their financial investments to ensure that they do not have financial investments in companies on the Prohibited Holding list. Questions may be sent to: [email protected]. Statutory and Regulatory Background Pursuant to the BLM Organic Act (43 U.S.C. § 11) and implementing regulations (43 C.F.R. § 20.401(a); 5 C.F.R. § 3501.103(a)), all BLM employees are prohibited from purchasing or voluntarily acquiring interests in Federal lands. Employees are also barred from owning stock in companies that have interests in Federal lands. 43 C.F.R. § 20.401(2)(B). These prohibitions are designed to avoid conflicts of interest between a BLM employee’s work and his or her personal financial interests and to increase public confidence in the management of Federal lands. Direct interest includes: • Ownership of stocks and other securities that have interests in Federal lands • Participation in earnings from Federal lands; • The right to occupy or use Federal lands; • The right to take any benefit from Federal lands under a contract, grant, lease, permit, easement, rental agreement, or application. -

Big Oil's Oily Grasp

Big Oil’s Oily Grasp The making of Canada as a Petro-State and how oil money is corrupting Canadian politics Daniel Cayley-Daoust and Richard Girard Polaris Institute December 2012 The Polaris Institute is a public interest research organization based in Canada. Since 1997 Polaris has been dedicated to developing tools and strategies to take action on major public policy issues, including the corporate power that lies behind public policy making, on issues of energy security, water rights, climate change, green economy and global trade. Polaris Institute 180 Metcalfe Street, Suite 500 Ottawa, ON K2P 1P5 Phone: 613-237-1717 Fax: 613-237-3359 Email: [email protected] www.polarisinstitute.org Cover image by Malkolm Boothroyd Table of Contents Introduction 1 1. Corporations and Industry Associations 3 2. Lobby Firms and Consultant Lobbyists 7 3. Transparency 9 4. Conclusion 11 Appendices Appendix A, Companies ranked by Revenue 13 Appendix B, Companies ranked by # of Communications 15 Appendix C, Industry Associations ranked by # of Communications 16 Appendix D, Consultant lobby firms and companies represented 17 Appendix E, List of individual petroleum industry consultant Lobbyists 18 Appendix F, Recurring topics from communications reports 21 References 22 ii Glossary of Acronyms AANDC Aboriginal Affairs and Northern Development Canada CAN Climate Action Network CAPP Canadian Association of Petroleum Producers CEAA Canadian Environmental Assessment Act CEPA Canadian Energy Pipelines Association CGA Canadian Gas Association DPOH -

Williston Quick Look 4-15-2020.Xlsm

WILLISTON BASIN Wells Put Online Lateral Length (ft) Fluid Intensity (bbls/ft) 6/30/2018 9/30/2018 12/31/2018 3/31/2019 6/30/2018 9/30/2018 12/31/2018 3/31/2019 6/30/2018 9/30/2018 12/31/2018 3/31/2019 OPERATOR SPOTLIGHT 4Q18 1Q19 2Q19 3Q19 4Q18 1Q19 2Q19 3Q19 4Q18 1Q19 2Q19 3Q19 Operator Well Count* CONTINENTAL RESOURCES 507 22 37 36 45 9,690 9,495 9,702 8,523 19 24 22 25 WHITING PETROLEUM 374 41 9 53 40 9,481 7,225 9,027 8,380 20 27 17 18 HESS 355 35 25 39 33 8,236 10,183 9,800 9,993 20 18 18 19 OASIS PETROLEUM 286 28 12 24 18 7,180 4,811 8,515 8,717 30 53 33 28 MARATHON OIL 236 29 19 31 29 5,081 5,161 8,574 8,813 30 18 19 22 EXXON MOBIL 225 7 31 21 19 9,762 10,026 10,048 8,706 40 40 35 31 CONOCOPHILLIPS 212 13 13 13 13 9,825 10,389 9,657 9,699 18 17 21 18 WPX ENERGY 202 20 13 15 23 7,872 9,661 10,331 9,267 21 16 17 12 KRAKEN OPERATING, LLC 169 19 19 18 15 5,844 8,339 7,303 8,121 35 33 30 26 EQUINOR 161 12 11 9 19 8,289 4,422 8,469 9,135 14 24 13 17 EOG RESOURCES 139 7 14 7,313 10,585 25 25 ENERPLUS 120 1 3 26 11 4,102 9,431 9,743 8,960 30 26 18 30 BRUIN E&P PARTNERS 112 11 5 17 7 4,535 9,860 10,797 10,062 49 23 25 26 PETRO-HUNT 107 75445,5377,75510,0498,67456143639 SLAWSON 104 1957810,1103,75414,5449,22623392929 CRESCENT POINT ENERGY U.S. -

Husky Energy and BP Announce Integrated Oil Sands Joint Development

December 5, 2007 For immediate release Husky Energy and BP Announce Integrated Oil Sands Joint Development CALGARY, Alberta – Husky Energy Inc is pleased to announce that an agreement has been reached with BP to create an integrated, North American oil sands business consisting of pre-eminent upstream and downstream assets. The development will be comprised of two joint 50/50 partnerships, a Canadian oil sands partnership to be operated by Husky and a U.S. refining LLC to be operated by BP. Husky and BP will each contribute assets of equal value to the business. Husky will contribute its Sunrise asset located in the Athabasca oil sands in northeast Alberta, Canada and BP will contribute its Toledo refinery located in Ohio, USA. The transaction, which is subject to the execution of final definitive agreements and regulatory approval, is expected to close in the first quarter of 2008 and with effective date January 1, 2008. "This transaction completes Husky’s Sunrise Oil Sands total integration with respect to upstream and downstream solutions," said Mr. John C.S. Lau, President & Chief Executive Officer of Husky Energy Inc. “Husky is extremely pleased to be partnering with BP, a world class global E & P and Refining company. The joint venture will provide better monitoring of project execution, costs and completion timing for this mega project development.” “Toledo and Sunrise are excellent assets. BP’s move into oil sands with Husky is an opportunity to build a strategic, material position and the huge potential of Sunrise is the ideal entry point for BP into Canadian oil sands.” said Tony Hayward, BP’s group chief executive.