Malaysia Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Asian Insights Sparx

Asian Insights SparX KL-SG High Speed Rail Refer to important disclosures at the end of this report DBS Group Research . Equity 27 Jun 2019 KLCI : 1,676.61 Riding the HSR revival Success of Bandar Malaysia hinges on HSR Analyst Tjen San CHONG, CFA +60 3 26043972 [email protected] Holistic project financing is key QUAH He Wei, CFA +603 2604 3966 [email protected] Strong catalyst to revitalise property market STOCKS Top picks – IJM Corp, Gamuda, Matrix Concepts 12-mth HSR revival. Two key events unfolded in 2Q19 which could pave the Price Mkt Cap Target Price Performance (%) way for the recommencement of the Kuala Lumpur (KL)-Singapore(SG) RM US$m RM 3 mth 12 mth Rating high-speed rail (HSR) project in May 2020. First, MyHSR Corp called for a Technical Advisory Consultant (TAC) and a Commercial Advisory Gamuda 3.62 2,165 4.30 27.5 11.0 BUY Consultant (CAC) tender. Second is the revival of the Bandar Malaysia. IJM Corp 2.40 2,108 2.55 8.6 32.6 BUY Muhibbah 2.77 323 3.55 (6.1) (9.5) BUY The revival would be timely for construction as it will ensure a growth WCTEngineering Holdings Bhd 1.05 358 1.37 30.6 33.0 BUY agenda during the mid-term of the PH-led government. From an Kimlun Corp 1.40 113 2.16 15.7 2.9 BUY economic standpoint, the project would appear feasible given that the Sunway 2.02 631 1.91 9.2 8.6 HOLD KL-SG flight route remains the world’s busiest. -

TA Securities COMPANY UPDATE Tues Day , 14 February , 201 7 a Member of the TA Group FBMKLCI : 1, 710 .24

TA Securities COMPANY UPDATE Tues day , 14 February , 201 7 A Member of the TA Group FBMKLCI : 1, 710 .24 MENARA TA ONE, 22 JALAN P. RAM LEE, 50250 KUALA LUMPUR, MALAYSIA TEL: +603 -20721277 / FAX: +603 -20325048 Sector: Construction Ekovest Berhad TP: RM 3.43 (+20.4%) A Cash Cow in the Making Last traded: RM2.85 THIS REPORT IS STRICTLY FOR INTERNAL CIRCULATION ONLY* Not Rated Ooi Beng Hooi +603-2167-9612 [email protected] www.taonline.com.my Despite a sharp rally in sha re price of 166. 4% since early -2015, we still Share Information think the stock is undervalued and see long term value in this rising star. Bloomberg Code EKO MK We like the company for its i) sizeable outstanding construction order book; Stock Code 8877 Listing Main Market ii) likelihood of sustaining its construction order book for another 5 to 10 Share Cap (mn) 855.5 years; iii) potential unlocking of asset value through IPO for its Market Cap (RMmn) 2438.0 expressways; iv) potential REITing of its shopping malls in long term; and Par Value 0.50 v) potential transformation into a prominent cash cow in long run. We 52-wk Hi/Lo (RM) 1.01/2.88 arrive at a fair value of RM3.43/share. NOT RATED 12-mth Avg Daily Vol ('000 shrs) 1,603.7 Estimated Free Float (%) 40.8 Listed on the Second Board of Bursa Malaysia in 1993 and promoted to the Beta 0.36 Major Shareholders (%) Main Board in 2000, Ekovest Berhad is involved in construction, property Lim Kang Hoo - 20.19 development and highway toll operation. -

BANDAR MALAYSIA FAQ IWH-CREC Sdn Bhd (ICSB)

BANDAR MALAYSIA FAQ IWH-CREC Sdn Bhd (ICSB) has signed a deal to acquire 60% of Bandar Malaysia Sdn Bhd (BMSB) equity from TRX City Sdn Bhd (TRXC) on 17th December 2019 for a consideration of RM6.45 billion. 1. Who is IWH-CREC Sdn Bnd (ICSB)? ICSB is a joint venture between Iskandar Waterfront Holdings Sdn Bhd (IWH) and China Railway Engineering Corp (M) Sdn Bhd (CRECM). IWH holds 60% interest in ICSB and the remaining 40% is by CRECM. CRECM is a 100% owned subsidiary of CREC. CREC is a world-leading construction conglomerate with more than 120 years history. As one of the world’s largest construction and engineering contractors, CREC takes a leading position in infrastructure construction, industrial equipment manufacturing and real estate development. Over the decades, the CREC has built more than 2/3 of China’s national railway network and 90% of China’s electrified railway. IWH shareholding is 37% Kumpulan Prasarana Rakyat Johor (KPRJ – Johor State Govt) and 63% Credence Resources (Tan Sri Dato’ Lim Kang Hoo). At the BMSB level, there will be approximately 76% Malaysian/local interest or 53% federal/state’s interest. Credence KPRJ Resources China Railway (Johor (TS Lim Engineering State Govt) Kang Hoo) Corporation 37% 63% (M) Sdn. Bhd. 100% China Railway Iskandar Engineering Waterfront Corporation (M) Holdings Sdn. Bhd Sdn. Bhd. Bhd. 60% 40% IWH CREC Sdn. Bhd. 2. Who is TRX City Sdn Bhd (TRXC)? TRXC is a wholly owned subsidiary of the Ministry of Finance, Malaysia. TRXC was formerly a subsidiary of 1Malaysia Development Bhd before it was transferred to MoF due to mounting 1MDB debts and the inability to fund the TRXC projects, including Bandar Malaysia. -

Taman Sri Segambut to See Its ˎrst High-Rise Residences

EP 2 FRIDAY OCTOBER 6, 2017 • THEEDGE FINANCIAL DAILY NEWS HIGHLIGHTS from www.EdgeProp.my Tropicana TRX Residences eyes 1Q18 launch founder’s son Dion Tan is new MD; CEO TRX Residences, the residential com- es will comprise about 900 units, Yau retires ponent of the 17-acre TRX Lifestyle but not all of these units will be Tropicana Corp Bhd has redesignat- Quarter, is aiming to launch its fi rst launched simultaneously, said ed its executive director, 27-year-old homes sometime in the fi rst quarter Lendlease Malaysia residential di- Dion Tan, the son of founder and of next year. rector Eric Chan. largest shareholder Tan Sri Danny The TRX Lifestyle Quarter is part The unit sizes, which may range Tan Chee Sing who has a 30.45% of the 70-acre Tun Razak Exchange from 1-bedroom units of 500 sq ft to stake in the company, as managing (TRX) development which is set to be- 4-bedroom units of 2,000 sq ft, will director eff ective Oct 2. come a world-class fi nancial district be designed to cater for a broader Dion’s eldest brother, Datuk Dick- in Kuala Lumpur. It will encompass swathe of Malaysian property buy- son Tan Yong Long, is Tropicana’s investment Grade A offi ce space un- ers, said Lendlease Malaysia man- deputy group CEO, while another derpinned by world-class residential, aging director Stuart Mendel. brother, Dillon Tan Yong Chin, is an hospitality, retail, leisure and cultur- TRX Residences will comprise six executive director. al off erings. towers of 40 to 57 storeys each that Meanwhile, Tropicana said CEO The fi rst phase of TRX Residenc- will off er a total of 2,400 homes. -

Bandar Malaysia Jv Partners Settle Contractual Obligations to Government

PRESS RELEASE FOR IMMEDIATE RELEASE BANDAR MALAYSIA JV PARTNERS SETTLE CONTRACTUAL OBLIGATIONS TO GOVERNMENT ALL IS CLEAR FOR PROJECT TO TAKE OFF NOW KUALA LUMPUR, SEPTEMBER 15 2020 – Bandar Malaysia, the single largest city development in the region, is now ready to take off with the settlement of the RM1.24 billion payment due to the Federal Government by IWH-CREC Sdn Bhd. A total of RM1,24 billion has been paid by IWH-CREC, under the revised share sale agreement and shareholders’ agreement, which includes the 10-per cent deposit and a RM500 million advance payment to TRX City Sdn Bhd, which is wholly owned by Minister of Finance Inc. Under the agreements, IWH-CREC will take up a 60-per cent stake in Bandar Malaysia Sdn Bhd, the project’s master developer, from TRX City, with the remaining 40- per cent held by the Ministry of Finance. IWH-CREC is a joint venture between Iskandar Waterfront Holdings Sdn Bhd (IWH) and China state-owned enterprise, China Railway Engineering Corporation (CREC). The Johor State Government also has an interest through Kumpulan Prasarana Rakyat Johor Sdn Bhd (KPRJ), which owns 37-per cent of IWH. Page 1 of 5 At a ceremony today, IWH, led by its executive vice chairman Tan Sri Lim Kang Hoo and CREC Malaysia Chairman Mr Chen ZhiGong handed over a cheque for RM1.24 billion to TRX City Sdn Bhd represented by Dato’ Asri bin Hamidon, witnessed by Minister of Finance YB Senator Dato’ Sri Tengku Zafrul Bin Tengku Abdul Aziz, Minister of Transport Datuk Seri Dr Wee Ka Siong, Ambassador Extraordinary and Plenipotentiary of the People's Republic of China to Malaysia, H.E. -

Avara Brochure 12.5Inc Square 32Pages ENG FA Web

www.avara.com.my Developer : BA SHENG SDN BHD (1058822-W) No. 10 (Lot 30), Jalan Seputeh, 58000 Kuala Lumpur. T: +603-7972 3365 Developer’s License No.: __________ • Validity: __________ – __________ • Advertising Permit No.: __________ • Validity: __________ – __________ • Building Plan Approving Authority: Dewan Bandaraya Kuala Lumpur • Building Plan Approval No.: BP S1 OSC 2017 1667 • Expected Date of Completion: 48 months (October 2021) • Land Tenure: Freehold • Land Encumbrances: Charged To RHB Bank Berhad (October 2021) • Type of Property: Serviced Apartment • Total Units: 366 • Selling Price: Type A (46 Units - 667 sq ft) – RM731,250.00 (Min.) RM821,250.00 (Max.) • Type A1 (23 Units - 689 sq ft) – RM757,500.00 (Min.) RM843,750.00 (Max.) • Type B (23 Units - 807 sq ft) – RM868,750.00 (Min.) RM958,750.00 (Max.) • Type C (91 Units - 829 sq ft) – RM890,000.00 (Min.) RM980,000.00 (Max.) • Type D (46 Units - 915 sq ft) RM970,000.00 (Min.) RM1,067,500 (Max.) • Type E (23 Units - 1,087 sq ft) RM1,126,250.00 (Min.) RM1,217,500.00 (Max.) • Type F (23 Units - 926 sq ft) RM981,250.00 (Min.) RM1,071,250.00 (Max.) • Type G (23 Units - 1,076 sq ft) RM1,116,250.00 (Min.) RM1,207,500.00 (Max.) • Type H (22 Units - 850 sq ft) RM910,000.00 (Min.) RM1,000,000.00 (Max.) Type I (46 Units - 1,216 sq ft) RM1,238,750.00 (Min.) RM1,328,750.00 (Max.) • Bumiputra Discount: 5% • Restriction in Interest: N/A. IKLAN INI TELAH DILULUSKAN OLEH JABATAN PERUMAHAN NEGARA. -

Greater Kuala Lumpur: Bridge Between Asia and the World Why Greater Kuala Lumpur Is the Ideal Business Hub for Regional and Global Companies

www.pwc.com/my Greater Kuala Lumpur: Bridge between Asia and the world Why Greater Kuala Lumpur is the ideal business hub for regional and global companies July 2017 This publication has been prepared for general guidance on matters of interest only, and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, PwC, its members, employees and agents do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. ©2017 PwC. All rights reserved. “PricewaterhouseCoopers” and/or “PwC” refers to the individual members of the PricewaterhouseCoopers organisation in Malaysia, each of which is a separate and independent legal entity. Please see www.pwc. com/structure for further details. 2 Greater Kuala Lumpur: Bridge between Asia and the world Foreword Asia remains the world’s growth driver, and Greater Kuala Lumpur is at the heart of it In PwC’s World in 2050 report, released earlier this year, Foreign investors are particularly interested in using we continue to foresee the shift in global economic power Malaysia and Greater KL as their regional operational away from established advanced economies towards hub to tap into the growing opportunities in emerging emerging economies in Asia. -

Newsletter-April 2017 5

FREEHOLD APRIL 2017 EKOVEST PP18916/11/2015(034379) TOP ASIA AWARD FOR SUKUK ISSUANCE SOME THINGS ARE DUKE 3 Worth Treasuring PRIME MINISTER'S VISIT In Life TO RIVER OF LIFE SITE River Beautification In Precinct 7 EkoCheras Mall EKOCHERAS EQUATES EARTH-CONSCIOUSNESS SUSTAINABILITY EkoCheras BEST MIXED DEVELOPMENT EkoRiver Centre (KL River City) REDEFINED by Ekovest Berhad LAVISH YOURSELF IN THE HEART OF THE CITY LIKE NEVER BEFORE Embrace uber modern contemporary living. Inside and outside. From lavish living space full of natural light to leisurely outdoors filled with breezy style and comfort. EkoTitiwangsa is a living icon connected to a 7-storey shopping mall (approx. 600,000sf) with a breathtaking view of the stunning KL skyline. Not Least, EkoTitiwangsa is located along Titiwangsa, right next to the DUKE Highway and KL River City. Offering exceptional accessibility, these 3 blocks of freehold service apartments are the answer to urbane living in luxury suites ranging from 820sf to 1340sf, as well as immense safety via 24-hour CCTV surveillance with 3-tier security complete with smart card access and guard patrol. EKOVEST BERHAD DEVELOPER HEAD OFFICE EKOVEST BERHAD SALES GALLERY Ground Floor, Wisma Ekovest, No. 118, No 122, Jalan Desa Gombak 1, Ekovest Land Sdn Bhd (549480-K) Jalan Gombak, 53000 Kuala Lumpur. 53000 Kuala Lumpur. +603 4032 1881 (A wholly owned subsidiary of Ekovest Berhad) T : +603-4021 5948 F : +603-4032 1771 GPS Co.: N 3°11'38.6" E 101°42'18.5" www.ekotitiwangsa.com E : [email protected] fb.com/Ekovest Berhad -

Kuala Lumpur Office

Asian Cities Report – 2H 2019 REPORT Savills Research Kuala Lumpur Offi ce Kuala Lumpur Offi ce Strong interest in quality offi ce space is being led by the expansion of fl exible space operators NEW SUPPLY GRAPH 1: Greater KL Offi ce Stock, 2010 to 1H/2019 Stock of offi ce space in Greater KL, the single largest offi ce market in ASEAN, stands at approximately 126 million sq ft, with the completion of four new offi ce buildings KL City The Rest of Greater KL Greater KL contributing 1.08 million sq ft in 1H/2019. 140 125.3 126.4 The fi rst offi ce tower within the Tun Razak Exchange, namely Menara Prudential, 120.4 115.4 was completed this year and serves as the headquarters for Prudential Assurance 120 111.5 105.4 Malaysia Bhd. The KYM Tower in Mutiara Damansara and Symphony Square in 102.2 97.9 Petaling Jaya were also completed in early 2019. With the exception of the EkoCheras 100 91.5 86.7 Offi ce Suites, the other three new buildings are single-owned en-bloc buildings, built with quality features and modern specifi cations. 80 By the end of 2019, the stock of offi ce space is expected to expand by 3.8 million sq 60 ft, touching approximately 130 million sq ft – with the completion of Southeast Asia’s tallest building, The Exchange 106, which will replace the Petronas Twin Towers as MILLION SQ FT 40 the tallest building in the country. This landmark offi ce tower, located within the Tun Razak Exchange (TRX), stands at 492m tall, off ering 2.4 million sq ft of column- 20 free offi ce space with spacious fl oor plates ranging from 22,000 to 34,000 sq ft. -

Malaysia Real Estate Highlights

RESEARCH REAL ESTATE HIGHLIGHTS 1ST HALF 2015 KUALA LUMPUR PENANG JOHOR BAHRU KOTA KINABALU KUALA LUMPUR HIGH END CONDOMINIUM MARKET (MPC) meeting in May in an effort to support economic growth and domestic HIGHLIGHTS consumption. • Softening demand in the SUPPLY & DEMAND high-end condominium With the completion of seven notable segment amid a cautious projects contributing an additional market. 1,296 units [includes projects that are physically completed but pending Madge Mansions issuance of Certificate of Completion • Lower volume of transactions and Compliance (CCC)], the cumulative expected to come on-stream. The KL in 1Q2015. supply of high end condominiums in City locality will account for circa 35% Kuala Lumpur stands at 39,610 units. (1,310 units) of the new supply; followed • Developers with niche high by Mont’ Kiara / Sri Hartamas with Approximately 45% (582 units) of the new 34% (1,256 units); KL Sentral / Pantai / end residential projects in KL completions are located in the Ampang Damansara Heights with 20% (734 units); City review products, pricing Hilir / U-Thant area, followed by some and the remaining 11% (425 units) from and marketing strategies in 26% (335 units) in the locality of KL City; the locality of Ampang Hilir / U-Thant. a challenging market with 16% (204 units) from the locality of KL lacklustre demand, impacted Sentral / Pantai / Damansara Heights Notable projects slated for completion by a general slowdown in the area; and 14% (175 units) from the Mont’ in KL City include Face Platinum Suites, economy, tight lending Kiara / Sri Hartamas locality. Le Nouvel, Mirage Residences as well as guidelines, weaker job market the delayed project of Crest Jalan Sultan The three completions in Ampang Hilir amongst other reasons. -

Section 3 Project Description Projek Mass Rapid Transit Laluan 2 : Sg

Section 3 Project Description Projek Mass Rapid Transit Laluan 2 : Sg. Buloh – Serdang - Putrajaya Detailed Environmental Impact Assessment SECTION 3 : PROJECT DESCRIPTION 3. SECTION 3 : PROJECT DESCRIPTION 3.1 INTRODUCTION The main objective of the Project is to facilitate future travel demand in the Klang Valley and to complement the connectivity to Kuala Lumpur by improving the current rail coverage and increasing accessibility of public transport network to areas not currently served or covered by public transport. The SSP Line will serve the existing residential areas, minimize overlapping with existing rail service and provide convenient access to Kuala Lumpur city centre. This section describes the Project in terms of the proposed alignment and stations, the planning and design basis, operation system and the construction methodology. 3.2 PLANNING AND DESIGN BASIS The over-arching principles in the development of the KVMRT is even network coverage, entry into the city centre, location of stations in densely populated areas and ability to sustain future expansion. The GKL/KV PTMP has identified key issues in the rail network such as capacity and quality of existing systems, integration between modes, gaps in network coverage and mismatch in land use planning. Considering the gap in the network, particularly in the northwest – southern corridor, the SSP Line is designed to serve the city centre to Sg Buloh, Kepong, Serdang and Putrajaya areas. The SSP Line will traverse through high density residential and commercial areas and has the capacity to move large volumes of people from the suburban areas to the employment and business centres. In terms of planning basis, the main objectives of the Project are as follows:- • To meet the increasing demand for rail based urban public transportation • To increase the railway network coverage and its capacity • To provide better integration between the new SSP Line and existing rail lines such as LRT, Monorail, SBK Line and KTM lines as well as the future High Spee Rail. -

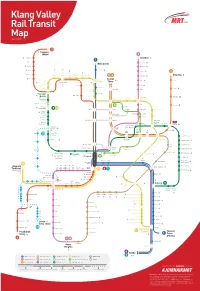

Klang Valley Rail Transit Map April 2020

Klang Valley Rail Transit Map April 2020 2 P Tanjung Malim 5 P Kuala Kubu Baru Gombak P 1 P Rasa Taman Melati P Batu Caves P Batang Kali Wangsa Maju P P P P Serendah Taman Wahyu P P Sri Rampai P 3 Sri Sri P Metro P Rawang Damansara Damansara Kepong Sri Prima Ampang P Sentral Timur Baru Jinjang Delima 4 3 Setiawangsa P P Kuang Sentul Cahaya Kampung P Jelatek P Sri Batu P Timur P Damansara Kepong Sentral P Barat P Kentonmen Dato’ Keramat Kepong Damansara Batu Kentomen Damai Cempaka P Sentul P Jalan Damai Ipoh *Sungai Sentul P P P Segambut Sentul Buloh Pandan Indah P Barat Hospital Raja Ampang *Kampung Titiwangsa Kuala Lumpur Uda Park Selamat *Rubber Research Institute 8 KLCC Pandan Jaya P *Kwasa Chow Kit P Damansara 9 12 Putra PWTC Medan Tuanku Kampung Baru Persiaran KLCC Kwasa P Sentral Sultan Ismail Dang Wangi Bukit Nanas Kota Conlay Damansara Raja Chulan Surian Bank Negara Bandaraya Tun Razak Mutiara Exchange (TRX) Damansara Bukit Bintang Cochrane Maluri P Bandar Bukit Bintang P Masjid Utama Jamek Imbi S01 P Miharja P Plaza Hang Rakyat Tuah Pudu S02 Taman Tun 11 Dr Ismail Taman Pertama Chan Phileo P Merdeka Sow Lin Damansara Taman Midah P S03 P Kuala Lumpur Cheras Taman Mutiara Bukit Kiara Bandar Malaysia P Muzium Negara Pasar Utara Seni Maharajalela Taman Connaught S04 Salak Selatan P KL Sentral P Bandar Malaysia Taman Suntex Selatan P P Tun Sambanthan Semantan KL Sentral 8 Pusat Bandar Sri Raya P S05 Damansara P Mid Valley Seputeh Salak Selatan Bandar Tun Bandar Tun Razak P Hussein Onn 10 Bangsar P P P P P S06 Batu 11 Cheras Skypark