Pubali Bank Visa Credit Card

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Country Wise List of Our Foreign Correspondents Sonali Bank Limited

Country wise list of our Foreign correspondents as on 31-12-2018. Prepared bv : Sonali Bank limited Foreign Remittance Management Division Head office.Dhaka. Courtesv : Sonali Bank limited (Product Development Team) Business Development Division Head office,Dhaka. E mail-dgmb ddp dt@s on aliban k. co m.b d Md Mizanur Rahman Md Zillur Rahman Sikder Senior Principal officer Senior ofl.icer Product Development Team. Product Der elopment Team. mob-01708159313. mob-019753621 15. Corp Bank Country dents as on 3ut2na18 Sl.No. Name ofCountry No. o No. of SI. No. Name ofCountry No. of No. of Corp. RMA Corn. RMA 01. Afganistan J I 45. Malaysia t2 12 02. Australia 8 7 46. Monaco I I 03. Algeria J 1 41. Malta 2 04. Argentina I Z I 48. Netherlands 8 7 , 05. Albenia i 49. New Zealand J J 06. Austria 7 6 50. Nepal 2 2 07. Balrain J J 51. Norway 2 I 08. Belgium 9 7 52. Nigeria I ) 09. Bhutan 2 53. Oman I q 2 10. Bulgaria 4 4 54. Pakistan 18 18 ll Brunei I 55, Poland 3 1 12. Brazrl 4 2 56. Philippines 5 5 lJ. Republic ofBelarus I 57. Portugal 4 J 14. Canada 8 7 58. Qatar 6 5 15. China 4 l3 59. Romania 1 1 16. Chile I I 60 Russia 9 8 17. Croatia I 61. SaudiArabia l6 t5 18. Cyprus I I o/.. Senegal 1 1 t 19. CzechRepublic 6 J 63. Serbia + J ,1 20. Denmark J J 64. Srilanka 5 21. -

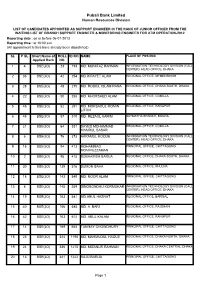

List of Candidates Appointed As Support Engineer in the Rank of Junior Officer From

Pubali Bank Limited Human Resources Division LIST OF CANDIDATES APPOINTED AS SUPPORT ENGINEER IN THE RANK OF JUNIOR OFFICER FROM THE WAITING LIST OF BRANCH SUPPORT ENGINEER & MONITORING ENGINEER FOR ATM OPERATION-2012 Reporting date : on or before 06-01-2013 Reporting time : at 10:00 a.m. (All appointment letters have already been dispatched) SL P SL Short Name of ROLL ID NO. NAME PLACE OF POSTING Applied Rank NO. 1 4 BSE(JO) 23 193 MD. MONITAZ RAHMAN INFORMATION TECHNOLOGY DIVISION (CALL CENTER), HEAD OFFICE, DHAKA 2 33 BSE(JO) 42 254 MD.RIFAYET ALAM REGIONAL OFFICE, MYMENSINGH 3 28 BSE(JO) 48 270 MD. ROBIUL ISLAM RANA REGIONAL OFFICE, DHAKA SOUTH, DHAKA 4 22 BSE(JO) 50 285 MD. KHORSHED ALAM REGIONAL OFFICE, COMILLA 5 45 BSE(JO) 52 291 MD. MOKSADUL MOMIN REGIONAL OFFICE, RANGPUR LITON 6 48 BSE(JO) 57 310 MD. REZAUL KARIM SATMATHA BRANCH, BOGRA 7 21 BSE(JO) 64 331 SAYED MOHAMMAD REGIONAL OFFICE, COMILLA KHAIRUL BASAR 8 6 BSE(JO) 76 373 AKRAMUL HOQUE INFORMATION TECHNOLOGY DIVISION (CALL CENTER), HEAD OFFICE, DHAKA 9 15 BSE(JO) 94 413 MOHAMMAD PRINCIPAL OFFICE, CHITTAGONG MONIRUZZAMAN 10 2 BSE(JO) 95 415 SUBHASISH BARUA REGIONAL OFFICE, DHAKA SOUTH, DHAKA 11 30 BSE(JO) 139 516 SUMON SAHA REGIONAL OFFICE, KHULNA 12 18 BSE(JO) 143 549 MD. NOOR ALAM PRINCIPAL OFFICE, CHITTAGONG 13 8 BSE(JO) 145 559 DINOBONDHU KORMOKAR INFORMATION TECHNOLOGY DIVISION (CALL CENTER), HEAD OFFICE, DHAKA 14 19 BSE(JO) 153 581 MD.ABUL HASNAT REGIONAL OFFICE, BARISAL 15 40 BSE(JO) 156 585 MD. -

SEBL Financial Statements As on 31

Southeast Bank Limited Report and Consolidated & Separate Financial Statements as at and for the year ended 31 December 2016 Rahman Rahman Huq Telephone +880 (2) 988 6450-2 Chartered Accountants Fax +880 (2) 988 6449 9&5Mohakhali C/A E-mail [email protected] Dtaka 1212 lnternet www.kpmg.com/bd Bangladesh independent auditoris report to the shareholders of Southeast Bank lJ■ lited Report on the financiat statements We have audited the accompanying consolidated financial statements ol Southeast Bank Limited and its subsidiaries (the "Group') as well as the separate financial statements of Southeast Bank Limited (the "Bank'), which comprise the consolidated balance sheet and the separate balance sheet as at 3l December 2016, and the consolidated and separate profit and loss accounts, consolidated and separate statements of changes in equity and consolidated and separate cash ffow statements for the year then ended, and a summary of significant accounting policies and other explanatory information. Management's responslbility for the financial statements and internal controls Management is responsible for the preparation of consolidated financial statements of the Group and also separate 'linancial statements of the Bank that give a true and lair view in accordance with Bangladesh Financial Reporting Standards as explained in note 2 and for such intemal control as management determines is necessary to enable the preparation of consolidated financial statements of the Group and also separate financial statements of the Bank that are lree from matedal mi$statement, whether due to traud or eror. The Bank Company Act, 1991 and the Bangladesh Bank Regulations require the Management to ensure etf€ctive intemal audit, intemal control and risk management functions of the Bank. -

Sl. Correspondent / Bank Name SWIFT Code Country

International Division Relationship Management Application( RMA ) Total Correspondent: 156 No. of Country: 36 Sl. Correspondent / Bank Name SWIFT Code Country 1 ISLAMIC BANK OF AFGHANISTAN IBAFAFAKA AFGHANISTAN 2 MIZUHO BANK, LTD. SYDNEY BRANCH MHCBAU2S AUSTRALIA 3 STATE BANK OF INDIA AUSTRALIA SBINAU2S AUSTRALIA 4 KEB HANA BANK, BAHRAIN BRANCH KOEXBHBM BAHRAIN 5 MASHREQ BANK BOMLBHBM BAHRAIN 6 NATIONAL BANK OF PAKISTAN NBPABHBM BAHRAIN 7 AB BANK LIMITED ABBLBDDH BANGLADESH 8 AGRANI BANK LIMITED AGBKBDDH BANGLADESH 9 AL-ARAFAH ISLAMI BANK LTD. ALARBDDH BANGLADESH 10 BANGLADESH BANK BBHOBDDH BANGLADESH 11 BANGLADESH COMMERCE BANK LIMITED BCBLBDDH BANGLADESH BANGLADESH DEVELOPMENT BANK 12 BDDBBDDH BANGLADESH LIMITED (BDBL) 13 BANGLADESH KRISHI BANK BKBABDDH BANGLADESH 14 BANK ASIA LIMITED BALBBDDH BANGLADESH 15 BASIC BANK LIMITED BKSIBDDH BANGLADESH 16 BRAC BANK LIMITED BRAKBDDH BANGLADESH 17 COMMERCIAL BANK OF CEYLON LTD. CCEYBDDH BANGLADESH 18 DHAKA BANK LIMITED DHBLBDDH BANGLADESH 19 DUTCH BANGLA BANK LIMITED DBBLBDDH BANGLADESH 20 EASTERN BANK LIMITED EBLDBDDH BANGLADESH EXPORT IMPORT BANK OF BANGLADESH 21 EXBKBDDH BANGLADESH LTD 22 FIRST SECURITY ISLAMI BANK LIMITED FSEBBDDH BANGLADESH 23 HABIB BANK LTD HABBBDDH BANGLADESH 24 ICB ISLAMI BANK LIMITED BBSHBDDH BANGLADESH INTERNATIONAL FINANCE INVESTMENT 25 IFICBDDH BANGLADESH AND COMMERCE BANK LTD (IFIC BANK) 26 ISLAMI BANK LIMITED IBBLBDDH BANGLADESH 27 JAMUNA BANK LIMITED JAMUBDDH BANGLADESH 28 JANATA BANK LIMITED JANBBDDH BANGLADESH 29 MEGHNA BANK LIMITED MGBLBDDH BANGLADESH 30 MERCANTILE -

Procedure of Open Foreign Currency Account.Pdf

Embassy of Bangladesh Washington DC Wage Earner Development Bond Foreign Currency Foreign Currency Accounts Specimern Signature Specimern Signature FC Account Opening Form and Specimen Signature Extension [email protected] Diplomatic Bag /DHL/Fedex English Version The Government of the People’s Republic of Bangladesh have introduced special saving facilities for Non Resident Bangladeshis and also foreigner’s of Bangladeshi decent. Wage Earner Development Bond : Most profitable fixed deposit investment “Wage Earner Development Bond” for Non Resident Bangladeshi’s and Foreigners of Bangladeshi decent introduced by the Government of the People’s Republic of Bangladesh. Compound rate of profit is 12.00% per annum. Tk. 25,000 become Tk. 44,750 with profit after 5 years Tk. 50,000 become Tk. 89,500 with profit after 5 years Tk. 1,00,000 become Tk. 1,79,000 with profit after 5 years Tk. 5,00,000 become Tk. 8,95,000 with profit after 5 years Profits could be withdrawn at a rate of Tk. 1000.00 per month for every Tk. 100000.00. For withdrawal of profit simple rate is applicable. Nominee is entitled to 30% to 50% of invested amount as a death risk insurance at no extra charge in case of death of the bond owner. No income tax is levied on the initial investment or profits thereof. Initial investment amount could be transferred back in foreign currency. If encashed before maturity you will get interest at following rate : a. Before six month no interest b. After six month and before 1 year : 9% c. After 1 year and before 2 years : 10% d. -

A Framework on Internet Banking Services for the Rationalized Generations

Asian Business Review, Volume 3, Number 2/2013 (Issue 6) ISSN 2304-2613 (Print); ISSN 2305-8730 (Online) 0 A Framework on Internet Banking Services for the Rationalized Generations Md. Rahimullah Miah Lecturer in MIS, Leading University, Sylhet, Bangladesh ABSTRACT The augmented Internet Banking Service is increasingly popular both in Bangladesh and elsewhere. This paper explores a predicted framework for global Internet Banking that emphasizes the transformative interaction among the effective customers around the regional, national and global banking indicating advanced on backend models, instructional strategies, and transaction technologies in the context on upcoming generations. We have to develop the framework on global enhanced transaction systems especially individual global account, effective online banking systems to fulfill the required method, implementing design and appraising the feedback with standard technology according to network topology for disseminating of global banking technological arena. Despite decades of development, electronic payments still need practical examples of how to use electronic payment technology within a uniqueness and rationalized way including global electronic transaction, language tools, currency converter and electronic workstation. This research focuses the major issues responsible for Internet Banking based on respondents’ perception through various internet applications. The author presents a theoretical framework for our represented method, taking into account previous models and characteristics -

District Bank Branch Location Bank Bank Branch Address DLI Office

DLI Bank Branch DLI District Bank Bank Branch Address A/C Location Office No. Bagerhat Bagerhat Agrani Bank Ltd Bagerhat, Khulna Khulna 737 Bagerhat Bagerhat Pubali Bank Ltd Bagerhat-9300 Khulna 9 Bagerhat Chakshree Bazar Bangladesh Krishi Bank Chakshree Bz. Rampal, Bagerhat Khulna 110 Bagerhat Chital Mari Bazar Bangladesh Krishi Bank Chitalmari Bz.,Bagerhat-9360 Khulna 214 Bagerhat Fakirhat Bangladesh Krishi Bank Fakirhat, Bagerhat-9370 Khulna 293 Bagerhat Mongla Pubali Bank Ltd Mongla Bazar,MadrasaRd.,Bagerhat-9351 Khulna 5 Bagerhat Morelgonj Bangladesh Krishi Bank Morelgonj, Bagerhat-9320 Khulna 281 Bagerhat Raindabazar Bangladesh Krishi Bank Raindabazar,Sarankhola, Bagerhat-9330 Khulna 263 Bagerhat Rampal Bangladesh Krishi Bank Rampal, Bagerhat-9340 Khulna 211 Bagerhat Doiboghohati Bangladesh Krishi Bank Morelgonj, Bagerhat-9320 Khulna 44 Bagerhat Foltita Bangladesh Krishi Bank Kolkolia, Fakirhat, Bagerhat Khulna 30 Bagerhat Mollahat Bangladesh Krishi Bank Mollahat, Bagerhat-9380 Khulna 243 Bagerhat Sannayashibazar Bangladesh Krishi Bank Morelgonj, Bagerhat-9321 Khulna 1 Bagerhat Town Noapara Bangladesh Krishi Bank Town Noapara, Fakirhat, Bagerhat-9370 Khulna 45 Bandarban Baishari Bangladesh Krishi Bank Baishari, Naikhagchari, Bandarban-4660 Chittagong 81 Bandarban Bandarban Pubali Bank Ltd Bandarban-4600 Chittagong 16 Bandarban Lama Bangladesh Krishi Bank Lama, Bandarban Chittagong 453 Barguna Amtoli Bangladesh Krishi Bank Amtoli, Borguna-8710 Barisal 149 Barguna Barguna Pubali Bank Ltd Barguna-8700 Barisal 9 Barguna Betagi Bangladesh -

Premittances.Pdf

BANGLADESH BANK Statistics Department (BOP Division) Wage Earners’ Remittance during the month of September’2021 (Million USD) Sl. Bank Sep,2021 no State Owned Commercial Banks 01-02,Sep 05-09,Sep 12-16,Sep 19-23,Sep 01-23,Sep 1 Agrani Bank 8.88 46.99 40.12 25.57 121.56 2 Janata Bank 5.30 18.30 14.79 10.40 48.79 3 Rupali Bank 3.72 11.14 8.91 10.13 33.90 4 Sonali Bank 11.93 18.33 29.07 17.47 76.80 5 BASIC Bank 0.01 0.05 0.03 0.02 0.11 6 BDBL 0.00 0.00 0.00 0.00 0.00 Sub Total 29.84 94.81 92.92 63.59 281.16 Specialized Banks 7 Bangladesh Krishi Bank 2.67 11.59 10.17 5.99 30.42 8 RAKUB. 0.00 0.00 0.00 0.00 0.00 Sub Total 2.67 11.59 10.17 5.99 30.42 Private Commercial Banks 9 AB Bank Ltd. 1.70 4.04 2.81 2.52 11.07 10 Al-Arafah Islami Bank Ltd. 3.41 10.83 11.82 10.58 36.64 11 Bangladesh Commerce Bank Ltd. 0.14 0.35 0.27 0.20 0.96 12 Bank Asia Ltd. 9.42 24.57 19.44 15.83 69.26 13 BRAC Bank Ltd. 2.14 9.40 6.76 5.03 23.33 14 Community Bank Bangladesh Ltd. 0.00 0.00 0.00 0.00 0.00 15 Dhaka Bank Ltd. -

Sonali Bank Limited and Its Subsidiaries Bakertitly

Sonali Bank Limited and its Subsidiaries IndePendent Auditors' RePort and Audited Consolidated and Separate Flnancial Statements For the Year ended 31 DecemberZ0t9 ACI,IABIN trFgH<,EE.E. @ furtefldArcMlanlt Aztz Halim lftair ChoudhurY ACNABIN Chartered Accountants Chartered Accountants Phulbari House, House 25, BDBL Bhaban (Level-13), Bazar C/ A, Road 01, Sector 09, 12 Kawran Uttara Model Town Dhaka-1215, Bangladesh. -Dhaka-1230, Bangladesh. Tel.: +88-02-41020030 Tel.: +88-02-55080235 Fax:+88-02-41020036 Fax: +88-02-55080235 A member firm of A member firm of G bakertitly PKr ,1, INTEFINATIONAL Aziz Hdim lGair Choudhury ACNABIN Chartered Accountants Chartered Accoutrtants Phulbari House, House 25, BDBL Bhaban (Level-13), Road 01, Sector 09, 12 lGwran Bazar C/A, Uttara Model Town Dhaka-1215, Bangladesh. Dhaka-1230, Bangladesh. Tel.: +88-02-41020030 Tel.: +88-02-55080235 Fax:+88-02-41020036 Fax: +88-02-55080236 Independent Auditors' Report To the Shareholders ofSonali Bank Llmited Report on the Audit of the Consolldated and Separate Fimncid Statements Opinion We have audited the consolidated financial statements ofSonali Bank Limited and its subsidiaries (the "GroupJ as well as the separate financial statements of Sonali Bank Limited (the 'BankJ, which comprise the consolidated and separate balance sheets as at 31 December 2019 and the consolidated and separate profit and loss accounts, consolidated and separate statements of changes in equity and consolidated and separate cash flows statement for the year then ended, and notes to the consolidated -

Ecais Credit Rating of Scheduled Banks for 2020-21 (As of Financial Statements 2019) Sl

ECAIs Credit Rating of Scheduled Banks for 2020-21 (As of Financial Statements 2019) Sl. Long Term Equivalent BB No. Name Name of ECAI Rating Rating Short Term Rating Date of Rating SCBs(04) 1 Sonali Bank Limited CRISL A(AAA) 2 ST-2(ST-1) Nov 26, 2020 2 Janata Bank Limited CRISL A(AAA) 2 ST-2(ST-1) July 18, 2020 3 Agrani Bank Limited Alpha A+(AAA) 2 ST-2(ST-1) July 26, 2020 4 Rupali Bank Limited ECRL A-(AAA) 2 ST-3(ST-1) Sept 21, 2020 PCBs (23) 5 Mercantile Bank Limited ECRL AA 1 ST-2 May 22, 2020 6 AB Bank Limited Argus A+ 2 ST-2 Dec 19, 2019 7 One Bank Limited ECRL AA 1 ST-2 Mar 10, 2020 8 Eastern Bank Ltd CRISL AA+ 1 ST-2 June 22, 2020 9 Standard Bank Limited CRISL AA 1 ST-2 June 28, 2020 10 Uttara Bank Limited ECRL AA 1 ST-2 July 01, 2020 11 Dutch-Bangla Bank Limited CRISL AA+ 1 ST-1 July 16, 2020 12 Pubali Bank Limited NCRL AA+ 1 ST-1 June 30, 2020 13 Dhaka Bank Limited ECRL AA 1 ST-2 April 8, 2020 14 Jamuna Bank Limited CRAB AA2 1 ST-2 June 30, 2020 15 The City Bank Limited CRAB AA2 1 ST-2 May 29, 2020 16 United Commercial Bank Ltd ECRL AA 1 ST-2 May 07, 2020 17 Bank Asia Limited CRAB AA2 1 ST-2 June 30, 2020 18 IFIC Bank Limited ECRL AA 1 ST-2 July 01, 2020 19 BRAC Bank Limited CRAB AA1 1 ST-1 June 28, 2020 20 Premier Bank Limited Argus AA+ 1 ST-1 May 30, 2020 21 Prime Bank Limited ECRL AA 1 ST-2 July 01, 2020 22 Mutual Trust Bank Ltd. -

Guidelines on Credit Risk Management (Crm) Revised Edition

GUIDELINES ON CREDIT RISK MANAGEMENT (CRM) REVISED EDITION PUBALI BANK LIMITED CREDIT DIVISION HEAD OFFICE 26, DILKUSHA COMMERCIAL AREA DHAKA-1000 Website : www.pubalibangla.com Approved on December 6, 2017 Preamble To cope with the best risk management practices, Pubali Bank Limited introduced “Credit Risk Management Manual” in 2006 for managing core risks in banking’ in all the major areas. Witnessing & experiencing different changes and transformation in banking, it was revised afterwards accumulating necessary spreading out & variations to address the changes, owing to the significant time lag. The ongoing development of contemporary credit methods & practices and the increased use of innovative credit products have brought about substantial changes in the business environment faced by credit institutions today. Especially in the field of lending, these changes and innovations are now forcing banks to adapt their in-house relevant lending policies to meet these new requirements. In this regard, revised edition of these guidelines has been prepared in conformity with “Guidelines on Credit Risk Management (CRM) for Banks” circulated by Bangladesh Bank vide BRPD Circular No. 04, dated March 8, 2016. The Revised edition of these Guidelines on Credit Risk Management are intended to assist our credit officials to deal with redesigned banking systems and credit processes in course of implementing the Basel III framework. The content of these guidelines is based on current developments in the banking field and is meant to provide its users with best practices. These guidelines will provide broad-based policy on the core principles for identifying, measuring, managing and controlling credit risk in bank. The purpose of these publications is to develop mutual understanding between Top Management and credit officials in different levels of field with regard to the upcoming changes in mode of financing. -

International Division Total Correspondent: 150 No. of Country

International Division Relationship Management Application( RMA ) Total Correspondent: 150 No. of Country: 34 Dated : 04.02.2018 Sl. Correspondent / Bank Name SWIFT Code Country 1 MIZUHO BANK, LTD. SYDNEY BRANCH MHCBAU2S AUSTRALIA 2 STATE BANK OF INDIA AUSTRALIA SBINAU2S AUSTRALIA 3 KEB HANA BANK, BAHRAIN BRANCH KOEXBHBM BAHRAIN 4 MASHREQ BANK BOMLBHBM BAHRAIN 5 NATIONAL BANK OF PAKISTAN NBPABHBM BAHRAIN 6 AB BANK LIMITED ABBLBDDH BANGLADESH 7 AGRANI BANK LIMITED AGBKBDDH BANGLADESH 8 AL-ARAFAH ISLAMI BANK LTD. ALARBDDH BANGLADESH 9 BANK ASIA LIMITED BALBBDDH BANGLADESH 10 BANGLADESH BANK BBHOBDDH BANGLADESH 11 BANGLADESH DEVELOPMENT BANK LIMITED (BDBL) BDDBBDDH BANGLADESH 12 BANGLADESH COMMERCE BANK LIMITED BCBLBDDH BANGLADESH 13 BANGLADESH KRISHI BANK BKBABDDH BANGLADESH 14 BASIC BANK LIMITED BKSIBDDH BANGLADESH 15 BRAC BANK LIMITED BRAKBDDH BANGLADESH 16 SONALI BANK LIMITED BSONBDDH BANGLADESH 17 COMMERCIAL BANK OF CEYLON LTD. CCEYBDDH BANGLADESH 18 DUTCH BANGLA BANK LIMITED DBBLBDDH BANGLADESH 19 DHAKA BANK LIMITED DHBLBDDH BANGLADESH 20 EXPORT IMPORT BANK OF BANGLADESH LTD EXBKBDDH BANGLADESH 21 EASTERN BANK LIMITED EBLDBDDH BANGLADESH 22 THE FARMERS BANK LIMITED FRMSBDDH BANGLADESH 23 FIRST SECURITY ISLAMI BANK LIMITED FSEBBDDH BANGLADESH 24 HABIB BANK LTD HABBBDDH BANGLADESH 25 ISLAMI BANK LIMITED IBBLBDDH BANGLADESH INTERNATIONAL FINANCE INVESTMENT AND 26 IFICBDDH BANGLADESH COMMERCE BANK LTD (IFIC BANK) 27 JAMUNA BANK LIMITED JAMUBDDH BANGLADESH 28 JANATA BANK LIMITED JANBBDDH BANGLADESH 29 MERCANTILE BANK LIMITED MBLBBDDH BANGLADESH