Financial Inclusion in Tripura – an Assessment

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PMMY - Bank Wise Performance Financial Year: 2017-20182018-2019 [Amount Rs

PMMY - Bank wise Performance Financial Year: 2017-20182018-2019 [Amount Rs. in Crore] Shishu Kishore Tarun Total Sr No Bank Type Name Bank Name (Loans up to Rs. 50,000) (Loans from Rs. 50,001 to Rs. 5.00 Lakh) (Loans from Rs. 5.00 to Rs. 10.00 Lakh) No Of A/Cs Sanction Amt Disbursement Amt No Of A/Cs Sanction Amt Disbursement Amt No Of A/Cs Sanction Amt Disbursement Amt No Of A/Cs Sanction Amt Disbursement Amt 1 SBI and Associates 1.1 State Bank of India 2114366 6150.08 6113.25 405922 10807.62 10676.13 216791 16868.23 16823.12 2737079 33825.92 33612.5 Total 2114366 6150.08 6113.25 405922 10807.62 10676.13 216791 16868.23 16823.12 2737079 33825.92 33612.5 2 Public Sector Commercial Banks 2.1 Allahabad Bank 22159 92.19 91.79 82219 1656.13 1645 16637 1226.27 1221.24 121015 2974.59 2958.03 2.2 Andhra Bank 88525 90.56 74.73 76940 1755.93 1558.19 14130 1161.12 1107.76 179595 3007.62 2740.67 2.3 Bank of Baroda 278269 769.4 761.95 129016 2784.03 2698.49 28666 2470.23 2428.78 435951 6023.66 5889.23 2.4 Bank of India 181610 585.25 557.96 149641 3157.44 2895.28 34021 2688.04 2439.19 365272 6430.74 5892.44 2.5 Bank of Maharashtra 9024 36.28 30.51 37086 967.66 856.37 13040 1126.29 1015.05 59150 2130.23 1901.93 2.6 Canara Bank 354483 729.3 723.9 183552 4438.86 4217.19 61160 5128.84 4828.06 599195 10297 9769.16 2.7 Central Bank of India 314064 193.05 112.67 56769 1306.91 1077.4 12814 1058.05 878.89 383647 2558.02 2068.96 2.8 Corporation Bank 34378 150.26 126.2 31651 675.45 653.29 13297 1032.2 1022.89 79326 1857.9 1802.38 2.9 Dena Bank 1094 3.54 3.35 -

Regional Rural Banks

Regional Rural Banks Sl.No. Bank's Name Address City State 1 ANDHRA PRADESH GRAMEENA VIKAS BANK H. NO. 2/-5-8/1, HEAD OFFICE, WARANGAL Warangal Andhra Pradesh 2 SAPTAGIRI GRAMEENA BANK P. B. NO. 17 HEAD OFFICE, CHITTOOR Chittoor Andhra Pradesh 3 CHAITANYA GODAVARI GRAMEENA BANK HEAD OFFICE, GUNTUR Guntur Andhra Pradesh 4 ANDHRA PRAGATHI GRAMEENA BANK, KADAPA 20/384 - A,POST BOX NO 65 HEAD OFFICE, KADAPA Kadapa Andhra Pradesh 5 ARUNACHAL PRADESH RURAL BANK, E - SECTOR, HEAD OFFICE,NAHARLAGUN, SHIV MANDIR ROAD, PAPUMPARE Papumpare Arunachal Pradesh 6 ASSAM GRAMIN VIKAS BANK, GUWAHATI HEAD OFFICE, GUWAHATI Guwahati Assam Sri Vishnu Commercial Complex, 30 New Bypass Near BP Highway Services, Petrol Pump, 7 Dakshin Bihar Gramin Bank Patna Bihar Asochak, Patna 8 UTTAR BIHAR GRAMIN BANK HEAD OFFICE, KALAMBAGH CHOWK MUZAFFARPUR Muzaffarpur Bihar 9 CHHATTISGARH RAJYA GRAMIN BANK 15, H.O., RECREATION ROAD, RAIPUR Raipur Chhattisgarh 10 Baroda Gujarat Gramin Bank Vadodara 101/ A, B N Chambers, First Floor, Opp Welcome Hotel, R C Dutt Road, Alkapuri Vadodara Gujarat 11 SAURASHTRA GRAMIN BANK HEAD OFFICE, S. J. PALACE, GOPAL NAGAR. DHEBARBHAI ROAD, RAJKOT Rajkot Gujarat 12 SARVA HARYANA GRAMIN BANK H. O., FINANCE DIVISION, ROHTAK Rohtak Haryana 13 HIMACHAL PRADESH GRAMIN BANK HEAD OFFICE, MANDI Mandi Himachal Pradesh 14 ELLAQUAI DEHATI BANK, HEAD OFFICE, SRINAGAR Srinagar Jammu & Kashmir 15 J& K GRAMEEN BANK HEAD OFFICE, P.O.UNIVERSITY CAMPUS, NARWAL, JAMMU Jammu Jammu & Kashmir 16 JHARKHAND RAJYA GRAMIN BANK 3rd Floor, Market Complex, District Board -

A Study on Sustainable Finance by Tripura Gramin Bank for Sustainable Rural Development

SSRG International Journal of Economics and Management Studies (SSRG-IJEMS) – Volume 7 Issue 3 – March 2020 A Study on Sustainable Finance by Tripura Gramin Bank for Sustainable Rural Development Puranjan Chakraborty1 Dr. Ram Chandra Das2 Research scholar, Asst Professor, Department of Commerce, Assam University, Silchar P.O Dorgakona, District Cachar, Assam, PIN-788011, India Abstract Tripura Gramin Bank (TGB) is the only Regional finance. Firstly such sustainable finance will ensure ural Bank in Tripura operating since 1976 with an the very survival of the business and it will not cease objective of amelioration of socioeconomic condition in the future course of time due to any sort of crisis. of rural population of Tripura. Tripura Gramin bank Secondly Such sustainable finance will ensure the was facing challenges from internal and external protection of the environmental by green investment. banking environment in terms of Technology, Thirdly such sustainable finance will ensure the rural structure of business, policy of Bank and competition economic development uninterrupted and exist for with other commercial banks in the area of the future period of time. Tripura is a small hilly operation. Tripura was an environment friendly state state in the North East region of India with three but in the course of time there is sustained sides are surrounded by the international border with environmental degradation in terms of deposition of Bangladesh and one side is connected with Assam carbon in the environment due to increased motor state of India. Tripura has areas mostly rural with a vehicles, industries, brickfields which is the outcome population of 37 lacks. -

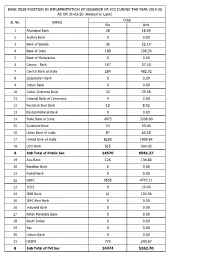

KCC DURING the YEAR 2019-20 AS on 31-03-20 (Amount in Lakh) Crop Sl

BANK WISE POSITION IN IMPLEMENTATION OF ISSUANCE OF KCC DURING THE YEAR 2019-20 AS ON 31-03-20 (Amount in Lakh) Crop Sl. No. BANKS No Amt 1 Allahabad Bank 28 18.00 2 Andhra Bank 0 0.00 3 Bank of Baroda 36 52.14 4 Bank of India 189 206.26 5 Bank of Maharastra 0 0.00 6 Canara Bank 107 57.20 7 Central Bank of India 284 482.72 8 Corporation Bank 0 0.00 9 Indian Bank 0 0.00 10 Indian Overseas Bank 32 29.58 11 Oriental Bank of Commerce 4 2.00 12 Punjab & Sind Bank 10 8.92 13 Punjab National Bank 0 0.00 14 State Bank of India 4975 3368.00 15 Syndicate Bank 53 59.00 16 Union Bank of India 87 63.18 17 United Bank of India 8250 1909.84 18 UCO Bank 515 304.43 A Sub Total of Public Sec 14570 6561.27 19 Axis Bank 126 134.86 20 Bandhan Bank 0 0.00 21 Fedral Bank 0 0.00 22 HDFC 9505 4747.11 23 ICICI 9 29.00 24 IDBI Bank 61 102.06 25 IDFC First Bank 0 0.00 26 Indusind Bank 0 0.00 27 Kotak Mahindra Bank 0 0.00 28 South Indian 0 0.00 29 Yes 0 0.00 30 Ujjivan Bank 0 0.00 31 NESFB 773 249.67 B Sub Total of Pvt Sec 10474 5262.70 32 Tripura Gramin Bank 22163 8714.73 C Sub Total of RRB 22163 8714.73 33 ACUB 0 0.00 34 TCARDB 0 0.00 35 TSCB 8200 4320.05 D Sub Total of Coop Bank 8200 4320.05 Grand TOTAL 55407 24858.75 Bank wise KCC (Crop) achievement during the year 2018-19 (Amt in Lakh) SL Crop Loan Banks Branch Name NO No. -

List of Banks for the Purpose of Proof of Address and Photo Identity for Passport Application

ANNEXURE List of Banks for the purpose of proof of Address and Photo identity for Passport Application A. PUBLIC SECTOR BANKS 1. AIlahabad Bank 31. Gramin Bank of Aryavart 2. Andhra Bank 32. Assam Gramin Vikash Bank 3. Bank of Baroda 33. Bangiya Gramin Vikash Bank 4. Bank of India 34. Baroda Gujarat Gramin Bank 5. Bank of Maharashtra 35. Baroda Rajasthan Kshetriya Gramin 6. Canara Bank Bank 7. Central Bank of India 36. Baroda. U P Gramin Bank 8. Corporation Bank 37. Bihar Gramin Bank 9. Dena Bank 38. Central Madhya Pradesh Gramin 10. Indian Bank Bank 11. Indian Overseas Bank 39. Chaitanya Godavari Grameena Bank 12. Oriental Bank of Commerce 40. Chhattisgarh Rajya Gramin Bank 13. Punjab National Bank 41. Deccan Grameena Bank 14. Punjab & Sind Bank 42. Dena Gujarat Gramin Bank 15. Syndicate Bank 43. Ellaquai Dehati Bank 16. Union Bank of India 44. Himachal Pradesh Gramin Bank 17. United Bank of India 45. Jharkhand Gramin Bank 18. UCO Bank 46. Jammu And Kashmir Gramin Bank 19. Vijaya Bank 47. Karnataka Vikas Grameena Bank 20. IDBI Bank Ltd 48. Kashi Gomti Samyut Gramin Bank 21. State Bank of India 49. Kaveri Grameena Bank 22. State Bank of Bikaner & Jaipur 50. Kerala Gramin Bank 23. State Bank of Patiala 51. Langpi Dehangi Rural Bank 24. State Bank of Hyderabad 52. Madhyanchal Gramin Bank 25. State Bank of Mysore 53. Maharashtra Gramin Bank 26. State Bank of Travancore 54. Malwa Gramin Bank 55. Manipur Rural Bank B. LIST OF REGIONAL RURAL BANKS 56. Marudhara Rajasthan Gramin Bank 57. Meghalaya Rural Bank 27. -

DIGITAL PAYMENTS BOOK Part1

DIGITAL PAYMENTS Trends, Issues And Opportunities July 2018 FOREWORD A Committee on Digital Payments was growth figures for both volume and value. constituted by Department of Economic Notwithstanding this the analysis finds that Affairs, Ministry of Finance in August 2016 both the data are relevant and equally under my Chairmanship to inter-alia important. They are complementary. In recommend medium term measures of addition to this the underlying growth trends promotion of Digital Payments Ecosystem in Digital Payments over the last seven in the country. The Committee submitted its years are also covered in this booklet. final report to Hon’ble Finance Minister in December 2016. One of the key This booklet has some new chapters which recommendations of the Committee related cover the areas of policy developments, to development of a metric for Digital global trends and opportunities in Digital Payments. As a follow-up on this a group of Payments. In the policy space the important Stakeholders from Different Departments of developments with respect to the Government of India and RBI was amendment of the Payment and Settlement constituted in NITI Aayog under my Act 2007 are covered. chairmanship to facilitate the work relating I am grateful to Governor, RBI, Secretary to development of the metric. This group MeitY and CEO, NPCI for their support in prepared a document on the measurement preparing this booklet. Shri. B.N. Satpathy, issues of Digital Payments. Accordingly, a Senior Consultant, EAC-PM and Shri. booklet titled “Digital Payments: Trends, Suneet Mohan, Young Professional, NITI Issues and Challenges” was prepared in Aayog have played a key role in compiling May 2017 and was released by me in July this booklet. -

JAIIB | CAIIB | RRB NTPC | SSC and State Government 1 Jobs Ambitiousbaba.Com Online Test Series

ambitiousbaba.com Online Test Series Best Online Test Series Site for Bank | JAIIB | CAIIB | RRB NTPC | SSC and State Government 1 Jobs ambitiousbaba.com Online Test Series Financial Awareness for IBPS RRB PO & CLEKR MAINS 2021 Part 1: Financial & Banking Awareness (Static Part) Number of Chapter Topics Name Chapter 1 RBI, Subsidiaries of RBI, NABARD, NHB, ECGC Chapter 2 Banks in India Commercial Bank, Exim Bank of India, Payment Bank, Co-operative Banks, Regional Rural Banks, Small Finance Banks Chapter 3 Banking Ombudsman, National Income Chapter 4 Money Market, Capital Market Chapter 5 Inflation Chapter 6 Negotiable Instrument, Mutual Fund, Money Laundering Chapter 7 Types of Cheque & Types of Account Chapter 8 Types of Payment Cards, Fund transfer service Chapter 9 Basel I, II and III Chapter 10 NPA & SARFAESI Act, 2002 Chapter 11 LIBOR & MIBOR, SWIFT Codes for banks Chapter 12 CIBIL, Priority Sector lending & Banks Merger Chapter 13 Important Terms Chapter 14 Micro, Small and Medium Enterprise in India Chapter 15 Regional Rural Bank (RRB) Best Online Test Series Site for Bank | JAIIB | CAIIB | RRB NTPC | SSC and State Government 2 Jobs ambitiousbaba.com Online Test Series Part 2: Banking and Financial News PDF 2021 (Feb to August) Index No. of Topic Topic Name Topic 1 List of Banks who has been imposed penalty by RBI in 2021 Topic 2 List of Banks whose licence has been canceled by RBI in 2021 Topic 3 Important Committee (Feb to July) Topic 4 List of Merger and Acquisition (Covered Feb to July) Topic 5 List of Partnership/Agreement -

Monthly Banking Awareness PDF – May 2019

Monthly Banking Awareness PDF – May 2019 We Exam Pundit Team, has made “BOOST UP PDFS” Series to provide The Best Free PDF Study Materials on All Topics of Reasoning, Quantitative Aptitude & English Section. This Boost Up PDFs brings you questions in different level, Easy, Moderate & Hard, and also in New Pattern Questions. Each PDFs contains 50 Questions along with Explanation. For More PDF Visit: pdf.exampundit.in Only Banking! Monthly Banking Awareness PDF Issue #18 – May 2019 Features: RBI Policy Rates Type of Risks Detailed Banking News (May 2019) Expected Banking Questions Page 1 of 19 Join Our Telegram Group to Get Instant Notifications, Study Materials, Quizzes & PDFs: https://t.me/exampunditofficial For Quality Study Materials & Practice Quiz Visit: www.exampundit.in | For Free PDF Materials Visit: pdf.exampundi.in Monthly Banking Awareness PDF – May 2019 About Reserve bank of India Headquarter at Mumbai The Governor of RBI is Shaktikanta Das The slogan is “ India’s central Bank” RBI Follows July to June Financial Cycle Why does RBI Follow July to June Financial Year? The banks in India follow April to March financial year and hence their annual financial information is compiled after that. RBI follows July to June financial year because RBI as a supervisor and regulator looks into the books of banks and then analyses and prepares its statutory document called as Annual Report. So a lag of 3 months from normal financial cycle (Apr-Mar) is justified as this is the time which RBI uses to analyse the information. Current Policy Rates: Policy Repo Rate 6.0% Reverse Repo Rate 5.75 % Marginal Standing Facility Rate 6.25% Bank Rate 6.25% CRR 4% SLR 19.25% Types of Risks There are eight major risk in banking sector 1. -

A Study on Measuring the Operational Performance of Tripura Gramin Bank

Vidyasagar University Journal of Economics Vol. XXII, 2017-18, ISSN - 0975-8003 A Study on Measuring the Operational Performance of Tripura Gramin Bank Puranjan Chakraborty Research scholar (Correspondent), Department of Commerce, Assam University, Assam Ram Chandra Das Assistant Professor, Department of Commerce, Assam University, Assam Abstract Regional rural bank plays an important role by providing easy and small credit facilities to the people of weaker section living in rural India. The Tripura Gramin Bank (TGB) has been performing its operation in the state Tripura with its 144 number of active branches and helping the state for financial inclusion. These 144 branches are spread across the state covering all the eight districts and rural, semi urban and urban areas of Tripura. In the present paper, an attempt has been made to measure the operational performance of Tripura Gramin Bank. The secondary data of the study has collected from the Annual Reports of Tripura Gramin Bank for the period ranging from 2003-04 to 2016-17. The performance of TGB is measured through deposit mobilization, credit deployment and, status of CD ratio and NPA. The study reveals that the operational performance of TGB in terms of saving deposit, current deposit, term deposit, priority sector lending, non-priority sector lending, status of C/D ratio and NPA is improved during the study period. Key word : Tripura Gramin Bank, Performance, NPA, Deposit Mobilization, Credit Deployment 1. Introduction Operational performance of a bank is an important factor in banking business which dictates the very survival of the bank. A small mistake in the bank’s operation may cause total collapse of the business in the course of time. -

Perceptions of Bank Account Holders About PMJDY – a Study on Baikhora Region of South Tripura

Volume 1 Issue 1 2016 AJF Amity Journal of Finance 1(1), (67-91) ©2016 ADMAA Perceptions of Bank Account holders about PMJDY – A Study on Baikhora Region of South Tripura Rajat Deb Tripura University, Tripura, India & Prasenjit Das Tripura State Electricity Corporation Limited, Tripura, India (Received: 06/10/2015; Accepted: 17/02/2016) The study has explored the motivating factors of the respondents of Latuatila village, Baikhora region under Santirbazar sub-division, Tripura South, Tripura, India for opening bank accounts under PMJDY and their preference for nationalized banks. An interview schedule comprising of 37 questions has used to collect data in three stages from a sample size of 125 respondents chosen using different non-probability sampling techniques which subsequently has processed through IBM SPSS-20. A protocol interview with 10 experts followed by a pilot survey with 30 respondents has carried out to check the validity of the questions; reliability and sample adequacy test has also performed. Through Factor analysis, four major factors have extracted. Several statistical tests like Independent Sample t-test, Cross-tabulation, Regression analysis has used to test the hypotheses. The empirical results have indicated the catalysts like demographic characteristics, service quality and scheme benefits. Policy lags and perceptions about private banks have attracted the respondents to nationalized banks. The public sector banks may incorporate the results in their strategic policy formulations to attract the potential customers and may frame course of actions to compete with the tentative private players in PMJDY. The study offers policy relevance, acknowledges few limitations and indicates the future research agenda. -

09-2020-CA List

LIST OF CORPORATE AGENTS REGISTERED WITH THE AUTHORITY AS ON 30.09.2020 ( COR Number Corporate Agent Name (Life/Non Life/Composite) Principle Officer Address Phone Number Valid From Valid Upto Life 1 Life 2 Life 3 General 1 General 2 General 3 Health 1 Health 2 Health 3 (सी.ओ.आर. (कॉपरेट एजट का नाम) (जीवन / गैर जीवन / सम) (िंिसपल ऑिफसर) (पता) (दू रभाष नंबर) (वैधता से) (वैधता तक) (जीवन 1) (जीवन 2) (जीवन 3) (गैर जीवन 1) (गैर जीवन 2) (गैर जीवन 3) (ा 1) (ा 2) (ा 3) संा) 2401, GENERAL THIMMAYAH TATA AIA LIFE INSURANCE COMPANY CHOLAMANDALAM MS GENERAL RELIANCE GENERAL INSURANCE TATA AIG GENERAL INSURANCE RELIGARE HEALTH INSURANCE CA0001 INDUSIND BANK LIMITED COMPOSITE KRISHNEKUMAR .S.T ROAD,CANTONMENT,PUNE,MAHARASHTR 2026343201 4/1/2019 3/31/2022 ICICI PRUDENTIAL LIFE INSURANCE LTD INSURANCE COLTD COMPANY LTD. COMPANY LTD COMPANY LIMITED A STATE BANK OF INDIA, STATE BANK BHAVAN, MADAME CAMA SBI GENERAL INSURANCE COMPANY CA0003 STATE BANK OF INDIA COMPOSITE DEEPENDRA KUMAR YADAV 2222740690 4/1/2019 3/31/2022 SBI LIFE INSURANCE COMPANY LIMITED ROAD,NARIMAN LTD POINT,MUMBAI,MAHARASHTRA BARODA HOUSE,P B 506, CHOLAMANDALAM MS GENERAL TATA AIG GENERAL INSURANCE NATIONAL INSURANCE COMPANY MAX BUPA HEALTH INSURANCE STAR HEALTH AND ALLIED INSURANCE CA0004 BANK OF BARODA COMPOSITE VIKAS SRIVASTAVA 2267592513 4/1/2019 3/31/2022 INDIA FIRST LIFE INSURANCE MANDVI,BARODA,GUJARAT INSURANCE COLTD COMPANY LTD LIMITED COMPANY LTD. CO.LTD NEW NO 19, OLD NO 154,2ND FLOOR, CHOLA INSURANCE DISTRIBUTION CHOLAMANDALAM MS GENERAL CA0006 COMPOSITE SRINIVAS KOMMU THAMBU CHETTY STREET,PARRYS,TAMIL 4442166011 4/1/2019 3/31/2022 SERVICES PRIVATE LIMITED INSURANCE COLTD NADU KALYANM_ASTU , OM VIJAYKRISHNA THE KALYAN JANATA SAHAKARI BANK KOTAK MAHINDRA LIFE INSURANCE CA0008 COMPOSITE AVINASH RAMCHANDRA JOSHI APT,NR LAL CHOWKI , ADHARWADI 2512221375 4/1/2019 3/31/2022 THE NEW INDIA ASSURANCE CO. -

Acceptance of Bank Passbook As Proof of Address for Passports

No. VI/40L lt I t2l2otg Government of India Ministry of External Affairs CPV Division Patiala House Annexe, Tilak Marg, New Delhi, February 19, 2OI5 OFFICE MEMORAI.{DUM Subject: Acceptance ofbank passbook as proofofaddress for Passports. ***** As per the existing provisions, Passbook/Statement of running bank account of Public Sector Banks is accepted as one of the valid documents for proof of address for submitting a Passport application. The Ministry has been receiving references for inclusion of photo passbook issued by the Scheduled Private Indian Banks as well as Regional Rural Banks in addition to Scheduled Public Sector Banks. 2. The matter has been examined in the Ministry and it has been decided that henceforth ptroto pa$sbooks of the following categories of banks authorized by the Reserve Bank of India may be accepted as proof of address and photo identity: (a) Scheduled Fublic Sector Banks; (b) Scheduled Private Sector Indian Banks; and (c) Regional Rural Banks. 3. The indicative list of above three categories of banks is enclosed. In case of any doubt about the status and name of any particular bank, the same may be ascertained from the updated website of the Reserve Bank of India. Encls. a/a 0n-b. (Muktesh r. Pai6eshi) Joint Secretary(PsP) & Chief Passport Officer A11 PIAs in India and abroad 4NIIEXIJFE List of Banks for the purpose of Proof of Address and Photo identity for Passport Application A. PUBLIC SECTOR BANKS 34. Baroda Gujarat Gramin Bank 35. Baroda Rajasthan Kshetriya 1. Allahabad Bank Gramin Bank 2. Andhra Bank 36. BarodaUPGraminBank 3. Bank of Baroda 37.