Philippines Dairy and Products Annual 2004

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

M. Cojuangco, Jr., Chairman and Ceo of San Miguel Corporation, Former Diplomat and Public Servant

EIGHTEENTH CONGRESS OF THE ) REPUBLIC OF THE PHILIPPINES ) Second Regular Session ) RECEIVEDFILED DATC SENATE P.S. Res. No. 449 E4LLS Introduced by SENATOR RAMON BONG REVILLA, JR. RESOLUTION EXPRESSING PROFOUND SYMPATHY AND SINCERE CONDOLENCES OF THE SENATE OF THE PHILIPPINES ON THE DEATH OF EDUARDO "DANDING" M. COJUANGCO, JR., CHAIRMAN AND CEO OF SAN MIGUEL CORPORATION, FORMER DIPLOMAT AND PUBLIC SERVANT 1 WHEREAS, the Senate of the Philippines has, on numerous occasions, 2 recognized and honored distinguished Filipinos for their important contribution to their 3 respective fields and for their positive impact and influence in the development of our 4 society; 5 WHEREAS, Eduardo "Danding" M. Cojuangco, Jr., a former diplomat, public 6 servant, industrialist, businessman, and sports patron, died on 16 June 2020, just a 7 few days after he celebrated his 85th birthday; 8 WHEREAS, he is a well-known and respected businessman who served as 9 Chairman and Chief Executive Officer of San Miguel Corporation, considered as the 10 biggest food and beverage corporation in the Philippines and Southeast Asia, whose 11 several businesses include San Miguel Brewery, Inc., the oldest brewery in Southeast 12 Asia and the largest beer producer in the Philippines, and Ginebra San Miguel, Inc., 13 the largest gin producer in the world by volume1; 14 WHEREAS, under his stewardship, San Miguel Corporation greatly expanded 15 and transformed into a highly diversified conglomerate with valuable investments in 1 https://www.sanmicuel.coin.ph/article/food-and-beverages -

Ticketworld Branches 2

Ticketworld Contact Number 891-9999 Ticketworld Branches National Bookstore NBS @ Cubao Super Branch Aranceta Center, Cubao, QC NBS @ Shangri-La Plaza Level 1 Shangri-la Mall Edsa corner Shaw Blvd, Mandaluyong City NBS @ Rockwell Power Plant Mall 2F Lifestyles Rockwell Center, Amapola cor. Estrella St. NBS @ Quezon Avenue Scout Borromeo cor. Quezon Ave., QC NBS @ Glorietta 1 3F Glorietta 1, South Drive, Ayala Center, Makati City NBS @ Alabang Commercial Center Near the Acctivity Center (within the vicinity of Alabang town Center) GF Alabang Commercial Center, Muntinlupa City Robinsons's Dept. Store Robinsons Galleria EDSA cor. Ortigas Ave.,Quezon City(Customer Service Section) Robinsons Place Manila\ M. Adriatico St., Ermita Manila(Customer Service Section) Robinsons Metro East Marcos Highway, cor Imelda Ave. Brgy. dela Paz Pasig City Robinsons Forum Pioneer EDSA cor. Pioneer St., Mandaluyong City Robinsons Magnolia UG Level 2&3 Auroral Blvd, New Manila, QC Robinsons Festival Mall Festival Mall, Supermall Alabang, Muntinlupa City Robinsons Starmills Pampanga Gapan-Olongapo Road, Brgy. San Jose, San Fernando, Pampanga Robinsons Place Cebu Fuente Osmena cor. Jones Ave., Cebu City Resorts World Manila GF Newport Mall (Near Casino), Newport Blvd. Newport City, Cybertourism Zone, Pasay City Ayala Malls - Greenbelt 1 GF Cinema Ticket Counter Ayala Malls - Trinoma 4F Cinema TicketBooth Area, EDSA cor. North Avenue, QC CCP Box Office CCP Complex, Roxas Blvd, Pasay City Music Museum Shoppesville Arcade, Greenhills, San Juan Eastwood Mall Concierge Section E. Rodriguez Jr. Ave., BagumbayanLibis, QC Ticketworld Head Office Suite 701, V. Madrigal Bldg., 6793 Ayala Ave., Makati City Ticketworld Website www.ticketworld.com.ph Online Purchase using your Visa, JCB or Mastercard Credit Cards BarkadaTix on Facebook www.facebook.com/TicketWorldInc Online Purchase using your Visa, JCB or Mastercard Credit Cards. -

View/Download

C O V E R S H E E T P W- 2 7 7 S. E. C. Registration Number S A N M I G U E L C O R P O R A T I O N (Company’s Full Name) N o. 4 0 S a n M i g u e l A v e. M a n d a l u y o n g C i t Y (Business Address: No. Street City/Town/Province) Atty. Mary Rose S. Tan (632) 632-3000 Contact Person Company Telephone Number SEC FORM 1 2 3 1 1 7 - A Month Day FORM TYPE Month Day Annual Meeting Secondary License Type, If Applicable Dept. Requiring this Doc. Amended Articles Number/Section Total Amount of Borrowings Total No. of Stockholders Domestic Foreign ------------------------------------------------------------------------------------------------------------ To be accomplished by SEC Personnel concerned ____________________________ File Number LCU ____________________________ Document I. D. Cashier - - - - - - - - - - - - - - - - - - S T A M P S - - - - - - - - - - - - - - - - - - Remarks = pls. Use black ink for scanning purposes SECURITIES AND EXCHANGE COMMISSION SEC FORM 17-A ANNUAL REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODE AND SECTION 141 OF THE CORPORATION CODE OF THE PHILIPPINES 1. For the fiscal year ended December 31, 2011 2. SEC Identification Number PW 000277 3. BIR Tax Identification No. 041-000-060-741-V 4. Exact name of issuer as specified in its charter SAN MIGUEL CORPORATION 5. Philippines 6. Province, Country or other jurisdiction of Industry Classification Code: incorporation or organization 7. No. 40 San Miguel Avenue, Mandaluyong City 1550 Address of principal office Postal Code 8. -

Serving the Nation 2019 ANNUAL REPORT ABOUT SAN MIGUEL FOOD and BEVERAGE, INC

serving the nation 2019 ANNUAL REPORT ABOUT SAN MIGUEL FOOD AND BEVERAGE, INC. San Miguel Food and Beverage, Inc. (SMFB) is a leading food and beverage company in the Philippines. The brands under which we produce, market, and sell our products are among the most recognizable and top-of-mind brands in the industry and hold market- leading positions in their respective categories. Key brands in the SMFB portfolio include San Miguel Pale Pilsen, San Mig Light, and Red Horse for beer; Ginebra San Miguel for gin; Magnolia for chicken and dairy products; Monterey for fresh and marinated meats; Purefoods for refrigerated, prepared, processed, and canned meats; Star and Dari Creme for margarine; and B-MEG for animal feeds. We have three primary operating divisions— beer and non-alcoholic beverages (NAB), spirits, and food. The Beer and NAB Division, through San Miguel Brewery Inc., and Spirits Division, through Ginebra San Miguel Inc., comprise our beverage business. On the other hand, our Food Division, San Miguel Foods, OUR CORE VALUE is operated through a number of key subsidiaries such as San Miguel Foods, Inc., Magnolia Inc., and MALASAKIT The Purefoods-Hormel Company, Inc. We serve It is in this spirit that we will look after the welfare and the Philippine archipelago through an extensive interests of our stakeholders. distribution and dealer network and export our products to over 60 markets worldwide. We will delight our customers with products and services of uncompromising quality, great taste and SMFB is a subsidiary of San Miguel Corporation (SMC), value, and are easily within their reach. -

MAGNOLIA INCORPORATED, } IPC No

MAGNOLIA INCORPORATED, } IPC No. 14-2008-00241 Opposer, } Opposition to: } Appln. Serial No. 4-2006-008852 } Date Filed: 11 August 2006 -versus- } TM: "GOLD LABEL" } } } DYNAMIC MULTl-PRODUCTS, INC., } Respondent- Applicant. } )(--------~-----------------------------------------------------)( NOTICE OF DECISION ANGARA ABELLO CONCEPCION REGALA & CRUZ Counsel for Opposer 22nd Floor, ACCRALAW TOWER Second Avenue corner 30th Street Crescent Park West, Bonifacio Global City 0399 Taguig City VILLARAZA CRUZ MARCELO & ANGANGCO Counsel for the Respondent-Applicant V & A LAW CENTER 11th Avenue comer 39th Street Bonifacio Triangle, Bonifacio Global City 1634 Metro Manila GREETINGS: Please be informed that Decision No. 2016 - 7't dated March 14, 2016 (copy enclosed) was promulgated in the above entitled case. Taguig City, March 14, 2016. For the Director: ' "'"' Atty. ED~iNDA~O ~G Director Ill Bureau of Legal Affairs Republic of the Philippines INTELLECTUAL PROPERTY OFFICE Intellectual Property Center # 28 Upper McKinley Road. McKinley Hill Town Center, Fort Bonifacio, Taguig City 1634 Philippines •www.ipophil.qov.ph T: +632-2386300 • F: +632-5539480 •[email protected] MAGNOLIA INCORPORA TED, IPC NO. 14-2008-00241 Opposer, Opposition to: -versus- Appl. Ser. No. 4-2006-008852 (Filing Date: 11 August 2006) Trademark: "GOLD LABEL" DYNAMIC MULTI-PRODUCTS, INC. Respondent-Applicant. x-----------------------------------------------------x Decision No. 2016-_T_q~- DECISION MAGNOLIA IN CORPORATED 1 ("Opposer") filed on 06 October 2008 a Verified Notice of Opposition to Trademark Application Serial No. 4-2006-008852. The application, filed by Dynamic Multi-Products, Inc.2 ("Respondent-Applicant"), covers the mark "GOLD LABEL" for use on "oats" under Class 31 of the International Classification of Goods and Services.3 The Opposer alleges among other thing that, the mark applied for registration by the Respondent-Applicant is identical to its mark "GOLD LABEL" and to its parent company San Miguel Corporation's ("SMC") mark "MAGNOLIA ICE CREAM GOLD LABEL". -

PCC-Issues-Paper-2021-03-Issues-Paper-On-The-Philippine-Milk-Products-Industry.Pdf

PCC Issues Paper No. 03 Series of 2021 PAPER ISSUES Issues Paper on the Philippine Milk Products Industry Francis Mark A. Quimba Kirsten J. Dela Cruz Issues Paper on the Philippine Milk Products Industry Francis Mark A. Quimba and Kirsten J. Dela Cruz Published by: Philippine Competition Commission 25/F Vertis North Corporate Center 1 North Avenue, Quezon City 1105 PCC Issues Papers aim to examine the structure, conduct, and performance of select industries to better inform and guide PCC’s advocacy and enforcement initiatives. The opinions, findings, conclusions, and recommendations expressed in these studies are those of the author(s) and do not necessarily reflect the views of the Commission. This work is protected by copyright and should be cited accordingly. The views reflected in this paper shall not in any way restrict or confine the ability of the PCC to carry out its duties and functions, as set out in the Philippine Competition Act. PCC reserves the right, when examining any alleged anti-competitive activity that may come to its attention, to carry out its own market definition exercise and/or competition assessment, in a manner which may deviate or differ from the views expressed in this paper. [email protected] | www.facebook.com/CompetitionPH | www.twitter.com/CompetitionPH | www.phcc.gov.ph CONTENTS LIST OF TABLES AND FIGURES ...................................................................................... 2 BACKGROUND ................................................................................................................. -

Manila Retail Guide

MANILA Cushman & Wakefield Global Cities Retail Guide Cushman & Wakefield | Manila | 2019 0 Metro Manila, the country’s capital region, consists of 16 cities and one municipality. This includes the country’s most populated city, Quezon City, and the primary financial and business hubs, Makati Central Business District and Bonifacio Global City in Taguig City. As of 2018, Metro Manila has more than 100 operational shopping centers, with eleven (11) more anticipated for completion up to year 2022. The region is home to three (3) of the largest shopping malls in the Philippines, namely: SM City North EDSA in Quezon City, SM Megamall in Mandaluyong City, and SM Mall of Asia in Pasay City. FACTS ABOUT METRO MANILA: 12.88 million (2015 Census) total population 4.8 million total foreign visitor arrivals via Manila airports and seaports in 2018 MANILA 7.9 million sqm approximate existing retail space in shopping centers and malls in Metro Manila as of 2018. OVERVIEW Cushman & Wakefield | Manila | 2019 1 MANILA KEY RETAIL STREETS & AREAS BAY AREA BONIFACIO GLOBAL CITY (BGC) The Bay Area along the coast of Manila Bay stretches from Bonifacio Global City has attracted a lot of office relocations, Parañaque City to Pasay City. With healthy a demand coming proving itself as a popular business district among multi-national from offshore gaming, IT-BPM, and retail segments, it is home to companies and financial institutions, among others. Apart from one of the country’s biggest retail complexes, the SM Mall of its office buildings and upper-mid to high-end residential Asia (MOA). -

ANGARA ABELLO CONCEPCION REGALA & CRUZ 22Nd Floor

INTELLECTUAL fflOPfSIT 1 3FFICE OF THE PHILIPPINES SAN MIGUEL PURE FOODS, } IPCNo. 14-2015-00001 COMPANY, INC., Opposition to. Opposer. ) Appln. Serial No. 4-2014-504342 } Date Filed. 15 October 2014 -versus - } TM. "MAGNOLIA BAKERY } NEW YORK CITY" MAGNOUA INTELLECTUAL } * PROPERTY LLCP Respondent- Applicant. NOTfCE OF DECISION ANGARA ABELLO CONCEPCION REGALA & CRUZ Counsel for Opposer 22nD Floor, ACCRALAW Tower Second Avenue corner 30;h Street Crescent Park West. Bonjfacio Global City 0399 Taguig, Metro Manila LAW FIRM OF REYES RARA & ASSOCIATES Counsel for Respondent-Applicant Ground FJoor, W Tower 39 Street, Bonifacio Global City Taguig City 1634 GREETINGS: Please be informed thai Decision No 2017 - dated December 22, 2017 (copy enclosed) was promulgated in the above entitled case. Pursuant to Section 2 Rule 9 of the IPOPHL Memorandum Circular No. 16-007 series of 2016, any party may appeal the decision to the Director of The Bureau of Legal Affairs within ten (10) days after receipt of the decision together with the payment of applicable fees Taguig City, January 03, 2018. MARILYN F. RETUTAL IPRS IV Bureau of Legst Affairs intuitJu.ri Propnrty ■".. -U- +632 £S39d«l INTELLECTUAL PPOPFPT' OnTCEO* THE PHIUCPINES SAN MIGUEL PURE FOODS COMPANY, INC., IPCNo. 14-2015-00001 Opposer, Opposition to Trademark Application No. 4-2014-504842 -versus- Date Fifed: 15 October 2014 MAGNOLIA INTELLECTUAL Trademark: "MAGNOLIA BAKERY PROPERTY LLC, NEW YORK CITY'•ft Responde nt- Appl ica nt. x x Decision No. 2017- DECISION San Miguel Pure Foods Company, -

Top 100 Stockholders As of September 30, 2011

11 October 2011 Philippine Stock Exchange Disclosure Department Listings & Disclosure Group 3/F, The Philippine Stock Exchange, Inc. Tower One and Exchange Plaza, Ayala Ave., Makati City Subject: Report on the Top 100 Shareholders Gentlemen: This is in connection with your Revised Disclosure Rules requiring Integrated Micro- Electronics, Inc. to submit a report on the list of top 100 shareholders of the Company. In compliance therewith, we are submitting herewith the list of top 100 shareholders on the Company’s common shares for the quarter-ending 30 September 2011. Thank you. Very truly yours, SHEILA MARIE U. TAN Corporate Secretary BPI STOCK TRANSFER OFFICE INTEGRATED MICROELECTRONICS, INC TOP 100 STOCKHOLDERS AS OF SEPTEMBER 30, 2011 RANK STOCKHOLDER NUMBER STOCKHOLDER NAME NATIONALITY CERTIFICATE CLASS OUTSTANDING SHARES PERCENTAGE TOTAL 1 0100000004 AYC HOLDINGS, LTD. NOF U 957,537,373 66.7702% 957,537,373 33/F TOWER ONE, AYALA TRIANGLE,AYALA AVENUE, MAKATI CITY 2 1600000008 PCD NOMINEE CORPORATION (FILIPINO) FIL U 278,454,616 19.4169% 278,454,616 37F TOWER ONE, THE ENTERPRISE CENTER, 6766 AYALA AVENUE COR. PASEO DE ROXAS, MAKATI CITY 3 1600000002 POMS INVESTMENT PTE LTD. SGN U 57,339,671 3.9983% 57,339,671 10 ANSON ROAD, #34-18 INTERNATIONAL PLAZA, SINGAPORE 079903 4 0500000008 2007 ESOWN SUBSCRIPTION FIL U 45,048,609 3.1412% 45,048,609 C/O ESOWN ADMINISTRATOR, NENENG CARVAJAL 5 0500000018 2009 ESOWN SUBSCRIPTION FIL U 30,546,893 2.1300% 30,546,893 C/O ESOWN ADMINISTRATOR, NENENG CARVAJAL 6 0500000010 2004 ESOWN SUBSCRIPTION FIL U 21,374,044 1.4904% 21,374,044 C/O ESOWN ADMINISTRATOR, NENENG CARVAJAL 7 1300000005 MITSUBISHI CORP. -

Marketing Final Paper Submitted By: (Jollibee) Starr Cunanan

Marketing Final Paper Submitted By: (Jollibee) Starr Cunanan Pearly Magto Angelo Santillana Arnon Sibulo Jericho Tamayo Submitted To: Mrs. Retchell Morales May 10, 2019 CUNANAN, MAGTO, SANTILLANA, SIBULO, TAMAYO May 10, 2019 Final Paper Section 1-6 Ms. Retchell Morales I. EXECUTIVE SUMMARY A. Summary of Marketing Plan This paper is all about the group’s proposed marketing plan on its chosen brand or company, Jollibee Food Corporation (J.F.C). The first few parts of the paper will contain the situational analysis about Jollibee. It gives a brief background about the brand and the current product offerings, marketing strategies and the possible marketing advantages and disadvantages that the Jollibee may face. It delves into the present situation as well as in terms of its external and internal factors by the use of the Industry Analysis (Porter’s Five Forces, S.W.O.T., P.E.S.T.E.L. Analysis, Porter’s Value Chain). On the latter part of the marketing plan, it then delves on the chosen market segmentation and target audience of the group which will help in determining who will be the customers of the extended product which are the Jollibee Chicken Wings. This part will contain a brief target-audience profile based on demographics such as the age, gender, and other important characteristics. Lastly, after determining the chosen product extension to its chosen market, the market strategy will then be laid out through the use the Marketing Mix (4Ps). From here it will give a detailed proposal of the marketing plan the Jollibee Chicken Wings. -

Report Name:Philippine Broiler Market Trends and Prospects

Voluntary Report – Voluntary - Public Distribution Date: March 31,2020 Report Number: RP2020-0035 Report Name: Philippine Broiler Market Trends and Prospects Country: Philippines Post: Manila Report Category: Poultry and Products, Product Brief Prepared By: Approved By: Ryan Bedford Report Highlights: Boosted by rising incomes, a growing middle class, and robust demand in food service and retail, the Philippine broiler sector has surged over the past decade and is set to continue in the coming years. The United States Department of Agriculture (USDA), Foreign Agricultural Service (FAS) in Manila, Philippines commissioned the University of Asia and the Pacific (UA&P) to conduct a broad study on the Philippine broiler market, emerging trends, and prospects for future growth. THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Introduction The Philippines is a fast-growing emerging market with a service-based economy and a population of 109 million in a combined landmass the size of Arizona. With increasing incomes and a burgeoning middle class, Filipinos are consuming more protein while also showing increasing preference for poultry. While pork had traditionally been the main protein source for Philippine diets, in 2019, chicken overtook pork for the first time in per capita consumption. As such and despite still present market access constraints limiting access to U.S. corn and poultry products, the Philippines continues to present long-term growth prospects for U.S. suppliers throughout the value chain, including in the form of agricultural inputs to support local poultry production, ingredients used by the local meat processing industry, and finished, consumer-ready products sold to retailers and food service providers. -

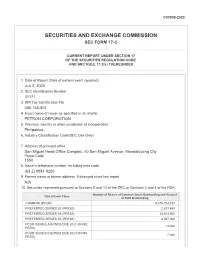

Securities and Exchange Commission Sec Form 17-C

C03909-2020 SECURITIES AND EXCHANGE COMMISSION SEC FORM 17-C CURRENT REPORT UNDER SECTION 17 OF THE SECURITIES REGULATION CODE AND SRC RULE 17.2(c) THEREUNDER 1. Date of Report (Date of earliest event reported) Jun 2, 2020 2. SEC Identification Number 31171 3. BIR Tax Identification No. 000-168-801 4. Exact name of issuer as specified in its charter PETRON CORPORATION 5. Province, country or other jurisdiction of incorporation Philippines 6. Industry Classification Code(SEC Use Only) 7. Address of principal office San Miguel Head Office Complex, 40 San Miguel Avenue, Mandaluyong City Postal Code 1550 8. Issuer's telephone number, including area code (63 2) 8884-9200 9. Former name or former address, if changed since last report N/A 10. Securities registered pursuant to Sections 8 and 12 of the SRC or Sections 4 and 8 of the RSA Number of Shares of Common Stock Outstanding and Amount Title of Each Class of Debt Outstanding COMMON (PCOR) 9,375,104,497 PREFERRED SERIES 2B (PRF2B) 2,877,680 PREFERRED SERIES 3A (PRF3A) 13,403,000 PREFERRED SERIES 3B (PRF3B) 6,597,000 PCOR SERIES A BONDS DUE 2021 (IN MIL 13,000 PESO) PCOR SERIES B BONDS DUE 2023 (IN MIL 7,000 PESO) PCOR SERIES C BONDS DUE 2024 (IN MIL 13,200 PESO) PCOR SERIES D BONDS DUE 2025 (IN MIL 6,800 PESO) TOTAL DEBT AS OF MAR 31, 2020 (IN MIL 285,072 PESO-CONSO) 11. Indicate the item numbers reported herein Item 9 The Exchange does not warrant and holds no responsibility for the veracity of the facts and representations contained in all corporate disclosures, including financial reports.