In Association with EUROPEAN ELITE Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Public Cloud – Solutions & Service Partners

Public Cloud – Solutions & A research report comparing provider Service Partners strengths, challenges Germany 2019 and competitive differentiators Quadrant Report November 2019 ISG Provider Lens™ Quadrant Report | November 2019 Section Name About this Report Information Services Group Inc. is solely responsible for the content of this report. ISG Provider Lens™ delivers leading-edge and actionable research studies, reports Unless otherwise cited, all content, including illustrations, research, conclusions, and consulting services focused on technology and service providers’ strengths and assertions and positions contained in this report were developed by, and are the sole weaknesses and how they are positioned relative to their peers in the market. These property of Information Services Group Inc. reports provide influential insights accessed by our large pool of advisors who are The research and analysis presented in this report includes research from the ISG actively advising outsourcing deals as well as large numbers of ISG enterprise clients Provider Lens™ program, ongoing ISG Research programs, interviews with ISG advisors, who are potential outsourcers. briefings with services providers and analysis of publicly available market information from multiple sources. The data collected for this report represents information that For more information about our studies, please email [email protected], ISG believes to be current as of August 2019 for providers who actively participated and call +49 (0) 561-50697537, or visit ISG Provider Lens™ under ISG Provider Lens™. for providers who did not. ISG recognizes that many mergers and acquisitions have taken place since that time, but those changes are not reflected in this report. All revenue references are in U.S. -

Top Vars 2020 Intros.Indd

Top In association with ARs V 2020 Welcome to Top VARs 2020 Although uncertain times lie ahead, the UK’s top 100 resellers, MSPs and front-line channel partners turned over £17bn in their latest financial years on record, Doug Woodburn discovers This year’s report has a feel of the calm Together, they now turn over before the storm about it. £16.96bn – that’s more than the GDP As a group, the UK’s largest 100 of Botswana and equal to what the resellers and MSPs had a fairly serene government has spent on PPE and and uneventful time of it in their most other COVID-related goods and recent financial years, posting collective services since April. Combined revenues of nearly £17bn – an 8.5 per headcount of over 42,000 means cent annual jump. Profits were also they employ more staff than the roughly flat, depending on how you population of ancient Egyptian city look at it (see p13). Thebes in its pomp. Top VARs charts not current financial When it comes to the rankings, this performance, but the fortunes of these year’s supplement contains more sub- 100 firms in their latest financial years plots than a presidential election. on record – most of which ended The race for top spot has heated before the pandemic hit the industry up, with Softcat just £60m shy of like a force 10 gale. Computacenter’s UK top line (we opted This centuplicate of front-line this year to rank both on their gross channel partners has, however, held up invoiced income, rather than revenue, remarkably well this year. -

REGISTER of SPONSORS (Tiers 2 & 5 and Sub Tiers Only)

REGISTER OF SPONSORS (Tiers 2 & 5 and Sub Tiers Only) DATE: 20-May-2019 Register of Sponsors Licensed Under the Points-based System This is a list of organisations licensed to sponsor migrants under Tiers 2 & 5 of the Points-Based System. It shows the organisation's name (in alphabetical order), the sub tier(s) they are licensed for, and their rating against each sub tier. A sponsor may be licensed under more than one tier, and may have different ratings for each tier. No. of Sponsors on Register Licensed under Tiers 2 and 5: 30,096 Organisation Name Town/City County Tier & Rating Sub Tier ?What If! Ltd London Tier 2 (A rating) Tier 2 General Tier 2 (A rating) Intra Company Transfers (ICT) @ Home Accommodation Services Ltd London Tier 2 (A rating) Tier 2 General Tier 5 (A rating) Creative & Sporting ]performance s p a c e [ Folkestone Kent Tier 5 (A rating) Creative & Sporting 0-two Maintenance London Tier 2 (A rating) Tier 2 General 1 minus 1 Limited Farnham Surrey Tier 2 (A rating) Tier 2 General 1 Stop Halal Limited Eye Suffolk Tier 2 (A rating) Tier 2 General 1 Stop Print Ltd Ilford Tier 2 (A rating) Tier 2 General 1 Tech LTD London Tier 2 (A rating) Tier 2 General 10 Europe Limited Edinburgh Tier 2 (A rating) Tier 2 General Tier 2 (A rating) Intra Company Transfers (ICT) 10 GROUP LTD T/A THE 10 GROUP LONDON Tier 2 (A rating) Tier 2 General Page 1 of 1986 Organisation Name Town/City County Tier & Rating Sub Tier 100 SHAPES LTD LONDON Tier 2 (A rating) Tier 2 General 1000heads Ltd London Tier 2 (A rating) Tier 2 General 1000mercis -

Annual Report 2019 Ströer Se & Co

ANNUAL REPORT 2019 STRÖER SE & CO. KGAA ANNUAL REPORT 2019 REPORT ANNUAL CONTENT The Group’s Financial Figures at a Glance 3 Foreword by the Board of Management 5 Supervisory Board Report 6 Combined Management Report Background and Strategy of the Ströer Group 10 Economic Report 25 Business Environment 25 Financial Performance of the Group 26 Assets, Liabilities and Financial Position 29 Financial Performance of the Segments 34 Information on Ströer SE & Co. KGaA 36 Information on the Share 40 Employees 43 Remuneration Report 45 Opportunities and Risks 51 Forecast 57 Subsequent Events 60 Information in Accordance with Sec. 315a HGB 61 Consolidated Financial Statements Consolidated Income Statement 64 Consolidated Statement of Comprehensive Income 65 Consolidated Statement of Financial Position 66 Consolidated Statement of Cash Flows 68 Consolidated Statement of Changes in Equity 70 Notes to the Consolidated Financial Statements 72 Responsibility Statement 139 Independent Auditor’s Report 140 Other Information Imprint/Financial Calendar Ströer SE & Co. KGaA (hereinafter „Ströer KGaA“) The Group’s Financial Figures at a Glance 3 THE GROUP’S FINANCIAL FIGURES AT A GLANCE1 CONTINUING OPERATIONS EBITDA (ADJUSTED)2 EBITDA MARGIN (ADJUSTED) REVENUE EUR 570.5m 35.9% EUR 1,591.1m (prior year: EUR 538.2m) (prior year: 35.7%) (prior year: EUR 1,507.8m) ORGANIC REVENUE ADJUSTED EARNINGS GROWTH PER SHARE 7.1% EUR 3.47 SEGMENT REVENUE (prior year: 7.9%) (prior year: EUR 3.40) In EUR m 709.1 663.7 567.0 588.3 FREE CASH FLOW BEFORE ROCE 340.6 302.6 M&A -

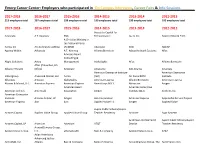

Employers Who Participated in on Campus Interviews, Career Fairs & Info Sessions

Emory Career Center: Employers who participated in On Campus Interviews, Career Fairs & Info Sessions 2017-2018 2016-2017 2015-2016 2014-2015 2013-2014 2012-2013 213 employers total 207 employers total 198 employers total 190 employers total 190 employers total 192 employers total 2017-2018 2016-2017 2015-2016 2014-2015 2013-2014 2012-2013 Access to Capital for Advocate A.T. Kearney 360i Entrepreneurs [x+1], Inc. Abercrombie & Fitch A Christian Ministry in the National Parks Aetna, Inc. Acuity Brands Lighting (ACMNP) Advocate 360i ADCAP Agency Within Advocate A.T. Kearney AllianceBernstein Adcap Network Systems Aflac Advisory Board Consulting & Alight Solutions Aetna Management AlphaSights Aflac AllianceBernstein Aflac (Columbus, GA Alliance Theatre Office) Advocate Altisource AGI Atlanta Allscripts American Enterprise Institute American Enterprise alliantgroup Alvarez & Marsal, LLC Aetna (AEI) Air Force ROTC Institute Allscripts Amazon AlphaSights American Express AllianceBernstein American Express Alvarez & Marsal, LLC American Express American Express AmeriCorps NCCC Altisource Amgen American Heart American Enterprise American Airlines Americold Association Amgen Institute (AEI) Anthem, Inc. American Enterprise Institute Antares Capital, LP Amgen Aon Corporation American Express Appalachia Service Project American Express Aon Aon Applied Value LLC Amgen Applied Value Aspire Public Schools/Aspire Antares Capital Applied Value Group Applied Value Group Teacher Residency Andover Argo Systems Andrews Entertainment Aspire Public Schools/Aspire Antares Capital, LP Arcesium Arcesium AT&T District Teacher Residency AroundCampus Group, Applied Value Group LLC athenahealth Bain & Company Applied Value Group AT&T Asian Americans Advancing Justice - ArchieMD, Inc. Atlanta Bain & Company Bank of America AroundCampus Group, The AutoTrader.com Atlanta Falcons - AMB AT&T Sports + Entertainment Bank of America BBVA Compass Aspire Public Schools Bain & Company Bard Globalization and Atlanta Network International Affairs Technologies, Inc. -

Advancing Open Collaboration Amid the Challenges of a Lifetime Decentralized Innovation

Annual Report 2020 Advancing open collaboration amid the challenges of a lifetime www.linuxfoundation.org Decentralized Innovation. Built on Trust. Our Mission: Create the greatest shared technology investment in the history of the world Executive Director Update 2020 has been a year of challenges for the Linux Foundation (“LF”) and our hosted communities. During this pandemic, we’ve all seen our daily lives and those of many of our colleagues, friends, and family around the world completely changed. Too many in our community also grieved over the loss of family and friends. It was uplifting to see LF members join the fight against COVID-19. Our members worldwide contributed technical resources for scientific researchers, offered assistance to struggling families and individuals, contributed to national and international efforts, and some even came together to create open source projects under LF Public Health to help countries deal with the pandemic. Our project communities continued to grow this year, with new initiatives across many open technology segments, open standards, open data, and open hardware. We welcomed over 150 new communities to the LF this year, including the FINOS Foundation which serves as an umbrella home for open source financial services projects. Our events team had to undergo a significant transformation, pivoting over a few weeks from in-person to virtual events ranging from under 100 to tens of thousands of participants. These virtual gatherings helped many in our communities connect during this difficult time. We also learned much about potentially offering a more inclusive experience by providing hybrid in-person events with virtual experiences in the future. -

Report on the German Cloud and Hosting Sector Trends, Valuations and M&A Environment H1 2017

GERMAN CLOUD AND HOSTING SECTOR TRENDS, VALUATIONS AND M&A-ENVIRONMENT June 2017 Strictly private & confidential 1 CONTENTS § PRESENTATION SUMMARY § OVERVIEW ICT MARKET IN GERMANY AND TOP TRENDS § CLOUD AND HOSTING MARKET AT A GLANCE § MARKET STUDIES ABOUT CLOUD COMPUTING § INTRODUCTION TO CLAIRFIELD INTERNATIONAL § GERMAN SENIOR TEAM AND TRANSACTIONS § M&A ACTIVITY IN TECHNOLOGY SECTORS AND PEER GROUP VALUATION § CONTACT 2 PRESENTATION SUMMARY ClouD solution marKet Tech trenDs in M&A § The size of the global ClouD ComPuting marKet is about 203.9bn€ in § Technology, MeDia & Telecommunication (TMT) comPleteD 3,021 deals 2016 anD accounts for 22.7% of the IT Service marKet. However, the worlDwiDe worth 698.2bn USD in 2016, rePresenting a decrease of global Webhosting marKet has a volume of about 69.0bn€, rePresenting 4.5% in value anD 5.7% in deal count comPareD to a record 2015 (3,203 a share of 7.7% of the global IT Service marKet. deals, 730.8bn USD), while deal count remaineD consistent. § The EuroPean Webhosting marKet is the seconD biggest in the global § Tech anD non-tech comPanies being disrupteD by innovative digital comParison. Furthermore, the EuroPean Webhosting marKet shows a technologies turneD to M&A in numbers that maDe 2016 another continuous growth over the last years. Especially German anD the blocKbuster year for global technology M&A value. British marKet are fast growing marKets with an average annual growth § A slowDown in the M&A marKet in 2017 is more likely in the seconD rate of about 10.0%. part of the year as a result of the election in SePtember anD relateD to § We exPect the ClouD ComPuting marKet to keeP growing as the number high levels of uncertainty, accorDing to Mergermarket intelligence. -

Mandatory Publication Mandatory Publication Pursuant to for The

NON -BINDING ENGLISH TRANSLATION Mandatory publication pursuant to Sections 34, 14 paras. 2 and 3 of the German Securities Acquisitionisition and Takeover Act (Wertpapiererwerbs - und Übernahmegesetz – WpÜG ) Shareholders of Scout24 AG, in particular those who havehave theirtheir placeplace ofof residence,residence, seatseat oror placeplace ofof hahabitual abode in the United States of America or otherwise outside the Federal Republic of Germany, the Member States of the Europe an Union and the European Economic Area should pay particularticular attentionattention toto thethe informationinformation containedcontained inin SSection 1 (General information on the implementation of the takeover offer ), Section 6.8 (Possible future acquisition of Scout24 Shares ) and Section 13. 10 ( Holders of American depositary receipts ) of this Offer Document. OFFER DOCUMENT VOLUNTARY PUBLIC TAKEOVER OFFER (CASH OFFER) by Pulver BidCo GmbH c/o Latham & Watkins LLP Maximilianstraße 13 80539 Munich Germany to the shareholders of Scout24 AG Bothestraße 11 -15 81675 Munich Germany for the acquisition of all non -par value registered shares held by them in Scout24 AG against a cash consideration in the amount of EUR 46.00 per share of Scout24 AG Acceptance Period: 28 March 2019 to 9 May 2019, 24 :00 hrs. (local time Frankfurt am Main) 18:00 hrs. (local time New York) Scout24 Shares: ISIN DE000A12DM80 Tendered Scout24 Shares: ISIN DE000A2TSEV4 Subsequently Tendered Scout24 Shares: ISIN DE000A2TSEW2 TABLE OF CONTENTS 1. GENERAL INFORMATION ON THE IMPLEMENTATION -

Top Vars 2018

Top VARs In association with 2018 BROADEN YOUR SCOPE, ENABLE YOUR GROWTH Delivering technical excellence to the channel A specialist services partner you can rely on: • Strategic IT support • Modular-based service design • Flexible, scalable, adaptable Comms-care is the UK’s leading strategic partner dedicated to supporting the IT channel. A natural extension to your team; we deliver world-class value and services on your behalf, tailored to fit any customer requirement, that help increase productivity and reduce operational costs. For more information contact us on: T: +44 (0) 8702 644 303 E: [email protected] www.comms-care.com calls cost 7 pence per minute plus your phone company’s access charge CRN TOP VARs 2018 Welcome to Top VARs 2018 Uncertain market conditions led to resellers of all sizes seeing a decrease in average profit margins for the second year running, but these resilient VARs fight on, generating a combined revenue of £15.7bn this year I’d like to begin with an apology to neutral or better than neutral any football fans stumbling upon encounters. That said, only one this supplement and expecting of the top 50 polled an average it to contain profiles of Michael satisfaction rating of above 60 per Oliver and Martin Atkinson. cent, signalling that there is clearly There are an estimated 10,000 room for improvement. ‘value-added resellers’ in the UK, Many people feel that ‘VAR’ has and this report – which ranks the become a grossly inadequate term top 100 by revenue – suggests for most companies in this report, they’ve had just as eventful a year and it is true that the majority as their refereeing namesakes. -

Market Intelligence

34 | BUYOUTS | August 28, 2017 www.buyoutsnews.com MARKET INTELLIGENCE The following charts reflect transactions involving U.S.-based financial sponsors. The categories include seeking buyers, announced deals, closed transactions. The source for the data is Thomson One, a product of Thomson Reuters Markets. Please contact Paul Centopani at [email protected] with questions or comments. DEAL FLOW Seeking Buyers–U.S. Targets (July 26, 2017 - August 14, 2017) CONSUMER PRODUCTS AND SERVICES Date Target Name Target City Target State Target Full Business Description Target Advisors Synopsis Announced 08/11/17 Brambles Ltd-N - Michigan The North American Recycled - US - In August 2017, Brambles Ltd, a Sydney, Amer Recycled Whitewood Pallet Business of Brambles New South Wales-based provider of pallet Ltd, located in Michigan. It includes and container pooling services, announced 80 plants and TPM (total pallet that it was seeking a buyer for its North management) sites which currently American Recycled Whitewood Pallet service its recycled pallet operations. Business. REAL ESTATE Date Target Name Target City Target State Target Full Business Description Target Advisors Synopsis Announced 08/04/17 Chesterfield Chesterfield Missouri Chesterfield Mall, located in Chesterfield, - US - In August 2017, C-III Asset Management Missouri, is a shopping center. LLC announced that it was seeking a buyer for its Chesterfield Mall unit, a Chesterfield- based lessor of nonresidential buildings. RECENT DEALS Announced, Pending LBOs By U.S. Sponsors (July 26, 2017 - August 14, 2017) CONSUMER PRODUCTS AND SERVICES Rank Date Target Name Target Short Acquiror Full Name Acquiror Ranking Value Synopsis Business Ultimate inc. Net Debt of Description Parent Target ($Mil) 08/11/17 Mayors Jewelers Mnfr and Aurum Holdings Ltd Apollo - US - Aurum Holdings Ltd of the UK, a unit of Apollo Global Inc wholesale Global Management LLC, planned to acquire Mayors Jewelers Inc, a Sunrise- jewelry Management based manufacturer of jewelry, from Birks & Mayors Inc. -

Public Cloud – Solutions & Services

Public Cloud – Solutions & Services A research report comparing provider France 2020 strengths, challenges and competitive differentiators Quadrant Report Customized report courtesy of: November 2020 ISG Provider Lens™ Quadrant Report | November 2020 Section Name About this Report Information Services Group Inc. is solely responsible for the content of this report. ISG Provider Lens™ delivers leading-edge and actionable research studies, reports Unless otherwise cited, all content, including illustrations, research, conclusions, and consulting services focused on technology and service providers’ strengths and assertions and positions contained in this report were developed by, and are the sole weaknesses and how they are positioned relative to their peers in the market. These property of Information Services Group Inc. reports provide influential insights accessed by our large pool of advisors who are actively advising outsourcing deals as well as large numbers of ISG enterprise clients The research and analysis presented in this report includes research from the ISG who are potential outsourcers. Provider Lens™ program, ongoing ISG Research programs, interviews with ISG advisors, briefings with services providers and analysis of publicly available market information For more information about our studies, please email [email protected], from multiple sources. The data collected for this report represents information that call +49 (0) 561-50697537, or visit ISG Provider Lens™ under ISG Provider Lens™. ISG believes to be current as of August 2020, for providers who actively participated as well as for providers who did not. ISG recognizes that many mergers and acquisitions have taken place since that time, but those changes are not reflected in this report.