2010 ATA Economic Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK-HFM Tupolev Tu-134 CSA -large OK on fin 91 2 £3 CC211 G-31-962 HP Jetstream 31 American eagle 92 2 £1 CC368 N4213X Douglas DC-6 Northern Air Cargo 88 4 £2 CC373 G-BFPV C-47 ex Spanish AF T3-45/744-45 78 1 £4 CC446 G31-862 HP Jetstream 31 American Eagle 89 3 £1 CC487 CS-TKC Boeing 737-300 Air Columbus 93 3 £2 CC489 PT-OKF DHC8/300 TABA 93 2 £2 CC510 G-BLRT Short SD-360 ex Air Business 87 1 £2 CC567 N400RG Boeing 727 89 1 £2 CC573 G31-813 HP Jetstream 31 white 88 1 £1 CC574 N5073L Boeing 727 84 1 £2 CC595 G-BEKG HS 748 87 2 £2 CC603 N727KS Boeing 727 87 1 £2 CC608 N331QQ HP Jetstream 31 white 88 2 £1 CC610 D-BERT DHC8 Contactair c/s 88 5 £1 CC636 C-FBIP HP Jetstream 31 white 88 3 £1 CC650 HZ-DG1 Boeing 727 87 1 £2 CC732 D-CDIC SAAB SF-340 Delta Air 89 1 £2 CC735 C-FAMK HP Jetstream 31 Canadian partner/Air Toronto 89 1 £2 CC738 TC-VAB Boeing 737 Sultan Air 93 1 £2 CC760 G31-841 HP Jetstream 31 American Eagle 89 3 £1 CC762 C-GDBR HP Jetstream 31 Air Toronto 89 3 £1 CC821 G-DVON DH Devon C.2 RAF c/s VP955 89 1 £1 CC824 G-OOOH Boeing 757 Air 2000 89 3 £1 CC826 VT-EPW Boeing 747-300 Air India 89 3 £1 CC834 G-OOOA Boeing 757 Air 2000 89 4 £1 CC876 G-BHHU Short SD-330 89 3 £1 CC901 9H-ABE Boeing 737 Air Malta 88 2 £1 CC911 EC-ECR Boeing 737-300 Air Europa 89 3 £1 CC922 G-BKTN HP Jetstream 31 Euroflite 84 4 £1 CC924 I-ATSA Cessna 650 Aerotaxisud 89 3 £1 CC936 C-GCPG Douglas DC-10 Canadian 87 3 £1 CC940 G-BSMY HP Jetstream 31 Pan Am Express 90 2 £2 CC945 7T-VHG Lockheed C-130H Air Algerie -

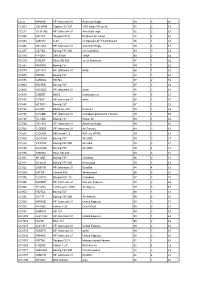

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

Approve Airline Lease with Allegiant Air LLC

DRAFT Agenda Item 3 AGENDA STAFF REPORT ASR Control 20-00 l 077 MEETING DATE: 01 /1 2/21 LEGAL ENTITY TAKING ACTION: Board ofSupervisors BOARD OF SUPERVISORS DISTRICT(S): 2 SUBMITTING AGENCY/DEPARTMENT: John Wayne Airport (Approved) DEPARTMENT CONTACT PERSON(S): Barry A. Rondinella (949) 252-5183 Dave Pfeiffer (949) 252-5291 SUBJECT: Approve Airline Lease with Allegiant Air LLC CEO CONCUR COUNTY COUNSEL REVIEW CLERK OF THE BOARD Concur Approved Agreement to Form Discussion 4/5 Vote Budgeted: Yes Current Year Cost: NI A Annual Cost: NIA Staffing Impact: No # of Positions: Sole Source: No Current Fiscal Year Revenue: $614,681 Funding Source: Airport Operating Fund 280: 100% County Audit in last 3 years: No Prior Board Action: 11/03/2020 #6 RECOMMENDED ACTION(S): 1. Approve and execute the Certificated Passenger Airline Lease with Allegiant Air LLC, for a term effective February 1, 2021, through December 31, 2025. 2. Authorize John Wayne Airport to allocate three Regulated Class A Average Daily Departures and seat capacity, effective February I, 2021, through December 31, 2025, consistent with the terms of the Phase 2 Commercial Airline Access Plan and Regulation. 3. Authorize the Airport Director or designee to make minor modifications and amendments to the lease that do not materially alter the terms or financial obligations to the County and perform all activities specified under the terms ofthe lease. SUMMARY: Approval of the Certificated Passenger Airline Lease between the County of Orange and Allegiant Air LLC and approval of the allocation of operating capacity will allow Allegiant Air LLC, a new carrier from the commercial air carrier new entrant waiting list, to initiate operations at John Wayne Airport. -

Appendix 25 Box 31/3 Airline Codes

March 2021 APPENDIX 25 BOX 31/3 AIRLINE CODES The information in this document is provided as a guide only and is not professional advice, including legal advice. It should not be assumed that the guidance is comprehensive or that it provides a definitive answer in every case. Appendix 25 - SAD Box 31/3 Airline Codes March 2021 Airline code Code description 000 ANTONOV DESIGN BUREAU 001 AMERICAN AIRLINES 005 CONTINENTAL AIRLINES 006 DELTA AIR LINES 012 NORTHWEST AIRLINES 014 AIR CANADA 015 TRANS WORLD AIRLINES 016 UNITED AIRLINES 018 CANADIAN AIRLINES INT 020 LUFTHANSA 023 FEDERAL EXPRESS CORP. (CARGO) 027 ALASKA AIRLINES 029 LINEAS AER DEL CARIBE (CARGO) 034 MILLON AIR (CARGO) 037 USAIR 042 VARIG BRAZILIAN AIRLINES 043 DRAGONAIR 044 AEROLINEAS ARGENTINAS 045 LAN-CHILE 046 LAV LINEA AERO VENEZOLANA 047 TAP AIR PORTUGAL 048 CYPRUS AIRWAYS 049 CRUZEIRO DO SUL 050 OLYMPIC AIRWAYS 051 LLOYD AEREO BOLIVIANO 053 AER LINGUS 055 ALITALIA 056 CYPRUS TURKISH AIRLINES 057 AIR FRANCE 058 INDIAN AIRLINES 060 FLIGHT WEST AIRLINES 061 AIR SEYCHELLES 062 DAN-AIR SERVICES 063 AIR CALEDONIE INTERNATIONAL 064 CSA CZECHOSLOVAK AIRLINES 065 SAUDI ARABIAN 066 NORONTAIR 067 AIR MOOREA 068 LAM-LINHAS AEREAS MOCAMBIQUE Page 2 of 19 Appendix 25 - SAD Box 31/3 Airline Codes March 2021 Airline code Code description 069 LAPA 070 SYRIAN ARAB AIRLINES 071 ETHIOPIAN AIRLINES 072 GULF AIR 073 IRAQI AIRWAYS 074 KLM ROYAL DUTCH AIRLINES 075 IBERIA 076 MIDDLE EAST AIRLINES 077 EGYPTAIR 078 AERO CALIFORNIA 079 PHILIPPINE AIRLINES 080 LOT POLISH AIRLINES 081 QANTAS AIRWAYS -

Airline Schedules

Airline Schedules This finding aid was produced using ArchivesSpace on January 08, 2019. English (eng) Describing Archives: A Content Standard Special Collections and Archives Division, History of Aviation Archives. 3020 Waterview Pkwy SP2 Suite 11.206 Richardson, Texas 75080 [email protected]. URL: https://www.utdallas.edu/library/special-collections-and-archives/ Airline Schedules Table of Contents Summary Information .................................................................................................................................... 3 Scope and Content ......................................................................................................................................... 3 Series Description .......................................................................................................................................... 4 Administrative Information ............................................................................................................................ 4 Related Materials ........................................................................................................................................... 5 Controlled Access Headings .......................................................................................................................... 5 Collection Inventory ....................................................................................................................................... 6 - Page 2 - Airline Schedules Summary Information Repository: -

Pages 91-120

Relocation of U.S. Navy’s Keehi Beach facilities was necessary to clear the site for the runway construction. The marina was to be relocated to Rainbow Bay in Pearl Harbor and the swimming and sunbathing activities were moved to Barbers Point. The State reimbursed the federal government for the cost of replacing these facilities in their new loca- tions. The total estimated cost was $1,598,000 and payment was made as work progressed. As of June 30,1973, the work was about 10 percent completed under the Navy contract. Although the Reef Runway was designed to improve the environment as well as provide for traffic gains into the 1990s, it was opposed on environmental grounds, including its possible effects on bird life and fishing grounds. The project’s effectiveness in reducing noise was also questioned. The bid opening was originally set for November 9, 1972. On November 8, Federal Judge Martin Pence signed a temporary restraining order which forbade the DOT to open the bids. The restraining order was granted on a complaint filed on behalf of four groups and four individuals. The groups were Life of the Land, the Hawaii Audubon Society, the Sierra Club and Friends of the Earth. The four individuals were men who lived and worked in the area which would be affected by the Reef Runway. The order remained in effect until after hearings before Federal Judge Samuel P. King were completed, and his decision announced. On December 22, 1972, Judge King ruled that the environmental impact statement on the proposed Reef Runway was adequate and that construction could begin. -

Miami-Dade Aviation Department

Miami-Dade Aviation Department Aviation Statistics Freight Carried - All Airlines Facility: MIA Units: Short Tons Current Year: 10/2008 - 09/2009 Prior Year:10/2007 - 09/2008 Domestic International Total % Total Domestic International Arrival Departure Arrival Departure Freight Change Operator Freight Arrival Departure Arrival Departure 1,072.71 576.85 102,274.77 82,085.54 186,009.87 4.70% Arrow Air Inc dba Arrow Cargo 177,658.38 176.02 24.64 90,907.92 86,549.80 0.00 0.00 88,469.11 80,646.07 169,115.18 -19.72% LAN Airlines f/k/a LAN Chile SA 210,661.41 0.00 0.00 108,679.01 101,982.40 16,930.09 10,610.21 66,304.74 52,151.21 145,996.25 -13.02% United Parcel Service 167,841.52 18,554.52 13,794.09 75,516.57 59,976.34 0.00 0.00 74,171.56 59,663.09 133,834.65 -16.64% Tampa Cargo S.A. fka Tampa 160,545.15 0.00 0.00 85,662.87 74,882.28 Airlines 92.00 92.00 70,159.66 59,667.03 130,010.69 -26.35% Centurion Air Cargo 176,520.00 190.00 190.00 92,027.00 84,113.00 19,053.20 18,085.60 47,488.80 31,104.70 115,732.30 -24.58% American Airlines Inc 153,450.50 24,095.50 28,221.40 64,487.20 36,646.40 54,637.00 45,007.83 0.00 290.00 99,934.83 -9.93% Federal Express Corporation 110,952.56 64,973.52 45,661.52 0.00 317.52 10,005.77 7,325.30 28,235.37 37,789.61 83,356.05 30.42% ABX Air 63,912.36 304.01 684.77 28,837.23 34,086.35 0.00 0.00 29,650.30 37,691.47 67,341.77 -14.12% Amerijet International 78,411.69 0.00 0.00 29,877.59 48,534.10 813.27 732.46 35,167.78 21,852.19 58,565.70 -32.36% Southern Air Inc 86,581.41 0.00 0.00 49,197.13 37,384.28 1,219.03 60.08 28,053.94 20,361.20 49,694.25 22.68% Atlas Air Inc 40,507.95 9,678.58 1,175.01 16,043.06 13,611.30 42.35 42.35 24,096.30 19,103.37 43,284.37 -39.15% Cielos Del Peru SA 71,135.13 0.00 0.00 39,146.51 31,988.62 3,027.07 886.64 18,678.17 17,239.72 39,831.60 -36.46% Florida West International Airways 62,687.03 3,077.66 2,773.66 29,842.93 26,992.78 0.00 0.00 17,874.13 14,802.81 32,676.94 100.00% Linea Aerea Carguera de Colombia 0.00 0.00 0.00 0.00 0.00 S.A. -

Attachment F – Participants in the Agreement

Revenue Accounting Manual B16 ATTACHMENT F – PARTICIPANTS IN THE AGREEMENT 1. TABULATION OF PARTICIPANTS 0B 475 BLUE AIR AIRLINE MANAGEMENT SOLUTIONS S.R.L. 1A A79 AMADEUS IT GROUP SA 1B A76 SABRE ASIA PACIFIC PTE. LTD. 1G A73 Travelport International Operations Limited 1S A01 SABRE INC. 2D 54 EASTERN AIRLINES, LLC 2I 156 STAR UP S.A. 2I 681 21 AIR LLC 2J 226 AIR BURKINA 2K 547 AEROLINEAS GALAPAGOS S.A. AEROGAL 2T 212 TIMBIS AIR SERVICES 2V 554 AMTRAK 3B 383 Transportes Interilhas de Cabo Verde, Sociedade Unipessoal, SA 3E 122 MULTI-AERO, INC. DBA AIR CHOICE ONE 3J 535 Jubba Airways Limited 3K 375 JETSTAR ASIA AIRWAYS PTE LTD 3L 049 AIR ARABIA ABDU DHABI 3M 449 SILVER AIRWAYS CORP. 3S 875 CAIRE DBA AIR ANTILLES EXPRESS 3U 876 SICHUAN AIRLINES CO. LTD. 3V 756 TNT AIRWAYS S.A. 3X 435 PREMIER TRANS AIRE INC. 4B 184 BOUTIQUE AIR, INC. 4C 035 AEROVIAS DE INTEGRACION REGIONAL 4L 174 LINEAS AEREAS SURAMERICANAS S.A. 4M 469 LAN ARGENTINA S.A. 4N 287 AIR NORTH CHARTER AND TRAINING LTD. 4O 837 ABC AEROLINEAS S.A. DE C.V. 4S 644 SOLAR CARGO, C.A. 4U 051 GERMANWINGS GMBH 4X 805 MERCURY AIR CARGO, INC. 4Z 749 SA AIRLINK 5C 700 C.A.L. CARGO AIRLINES LTD. 5J 203 CEBU PACIFIC AIR 5N 316 JOINT-STOCK COMPANY NORDAVIA - REGIONAL AIRLINES 5O 558 ASL AIRLINES FRANCE 5T 518 CANADIAN NORTH INC. 5U 911 TRANSPORTES AEREOS GUATEMALTECOS S.A. 5X 406 UPS 5Y 369 ATLAS AIR, INC. 50 Standard Agreement For SIS Participation – B16 5Z 225 CEMAIR (PTY) LTD. -

Greater Orlando Aviation Authority

Greater Orlando Aviation Authority - Orlando International Airport Landed Weight Statistics For Period OCT-2019 through SEP-2020 Domestic International Airline Name Revenue Non-Revenue Revenue Non-Revenue Total 21 Air, LLC 22,357 22,357 ABC Aerolineas SA de CV 26,771 26,771 ABX Air Inc 3,158 3,158 Aer Lingus Ltd 34,373 34,373 Aerolineas Argentinas S.A. Inc. 16,362 16,362 Aerovias Del Continente Americano-Avianca 38,286 38,286 Pre-Bank Aerovias de Mexico SA de CV 8,192 8,192 Aerovias de Mexico SA de CV Pre- 38,193 38,193 Bankruptcy Air Canada 283,213 283,213 Air Transat A.T. Inc. 27,411 27,411 Alaska Airlines Inc 196,122 196,122 American Airlines Inc 2,187,113 2,187,113 Amerijet International, Inc. 64,184 64,184 Atlas Air Inc. 49,185 6,342 55,527 Azul Linhas Aereas Brasileiras S.A. Inc 142,783 142,783 Bahamasair Holdings Limited, Inc 23,245 23,245 British Airways 90,930 90,930 Caribbean Airlines Limited 11,996 11,996 Concesionaria Vuela Compania Aviacion 23,548 23,548 SAPI de CV Copa Airlines 117,871 117,871 Delta Air Lines 2,188,785 45,992 2,234,777 Eastern Airlines, LLC 278 278 Edelweiss Air AG 1,649 1,649 Emirates Inc 17,174 70,234 87,408 Fast Colombia S.A.S. 284 284 Federal Express Corporation 360,287 360,287 Frontier Airlines 1,696,675 3,246 1,699,921 GOL Linhas Aereas S.A. 33,064 33,064 Hi Fly, Ltd 1,737 1,737 Hi Fly, Transportes Aereos SA 401 401 Icelandair, LLC 28,046 28,046 JetBlue Airways Corp. -

Foram Encontrados 367 Parceiros. Verifique Se Está Disponível No Seu Mercado

Foram encontrados 367 parceiros. Verifique se está disponível no seu mercado. Por favor use sempre o Quick Check em www.hahnair.com/quickcheck antes de emitir um bilhete. P4 Air Peace BG Biman Bangladesh Airl… T3 Eastern Airways 7C Jeju Air HR-169 HC Air Senegal NT Binter Canarias MS Egypt Air JQ Jetstar Airways A3 Aegean Airlines JU Air Serbia 0B Blue Air LY EL AL Israel Airlines 3K Jetstar Asia EI Aer Lingus HM Air Seychelles BV Blue Panorama Airlines EK Emirates GK Jetstar Japan AR Aerolineas Argentinas VT Air Tahiti OB Boliviana de Aviación E7 Equaflight BL Jetstar Pacific Airlines VW Aeromar TN Air Tahiti Nui TF Braathens Regional Av… ET Ethiopian Airlines 3J Jubba Airways AM Aeromexico NF Air Vanuatu 1X Branson AirExpress EY Etihad Airways HO Juneyao Airlines AW Africa World Airlines UM Air Zimbabwe SN Brussels Airlines 9F Eurostar RQ Kam Air 8U Afriqiyah Airways SB Aircalin FB Bulgaria Air BR EVA Air KQ Kenya Airways AH Air Algerie TL Airnorth VR Cabo Verde Airlines FN fastjet KE Korean Air 3S Air Antilles AS Alaska Airlines MO Calm Air FJ Fiji Airways KU Kuwait Airways KC Air Astana AZ Alitalia QC Camair-Co AY Finnair B0 La Compagnie UU Air Austral NH All Nippon Airways KR Cambodia Airways FZ flydubai LQ Lanmei Airlines BT Air Baltic Corporation Z8 Amaszonas K6 Cambodia Angkor Air XY flynas QV Lao Airlines KF Air Belgium Z7 Amaszonas Uruguay 9K Cape Air 5F FlyOne LA LATAM Airlines BP Air Botswana IZ Arkia Israel Airlines BW Caribbean Airlines FA FlySafair JJ LATAM Airlines Brasil 2J Air Burkina OZ Asiana Airlines KA Cathay Dragon -

Bankruptcy Tilts Playing Field Frank Boroch, CFA 212 272-6335 [email protected]

Equity Research Airlines / Rated: Market Underweight September 15, 2005 Research Analyst(s): David Strine 212 272-7869 [email protected] Bankruptcy tilts playing field Frank Boroch, CFA 212 272-6335 [email protected] Key Points *** TWIN BANKRUPTCY FILINGS TILT PLAYING FIELD. NWAC and DAL filed for Chapter 11 protection yesterday, becoming the 20 and 21st airlines to do so since 2000. Now with 47% of industry capacity in bankruptcy, the playing field looks set to become even more lopsided pressuring non-bankrupt legacies to lower costs further and low cost carriers to reassess their shrinking CASM advantage. *** CAPACITY PULLBACK. Over the past 20 years, bankrupt carriers decreased capacity by 5-10% on avg in the year following their filing. If we assume DAL and NWAC shrink by 7.5% (the midpoint) in '06, our domestic industry ASM forecast goes from +2% y/y to flat, which could potentially be favorable for airline pricing (yields). *** NWAC AND DAL INTIMATE CAPACITY RESTRAINT. After their filing yesterday, NWAC's CEO indicated 4Q:05 capacity could decline 5-6% y/y, while Delta announced plans to accelerate its fleet simplification plan, removing four aircraft types by the end of 2006. *** BIGGEST BENEFICIARIES LIKELY TO BE LOW COST CARRIERS. NWAC and DAL account for roughly 26% of domestic capacity, which, if trimmed by 7.5% equates to a 2% pt reduction in industry capacity. We believe LCC-heavy routes are likely to see a disproportionate benefit from potential reductions at DAL and NWAC, with AAI, AWA, and JBLU in particular having an easier path for growth.