Oncology Pharmaceutical

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Manufacturers and Wholesalers Street

Nevada AB128 Code of Conduct Compliant Companies Manufacturers and Wholesalers Street City ST Zip 10 Edison Street LLC 13 Edison Street LLC Abbott Diabetes Care Division Abbott Diagnostic Division Abbott Electrophysiology (including Kalila Medical 2- 2016)) Abbott Laboratories 100 Abbott Park Road, Dept. EC10, Bldg. APGA-2 Abbott Park IL 60064 Abbott Medical Optics Abbott Molecular Division Abbott Nutrition Products Division Abbott Vascular Division (includes Tendyne 9-2015) AbbVie, Inc. 1 N. Waukegan Road North Chicago IL 60064 Acadia Phamaceuticals 3611 Valley Centre Drive, Suite 300 San Diego CA 92130 Accelero Health Partners, LLC Acclarent, Inc. 1525-B O'Brien Dr. Menlo Park CA 94025 Accuri Cyometers, Inc. Ace Surgical Supply, Inc. 1034 Pearl St. Brockton MA 02301 Acorda Therapeutics, Inc. 420 Sawmill River Road Ardsley NY 10532 AcriVet, Inc. Actavis W.C. Holding, Inc. Morris Corporate Center III, 400 Interpace Parkway Parsippany NJ 07054 Actavis , Inc. Actelion Pharmaceuticals US, Inc. 5000 Shoreline Court, Suite 200 S. San Francisco CA 94080 Activis 400 Interpace parkway Parsippany NJ 07054 A-Dec, Inc. 2601 Crestview Dr. Newberg OR 97132 Advanced Respiratory, Inc. Advanced Sterilization Products 33 Technology Drive Irvine CA 92618 Advanced Vision Research, Inc., dba Akorn Consumer Health Aegerion Pharmaceuticals, Inc. 101 Main Street, Suite 1850 Cambridge MA 02142 Aesculap Implant Systems, Inc. Aesculap, Inc. 3773 Corporate Parkway Center Valley PA 18034 Aesthera Corporation Afaxys, Inc. PO Box 20158 Charleston SC 29413 AGMS, Inc. Akorn (New Jersey) Inc. Page 1 of 23 Pages 2/15/2017 Nevada AB128 Code of Conduct Compliant Companies Akorn AG (formerly Excelvision AG) Akorn Animal Health, Inc. -

Manufacturers with Signed Rebate Agreements February 1 , 2011

Wisconsin Medicaid Pharmacy Data Table Manufacturers with Signed Rebate Agreements February 1 , 2011 NEWLABELER NAME START END SC NEW LABELER NAME START END SC 00002 ELI LILLY AND COMPANY 1/1/1991 Y 00126 COLGATE ORAL PHARMACEUTICAL 1/1/1991 Y 00003 E R SQUIBB AND SONS INC. 1/1/1991 Y 00131 SCHWARZ PHARMA, INC. 1/1/1991 Y 00004 HOFFMANN LAROCHE INC 1/1/1991 00132 C B FLEET COMPANY INC. 1/1/1991 00005 LEDERLE LABORATORIES 1/1/1991 Y 00135 SMITHKLINE BEECHAM 1/1/1995 Y 00006 MERCK SHARP & DOHME 1/1/1991 Y 00143 WEST-WARD PHARMACEUTICAL C 1/1/1991 Y 00007 SMITHKLINE BEECHAM CORPORATI 1/1/1991 Y 00145 STIEFEL LABORATORIES INC. 1/1/1991 Y 00008 WYETH AYERST LABORATORIES 1/1/1991 Y 00149 PROCTER & GAMBLE PHARMACEU 1/1/1991 Y 00009 PHARMACIA AND UPJOHN 1/1/1991 Y 00168 E FOUGERA AND CO, DIV OF ALTAN 1/1/1991 Y 00013 PHARMACIA AND UPJOHN 1/1/1991 Y 00169 NOVO NORDISK PHARMACEUTICAL 1/1/1991 Y 00015 INVAMED, INC 1/1/1991 Y 00172 ZENITH LABORATORIES, INC 1/1/1991 Y 00023 ALLERGAN INC. 1/1/1991 Y 00173 GLAXOSMITHKLINE 1/1/1991 Y 00024 SANOFI SYNTHELABO 1/1/1991 Y 00178 MISSION PHARMACAL COMPANY 1/1/1991 Y 00025 PHARMACIA CORPORATION 1/1/1991 Y 00182 GOLDLINE LABORATORIES INC 1/1/1991 Y 00026 BAYER CORP PHARMACEUTICAL DI 1/1/1991 Y 00185 EON LABS MANUFACTURING, INC. 1/1/1991 Y 00028 NOVARTIS PHARMACEUTICALS 1/1/1991 Y 00186 ASTRAZENECA LP 1/1/1991 Y 00029 SMITHKLINE BEECHAM CORPORATI 1/1/1991 Y 00187 ICN PHARMACEUTICALS INC. -

Reporter's Handbook

2O14 RE POR TER’ S HANDBOOK for the biopharmaceutical research industry Member Companies 1 Research Associates 2 U.S. Health-Related Trade and Professional Organizations 3 Government Medical and Health Contacts 4 Voluntary Health Agencies 5 International Pharmaceutical Associations/Health Care Groups 6 Key Facts/About PhRMA 7 Company Products by Category 8 Member Companies 1 Member Companies Abbott Dept 383, AP6D 100 Abbott Park Road Abbott Park, IL 60064-3500 Phone: (847) 937-6100 Fax: (847) 937-1511 Website: www.abbott.com Melissa Brotz, Corporate Public Affairs Office: (847) 935-3456 E-Mail: [email protected] Kelly Morrison, Corporate Public Affairs, Science/Policy Office: (847) 937-3802 E-Mail: [email protected] Scott Stoffel, Corporate Public Affairs, Financial Office: (847) 936-9502 E-Mail: [email protected] Steve Chesterman, Medical Optics Office: (714) 247-8711 E-Mail: [email protected] Jonathon Hamilton, Vascular Devices 3200 Lakeside Drive, Suite 355 Santa Clara, CA 95054 Office: (408) 845-3491 E-Mail: [email protected] AbbVie 1 North Waukegan Road North Chicago, IL 60064 Phone: (847) 932-7900 Website: www.abbvie.com Gulden Mesara, Vice President, Global Commercial and Health Communications Office: (847) 938-2804 E-Mail: [email protected] Angela Sekston, Vice President, Leadership and Employee Communications Office: (847) 937-6636 E-Mail: [email protected] Morry Smulevitz, Head of U.S. Public Affairs Office: (847) 937-2152 E-Mail: [email protected] 1-1 -

Biocentury 8.15.16

WEEK OF AUGUST 15, 2016 6 PRODUCT DEVELOPMENT: NO ANTIGEN LEFT BEHIND Amgen has added to its immuno-oncology arsenal with its deal for Advaxis’ pan- epitope neoantigen vaccine platform. SERVING RETURNS 9 EMERGING COMPANY PROFILE: RESTRAINING TRANSLATION BY STEVE EDELSON, SENIOR EDITOR Bantam is developing small molecule eIF4E inhibitors to treat a range of cancers, China’s Ally Bridge Group hit the investment world’s starting with B cell malignancies. radar in 2015 with its audacious move to take CRO WuXi PharmaTech Inc. private. If the firm and its partners can engineer the first fruits of that move with REGULATION: the listing of WuXi’s biologics unit in Hong Kong this 10 year, the question is what will be its next moves to ADAPTING FOR THE REAL WORLD generate outsized returns for its investors. EMA says better strategies for real-world evidence and more patient and payer involvement are necessary Ally Bridge, which has a about $1.5 billion under next steps for its adaptive pathway initiative. management across three funds and an international base of LPs, thinks its returns and continued visibility will come from a handful of public and private portfolio companies with transformative data events, the first of EBB & FLOW: 13 which should come this half. LION’S SHARE OF THE WORK Aslan’s validating event. Plus: Cutting a check The firm also says it is working on new private equity to Cleave; and Ironwood’s operating leverage. deals that will rival WuXi in terms of size and impact. Ally Bridge is keeping its private equity plans under wraps, and does not disclose names of investments in its Asia hedge fund. -

2020-2021 Cancer Communications Committee Disclosures All Relationships Are Considered Compensated

2020-2021 Cancer Communications Committee Disclosures All relationships are considered compensated. Relationships are self-held unless otherwise noted. I = Immediate Family Member, Inst = My Institution Name EMAIL Committee Employment Leadership Stock and Other Honoraria Consulting or Advisory Speakers' Bureau Research Funding Patents, Royalties, Other Expert Testimony Travel, Other Relationship (OPTIONAL) (OPTIONAL) Open Member Status Ownership Interests Role Intellectual Property Accommodations, Uncompensated Payments Link Expenses Relationships Neeraj Agarwal [email protected] Active Astellas Pharma Active Biotech (Inst) Astellas Pharma Amgen (Inst) AstraZeneca AstraZeneca (Inst) AstraZeneca Bavarian Nordic (Inst) AVEO Bayer (Inst) Bayer BN ImmunoTherapeutics Bristol-Myers Squibb (Inst) Calithera Biosciences Bristol-Myers Squibb (Inst) Eisai Calithera Biosciences EMD Serono (Inst) Exelixis Celldex (Inst) Foundation Medicine Eisai (Inst) Foundation One Inc Exelixis (Inst) Genentech Genentech (Inst) Janssen Oncology GlaxoSmithKline (Inst) Lilly Immunomedics (Inst) Lilly Janssen (Inst) lily Merck (Inst) Medivation/Astellas Newlink Genetics (Inst) MEI Pharma Novartis (Inst) Merck Pfizer (Inst) Nektar Prometheus (Inst) Novartis Rexahn Pharmaceuticals Pfizer (Inst) Pfizer Sanofi (Inst) Pharmacyclics Takeda (Inst) Seattle Genetics TRACON Pharma (Inst) Muhammad S. Beg muhammad.beg@utsouthwestern. Active Array BioPharma Agios (Inst) edu AstraZeneca/MedImmune ArQule (Inst) Cancer Commons AstraZeneca/MedImmune Ipsen (Inst) Legend Biotech -

Spectrum Pharmaceuticals Inc

SPECTRUM PHARMACEUTICALS INC FORM 10-K (Annual Report) Filed 03/12/14 for the Period Ending 12/31/13 Address 11500 S. EASTERN AVE., SUITE 240 HENDERSON, NV 89052 Telephone 702-835-6300 CIK 0000831547 Symbol SPPI SIC Code 2834 - Pharmaceutical Preparations Industry Biotechnology & Drugs Sector Healthcare Fiscal Year 12/31 http://www.edgar-online.com © Copyright 2014, EDGAR Online, Inc. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use. UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2013 TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission File Number: 001-35006 SPECTRUM PHARMACEUTICALS, INC. (Exact Name of Registrant as Specified in its Charter) Delaware 93 -0979187 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 11500 South Eastern Avenue, Suite 240 Henderson, Nevada 89052 (Address of principal executive offices) (702) 835-6300 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common Stock, $0.001 par value The NASDAQ Stock Market, LLC Rights to Purchase Series B Junior Participating Preferred Stock Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Representative Healthcare and Life Sciences M&A Transactions

Representative Healthcare and Life Sciences M&A Transactions • Medtronic plc. Representing Medtronic plc in its $458 million acquisition of Twelve, Inc., a developer of devices for the treatment of chronic cardiovascular diseases. • Shire plc. Representing Shire plc in its $30 billion acquisition of Baxalta Incorporated, a developer of products for the treatment of hematology and immunology worldwide. • Pfizer Inc. Representing Pfizer Inc. in its $130 million acquisition of GlaxoSmithKline plc, a UK-based pharmaceuticals company. • Pfizer Inc. Representing Pfizer Inc. in its $17 billion acquisition of Hospira Inc., a provider of injectable drugs and infusion technologies. • Wright Medical Group. Representing Wright Medical Group in its $3.3 billion merger of equals with Tornier N.V., a Netherlands-based medical device company. • Synageva BioPharma. Represented Synageva BioPharma in its $8 billion sale to Alexion Pharmaceuticals, Inc., a biopharmaceutical company, develops and commercializes life-transforming therapeutic products. • Pfizer Inc. Represented Pfizer Inc. in its investment in AM-Pharma B.V., an Amsterdam-based biopharmaceutical company. • Becton, Dickinson & Company. Represented Becton, Dickinson & Company in its acquisition of CRISI Medical Systems, Inc., a medical device company, focuses on the development of drug-delivery systems. • Cubist Pharmaceuticals. Represented Cubist Pharmaceuticals in its $9 billion sale to Merck & Co. Inc., a provider of health care solutions worldwide. • Symmetry Medical. Represented Symmetry Medical Inc. In the sale of OEM Solutions business to Tecomet, a Genstar Capital portfolio company, for $450 million. As part of the deal, Symmetry, a publicly held medical device solutions provider, will also spin off and transfer to its shareholders ownership in a new company, Specialty Surgical Instruments. -

Based on Our Discussion with Radford, Management Identified Our Peer Companies to Include the Following 19 Biotechnology and Pharmaceutical Companies for 2015

Based on our discussion with Radford, management identified our peer companies to include the following 19 biotechnology and pharmaceutical companies for 2015: Ariad Pharmaceuticals Inc. Infinity Pharmaceuticals, Inc. Progenics Pharmaceuticals, Inc. Array BiopPharma, Inc. Lexicon Pharmaceuticals, Inc Repligen Corporation Celldex Therapeutics, Inc. MacroGenics, Inc. Spectrum Pharmaceuticals, Inc. CTI BioPharma Corp. Merrimack Pharmaceuticals, Inc. Synta Pharmaceuticals Corp. DepoMed Inc. NewLink Genetics Corporation XOMA Corporation Halozyme Therpeutics, Inc. OncoMed Pharmaceuticals, Inc. Immunomedics Inc. Peregrine Pharmaceuticals, Inc These peer companies were selected from among publicly-held U.S. pharmaceutical and biotechnology companies with comparable operations in mid– to late–stages of product development or small commercial products in the U.S. based on the following criteria: number and stage of development programs; number of employees; market capitalization; and number of and revenue from commercial products. The market data included information as to base salaries, cash bonuses and stock option awards. Use of Compensation Consultants Our Compensation Committee is authorized to retain its own independent advisors to assist in carrying out its responsibilities. Our Compensation Committee engaged Radford to analyze historic compensation and establish recommendations for executive compensation for 2015 and methodologies for determining compensation on an on-going basis. Benchmarking in the Context of Our Other Executive Compensation Principles Our Compensation Committee and our Board of Directors use market data as one means of evaluating and establishing executive pay. In instances where an executive officer is believed to be especially suited to our company or important to our success, the Compensation Committee may establish or recommend compensation that deviates from industry averages or other specific benchmarks. -

Major Employers of Chemists in the Northeastern Section

Major Employers of Chemists in the Northeastern Section by Don Rickter with valuable assistance from Karen Piper, Mike Filosa, Lee Johnson, Dorothy Phillips and others Eastern Massachusetts and New Hampshire are a hotbed of dynamic chemistry companies. Some are start-ups that will grow dramatically. There are dozens of companies in both states. Some will merge or be acquired or change their names. Each has a unique personality and spectrum of expertise. The following list is most of the employers of seven or more members of the American Chemical Society — as of the end of May 2010. A few of the larger employers, with more than 35 ACS chemists, are in ALL CAPS. The locations are in eastern Massachusetts — unless marked with NH for New Hampshire. Aerodyne Research BIOGEN IDEC Cubist Pharmaceuticals Billerica CAMBRIDGE Lexington www.aerodyne.com/ www.biogenidec.com/ www.cubist.com Alkermes Inc. Boston Scientific Corp. Dow Electronic Materials Waltham Natick Marlborough www.alkermes.com/ www.bostonscientific.com/ www.dow.com/ & home.bsci www.rohmhaas.com/ Alnylam Pharmaceuticals Broad Institute [rhymes DSM-Neoresins Cambridge with road] Cambridge Wilmington www.alnylam.com/ www.broadinstitute.org/ www.dsm.com/en_US/htm l/dnr/home. htm AMGEN INC. Bruker Corp. CAMBRIDGE Billerica www.bruker.com E-Ink Corp. www.amgen.com/ Cambridge www.e- Cabot Corp. ink.com Ariad Pharmaceuticals Billerica www.cabot- Cambridge corp.com EISAI RESEARCH www.ariad.com/ INSTITUTE Cambridge Isotope Labs ANDOVER Arqule Inc. Andover www.easai.com Woburn www.arqule.com/ www.isotope.com/ EMD Serono ASTRA ZENECA Concert Pharmaceuticals Rockland WALTHAM Lexington www.emdserono.com www.astrazeneca.com/ www.concertpharma.com Enanta Pharmaceuticals Microbia (Also see Physical Sciences Inc. -

JMP Securities Healthcare Conference to Be Held in New York

JMP Securities Healthcare Conference to Be Held in New York SAN FRANCISCO, Oct 01, 2008 (BUSINESS WIRE) -- JMP Group Inc. (NYSE:JMP), an investment banking and alternative asset management firm, announced today that its broker-dealer subsidiary, JMPSecurities, will host the third annual JMP Securities Healthcare Focus Conference at Le Parker Meridien in New York on Monday and Tuesday, October 6 and 7, 2008. The two-day conference will feature presentations by senior executives of nearly 90 public and private companies in the biotechnology, medical devices and healthcare services industries before an audience of institutional investors and financial sponsors. For additional details or to register to attend the event, visit www.jmpsecurities.com/about/events.html or www.twstevent.com/jmp.html. Companies scheduled to present as of September 30, 2008; subject to change: A.D.A.M., Inc. ACADIA Pharmaceuticals Inc. Acceleron Pharma, Inc. Achillion Pharmaceuticals, Inc. Alexza Pharmaceuticals, Inc. Allos Therapeutics, Inc. Allscripts Healthcare Solutions, Inc. Alnylam Pharmaceuticals, Inc. American CareSource Holdings, Inc. Anadys Pharmaceuticals, Inc. ARCA biopharma, Inc. Ardea Biosciences, Inc. athenahealth Inc. AtriCure, Inc. AVEO Pharmaceuticals, Inc. AVI BioPharma, Inc. BioCryst Pharmaceuticals, Inc. C. R. Bard, Inc. Cadence Pharmaceuticals, Inc. Celera Corporation Celgene Corporation Celleration, Inc. Cerus Corporation Chem Rx Corporation Concert Pharmaceuticals, Inc. Corcept Therapeutics Incorporated Cypress Bioscience, Inc. Cytokinetics, Incorporated DexCom, Inc. DiagnoCure Inc. Dialysis Corporation of America Echo Therapeutics, Inc. Eclipsys Corp. Enanta Pharmaceuticals, Inc. Endocare Inc. Exelixis, Inc. EyeGate Pharmaceuticals, Inc. Genomic Health, Inc. Given Imaging, Ltd. HeartWare Limited Horizon Therapeutics, Inc. Human Genome Sciences, Inc. HydroCision, Inc. Idenix Pharmaceuticals, Inc. Idera Pharmaceuticals, Inc. -

Oncology Pharmaceutical

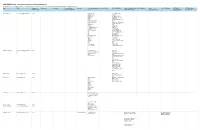

Quarterly Industry Update As of December 31, 2015 Industry: Oncology Pharmaceutical Industry Summary Cogent Valuation identified Oncology Pharmaceutical publicly traded companies, IPOs, and recent M&A transactions within the Oncology Pharmaceutical industry, which provides a basis for market and transaction pricing that can be used by your firm in estimating market sentiment and its impact on your firm's value. Over the last year since December 31, 2014, the median 52-week share price return of the Oncology Pharmaceutical industry was 5.0%. Between December 31, 2013 and December 31, 2015, the median EV/EBITDA multiple decreased from 15.6 to 13.2. However, the median price-to-earnings multiple increased from 21.5 to 23.0 over the same period. Comparable Public Company Key Statistics Median 52-Week Return5.0% Median EV/Revenue Multiple5.0x Median Price/Earnings Multiple 23.0x Median 3-Year CAGR Return26.7% Median EV/EBITDA Multiple13.2x Median EV/Gross CF Multiple 13.2x Comparable Public Company Market Price Returns As of December 31, 2015 YTD 3 Month 1 Year 2 Year 3 Year 5 Year 2015 2014 2013 2012 2011 Affimed N.V. 14.8% 15.4% 14.8% N/A N/A N/A 14.8% N/A N/A N/A N/A Ariad Pharmaceuticals Inc. -9.0% 7.0% -9.0% -4.3% -31.2% 4.2% -9.0% 0.7% -64.4% 56.6% 140.2% Bellicum Pharmaceuticals, Inc. -12.0% 39.5% -12.0% N/A N/A N/A -12.0% N/A N/A N/A N/A Calithera Biosciences, Inc. -

Company Description

November 8, 2017 Laura S. Engel, CPA [email protected] 214-987-4121 MARKET STATISTICS COMPANY DESCRIPTION Exchange / Symbol NasdaqGS: SPPI Spectrum Pharmaceuticals, Inc. is focused on the acquisition, development and Price: $19.00 commercialization of proprietary drugs, primarily addressing the oncology/hematology Market Cap ($mm): $1,912.6 markets. Spectrum's business strategy involves in-licensing or acquiring diversified drugs Enterprise Value ($mm): $1,766.6 as well as creating an expanding pipeline of prospective candidates in late-stage Phase 2 and Phase 3 clinical trials. Over the years, the Company has developed comprehensive in- Shares Outstanding (mm): 100.7 house clinical development/regulatory capabilities, along with an extensive commercial Float: 85% network, including a direct sales force in the U.S. and distributors in Europe and Japan Volume (3-month avg., mm): 1.8 for its marketed products. Spectrum’s diverse portfolio consists of six marketed oncology drugs and a pipeline with three advanced stage products that address sizable markets. 52-week Range: $3.73 – $21.95 Spectrum Pharmaceuticals is headquartered in Henderson, Nevada, and as last reported, Industry: Biotechnology the Company had 227 employees. CONDENSED BALANCE SHEET ($mm, except per share data) Balance Sheet Date 9/30/2017 SUMMARY Cash & Cash Equivalents: $247.7 Over the last several quarters, Spectrum’s primary focus has shifted beyond its Cash/Share: $2.46 established portfolio of niche cancer drugs to opportunities for its newer drugs, with three in its late-stage pipeline (Poziotinib, Rolontis™, and Qapzola®), and all of which Debt: $101.8 have meaningful competitive advantages and address indications with significant Equity (Book Value): $304.7 populations.