Cayman Islands Fund Services in FOCUS 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ocorian Guernsey Fund Services 20 17,000 1,250+ 8,000+ $260Bn

Corporate | Funds | Capital Markets | Private Client Ocorian Guernsey Fund Services Sponsors of the Guernsey Funds Forum Webinar - Ocorian in numbers Sanctuary II Ocorian is one of the largest administrators of private equity and listed funds in Guernsey, with services also provided from all key international jurisdictions including the UK, Jersey, Luxembourg, Ireland, Cayman and the UAE. 20 Ocorian have expertise across all investment structures to provide a full range Office locations of fund administration and associated services, working with fund managers of all sizes, in Guernsey and all over the world - with particular specialism in alternative investment funds including private equity, esoteric, real estate and debt. In addition, we offer comprehensive listing services as a sponsor and listing agent for The International Stock Exchange (TISE). 17,000 Our team of fund experts provides tailor-made services to a variety of open Structures under and closed-ended funds. We have an excellent track record in partnering administration with newly established fund managers, providing assistance and support with their first fund launch as well as established managers well into their second, third or fourth launch and beyond. Our commitment to delivering technically led, practical fund solutions, coupled with service excellence has led to long- standing client relationships across the Ocorian group. 1,250+ Key services Staff worldwide • Fund formation and administration • Fund accounting • Corporate secretarial • Registrar and transfer agency • Risk management solutions 8,000+ Clients • Depositary $260bn Assets under administration ocorian.com Contact us For more information on our further range of services for corporate, institutional and private clients visit ocorian.com or get in touch with our key contacts below. -

Ocorian Acquires Nordic Trustee

Press Release OCORIAN ACQUIRES NORDIC TRUSTEE Ocorian, the financial services group and leading provider of fund, corporate, capital markets and private client services acquires Nordic Trustee, the leading provider of trustee and agency services for bonds and direct lending in the Nordic region, from Altor Fund IV, subject to regulatory approval. This transaction reflects Ocorian’s strategy to further build its capital markets offering, one of its fastest growing business lines. Since it was founded in 1993, Nordic Trustee has played a primary role in the development of the Nordic bond market, facilitating issuers access to capital, as well as monitoring and securing bondholders’ rights. Nordic Trustee has been an integral part of the Nordic bond market supporting borrowers and lenders with advice through more than 400 bond restructurings and 2,000 bondholders’ meetings. Nordic Trustee is also the largest independent loan agent in the growing Nordic private credit market and supports various stakeholders in the bond and private loan markets with digital solutions. The company has over 3,000 running assignments in the non-bank lending sector for more than 850 issuers and borrowers from 30 countries. Furthermore, the company provides bond reference data, pricing information and indexes to institutional investors through its proprietary platforms Stamdata, Nordic Bond Pricing and eFIRDS. With offices in Oslo, Stockholm, Copenhagen and Helsinki, Nordic Trustee is led by CEO Cato A. Holmsen and a highly experienced management team. The team will continue to run Nordic Trustee’s business and secure the company’s role as an independent and market leading bond trustee and loan agent in the Nordics. -

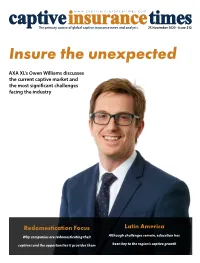

Insure the Unexpected

www.captiveinsurancetimes.com The primary source of global captive insurance news and analysis 25 November 2020 - Issue 212 Insure the unexpected AXA XL’s Owen Williams discusses the current captive market and the most significant challenges facing the industry Redomestication Focus Latin America Why companies are redomesticating their Although challenges remain, education has captives and the opportunities it provides them been key to the region’s captive growth The World’s Leading Independent Captive Manager SRS Europe is changing the Face of European Captive Management Specialist focus on captive insurance management and consultancy... It’s all we do Offering impartial advice and bespoke solutions without conflicting internal vested interests... It’s how we do it Driven by client service excellence underpinned by flexible, innovative and solid delivery... It’s focused on you Our Services European Operations Captive management Ireland Feasibility studies Liechtenstein Program management Luxembourg and underwriting services Malta Governance, risk & Netherlands compliance consulting Sweden Strategic reviews Switzerland Find out why over 500 captive clients trust SRS strategicrisks.com Captive Insurance Times Issue 212 www.captiveinsurancetimes.com Published by Black Knight Media Ltd 16 Bromley Road, New Beckenham Beckenham, BR3 5JE Editorial Editor: Becky Bellamy [email protected] Tel: +44 (0)208 075 0927 Reporter: Maria Ward-Brennan [email protected] Tel: +44 (0)208 075 0923 Contributor: Maddie Saghir [email protected] Designer: James Hickman [email protected] Marketing and sales Publisher: Justin Lawson [email protected] Associate Publisher: John Savage [email protected] Tel: +44 (0)208 075 0932 Office Manager: Chelsea Bowles Tel: +44 (0)208 075 0930 Follow us on Twitter: @CITimes Copyright © 2020 Black Knight Media Ltd All rights reserved. -

Ocorian Mauritius Budget 3

Corporate | Funds | Capital Markets | Private Client Mauritius Budget 2021/22: Recovery, Revival and Resilience amidst the Covid-19 Turmoil The Minister of Finance and Economic Development delivered his Budget Speech for the fiscal year 2021/2022 on the 11th June 2021 against the backdrop of the Covid-19 pandemic which had deep effects on the economy. The Budget Speech also coincided with the much-awaited announcement of the reopening of the Mauritius borders for tourism in a phased manner, starting on the 15th of July 2021 for vaccinated travellers. The tone of the budget was: Ocorian in numbers 1. to restore the confidence of economic operators through a series of incentives; 2. to kick start the recovery and the revival of the main economic sectors; and 3. to continue investing in major infrastructure projects to stimulate job creation, growth and to provide for further resilience of the economy. 16 Office locations The 2021 /22 Budget Speech is a continuum of the previous budget speeches with a strong accent on the inclusiveness of the society at large, further investment in education, health care, social infrastructure and skills development and support to the most vulnerable. A significant aspect of the speech was the measures announced to further open 17,000 the economy to investors and to professionals who wish to work, live and enjoy Structures under administration the quality of life the island provides but also for the long-awaited extension of the measures to include their families so that they can establish themselves on a longer term. As a small open economy faced with a demographic challenge, the Government has announced as series of reforms to complement the measures announced last year: 1,250+ Staff 1. -

Ancillary & Support Services

ANCILLARY & SUPPORT SERVICES Background A wave of regulatory changes has impacted fund and investment structures in recent years resulting in investment managers increasingly looking to independent fund administrators to support with their operations. We strive to deliver timely, accurate and independent fund administration services through the use of the latest in fund administration technology and highly qualified personnel with a deep understanding of local regulatory requirements. As well as providing full services to a range of fund managers, Ocorian has experience in providing a suite of support services to businesses with a local presence who partner with us to capitalise on our robust corporate governance framework and system capabilities. With further regulatory changes on the road ahead together with increasing investor demands for more detailed disclosures and transparency the decision to partner with a trusted service provider has never been easier. At Ocorian we will keep pace with the changes in regulations and continue to invest heavily in our technology so that you don't need to, allowing you the peace of mind to focus on managing your investors and investments. Services The key services that Ocorian are able to provide include: Compliance Services Provision of Compliance Office, MLRO, MLCO and supporting functions Bespoke compliance monitoring and management program and comprehensive board reporting Liaison with the JFSC Ongoing monitoring & oversight of investor CDD FATCA & CRS reporting AIFMD compliance & depositary -

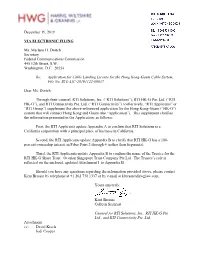

December 19, 2019 VIA ELECTRONIC FILING Ms. Marlene

December 19, 2019 VIA ELECTRONIC FILING Ms. Marlene H. Dortch Secretary Federal Communications Commission 445 12th Street, S.W. Washington, D.C. 20554 Re: Application for Cable Landing License for the Hong Kong-Guam Cable System, File No. SCL-LIC-20191122-00037 Dear Ms. Dortch: Through their counsel, RTI Solutions, Inc. (“RTI Solutions”), RTI HK-G Pte. Ltd. (“RTI HK-G”), and RTI Connectivity Pte. Ltd. (“RTI Connectivity”) (collectively, “RTI Applicants” or “RTI Group”) supplement the above-referenced application for the Hong Kong-Guam (“HK-G”) system that will connect Hong Kong and Guam (the “Application”). This supplement clarifies the information presented in the Application, as follows: First, the RTI Applicants update Appendix A to confirm that RTI Solutions is a California corporation with a principal place of business in California. Second, the RTI Applicants update Appendix B to clarify that RTI HK-G has a 100- percent ownership interest in Fiber Pairs 2 through 4 (rather than Segments). Third, the RTI Applicants update Appendix B to confirm the name of the Trustee for the RTI HK-G Share Trust: Ocorian Singapore Trust Company Pte Ltd. The Trustee’s role is reflected on the enclosed, updated Attachment 1 to Appendix B. Should you have any questions regarding the information provided above, please contact Kent Bressie by telephone at +1 202 730 1337 or by e-mail at [email protected]. Yours sincerely, Kent Bressie Colleen Sechrest Counsel for RTI Solutions, Inc., RTI HK-G Pte. Ltd., and RTI Connectivity Pte. Ltd. Attachment cc: David Krech Jodi Cooper Attachment 1 RTI HK-G Pte. -

UK Corporate Insolvency and Governance Act: Key Changes for Corporate Trustees

UK Corporate Insolvency and Governance Act: Key changes for corporate trustees Director ꢀ Transaction Management at Ocorian, Abigail Holladay and Charlotte Drake and Jayesh Patel of Stephenson Harwood LLP highlight the key implications of the Corporate Insolvency and Governance Act 2020 for corporate trustees. Introduction The Corporate Insolvency and Governance Act 2020 (the Act) received Royal Assent on 25 June 2020, introducing what has been described as the most significant reforms under English law for a generation. The Act is intended to facilitate increased protection for companies encountering financial difficulties and represents a shift towards a more debtor-friendly insolvency regime. It makes both permanent changes to the insolvency landscape (largely implementing proposals for insolvency law reform introduced in 2018), and some more temporary changes designed to address (or, at least try to mitigate) certain issues arising from the coronavirus pandemic. It is hoped that the coronavirus-related changes will be short lived, with certain temporary relaxations expressed to expire on 30 September 2020 (although the Act allows for this date to be further extended). The Act introduces a number of significant and permanent measures and corporate trustees will need to get up to speed with them quickly. This briefing aims to provide an analysis of those measures. 1 The capital markets exceptions There is also an exception for securitisation to the moratorium and the ban companies which means that they are not eligible to apply for a moratorium. on ipso facto clauses Relevant to security trustees in syndicated lending The moratorium transactions, a company in a moratorium would still The Act introduces a new “standalone” moratorium need to make payments due under its loans during which is intended to give companies struggling the moratorium. -

Ocorian Job Applicant Privacy Notice

OCORIAN JOB APPLICANT PRIVACY NOTICE ocorian.com Ocorian Job Applicant Privacy Notice: 20 Aug 2021 1. Introduction Members of the Ocorian Group are bound by data protection legislation in each of the various jurisdictions in which they operate and are committed to protecting your privacy. This Notice sets out the basis on which Personal Information that members of the Ocorian Group collect from you, or that you provide to a member of the Ocorian Group, will be processed. Most of the countries in which Ocorian operates have laws concerning the collection, use, transfer and disclosure of the personal information of individuals. The EU's General Data Protection Regulation ("GDPR") means that all EU jurisdictions and other countries such as Jersey that have adopted GDPR-compliant data protection laws will operate under broadly similar data protection regimes. The internal data protection policies and procedures of the Ocorian group are based on GDPR compliance. Your "Personal Information" means any information that can be used (whether alone or with other information) to identify you, the "data subject". In relation to you applying for a position in Ocorian, your Personal Information will mean a wide range of things, including: (a) your name, home and email addresses and phone numbers; and (b) details of previous employment, education and qualifications. The above list is not exhaustive and therefore, in the context of your applying for a position at Ocorian, your Personal Information will consist of all sorts of information that you provide to Ocorian or that Ocorian generates in the course of the recruitment process. A fuller definition of "Personal Information" is given in Appendix 1 and lists of the kinds of Personal Information that the Ocorian Group may process can be found in Appendix 2. -

Economic Substance Explained

ECONOMIC SUBSTANCE EXPLAINED ocorian.com INTRODUCTION TO ECONOMIC SUBSTANCE ECONOMIC SUBSTANCE LEGISLATION CAME INTO EFFECT IN THE CROWN DEPENDENCIES AND OVERSEAS TERRITORIES ON 1 JANUARY 2019. The legislation is designed to protect the reputation of offshore jurisdictions by ensuring that income streams from certain activities are based on actual local activity to substantiate the use of low tax jurisdictions. Substance legislation doesn’t apply to all entities in each jurisdiction – rather, it applies to certain ’relevant entities’ carrying out certain ‘relevant activities’. Affected entities are required to be managed and directed, to have adequate employees, expenditure and physical presence and to conduct their ‘core income generating activities’ in the local jurisdiction. There are two key stages to establishing how an entity might be impacted by substance regulations in any given jurisdiction: Is the entity in scope of the new law – i.e. is the entity a relevant entity carrying out a relevant activity? If it is in scope, does it meet the substance requirements? Each jurisdiction has its own subtle variances which may cause challenges if a client group has multiple entities registered in different jurisdictions. This guide aims to outline the new substance rules and show how Ocorian can assist its clients with their substance concerns and requirements. Please get in touch with us to discuss how the substance regulations impact you. 1. WHICH JURISDICTIONS ARE AFFECTED? The jurisdictions that have introduced economic substance legislation are Bermuda, British Virgin Islands, Cayman Islands, Guernsey, the Isle of Man and Jersey. Mauritius is set to introduce legislation in 2020. 2 ocorian.com WHICH ENTITIES ARE AFFECTED? EACH JURISDICTION HAS DEFINED – WITHIN ITS OWN LEGISLATION – THE LEGAL TYPE OF ENTITIES THAT WILL BE AFFECTED BY THE NEW ECONOMIC SUBSTANCE RULES. -

Caymanian Times

Caymanian Wednesday, February 12, 2020 Issue No 497 www.caymaniantimes.ky Complimentary TOURISM — A1 LOCAL NEWS — A3 EDUCATION — A6 INTERNATIONAL SPORTS — B2 THIS ISSUE INSIDE CAYMAN ISLANDS SCORE BIG ON Ocorian and Estera merge to School �ield renamed in honour of Kobe and Gianna Bryant’s NEW AMERICAN TV SHOW create a global leader beloved BT citizen memorial service is on Feb. 24 Amazing Coconuts at Cocofest By Lindsey Turnbull Cayman’s �ifth annual celebration of the humble coconut took place last Sat- urday at Pedro St James, a family-orien- tated afternoon of food and festivities all centred on one of Cayman’s most im- portant means of sustenance from days gone by. It’s always an excellent day out for foodie families because the event brings together an ensemble of local producers who use coconut, in its many guises, to create amazing food ready for sampling, often unavailable in supermarkets. The Caymanian staple of fried �ish and frit- ters was a welcome sight for visitors upon entrance to the Pedro St James grounds, fried in coconut oil to impart a lovely aroma and �lavour to the dish. The popular Powder Monkey Gourmet Treats stall was doing a good trade in their coconut pineapple marshmal- low �luff, not to mention their coconut and vanilla marshmallows in bags. The Farmfresh.ky team also had an array of coconut-inspired goodies such as their coconut... Continuedoil that comes story in a on wine page bottle, A4 Cristiano enjoyed his first coconut water of the day Libraries a mainstay of SMB walk to public life honour heart This second in our Then and Now series on icon- 1920, the Government included an annual amount ic Cayman buildings looks at the development of of 40 pounds in its budget for to establish a sub- warrior another important central George Town building, scription library, located in a room above the old the George Town Public Library. -

Global Private Equity Practice

Global Private Equity Practice Described as ‘The Kings of Fund Private equity houses and fund managers benefit from our global reach practice’ by Chambers and RELATED SERVICES and the sector expertise and knowledge Partners, Carey Olsen has an of our funds lawyers who advise on all ⁄ Fund Formation unrivalled offshore funds team aspects of the industry from structuring, ⁄ Fund Finance advising on the laws of fundraisings, listings and buyouts to ⁄ Fund Listings portfolio, restructuring and disputes Bermuda, the British Virgin ⁄ Investment Managers Islands, the Cayman Islands, advice across all public and private funds. ⁄ Fund Regulation and Guernsey and Jersey, with Compliance additional offices in Cape Town, Supporting the expertise of our ⁄ Restructuring and Winding Up international private equity team are Hong Kong, London and ⁄ Funds Strategies and Asset our top-tier corporate, M&A, and Singapore. Classes finance practices who advise on all Recognised as the leading legal adviser aspects of a fund’s lifecycle. ⁄ Mergers and Acquisitions to funds across the Channel Islands, and ⁄ Debt Capital Markets with fast-growing Caribbean and Asia practices, our clients in the private equity sector include the world’s leading private equity houses, international banks and financial institutions, as well 9/10 FOLLOW US as specialist private equity real estate We advise 9/10 of the and infrastructure funds. world’s largest private “Carey Olsen’s advice is equity firms. always delivered in simple, easy-to- We are constantly ranked as a top tier CONTACT US understand language law firm for private equity work, which We have one of the largest reflects the strength and depth of our private equity teams in the and always within a expertise in this sector. -

Renfin Limited 2019

RenFin Limited Annual Report and Audited Financial Statements For the year ended 31 December 2019 RenFin Limited Annual report and audited financial statements for the year ended 31 December 2019 Table of contents Page(s) Directors, officers and other information 1 - 2 Directors’ report 3 Independent auditor’s report 4 - 7 Statement of financial position 8 Statement of comprehensive income 9 Statement of changes in equity 10 Statement of cash flows 11 Notes to and forming part of the financial statements 12 - 35 RenFin Limited Directors, officers and other information Directors of the Fund David Blair John Elder James Keyes Subsidiary Rekha Holdings Limited Registered office Jayla Place Wickhams Cay 1 Road Town, Tortola VG1110 British Virgin Islands Investment manager Renasset Investment Management Limited (formerly Kashtan Limited, until 19 July 2019) Walkers Corporate Limited Cayman Corporate Centre 27 Hospital Road, George Town Grand Cayman KY1 9008 Cayman Islands Investment advisor Renasset Managers Limited (formerly Petrarca Management Limited, until 19 July 2019) Walkers Corporate Limited Cayman Corporate Center 27 Hospital Road, George Town Grand Cayman KY1-9008 Cayman Islands Administrator, registrar and Apex Group Limited transfer agent (formerly Custom House Global Fund Services Limited) Central North Business Centre Level 1 Sqaq il - Fawwara Sliema SLM 1670 Malta Corporate secretary Ocorian Limited (formerly Estera Corporate Services (BVI) Limited) Jayla Place Wickhams Cay 1 Road Town, Tortola VG1110 British Virgin Islands Payment bank Barclays Bank PLC Barclays House Victoria Street Isle of Man 1 RenFin Limited Directors, officers and other information (continued) Auditor’s Cohen & Co. Chartered Accountants Limited 4th Floor, 59/60 O’Connell Street Limerick Ireland Custodian of the Subsidiary AO Raiffeisenbank (from 31 May 2019) bld.