Afc Bournemouth Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Premier League 2 and Professional Development League

Premier League 2 and Professional Development League No.28 Results Division 1 Blackburn Rovers 2 - 2 Southampton Brighton & Hove Albion 2 - 1 Manchester City Leicester City 3 - 2 Tottenham Hotspur Arsenal 1 - 2 Chelsea Everton 2 - 1 Derby County Wolverhampton Wanderers 1 - 2 Liverpool Division 2 Fulham 2 - 0 Aston Villa Manchester United P - P Swansea City Newcastle United 2 - 0 Sunderland Reading 0 - 1 Middlesbrough West Bromwich Albion P - P Norwich City West Ham United 2 - 2 Stoke City Season 2019/2020 - 19/02/2020 League Tables Division 1 Pld W D L GF GA GD Pts 1 Chelsea 17 9 8 0 33 20 13 35 2 Leicester City 17 9 5 3 33 20 13 32 3 Brighton & Hove Albion 17 9 1 7 32 25 7 28 4 Derby County 17 7 6 4 32 28 4 27 5 Liverpool 17 7 5 5 34 34 0 26 6 Arsenal 17 6 7 4 30 28 2 25 7 Everton 17 5 7 5 32 32 0 22 8 Blackburn Rovers 17 6 3 8 27 26 1 21 9 Manchester City 17 5 3 9 26 27 -1 18 10 Tottenham Hotspur 17 5 3 9 28 32 -4 18 11 Southampton 17 4 3 10 22 44 -22 15 12 Wolverhampton Wanderers 17 2 5 10 19 32 -13 11 Division 2 Pld W D L GF GA GD Pts 1 West Ham United 17 13 4 0 54 21 33 43 2 Manchester United 16 13 1 2 42 15 27 40 3 West Bromwich Albion 15 10 1 4 37 22 15 31 4 Stoke City 17 8 3 6 30 24 6 27 5 Middlesbrough 17 8 2 7 34 41 -7 26 6 Aston Villa 16 6 4 6 26 25 1 22 7 Newcastle United 17 7 1 9 27 32 -5 22 8 Swansea City 16 6 3 7 22 31 -9 21 9 Reading 17 5 2 10 32 36 -4 17 10 Norwich City 16 5 2 9 23 31 -8 17 11 Fulham 17 5 2 10 23 32 -9 17 12 Sunderland 17 0 1 16 10 50 -40 1 Season 2019/2020 - 19/02/2020 Fixture Changes Premier League 2 -

2019-20 Impeccable Premier League Soccer Checklist Hobby

2019-20 Impeccable Premier League Soccer Checklist Hobby Autographs=Yellow; Green=Silver/Gold Bars; Relic=Orange; White=Base/Metal Inserts Player Set Card # Team Print Run Callum Wilson Gold Bar - Premier League Logo 13 AFC Bournemouth 3 Harry Wilson Silver Bar - Premier League Logo 8 AFC Bournemouth 25 Joshua King Silver Bar - Premier League Logo 7 AFC Bournemouth 25 Lewis Cook Auto - Jersey Number 2 AFC Bournemouth 16 Lewis Cook Auto - Rookie Metal Signatures 9 AFC Bournemouth 25 Lewis Cook Auto - Stats 14 AFC Bournemouth 4 Lewis Cook Auto Relic - Extravagance Patch + Parallels 5 AFC Bournemouth 140 Lewis Cook Relic - Dual Materials + Parallels 10 AFC Bournemouth 130 Lewis Cook Silver Bar - Premier League Logo 6 AFC Bournemouth 25 Lloyd Kelly Auto - Jersey Number 14 AFC Bournemouth 26 Lloyd Kelly Auto - Rookie + Parallels 1 AFC Bournemouth 140 Lloyd Kelly Auto - Rookie Metal Signatures 1 AFC Bournemouth 25 Ryan Fraser Silver Bar - Premier League Logo 5 AFC Bournemouth 25 Aaron Ramsdale Metal - Rookie Metal 1 AFC Bournemouth 50 Callum Wilson Base + Parallels 9 AFC Bournemouth 130 Callum Wilson Metal - Stainless Stars 2 AFC Bournemouth 50 Diego Rico Base + Parallels 5 AFC Bournemouth 130 Harry Wilson Base + Parallels 7 AFC Bournemouth 130 Jefferson Lerma Base + Parallels 1 AFC Bournemouth 130 Joshua King Base + Parallels 2 AFC Bournemouth 130 Nathan Ake Base + Parallels 3 AFC Bournemouth 130 Nathan Ake Metal - Stainless Stars 1 AFC Bournemouth 50 Philip Billing Base + Parallels 8 AFC Bournemouth 130 Ryan Fraser Base + Parallels 4 AFC -

Intermediary Transactions 2019-20 1.9MB

24/06/2020 01/03/2019AFC Bournemouth David Robert Brooks AFC Bournemouth Updated registration Unique Sports Management IMSC000239 Player, Registering Club No 04/04/2019AFC Bournemouth Matthew David Butcher AFC Bournemouth Updated registration Midas Sports Management Ltd IMSC000039 Player, Registering Club No 20/05/2019 AFC Bournemouth Lloyd Casius Kelly Bristol City FC Permanent transfer Stellar Football Limited IMSC000059 Player, Registering Club No 01/08/2019 AFC Bournemouth Arnaut Danjuma Groeneveld Club Brugge NV Permanent transfer Jeroen Hoogewerf IMS000672 Player, Registering Club No 29/07/2019AFC Bournemouth Philip Anyanwu Billing Huddersfield Town FC Permanent transfer Neil Fewings IMS000214 Player, Registering Club No 29/07/2019AFC Bournemouth Philip Anyanwu Billing Huddersfield Town FC Permanent transfer Base Soccer Agency Ltd. IMSC000058 Former Club No 07/08/2019 AFC Bournemouth Harry Wilson Liverpool FC Premier league loan Base Soccer Agency Ltd. IMSC000058 Player, Registering Club No 07/08/2019 AFC Bournemouth Harry Wilson Liverpool FC Premier league loan Nicola Wilson IMS004337 Player Yes 07/08/2019 AFC Bournemouth Harry Wilson Liverpool FC Premier league loan David Threlfall IMS000884 Former Club No 08/07/2019 AFC Bournemouth Jack William Stacey Luton Town Permanent transfer Unique Sports Management IMSC000239 Player, Registering Club No 24/05/2019AFC Bournemouth Mikael Bongili Ndjoli AFC Bournemouth Updated registration Tamas Byrne IMS000208 Player, Registering Club No 26/04/2019AFC Bournemouth Steve Anthony Cook AFC Bournemouth -

Watch Rotherham United FC Vs Brentford FC in HD

1 / 3 Watch Rotherham United FC Vs Brentford FC In HD Discover how you can watch the Brentford FC vs Rotherham United match for free & get all the H2H stats you need. Visit Protipster for free live streams today!. Welcome to the Official Derby County Football Club website. Get all the latest news, injury updates, TV match information, player info, match stats and highlights.. May 20, 2021 — Huddersfield Town - AFC Bournemouth Live Streaming and TV Schedule... Huddersfield ... Watch online match AFC Bournemouth - Brentford for free in HD. How to ... Live Events AFC Bournemouth vs Rotherham United.. Mar 25, 2021 — Watch USA-Jamaica on Thursday, March 25 at 1 p.m. ET on ESPN2, ... Bell (Blackburn Rovers/ENG; 0/0), Wes Harding (Rotherham United/ENG; 0/0), ... United), Liam Moore (Reading), Ethan Pinnock (Brentford FC), Curtis Tilt .... Latest on iFollow Wycombe · Bayo: "This is my last dance" · Watch Bayo's first day back · Wheeler: "A team effort is needed in the fight against climate change" · Blues .... Latest iFollow videos · Sheffield Wednesday v Blackburn Rovers - Extended highlights - Sat 18th January 2020 · Sheffield Wednesday v Brentford - Highlights - Sat .... 4 Wins. Rotherham United FC Logo. Rotherham United (36%). Brentford vs Rotherham United's head to head record shows that of the 11 meetings they've had, .... Rotherham United vs Brentford FC EFL Championship Live Score - Catch live score ... If you want to watch AFC Bournemouth vs Brentford stream without cable ... cable TV to watch the pay per view online live and in HD on the PC over the .... Nov 30, 2020 — A Struggling Rotherham United host Brentford on Tuesday night, but the home side will be confident having held second place AFC ... -

Dean Court Days Harry

MICHAEL DUNNE DEAN COURT DAYS HARRY REDKNAPP AT AFC BOURNEMOUTH Contents Acknowledgements 8 Foreword 9 1 Bright Lights to Pier Lights 1 2 2 Exodus 30 3 Falling Down 4 6 4 Desperate Times 5 8 5 Hiatus 7 8 6 In Return 9 2 7 Stage Manager 10 8 8 Into The Spotlight 1 30 9 Making Do 15 3 10 Striking Out 16 5 11 Glory 180 12 Learning Curve 207 13 Record-Breaker 226 14 Riots and Malaise 24 6 15 Catastrophe 272 16 All Played Out 29 1 17 Epilogue 313 Foreword HE 15 years I spent at AFC Bournemouth as a player, coach and manager were amongst the happiest of my career Tin football I first arrived in 1972 when my old friend John Bond was the manager and the club were on the up Everything seemed set for promotion, but we never quite made it and when John left for Norwich things were never quite the same again I enjoyed my playing days there, we had a great squad, but we never quite fulfilled our promise and persistent injuries limited my impact on the team in my final couple of seasons Despite the frustrations of those injuries, I loved every day I spent at Dean Court My family loved the area as well Coming from east London, we weren’t used to living near the coast but it wasn’t difficult to appreciate the benefits of bringing up our two boys near the seaside That was why we kept our house in the area whilst I was playing in America Thank goodness we did, because I was seriously considering a life outside of the game when we returned from the States for good, but the Bournemouth manager Dave Webb phoned me up out of the blue and asked me if I could -

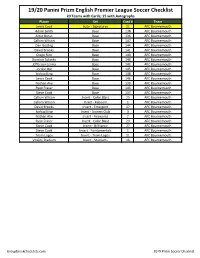

2019 Panini Prizm Soccer Checklist

19/20 Panini Prizm English Premier League Soccer Checklist 20 Teams with Cards; 15 with Autographs Player Set Card # Team Lewis Cook Auto - Signatures 21 AFC Bournemouth Adam Smith Base 138 AFC Bournemouth Artur Boruc Base 136 AFC Bournemouth Callum Wilson Base 147 AFC Bournemouth Dan Gosling Base 144 AFC Bournemouth David Brooks Base 141 AFC Bournemouth Diego Rico Base 140 AFC Bournemouth Dominic Solanke Base 149 AFC Bournemouth Jefferson Lerma Base 142 AFC Bournemouth Jordon Ibe Base 145 AFC Bournemouth Joshua King Base 148 AFC Bournemouth Lewis Cook Base 146 AFC Bournemouth Nathan Ake Base 139 AFC Bournemouth Ryan Fraser Base 143 AFC Bournemouth Steve Cook Base 137 AFC Bournemouth Callum Wilson Insert - Color Blast 25 AFC Bournemouth Callum Wilson Insert - Kaboom 1 AFC Bournemouth David Brooks Insert - Emergent 17 AFC Bournemouth Joshua King Insert - Scorers Club 3 AFC Bournemouth Nathan Ake Insert - Fireworks 7 AFC Bournemouth Ryan Fraser Insert - Color Blast 23 AFC Bournemouth Steve Cook Insert - Brilliance 27 AFC Bournemouth Steve Cook Insert - Fundamentals 1 AFC Bournemouth Team Logos Insert - Team Logos 11 AFC Bournemouth Vitality Stadium Insert - Stadiums 16 AFC Bournemouth Groupbreakchecklists.com 2019 Prizm Soccer Checklist Diego Rico Base 140 AFC Bournemouth David Seaman Auto - Flashback 5 Arsenal Dennis Bergkamp Auto - Club Legends Signatures 3 Arsenal Dennis Bergkamp Auto - Dual Player Signatures 3 Arsenal Freddie Ljungberg Auto - Club Legends Signatures 6 Arsenal Robert Pires Auto - Flashback 9 Arsenal Robin van Persie -

Handbook Season 2018/19 the Football Association Premier League Limited

Handbook Season 2018/19 The Football Association Premier League Limited Season 2018/19 Board of Directors Richard Scudamore (Executive Chairman) Claudia Arney (Non-Executive Director) Kevin Beeston (Non-Executive Director) Auditors Deloitte LLP 2 New Street Square London EC4A 3BZ Bankers Barclays Bank plc 27th Floor 1 Churchill Place London E14 5HP Registered Office 30 Gloucester Place London W1U 8PL Regd. No. 2719699 Telephone 020 7864 9000 Facsimile 020 7864 9001 Website www.premierleague.com Published by The Football Association Premier League Limited © The Football Association Premier League Limited 2018 Premier League Chairmen’s Charter Season 2018/19 Foreword The Chairmen’s Charter is a statement of our commitment and aim to run Premier League football to the highest possible standards in a professional manner and with the utmost integrity. With that aim we, the Chairmen of the Clubs in membership of the Premier League, are determined: • To conduct our respective Club’s dealings with the utmost good faith and honesty. • At all times to maintain a Rule book which is comprehensive, relevant and up-to-date. • To adopt disciplinary procedures which are professional, fair and objective. • To submit to penalties which are fair and realistic. • To secure the monitoring of and compliance with the Rules at all times. The Charter The Chairmen’s Charter sets out our commitment to run Premier League football to the highest possible standards and with integrity. We will ensure that our Clubs: • Behave with the utmost good faith and honesty to each other, do not unjustly criticise or disparage one another and maintain confidences. -

AFC Bournemouth

www.afcb.co.uk Design by CUDA - www.cuda.uk.com CD8331 CUDA - www.cuda.uk.com Design by AFC Bournemouth Dean Court, Kings Park Bournemouth Dorset, BH7 7AF Telephone: 01202 726300 www.afcb.co.uk AFCBournemouth CORPORATE BROCHURE 2009-10 For further information / Contact the Commercial Team on 01202 726322 or email [email protected] Welcome / Contents / FROM ROB MITCHELL “AFC BOURNEMOUTH AND OUR AFC BOURNEMOUTH Commercial Manager, AFC Bournemouth DEAN COURT STADIUM HAVE CORPORATE BROCHURE 2009 PROVED SUCCESSFUL FOR Matchday Hospitality 4 COMPANIES WISHING TO RAISE Enjoy the matchday atmosphere THEIR PROFILE AND ENGAGE WITH Executive Boxes 5 Enjoy panoramic views of the Stadium THE LOCAL COMMUNITY.” and first class hospitality Matchday Sponsorship 6 Raise your Company’s profile Match Ball, Match Programme 7 & Match Shirt Sponsorship An exciting alternative to enjoy hospitality and create awareness Mascot Packages 8 The ultimate experience for every young Cherries fan Player Kit Sponsorship 9 Show your support of a Cherries Player Seasonal & Matchday Advertising 10 Reach a captive audience! WELCOME TO AFC BOURNEMOUTH AND TO WHAT PROMISES Pitchside Advertising Boards 11 Stadium Big Screen 12 TO BE AN EXCITING SEASON AHEAD. Black Label Events 13 AFC Bournemouth, also known as the Cherries, is a family and This new development makes it a greater time than ever before Conferencing & Events corporate friendly Club offering a range of opportunities. to become commercially involved with AFC Bournemouth. Vice President Package 14 Our aim this season is to push for promotion to Coca-Cola League You can find out more about our commercial packages in this Telephone: One and secure as much support from local businesses, commercial brochure. -

Vitality Stadium Access Statement AFC BOURNEMOUTH VITALITY STADIUM ACCESS STATEMENT AFC BOURNEMOUTH

Vitality Stadium Access Statement AFC BOURNEMOUTH VITALITY STADIUM ACCESS STATEMENT AFC BOURNEMOUTH WELCOME We look forward to welcoming you to Vitality Stadium. We are committed to ensuring all our disabled supporters and visitors have as much access as reasonably possible to all goods, services and facilities provided or offered to the public by the club. If you have any queries, then please do not hesitate to contact me. Alice Jeans Disability Access Officer Telephone Number: 01202 726311 E-mail: [email protected] 1 Photo: Raised Viewing Platform VITALITY STADIUM ACCESS STATEMENT AFC BOURNEMOUTH Contents 3 Welcome to Vitality Stadium 4 Purchasing Tickets 5 Travelling to Vitality Stadium 10 Stadium Map 11 Arriving at the Stadium 14 Stadium Access 17 Accessible Toilets 21 Catering 22 Additional Information 23 Contact Information 2 Photo: Supporter enjoying match VITALITY STADIUM ACCESS STATEMENT AFC BOURNEMOUTH vitality stadium STADIUM ADDRESS AFC Bournemouth Vitality Stadium Dean Court Kings Park BH7 7AF Telephone: 0344 576 1910 Email: [email protected] The Vitality Stadium is situated within the heart of Kings Park. Park land surrounds both the south and main stand, with the east and north stands backing onto residential areas. Vitality Stadium is approximately 3.2 miles from Bournemouth Town Centre, and 7.8 miles from Poole. AFC Bournemouth takes much pride in welcoming visitors to our stadium, and wish you an enjoyable matchday experience. 3 Photo: Vitality Stadium together, anything is possible. is anything together, 0.00 207 Seat Steve Fletcher Vitality North Stand North Vitality Fletcher Steve £30.00 Enter Via Reception Via Enter possible. -

Season 2018/19

Impact report Season 2018/19 COMMUNITY SPORTS TRUST SUPPORTED BY CONTENTS Welcome from Steve Cuss 4 Who We Are... 6 Participation 8 Soccer Schools 10 Education 12 School Projects 14 Premier League Primary Stars 16 Premier League Enterprise Challenge 18 Partnership Work: Vitality 20 Health 22 Inclusion 24 Premier League Kicks 26 Linked Clubs 28 Care South 30 Premier league BT Disability Programme 32 Walking Football 34 Premier League Girls 36 Girls and Women’s Programme 38 Testimonials 40 CST Matchday 42 Cherries Community Fund 44 Themed Matchdays 46 International Work 48 Work in Partnership with the Army 50 Player Support 52 2018/19 Summary 54 3 The Trust continues to thrive and has grown with new employees appointed to specific targeted areas of Steve Cuss development Welcome to AFC Bournemouth The continued support of AFC Bournemouth Community Sports Trust 2018/19 plays a massive part in the success of the Impact Report. Community Sports Trust. This support is instrumental in the delivery of activities and The report looks at the continued growth and events, and provides the participants to development of the Trust over the course feel part of the club through participation, of our fourth year in the Premier League, as a fan, attending events or visiting the celebrating 10 years as a charity. Stadium. The commitment to this from AFC Bournemouth Chairman and Trustee The Trust continues to thrive and has grown Jeff Mostyn, Chief Executive Neill Blake, with new employees appointed to specific General Manager Liz Finney and Commercial targeted areas of development. Strategic Director Rob Mitchell has been instrumental direction has seen a wider approach in allowing the Community Sports Trust to on health and wellbeing for all through develop and we are particularly proud of the educating participants about healthy player support with 149 player appearances lifestyles and living, as well as promoting at Community activities throughout physical activity and respect of others in the the season. -

Harry SAVAGE (1921-1922) Winger

Harry SAVAGE (1921-1922) Winger Born Frodsham, Cheshire, 5 January 1897 Died Runcorn, Cheshire, 1968 Watford Career Football League: 7 appearances (1 goal) Début: 0-1 away defeat v Charlton Athletic, Football League Div 3 (South), 12 Nov 1921 Final game: 2-2 home draw v Swindon Town, Football League Div 3 (South), 22 Apr 1922 Longest run of consecutive appearances: Football League 4; all competitions 4 Career Path Army football during the First World War; Crewe Alexandra (1919); Sheffield United (£750 May 1920); WATFORD (£250 June 1921 until close season 1922); Frodsham; Connah’s Quay (January 1924); Mold Town (July 1925); Frodsham (September 1926) Football League Career Apps Subs Goals League Status and Final Position 1920/21 Sheffield United 10 Football League Division 1 – 20th of 22 1921/22 WATFORD 7 1 Football League Division 3 (South) – 7th of 22 A winger on whom the club wasted what was then their record fee, although it was only half the original asking price. He’d played amateur football before the Great War, and army football during it, and on joining Sheffield United went straight into their First Division line-up. Watford retained his League registration for a second season and transfer-listed him at a valuation of £200 (subsequently reduced to £100), but his brief career in the Football League was over. Birth (M1897) & death (D1968) indexes OK, probate nothing. 1901 census: Marsh Green, Frodsham, Harry, 4, b Frodsham, parents Joseph & Mary. 1911 census: Marsh Green Frodsham, Harry, 14, nephew of head of household – Mary Savage, 64, widow. 1939 Register: 2 Alvanley Terrace, Runcorn, born 5 Jan 1897, road locomotive driver, wife Dorothy (she was Dorothy Hayes before they married at Runcorn D1925). -

This Work Is Distributed As a Discussion Paper by The

This work is distributed as a Discussion Paper by the STANFORD INSTITUTE FOR ECONOMIC POLICY RESEARCH SIEPR Discussion Paper No. 01-16 The Economics of Promotion and Relegation In Sports Leagues: The Case of English Football Roger G. Noll Stanford University January 2002 Stanford Institute for Economic Policy Research Stanford University Stanford, CA 94305 (650) 725-1874 The Stanford Institute for Economic Policy Research at Stanford University supports research bearing on economic and public policy issues. The SIEPR Discussion Paper Series reports on research and policy analysis conducted by researchers affiliated with the Institute. Working papers in this series reflect the views of the authors and not necessarily those of the Stanford Institute for Economic Policy Research or Stanford University. ABSTRACT THE ECONOMICS OF PROMOTION AND RELEGATION IN SPORTS LEAGUES: THE CASE OF ENGLISH FOOTBALL by Roger G. Noll In most o f the world, pro fessional sports leagues use a promotion and relegation system, in which at the end of each season the worst teams in better leagues are demoted while the best teams in weaker leagues are promoted. The research reported in this essay examines the economic effects of promotion and relegation, using data from English football (soccer), one of the oldest and most successful group of professional leagues in the world. The crucial findings are: players tend to earn higher wages in promotion and relegation systems; promotion and relegation apparently has a net positive effect on attendance (teams gain more from promotion than they lose from relegation); and the effect of promotion and relegation on competitive balance is ambiguous, with the negative effect arising because the system inevitably places some teams in leagues for which they have no realistic chance to afford a winning team, thereby causing teams to spend less on players during their (brief) stay in a higher league than they spent while trying to be promoted from as lesser league.