Investment Daily

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2016/2017 Annual Results Presentation 7 June 2017

2016/2017 Annual Results Presentation 7 June 2017 Consistently Strong Financial Performance Revenue Net Property Income (HK$’M) (HK$’M) 6,994 9,255 +5.9% +7.4% 6,513 8,740 2015/16 2016/17 2015/16 2016/17 Valuation Distribution per unit (HK$’M) (HK cents) 174,006 160,672 228.41 +8.3% 206.18 +10.8% 2015/16 2016/17 2015/16 2016/17 P.2 A Platform for Tenants to Flourish High productivity (1) Community engagement Hong Kong Mainland China HK$38.1M 96% 100% Donated since 2013 Occupancy Occupancy 28.2% Reduction in energy Hong Kong Hong Kong consumption since +4.0% 12.1% 2010 ~18,000 Tenant sales Rent to sales Tenant Academy growth ratio participants since 2008 Improving portfolio quality Global recognitions 53 enhancement 8 acquisitions (2) projects & completed 28 disposals to date to date Notes: (1) For the year ended 31 March 2017. (2) Including the acquisition of Metropolitan Plaza which was completed in May 2017. P.3 Link’s Value Creation Model Our communities Our investors Our business partners Our employees Our tenants Be a world class real estate investor and manager, serving and improving the lives of those around us 1. Building a productive and quality portfolio 2. Maintaining a prudent and flexible capital structure 3. Developing a strong management team 4. Helping our tenants and communities grow while delighting shoppers P.4 Financial Review Robust Revenue Growth Year ended Year ended 31 Mar 2017 31 Mar 2016 HK$’M HK$’M Change Revenue 9,255 (1) 8,740 +5.9% Property operating expenses (2,261) (2,227) +1.5% Net property income 6,994 (2) 6,513 +7.4% Total distributable income 4,992 4,567 +9.3% Discretionary distribution 83 (3) 67 +23.9% Total distributable amount 5,075 4,634 +9.5% Distribution Per Unit (HK cents) 228.41 206.18 +10.8% Total distributable amount as a percentage of total 102% (3) 101% +1ppt distributable income (%) Notes: (1) Includes revenue of HK$574M (2016: HK$421M) from Mainland China portfolio. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

The Link REIT”) Solely for Use at the Presentations Held in This Meeting and May Not Be Reproduced Or Redistributed to Any Other Person Or the Press Or Other Media

The Link Real Estate Investment Trust Investor Presentation September 2011 P.1 Disclaimer This document has been prepared by The Link Management Limited in its capacity as the Manager (the “Manager”) of The Link Real Estate Investment Trust (“The Link REIT”) solely for use at the presentations held in this meeting and may not be reproduced or redistributed to any other person or the press or other media. Neither this document nor any copy may be taken or transmitted into or distributed, directly or indirectly, in the United States or to any U.S. person (within the meaning of Regulation S under the United States Securities Act of 1933, as amended). Neither this document nor any copy may be taken or transmitted into or distributed or redistributed in Canada or to the resident thereof. The distribution of this document in other jurisdictions may be restricted by law and persons into whose possession this document comes should inform themselves about, and observe any such restrictions. By attending this presentation, you are deemed to agree to be bound by the foregoing restrictions and represent that you have understood and accepted the terms of this disclaimer. Any failure to comply with these restrictions may constitute a violation of applicable securities laws. All information and data are provided for information purposes only. All opinions expressed by The Link REIT herein are based on information available as of the date hereof and are subject to change without notice. The information contained in this document is not intended to provide, and you may not rely on this document as providing, a complete or comprehensive analysis of The Link REIT’s financial or trading position or prospects. -

Hang Seng Indexes Announces Index Review Results

10 November 2017 Hang Seng Indexes Announces Index Review Results Hang Seng Indexes Company Limited (“Hang Seng Indexes”) today announced the results of its review of the Hang Seng Family of Indexes for the quarter ended 29 September 2017. All changes will be effective on 4 December 2017 (Monday). 1. Hang Seng Index The following constituent changes will be made to the Hang Seng Index. The total number of constituents is fixed at 50. Inclusion: Code Company 2007 Country Garden Holdings Co. Ltd. 2382 Sunny Optical Technology (Group) Co. Ltd. Removal: Code Company 135 Kunlun Energy Co. Ltd. 293 Cathay Pacific Airways Ltd. The list of constituents is provided in Appendix 1. 2. Hang Seng China Enterprises Index The following constituent changes will be made to the Hang Seng China Enterprises Index. The total number of constituents is fixed at 40. Inclusion: Code Company 2238 Guangzhou Automobile Group Co., Ltd. - H Shares Removal: Code Company 916 China Longyuan Power Group Corporation Ltd. - H Shares The list of constituents is provided in Appendix 2. Changes in constituent companies of the HSCEI will also be applied to the Hang Seng China Enterprises Smart Index. more… Hang Seng Indexes Announces Index Review Results/ 2 3. Hang Seng Composite LargeCap & MidCap Index The following constituent changes will be made to the Hang Seng Composite LargeCap & MidCap Index. The total number of constituents will increase from 289 to 291. Inclusion: Code Company Size Industry ZhongAn Online P & C Insurance 6060 MidCap Financials Co., Ltd. – H Shares 6088 FIT Hong Teng Ltd. MidCap Information Technology Following the constituent changes above, the number of constituents in the Hang Seng Composite Index will increase from 491 to 493. -

September 2020 2 Why Invest in Link REIT?

Corporate Presentation September 2020 2 Why invest in Link REIT? 01 02 03 04 05 100% FREE FLOAT QUALITY ASSETS RESILIENT TRACK RECORD OF STRONG CORPORATE DIVERSIFIED TRADE MIX PERFORMANCE GOVERNANCE ACROSS REGIONS One of the largest retail- Commercial assets in Focus on Fifteen years of Highly independent focused REITs in Asia Hong Kong, London, non-discretionary active asset Board with professional with 100% free float Sydney and Tier-1 cities retail, car parks and management management in Mainland China premium grade A offices performance 3 Top Global Retail-focused REITs Link is one of the largest retail-focused REITs in the world US$B No.1 Largest retail-focused 25.0 21.9 REIT in Asia by market 21.4 capitalisation 20.0 16.5 15.0 1st First REIT listed in Hong Kong 10.0 8.6 6.7 6.1 5.3 5.2 5.1 4.8 5.0 3.9 3.8 2.4 1.7 1.4 1.2 Only 1 Only internally-managed 0.0 REIT in Asia 100% 100% free float held by institutions and private investors Note: Comparison of selected major REITs in the world based on market capitalisation. Source: Bloomberg as at 31 August 2020. 4 Quality Portfolio Diversified across Regions Pro-forma Portfolio Value(1) – HK$200B Includes retail facilities, car parks and (31 March 20) offices 1.6% 1.8% 3.1% 9.6% GEOGRAPHY NO. OF PROPERTIES AREA 4.3% Hong Kong 63.7% 126 ~ 9M sq ft 83.9% Hong Kong Retail, office and car parks Retail and Mainland China office space 12.7% 15.9% Overseas 5 ~ 5M sq ft 3.4% Mainland China Retail and office Retail and office space Hong Kong Hong Kong Hong Kong Retail Car park Office 2 ~ 305K sq ft Mainland Mainland Sydney China Retail China Office Overseas Premium Grade A offices Sydney London in Sydney and London ~ 482K sq ft Office Office London Note: (1) As at 31 March 2020 on a pro forma basis, including the acquisitions of Sydney office completed on 7 April 2020 and London office completed on 25 August 2020. -

Hang Seng Indexes Announces Index Review Results

14 August 2020 Hang Seng Indexes Announces Index Review Results Hang Seng Indexes Company Limited (“Hang Seng Indexes”) today announced the results of its review of the Hang Seng Family of Indexes for the quarter ended 30 June 2020. All changes will take effect on 7 September 2020 (Monday). 1. Hang Seng Index The following constituent changes will be made to the Hang Seng Index. The total number of constituents remains unchanged at 50. Inclusion: Code Company 1810 Xiaomi Corporation - W 2269 WuXi Biologics (Cayman) Inc. 9988 Alibaba Group Holding Ltd. - SW Removal: Code Company 83 Sino Land Co. Ltd. 151 Want Want China Holdings Ltd. 1088 China Shenhua Energy Co. Ltd. - H Shares The list of constituents is provided in Appendix 1. The Hang Seng Index Advisory Committee today reviewed the fast expanding innovation and new economy sectors in the Hong Kong capital market and agreed with the proposal from Hang Seng Indexes to conduct a comprehensive study on the composition of the Hang Seng Index. This holistic review will encompass various aspects including, but not limited to, composition and selection of constituents, number of constituents, weightings, and industry and geographical representation, etc. The underlying aim of the study is to ensure the Hang Seng Index continues to serve as the most representative and important benchmark of the Hong Kong stock market. Hang Seng Indexes will report its findings and propose recommendations to the Advisory Committee within six months. The number of constituents of the Hang Seng Index may increase during this period. Hang Seng Indexes Announces Index Review Results /2 2. -

Stephen Chan

Stephen Chan Partner Hong Kong | Dechert, 31/F Jardine House, One Connaught Place, Central, Hong Kong, Hong Kong T +852 3518 4733 | F +852 3518 4777 [email protected] Services Corporate > Corporate Finance and Capital Markets > Energy and Natural Resources > Financial Services and Investment Management > Mergers and Acquisitions > Private Equity > Stephen Chan advises clients on corporate finance transactions, including public and private mergers and acquisitions, private equity, REIT listings, restructuring, takeovers, initial public offerings, H share listing and general compliance matters. Mr. Chan has advised on multiple high- profile public takeovers and global offerings in Hong Kong. He has over 18 years of experience advising clients in a broad spectrum of industry sectors, including healthcare, real estates, energy, media, retail, mining and financial services. Mr. Chan is recommended in The Legal 500 Asia Pacific 2019-2021 for his corporate and M&A work in Hong Kong. He has also been recognized as notable practitioner in the Equity Capital Markets area by IFLR1000. Prior to joining Dechert, Mr. Chan was resident in Cadwalader, Wickersham & Taft’s Hong Kong office where he served as a partner in the corporate practice. His previous experience also includes being a partner-designate at Latham & Watkins and working as an associate at Allen & Overy. EXPERIENCE Takeovers, Mergers & Acquisitions and Private Equity New Century Asset Management Limited, manager of NC REIT, on the very substantial and connected disposal of all assets of NC REIT and the subsequent termination, liquidation, deauthorization and delisting from HKSE - the first successful delisting and deauthorization of a Hong Kong-listed REIT. -

Monthly Stocks Savings Plan Stocks List

Monthly Stocks Savings Plan Stocks List Stock code Stock name Stock code Stock name 1 CKH HOLDINGS 241 ALI HEALTH 2 CLP HOLDINGS 257 CHINA EB INT'L 3 HK & CHINA GAS 267 CITIC 4 WHARF HOLDINGS 268 KINGDEE INT'L 5 HSBC HOLDINGS 270 GUANGDONG INV 6 POWER ASSETS 285 BYD ELECTRON 8 PCCW 288 WH GROUP 11 HANG SENG BANK 291 CHINA RES BEER 12 HENDERSON LAND 293 CATHAY PAC AIR 14 HYSAN DEV 322 TINGYI 16 SHK PPT 323 MAANSHAN IRON 17 NEW WORLD DEV 330 ESPRIT HOLDINGS 19 SWIRE PACIFIC A 338 SHANGHAI PECHEM 23 BANK OF E ASIA 347 ANGANG STEEL 27 GALAXY ENT 358 JIANGXI COPPER 66 MTR CORPORATION 363 SHANGHAI IND H 83 SINO LAND 371 BJ ENT WATER 97 HENDERSON INV 384 CHINA GAS HOLD 101 HANG LUNG PPT 386 SINOPEC CORP 119 POLY PROPERTY 388 HKEX 123 YUEXIU PROPERTY 390 CHINA RAILWAY 135 KUNLUN ENERGY 392 BEIJING ENT 144 CHINA MER PORT 405 YUEXIU REIT 151 WANT WANT CHINA 489 DONGFENG GROUP 152 SHENZHEN INT 506 CHINA FOODS 165 CHINA EB LTD 586 CONCH VENTUR 168 TSINGTAO BREW 656 FOSUN INTL 175 GEELY AUTO 669 TECHTRONIC IND 177 JIANGSU EXPRESS 688 CHINA OVERSEAS 200 MELCO INT'L 700 TENCENT Stock code Stock name Stock code Stock name 728 CHINA TELECOM 1128 WYNN MACAU 753 AIR CHINA 1157 ZOOMLION 762 CHINA UNICOM 1171 YANZHOU COAL 763 ZTE 1177 SINO BIOPHARM 772 CHINA LIT 1186 CHINA RAIL CONS 788 CHINA TOWER 1193 CHINA RES GAS 813 SHIMAO PROPERTY 1199 COSCO SHIP PORT 817 CHINA JINMAO 1211 BYD COMPANY 823 LINK REIT 1288 ABC 836 CHINA RES POWER 1299 AIA 857 PETROCHINA 1313 CHINARES CEMENT 883 CNOOC 1336 NCI 884 CIFI HOLD GP 1339 PICC GROUP 902 HUANENG POWER 1347 HUA -

Xiaomi Soars on Dualclass Shares Deal

16 BUSINESS Thursday, July 19, 2018 CHINA DAILY HONG KONG EDITION BGI officials hike equity stakes as prices fall Xiaomi soars By CHAI HUA range of its gene testing in Shenzhen, Guangdong methods. [email protected] The company said it had performed DNA-based non- on dual-class Chinese genomics giant invasive prenatal testing on BGI, known as the Beijing 3.1 million pregnant women Genomics Institute previous- globally by the end of May, ly, announced on Tuesday that and 2.48 million of their seven of its executives have babies were born. It also shares deal decided to increase their equi- admitted 70 infants with ty holdings in the company, abnormal chromosome con- after a two-day stock slump ditions were born due for Mainland, HK bourses’ agreement on triggered by a series of reports different reasons and insur- attacking its credibility. ance was provided for these Stock Connect inclusion lifts sentiment A report from tech news families. site huxiu revealed some new- DNA-based non-invasive By SUN FEIER in Hong Kong structure, Xiaomi, which borns with defects were previ- prenatal testing is generally [email protected] opened at HK$21.40 ($2.73) ously assessed as low risk by used to test for Down syn- on Wednesday, surged more BGI’s DNA-based non-inva- drome, and 98 percent of Mainland stock exchanges than six percent in the morn- sive prenatal testing. It took fetuses with the condition can and the Hong Kong stock ing trading session. It hit an the case of a boy with mental be tested, according to a study exchange have reached an intraday high of HK$22.20, disabilities and physical in the United Kingdom, said agreement on adjusting Stock before closing at HK$21.55 in deformities in Hunan prov- Cheung Ching-lung, assistant A visitor walks past a board showing big data for genomics in a BGI R&D facility in Qingdao, Connect inclusion arrange- the afternoon, up 3.11 percent ince as an example. -

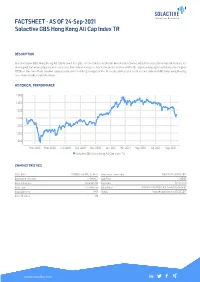

FACTSHEET - AS of 24-Sep-2021 Solactive GBS Hong Kong All Cap Index TR

FACTSHEET - AS OF 24-Sep-2021 Solactive GBS Hong Kong All Cap Index TR DESCRIPTION The Solactive GBS Hong Kong All Cap Index TR is part of the Solactive Global Benchmark Series which includes benchmark indices for developed and emerging market countries. The index intends to track the performance of the all cap covering approximately the largest 100% of the free-float market capitalization in the Hong Kong market. It is calculated as a total return index in HKD andweightedby free-float market capitalization. HISTORICAL PERFORMANCE 1,500 1,400 1,300 1,200 1,100 1,000 900 Mar-2020 May-2020 Jul-2020 Sep-2020 Nov-2020 Jan-2021 Mar-2021 May-2021 Jul-2021 Sep-2021 Solactive GBS Hong Kong All Cap Index TR CHARACTERISTICS ISIN / WKN DE000SLA4JY6 / SLA4JY Base Value / Base Date 1000 Points / 08.05.2017 Bloomberg / Reuters / .SHKACT Last Price 1220.68 Index Calculator Solactive AG Dividends Reinvested Index Type Total Return Calculation 8:00 am to 10:30 pm (CET), every 15 seconds Index Currency HKD History Available daily back to 08.05.2017 Index Members 173 FACTSHEET - AS OF 24-Sep-2021 Solactive GBS Hong Kong All Cap Index TR STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -8.02% -13.44% -12.28% 10.53% -5.61% 2.91% Performance (p.a.) - - - - - 1.75% Volatility (p.a.) 19.86% 18.30% 16.27% 17.51% 18.41% 21.63% High 1344.72 1404.68 1460.66 1473.97 1473.97 1473.97 Low 1214.90 1214.90 1214.90 1099.92 1214.90 879.57 Sharpe Ratio -3.21 -2.42 -1.43 0.61 -0.41 0.08 Max. -

Corporate Presentation September 2019 Link REIT to Update Figures & Graphics About Link REIT

Corporate Presentation September 2019 Link REIT To update figures & graphics About Link REIT Link is Our Portfolio Includes retail facilities, car parks and offices No.1 1st Hong Kong Largest REIT First REIT ~ 8M sq ft (1) in Asia by market listed in 86.8% 126 Retail space capitalisation Hong Kong of portfolio Properties ~ 56,000 by value Car park spaces Mainland China Only 1 100% (1) 5 ~ 5M sq ft Only internally- 100% free float held 13.2% Properties managed by institutions and Retail and of portfolio REIT in Asia private investors across Beijing, Shanghai, Guangzhou and Shenzhen office space by value Note: (1) As at 31 March 2019 Corporate Presentation | P.3 Quality Assets Across Hong Kong and Mainland China 131 Assets Geographical Split Mainland Mainland China Retail China Office 9.7% 3.5% HK Retail HK Office 66.0% 4.8% Beijing HK 01 | 2019 Car park China Shanghai Acquisition of Roosevelt Plaza, Beijing 16.0% Guangzhou Shenzhen Hong Kong Total portfolio value 03 | 2019 (1) Disposal of 12 properties in 03 | 2019 HK$218B Hong Kong Acquisition of +7.6%YoY CentralWalk, Shenzhen Note: (1) By valuation as at 31 March 2019 Corporate Presentation | P.4 To be updated on 31 Aug 2019 Top Global Retail-focused REITs Link is the largest REIT in Asia US$B 50.0 45.7 40.0 30.0 23.6 23.5 18.4 20.0 14.4 10.3 9.7 9.2 10.0 7.8 7.0 6.6 6.1 5.2 4.0 2.4 2.1 0.7 0.0 Note: Comparison of selected major REITs in the world based on market capitalisation Source: Bloomberg as of 30 August 2019 Corporate Presentation | P.5 ValueToday’s Creation Agenda Model to Achieve -

Voluntary Announcement Strategic Review

The Securities and Futures Commission of Hong Kong, Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. VOLUNTARY ANNOUNCEMENT STRATEGIC REVIEW The Board of the Manager announces that it intends to conduct a strategic review of Link’s asset portfolio. The strategic review seeks to optimise Link’s asset portfolio and maximise value for the Unitholders. For the purpose of the strategic review, the Manager has appointed HSBC and UBS (both as financial advisors) and C&W (as real estate advisor) to assist the Manager in assessing strategic options for Link. As at the date of this announcement, no decision has yet been made as to any proposal and there is no assurance that the process of the strategic review will lead to any transaction being announced or concluded. Unitholders and potential investors of Link should note that the strategic review may or may not lead to or result in any transaction, and accordingly are advised to exercise caution when dealing in the units of Link. The board of directors (the Board) of Link Asset Management Limited (the Manager), as manager of Link Real Estate Investment Trust (Link), announces that it intends to conduct a strategic review of Link’s asset portfolio. The strategic review seeks to optimise Link’s asset portfolio and maximise value for Link’s unitholders (the Unitholders).