Nber Working Paper Series the Rise and Fall of the Dollar, Or When Did The

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1935 Time Capsule Part 3

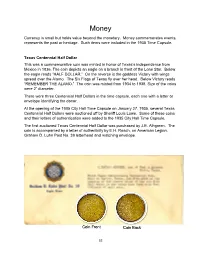

Money Currency is small but holds value beyond the monetary. Money commemorates events, represents the past or heritage. Such items were included in the 1935 Time Capsule. Texas Centennial Half Dollar This was a commemorative coin was minted in honor of Texas’s independence from Mexico in 1836. The coin depicts an eagle on a branch in front of the Lone Star. Below the eagle reads “HALF DOLLAR.” On the reverse is the goddess Victory with wings spread over the Alamo. The Six Flags of Texas fly over her head. Below Victory reads “REMEMBER THE ALAMO.” The coin was minted from 1934 to 1938. Size of the coins were 2” diameter. There were three Centennial Half Dollars in the time capsule, each one with a letter or envelope identifying the donor. At the opening of the 1905 City Hall Time Capsule on January 27, 1935, several Texas Centennial Half Dollars were auctioned off by Sheriff Louis Lowe. Some of these coins and their letters of authentication were added to the 1935 City Hall Time Capsule. The first auctioned Texas Centennial Half Dollar was purchased by J.E. Alhgreen. The coin is accompanied by a letter of authenticity by E.H. Roach, on American Legion, Graham D. Luhn Post No. 39 letterhead and matching envelope. Coin Front Coin Back 32 Letter Front 33 Letter Back 34 The second Texas Centennial Half Dollar was purchased at the same auction by E.E. Rummel. Shown below are the paperwork establishing the authenticity of the purchase by E.H. Roach, on American Legion, Graham D. -

A History of Money in Palestine: from the 1900S to the Present

A History of Money in Palestine: From the 1900s to the Present The Harvard community has made this article openly available. Please share how this access benefits you. Your story matters Citation Mitter, Sreemati. 2014. A History of Money in Palestine: From the 1900s to the Present. Doctoral dissertation, Harvard University. Citable link http://nrs.harvard.edu/urn-3:HUL.InstRepos:12269876 Terms of Use This article was downloaded from Harvard University’s DASH repository, and is made available under the terms and conditions applicable to Other Posted Material, as set forth at http:// nrs.harvard.edu/urn-3:HUL.InstRepos:dash.current.terms-of- use#LAA A History of Money in Palestine: From the 1900s to the Present A dissertation presented by Sreemati Mitter to The History Department in partial fulfillment of the requirements for the degree of Doctor of Philosophy in the subject of History Harvard University Cambridge, Massachusetts January 2014 © 2013 – Sreemati Mitter All rights reserved. Dissertation Advisor: Professor Roger Owen Sreemati Mitter A History of Money in Palestine: From the 1900s to the Present Abstract How does the condition of statelessness, which is usually thought of as a political problem, affect the economic and monetary lives of ordinary people? This dissertation addresses this question by examining the economic behavior of a stateless people, the Palestinians, over a hundred year period, from the last decades of Ottoman rule in the early 1900s to the present. Through this historical narrative, it investigates what happened to the financial and economic assets of ordinary Palestinians when they were either rendered stateless overnight (as happened in 1948) or when they suffered a gradual loss of sovereignty and control over their economic lives (as happened between the early 1900s to the 1930s, or again between 1967 and the present). -

Elimination of the One Cent Coin the Bahamian One Cent Coin Or the “Penny” Is Being Phased

Central Bank of The Bahamas FAQS: Elimination of the One Cent Coin The Bahamian one cent coin or the “penny” is being phased out of circulation. After the end of 2020 it will no longer be legal tender in The Bahamas. It is further proposed that circulation of or acceptance of US pennies will cease at the same time as the Bahamian coin. Why is the one cent coin or penny being phased out? Rising cost of production relative to face value Increased accumulation and non-use of pennies The significant handling cost of pennies When will the Central Bank stop distributing the penny? The Central Bank will stop distributing pennies to commercial banks on the 31st January 2020. Financial institutions will no longer be providing new supplies of the coins to consumers and businesses. Are businesses required to accept pennies after the end of January 2020? NO. Businesses may decide to stop accepting pennies anytime after the end of January 2020. Can businesses continue to accept pennies after the end of December 2020? NO. Businesses will not be able to accept payment or give change in one cent pieces after the end of December 2020. All cash payments will to be rounded to the nearest five cents. How will cash amounts be rounded? Business must round the total amount due to the nearest five cents If your total bill is $9.42 or $9.41. The nearest five cents to either of these would be $9.40 If your total bill is $9.43 or $9.44, the nearest five cents to either of these would be $9.45. -

A History of the Canadian Dollar 53 Royal Bank of Canada, $5, 1943 in 1944, Banks Were Prohibited from Issuing Their Own Notes

Canada under Fixed Exchange Rates and Exchange Controls (1939-50) Bank of Canada, $2, 1937 The 1937 issue differed considerably in design from its 1935 counterpart. The portrait of King George VI appeared in the centre of all but two denominations. The colour of the $2 note in this issue was changed to terra cotta from blue to avoid confusion with the green $1 notes. This was the Bank’s first issue to include French and English text on the same note. The war years (1939-45) and foreign exchange reserves. The Board was responsible to the minister of finance, and its Exchange controls were introduced in chairman was the Governor of the Bank of Canada through an Order-in-Council passed on Canada. Day-to-day operations of the FECB were 15 September 1939 and took effect the following carried out mainly by Bank of Canada staff. day, under the authority of the War Measures Act.70 The Foreign Exchange Control Order established a The Foreign Exchange Control Order legal framework for the control of foreign authorized the FECB to fix, subject to ministerial exchange transactions, and the Foreign Exchange approval, the exchange rate of the Canadian dollar Control Board (FECB) began operations on vis-à-vis the U.S. dollar and the pound sterling. 16 September.71 The Exchange Fund Account was Accordingly, the FECB fixed the Canadian-dollar activated at the same time to hold Canada’s gold value of the U.S. dollar at Can$1.10 (US$0.9091) 70. Parliament did not, in fact, have an opportunity to vote on exchange controls until after the war. -

The Pound Sterling

ESSAYS IN INTERNATIONAL FINANCE No. 13, February 1952 THE POUND STERLING ROY F. HARROD INTERNATIONAL FINANCE SECTION DEPARTMENT OF ECONOMICS AND SOCIAL INSTITUTIONS PRINCETON UNIVERSITY Princeton, New Jersey The present essay is the thirteenth in the series ESSAYS IN INTERNATIONAL FINANCE published by the International Finance Section of the Department of Economics and Social Institutions in Princeton University. The author, R. F. Harrod, is joint editor of the ECONOMIC JOURNAL, Lecturer in economics at Christ Church, Oxford, Fellow of the British Academy, and• Member of the Council of the Royal Economic So- ciety. He served in the Prime Minister's Office dur- ing most of World War II and from 1947 to 1950 was a member of the United Nations Sub-Committee on Employment and Economic Stability. While the Section sponsors the essays in this series, it takes no further responsibility for the opinions therein expressed. The writer's are free to develop their topics as they will and their ideas may or may - • v not be shared by the editorial committee of the Sec- tion or the members of the Department. The Section welcomes the submission of manu- scripts for this series and will assume responsibility for a careful reading of them and for returning to the authors those found unacceptable for publication. GARDNER PATTERSON, Director International Finance Section THE POUND STERLING ROY F. HARROD Christ Church, Oxford I. PRESUPPOSITIONS OF EARLY POLICY S' TERLING was at its heyday before 1914. It was. something ' more than the British currency; it was universally accepted as the most satisfactory medium for international transactions and might be regarded as a world currency, even indeed as the world cur- rency: Its special position waS,no doubt connected with the widespread ramifications of Britain's foreign trade and investment. -

Modelling Australian Dollar Volatility at Multiple Horizons with High-Frequency Data

risks Article Modelling Australian Dollar Volatility at Multiple Horizons with High-Frequency Data Long Hai Vo 1,2 and Duc Hong Vo 3,* 1 Economics Department, Business School, The University of Western Australia, Crawley, WA 6009, Australia; [email protected] 2 Faculty of Finance, Banking and Business Administration, Quy Nhon University, Binh Dinh 560000, Vietnam 3 Business and Economics Research Group, Ho Chi Minh City Open University, Ho Chi Minh City 7000, Vietnam * Correspondence: [email protected] Received: 1 July 2020; Accepted: 17 August 2020; Published: 26 August 2020 Abstract: Long-range dependency of the volatility of exchange-rate time series plays a crucial role in the evaluation of exchange-rate risks, in particular for the commodity currencies. The Australian dollar is currently holding the fifth rank in the global top 10 most frequently traded currencies. The popularity of the Aussie dollar among currency traders belongs to the so-called three G’s—Geology, Geography and Government policy. The Australian economy is largely driven by commodities. The strength of the Australian dollar is counter-cyclical relative to other currencies and ties proximately to the geographical, commercial linkage with Asia and the commodity cycle. As such, we consider that the Australian dollar presents strong characteristics of the commodity currency. In this study, we provide an examination of the Australian dollar–US dollar rates. For the period from 18:05, 7th August 2019 to 9:25, 16th September 2019 with a total of 8481 observations, a wavelet-based approach that allows for modelling long-memory characteristics of this currency pair at different trading horizons is used in our analysis. -

View Currency List

Currency List business.westernunion.com.au CURRENCY TT OUTGOING DRAFT OUTGOING FOREIGN CHEQUE INCOMING TT INCOMING CURRENCY TT OUTGOING DRAFT OUTGOING FOREIGN CHEQUE INCOMING TT INCOMING CURRENCY TT OUTGOING DRAFT OUTGOING FOREIGN CHEQUE INCOMING TT INCOMING Africa Asia continued Middle East Algerian Dinar – DZD Laos Kip – LAK Bahrain Dinar – BHD Angola Kwanza – AOA Macau Pataca – MOP Israeli Shekel – ILS Botswana Pula – BWP Malaysian Ringgit – MYR Jordanian Dinar – JOD Burundi Franc – BIF Maldives Rufiyaa – MVR Kuwaiti Dinar – KWD Cape Verde Escudo – CVE Nepal Rupee – NPR Lebanese Pound – LBP Central African States – XOF Pakistan Rupee – PKR Omani Rial – OMR Central African States – XAF Philippine Peso – PHP Qatari Rial – QAR Comoros Franc – KMF Singapore Dollar – SGD Saudi Arabian Riyal – SAR Djibouti Franc – DJF Sri Lanka Rupee – LKR Turkish Lira – TRY Egyptian Pound – EGP Taiwanese Dollar – TWD UAE Dirham – AED Eritrea Nakfa – ERN Thai Baht – THB Yemeni Rial – YER Ethiopia Birr – ETB Uzbekistan Sum – UZS North America Gambian Dalasi – GMD Vietnamese Dong – VND Canadian Dollar – CAD Ghanian Cedi – GHS Oceania Mexican Peso – MXN Guinea Republic Franc – GNF Australian Dollar – AUD United States Dollar – USD Kenyan Shilling – KES Fiji Dollar – FJD South and Central America, The Caribbean Lesotho Malati – LSL New Zealand Dollar – NZD Argentine Peso – ARS Madagascar Ariary – MGA Papua New Guinea Kina – PGK Bahamian Dollar – BSD Malawi Kwacha – MWK Samoan Tala – WST Barbados Dollar – BBD Mauritanian Ouguiya – MRO Solomon Islands Dollar – -

Problems of the Sterling Area with Special Reference to Australia

ESSAYS IN INTERNATIONAL FINANCE No. 17, September 1953 PROBLEMS OF THE STERLING AREA WITH SPECIAL REFERENCE TO AUSTRALIA SIR DOUGLAS COPLAND INTERNATIONAL FINANCE SECTION DEPARTMENT OF ECONOMICS AND SOCIAL INSTITUTIONS PRINCETON UNIVERSITY Princeton, New Jersey This essay was prepared as the *seventeenth in the series ESSAYS IN INTERNATIONAL FINANCE published by the International Finance Section of the Depart- ment of Economics and Social Institutions in Prince- ton University. The author, Sir Douglas Copland, is an Austral- ian economist and was formerly Vice-Chancellor of the Australian National University. At present he is Australian High Commissioner in Canada. The views he expresses here do not purport to reflect those of his Government. The Section sponsors the essays in this series but it takes no further responsibility for the opinions expressed in them. The writers are free to develop their topics as they will and their ideas may or may not be shared by the editarial committee of the Sec- tion or the members of the Department. The Section welcomes the submission of manu- scripts for this series and will assume responsibility for a careful reading of them and for returning to the authors those found unacceptable for publication. GARDNER PATTERSON, Director International Finance Section ESSAYS IN INTERNATIONAL FINANCE No. 17, September 1953 PROBLEMS OF THE STERLING AREA WITH SPECIAL REFERENCE TO AUSTRALIA SIR DOUGLAS COPLAND INTERNATIONAL/ FINANCE SECTION • DEPARTMENT OF ECONOMICS AND SOCIAL INSTITUTIONS PRINCETON UNIVERSITY Princeton,- New Jersey 9 PROBLEMS OF THE STERLING AREA WITH SPECIAL REFERENCE TO AUSTRALIA SIR DOUGLAS COPLAND I. INTRODUCTION N the latter stages of the 1939-45 war, when policies were being evolved for a united world operating through a new and grand Iconception of a United Nations and its agencies, plans for coopera- tive action on the economic front, in international finance and trade, were discussed with much fervour and hope. -

Countries Codes and Currencies 2020.Xlsx

World Bank Country Code Country Name WHO Region Currency Name Currency Code Income Group (2018) AFG Afghanistan EMR Low Afghanistan Afghani AFN ALB Albania EUR Upper‐middle Albanian Lek ALL DZA Algeria AFR Upper‐middle Algerian Dinar DZD AND Andorra EUR High Euro EUR AGO Angola AFR Lower‐middle Angolan Kwanza AON ATG Antigua and Barbuda AMR High Eastern Caribbean Dollar XCD ARG Argentina AMR Upper‐middle Argentine Peso ARS ARM Armenia EUR Upper‐middle Dram AMD AUS Australia WPR High Australian Dollar AUD AUT Austria EUR High Euro EUR AZE Azerbaijan EUR Upper‐middle Manat AZN BHS Bahamas AMR High Bahamian Dollar BSD BHR Bahrain EMR High Baharaini Dinar BHD BGD Bangladesh SEAR Lower‐middle Taka BDT BRB Barbados AMR High Barbados Dollar BBD BLR Belarus EUR Upper‐middle Belarusian Ruble BYN BEL Belgium EUR High Euro EUR BLZ Belize AMR Upper‐middle Belize Dollar BZD BEN Benin AFR Low CFA Franc XOF BTN Bhutan SEAR Lower‐middle Ngultrum BTN BOL Bolivia Plurinational States of AMR Lower‐middle Boliviano BOB BIH Bosnia and Herzegovina EUR Upper‐middle Convertible Mark BAM BWA Botswana AFR Upper‐middle Botswana Pula BWP BRA Brazil AMR Upper‐middle Brazilian Real BRL BRN Brunei Darussalam WPR High Brunei Dollar BND BGR Bulgaria EUR Upper‐middle Bulgarian Lev BGL BFA Burkina Faso AFR Low CFA Franc XOF BDI Burundi AFR Low Burundi Franc BIF CPV Cabo Verde Republic of AFR Lower‐middle Cape Verde Escudo CVE KHM Cambodia WPR Lower‐middle Riel KHR CMR Cameroon AFR Lower‐middle CFA Franc XAF CAN Canada AMR High Canadian Dollar CAD CAF Central African Republic -

Are Pound and Euro the Same Currency?

Are Pound and Euro the Same Currency? Raul Matsushitaa, Andre Santosb, Iram Gleriac, Annibal Figueiredod, Sergio Da Silvab∗ aDepartment of Statistics, University of Brasilia bDepartment of Economics, Federal University of Santa Catarina cDepartment of Physics, Federal University of Alagoas dDepartment of Physics, University of Brasilia Abstract Relying on a fictitious euro some physicists have claimed that the pound and the euro have been locked together for years despite daily changes in their respective exchange rates. They then conclude that pound and euro are in practice the same currency. We employ a novel technique based on time-varying Hurst exponents to assess efficiency and find that, in this respect, the pound and the euro are unambiguously distinct. While the pound is becoming more efficient, this is not the case for the euro. JEL Classification: F31, F32, F41 Keywords: False euro; Exchange rates; Financial efficiency; Hurst exponent 1. Introduction Some physicists have suggested that the pound is redundant in that it behaves like the euro [1, 6]. This claim has received reasonable media coverage in the financial press. The authors devise a fictitious (false) euro to get the euro’s short time series extended. And they find that before 1999, the pound fluctuated against the Deutschemark, the French franc, Finnish markka, Dutch guilder, and Austrian schilling in the same way as it fluctuated against the false euro. After 1999, the same matching pattern was seen between the pound and the euro itself. The correlation coefficients of the pound, Deutschemark and French franc were all similar to that of the actual euro. (Yet the Italian lira followed a different pattern.) According to the two physicists the results show that the pound and the euro have been locked together for years despite daily changes in their respective exchange rates. -

Working Paper No. 86

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Wray, L. Randall Working Paper The Origins of Money and the Development of the Modern Financial System Working Paper, No. 86 Provided in Cooperation with: Levy Economics Institute of Bard College Suggested Citation: Wray, L. Randall (1993) : The Origins of Money and the Development of the Modern Financial System, Working Paper, No. 86, Levy Economics Institute of Bard College, Annandale-on-Hudson, NY This Version is available at: http://hdl.handle.net/10419/186771 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. www.econstor.eu The Origins of Money and the Development of the Modem Financial System by L. Randall Wray* Working Paper No. -

E Euro Symbol Was Created by the European Commission

e eu ro c o i n s 1 unity an d d i v e r s i t The euro, our currency y A symbol for the European currency e euro symbol was created by the European Commission. e design had to satisfy three simple criteria: ADF and BCDE • to be a highly recognisable symbol of Europe, intersect at D • to have a visual link with existing well-known currency symbols, and • to be aesthetically pleasing and easy to write by hand. Some thirty drafts were drawn up internally. Of these, ten were put to the test of approval by the BCDE, DH and IJ general public. Two designs emerged from the are parallel scale survey well ahead of the rest. It was from these two BCDE intersects that the President of the Commission at the time, at C Jacques Santer, and the European Commissioner with responsibility for the euro, Yves-ibault de Silguy, Euro symbol: geometric construction made their final choice. Jacques Santer and Yves-ibault de Silguy e final choice, the symbol €, was inspired by the letter epsilon, harking back to classical times and the cradle of European civilisation. e symbol also refers to the first letter of the word “Europe”. e two parallel lines indicate the stability of the euro, as they do in the symbol of the dollar and the yen. e official abbreviation for the euro is EUR. © European Communities, 2008 e eu ro c o i n s 2 unity an d d i v e r s i t The euro, our currency y Two sides of a coin – designing the European side e euro coins are produced by the euro area countries themselves, unlike the banknotes which are printed by the ECB.