Final Results Announcement for the Year Ended 31 December 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

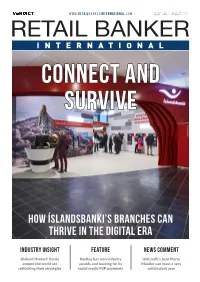

How Íslandsbanki's Branches Can Thrive in the Digital

www.retailbankerinternational.com Issue 740 / AUGUST 2017 CONNECT AND SURVIVE HOW ÍSLANDSBANKI’S BRANCHES CAN THRIVE IN THE DIGITAL ERA INDUSTRY INSIGHT FEATURE NEWS COMMENT Diebold Nixdorf: Banks PayKey has won industry UniCredit’s Jean Pierre around the world are awards and backing for its Mustier can toast a very rethinking their strategies social media P2P payments satisfactory year RBI August 740.indd 1 18/08/2017 16:23:45 contents this month NEWS COVER STORY 05 / EDITOR’S LETTER ÍSLANDSBANKI IN 18 / DIGEST • CBA to refund $8m for unsuitable CCI • CBA CEO to retire • ADGM, UAE Exchange sign agreement THE DIGITAL ERA • Barclays names new Barclaycard CEO • PayPal to acquire Swift Financial • Banco Popular acquisition approved • ThinCats gains full FCA authorisation • UK branch closures top 4,000 • Tandem to buy Harrods Bank • PwC, Featurespace collaborate • DBS closes migration of ANZ businesses • Tesco Bank adds card block feature • BoA Merrill launches in China • Fiserv launches analytics solution • China creates new clearing house 12 Editor: Douglas Blakey Group Editorial Director: Head of Subscriptions: +44 (0)20 7406 6523 Ana Gyorkos Alex Aubrey [email protected] +44 (0)20 7406 6707 +44 (0)20 3096 2603 [email protected] [email protected] Deputy Editor: Anna Milne +44 (0)20 7406 6701 Sub-editor: Nick Midgley Director of Events: Ray Giddings [email protected] +44 (0)161 359 5829 +44 (0)20 3096 2585 [email protected] [email protected] Senior Reporter: Patrick Brusnahan +44 (0)20 7406 6526 [email protected] Customer Services: +44 (0)20 3096 2603 or +44 (0)20 3096 2636, [email protected] Financial News Publishing, 2012. -

CONVOY GLOBAL HOLDINGS LIMITED 康宏環球控股有限公司 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 1019)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. CONVOY GLOBAL HOLDINGS LIMITED 康宏環球控股有限公司 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 1019) DISCLOSEABLE TRANSACTION SUBSCRIPTION OF SHARES IN TANDEM MONEY SUBSCRIPTION Reference is made to the announcement of Convoy Global Holdings Limited (the “Company”) dated 20 November 2018. The Board wishes to announce that on 2 April 2020, Convoy Technologies, an indirect wholly-owned subsidiary of the Company, entered into the Subscription Agreement with Tandem Money, pursuant to which Convoy Technologies agrees to subscribe and Tandem Money agrees to issue a certain number of ordinary B shares in Tandem Money for a consideration of £10 million. IMPLICATIONS UNDER THE LISTING RULES As one or more of the applicable percentage ratios (as defined under the Listing Rules) in respect of the Subscription are more than 5% but less than 25%, the Subscription constitutes a discloseable transaction of the Company under Chapter 14 of the Listing Rules and is therefore subject to the notification and announcement requirements under the Listing Rules. 1 THE SUBSCRIPTION The Board wishes to announce that on 2 April 2020, Convoy Technologies, an indirect wholly-owned subsidiary of the Company, entered into the Subscription Agreement with Tandem Money, pursuant to which Convoy Technologies agrees to subscribe and Tandem Money agrees to issue a certain number of ordinary B shares in Tandem Money for a consideration of £10 million. -

Norsk Varemerketidende Nr 04/21

. nr 04/21 - 2021.01.25 NO årgang 111 ISSN 1503-4925 Norsk varemerketidende er en publikasjon som inneholder kunngjøringer innenfor varemerkeområdet BESØKSADRESSE Sandakerveien 64 POSTADRESSE Postboks 4863 Nydalen 0422 Oslo E-POST [email protected] TELEFON +47 22 38 73 00 8.00-15.45 innholdsfortegnelse og inid-koder 2021.01.25 - 04/21 Innholdsfortegnelse: Registrerte varemerker ......................................................................................................................................... 3 Internasjonale varemerkeregistreringer ............................................................................................................ 61 Ansvarsmerker .................................................................................................................................................. 137 Innsigelser .......................................................................................................................................................... 138 Avgjørelser etter innsigelser ............................................................................................................................ 139 Avgjørelser fra Klagenemnda........................................................................................................................... 140 Merkeendringer .................................................................................................................................................. 142 Begrensing i varefortegnelsen for internasjonale varemerkeregistreringer -

Diana Milanesi TTLF Working Paper (08.22.2017)

Stanford – Vienna Transatlantic Technology Law Forum A joint initiative of Stanford Law School and the University of Vienna School of Law TTLF Working Papers No. 29 A New Banking Paradigm: The State of Open Banking in Europe, the United Kingdom, and the United States Diana Milanesi 2017 TTLF Working Papers About the TTLF Working Papers TTLF’s Working Paper Series presents original research on technology, and business- related law and policy issues of the European Union and the US. The objective of TTLF’s Working Paper Series is to share “work in progress”. The authors of the papers are solely responsible for the content of their contributions and may use the citation standards of their home country. The TTLF Working Papers can be found at http://ttlf.stanford.edu. Please also visit this website to learn more about TTLF’s mission and activities. If you should have any questions regarding the TTLF’s Working Paper Series, please contact Vienna Law Professor Siegfried Fina, Stanford Law Professor Mark Lemley or Stanford LST Executive Director Roland Vogl at the Stanford-Vienna Transatlantic Technology Law Forum http://ttlf.stanford.edu Stanford Law School University of Vienna School of Law Crown Quadrangle Department of Business Law 559 Nathan Abbott Way Schottenbastei 10-16 Stanford, CA 94305-8610 1010 Vienna, Austria About the Author Diana Milanesi is an attorney member of the State Bar of California, the New York State Bar, and the International Bar Association. Since 2016, Diana has served as legal adviser to Startup Europe India Network, a high-profile network built in collaboration with the European Commission to connect the pan-European and Indian startup ecosystems and foster growth and investments across the Indian, EU and U.S. -

Authorised Payment Institutions

Authorised Payment Institutions Ref number Firm name 533178 Dek-Co (UK) Limited 115248 Hargreaves Lansdown Asset Management Limited 140822 Instinet Europe Limited 149970 Hargreaves Lansdown Stockbrokers Limited 185223 Goldenway Global Investments (UK) Limited 188753 Direct Sharedeal Ltd 192815 Hartmann Capital Limited 204572 Santander Cards UK Limited 204440 Capital One (Europe) plc 204487 MBNA Limited 313153 Creation Financial Services Limited 315407 Paymaster (1836) Limited 225539 Otkritie Capital International Limited 308919 TTT Moneycorp Ltd 415532 American Express Services Europe Limited 462444 HiFX Europe Limited 436215 Dinosaur Merchant Bank Limited 446699 AirPlus International Ltd 446717 INTL FCStone LTD 437558 Global Investment Strategy UK Ltd 507189 Jalloh Enterprise Limited 463951 Monex Europe Limited 511810 JCB International (Europe) Ltd 504290 GPUK LLP 504315 Global Reach Partners Limited 504318 Kalixa Accept Limited 504329 UAE Exchange UK Limited 504346 Global Currency Exchange Network Ltd 504353 Currency Index Ltd 504354 Pure FX Limited 504475 BDO Remit (UK) Ltd 504482 LCC Trans-Sending Limited 504494 Cornhill International Payments Limited 504504 WorldPay Limited 504509 Smart Currency Exchange Limited 504521 Unity Link Financial Services Limited 504547 Spectrum Payment Services Limited 504575 KBR Foreign Exchange PLC 504589 Xpress Money Services Limited 504592 Currency UK Limited 504599 BFC Exchange Limited 504611 MSBB Money Ltd 504626 AN Express Ltd 504630 Euronet Payment Services Ltd 488396 FairFX PLC 467596 Santander -

2020 Member Magazine. Download

108 2 AGM 2021: Your Society. Your Vote. Your Future. Cast your vote today: leedsbuildingsociety.co.uk/voting 3 The reason we exist is to serve you. We’re always working to help you in the best way possible – to meet your needs of today and prepare for those of tomorrow. This is our annual update on what’s been happening, and how you can help shape what happens next. What’s inside? 4 Chair’s Welcome 6 Chief Executive Officer’s Review of 2020 10 Year at a glance 12 Our focus is on you 14 Putting your future first Help shape 16 Doing the right thing 18 Positive changes in your community 20 Meet the Directors the future 26 Summary Financial Statement 29 Directors’ remuneration report 38 How to vote in AGM 2021 of your 39 Why your vote matters 40 Ways to get involved Society 4 AGM 2021: Your Society. Your Vote. Your Future. Cast your vote today: leedsbuildingsociety.co.uk/voting 5 Chair’s Welcome I was privileged to succeed Robin from home, while all our premises were made right balance in supporting members through the COVID-secure to ensure colleagues and members pandemic, maintaining the Society’s exceptional Ashton as Chair last April. I would were safe in branches and essential office financial strength and positioning it well for like to begin my first update by locations. We recorded high levels of employee future success. paying tribute to my colleagues engagement, and colleagues acknowledged confidence in the Society’s leadership and the Remuneration matters are covered separately in throughout the Society, and support that has been provided to them. -

Fintech Market Enters a New Stage of Maturity Fintech Is Gearing Up, Shifting Away from the Start-Up World to Mature Big Ticket Transactions

FINTECH FOCUS EUROPEAN TRENDS Fintech market enters a new stage of maturity Fintech is gearing up, shifting away from the start-up world to mature big ticket transactions. Richard Woods, Clive Cunningham and Wendy Saunders of Herbert Smith Freehills review macro-developments in Europe intech refers to the many ways in which businesses are using technology to change and improve the provision of financial Fservices. There are many ways in which regulators are reacting to and supporting the continued growth of fintech, and how ambitious businesses are adapting to that regulatory landscape. We see 2020 as being a year of consolidation as much as transformation, both in terms of firms’ reaction to the regulatory environment, and in terms of transactional activity. In the last two years, a number of fundamental regulatory developments took effect in the region and these are now an established part of the regulatory framework. In particular, the second Payment Services Directive (PSD2 – January 2018), Mifid II (January 2018) and the General Data Protection Regulation (GDPR – May 2018) established a new architecture in which fintech businesses must operate. Although the next phase of regulation is never far away (the www.herbertsmithfreehills.com Fifth Money Laundering Directive very recently took effect on January 10 2020) in 2020 fintechs will, for a while, have an opportunity to work within a relatively well-established regulatory framework. 2020 may well be the year in which open banking becomes more widely adopted. Open banking allows customers to authorise their banks to share their financial data with third party providers. It is designed to increase competition and innovation in favour of consumers. -

Pwc UK 2019 Transparency Report

Transparency Report Building trust through our audits Year ended 30 June 2019 Building trust through our audits Assurance* at a glance Here are some of the highlights of our year to 30 June 2019, and some of the key data points within this report: Our pursuit of quality Partner and staff survey Audit quality reviews – internal The leaders I work with Results of the firm’s own audit quality reviews – percentage Number of audit engagements encourage me to deliver of audits rated compliant, compliant with review matters, reviewed and the annualised high quality services and non-compliant: percentage of Responsible 4% 14% Individuals subject to the firm’s 7% own audit quality reviews 2% audit FY19 142 engagments 2019 2018 were reviewed in 89% FY19 covering 41% of the firm’s FY18: 89% 84% 89% Responsible Individuals Compliant Compliant with Review Matters Non-Compliant FY18: 136, 39% PwC AQR Inspection Gradings 2014/15 – 2018/19 All reviews 100% 25 23 21 80% 20 16 60% 40% 5 20% 4 4 4 2 2 2 0% 2018/19 2017/18 2016/17 2015/16 2014/15 Good or limited improvements required Improvements required Signicant improvements required Revenue Investing in our people Assurance UK revenues Investment in training and development New partner admissions £1,201m 1.4 million 1 in 2 FY18: £1,132m hours of training and personal development of new partner admittances in the Audit by Assurance people in the 2018 calendar year line of service in FY19 were women 2017 calendar year: 1.4m FY19: 2 in 5 for the combined Audit and Risk Assurance lines of service (together previously the Assurance line of service) FY18: 1 in 5 for the Assurance line of service; FY17: 1 in 5 for the Assurance line of service For more on the Audit Quality Indicators, including training, see section 16 of this report, and for human resources see section 9. -

100 Most Influential Fintech Companies 2018

The Financial Technologist Q1 .. 2018 THE DEFINITIVE LIST OF THE 100 MOST INFLUENTIAL FINTECH COMPANIES OF 2018 Hear from the winners and the judges Plus Women of FinTech Hottest market trends FinTech FOCUS TV The Financial Technologist | Q1 | 2018 Watch, feature, and subscribe Contents to our brand-new channels! FinTech Focus TV focusses on the leading names in the Financial 04 Introduction by Toby Babb 30 FEATURE The definitive list of the 100 most Services Technology community discussing the challenges facing the influential FinTech companies 2018 10 FEATURE RegTech – barking up the Voted for by judges from Lloyds Banking Group, LSE, industry, the latest innovations, and the differentiators separating the wrong tree? EY, Innovate Finance, Seismic Foundry, CBPE Capital, best companies from the rest of the pack. Co-Founder of Finbourne Technology, Benedict London & Partners, The Realization Group, Baringa Nielsen on how the RegTech industry can better and Harrington Starr, these are the most influential direct their efforts FinTech Companies to look out for in 2018 Hear from the companies themselves on why 14 FEATURE Improving your software they believe they were recognised development process 42 FundApps Harrington Starr Technology Consulting’s Gav Patel 45 SteelEye and Ehab Roufail answer some of the most pressing 48 Mambu questions in the market today 50 Acuris 51 Crypto Facilities 19 FEATURE Open APIs: who’s going to profit? 52 Finbourne Tom Bandy of Athlon looks at whose best situated 54 Trade Informatics to take advantage of one -

Octopus Titan VCT Prospectus

Octopus Titan VCT Octopus Titan VCT Prospectus Offer for subscription by Octopus Titan VCT plc for the tax years 2018/2019 and 2019/2020 to raise up to £120 million by way of an issue of New Shares, with an over-allotment facility of a further £80 million. 13 September 2018 THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt about the action to be taken, you should immediately consult your bank manager, stockbroker, solicitor, accountant or financial adviser authorised pursuant to the Financial Services and Markets Act 2000 (FSMA). This document, which comprises a prospectus relating to Octopus Titan VCT plc (the “Company”) dated 13 September 2018, has been prepared in accordance with the prospectus rules made under Part VI of FSMA, and has been approved for publication by the Financial Conduct Authority as a prospectus under the Prospectus Rules on 13 September 2018. The Company and the Directors, whose names appear on pages 28 and 29 of this document, accept responsibility for the information contained herein. To the best of the knowledge of the Company and the Directors (who have taken all reasonable care to ensure that such is the case), the information contained in this document is in accordance with the facts and does not omit anything likely to affect the import of such information. Persons receiving this document should note that Howard Kennedy, which is authorised and regulated in the United Kingdom by the Financial Conduct Authority, is acting as sponsor for the Company and no- one else and will not, subject to the responsibilities and liabilities imposed by FSMA or the regulatory regime established thereunder, be responsible to any other person for providing the protections afforded to customers of Howard Kennedy or providing advice in connection with any matters referred to herein. -

Profiles of Selected Bank Challengers in Europe

2 Profiles of selected bank challengers in Europe Company profiles, 2019 Inteliace Research January 2019 Table of Contents* Selected bank challengers 1. Revolut 2. N26 bank 3. Monzo bank 4. Monese 5. Starling bank 6. Tandem bank 7. Loot 8. Atom bank 9. Pockit 10. Tide 11. Holvi 12. Bunq 13. Kontist 14. Shine 15. Fidor bank 16. Cashplus Other meta-banking / payment apps 1. Transferwise 2. Curve Remarks: * Please note that the availability and accuracy of data might differ depending on particular company. Number of users or payment volumes might be incomplete or missing for selected players APP Revolut CHALLENGER BANK $ 336m $ 1700m Total funding Last valuation Basic facts Key products and services • Brand: Revolut • Type: Mobile only; Focus on payments Current Accounts €, £ + balances in 25 ccies • License: Banking & EMI licenses (from Lithuania) Deposits/Savings None, vaults only • Operator: Revolut Ltd Loans 3rd party loans • HQ: 107 Cheapside, EC2V 6DN London, United Kingdom Transfers Up to €6k per month • Owners: Private investors, VC (DST Global, Index, Ribbit ao.) P2P transfers Yes, in 25 currencies • Markets served: 32 European markets (Dec. 2018) FX card payments Yes (with balance or fx) • Segments served: Individuals, business accounts Cards: Debit/Credit Prepaid Mastercard or Visa • Key dates: Founded 2014, Launched 2015, Banking licenses (Lithuania) 2018 Cashback or Loyalty in premium plans Marketplace (3rd • Key competitors: Monese, N26, other local challenger banks Loans • Partners: Mastercard, Visa, Prepay Technologies Ltd party offers) • Headcount: Over 800 Cryptocurrencies In premium plans • CEO: Nikolay Storonsky (Founder and CEO) Google Pay, Apple Pay Other integration Overview Pricing – key elements (basic offer) • Revolut is a Fintech company with E-money and bank licenses Acct./card fee (basic) Free, card delivery cost • Since its begin, Revolut has offered highly competitive payment ATM withdrawals Up to £200/m. -

Payments International 2017, London, 12-13/09/2017, Speaker

HILTON TOWER BRIDGE LONDON Tuesday 12 September 2017 The Payments Regulation Boot Camp 08.45 Registration 09.15 Opening Remarks From The Chair Ruth Wandhöfer, Global Head of Regulatory & Market Strategy, CITI 09.25 Keynote Address From The European Banking Authority: Outlining The Draft Regulatory Technical Standards (RTS) On Strong Customer Authentication (SCA) And Common And Secure Communication (CSC) Under PSD2 Dr Dirk Haubrich, Head of Consumer Protection & Financial Innovation, EUROPEAN BANKING AUTHORITY 09.55 Expert Legal Insight: Complying With The EBA RTS For PSD2: What Do Financial Institutions Need To Understand? 10.15 Paul Anning, Partner, Financial Institutions Group, OSBORNE CLARKE Industry Strategy Roundtable: Practical Steps Needed To Prepare For The EBA RTS For PSD2. How Will PSD2 Work In Practice? What Are The Risks To Be Addressed? Which Market Segments Will Be Looking For Direct Access To Accounts? What Needs To Be Agreed Between The Account Servicing Banks & The Providers Of Payment Initiation Services? Derrick Brown, Head Of Payments, WORLDPAY & Chair of the Board, EUROPEAN PAYMENT INSTITUTIONS FEDERATION Thomas Egner, Secretary General, EURO BANKING ASSOCIATION Kirstine Nilsson, Head of Strategic Engagement, SWEDBANK James Whittle Director of Industry Policy, PAYMENTS UK 11.00 Morning Coffee & Networking Break 11.25 The General Data Protection Regulation & PSD2: What Are The Tensions Between The Two? Pascale-Marie Brien, Senior Policy Adviser, EUROPEAN BANKING FEDERATION 11.45 Strategy Roundtable: How PSD2 Overlaps