Research Communication PUBLIC AWARENESS TOWARDS CAPITAL

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mirae Asset NYSE FANG+ ETF an Open Ended Scheme Replicating/Tracking NYSE FANG+ Total Return Index

SCHEME INFORMATION DOCUMENT Mirae Asset NYSE FANG+ ETF An open ended scheme replicating/tracking NYSE FANG+ Total Return Index Offer for Sale of Units at 1/10,000th value of the NYSE FANG+ closing Index (Converted to INR) as on the date of allotment for applications received during the New Fund Offer (“NFO”) period and at order execution based prices (along with applicable charges and execution variations) during the Ongoing Offer for applications directly received at AMC. New Fund Offer opens on :19/04/2021 New Fund Offer closes on : 30/04/2021 Scheme re-opens for continuous Sale and Repurchase from 07/05/2021 The subscription list may be closed earlier by giving at least one day’s notice in one daily newspaper. The Trustee reserves the right to extend the closing date of the New Fund Offer Period, subject to the condition that the subscription list of the New Fund Offer Period shall not be kept open for more than 15 days. The units of the Scheme are listed on the National Stock Exchange of India Ltd. (NSE) and BSE Limited (BSE). All investors including Authorized Participants and Large Investors can subscribe (buy) / redeem (sell) units on a continuous basis on the NSE/BSE on which the Units are listed during the trading hours on all the trading days. In addition, Authorized Participants and Large Investors can directly subscribe to / redeem units of the Scheme on all Business Days with the Fund in ‘Creation Unit Size’ at order execution based prices (along with applicable charges and execution variations). -

SEBI-Annual-Report-2017-18

ANNUAL REPORT 2017-18 This Report is in conformity with the format as per the Securities and Exchange Board of India (Annual Report) Rules, 1994, notified in Official Gazette on April 7, 1994 MEMBERS OF THE BOARD (As on March 31, 2018) Appointed under Section 4(1)(a) of the SEBI Act, 1992 (15 of 1992) AJAY TYAGI CHAIRMAN Appointed under Section 4(1)(d) of the SEBI Act, 1992 (15 of 1992) G. MAHALINGAM WHOLE TIME MEMBER MADHABI PURI BUCH WHOLE TIME MEMBER ARUN P. SATHE PART TIME MEMBER Nominated under Section 4(1)(b) of the SEBI Act, 1992 (15 of 1992) SUBHASH CHANDRA GARG Secretary, Ministry of Finance, Department of Economic Aairs, Government of India INJETI SRINIVAS Secretary, Ministry of Corporate Aairs, Government of India Nominated under Section 4(1)(c) of the SEBI Act, 1992 (15 of 1992) N. S. VISHWANATHAN Deputy Governor, Reserve Bank of India MEMBERS OF THE BOARD AJAY TYAGI Chairman G. MAHALINGAM MADHABI PURI BUCH ARUN P. SATHE Whole Time Member Whole Time Member Part Time Member SUBHASH CHANDRA GARG INJETI SRINIVAS N. S. VISHWANATHAN Secretary, Ministry of Finance, Secretary, Ministry of Corporate Deputy Governor, Department of Economic Aairs, Aairs, Government of India Reserve Bank of India Government of India Chairman, Whole Time Members and Executive Directors (Left to Right) Sitting: Shri G. Mahalingam, Whole Time Member; Shri Ajay Tyagi, Chairman; Ms. Madhabi Puri Buch, Whole Time Member Standing: Shri S. Ravindran, Executive Director; Shri Nagendraa Parakh, Executive Director; Shri Ananta Barua, Executive Director; Shri S K Mohanty, Executive Director; Shri SVMD Rao, Executive Director; Shri Sujit Prasad, Executive Director; Shri P. -

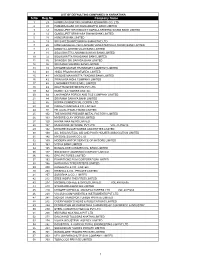

List of Section25 Companies

Note:The information contained in the list is derived from e-records available in the MCA portal. If any discrepancy/ deviation is noticed by company/ representative of company, the same may be kindly brought to the notice of ministry for rectification. LIST OF SECTION25 COMPANIES S.No. CIN COMPANY NAMEDATE OF REGISTERED OFFICE ADDRESS INCORPORATION( mm/dd/yyyy) 1 U91110AP1918NPL000029 THE COCONADA CHAMBER OF COMMERCE 1/31/1918 26/9/16, RAMA RAO STREET,GANDHI NAGAR, VIJAYAWADA 2 U99999AP1966NPL001111 THE MICA CHAMBER OF COMMERCE 5/7/1966 NATHAYYAMPALAM, TUNGALAM VISAKHAPATNAM 3 U92411AP1971NPL001403 HYDERABAD RACE CLUB LIMITED 4/15/1971 MA LAKPET HYDERABAD 4 U75200AP1980NPL002744 METHODIST CHURCH OF INDIA 7/26/1980 HYDERABAD. 5 U80101AP1982NPL003594 HENRY MARTYN INSTITUTE INTERNATIONAL CENTRE 8/3/1982 6-3-128/1, BESIDE NATIONAL POLICE ACADAMY SHIVARAM FOR RESEARCH, INTERNATIONAL RELATION AND PALLY HYDERABAD RECONCILIATION 6 U72200AP1991NPL012482 KRIYA SOCIAL SERVICES 3/22/1991 6-3-649/1, FIRST FLOOR, NALANDA APARTMENT MEDINOVA COMPLEX, SOMAJIGUDA HYDERABAD 7 U65910AP1991NPL012989 ALL INDIA ECONOMIC OFFENSES AWARENESS BUREAU 7/25/1991 3-6-147/2 HYMAYATNAGAR HYDERABAD 8 U24110AP1992NPL014008 GENETIC PRODUCTS CHARITABLE ASSOCIATION 3/19/1992 G-BLOCK,KANTHISHIKARA COMPLEX GROUND FLOOR PUNJAGUTTA, HYDERABAD 9 U80100AP1992NPL014292 NAGARJUNA FOUNDATION 5/27/1992 NAGARJUNA HILLS,PANJAGUTTA,HYDERABAD HYDERABAD HYDERABAD 10 U91910AP1992NPL014503 INTERNATIONAL BIBLE SOCIETY INDIA 7/10/1992 2.157, Logos Bhavan Medchal Road, Jeedimetla Village Secunderabad 11 U92140AP1993NPL015662 AUROBHARATHI DEVELOPMENT FOUNDATION 4/20/1993 GADDIPLLI [PO], GAREDIPALLI[M]NALGONDA DIST. NALGONDA 12 U99999AP1994NPL017022 ASSOCIATION OF LADY ENTREPRENEURS OF ANDHRA 2/14/1994 D.NO 8-3-677/6, SRI KRISHNADEVARAYA NAGAR SRINAGAR PRADESH COLONY POST, YELLAREDDYGUDA HYDERABAD 13 U91120AP1994NPL018733 AWARE (INDIA) FOUNDATION 11/11/1994 H. -

Complete Book of Banking & Computer Awareness by Debarati

IBPS Examinations Banking Awareness tips for recruitment as clerks and officers in banks e-book (Banking Awareness) PART: 01 Prepared by Debarati Mukherjee meetdebaratimukherjee.wordpress.com Follow in Facebook https://www.facebook.com/bforbureaucracy 1 BULLET POINTS - PART: 001 Reserve Bank of India 01. Central bank is a bank which acts as a banker to the government; has monopoly of note issue and controls the entire banking system 02. RBI is the central bank in India 03. RBI was established by an act of Parliament in 1934 04. The initial share capital for RBI was Rs. 5 crores 05. RBI was nationalized under (transfer of public ownership) act 1948 06. Its affairs are regulated by central board of directors 07. It has four regional centres at Mumbai, Kolkatta, Chennai and Delhi 08. The central office of the bank is at Mumbai 09. RBI is note issuing authority; banker, agent and financial adviser to the government; custodian of cash reserves of banks; custodian of nation's reserves of foreign exchange; lender of the last resort; controller of credit etc. 10. Currency notes other than one rupee notes are issued by RBI 11. RBI has credit control ± regulation of cash reserves of commercial banks, regulating the flow of credit, qualitative control and open market operations 12. Handles all government transactions 13. It is a banker's bank 14. It maintains the exchange rate for the Indian rupee; hold the country's reserves in foreign currencies and administration of the exchange management regulations Scheduled commercial banks 15. They are included in the second schedule to the RBI act, 1934 16. -

Front Cover Page

SCHEME INFORMATION DOCUMENT Product Labeling This product is suitable for investors who are seeking*: • Long term Capital appreciation. • Investment in securities covered by Nifty Next 50 Index *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. Offer of Units of Rs. 10 each during the New Fund Offer and NAV related prices on ongoing basis New Fund Offer New Fund Offer Scheme re-opens on Opens on Closes on Within 5 business days from the April 28, 2021 May 11, 2021 date of allotment Mutual Fund Trustee Company Asset Management Company SBI Mutual Fund SBI Mutual Fund Trustee SBI Funds Management Private Company Private Limited Limited ('AMC') ('Trustee Company') (A joint venture between SBI and CIN: AMUNDI) U65991MH2003PTC138496 CIN: U65990MH1992PTC065289 Corporate Office Registered Office: Registered Office: 9th Floor, Crescenzo, C– 9th Floor, Crescenzo, C– 38 9th Floor, Crescenzo, C– 38 & 39, 38 & 39, G Block, & 39, G Block, Bandra-Kurla, G Block, Bandra-Kurla, Complex, Bandra-Kurla, Complex, Complex, Bandra (East), Bandra (East), Mumbai- 400 051 Bandra (East), Mumbai- Mumbai- 400 051 400 051 Website : www.sbimf.com The particulars of the Scheme have been prepared in accordance with the Securities and Exchange Board of India (Mutual Funds) Regulations 1996, (herein after referred to as SEBI (MF) Regulations) as amended till date, and filed with SEBI, along with a Due Diligence Certificate from the AMC. The units being offered for public subscription have not been approved or recommended by SEBI nor has SEBI certified the accuracy or adequacy of the Scheme Information Document. -

Secondary Or Stock Market in India

By Dr. Snigdha Mishra Assistant Professor The stock exchange is an organised and centralised market for the purchase and sale of industrial and financial securities of all descriptions, viz., Stocks, Shares, Debentures etc. It is a market for transactions in old securities. Practically, it is a place where the buyer of a security may find a seller who is ready to sell his holdings at a fair and reasonable price provided the security has been listed. According to the Securities Contracts (Regulations) Act of 1956, a stock exchange is „an association, organisation or body of individuals, whether incorporated or not, established for the purpose of assisting, regulating and controlling business in buying, selling and dealing in securities‟. The stock exchange was established by “East India company” in 18th century . In India it was established in 1850 with 22 stock brokers opposite to town hall Bombay .This stock exchange is known as oldest stock exchange of Asia. In 1975, it was renamed as Bombay Stock Exchange (BSE). There are 23 stock exchanges in the India. Mumbai's (earlier known as Bombay), Bombay Stock Exchange is the largest, with over 6,000 stocks listed. The BSE accounts for over two thirds of the total trading volume in the country. Established in 1875, the exchange is also the oldest in Asia. Among the twenty- two Stock Exchanges recognised by the Government of India under the Securities Contracts (Regulation) Act, 1956, it was the first one to be recognised and it is the only one that had the privilege of getting permanent recognition ab-initio. -

KARNATAKA.Pdf

LIST OF DEFAULTING COMPANIES IN KARNATAKA S.No Reg.No Company Name 1 23 HAMRAJNAGAR SRI CHAMARAJESHWARA CO. LTD 2 38 HAMARAJAGAR SRI RANGANATHA BANK LIMITED 3 12 GUNDLUPET SIR HIMAVAT GOPALA KRISHNA SWAMI BANK LIMITED 4 14 GUNDLUPET SRINIVASA SWAMI BANK LIMITED 5 18 HUNSUR BANK LIMITED 6 19 SRI SHREEKANTESWARA SAMASTHE LTD 7 20 MANCHENAHALLI SRI LAKSHMI VENKATESWARA SWAMI BANK LIMITED 8 21 MANDYA LAKSHMI VILAS BANK LIMITED 9 31 SIDLAGHATTA LAKSHMI SAHAYA BANK LIMITED 10 32 SIDLAGHATTA RAJADHANI BANK LIMITED 11 35 SRINGERI SRI SARADA BANK LIMITED 12 36 SRI RAMACHANDRA BANK LIMITED 13 39 MYSORE MOTOR TRANSPORT COMPANY LIMITED 14 40 3INDU PROVISION STORES, LIMITED 15 41 MYSORE MAHARATTA TRADING BANK LIMITED 16 42 SRINIVASA NIDHI COMPANY LIMITED 17 48 LAKSHMIPATI RICE MILL LIMITED 18 49 KRAFTS INVESTMENTS PVT.LTD. 19 62 GUBBI TILE WORKS LIMITED 20 64 LAKSANDRA PORICK AND TILE COMPANY LIMITED 21 84 SRI RAMA SAHAYA BANK LIMITED 22 86 KOPPA COMMERCIAL CORPN. LTD 23 92 OAKLEY DUNCAN & CO. LIMITED 24 98 HE JAVALI FAMILY BANK LIMITED 25 102 THE MYSORE PREMIER METAL FACTORY LIMITED 26 103 MYSORE CLAY WORKS LIMITED 27 120 KARNATAKA NEWS LIMITED 28 127 MUSASONS (MYSORE) PVT LTD VOL.41-PG215 29 132 MYSORE SUGAR WORKS AND ESTTES LIMITED 30 140 ALL INDIA MUTUAL AID AND POOR HOUSES ASSOCIATION LIMITED 31 142 MYSORE SUGAR CO LTD 32 160 MODERN MOTOR SERVICE OF MYSORE LIMITED 33 163 VYSYA BANK LIMITED 34 185 BANGALORE COMMERCIAL BANK LIMITED 35 187 SREENIDHY (BANKING) COMPANY LIMITED 36 192 EPIC PICTURES LIMITED 37 193 EXHIBITIONS FILM CORPORATION LIMITED 38 196 NARAYANA TYPEWRITERS LIMITED 39 200 RANGAPPA & CO., LIMITED 40 203 KRISHNA & CO., PRIVATE LIMITED 41 207 SUBODHA & CO., LIMITED 42 212 SREE INDIRA THEATRES LIMITED 43 217 MYSORE COFFEE & SPICES LIMITED VOL.48 PG595 44 218 STANDARD AGENCIES LIMITED 45 220 MYSORE CHEMICAL MANUFACTURERS LTD VOL.48 PG64 46 228 VACUUN COMPONENTS & INSTRUMENTS PVT.LTD. -

Stock Exchanges – the More the Merrier?

Institutional EYE Stock exchanges – the more the merrier? It is hard to argue against SEBI’s intent to foster competition for stock exchanges and depositories. However, it is unclear if adding more stock exchanges will accomplish the desired outcome. While ownership regulations are being eased to lower entry barriers, SEBI needs to ensure this be done with stronger guardrails. Source: morguefile.com Competition is essential for continuous improvement to products and services, and to this extent, the intent of fostering greater competition for stock exchanges and depositories is in the right direction. Increasing use of technology, breakdown of trading platforms, co-location issues, have all laced the ‘equity’ exchanges. Commodity exchanges too have seen their fair share of scams. While the regulator can provide an enabling 05 February 2021 iiasadvisory.com 1 Institutional EYE environment, it cannot run the exchange. Therefore, the most enduring solution to customer delight is market-driven competition. Will having more stock exchanges and depositories achieve that objective? SEBI, in its January 2021 discussion paper on “Review of Ownership and Governance norms for facilitating new entrants to set up Stock Exchange / Depository” believes it will1. SEBI has argued that newer technologies of block chain and distributed ledgers will bring an innovative element to trading and price discovery, and perhaps that will. If nothing else, it will increase the technology intensity of trading from its current levels. Yet, India had over 20 stock exchanges in the past – most of them being local / territorial2. Although the Calcutta Stock Exchange continues (largely in name only), none of the other local / territorial exchanges survived against the size and liquidity of NSE and BSE (Exhibit 1). -

LONG TERM EQUITY FUND (An Open-Ended Equity Linked Savings Scheme with a 3 Year Lock-In)

KEY INFORMATION MEMORANDUM AND APPLICATION FORM Axis Asset Management Company Limited (Investment Manager) AXIS LONG TERM EQUITY FUND (An open-ended equity linked savings scheme with a 3 year lock-in) dera RISKOMETER ly Mo te Mo ate de This product is suitable for investors who are seeking* er ra d w Hi te o Lo gh ly • Capital appreciation & generating income over long term M H i g w h o • Investment in a diversified portfolio predominantly consisting of equity and equity L related instruments LOW HIGH * Investors should consult their financial advisers if in doubt about whether the product is suitable for them. Investors understand that their principal will be at Moderately high risk Offer for units at applicable NAV based prices This Key Information Memorandum (KIM) sets forth the information, which a prospective investor ought to know before investing. For further details of the scheme/Mutual Fund, due diligence certificate by the AMC, Key Personnel, investors’ rights & services, risk factors, penalties & pending litigations etc. investors should, before investment, refer to the Scheme Information Document and Statement of Additional Information available free of cost at any of the Investor Service Centres or distributors or from the website: www.axismf.com The Scheme particulars have been prepared in accordance with Securities and Exchange Board of India (Mutual Funds) Regulations 1996, as amended till date and filed with Securities and Exchange Board of India (SEBI). The units being offered for public subscription have not been approved or disapproved by SEBI, nor has SEBI certified the accuracy or adequacy of this KIM. -

Debt, Liquid & Interval Schemes

Reliance Capital Asset Management Limited A Reliance Capital Company Key Information Memorandum cum Common Application Form Debt, Liquid & Interval Schemes Continuous offer of Open-Ended Debt, Liquid & Interval Schemes at NAV based prices. Reliance Reliance Reliance Money Manager Fund Medium Term Fund Liquidity Fund An open-ended Income Scheme An open-ended Income Scheme with no assured returns An open-ended Liquid Scheme Reliance Liquid Fund Reliance Liquid Fund Reliance Floating Rate Fund - - Treasury Plan - Cash Plan Short Term Plan An open-ended Liquid scheme An open-ended Liquid scheme An open-ended Income Scheme Reliance Regular Reliance RRelianceeliance Savings Fund CorporateIncome Fund Bond Fund Short Term Fund -Debt Option A open-ended Income Scheme A open-ended Income Scheme An open-ended scheme A Open-ended Income Scheme Reliance Monthly Reliance Reliance Gilt Reliance Reliance SecuritiesReliance Fund Income Plan Dynamic Bond Fund Dynamic Bond Fund AnGil open-endedt Securities Fund. MonthlyFund Income Fund An open-ended Government An open-ended Government A open-ended Income Scheme Income is not assured & is subject to Securities Scheme A open-ended Income Scheme SecuritiesA open-ended Scheme Income Scheme the availability of distributable surplus Reliance Reliance Reliance Reliance Monthly Income Plan Interval Fund Banking & PSU Debt Fund AnInterval open-ended Fund Fund. Monthly IncomeA debt isoriented not assured Interval & is Scheme subject to A debt oriented Interval Scheme An open ended Income scheme the availability of distributable surplus SPONSOR INVESTMENT MANAGER REGISTERED OFFICE Corporate Office Corporate Office Reliance Capital Asset Management H Block, 1st Floor, Dhirubhai Ambani Knowledge City, Reliance Capital Asset Management Limited/Reliance Capital Trustee Co. -

Please Click Here to View Page 218 To

BOARD OF DIRECTORS DIRECTORS’ REPORT FOR THE FINANCIAL YEAR 2005 - 2006 Shri Subir Raha Chairman (Up to 24th May, 2006) Dear Members, Shri R. S. Sharma Chairman (From 30th May, 2006) 1. Your Directors are pleased to present the 18th Annual Report of the Company, together with the audited accounts for the financial Dr. A. K. Balyan year ended 31st March, 2006. Shri N. K. Mitra It is a matter of great satisfaction that operational performance of your Company has reached new heights of excellence during the Shri Sunjoy Joshi Government Director (Up to 31st July, 2006) year under review: Shri Prabh Das Government Director (From 2nd June, 2006) • Highest-ever capacity utilisation of 125% - which is also the highest among all refineries in India Shri V. P. Joy Government Director (Up to 17th February, 2006) • Lowest-energy consumption among all refineries with similar complexity in India Shri Arun Balakrishnan (Up to 13th July, 2006) • Highest-ever turnover of Rs. 28,243 crore and the highest-ever export earnings of Rs. 11,917 crore Shri C. N. Rao (Up to 1st September, 2005) • Lowest-ever Interest & Finance cost of Rs. 188 crore; the long term debt-equity ratio further improved to 0.87:1 Shri S. Roy Choudhury (From 1st September, 2005) • Safety record: 843 days of reportable accident-free days as on 31st March, 2006 (972 days as on 8th August, 2006) Shri M. P. Modi Nominee of ICICI Bank Ltd. (Up to 17th July, 2006) Shri G. M. Ramamurthy Nominee of IDBI Bank Ltd. 1.1 FINANCIAL PERFORMANCE Shri Girish M. -

SEBI – Chapter 6 – Administration of Stock Exchanges

भारतीय प्रततभूतत और वितिमय बो셍 ड Securities and Exchange Board of India CHAPTER 6 - ADMINISTRATION OF STOCK EXCHANGES I. ALLOTMENT OF CODES TO STOCK EXCHANGES .......................................... 3 II. SUBSIDIARY MANAGEMENT BY STOCK EXCHANGE ................................... 5 2.1 Conditions for floating/promoting a subsidiary company by small stock exchanges ........................................................................................................... 5 2.2 Eligibility criteria to become trading member and / or clearing member of the derivatives segment of BSE and NSE: ........................................................... 6 2.3 Subsidiary Management .................................................................................. 6 2.4 Responsibilities of Parent Exchange towards Subsidiary ........................... 8 2.5 Access to unauthorized persons by the members of subsidiaries ............. 9 III. ADMINISTRATION AND GOVERNANCE FOR STOCK EXCHANGES AND CLEARING CORPORATIONS ............................................................................. 10 3.1 Procedural norms on Recognitions, Ownership and Governance for Stock Exchanges and Clearing Corporations. ....................................................... 10 3.2 Facilitating transaction in Mutual Fund schemes through the Stock Exchange Infrastructure ........................................................................................... 23 3.3 Standard Operating Procedure for Suspension of Trading ...................... 24 3.4 Exit Policy