Agent Banking Activities in Bangladesh

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

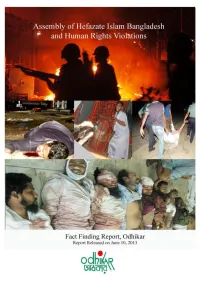

Odhikar's Fact Finding Report/5 and 6 May 2013/Hefazate Islam, Motijheel

Odhikar’s Fact Finding Report/5 and 6 May 2013/Hefazate Islam, Motijheel/Page-1 Summary of the incident Hefazate Islam Bangladesh, like any other non-political social and cultural organisation, claims to be a people’s platform to articulate the concerns of religious issues. According to the organisation, its aims are to take into consideration socio-economic, cultural, religious and political matters that affect values and practices of Islam. Moreover, protecting the rights of the Muslim people and promoting social dialogue to dispel prejudices that affect community harmony and relations are also their objectives. Instigated by some bloggers and activists that mobilised at the Shahbag movement, the organisation, since 19th February 2013, has been protesting against the vulgar, humiliating, insulting and provocative remarks in the social media sites and blogs against Islam, Allah and his Prophet Hazrat Mohammad (pbuh). In some cases the Prophet was portrayed as a pornographic character, which infuriated the people of all walks of life. There was a directive from the High Court to the government to take measures to prevent such blogs and defamatory comments, that not only provoke religious intolerance but jeopardise public order. This is an obligation of the government under Article 39 of the Constitution. Unfortunately the Government took no action on this. As a response to the Government’s inactions and its tacit support to the bloggers, Hefazate Islam came up with an elaborate 13 point demand and assembled peacefully to articulate their cause on 6th April 2013. Since then they have organised a series of meetings in different districts, peacefully and without any violence, despite provocations from the law enforcement agencies and armed Awami League activists. -

Journal of Economics and Business

Journal of Economics and Business Akther, Shahin, and Tariq, Javed. (2020), The Impact of Effective Training on Employee Retention: A Study in Private Banks of Bangladesh. In: Journal of Economics and Business, Vol.3, No.1, 96-114. ISSN 2615-3726 DOI: 10.31014/aior.1992.03.01.181 The online version of this article can be found at: https://www.asianinstituteofresearch.org/ Published by: The Asian Institute of Research The Journal of Economics and Business is an Open Access publication. It may be read, copied, and distributed free of charge according to the conditions of the Creative Commons Attribution 4.0 International license. The Asian Institute of Research Journal of Economics and Business is a peer-reviewed International Journal. The journal covers scholarly articles in the fields of Economics and Business, which includes, but not limited to, Business Economics (Micro and Macro), Finance, Management, Marketing, Business Law, Entrepreneurship, Behavioral and Health Economics, Government Taxation and Regulations, Financial Markets, International Economics, Investment, and Economic Development. As the journal is Open Access, it ensures high visibility and the increase of citations for all research articles published. The Journal of Economics and Business aims to facilitate scholarly work on recent theoretical and practical aspects of Economics and Business. The Asian Institute of Research Journal of Economics and Business Vol.3, No.1, 2020: 96-114 ISSN 2615-3726 Copyright © The Author(s). All Rights Reserved DOI: 10.31014/aior.1992.03.01.181 The Impact of Effective Training on Employee Retention: A Study in Private Banks of Bangladesh Shahin Akther1, Javed Tariq2 1 Faculty Member, Training Institute, Mercantile Bank Limited, Dhaka, Bangladesh, Email:[email protected] 2 Principal, Training Institute, Mercantile Bank Limited, Dhaka, Bangladesh Email:[email protected] Abstract This examination underlines on the affectability of variables influencing employee continuation in Banking Industry of Bangladesh. -

The Role of Islami Bank Bangladesh Limited in Economic Development of Bangladesh

ISSN: 2308-5096(P) ISSN 2311-620X (O) [International Journal of Ethics in Social Sciences Vol.4, No. 1, June 2016] The Role of Islami Bank Bangladesh Limited in Economic Development of Bangladesh Mohammed Mahbubur Rahaman1 Md. Rafiqul Islam Rafiq2 Abstract The main objective of the study is to analyze the role of IBBL in economic development of Bangladesh and to give some suggestions to overcome the challenges Islami Bank Bangladesh Ltd. (IBBL) is the pioneer of Islamic banking in Bangladesh. IBBL is performing a significant role in the development of the country. The Bank is working in the export sector from the very beginning resulting in maximizing export earnings as well as creating employment opportunities in Bangladesh. The Bank has already emerged as the top export-import bank in Bangladesh. IBBL satisfies most of the efficiency conditions if they can operate as a sole system in an economy. Conventional banking, on the other hand, does not satisfy any of the efficiency conditions analyzed in the present study. However, when Islamic banks start operation within the conventional banking framework, their efficiency goes on decreasing in a number of dimensions. 1. Introduction In a modern economy, banks are the fundamental financial intermediary. Recently they are engaged in value generating activities by assuring uninterrupted supply of financial resources and also help accelerate the pace of development process. In terms of deposit collection, investment, and foreign exchange business the Islami Bank Bangladesh Limited (IBBL) place the position of being the leading other banks, IBBL has been continuously operating their banking activities and to provide efficient banking service with a view to accelerate 1. -

Bank Code Br. Code Bank & Branch Name 01 INVESTMENT CORPORATION of BANGLADESH (ICB) 02 BRAC BANK LIMITED 03 EASTERN BANK

Bank Code Br. Code Bank & Branch Name 01 INVESTMENT CORPORATION OF BANGLADESH (ICB) 01 Head Office, Purana Paltan, Dhaka 02 Local Office, Nayapaltan, Dhaka 03 Chittagong Branch, Chittagong 04 Khulna Branch, Khulna 05 Rajshahi Branch, Rajshahi 06 Barisal Branch, Barisal 07 Sylhet Branch, Sylhet 08 Bogra Branch, Bogra 02 BRAC BANK LIMITED 01 Asad Gate Branch, Dhaka 02 Banani Branch, Dhaka 03 Bashundhara Branch, Dhaka 04 Donia Branch, Dhaka 05 Eskaton Branch, Dhaka 06 Graphics Building Branch, Motijheel, Dhaka 07 Uttara Branch, Dhaka 08 Shyamoli Branch, Dhaka 09 Gulshan Branch, Dhaka 10 Manda Branch, Dhaka 11 Mirpur Branch, , Dhaka 12 Nawabpur Branch, Dhaka 13 Rampura Branch, Dhaka 14 Narayanqani Branch, Narayanganj 15 Agrabad Branch, Chittagong 16 CDA Avenue Branch, Chittagong 17 Potia Branch, Chittagong 18 Halisohor Branch, Chittagong 19 Kazirdeuri Branch, Chittagong 20 Momin Road Branch, Chittagong 21 Bogra Branch, Bogra 22 Rajshahi Branch, Rajshahi 23 Jessore Branch, Jessore 24 Khulna Branch, Khulna 25 Barisal Branch, Barisal 26 Zindabazar Branch, Sylhet 03 EASTERN BANK LIMITED 01 Principal Branch, Dilkusha, Dhaka 02 Motijheel Branch, Dhaka 03 Mirpur Branch, Dhaka 04 Bashundhara Branch, Dhaka 05 Shyamoli Branch, Dhaka 06 Narayanganj Branch 07 Jessore Branch 08 Choumuhoni Branch 09 Agrabad Branch, Chittagong 10 Khatunganj Branch, Chittagong 11 Bogra Branch, Bogra 12 Khulna Branch, Khulna 13 Rajshahi Branch, Rajshahi 14 Savar Branch, Savar, Dhaka 15 Moulvi Bazar Branch, Sylhet Page # 1 Bank Code Br. Code Bank & Branch Name 04 BANK ASIA LIMITED 01 Principal Office , Motijheel C.A., Dhaka 02 Corporate Branch, Dhaka 03 Gulshan Branch, Dhaka 04 Uttara Branch, Dhaka 05 North South Rd. -

INTERNATIONAL FINANCE INVESTMENT and COMMERCE BANK LIMITED Audited Financial Statements As at and for the Year Ended 31 December 2019

INTERNATIONAL FINANCE INVESTMENT AND COMMERCE BANK LIMITED Audited Financial Statements as at and for the year ended 31 December 2019 INTERNATIONAL FINANCE INVESTMENT AND COMMERCE BANK LIMITED Consolidated Balance Sheet as at 31 December 2019 Amount in BDT Particulars Note 31 December 2019 31 December 2018 PROPERTY AND ASSETS Cash 18,056,029,773 16,020,741,583 Cash in hand (including foreign currency) 3.a 2,872,338,679 2,899,030,289 Balance with Bangladesh Bank and its agent bank(s) (including foreign currency) 3.b 15,183,691,094 13,121,711,294 Balance with other banks and financial institutions 4.a 5,637,834,204 8,118,980,917 In Bangladesh 4.a(i) 4,014,719,294 6,823,590,588 Outside Bangladesh 4.a(ii) 1,623,114,910 1,295,390,329 Money at call and on short notice 5 910,000,000 3,970,000,000 Investments 47,216,443,756 32,664,400,101 Government securities 6.a 41,369,255,890 27,258,506,647 Other investments 6.b 5,847,187,866 5,405,893,454 Loans and advances 232,523,441,067 210,932,291,735 Loans, cash credit, overdrafts etc. 7.a 221,562,693,268 198,670,768,028 Bills purchased and discounted 8.a 10,960,747,799 12,261,523,707 Fixed assets including premises, furniture and fixtures 9.a 6,430,431,620 5,445,835,394 Other assets 10.a 9,606,537,605 9,003,060,522 Non-banking assets 11 373,474,800 373,474,800 Total assets 320,754,192,825 286,528,785,052 LIABILITIES AND CAPITAL Liabilities Borrowing from other banks, financial institutions and agents 12.a 8,215,860,335 9,969,432,278 Subordinated debt 13 2,800,000,000 3,500,000,000 Deposits and other -

“E-Business and on Line Banking in Bangladesh: an Analysis”

“E-Business and on line banking in Bangladesh: an Analysis” AUTHORS Muhammad Mahboob Ali ARTICLE INFO Muhammad Mahboob Ali (2010). E-Business and on line banking in Bangladesh: an Analysis. Banks and Bank Systems, 5(2-1) RELEASED ON Wednesday, 07 July 2010 JOURNAL "Banks and Bank Systems" FOUNDER LLC “Consulting Publishing Company “Business Perspectives” NUMBER OF REFERENCES NUMBER OF FIGURES NUMBER OF TABLES 0 0 0 © The author(s) 2021. This publication is an open access article. businessperspectives.org Banks and Bank Systems, Volume 5, Issue 2, 2010 Muhammad Mahboob Ali (Bangladesh) E-business and on-line banking in Bangladesh: an analysis Abstract E-business has created tremendous opportunity all over the globe. On-line banking can act as a complementary factor of e-business. Bangladesh Bank has recently argued to introduce automated clearing house system. This pushed up- ward transition from the manual banking system to the on-line banking system. The study has been undertaken to ob- serve present status of the e-business and as its complementary factor on-line banking system in Bangladesh. The arti- cle analyzes the data collected from Bangladeshi banks up to February 2010 and also used snowball sampling tech- niques to gather answer from the five hundred respondents who have already been using on-line banking system on the basis of a questionnaire which was prepared for this study purpose. The study found that dealing officials of the banks are not well conversant about their desk work. The author observed that the country can benefit from successful utiliza- tion of e-business as this will help to enhance productivity. -

Bangladesh Development Bibliography List of Publications from 2000 – 2005 (As of January 16, 2012)

Bangladesh Development Bibliography List of publications from 2000 – 2005 (as of January 16, 2012) Aaby, Peter; Abbas Bhuiya; Lutfun Nahar; Kim Knudsen; Andres de Francisco; and Michael Strong (2003) The survival benefit of measles immunization may not be explained entirely by the prevention of measles disease: a community study from rural Bangladesh ; International Journal of Epidemiology, Vol. 32, No. 1 (February), pp. 106-115. Abbasi, Kamran (2002) Health policy in action: the World Bank in South Asia; Brighton, UK: University of Sussex, Institute of Development Studies (IDS). Abdalla, Amr; A. N. M. Raisuddin; and Suleiman Hussein with the assistance of Dhaka Ahsania Mission (2004) Bangladesh Educational Assessment - Pre-primary and Primary Madrasah Education in Bangladesh ; Washington, DC, USA: United States Agency for International Development (USAID) for Basic Education and Policy Support (BEPS) Activity (Contract No. HNE-I-00-00-00038-00) (June). Abdullah, Abu (2001) The Bangladesh Economy in the Year 2000: Achievements and Failures; In: Abu Abdullah (ed.) Bangladesh Economy 2000: Selected issues (Dhaka: Bangladesh Institute of Development Studies (BIDS)), pp. xv-xxix. Abdullah, Abu (ed.) (2001) Bangladesh Economy 2000: Selected Issues; Dhaka, Bangladesh: University Press Ltd. and Bangladesh Institute of Development Studies. Abdullah, Abu A. (2000) Social Change and ‘Modernisation‘; In: Rounaq Jahan (ed.) Bangladesh: Promise and Performance (London, UK: Zed Books; and Dhaka, Bangladesh: The University Press), Chapter 5. Abdullah, Mohammad (ed.) (2004) Technologies on Livestock and Fisheries for Poverty Alleviation in SAARC Countries; Dhaka, Bangladesh: SAARC Agricultural Information Centre (SAIC). Abdullah, S. T.; Mullineux, A. W.; Fielding, A.; and W. Spanjers (2004) Intra-household resource allocation and bargaining power of the women using micro-credit in Bangladesh; Birmingham, UK: University of Birmingham, Department of Economics Discussion Paper, No. -

Agent Banking, the Revolution in Financial Service Sector of Bangladesh

IOSR Journal of Economics and Finance (IOSR-JEF) e-ISSN: 2321-5933, p-ISSN: 2321-5925.Volume 5, Issue 1. (Jul-Aug. 2014), PP 28-32 www.iosrjournals.org Agent banking, the revolution in financial service sector of Bangladesh Md. Razib Siddiquie (Department of Business Administration, University of Asia Pacific, Bangladesh) Abstract: Agent banking is one of the most popular financial services in the world where there are difficulties in accessing geographical locations easily. And that is why agent banking is very successful in Latin America & Africa. Other developed like United Kingdom, Australia etc countries are also gradually deploying agent banking because it reduces the cost of operating of the bank. Most of the services of a bank can be provided through agents, thus people of remotest area of a country can be brought under proper financial structure by the virtue of agent banking. According to the agent banking guideline the software of any individual agent will be connected to the core software of the bank, so transactions that will take place in agent premises will be shown in the banking system real-time and those transactional statements can be used anywhere and everywhere for different purposes of the client. I have done my research on agent banking and its prospect for last one year and finally prepared this paper. Keywords: Alternative Banking, Internet service provider, Bank, Regulation, vision I. Introduction of Agent banking in Bangladesh: People's Republic of Bangladesh, a delta in South Asia, Bangladesh shares large borders with India and a small southern strip with Myanmar. Bangladesh is home to the Ganges, the Brahmaputra and the Meghna rivers, and networks of smaller rivers and canals. -

Independent Auditor's Report and Audited Consolidated & Separate Financial Statements for the Year Ended 31 December 2016

Dhaka Bank Limited and its subsidiaries Independent Auditor's Report and Audited Consolidated & Separate Financial Statements For the year ended 31 December 2016 BDBL Bhaban (Level -13 & 14), 12 Kawran Bazar Commercial Area, Dhaka - 1215, Bangladesh. ACNABIN Cbartered Accowntants BDBL Bhaban (Level-13 & 14) Telephone: (88 02) 81.44347 ro 52 1.2 Kawran Bazar Commercial Area (88 02) 8189428 to 29 Dhaka-121.5, Bangladesh. Facsimile: (88 02) 8144353 e-mail: <[email protected]> Web: www.acnabin.com INDEPENDENT AUDITOR'S REPORT TO THE SHAREHOLDERS OF DHAKA BANK LIMITED Report on the Financial Statements We have audited the accompanying consolidated financial statements of Dhaka Bank Limited and its subsidiaries namely Dhaka Bank Securities Limited and Dhaka Bank Investment Limited ("the Group") as well as the separate financial statements of Dhaka Bank Limited ("the Bank"), which comprise the consolidated balance sheet of the Group and the separate balance sheet as at 31" December 2016 and the consolidated and separate profit and loss accounts, consolidated and separate statements of changes in equity and consolidated and separate cash flow statements for the year then ended and a summary of significant accounting policies and other explanatory information. Management's Responsibility for the Financial Statements and Internal Controls Management is responsible for the preparation of consolidated financial statements of the Group and also the separate financial statements of the Bank that give a true and fair view in accordance with Bangladesh -

Sl. Correspondent / Bank Name SWIFT Code Country

International Division Relationship Management Application( RMA ) Total Correspondent: 156 No. of Country: 36 Sl. Correspondent / Bank Name SWIFT Code Country 1 ISLAMIC BANK OF AFGHANISTAN IBAFAFAKA AFGHANISTAN 2 MIZUHO BANK, LTD. SYDNEY BRANCH MHCBAU2S AUSTRALIA 3 STATE BANK OF INDIA AUSTRALIA SBINAU2S AUSTRALIA 4 KEB HANA BANK, BAHRAIN BRANCH KOEXBHBM BAHRAIN 5 MASHREQ BANK BOMLBHBM BAHRAIN 6 NATIONAL BANK OF PAKISTAN NBPABHBM BAHRAIN 7 AB BANK LIMITED ABBLBDDH BANGLADESH 8 AGRANI BANK LIMITED AGBKBDDH BANGLADESH 9 AL-ARAFAH ISLAMI BANK LTD. ALARBDDH BANGLADESH 10 BANGLADESH BANK BBHOBDDH BANGLADESH 11 BANGLADESH COMMERCE BANK LIMITED BCBLBDDH BANGLADESH BANGLADESH DEVELOPMENT BANK 12 BDDBBDDH BANGLADESH LIMITED (BDBL) 13 BANGLADESH KRISHI BANK BKBABDDH BANGLADESH 14 BANK ASIA LIMITED BALBBDDH BANGLADESH 15 BASIC BANK LIMITED BKSIBDDH BANGLADESH 16 BRAC BANK LIMITED BRAKBDDH BANGLADESH 17 COMMERCIAL BANK OF CEYLON LTD. CCEYBDDH BANGLADESH 18 DHAKA BANK LIMITED DHBLBDDH BANGLADESH 19 DUTCH BANGLA BANK LIMITED DBBLBDDH BANGLADESH 20 EASTERN BANK LIMITED EBLDBDDH BANGLADESH EXPORT IMPORT BANK OF BANGLADESH 21 EXBKBDDH BANGLADESH LTD 22 FIRST SECURITY ISLAMI BANK LIMITED FSEBBDDH BANGLADESH 23 HABIB BANK LTD HABBBDDH BANGLADESH 24 ICB ISLAMI BANK LIMITED BBSHBDDH BANGLADESH INTERNATIONAL FINANCE INVESTMENT 25 IFICBDDH BANGLADESH AND COMMERCE BANK LTD (IFIC BANK) 26 ISLAMI BANK LIMITED IBBLBDDH BANGLADESH 27 JAMUNA BANK LIMITED JAMUBDDH BANGLADESH 28 JANATA BANK LIMITED JANBBDDH BANGLADESH 29 MEGHNA BANK LIMITED MGBLBDDH BANGLADESH 30 MERCANTILE -

Policy Analysis Unit* (PAU)

Policy Analysis Unit* (PAU) Policy Note Series: PN 0703 Recent Experiences in the Foreign Exchange and Money Markets Md. Habibur Rahman, Ph. D Shubhasish Barua Policy Analysis Unit Research Department Bangladesh Bank September 2006 Copyright © 2006 by Bangladesh Bank * The Bangladesh Bank (BB), in cooperation with the World Bank Institute (WBI), has formed the Policy Analysis Unit (PAU) within its Research Department in July 2005. The aim behind this initiative is to upgrade the capacity for research and policy analysis at BB. As part of its mandate PAU will prepare and publish, among other, several Policy Notes on macroeconomic issues every quarter. The precise topics of these Notes are chosen by the Resident Economic Adviser in consultation with the senior management of the Bangladesh Bank. These papers are primarily intended as background documents for the policy guidance of the senior management of BB. Neither the Board of Directors nor the management of the Bangladesh Bank, nor WBI, nor any agency of the Government of Bangladesh or the World Bank Group necessarily endorses any or all of the views expressed in these papers. The latter reflect the judgment based on professional analysis carried out by the staff of the Policy Analysis Unit, and hence the usual caveat as to the veracity of research reports applies. [An electronic version of this paper is available at www.bangladeshbank.org.bd] i Recent Experiences in the Foreign Exchange and Money Markets Md. Habibur Rahman, Ph. D∗ and Shubhasish Barua∗ September 2006 Abstract Over the last two fiscal years both the foreign exchange and the money markets in Bangladesh experienced notable volatility, which resulted in substantial depreciation of BDT against major currencies and a temporary rise in the interest rate in the money market. -

Banking Sector Performance, Regulation and Bank Supervision

Chapter-5 Banking Sector Performance, Regulation and Bank Supervision 5.1 Bangladesh Bank (BB) continued to measures initiated by BB for banks and financial focus on strengthening the financial system and institutions and also the industry statistics of the improving functioning of the various segments. banking sector and the performances trends. The broad parameters of the reforms undertaken during the year comprised ongoing A. Banking Sector Performance deregulation of the operation of institutions within the BB's regulatory ambit, tightening of 5.2 The banking sector of Bangladesh prudential regulation and improvement in comprises of four categories of scheduled supervisory oversight, expanding transparency banks. These are state-owned commercial and market disclosure, all with a view to banks (SCBs), state-owned development improving overall efficiency and stability of the finance institutions (DFIs), private commercial financial system. The following paragraphs banks (PCBs) and foreign commercial banks highlight the recent regulatory and supervisory (FCBs). The number of banks remained Table 5.1 Banking system structure (billion Taka) 2006 2007 Bank Number Number of Total %of Deposits % of Number Number of Total %of Deposits % of types of banks branches assets industry deposits of banks branches assets industry deposits assets assets SCBs 4 3384 786.7 32.7 654.1 35.2 4 3383 917.9 33.1 699.7 32.6 DFIs 5 1354 187.2 7.8 100.2 5.4 5 1359 201.7 7.3 115.6 5.4 PCBs 30 1776 1147.8 47.7 955.5 51.3 30 1922 1426.6 51.4 1150.2 53.5 FCBs 09 48 284.9 11.8 150.8 8.1 09 53 227.7 8.2 183.4 8.5 Total 48 6562 2406.7 100.0 1860.6 100.0 48 6717 2773.9 100.0 2148.9 100.0 unchanged at 48 in 2007.