Georgian Tourism in Figures Structure & Industry Data

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

08-06-2021 Airline Ticket Matrix (Doc 141)

Airline Ticket Matrix 1 Supports 1 Supports Supports Supports 1 Supports 1 Supports 2 Accepts IAR IAR IAR ET IAR EMD Airline Name IAR EMD IAR EMD Automated ET ET Cancel Cancel Code Void? Refund? MCOs? Numeric Void? Refund? Refund? Refund? AccesRail 450 9B Y Y N N N N Advanced Air 360 AN N N N N N N Aegean Airlines 390 A3 Y Y Y N N N N Aer Lingus 053 EI Y Y N N N N Aeroflot Russian Airlines 555 SU Y Y Y N N N N Aerolineas Argentinas 044 AR Y Y N N N N N Aeromar 942 VW Y Y N N N N Aeromexico 139 AM Y Y N N N N Africa World Airlines 394 AW N N N N N N Air Algerie 124 AH Y Y N N N N Air Arabia Maroc 452 3O N N N N N N Air Astana 465 KC Y Y Y N N N N Air Austral 760 UU Y Y N N N N Air Baltic 657 BT Y Y Y N N N Air Belgium 142 KF Y Y N N N N Air Botswana Ltd 636 BP Y Y Y N N N Air Burkina 226 2J N N N N N N Air Canada 014 AC Y Y Y Y Y N N Air China Ltd. 999 CA Y Y N N N N Air Choice One 122 3E N N N N N N Air Côte d'Ivoire 483 HF N N N N N N Air Dolomiti 101 EN N N N N N N Air Europa 996 UX Y Y Y N N N Alaska Seaplanes 042 X4 N N N N N N Air France 057 AF Y Y Y N N N Air Greenland 631 GL Y Y Y N N N Air India 098 AI Y Y Y N N N N Air Macau 675 NX Y Y N N N N Air Madagascar 258 MD N N N N N N Air Malta 643 KM Y Y Y N N N Air Mauritius 239 MK Y Y Y N N N Air Moldova 572 9U Y Y Y N N N Air New Zealand 086 NZ Y Y N N N N Air Niugini 656 PX Y Y Y N N N Air North 287 4N Y Y N N N N Air Rarotonga 755 GZ N N N N N N Air Senegal 490 HC N N N N N N Air Serbia 115 JU Y Y Y N N N Air Seychelles 061 HM N N N N N N Air Tahiti 135 VT Y Y N N N N N Air Tahiti Nui 244 TN Y Y Y N N N Air Tanzania 197 TC N N N N N N Air Transat 649 TS Y Y N N N N N Air Vanuatu 218 NF N N N N N N Aircalin 063 SB Y Y N N N N Airlink 749 4Z Y Y Y N N N Alaska Airlines 027 AS Y Y Y N N N Alitalia 055 AZ Y Y Y N N N All Nippon Airways 205 NH Y Y Y N N N N Amaszonas S.A. -

Seasonal Schedule of the International Airport Borispol, Winter 2019-2020

BORYSPIL INTERNATIONAL AIRPORT SEASON TIMETABLE WINTER 2019-2020 Notes: The timetable is for information only and may not contain the most up-to-date information. For the most up-to-date information, please visit online timetable at https://kbp.aero. Thetimetable contains information on scheduled passenger flights. The arrival/departure time is local (UTC +2h) Numbers in «Days of Operation» column correspond to the day of week (1 – Monday, … 7 – Sunday), 0 – no flights in this day of the week. Airport Flight Departure Days of Date of Date of Destination City Airlines Terminal Code Number Time Operation Ops Start Ops End DEPARTURES Alicante ALC SkyUP Airlines PQ 731 12:00 0200000 24.12.2019 24.03.2020 F Alicante ALC SkyUP Airlines PQ 731 12:00 0004000 31.10.2019 26.03.2020 F Alicante ALC SkyUP Airlines PQ 731 12:00 0000007 10.11.2019 22.03.2020 F Almaty ALA Air Astana KC 406 09:40 1000000 28.10.2019 23.03.2020 D Almaty ALA Air Astana KC 406 09:40 0000500 01.11.2019 27.03.2020 D Almaty ALA Air Astana KC 402 20:40 0200000 29.10.2019 24.12.2019 D Almaty ALA Air Astana KC 402 20:40 0200000 07.01.2020 24.03.2020 D Almaty ALA Air Astana KC 402 20:40 0030000 30.10.2019 25.03.2020 D Almaty ALA Air Astana KC 402 20:40 0000007 27.10.2019 22.03.2020 D Almaty ALA Air Astana KC 402 21:15 0004060 31.10.2019 28.03.2020 D Amman AMM Bravo Airways BAY 781 11:15 0000060 23.11.2019 28.03.2020 F Amsterdam AMS Ukraine International Airlines PS 101 10:00 1234567 27.10.2019 28.03.2020 D Amsterdam AMS KLM KL 1386 13:55 1234567 28.10.2019 28.03.2020 D Ankara ESB -

Monthly OTP July 2019

Monthly OTP July 2019 ON-TIME PERFORMANCE AIRLINES Contents On-Time is percentage of flights that depart or arrive within 15 minutes of schedule. Global OTP rankings are only assigned to all Airlines/Airports where OAG has status coverage for at least 80% of the scheduled flights. Regional Airlines Status coverage will only be based on actual gate times rather than estimated times. This July result in some airlines / airports being excluded from this report. If you would like to review your flight status feed with OAG pleas [email protected] MAKE SMARTER MOVES Airline Monthly OTP – July 2019 Page 1 of 1 Home GLOBAL AIRLINES – TOP 50 AND BOTTOM 50 TOP AIRLINE ON-TIME FLIGHTS On-time performance BOTTOM AIRLINE ON-TIME FLIGHTS On-time performance Airline Arrivals Rank No. flights Size Airline Arrivals Rank No. flights Size SATA International-Azores GA Garuda Indonesia 93.9% 1 13,798 52 S4 30.8% 160 833 253 Airlines S.A. XL LATAM Airlines Ecuador 92.0% 2 954 246 ZI Aigle Azur 47.8% 159 1,431 215 HD AirDo 90.2% 3 1,806 200 OA Olympic Air 50.6% 158 7,338 92 3K Jetstar Asia 90.0% 4 2,514 168 JU Air Serbia 51.6% 157 3,302 152 CM Copa Airlines 90.0% 5 10,869 66 SP SATA Air Acores 51.8% 156 1,876 196 7G Star Flyer 89.8% 6 1,987 193 A3 Aegean Airlines 52.1% 155 5,446 114 BC Skymark Airlines 88.9% 7 4,917 122 WG Sunwing Airlines Inc. -

356 Partners Found. Check If Available in Your Market

367 partners found. Check if available in your market. Please always use Quick Check on www.hahnair.com/quickcheck prior to ticketing P4 Air Peace BG Biman Bangladesh Airl… T3 Eastern Airways 7C Jeju Air HR-169 HC Air Senegal NT Binter Canarias MS Egypt Air JQ Jetstar Airways A3 Aegean Airlines JU Air Serbia 0B Blue Air LY EL AL Israel Airlines 3K Jetstar Asia EI Aer Lingus HM Air Seychelles BV Blue Panorama Airlines EK Emirates GK Jetstar Japan AR Aerolineas Argentinas VT Air Tahiti OB Boliviana de Aviación E7 Equaflight BL Jetstar Pacific Airlines VW Aeromar TN Air Tahiti Nui TF Braathens Regional Av… ET Ethiopian Airlines 3J Jubba Airways AM Aeromexico NF Air Vanuatu 1X Branson AirExpress EY Etihad Airways HO Juneyao Airlines AW Africa World Airlines UM Air Zimbabwe SN Brussels Airlines 9F Eurostar RQ Kam Air 8U Afriqiyah Airways SB Aircalin FB Bulgaria Air BR EVA Air KQ Kenya Airways AH Air Algerie TL Airnorth VR Cabo Verde Airlines FN fastjet KE Korean Air 3S Air Antilles AS Alaska Airlines MO Calm Air FJ Fiji Airways KU Kuwait Airways KC Air Astana AZ Alitalia QC Camair-Co AY Finnair B0 La Compagnie UU Air Austral NH All Nippon Airways KR Cambodia Airways FZ flydubai LQ Lanmei Airlines BT Air Baltic Corporation Z8 Amaszonas K6 Cambodia Angkor Air XY flynas QV Lao Airlines KF Air Belgium Z7 Amaszonas Uruguay 9K Cape Air 5F FlyOne LA LATAM Airlines BP Air Botswana IZ Arkia Israel Airlines BW Caribbean Airlines FA FlySafair JJ LATAM Airlines Brasil 2J Air Burkina OZ Asiana Airlines KA Cathay Dragon GA Garuda Indonesia XL LATAM Airlines -

Market Segmentation in Air Transportation in Slovak Republic

Volume XXI, 40 – No.1, 2019, DOI: 10.35116/aa.2019.0006 MARKET SEGMENTATION IN AIR TRANSPORTATION IN SLOVAK REPUBLIC Marek PILAT*, Stanislav SZABO, Sebastian MAKO, Miroslava FERENCOVA Technical university of Kosice, Faculty of aeronautics *Corresponding author. [email protected] Abstract. This article talks about segmentation of air transport market in the Slovak Republic. The main goal was to explore all regular flights from three International airports in Slovak Republic. The researched airports include M.R. Štefánik in Bratislava, Košice International Airport and Poprad - Tatry Airport. The reason for the selection of airports was focused on scheduled flights. The main output of the work is a graphical representation of scheduled flights operated from the territory of the Slovak Republic. The work includes an overview of airlines, destinations, attractions, and other useful information that has come up with this work. Keywords: Airport; segmentation; scheduled flights 1. INTRODUCTION The main aim of this article is to point out the coverage of the air transport market from the territory of the Slovak Republic. Initial information was processed for three International airports and their regular flights to different parts of the world. We chose M.R. Stefanik in Bratislava, Kosice International Airport and Poprad - Tatry Airport. In practical part the authors collected all regular flights from the airports and processed them in table form. All these lines were needed to develop a comprehensive graphical model which is also the main output. The graphical model clearly shows where it can be reached from the territory of the Slovak Republic by a direct route. All data is current for the 2018/2019 Winter Timetable with all the current changes, whether in terms of line cancellation or adding new carriers to new destinations. -

The Treasures of Georgia 10 - 21 September 2022

THE TREASURES OF GEORGIA 10 - 21 SEPTEMBER 2022 FROM £3,395 PER PERSON Tour Leader: Bridget Wheeler RICH HERITAGE, MEDIEVAL HISTORY & NATURAL BEAUTY Situated between the subtropical Black Sea coast, the Caspian Sea and the snowy peaks of the Caucasus, the state of Georgia sits at the crossroads of Europe and Asia. Georgia’s rich heritage has been hugely influenced by both Byzantine and Persian cultures. With Russia (and Chechnya, Ingushetia, Kabardino-Balkar, North Osetia-Alania) to the north, Turkey to the west, Armenia and Iran to the south and Azerbaijan to the east, Georgia remains a fiercely independent nation after years of oppression by the Russian Tsars and the Soviet Union. Georgia’s mix of natural beauty and medieval history has made this small country one of Eastern Europe’s most fascinating destinations. Bodbe Monastery Uplistsikhe Alazani Valley 12-DAY ITINERARY, DEPARTING 10 SEPTEMBER 2022 10 September London ancient land of Colchis, spectacular and filled with historical sights. modern and contemporary paintings Visit Bodbe Nunnery, just outside Suggested flights (not included in the by Georgian artists and masterpieces Sighnaghi. In the 4th century, after cost of the tour) Georgian Airways of Oriental, Western European and Georgia converted to Christianity, A9 752 departing London Gatwick at Russian decorative arts. Dinner at a Saint Nino, the queen responsible for 22.50 hrs. local restaurant. the conversion, withdrew to Bodbe Gorge where she died. She wanted 11 September Tbilisi to be buried in a church in Bodbe 12 September Tbilisi Arrive Tbilisi at 06.35 hrs. Transfer and rather than being taken away to be Morning walking tour of Tbilisi. -

Global Volatility Steadies the Climb

WORLD AIRLINER CENSUS Global volatility steadies the climb Cirium Fleet Forecast’s latest outlook sees heady growth settling down to trend levels, with economic slowdown, rising oil prices and production rate challenges as factors Narrowbodies including A321neo will dominate deliveries over 2019-2038 Airbus DAN THISDELL & CHRIS SEYMOUR LONDON commercial jets and turboprops across most spiking above $100/barrel in mid-2014, the sectors has come down from a run of heady Brent Crude benchmark declined rapidly to a nybody who has been watching growth years, slowdown in this context should January 2016 low in the mid-$30s; the subse- the news for the past year cannot be read as a return to longer-term averages. In quent upturn peaked in the $80s a year ago. have missed some recurring head- other words, in commercial aviation, slow- Following a long dip during the second half Alines. In no particular order: US- down is still a long way from downturn. of 2018, oil has this year recovered to the China trade war, potential US-Iran hot war, And, Cirium observes, “a slowdown in high-$60s prevailing in July. US-Mexico trade tension, US-Europe trade growth rates should not be a surprise”. Eco- tension, interest rates rising, Chinese growth nomic indicators are showing “consistent de- RECESSION WORRIES stumbling, Europe facing populist backlash, cline” in all major regions, and the World What comes next is anybody’s guess, but it is longest economic recovery in history, US- Trade Organization’s global trade outlook is at worth noting that the sharp drop in prices that Canada commerce friction, bond and equity its weakest since 2010. -

Flights to Tbilisi

Flights to Tbilisi ISTANBUL-TBILISI TURKISH AIRLINE EVERYDAY TK 384 246 IST I TBS 0705 1020 TK 386 X35 IST I TBS 0005 0320 TK 382 D IST I TBS 1310 1625 PEGASUS EVERY DAY PC 462 D SAW TBS 2340 0250+1 TBILISI-ISTANBUL TURKISH AIRLINE EVERYDAY TK 387 35 TBS IST I 0415 0545 TK 385 246 TBS IST I 1120 1250 TK 383 D TBS IST I 1715 1845 PEGASUS EVERY DAY PC 463 X4 TBS SAW 0440 0600 ----------------------------------------------------------- DOHA TBILSI QATAR AIRWAYS EVERY DAY QR 976 1367 DOH 2 TBS 1300 1905 TBILSI -DOHA QATAR AIRWAYS EVERY DAY TBS DOH 2 1505 1905 ------------------------------------------------------- VIENNA TBILISI GEORGIAN AIRWAYS SUNDAY AND THURSDAY A9 682 4 VIE TBS 1045 1600 TBILISI-VIENNA GEORGIAN AIRWAYS SUNDAY AND THURSDAY A9 681 4 TBS VIE 0815 0945 --------------------------------------------------------- AMSTERDAM TBILISI GEORGIAN AIRWAYS MONDAY, SATURDAY A9 652 16 AMS TBS 1040 1715 TBILISI-AMSTERDAM GEORGIAN AIRWAYS MONDAY, SATURDAY A9 651 16 TBS AMS 0510 0745 --------------------------------------------------------- PARIS TBILISI GEORGIAN AIRWAYS FRIDAY A9 628 5 CDG2D TBS 1110 1750 TBILISI-PARIS GEORGIAN AYRWAYS FRIDAY A9 627 5 TBS CDG2D 0720 1020 --------------------------------------------------------- PRAGUE TBILISI CZECH AIRLINES MONDAY, WEDNESDAY, FRIDAY OK 934 35 PRG 1 TBS 2200 0340+1 PRAGUE TBILISI CZECH AIRLINES TUESDAY, THURSDAY, SATURDAY OK 935 46 TBS PRG 1 0430 0625 TBILISI KIEV FLY GEORGIA TUESDAY, FRIDAY, SUNDAY 9Y 221 257 TBS KBP 1705 1820 ------------------------------------------------------------ KIEV -

List of Government-Owned and Privatized Airlines (Unofficial Preliminary Compilation)

List of Government-owned and Privatized Airlines (unofficial preliminary compilation) Governmental Governmental Governmental Total Governmental Ceased shares shares shares Area Country/Region Airline governmental Governmental shareholders Formed shares operations decreased decreased increased shares decreased (=0) (below 50%) (=/above 50%) or added AF Angola Angola Air Charter 100.00% 100% TAAG Angola Airlines 1987 AF Angola Sonair 100.00% 100% Sonangol State Corporation 1998 AF Angola TAAG Angola Airlines 100.00% 100% Government 1938 AF Botswana Air Botswana 100.00% 100% Government 1969 AF Burkina Faso Air Burkina 10.00% 10% Government 1967 2001 AF Burundi Air Burundi 100.00% 100% Government 1971 AF Cameroon Cameroon Airlines 96.43% 96.4% Government 1971 AF Cape Verde TACV Cabo Verde 100.00% 100% Government 1958 AF Chad Air Tchad 98.00% 98% Government 1966 2002 AF Chad Toumai Air Tchad 25.00% 25% Government 2004 AF Comoros Air Comores 100.00% 100% Government 1975 1998 AF Comoros Air Comores International 60.00% 60% Government 2004 AF Congo Lina Congo 66.00% 66% Government 1965 1999 AF Congo, Democratic Republic Air Zaire 80.00% 80% Government 1961 1995 AF Cofôte d'Ivoire Air Afrique 70.40% 70.4% 11 States (Cote d'Ivoire, Togo, Benin, Mali, Niger, 1961 2002 1994 Mauritania, Senegal, Central African Republic, Burkino Faso, Chad and Congo) AF Côte d'Ivoire Air Ivoire 23.60% 23.6% Government 1960 2001 2000 AF Djibouti Air Djibouti 62.50% 62.5% Government 1971 1991 AF Eritrea Eritrean Airlines 100.00% 100% Government 1991 AF Ethiopia Ethiopian -

Company Position Aeroflot Chief Division (Spares & Logistics

Company Position Chief Division (Spares & Logistics Procurement Aeroflot Department) Deputy Division Chief (Spares & Logistics Aeroflot Procurement Department) Aeroflot Leading Expert Contract Division Aeroflot Head of Production Support Service Air Astana Technical Procurement Supervisor Air Astana Technical Procurement Manager Air Astana Senior Technical Procurement Executive Air Company Alrosa Head of Material Support Department Aquila Technics Shareholder Aquila Technics Head of Logistics Department ATRAN LLC Head of Procurement Department Aurora Airlines Technical Director Aurora Airlines Lead Engineer Aurora Airlines Head of Aircraft preparation Department Avia Traffic Head of Engineering Avia Traffic Technical Director Belavia First Deputy Director General BELAVIA - Belarusian Airlines Production Manager BELAVIA - Belarusian Airlines The Chief of Logistic and Procurement Department BELAVIA - Belarusian Airlines Head of logistic and Procurement Department Deputy Head of logistic and Procurement BELAVIA - Belarusian Airlines Department BH Air Manager logistics departments and store Cargo Air Director of Maintenance & Engineering Cargo Air Expert Logistics Ellinair Purchasing Manager FLY ONE S.R.L. Technical Director Georgian Airways Technical Director I FLY Airlines Head of Purchasing Department I FLY Airlines Deputy General Director Yakutia Airlines Maintenance Support Department Manager JAT Technika Head of Material Planning, Purchasing and Logistics Job Air CEO JSC Nordavia-RA Head of Logistic Department Linetech Managing Partner Meridiana Head of Base Vice President, Maintenance and Engineering My Way Airlines Director MIAT (Mongolian Airlines) Manager of Material Department Orange2Fly CEO Rossiya Airlines Head of Logistics & Purchasing Division Rossiya Airlines Deputy Head of Logistics & Purchasing Department Rossiya Airlines Deputy Head Rossiya Airlines Procurement Director Rossiya Airlines Head of Logstics Silk Way Technics Director, Supply Chain Management TS Technic CEO Deputy Head of Budget Planning and Material Support Division. -

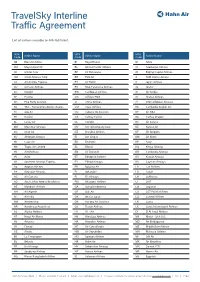

Travelsky Interline Traffic Agreement

TravelSky Interline Traffic Agreement List of airlines issuable on HR-169 ticket. IATA IATA IATA Code Airline Name Code Airline Name Code Airline Name 0B Blue Air Airline BI Royal Brunei IZ Arkia 2M Maya Island Air BL Jetstar Pacific Airlines J2 Azerbaijan Airlines 3K Jetstar Asia BP Air Botswana JD Beijing Capital Airlines 3M Silver Airways Corp BR EVA Air JJ TAM Linhas Aereas 3S Air Antilles Express BT Air Baltic JL Japan Airlines 3U Sichuan Airlines BV Blue Panorama Airlines JQ Jetstar 4O Interjet BW Caribbean Airlines JU Air Serbia 5F FlyOne CG Airlines PNG JX Starlux Airlines 5H Five Forty Aviation CI China Airlines JY Intercaribbean Airways 5U TAG - Transportes Aereos Guate... CM Copa Airlines K6 Cambodia Angkor Air 7C Jeju Air CU Cubana de Aviacion K7 Air KBZ 7R Rusline CX Cathay Pacific KA Cathay Dragon 8L Lucky Air DE Condor KC Air Astana 8M Myanmar Airways DV JSC Aircompany Scat KE Korean Air 8Q Onur Air DZ Donghai Airlines KF Air Belgium 8U Afriqiyah Airways EI Aer Lingus KM Air Malta 9K Cape Air EK Emirates KP Asky 9N Tropic Air Limited EL Ellinair KQ Kenya Airways 9U Air Moldova EN Air Dolomiti KR Cambodia Airways 9V Avior ET Ethiopian Airlines KU Kuwait Airways 9X Southern Airways Express EY Etihad Airways KX Cayman Airways A3 Aegean Airlines FB Bulgaria Air LA Lan Airlines A9 Georgian Airways FI Icelandair LG Luxair AC Air Canada FJ Fiji Airways LH Lufthansa AD Azul Linhas Aereas Brasileiras FM Shanghai Airlines LI LIAT AE Mandarin Airlines GA Garuda Indonesia LM Loganair AH Air Algerie GF Gulf Air LO LOT Polish Airlines -

IATA Airline Designators Air Kilroe Limited T/A Eastern Airways T3 * As Avies U3 Air Koryo JS 120 Aserca Airlines, C.A

Air Italy S.p.A. I9 067 Armenia Airways Aircompany CJSC 6A Air Japan Company Ltd. NQ Arubaanse Luchtvaart Maatschappij N.V Air KBZ Ltd. K7 dba Aruba Airlines AG IATA Airline Designators Air Kilroe Limited t/a Eastern Airways T3 * As Avies U3 Air Koryo JS 120 Aserca Airlines, C.A. - Encode Air Macau Company Limited NX 675 Aserca Airlines R7 Air Madagascar MD 258 Asian Air Company Limited DM Air Malawi Limited QM 167 Asian Wings Airways Limited YJ User / Airline Designator / Numeric Air Malta p.l.c. KM 643 Asiana Airlines Inc. OZ 988 1263343 Alberta Ltd. t/a Enerjet EG * Air Manas Astar Air Cargo ER 423 40-Mile Air, Ltd. Q5 * dba Air Manas ltd. Air Company ZM 887 Astra Airlines A2 * 540 Ghana Ltd. 5G Air Mandalay Ltd. 6T Astral Aviation Ltd. 8V * 485 8165343 Canada Inc. dba Air Canada rouge RV AIR MAURITIUS LTD MK 239 Atlantic Airways, Faroe Islands, P/F RC 767 9 Air Co Ltd AQ 902 Air Mediterranee ML 853 Atlantis European Airways TD 9G Rail Limited 9G * Air Moldova 9U 572 Atlas Air, Inc. 5Y 369 Abacus International Pte. Ltd. 1B Air Namibia SW 186 Atlasjet Airlines Inc. KK 610 ABC Aerolineas S.A. de C.V. 4O * 837 Air New Zealand Limited NZ 086 Auric Air Services Limited UI * ABSA - Aerolinhas Brasileiras S.A. M3 549 Air Niamey A7 Aurigny Air Services Limited GR 924 ABX Air, Inc. GB 832 Air Niugini Pty Limited Austrian Airlines AG dba Austrian OS 257 AccesRail and Partner Railways 9B * dba Air Niugini PX 656 Auto Res S.L.U.