Interim Report 2021 中期報告

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bay State Games' Hall of Fame Inductees Honored at June

BAY STATE GAMES’ HALL OF FAME INDUCTEES HONORED AT JUNE 16 RED SOX-BRAVES GAME Mansfield’s Greg Derr, Somerset’s Joe LeMar & Gloucester’s David Harrison Join Past Inductees Carlos Pena & Rich Hill of MLB; Celtics Reggie Lewis & Dana Barros; Winter Olympians Bill Cleary & Nancy Kerrigan, and the NHL’s Bill Guerin BOSTON – Former Olympian Greg Derr of Mansfield, longtime Bay Sate Games volunteer David E. Harrison of Gloucester, and Paralympian Joe LeMar of Somerset, were honored for their recent induction into the Bay State Games’ Hall of Fame during the Red Sox-Atlanta Braves pre-game ceremonies at Fenway Park on Tuesday, June 16. The Bay State Games Hall of Fame was created to recognize past participants who have gone on to prestigious and successful athletic careers, as well as former and current coaches, officials, sports organizers, and volunteers who have made significant contributions to the organization throughout its 30-year history. Past inductees include the NBA’s Dana Barros (`06) and the late Reggie Lewis (`02); the NHL’s Bill Guerin (`09); Major League Baseball’s Carlos Pena (`11) and Rich Hill (`13); and Winter Olympians Nancy Kerrigan (`07), and Bill Cleary (`14). Mansfield’s Greg Derr is a former Olympian (`96) and longtime participant in the Bay States Games pistol shooting competition. He is a former U.S. National Champion, represented the U.S. in world competitions for six years, and set multiple NRA national records. In 1992, he founded the gunsmith shop Derr Precision, which specializes in Olympic-style pistols of European origin. In 1990, Brockton’s Joe LeMar was the New England High School Indoor Track Boy’s Champion in the mile run and participated in the Bay State Games. -

Richard Rodríguez Fue Juramentado

READ RUMBO ONLINE! RUMBONEWS.COM DECEMBER 22,RUMBONEWS.COM 2016 • EDITION 560 • LAWRENCE,FREE! MA •TAKE YEAR ONE 21 .: |Rumbo GRATIS :. 1 Modesto Maldonado’s mayoral announcement Pg. 10 RumboEDICIÓN NO. 560 (MA) Lawrence, Methuen, Haverhill, Andover, North Andover, Lowell Diciembre/December 22, 2016 The BILINGUAL Newspaper of the Merrimack Valley (NH) Salem, Nashua, Manchester Juramentan a nuevos bomberos Richard Rodríguez Firefighters’ swearing in ceremony fue juramentado Left to right, Jean Jimenez, Felix Hernandez, Lt. Johnny Jimenez, Chief Moriarty, Lt. Darren Cassista and Giovanni Bonet. |7 Unión de Carpinteros protege Aguinaldo El abogado Richard Rodríguez fue nombrado miembro de la Junta Asesora de la Comisión Contra Discriminación de beneficios de empleados Navideño de Massachusetts por el Gobernador Charlie Baker. |6 Noche y Desfile Richard Rodriguez sworn in Dominicano Attorney Richard Rodriguez was appointed to the Massachusetts Commission Against Discrimination’s Advisory Board by Pg. 9 Governor Charlie Baker. |6 American Training’s Christmas in Oz Steve Falvey, organizador de la Unión de Carpinteros, con un cartel junto a un muñeco inflado, hizo una demostración de protesta la Calle Merrimack frente una de las propiedades de Sal Lupoli. |5 Carpenters’ Union protects Personajes de Oz, de izquierda a derecha, Stephanie Feliz, Ratha Teng, Ariella Roberts, Michelle Forti, employee benefits Ashley Duhamel y Paul y Fran Kuchar como el Sr. y la Sra. Claus. |12 Steve Falvey, Carpenters Union organizer, with a sign next to an inflatable puppet staging a demonstration on Merrimack Street in front American Training Colleagues and Oz characters, from left to right, Stephanie Feliz, Ratha Teng, Ariella of one of Sal Lupoli’s properties. -

2020 Bay State Winter Games Figure Skating Media Information Kit

2020 BAY STATE WINTER GAMES FIGURE SKATING MEDIA INFORMATION KIT Bay State Games @BayStateGames @baystategames baystategames baystategames.org | #BayStateGames Bay State Games 55 Sixth Road Woburn, MA 01801 Phone: (781)932-6555 Fax: (781)932-3441 Email: [email protected] Local Press and Media, Thank you in advance for your coverage of the 2020 Bay State Summer Games. Included in this media information kit is a variety of information on the Winter Games. Bay State Games has assembled an participant list organized alphabetically by town. In order to ensure accuracy of the athlete list, we will customize a list for those who request it. If you wish to get a list of athletes from your coverage area, please email Erika Sheinhait at [email protected] or call our office at (781) 932-6555. Additional registration lists of competitors in sports other than figure skating will be posted as competition dates near. Any members of the media who wish to speak with specific competitors are asked to contact the Bay State Games office with your name, email address, phone number, and the names of the athletes you would like to speak to. We will contact each participant you are interested in speaking with and provide them with your contact information and let them know you would like to speak with them. All competition results will be posted at https://www.baystategames.org/winter-games- results. Recaps and competition summaries can be found at https://baystategames.blogspot.com . Copies of the Bay State Winter Games logo can be found on our media site at https://www.baystategames.org/logo-links. -

2019-2020 MIAA Game Officials of the Year!

Fifth Annual Game Official of the Year Recognition Program 2020 MIAA Game Officials Award Recipients A Message from the MIAA Game Officials Committee Chair Elizabeth McAndrews, MIAA Game Officials Committee Chair (page 2) MIAA Game Official of the Year Award Officials recognized for their outstanding service to all MIAA student-athletes and for their commitment to the promotion of Educational Athletics. (page 3-13) Baseball – Mike Sullivan, North Shore, MA Basketball (Boys) – Bruce Anderson, Southeastern, MA Basketball (Girls) – Julie Ruane, Northeastern, MA Cross Country– Stanley “Ley” Ricker, Central, MA Field Hockey – Julie Halloran, Boston, MA Football – Peter Ochs, Berkshire County, MA Gymnastics (Girls) – Jeanne Peckham, Eastern/Central, MA Ice Hockey (Boys) – Thomas Fyrer, Eastern, MA Ice Hockey (Girls) – Thomas Murray, Cape Cod, MA Lacrosse (Boys) – Anthony Cordani, Eastern, MA Lacrosse (Girls) – Teri Riggs, Eastern, MA Soccer (Boys) – Ric Beaudoin, Eastern, MA Soccer (Girls) – Leah Murphy, Eastern, MA Softball – Louis Pearlstein, North Shore, MA Swimming & Diving (Fall) – Barbara “Cam” Townsend, Eastern, MA Swimming & Diving (Winter) – William “Bill” Whigham, Western, MA Track & Field, Indoor – Michelle Cote, Central, MA Track & Field, Outdoor – Linda George, MA Track and Field Association: Volleyball (Boys) – Kevin McDermott, Merrimack Valley, MA Volleyball (Girls) – Michael Simmarano, Central, MA Wrestling – Daniel J. Buckley, Sr., MA Interscholastic Wrestling Officials Association MIAA Student-Athlete of the Month Award Recognizing -

2013 Finalist Packet

2013 Finalist Packet 1 Dear Athlete, On behalf of the Massachusetts Amateur Sports Foundation, welcome to the 32nd anniversary of the Bay State Summer Games! This year, nearly 7,000 athletes ranging in ages from 5 to over age 80 from over 300 Massachusetts cities and towns will participate in our Olympic-style event. Competitions will take place over 16 days in 27 different sports at 20 of the finest sports facilities in the commonwealth. This finalist packet was created to provide you with as much information as possible on the rules, regulations and procedures of the Summer Games. From the first game to the championships, this packet will guide you through every phase of competition. It is our hope that this will give you a clear picture of what you can expect at the 2013 Bay State Summer Games. Congratulations on all your athletic accomplishments and for your participation in the 2013 Bay State Summer Games. You embody the spirit of amateur athletics and for that you should be proud. Let the Games begin! Best wishes, The Bay State Games Staff Kevin Cummings Executive Director Jeff Baker Assistant Director Jon Casey Operations Coordinator 2 Table of Contents General Information 4 Bay State Games Quick Facts 5 MASF Programs 6 Finals Schedule 7 Facility Locations 7 Finalist Fees 8 Uniform / Footwear Information 9 Sportsmanship 10 - 11 Medical Information 12 - 13 Volunteer Information 14 Hall of Fame 14 3 GENERAL INFORMATION General Questions For general questions go to www.baystategames.org, e-mail [email protected] or call (781) 932-6555. -

2012 Sept Newsletter

MAHPERD Annual State Convention October 29 & 30, 2012 We Hope You Can Join Us! MAHPERD Convention Hotel Reserve a room with the Hilton Garden Inn to enjoy Convention the complete convention experience! Room rates are: Preliminary $105/Single Schedule of Events $105/Double $115/Triple $125/Quad Begining on Page 7! Reservations must be received by October 5, 2012. Reserve your room by calling 508-753-5700 and let them know that you are with the MAHPERD Convention! Check-in: 4:00 PM Check-out: 12:00 Noon A Taste of Some of the Exhibitors! American Heart Association New England Dairy and Food Council Jones and Bartlett Learning Kid Power Programs Boston Children’s Hospital Medical Inflatables New England Flaghouse Project Adventure USTA New England Brax Fundraising Emporia State University-Department of HPER Greater Boston PFLAG Your Self Series™ MEDA Bay State Games Mega Brain Exhibit Bridgewater State University Westfield State University at US Games-Sport Supply Group Salem State University MAHPERD Convention! Play Rugby USA/MA Youth Rugby Organization UltiPlay Parks & Playgrounds See Page 6! Cambridge College Springfield College Endicott College The Children’s Health Market Brewers Ledge American Lung Association MAHPERD Massachusetts Association for Health, Physical Education, Recreation and Dance September www.ma-hperd.org Mark Your Calendar President’s Message Dr. Patricia McDiarmid MAHPERD Annual State Convention Welcome back to what promises to be another exciting and October 29 & 30, 2012 productive year for MAHPERD professionals! The fall season is the Worcester, MA time we can channel the vibrant energy of summer into something of form and substance in both our personal and professional lives. -

Youth Sports Relief and Recovery Sign on Letter

April 20, 2020 The Honorable Nancy Pelosi Speaker United States House of Representatives 1236 Longworth House Office Building Washington, DC 20510 The Honorable Kevin McCarthy Minority Leader United States House of Representatives 2468 Rayburn House Office Building Washington, DC 20510 Dear Speaker and Minority Leader, Thank you for your leadership in these trying times. As a coalition of over 400 youth sports organizations, we are calling upon your leadership to provide economic stability to the youth sports sector which has been dramatically disrupted by this crisis. Youth sports offer a multitude of positive benefits to participants, including physical, social, emotional, and cognitive perks, that extend far beyond the playing field. • Some 60 million youth in this country are registered participants in organized youth sports programs.1 • Youth sports is an estimated $19 billion industry.2 • Sports participation has a greater association with lower school dropout rates than any other activity.3 • Physically active adolescents are more likely to like to go to school, graduate from high school, and have a higher GPA.4 • Regular participation in sports can improve health factors and prevent obesity, chronic diseases, and other health problems.5 1 National Council of Youth Sports. Sports Participation Data. 2 https://www.globenewswire.com/news-release/2019/12/26/1964575/0/en/Youth-Sports-Market-Projected-to- Reach-77-6-Billion-by-2026-Comprehensive-Industry-Analysis-Insights.html 3 Rosewater, A. (2009). Learning to play and playing to learn: Organized sports and educational outcomes. Prepared for Team Up for Youth: Oakland, CA. 4 Barber, B.L., Stone, M.R., & Eccles, J. -

Wright State University Men's Basketball Media Guide 1995-1996

Wright State University CORE Scholar Athletics Publications Athletics 11-14-1995 Wright State University Men's Basketball Media Guide 1995-1996 Wright State University Athletics Follow this and additional works at: https://corescholar.libraries.wright.edu/athletics_publications Part of the Public Relations and Advertising Commons Repository Citation Wright State University Athletics (1995). Wright State University Men's Basketball Media Guide 1995-1996. : Wright State University. This Media Guide is brought to you for free and open access by the Athletics at CORE Scholar. It has been accepted for inclusion in Athletics Publications by an authorized administrator of CORE Scholar. For more information, please contact [email protected]. November February Tue., Nov.14 Exhibition 7:35P.M. Thu ., Feb. 1 Illinois-Chicago* & 7:35P.M. Tue., Nov. 21 Athletes in Action& 7:35 P.M. Sat., Feb. 3 UW-Green Bay*@ 2:05P.M. Sat., Nov. 25 Wilmington 7:35 P.M. Sat. , Feb. 1o at Loyola * 2:05 P.M. December Mon ., Feb. 12 at Butler * 7:35 P.M . Wed., Feb. 14 Cleveland State*+ 7:35P.M. Sat., Dec. 2 Eastern Kentucky& 7:35P.M. Sat., Feb. 17 Detroit*$ Tue., Dec. 5 Wisconsin$ 7:35P.M. 2:05 P.M. Thu., Feb. 22 UW-Milwaukee* & 7:35P.M. Sat., Dec. 9 at Dayton# 8:05 P. M. Sat ., Feb. 24 at Northern Illinois * P.M. Tue., Dec. 12 Ohio& 7:35P.M. 8:05 Sat ., Dec . 16 at Toledo 7:05 P.M. March Tue., Dec. 19 Youngstown State& 7:35 P.M. Sat., March 2 MCC Tournament Quarter-Finals+ Start Noon Sat., Dec. -

National Congress of State Games Announces 2017 Athletes of the Year

FOR IMMEDIATE RELEASE Contact: Chip Hofler [email protected] NATIONAL CONGRESS OF STATE GAMES ANNOUNCES 2017 ATHLETES OF THE YEAR Grand Rapids, Mich., September, 26, 2017 – Officials with the National Congress of State Games (NCSG) announced the 2017 Athletes of the Year. A youth female, youth male, adult female and adult male athlete are chosen as Athlete of the Year. Athletes are nominated after winning Athlete of the Year at their local State Games. Thirty-One State Games organizations awarded Athletes of the Year in 2017 and submitted their nominations for the national award. The 2017 Athletes are: - Youth Female: Hailey Poole – Multi-sport – Worden, MT - Adult Male: Dave Winslow – Bowling – Billings, MT - Adult Female: Dorian McMenemy – Swimming – Northboro, MA - Youth Male: Daylin Toms – Wrestling – Cool Ridge, WV The 2017 recipients will be recognized at the NCSG Annual Symposium and TEAMS Conference and Expo on Tuesday, October 31, 2017 in Orlando, FL. Hailey Poole (Youth Female AOY), 18, won the Big Sky State Games Female Youth Athlete of the Year. She has competed in Track & Field, Volleyball, and Swimming with her dominate sport being Track & Field. In 2017, she earned 11 Gold, 8 Silver and 2 Bronze medals in Track & Field. Hailey broke her own Big Sky State Games Javelin record in 2017 with a throw of 147’00”. Poole ranked No. 2 in the nation for high school girls javelin last spring, having thrown 158 feet, 9 inches. Javelin is in her genes as her father and grandfather were both successful javelin throwers, her father was a three-time All American for the University of Texas. -

2018 Bay State Summer Games Media Information Kit

2018 BAY STATE SUMMER GAMES MEDIA INFORMATION KIT Bay State Games @BayStateGames @baystategames baystategames baystategames.org | #BSG2018 Bay State Games 55 Sixth Road Woburn, MA 01801 Phone:(781)932-6555 Fax:(781)932-3441 Email: [email protected] Local Press and Media, Thank you in advance for your coverage of the 2018 Bay State Summer Games. Included in this media information kit is a variety of information on the Summer Games. A listing of all the athletes from the Commonwealth who will be competing in the finals can be found at http://www.baystategames.org/participants. The list is organized by town and name. Please note that the athlete list was created as of July 5, and therefore is not a complete listing due to rosters and registrations still coming to our office. It will be updated throughout the Games. If you would like to get in contact with an athlete or a coach, please contact us and we will notify them. In addition, you can find results at http://www.baystategames.org/summer-games-results. Daily recaps and game summaries can be found in our Media Section at http://www.baystategames.org/press-releases. In the meantime, if you have any other questions or inquiries regarding the Bay State Games, please feel free to contact us. We hope to see you at the Summer Games! Best wishes, Erika Sheinhait Kiara Killelea Public Relations Interns Bay State Games 55 6th Road Woburn, MA 01801 781-932-6555 [email protected] | [email protected] Bay State Games @BayStateGames @baystategames STAFF & ORGANIZING COMMITTEE Kevin Cummings - Executive Director Margo Murphy – Sports Coordinator [email protected] [email protected] w. -

Stanford Field Hockey Stanford Athletics— Home of Champions

2002 Stanford Field Hockey Stanford Athletics— Home of Champions “Home of Champions.” Those are the bywords for the Stanford University Athletic Department. And for good reason. No athletic department in the country can boast of the kind of success that Stanford has accomplished since the 1980s. NCAA team champions. NCAA individual champions. Olympic medalists. Stanford University athletes have been all over the world capturing championships. The statistics speak for themselves Stanford University has won 66 NCAA team championships since 1980, the most in the nation; Cardinal athletes have won 43 NCAA championships since 1990—again the most in the nation. Stanford has brought home 19 NCAA champi- onship trophies the past five years, including an unprecedented six NCAA team titles in 1996-97. In 1991-92, Stanford athletes took home 29 individual NCAA titles—an NCAA record. Cardinal athletes won 21 individual championships during the 1992-93 season, the second most in history. Even more impressive is Stanford’s string of eight consecutive Sears Directors’ Cup titles (1995-02). The award honors the nation’s top overall athletic program and with eight straight #1 finishes, it’s no wonder Stanford is considered the dominant athletic program in the nation. Stanford captured its eighth straight Sears Directors’ Cup in 2001-02 with 1499 points, winning the honor by 388.5 points over second place Texas. The Cardinal won a total of four NCAA team crowns with championships in women’s tennis and women’s volleyball, as well as men’s and women’s water polo. The Cardinal added second place national finishes in men’s cross country, men’s swimming and synchronized swimming. -

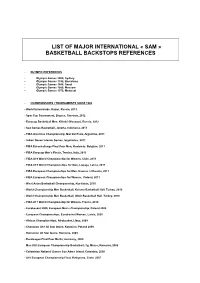

Reference List

LIST OF MAJOR INTERNATIONAL « SAM » BASKETBALL BACKSTOPS REFERENCES • OLYMPIC REFERENCES - Olympic Games 2000, Sydney - Olympic Games 1992, Barcelona - Olympic Games 1988, Seoul - Olympic Games 1980, Moscow - Olympic Games 1976, Montreal • CHAMPIONSHIPS / TOURNAMENTS SINCE 1988 - World Universiade, Kazan, Russia, 2013 - Spar Cup Tournament, Brezice, Slovenia, 2012 - Eurocup Basketball Men, Khimki (Moscow), Russia, 2012 - Sea Games Basketball, Jakarta, Indonesia, 2011 - FIBA Americas Championship, Mar Del Plata, Argentina, 2011 - Indian Ocean Islands Games, Seychelles, 2011 - FIBA Eurochallenge Final Four Men, Oostende, Belgium, 2011 - FIBA Eurocup Men’s Finals, Treviso, Italy, 2011 - FIBA U19 World Championship for Women, Chile, 2011 - FIBA U19 World Championships for Men, Liepaja, Latvia, 2011 - FIBA European Championships for Men, Kaunas, Lithuania, 2011 - FIBA European Championships for Women, Poland, 2011 - West Asian Basketball Championship, Kurdistan, 2010 - World Championship Men Basketball, Kaisere Basketball Hall, Turkey, 2010 - World Championship Men Basketball, Izimir Basketball Hall, Turkey, 2010 - FIBA U17 World Championship for Women, France, 2010 - Eurobasket 2009, European Men’s Championship, Poland 2009 - European Championships, Eurobasket Women, Latvia, 2009 - African Championships, Afrobasket, Libya, 2009 - Champion U18 All Star Game, Katowice, Poland 2009 - Romanian All Star Game, Romania, 2009 - Euroleague Final Four Berlin, Germany, 2009 Men U20 European Championship Basketball, Tg. Mures, Romania, 2008 - Colombian