903840Ppp0refe0box385311b

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Konzept Erfolgreiche Zusammenarbeit 2013

„Erfolgreiche Zusammenarbeit ab 2013 als Sponsor und Partner von Max Kramer“ „Max Kramer auf einen Blick“ Name: Maximilian Kramer Geboren: 12. Januar 1984 in Fulda Familienstand: ledig Wohnort: Fulda Trainer: Günter Kessler 222 Erfolg benötigt ein Fundament ∙ Extreme Leistungsdichte im Spitzengolf mit sehr guter internationaler Konkurrenz ∙ Fördersystem für Top Golfer / Talenteförderung in Deutschland nicht ausreichend vorhanden ∙ Sportlich stehen die deutschen Profis aber im Wettbewerb mit Spielern aus Ländern wie Spanien, Holland, Skandinavien, in denen eine Förderkultur existiert ∙ Hohes Risiko und große Herausforderung für junge Spieler ∙ Eine professionelle finanzielle Basis ist die Voraussetzung für den sportlichen Erfolg im Spitzengolf 333 Eine Karriere am Abschlag 1997-2007 Nationalspieler 2003 Sieger der Internationalen Deutschen Amateurmeisterschaften 2006 Vizeweltmeister bei den Militärmeisterschaften 2007 Wechsel ins Profilager Mitglied des Golfteam Germany seit 2007 European Tour (Deutsche Bank) 7 Siege bei EPD-Turnieren 2008 2. Platz der Renault EPD-Tour und damit direkte Qualifikation für die Challenge Tour 2009 Zweimal 2. Platz auf der EPD-Tour und 39. Platz auf der European Tour bei den BMW Open in München 2010 2 Siege und zweimal 2. Platz auf der EPD-Tour und damit direkte Qualifikation für die Challenge Tour 2011 2011 Challenge Tour nur halbe Saison 2012 Qualifikation für die Challenge Tour 2013 12mal Top 10 von 20 Rang 3 444 Eine Karriere am Abschlag Ziele 2013: - Top 20 der Challenge Tour - dafür die Karte European Tour 2014 Ziele 2014 bis 2016 Volle Spielberechtigung für die European Tour Top 50 auf der Tour 555 Das Projekt „Max Kramer“ TurnierTurnier----KalenderKalender für 2013 Challenge Tour Datum Turnier 14.02. -

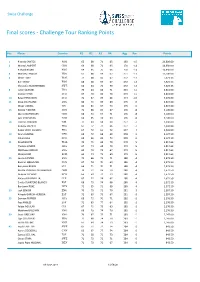

Final Scores - Challenge Tour Ranking Points

Swiss Challenge Final scores - Challenge Tour Ranking Points Pos Player Country R1 R2 R3 R4 Agg Par Points 1 Ricardo SANTOS POR 65 68 71 65 269 -15 29,600.00 2 Moritz LAMPERT GER 66 68 71 65 270 -14 16,650.00 Richard BLAND ENG 69 65 70 66 270 -14 16,650.00 4 Mathieu FENASSE FRA 67 68 69 67 271 -13 11,100.00 5 Oliver FARR WAL 71 68 66 67 272 -12 7,523.33 Ben STOW ENG 68 68 69 67 272 -12 7,523.33 Christofer BLOMSTRAND SWE 66 64 72 70 272 -12 7,523.33 8 Julien QUESNE FRA 70 64 68 71 273 -11 4,810.00 Connor SYME SCO 67 70 66 70 273 -11 4,810.00 10 Ewen FERGUSON SCO 72 67 69 66 274 -10 4,070.00 11 Dave COUPLAND ENG 66 71 69 69 275 -9 3,607.50 Oliver LINDELL FIN 66 69 67 73 275 -9 3,607.50 13 Nicolai TINNING DEN 72 68 69 67 276 -8 3,145.00 Marcel SCHNEIDER GER 68 70 67 71 276 -8 3,145.00 Lars VAN MEIJEL NED 68 65 74 69 276 -8 3,145.00 16 Cormac SHARVIN NIR 71 69 68 69 277 -7 2,590.00 Antoine ROZNER FRA 67 72 72 66 277 -7 2,590.00 Robin SCIOT-SIEGRIST FRA 67 72 66 72 277 -7 2,590.00 19 Daan HUIZING NED 69 72 68 69 278 -6 2,127.50 Calum HILL SCO 69 66 69 74 278 -6 2,127.50 21 David BOOTE WAL 70 71 68 70 279 -5 1,817.63 Thomas LINARD FRA 67 74 68 70 279 -5 1,817.63 Matthew JORDAN ENG 69 70 73 67 279 -5 1,817.63 Minkyu KIM KOR 63 74 73 69 279 -5 1,817.63 25 Laurie CANTER ENG 72 66 71 71 280 -4 1,572.50 Rasmus HØJGAARD DEN 67 74 70 69 280 -4 1,572.50 Benjamin RUSCH SUI 68 71 70 71 280 -4 1,572.50 Nicolai VON DELLINGSHAUSEN GER 70 71 69 70 280 -4 1,572.50 Duncan STEWART SCO 66 69 72 73 280 -4 1,572.50 Alvaro ARIZABALETA COL 67 72 74 67 280 -4 1,572.50 -

Swiss Challenge 2019 − Golfsport Auf Höchstem Niveau

Medienmitteilung vom 29. Mai 2019 Seite 1 von 1 Presenting Partner Kurzversion Swiss Challenge 2019 − Golfsport auf höchstem Niveau Partner Zum zehnten Mal in Folge gastiert die European Challenge Tour anlässlich der Swiss Chal- lenge vom 6. bis 9. Juni 2019 auf Golf Sempach. Im grössten Golf Resort der Schweiz kämpfen 156 nationale und internationale Golf Professionals um ein Preisgeld von EUR 185‘000 sowie den Aufstieg auf die höchste Golf Tour in Europa. Besucher erleben Spitzen- Organisation Golfsport und ein erstklassiges Eventprogramm. Vom 6. bis 9. Juni 2019 trifft die Schweizer Elite auf die zukünftigen Stars des internationalen Golfsports. Auf dem schweizweit längsten Meisterschaftsplatz, dem 18 Hole Championship Course Woodside auf Golf Sempach, kämpfen die Professionals während vier Turniertagen um ein Preisgeld von EUR 185‘000 und um den Aufstieg auf die European Tour. Die Schweizer Hoffnungsträger Aus Schweizer Sicht stehen 13 Professionals und vier Amateure im Teilnehmerfeld. Gespannt schau- en wir auf Joel Girrbach, der bei vier von sechs Events auf der European Tour in der Saison 2019 den Cut schaffte und aktuell auf Rang 55 im European Challenge Tour Ranking liegt. Marco Iten sicherte sich die Tourkarte 2019 der Challenge Tour mit Rang 38 der Order of Merit. Der Westschweizer Ra- phaël de Sousa ist mit drei Triumphen an der Portugal Pro Golf Tour erfolgsversprechend in die Sai- son gestartet. Benjamin Rusch erreichte einen zweiten, dritten und vierten Rang auf der Pro Golf Tour und wurde an die diesjährige Swiss Challenge eingeladen. Weitere Schweizer Professionals am Start sind Luca Galliano, Mathias Eggenberger, Perry Cohen, Jeremy Freiburghaus, Yann Pfeiffer, Jean-Luc Burnier, Fredrik Svanberg und Philippe Weppernig. -

Daily News Prague Golf Challenge, Du Swiss Mathieu Fenasse (FRA) Golf Challenge

JOUEURS Les stars de demain Le Rolex Trophy rassemble les meilleurs joueurs du Challenge Tour et un invité, soit un champ de 40 joueurs. Le vainqueur du tournoi a toutes les chances d’accéder au circuit européen l’an prochain. Ce fut le cas de ses cinq derniers vainqueurs. Voici les 40 « top players » du Rolex Trophy avec leur meilleur résultat de l’année sur le circuit satellite. Antoine Rozner (FRA) Rhys Enoch (GAL) Ben Stow (ANG) Best results 2019 : vainqueur Best results 2019 : vainqueur Best results 2019 : 5e du Swiss du Prague Golf Challenge et du du D+D Real Slovakia Challenge. Challenge et des Hauts de CENTRE COURT Challenge de Espana. France-Pas de Calais Open. Adrian Meronk (POL) Richard Bland (ANG) Best results 2019 : 3e du D+D Mark Flindt Haastrup (DAN) ROGER FEDERER 2017 Best results 2019 : 2e du Real Slovakia Challenge. Best results 2019 : 2e du Prague Daily News Prague Golf Challenge, du Swiss Mathieu Fenasse (FRA) Golf Challenge. Challenge, du Hauts de France- Edition du 21 Août N° / Best results 2019 : 2e du Prague Pas de Calais Golf Open et du Lars Van Meij el (PB) Golf Challenge. Best results 2019 : 3e du D+D Vaudreuil Golf Challenge. QUE SONTILS DEVENUS ? L’ENFANT DU CLUB SOIRÉE VIP BEHIND THE SCENES JOUEURS Bryce Easton (AFS) Real Czech Challenge. Matthew Jordan (ANG) Byeonh Hun An, De Sousa Réchauff ement Albane, Les stars Best results 2019 : 2e du Best results 2019 : vainqueur Darius Van Driel (PB) vainqueur en 2014 revient aux sources climatique la fi erté de Genève de demain Vierumäki Finnish Challenge. -

2018 Staysure Tour Order of Merit 2018

September 3, 2018 Top Ten in the 2018 Race to Dubai Matt Fitzpatrick 1 Francesco MOLINARI (ITA) Pts 4,635,909 2 Patrick REED (USA) 3,057,948 3 Tommy FLEETWOOD (ENG) 2,805,043 4 Rory MCILROY (NIR) 2,760,667 5 Alex NOREN (SWE) 2,729,725 6 Thorbjørn OLESEN (DEN) 2,459,412 7 Jon RAHM (ESP) 2,161,574 8 Russell KNOX (SCO) 2,054,929 9 Tyrrell HATTON (ENG) 1,892,819 10 Rafa CABRERA BELLO (ESP) 1,775,523 This Week on the European Tour Sept 6 - 9, 2018 Omega European Masters Crans-sur-Sierre Golf Club, Crans Montana, Switzerland 2017 CHAMPION: Matt Fitzpatrick (ENG) PRIZE FUND: €2,500,000 DID YOU KNOW? OMEGA EUROPEAN MASTERS • If Matthew Fitzpatrick were to successfully defend his Omega • Crans-sur-Sierre will be staging the tournament for the 72nd European Masters title this week, he would be the first person to do so successive time. Only Augusta National (82 times for the Masters since Seve Ballesteros (1977-78) Tournament), has held the same event more times than the Swiss venue • With his victory last year, Fitzpatrick became the youngest player to reach four European Tour victories, aged 23 years and nine days, since • In 2010, Miguel Angel Jiménez won his first Omega European Masters Matteo Mannassero won the 2014 BMW PGA Championship aged 20 title at the 22nd attempt. At the time, it was a European Tour record for years and 37 days a player competing in the same event the most number of times before winning it for the first time. -

SWISS CHALLENGE 30. September Bis 3. Oktober Auf Golf Saint Apollinaire, Basel

SOMMER 2021 CLUBLIFE SWISS CHALLENGE 30. September bis 3. Oktober auf Golf Saint Apollinaire, Basel LE CLUB, GOLF SEMPACH Ein neues Gastronomie- gebäude in 140 Tagen www.leadinggolf.ch EDITORIAL 3 EDITOR’S LETTER IMPRESSUM Verlag Herausgeberin Anzeigen ClubGolf Schlachtstrasse 3 CH-6204 Sempach Tel. +41 41 925 24 24 [email protected] www.clubgolf.ch Auflage 20’000 Redaktion Nathalie Giger Irène Ulrich Inserateverkauf Margarita Schöpfer LIEBE LESERINNEN UND LESER Wir sind langsam auf dem Weg zur Normalität – nur nicht pandemiebedingt. Nach dem Grossbrand im Januar 2021 auf Golf Sempach durften wir bereits Ende Mai das neue Restaurant Le Club eröffnen. Somit steht Ihnen wieder eine vollständige Infrastruktur und alle Dienstleistungen auf Golf Sempach zur Verfügung. Nachdem im vergangenen Jahr leider auch die Swiss Challenge pandemiebedingt abgesagt werden musste, freuen wir uns auf eine tolle Turnierwoche auf Golf Saint Apollinaire. Die European Challenge Tour gastiert vom 30. September bis 3. Oktober 2021 zum ersten Mal im grössten Golf Resort im Grossraum Basel. Damit rücken wir Golf und Genuss wieder ins Zentrum – die aktuelle Ausgabe ist gefüllt mit Hintergrundstories über die Professionals der Swiss Challenge, kulinarischen Reisezielen, neuen Academy Angeboten und vielem mehr. Viel Vergnügen. Wir freuen uns, Sie schon bald in einem der ClubGolf Resorts begrüssen zu dürfen. Daniel Weber ClubGolf www.leadinggolf.ch Unterstützungsfonds für die Entwicklung des Golfsports Swiss Challenge Saint Apollinaire Andere Organisationen VP Bank Swiss Ladies Open Holzhäusern Swiss PGA Omega European Masters Crans-Montana Swiss Golf Team Swiss Seniors Open Angeschlossene Bad Ragaz Vereinigungen Flumserberg Ladies Open Special Olympics Gams-Werdenberg www.supportinggolf.ch 02_SC_NEW_210_297_ad_supportinggolf.indd 3 25.06.21 11:22 INHALT 5 INSIDE 6 GOLF SEMPACH Restauranteröffnung Ende Mai – nur vier Monate nach Brand. -

Draw for Round 2 Swiss Challenge Presented by Association Suisse De

Swiss Challenge presented by Association Suisse de Golf Draw for Round 2 Game Time Tee Name Country Attachment R1 R2 R3 R4 Agg Par Game Time Tee Name Country Attachment R1 R2 R3 R4 Agg Par 1 07:40 1 Manuel TRAPPEL AUT Lech Zürs Am Arlberg 73 73 2 27 12:40 1 Max KRAMER GER GC Olching 76 76 5 Wallace BOOTH SCO Comrie GC 79 79 8 Thriston LAWRENCE RSA Nelspruit GC 69 69 -2 Filippo BERGAMASCHI ITA 74 74 3 Dylan FRITTELLI RSA CC Johannesburg 74 74 3 2 07:50 1 Jack DOHERTY SCO North Gailes 67 67 -4 28 12:50 1 Tim GORNIK SLO Golf Club Bled 69 69 -2 Oliver BEKKER RSA Stellenbosch GC 67 67 -4 Stiggy HODGSON ENG Wisley 69 69 -2 Michael McGEADY IRL Northwest GC 72 72 1 Peter TARVER-JONES ENG Worthing GC 75 75 4 3 08:00 1 Sebastian HEISELE GER Ergopack 72 72 1 29 13:00 1 Antti AHOKAS FIN Viipurin Golf 67 67 -4 Cyril SUK CZE IMG Academy GC 77 77 6 Jacques BLAAUW RSA The Els Club, Copperleaf 72 72 1 Raymond RUSSELL SCO The Centurion Club 70 70 -1 Luca GALLIANO SUI 75 75 4 4 08:10 1 Daniel SUCHAN CZE GC Black Bridge 78 78 7 30 13:10 1 Alexander BJÖRK SWE Vaxjo GK 77 77 6 Thomas ELISSALDE FRA Biarritz Le phare 72 72 1 Guillaume WATREMEZ BEL Royal Waterloo GC 76 76 5 Marcel SCHNEIDER GER Schloss Monrepos GC 71 71 0 Julian KUNZENBACHER GER Golfclub Teutoburger Wald 67 67 -4 5 08:20 1 Julien GUERRIER FRA Golf PGA France du Vaudreuil 72 72 1 31 13:20 1 Nicolo RAVANO ITA GC Rapallo 75 75 4 Tobias NEMECZ AUT Murhof 78 78 7 Tim PFISTER SUI G&CC Zurich 76 76 5 Brinson PAOLINI USA Berkeley Hall 70 70 -1 James HEATH ENG Robert Heath Heating 69 69 -2 6 08:30 1 Daniel -

Club De Golf Alcanada, We Also Aim to Make the Most of Our Own Fantastic Opportunity and to Showcase Golf in Mallorca

MALLORCA 7-10 NOV/19 European Challenge Tour 1 Grand Final area map programm player profiles hole by hole Opening the “Road to Mallorca” Dear members, friends and visitors, The European Challenge Tour is a fertile breeding ground for the next generation of global stars. Golfers of the calibre of Rafa Cabrera-Bello, Tommy Fleetwood and Tyrell Hatton were all playing regularly on the Challenge Tour within the past decade and they now boast European Tour titles and Ryder Cup success on their list of achievements. There are many more like them who have since gone on to enjoy exceptional careers on the European Tour and beyond. Then there are two golfers who have gone on to claim six Major titles in Martin Kaymer (two) and Brooks Koepka (four). Clearly, the Challenge Tour has proved itself as an environment which has helped produce some of the best golfers on the planet. Long before those famous victories in the sport’s biggest events were achieved, there must have been times during those endless hours of dedication, sacrifice and practice where those players questioned (even if it was only for a fleeting moment) if their ambitions would ever be realised. But anything truly worth achieving, rarely comes easily and it is about being ready to prove yourself when the opportunity arises. At Club de Golf Alcanada, we also aim to make the most of our own fantastic opportunity and to showcase golf in Mallorca. Since the club opened in 2003, staging a high-profile event has been our ambition. So it is a source of great pride to achieve this and our thanks must go to the Challenge Tour, the Balearic and Spanish Golf Federations for their assistance and support in making our ambition a reality. -

European Challenge Tour Schedule 2017

EUROPEAN CHALLENGE TOUR SCHEDULE 2017 PRIZE DATES TOURNAMENT VENUE FUND 23 – 26 MARCH Barclays Kenya Open Muthaiga GC, Nairobi, Kenya €220,000 30 – 02 APRIL 06 – 09 13 – 16 20 – 23 Turkish Airlines Challenge Gloria GC, Old Course, Belek-Antalya, Turkey €200,000 27 – 30 04 – 07 MAY TBC TBC TBC 11 – 14 Open de Portugal at Morgado Golf Resort Morgado G&CC, Portimao, Algarve, Portugal €500,000 # 18 – 21 Match Play 9 Spain TBC Golf & Spa Kunětická Hora, Dřiteč, Czech 25 – 28 D+D REAL Czech Challenge Republic €180,000 Swiss Challenge presented by Association 01 – 04 JUNE Suisse de Golf Golf Sempachersee, Lucerne, Switzerland €170,000 08 – 11 KPMG Trophy Royal Waterloo GC, Lasne, Belgium €170,000 15 – 18 Najeti Open Aa Saint-Omer GC, Lumbres, France €200,000 Made in Denmark Challenge – Presented by Royal Oak GC, Vejen/Kolding, Denmark €180,000 22 – 25 Ejner Hessel SSE Scottish Hydro Challenge hosted by Macdonald Spey Valley GC, Aviemore, Scotland €250,000 29 – 02 JULY Macdonald Hotels & Resorts 06 – 09 Prague Golf Challenge Prague City Golf, Prague, Czech Republic €180,000 13 – 16 Italian Challenge TBC €300,000 Golf PGA France du Vaudreuil, Le Vaudreuil, 20 – 23 Le Vaudreuil Golf Challenge France €210,000 27 – 30 Swedish Challenge hosted by Robert Karlsson Katrineholms GK, Katrineholm, Sweden €200,000 03 – 06 AUGUST Vierumäki Finnish Challenge Vierumäki Resort, Vierumäki, Finland €180,000 10 – 13 NI Open Galgorm Castle, Ballymena, Northern Ireland TBC 17 – 20 TBC TBC TBC 23 – 26 (Wed to Sat) Rolex Trophy Golf Club de Genève, Genève, Switzerland -

Clubfrühling 2019 Golf St

CLUBFRÜHLING 2019 GOLF ST. APOLLINAIRE Golferlebnis neu definiert LIFE FASHION Golf Trends 2019 INTERNATIONAL Swiss Challenge 6. bis 9. Juni 2019 Golf Sempach 10 JAHRE RORY MCILROY’S CHOICE SEAMASTER AQUA TERRA MASTER CHRONOMETER Zürich • Genève • Luzern • Interlaken • Bern • Crans-Montana • Zermatt • Bürgenstock CLUBGOLF +,/',65,('(1 $$5$8(5675$66( *2/)6(03$&+ %$6(/%(51 +2&+'25) $86)$+57 6(03$&+ 6(03$&+(5675$66( 6&+/$&+7 $ / 8=(51 GOLF SEMPACH CH-6024 Hildisrieden, Tel +41 41 462 71 71, www.golf-sempach.ch :,17(57+85 $86)$+577g66 =h5&+(5675$66( *2/).<%85* )/8*+$)(1 5266%(5*675$66( =h5,&+ $ =h5,&+ GOLF KYBURG CH-8310 Kemptthal, Tel +41 52 355 06 06, www.golf-kyburg.ch $ (852$,53257%$6(/ 08/+286()5(,%85* $86)$+57 6$,17/28,6 *2/) 6$,17$32//,1$,5( $ ' %$6(/ ' ' ' Der neue Audi Q3. Das Leben wartet nicht. Warum in der Vergangenheit leben oder von der Zukunft träumen? F-68220 Folgensbourg, Tel. +41 61 205 65 65, www.golf-basel.com Die spannenden Dinge passieren im Jetzt. Wie der neue Audi Q3 mit selbstbewusster Optik, viel Platz und umfassender Variabilität. Audi Vorsprung durch Technik Jetzt Probe fahren bei Ihrem Audi Partner. EDITORIAL 3 EDITOR’S LETTER IMPRESSUM Verlag Herausgeberin Anzeigen ClubGolf CH-6024 Hildisrieden Tel. +41 41 462 71 71 [email protected] www.clubgolf.ch Auflage 20’000 Redaktion Jana Homjakova Nora Harksen Inserateverkauf Margarita Schöpfer LIEBE LESERINNEN UND LESER 10 Jahre Swiss Challenge – wer hätte das gedacht! Bereits zum zehnten Mal gastiert die European Challenge Tour vom 6. bis 9. Juni 2019 im schweizweit grössten Golf Resort. -

MAX KRAMER, GOLF PLAYING PRO Profil 2

Sponsoring 1 MAX KRAMER, GOLF PLAYING PRO Profil 2 Name: Maximilian Kramer Geboren: 12. Januar 1984 in Fulda Wohnort: Eichenzell, Hessen Größe: 193cm Gewicht: 90 kg Pro seit: 2007 (Hcp +4) Siege: EPD/Pro Golf Tour: 7 Beste Runde: 63(-9), 2010 Coburg Brose Open, EPD Tour Trainer: Marco Schmuck, Olching “Der deutsche Amateur Max Kramer schrieb Facebook: maxkramer.golf 2006 Geschichte, als er als erster Amateur in Sponsoren: Honma, Polo Ralph Lauren, Titleist, der Geschichte der European Tour ein Albatros bei einem offiziellen Turnier erzielte.“ Optimal AG & Co. KG BA-CA Golf Open Presented by Telekom Austria, Fontana GC Karriere - Amateur: 3 1997-2007 Jugend-/Herrennationalspieler Teilnahme an mehreren EM/WM für den Deutschen Golfverband e.V. 2003 Sieger der Int. Deutschen Amateurmeisterschaften Max Martin Florian 2006 Vizeweltmeister bei den Kramer Kaymer Fritsch Militärweltmeisterschaften 2007 Wechsel ins Profilager (Hcp +4), Dt. Mannschaft 2004 – Amateur Golfteam Germany Weltmeisterschaft (Eisenhower Trophy) Karriere - Professional: 7 Siege EPD-Tour/Pro Golf Tour 4 - 2015 Challenge Tour: Kategorie 13, 24 Turnierstarts möglich - 2014 Pro Golf Tour: Sieg Open Lixus, Order of Merit: Platz 4 Qualifikation Challenge Tour 2015 - 2013 Challenge Tour: 8 Starts, 1 cut Pro Golf Tour: 10 Starts, Order of Merit Platz 52 - 2012 EPD-Tour: Order of Merit: Platz 3, 12x Top 10/20 Qualifikation Challenge Tour 2013 - 2011 Challenge Tour: 11 Starts, 2 cuts - 2010 EPD-Tour: 2 Siege, 2x2. Platz, Order of Merit: Platz 2 Qualifikation für Challenge Tour 2011 - 2009 Challenge Tour: 15 Starts, 4 Cuts, Order of Merit: 143. Pl. EPD Tour: 2x2. Platz / 7 Starts, Order of Merit: 23. -

2017 Profesionales

REAL FEDERACION ANDALUZA DE GOLF COMITÉ TÉCNICO PROFESIONALES 373 REAL FEDERACION ANDALUZA DE GOLF INDICE Páginas PROGRAMA PRO SPAIN TEAM 377 CIRCUITO DE GOLF DE PROFESIONALES DE ANDALUCÍA RFGA-APGA 377 ALPS DE ANDALUCÍA 377 CAMPEONATOS DE ESPAÑA 378 EUROPEAN TOUR 379 CHALLENGE TOUR 382 EUROPEAN SENIOR TOUR 384 LADIES EUROPEAN TOUR 385 LADIES EUROPEAN TOUR ACCESS SERIES 387 LADIES PGA TOUR 387 PGA TOUR CHAMPIONS 391 ALPS TOUR DE GOLF 392 MENA GOLF TOUR 394 CIRCUITO PROFESIONAL GAMBITO TOUR 2017 396 THE GECKO PRO TOUR 2017 397 SANTANDER GOLF TOUR – CIRCUITO PROFESIONAL FEMENINO 398 OTROS CIRCUITOS 399 RANKINGS MUNDIALES 399 COMPETICIONES PROFESIONALES CELEBRADOS EN ANDALUCÍA 400 COMITÉ TÉCNICO PROFESIONALES 2017 375 REAL FEDERACION ANDALUZA DE GOLF COMITÉ TÉCNICO PROFESIONALES 2017 376 REAL FEDERACION ANDALUZA DE GOLF PROGRAMA PRO SPAIN TEAM Con este Programa, iniciativa de la Real Federación Española de Golf (RFEG), en colaboración con las Federaciones Autonómicas, se persigue la formación y la ayuda a los jugadores de golf de elite, que cuenten con una proyección y sobresaliente trayectoria, en sus primeros años en el campo profesional. El catálogo de golfistas seleccionados por el Comité de Profesionales de la RFEG en 2016 integró entre los componentes del mismo a Noemí Jiménez, María Parra, Mario Galiano y Scott Fernández. CIRCUITO DE GOLF DE PROFESIONALES RFGA-APGA Durante el año 2017, la Real Federación Andaluza de Golf (RFGA), con la colabo- ración de la Asociación de Profesionales de Golf de Andalucía (APGA), puso en marcha un Circuito de Golf dirigido a profesionales federados en Andalucía, que contó con 5 pruebas regulares más una Final.