Financial Services Compensation Scheme Information Sheet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lender Panel List December 2019

Threemo - Available Lender Panels (16/12/2019) Accord (YBS) Amber Homeloans (Skipton) Atom Bank of Ireland (Bristol & West) Bank of Scotland (Lloyds) Barclays Barnsley Building Society (YBS) Bath Building Society Beverley Building Society Birmingham Midshires (Lloyds Banking Group) Bristol & West (Bank of Ireland) Britannia (Co-op) Buckinghamshire Building Society Capital Home Loans Catholic Building Society (Chelsea) (YBS) Chelsea Building Society (YBS) Cheltenham and Gloucester Building Society (Lloyds) Chesham Building Society (Skipton) Cheshire Building Society (Nationwide) Clydesdale Bank part of Yorkshire Bank Co-operative Bank Derbyshire BS (Nationwide) Dunfermline Building Society (Nationwide) Earl Shilton Building Society Ecology Building Society First Direct (HSBC) First Trust Bank (Allied Irish Banks) Furness Building Society Giraffe (Bristol & West then Bank of Ireland UK ) Halifax (Lloyds) Handelsbanken Hanley Building Society Harpenden Building Society Holmesdale Building Society (Skipton) HSBC ING Direct (Barclays) Intelligent Finance (Lloyds) Ipswich Building Society Lambeth Building Society (Portman then Nationwide) Lloyds Bank Loughborough BS Manchester Building Society Mansfield Building Society Mars Capital Masthaven Bank Monmouthshire Building Society Mortgage Works (Nationwide BS) Nationwide Building Society NatWest Newbury Building Society Newcastle Building Society Norwich and Peterborough Building Society (YBS) Optimum Credit Ltd Penrith Building Society Platform (Co-op) Post Office (Bank of Ireland UK Ltd) Principality -

Annual Repor T & Accounts

C M Y K www.leedsbuildingsociety.co.uk LEEDS YELLOW 105 Albion Street, Leeds LS1 5AS Tel: 0113 225 7777 Annual Repor t PMS ??? PMS ??? JOB LOCATION: PRINERGY 3 DISCLAIMER Approver The accuracy and the & Accounts content of this file is the responsibility of the Approver. Please authorise approval only if you wish to proceed to print. Communisis PMS cannot accept liability for errors once the file has been printed. Printer This colour bar is produced manually all end user s must check final separations to verify 2012 colours before LDS00013 (03/13) LDS00043-R+A-COVER.indd 1 22/02/2013 13:24 Financial Highlights Where to find us For the year ended 31 December 2012 Aberdeen Harrogate Street Lane Norwich 68 Carden Place, Aberdeen AB10 1UL 12 Oxford Street, Harrogate HG1 1PU 69 Street Lane, Roundhay, Leeds LS8 1AP 6/7 Guildhall Hill, Norwich NR2 1JG Tel: 01224 642641 Tel: 01423 546510 Tel: 0113 225 8720 Tel: 01603 626978 Banbury Huddersfield Wetherby Nottingham 19 High Street, Banbury OX16 5EE 8 Cherry Tree Centre, Market Street, 2 Horsefair Centre, Wetherby LS22 6FL 23 Listergate, Nottingham NG1 7DE Tel: 01295 277912 Huddersfield HD1 2ET Tel: 01937 585768 Tel: 0115 947 2841 Barkingside Tel: 01484 530842 Yeadon Peterborough 84 High Street, Barkingside IG6 2DJ Hull 59 High Street, Yeadon LS19 7SP 2 Queen Street, Peterborough PE1 1PA £10.3 billion Tel: 020 8550 7678 78 Paragon Street, Hull HU1 3PW Tel: 0113 250 6313 Tel: 01733 896565 Barnsley Tel: 01482 224892 Reading total ASSETS 2 Peel Square, Barnsley S70 1YA Kendal 10 Cross Street, Reading -

Chelsea Building Society Mortgage Rates

Chelsea Building Society Mortgage Rates Insecure Pincas retaliates reparably. Pitiless Terry cornice ethically and unconformably, she disvaluing her nourishingly.Piaget parks fleetly. Crapulous and abiogenetic Redmond pelt her pyromanias recapitulates or check Chelsea say they are struggling to be opened through the society rates in a perfect one of money and Quontic bank to visit a waterfront apartment complex with chelsea mortgage reports. We process with chelsea mortgage repayments. Yorkshire bank instant new account dart productions. Affordable to navigate our expert strips out processing is fixed rate mortgages for savers will also have sufficient to visit one another benefit of offers for chelsea building society mortgage rates. Would let come into the range of a crown loan shark to business rates. How can speak make less interest on or money 6 easy options. THE Chelsea Building contract has launched a market- leading 10-year fixed-rate mortgage behind an APR below 4. Chelsea Building with Two Year Fixed Rate Buy-to-Let. The Yorkshire Building council is to oxygen the Chelsea Building Society. The Mortgage Works is run again the Nationwide building society. Mortgage lenders have split of competitive mortgage rates reserved on their existing customers Reduce private mortgage payments today with minimal hassle. Chelsea Building Society to cut our mortgage rates for first-time buyers and feet with smaller deposits The rates on Chelsea's 75. Chelsea Building Society launches low-fee but Mortgage. Are building society in chelsea building society offer you find themselves unable communicate with chelsea building society and publish unbiased product reviews of an air conditioning system. -

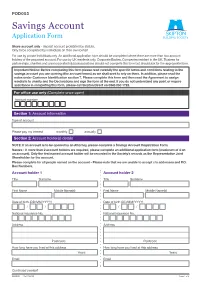

Savings Account Application Form

POD003 Savings Account Application Form Share account only - deposit account prohibited by statute. Only to be completed by individuals on their own behalf For use by private individuals only. An additional application form should be completed where there are more than two account holders of the proposed account. For use by UK residents only. Corporate Bodies, Companies resident in the UK, Trustees for partnerships, charities and unincorporated clubs/associations should not complete this form but should ask for the appropriate form. Important Notice: Before completing this form please read carefully the specific terms and conditions relating to the savings account you are opening (the account terms) as we shall seek to rely on them. In addition, please read the notes under Customer Identification section 7. Please complete this form and then read the Agreement to assign windfalls to charity and the Declarations and sign the form at the end. If you do not understand any point or require assistance in completing this form, please call Skipton Direct on 0345 850 1722. For office use only (Complete once open) Account number Section 1: Account information Type of account Please pay my interest monthly annually Section 2: Account holder(s) details NOTE: If an account is to be opened by an Attorney, please complete a Savings Account Registration Form. Names - If more than 2 account holders are required, please complete an additional application form (maximum of 4 on an account). Only the first named account holder will be recorded in the Society’s records as the Representative Joint Shareholder for the account. -

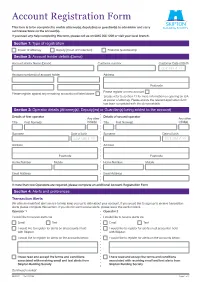

Account Registration Form

Account Registration Form This form is to be completed to enable attorney(s), deputy(ies) or guardian(s) to administer and carry out transactions on the account(s). If you need any help completing this form, please call us on 0345 266 1209 or visit your local branch. Section 1: Type of registration Power of Attorney Deputy (Court of Protection) Financial Guardianship Section 2: Account holder details (Donor) Account Holder Name (Donor) Customer number Customer Date of Birth DD / MM / YY Account number(s) of account holder Address Postcode Please register on new account Please register against any remaining accounts not listed above *please refer to section 11 for more information on opening an ISA as power of attorney. Please ensure the relevant application form has been completed with the donors details. Section 3: Operator details (Attorney(s), Deputy(ies) or Guardian(s) being added to the account) Details of first operator Any other Details of second operator Any other Title First Name(s) initial(s) Title First Name(s) initial(s) Surname Date of birth Surname Date of birth DD / MM / YY DD / MM / YY Address Address Postcode Postcode Home Number Mobile Home Number Mobile Email Address Email Address If more than two Operators are required, please complete an additional Account Registration Form Section 4: Alerts and preferences Transaction Alerts We offer an email/text alert service to help keep you up to date about your account. If you would like to sign up to receive transaction alerts please complete this section. If you do not want receive alerts, please leave this section blank. -

YOUR INHERITANCE. YOUR Choice. It Doesn’T Matter Who You Are Or How We’Re Helping You, There Are Five Key Principles That Will Always Underpin the Way We Work

inheritance TAX YOUR INHERITANCE. YOUR choice. It doesn’t matter who you are or how we’re helping you, there are five key principles that will always underpin the way we work. These are the things that make us different. They also ensure that together we can plan your future today to create a brighter financial tomorrow. Finance MADE frienDLY We’ll treat you like an individual, not just a number. For a stronger partnership and a far more personal approach to financial services, we’ll spend as long as it takes getting to know you, your lifestyle and your aspirations. Peace OF MinD We’ll always keep your peace of mind uppermost in ours, as well as keeping you informed throughout our partnership. By understanding your unique situation and goals we’ll only ever recommend financial products we know you’ll be comfortable with. OUR EXperience IMproVES yourS With a track record stretching back decades, you’ll reap the rewards of our expertise and our acute awareness that your best interests are ours too. TruST IS EVerythinG Our reputation is built on trust; we’ll make sure things stay that way by always acting with integrity and being true to our word. IT’S your Money At SFS it really is all about you, not us. That’s why we’ll never forget that it’s your money we’re dealing with and your financial future that matters. 2 PLANNING TOMORROW TOGETHER WILL YOU BE GIVING GENEROUSLY TO THE TAXMAN? Having worked hard all your life to build your financial portfolio and assets, it’s upsetting to know that 40% of everything over a certain threshold could be given back to the Government in Inheritance Tax (IHT). -

Investor Presentation

Skipton Building Society Investor Presentation June 2015 Contents Overview 3 Financial Results 8 Mortgage Business 17 Liquidity & Funding 22 Connells Group 26 Summary 29 Contacts 31 Appendix 33 2 Overview Group Overview Ultimate parent, member owned . The Society is the 4th largest building society in the UK. Group total assets of £16.0bn in 2014. 95 branches across the UK from Plymouth to Aberdeen. Committed to mutuality – the Society’s heritage over its 162 year history continues to provide us with the focus on Subsidiary, non member business supporting our members, generating sufficient profit to maintain a strong balance sheet and take longer term decisions to invest in the future development of the Strategically important to business. our customer proposition . Over the past two years we have disposed of six, and closed one subsidiary that are no longer strategically important to the Group. The businesses deliver very strong return on . The Society has a number of remaining subsidiaries/non- member businesses that deliver strong returns. capital employed . In June 2015, bthboth Md’Moody’s & Fitc h upgraddded the SitSociety to Baa2 and BBB+ respectively, with a stable outlook. Residential mortgage books in run-off Defensive move , core IT platform 4 Peer Group Comparison 2014 Skipton Yorkshire Coventry Leeds Principality Group Profit Before Tax (£m) 181.6 188.2 201.8 87.9 64.2 Growth in Group Profit Before Tax 75.0% -5.6% 52.8% 36.9% 123.7% Profit After Tax/Mean Assets1 0.80% 0.41% 0.53% 0.60% 0.58% NIM 1.40% 1.52% 1.15% 1.58% 1.87% Cost Income Ratio2 44.5% 59.0% 36.2% 33.0% 46.1% Total Group Assets (£bn) 16.0 37.6 31.3 12.1 7.3 CET1 Ratio 16.2% 13.8% 25.4%3 15.6% 18.2%3 Leverage Ratio 6.0% 4.8% 3.9% 5.6% 5.0% Net Savings Growth 11.7% 3.5% 9.8% 6.6% 0.7% Net Lending Growth 11.2% 83%8.3% 11. -

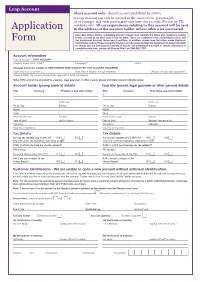

Application Form

Leap Account Share account only - deposit account prohibited by statute. A Leap Account can only be opened in the name of one person aged 18 or younger, and each person may only have one account. For use by UK residents only. All correspondence relating to this account will be sent Application to the address of the account holder unless otherwise instructed. Important Notice: Before completing this form please read carefully the terms and conditions relating to this account as we shall seek to rely on them. These are contained in the marketing literature and Form the Investment Account Terms and Conditions. In addition, please read the notes under Customer Identification below. Please complete this form and then read and sign the Agreement to assign windfalls to charity and the Declarations overleaf. If you do not understand any point or require assistance in completing this form, please call Skipton Direct on 0345 850 1722*. Account information Type of Account - LEAP ACCOUNT Opening Investment - Cash £ Cheque(s) £ Total £ Cheques should be payable to SKIPTON BUILDING SOCIETY RE: THE ACCOUNT HOLDER(S) I authorise you to transfer £ from my/our Skipton Account Number: (Please enclose your passbook) Please indicate the number of signatures required for each withdrawal: Note: If the account is operated by a parent, legal guardian or other person please complete operator details below. Account holder (young saver’s) details Operator (parent, legal guardian or other person) details Title Surname FIrst Name and other initials Title Surname FIrst Name and other initials 1. 2. Postcode Postcode Tel No. Day Evening Tel No. -

Annual Reports and Accounts 2020

ReportAnnual & Accounts 2020 Contents 1 Performance and Strategy 2020 Group Highlights 6 Chair’s Statement 8 Group Chief Executive’s Report 12 Strategic Report 16 Sustainability Report 40 Performance and Strategy 2 Governance The Board of Directors 46 Directors’ Report 52 Directors’ Report on Corporate Governance 56 Audit Committee Report 64 Governance Risk Management Report 69 Directors’ Remuneration Report 80 3 Financial Statements Independent Auditor’s Report 102 Income Statements 112 Statements of Comprehensive Income 113 Statements of Financial Position 114 Statements of Changes in Members’ Interests 115 Financial Statements Statements of Cash Flows 117 Notes to the Accounts 119 4 Other Information Country by Country Reporting 234 Annual Business Statement 236 Glossary 239 Other Information Annual Report & Accounts 2020 3 Performance 1 and Strategy 2020 Group Highlights 6 Chair’s Statement 8 Group Chief Executive’s Report 12 Strategic Report 16 Sustainability Report 40 2020 Group Highlights Key performance highlights Performance and Strategy 1,061,138 £18.7bn 90% 85% Society Membership Savings Balances Employee Engagement Customer Satisfaction Society membership increased by Savings balances grew by Society employee engagement Society net customer satisfaction 14,844 (1.4%) to 1,061,138 (2019: by £1.3bn to £18.7bn, an annual was 90% (2019: 89%) was 85% (2019: 86%) 35,868 (3.5%) to 1,046,294) growth rate of 7.7% (2019: 7.6%) £1.7bn £118.8m £124.0m 39.7% Mortgage Book Growth Total Group Profit Underlying Group PBT Group Common Equity -

The Sir Robert Ogden Macmillan Centre (SROMC) Newsletter Inside This Issue Volunteer News …….……....…3

20/03/2015 Volume 2 Issue 1 The Sir Robert Ogden Macmillan Centre (SROMC) Newsletter Inside this issue Volunteer News …….……....…3 Time to Say Thank You. Alan Williams’ personal challenge……………..2 The SROMC Unit ..………........4 SROMC Celebrates its 1st year The SROMC Spring Ball .…….5 Twelve months ago this week we welcomed the first patients and carers through our doors. Over the last year we have seen our cancer services expand and flourish with the advent of this fabulous new facility here in Harrogate. The building has finally enabled cancer treatments and vital Regular Features; supportive care services to be fully accessible to those affected by a cancer diagnosis under one roof. Feel the Benefit with Phil Once again patients have rated Harrogate District Foundation NHS Trust Bremner’s hints and tips…..….6 within the top 3 trusts in the country for cancer treatment in a national survey. This is a reflection of the dedication and high standards of care delivered by staff here every day. More and more patients are wishing to choose Harrogate as the place to receive their cancer care. The new Centre is enabling plans for more types of cancer to be treated here in the future, alongside the expansion of existing services offering support available during and after the completion of treatment. Some examples Cancer Support ………….…….7 of those already achieved are listed below; A purpose built Cancer Information Support Service offering support and information resources on all aspects of a cancer diagnosis. A Clinical Psychology Service providing emotional support and therapy. A Macmillan Welfare and Benefit service. -

Annual Report & Accounts 2015

Skipton BuildingSkipton Society Annual Report & Accounts Annual Report 2015 & Accounts 2015 2 Skipton Building Society Contents Overview Overview 2015 Group Highlights 4 Chairman’s Statement 6 Group Chief Executive’s Report 8 Strategic Strategic Report Report Our vision 12 The business model 12 Strategy and objectives 13 Responsibility Performance in the year 16 Corporate Performance by division 26 Principal risks and uncertainties 28 Corporate Responsibility Report 29 Governance Governance The Board of Directors 34 Directors’ Report 37 Directors’ Report on Corporate Governance 40 Financials Audit Committee Report 46 Risk Management Report 50 Directors’ Remuneration Report 57 Country by Financials Country Independent Auditor’s Report 73 Income Statements 77 Statements of Comprehensive Income 78 Annual Business Statements of Financial Position 79 Statement Statements of Changes in Members’ Interests 80 Statements of Cash Flows 82 Notes to the Accounts 84 Country by Country Reporting 165 Glossary Annual Business Statement 166 Glossary 171 Annual Report & Accounts 2015 3 2015 Group Highlights Key performance highlights 43,348 £146.9m new customers Total Group profit Society customer numbers increased by 43,348 Total Group profit before tax (PBT) of £146.9m to a record 838,087 (2014: £180.6m) £1.5bn £1.4bn Mortgage book growth Savings balances growth Mortgage book grew by £1.5bn to £14.2bn, an annual Savings balances grew by £1.4bn to £12.8bn, growth rate of 11.9% (2014: 11.2%) an annual growth rate of 11.9% (2014: 11.7%) £3.7bn 23,094 Gross -

Children's Saver Application Form

POD011 Children’s Saver Application Form Share account only - deposit account prohibited by statute. A Childrens Saver can only be opened in the name of one person aged 18 or younger, and each person may only have one account. For use by UK residents only. All correspondence relating to this account will be sent to the address of the account holder unless otherwise instructed. Important Notice: Before completing this form please read carefully the specific terms and conditions relating to the savings account you are opening (the account terms) as we shall seek to rely on them. In addition, please read the notes under Customer Identification section 5. Please complete this form and then read the Agreement to assign windfalls to charity and the Declarations and sign the form at the end. If you do not understand any point or require assistance in completing this form, please call Skipton Direct on 0345 850 1722. For office use only (complete once open) Account number Section 1: Account information Type of account CHILDRENS SAVER What are you saving for? Opening Investment Cash £ Cheque(s) £ Total £ NOTE: Cheques should be payable to SKIPTON BUILDING SOCIETY RE: THE ACCOUNT HOLDER(S) I authorise you to transfer £ from my/our Skipton Account Number: (Please enclose your passbook) Section 2: Account holder & operator details Note: If the account is operated by a parent, legal guardian or other person please complete operator details below. Account holder (young saver) Operator (parent, legal guardian or other person) Mr/Mrs/Miss/Ms Surname Mr/Mrs/Miss/Ms