Steve Meizinger FX Options Pricing, What Does It Mean?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Machine Learning Based Intraday Calibration of End of Day Implied Volatility Surfaces

DEGREE PROJECT IN MATHEMATICS, SECOND CYCLE, 30 CREDITS STOCKHOLM, SWEDEN 2020 Machine Learning Based Intraday Calibration of End of Day Implied Volatility Surfaces CHRISTOPHER HERRON ANDRÉ ZACHRISSON KTH ROYAL INSTITUTE OF TECHNOLOGY SCHOOL OF ENGINEERING SCIENCES Machine Learning Based Intraday Calibration of End of Day Implied Volatility Surfaces CHRISTOPHER HERRON ANDRÉ ZACHRISSON Degree Projects in Mathematical Statistics (30 ECTS credits) Master's Programme in Applied and Computational Mathematics (120 credits) KTH Royal Institute of Technology year 2020 Supervisor at Nasdaq Technology AB: Sebastian Lindberg Supervisor at KTH: Fredrik Viklund Examiner at KTH: Fredrik Viklund TRITA-SCI-GRU 2020:081 MAT-E 2020:044 Royal Institute of Technology School of Engineering Sciences KTH SCI SE-100 44 Stockholm, Sweden URL: www.kth.se/sci Abstract The implied volatility surface plays an important role for Front office and Risk Manage- ment functions at Nasdaq and other financial institutions which require mark-to-market of derivative books intraday in order to properly value their instruments and measure risk in trading activities. Based on the aforementioned business needs, being able to calibrate an end of day implied volatility surface based on new market information is a sought after trait. In this thesis a statistical learning approach is used to calibrate the implied volatility surface intraday. This is done by using OMXS30-2019 implied volatil- ity surface data in combination with market information from close to at the money options and feeding it into 3 Machine Learning models. The models, including Feed For- ward Neural Network, Recurrent Neural Network and Gaussian Process, were compared based on optimal input and data preprocessing steps. -

Futures and Options Workbook

EEXAMININGXAMINING FUTURES AND OPTIONS TABLE OF 130 Grain Exchange Building 400 South 4th Street Minneapolis, MN 55415 www.mgex.com [email protected] 800.827.4746 612.321.7101 Fax: 612.339.1155 Acknowledgements We express our appreciation to those who generously gave their time and effort in reviewing this publication. MGEX members and member firm personnel DePaul University Professor Jin Choi Southern Illinois University Associate Professor Dwight R. Sanders National Futures Association (Glossary of Terms) INTRODUCTION: THE POWER OF CHOICE 2 SECTION I: HISTORY History of MGEX 3 SECTION II: THE FUTURES MARKET Futures Contracts 4 The Participants 4 Exchange Services 5 TEST Sections I & II 6 Answers Sections I & II 7 SECTION III: HEDGING AND THE BASIS The Basis 8 Short Hedge Example 9 Long Hedge Example 9 TEST Section III 10 Answers Section III 12 SECTION IV: THE POWER OF OPTIONS Definitions 13 Options and Futures Comparison Diagram 14 Option Prices 15 Intrinsic Value 15 Time Value 15 Time Value Cap Diagram 15 Options Classifications 16 Options Exercise 16 F CONTENTS Deltas 16 Examples 16 TEST Section IV 18 Answers Section IV 20 SECTION V: OPTIONS STRATEGIES Option Use and Price 21 Hedging with Options 22 TEST Section V 23 Answers Section V 24 CONCLUSION 25 GLOSSARY 26 THE POWER OF CHOICE How do commercial buyers and sellers of volatile commodities protect themselves from the ever-changing and unpredictable nature of today’s business climate? They use a practice called hedging. This time-tested practice has become a stan- dard in many industries. Hedging can be defined as taking offsetting positions in related markets. -

Tracking and Trading Volatility 155

ffirs.qxd 9/12/06 2:37 PM Page i The Index Trading Course Workbook www.rasabourse.com ffirs.qxd 9/12/06 2:37 PM Page ii Founded in 1807, John Wiley & Sons is the oldest independent publishing company in the United States. With offices in North America, Europe, Aus- tralia, and Asia, Wiley is globally committed to developing and marketing print and electronic products and services for our customers’ professional and personal knowledge and understanding. The Wiley Trading series features books by traders who have survived the market’s ever changing temperament and have prospered—some by reinventing systems, others by getting back to basics. Whether a novice trader, professional, or somewhere in-between, these books will provide the advice and strategies needed to prosper today and well into the future. For a list of available titles, visit our web site at www.WileyFinance.com. www.rasabourse.com ffirs.qxd 9/12/06 2:37 PM Page iii The Index Trading Course Workbook Step-by-Step Exercises and Tests to Help You Master The Index Trading Course GEORGE A. FONTANILLS TOM GENTILE John Wiley & Sons, Inc. www.rasabourse.com ffirs.qxd 9/12/06 2:37 PM Page iv Copyright © 2006 by George A. Fontanills, Tom Gentile, and Richard Cawood. All rights reserved. Published by John Wiley & Sons, Inc., Hoboken, New Jersey. Published simultaneously in Canada. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the web at www.copyright.com. -

Airline Scams and Scandals Free

FREE AIRLINE SCAMS AND SCANDALS PDF Edward Pinnegar | 160 pages | 09 Oct 2012 | The History Press Ltd | 9780752466255 | English | Stroud, United Kingdom Airline Scams and Scandals by Edward Pinnegar | NOOK Book (eBook) | Barnes & Noble® We urge you to turn off your ad blocker for The Telegraph website so that you can continue to access our quality content in the future. Visit our adblocking instructions page. Telegraph Travel Galleries. Airline scams and scandals. Easyjet's idea of kosher When Easyjet announced a new route from London Luton to Tel Aviv found in Israel, a country where 76 per cent of the population are Jewish init also unveiled a special kosher menu designed by Hermolis of London, to be priced at the same Airline Scams and Scandals as standard ranges on other flights. However, in Februarymany Jewish passengers were somewhat taken aback Airline Scams and Scandals the inflight offering included bacon baguettes and ham melts. The airline claimed that the Airline Scams and Scandals food canisters had been loaded at Luton. But when the Airline Scams and Scandals thing happened two weeks later, Easyjet was forced to offer an official apology as well as issue staff with reminders as to the requirements of many passengers travelling to and from the Holy Land. Back to image. Travel latest. Latest advice as restrictions extended. Latest news on cruise lines and holidays. Everything you need to know about booking a trip this winter. Voucher Codes. The latest offers and discount codes from popular brands on Telegraph Voucher Codes. We've noticed you're adblocking. We rely on advertising to help fund our award-winning journalism. -

Seeking Income: Cash Flow Distribution Analysis of S&P 500

RESEARCH Income CONTRIBUTORS Berlinda Liu Seeking Income: Cash Flow Director Global Research & Design Distribution Analysis of S&P [email protected] ® Ryan Poirier, FRM 500 Buy-Write Strategies Senior Analyst Global Research & Design EXECUTIVE SUMMARY [email protected] In recent years, income-seeking market participants have shown increased interest in buy-write strategies that exchange upside potential for upfront option premium. Our empirical study investigated popular buy-write benchmarks, as well as other alternative strategies with varied strike selection, option maturity, and underlying equity instruments, and made the following observations in terms of distribution capabilities. Although the CBOE S&P 500 BuyWrite Index (BXM), the leading buy-write benchmark, writes at-the-money (ATM) monthly options, a market participant may be better off selling out-of-the-money (OTM) options and allowing the equity portfolio to grow. Equity growth serves as another source of distribution if the option premium does not meet the distribution target, and it prevents the equity portfolio from being liquidated too quickly due to cash settlement of the expiring options. Given a predetermined distribution goal, a market participant may consider an option based on its premium rather than its moneyness. This alternative approach tends to generate a more steady income stream, thus reducing trading cost. However, just as with the traditional approach that chooses options by moneyness, a high target premium may suffocate equity growth and result in either less income or quick equity depletion. Compared with monthly standard options, selling quarterly options may reduce the loss from the cash settlement of expiring calls, while selling weekly options could incur more loss. -

Are Defensive Stocks Expensive? a Closer Look at Value Spreads

Are Defensive Stocks Expensive? A Closer Look at Value Spreads Antti Ilmanen, Ph.D. November 2015 Principal For several years, many investors have been concerned about the apparent rich valuation of Lars N. Nielsen defensive stocks. We analyze the prices of these Principal stocks using value spreads and find that they are not particularly expensive today. Swati Chandra, CFA Vice President Moreover, valuations may have limited efficacy in predicting strategy returns. This piece lends insight into possible reasons by focusing on the contemporaneous relation (i.e., how changes in value spreads are related to returns over the same period). We highlight a puzzling case where a defensive long/short strategy performed well during a recent two- year period when its value spread normalized from abnormally rich levels. For most asset classes, cheapening valuations coincide with poor performance. However, this relationship turns out to be weaker for long/short factor portfolios where several mechanisms can loosen the presumed strong link between value spread changes and strategy returns. Such wedges include changing fundamentals, evolving positions, carry and beta mismatches. Overall, investors should be cognizant of the tenuous link between value spreads and returns. We thank Gregor Andrade, Cliff Asness, Jordan Brooks, Andrea Frazzini, Jacques Friedman, Jeremy Getson, Ronen Israel, Sarah Jiang, David Kabiller, Michael Katz, AQR Capital Management, LLC Hoon Kim, John Liew, Thomas Maloney, Lasse Pedersen, Lukasz Pomorski, Scott Two Greenwich Plaza Richardson, Rodney Sullivan, Ashwin Thapar and David Zhang for helpful discussions Greenwich, CT 06830 and comments. p: +1.203.742.3600 f: +1.203.742.3100 w: aqr.com Are Defensive Stocks Expensive? A Closer Look at Value Spreads 1 Introduction puzzling result — buying a rich investment, seeing it cheapen, and yet making money — in Are defensive stocks expensive? Yes, mildly, more detail below. -

Evidence from SME Bond Markets

Temi di discussione (Working Papers) Asymmetric information in corporate lending: evidence from SME bond markets by Alessandra Iannamorelli, Stefano Nobili, Antonio Scalia and Luana Zaccaria September 2020 September Number 1292 Temi di discussione (Working Papers) Asymmetric information in corporate lending: evidence from SME bond markets by Alessandra Iannamorelli, Stefano Nobili, Antonio Scalia and Luana Zaccaria Number 1292 - September 2020 The papers published in the Temi di discussione series describe preliminary results and are made available to the public to encourage discussion and elicit comments. The views expressed in the articles are those of the authors and do not involve the responsibility of the Bank. Editorial Board: Federico Cingano, Marianna Riggi, Monica Andini, Audinga Baltrunaite, Marco Bottone, Davide Delle Monache, Sara Formai, Francesco Franceschi, Salvatore Lo Bello, Juho Taneli Makinen, Luca Metelli, Mario Pietrunti, Marco Savegnago. Editorial Assistants: Alessandra Giammarco, Roberto Marano. ISSN 1594-7939 (print) ISSN 2281-3950 (online) Printed by the Printing and Publishing Division of the Bank of Italy ASYMMETRIC INFORMATION IN CORPORATE LENDING: EVIDENCE FROM SME BOND MARKETS by Alessandra Iannamorelli†, Stefano Nobili†, Antonio Scalia† and Luana Zaccaria‡ Abstract Using a comprehensive dataset of Italian SMEs, we find that differences between private and public information on creditworthiness affect firms’ decisions to issue debt securities. Surprisingly, our evidence supports positive (rather than adverse) selection. Holding public information constant, firms with better private fundamentals are more likely to access bond markets. Additionally, credit conditions improve for issuers following the bond placement, compared with a matched sample of non-issuers. These results are consistent with a model where banks offer more flexibility than markets during financial distress and firms may use market lending to signal credit quality to outside stakeholders. -

Module 6 Option Strategies.Pdf

zerodha.com/varsity TABLE OF CONTENTS 1 Orientation 1 1.1 Setting the context 1 1.2 What should you know? 3 2 Bull Call Spread 6 2.1 Background 6 2.2 Strategy notes 8 2.3 Strike selection 14 3 Bull Put spread 22 3.1 Why Bull Put Spread? 22 3.2 Strategy notes 23 3.3 Other strike combinations 28 4 Call ratio back spread 32 4.1 Background 32 4.2 Strategy notes 33 4.3 Strategy generalization 38 4.4 Welcome back the Greeks 39 5 Bear call ladder 46 5.1 Background 46 5.2 Strategy notes 46 5.3 Strategy generalization 52 5.4 Effect of Greeks 54 6 Synthetic long & arbitrage 57 6.1 Background 57 zerodha.com/varsity 6.2 Strategy notes 58 6.3 The Fish market Arbitrage 62 6.4 The options arbitrage 65 7 Bear put spread 70 7.1 Spreads versus naked positions 70 7.2 Strategy notes 71 7.3 Strategy critical levels 75 7.4 Quick notes on Delta 76 7.5 Strike selection and effect of volatility 78 8 Bear call spread 83 8.1 Choosing Calls over Puts 83 8.2 Strategy notes 84 8.3 Strategy generalization 88 8.4 Strike selection and impact of volatility 88 9 Put ratio back spread 94 9.1 Background 94 9.2 Strategy notes 95 9.3 Strategy generalization 99 9.4 Delta, strike selection, and effect of volatility 100 10 The long straddle 104 10.1 The directional dilemma 104 10.2 Long straddle 105 10.3 Volatility matters 109 10.4 What can go wrong with the straddle? 111 zerodha.com/varsity 11 The short straddle 113 11.1 Context 113 11.2 The short straddle 114 11.3 Case study 116 11.4 The Greeks 119 12 The long & short straddle 121 12.1 Background 121 12.2 Strategy notes 122 12..3 Delta and Vega 128 12.4 Short strangle 129 13 Max pain & PCR ratio 130 13.1 My experience with option theory 130 13.2 Max pain theory 130 13.3 Max pain calculation 132 13.4 A few modifications 137 13.5 The put call ratio 138 13.6 Final thoughts 140 zerodha.com/varsity CHAPTER 1 Orientation 1.1 – Setting the context Before we start this module on Option Strategy, I would like to share with you a Behavioral Finance article I read couple of years ago. -

307439 Ferdig Master Thesis

Master's Thesis Using Derivatives And Structured Products To Enhance Investment Performance In A Low-Yielding Environment - COPENHAGEN BUSINESS SCHOOL - MSc Finance And Investments Maria Gjelsvik Berg P˚al-AndreasIversen Supervisor: Søren Plesner Date Of Submission: 28.04.2017 Characters (Ink. Space): 189.349 Pages: 114 ABSTRACT This paper provides an investigation of retail investors' possibility to enhance their investment performance in a low-yielding environment by using derivatives. The current low-yielding financial market makes safe investments in traditional vehicles, such as money market funds and safe bonds, close to zero- or even negative-yielding. Some retail investors are therefore in need of alternative investment vehicles that can enhance their performance. By conducting Monte Carlo simulations and difference in mean testing, we test for enhancement in performance for investors using option strategies, relative to investors investing in the S&P 500 index. This paper contributes to previous papers by emphasizing the downside risk and asymmetry in return distributions to a larger extent. We find several option strategies to outperform the benchmark, implying that performance enhancement is achievable by trading derivatives. The result is however strongly dependent on the investors' ability to choose the right option strategy, both in terms of correctly anticipated market movements and the net premium received or paid to enter the strategy. 1 Contents Chapter 1 - Introduction4 Problem Statement................................6 Methodology...................................7 Limitations....................................7 Literature Review.................................8 Structure..................................... 12 Chapter 2 - Theory 14 Low-Yielding Environment............................ 14 How Are People Affected By A Low-Yield Environment?........ 16 Low-Yield Environment's Impact On The Stock Market........ -

Currencies Come in Pairs

Chapter 1.2 Currencies Come in Pairs 0 GETTING STARTED CURRENCIES COME IN PAIRS You know the advantages of trading forex, and you are excited to start Everything is relative in the forex market. The euro, by itself, is neither trading. Now you need to learn what this market is all about. How does it strong nor weak. The same holds true for the U.S. dollar. By itself, it is work? What makes currency pairs move up and down? Most importantly, neither strong nor weak. Only when you compare two currencies together how can you make money trading forex? can you determine how strong or weak each currency is in relation to the other currency. Every successful forex investor begins with a solid foundation of knowledge upon which to build. Let’s start with currency pairs—the For example, the euro could be getting stronger compared to the U.S. building blocks of the forex market—and how you will be using them in dollar. However, the euro could also be getting weaker compared to the your trading. British pound at the same time. In this first section, we will explain the following to get you ready to place Currencies always trade in pairs. You never simply buy the euro or sell the your first trade: U.S. dollar. You trade them as a pair. If you believe the euro is gaining strength compared to the U.S. dollar, you buy euros and sell U.S. dollars at What a currency pair is the same time. If you believe the U.S. -

Users/Robertjfrey/Documents/Work

AMS 511.01 - Foundations Class 11A Robert J. Frey Research Professor Stony Brook University, Applied Mathematics and Statistics [email protected] http://www.ams.sunysb.edu/~frey/ In this lecture we will cover the pricing and use of derivative securities, covering Chapters 10 and 12 in Luenberger’s text. April, 2007 1. The Binomial Option Pricing Model 1.1 – General Single Step Solution The geometric binomial model has many advantages. First, over a reasonable number of steps it represents a surprisingly realistic model of price dynamics. Second, the state price equations at each step can be expressed in a form indpendent of S(t) and those equations are simple enough to solve in closed form. 1+r D-1 u 1 1 + r D 1 + r D y y ÅÅÅÅÅÅÅÅÅÅÅÅÅÅÅÅÅÅÅÅÅÅÅÅÅÅÅÅÅÅÅÅÅÅ = u fl u = 1+r D u-1 u 1+r-u 1 u 1 u yd yd ÅÅÅÅÅÅÅÅÅÅÅÅÅÅÅÅ1+r D ÅÅÅÅÅÅÅÅ1 uêÅÅÅÅ-ÅÅÅÅu ÅÅ H L H ê L i y As we will see shortlyH weL Hwill solveL the general problemj by solving a zsequence of single step problems on the lattice. That K O K O K O K O j H L H ê L z sequence solutions can be efficientlyê computed because wej only have to zsolve for the state prices once. k { 1.2 – Valuing an Option with One Period to Expiration Let the current value of a stock be S(t) = 105 and let there be a call option with unknown price C(t) on the stock with a strike price of 100 that expires the next three month period. -

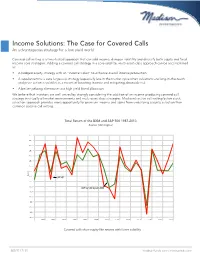

Income Solutions: the Case for Covered Calls an Advantageous Strategy for a Low-Yield World

Income Solutions: The Case for Covered Calls An advantageous strategy for a low-yield world Covered call writing is a time-tested approach that can add income, dampen volatility and diversify both equity and fixed income core strategies. Adding a covered call strategy in a core-satellite, multi-asset-class approach can be accomplished as: • A hedged equity strategy with an “income kicker” to enhance overall income production • A supplement to a core large-cap strategy (especially late in the market cycle when valuations are long-in-the-tooth and price action is volatile) as a means of boosting income and mitigating downside risk • A better-yielding alternative to a high yield bond allocation We believe that investors are well-served by strongly considering the addition of an income-producing covered call strategy in virtually all market environments and multi-asset class strategies. Madison’s active call writing/active stock selection approach provides more opportunity for premium income and alpha from underlying security selection than common passive call writing. Total Return of the BXM and S&P 500 1987-2013 Rolling Returns Source: Morningstar Time Period: 1/1/1987 to 12/31/2013 Rolling Window: 1 Year 1 Year shift 40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 Return 0.0 S&P 500 -5.0 -10.0 CBOE S&P 500 Buywrite BXM -15.0 -20.0 -25.0 -30.0 -35.0 -40.0 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 S&P 500 TR USD Covered calls show equity-likeCBOE returns S&P 500 with Buyw ritelower BXM volatility Source: Morningstar Direct 888.971.7135 madisonfunds.com | madisonadv.com Covered Call Strategy(A) Benefits of Individual Stock Options vs.