Proxy Season Review Q2 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

European Market Outlook

Market Outlook - 13 July 2021 European stocks shut higher on Monday, lifting a Both B&M and Natwest Group closed the day with a 2.2 considerable lot of the area's benchmarks to new record percent gain. Experian, Land Securities, Sage Group, highs, as financial backers bet on trusts top U.S. banks will Segro, AstraZeneca, Ashtead Group, and United Utilities report a solid second-quarter profit. all increased by 1 to 2%. The Stoxx 600 index in Europe rose 0.69 percent. The Sanofi, WorldLine, Dassault Systemes, Teleperformance, DAX in Germany increased by 0.65%, the CAC 40 in Essilor, Orange, Veolia, LOreal, STMicroelectronics, and France up by 0.46 percent, and the FTSE 100 in the Air Liquide all increased by 1 to 1.6 percent in the French United Kingdom increased by 0.05 percent. The SMI in market. Switzerland increased by 0.77 percent. Among other markets in Europe, Belgium, Czech Republic, On July 19th, British Prime Minister Boris Johnson is Denmark, Finland, Netherlands, Norway, Poland, Portgual, anticipated to endorse the proposal to abolish practically Russia, Spain and Sweden finished higher. all covid-19 limitations, however, he has cautioned the public. Meanwhile, there are concerns that as the virus Ireland and Turkey concluded the day on a low note, while spreads across Europe, many governments will impose Austria, Greece, and Iceland were all flat. new limitations. Admiral Group shares rose about 4% in the UK market According to Destatis data, wholesale prices in Germany after the business stated it expects a higher-than-expected climbed by 10.7% year on year in June, the fastest rate Group profit before tax from continuing operations in the since 1981. -

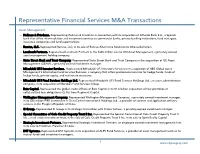

Representative Financial Services M&A Transactions

Representative Financial Services M&A Transactions Asset Management • Hellman & Friedman. Representing Hellman & Friedman in connection with its acquisition of Allfunds Bank S.A., a Spanish bank that offers intermediation and investment services to commercial banks, private banking institutions, fund managers, insurance companies and fund supermarkets. • Ramius, LLC. Represented Ramius, LLC, in its sale of Ramius Alternative Solutions to AllianceBernstein. • Landmark Partners. Represented Landmark Partners in the $465 million sale to OM Asset Management, a privately owned asset management holding company. • State Street Bank and Trust Company. Represented State Street Bank and Trust Company in the acquisition of GE Asset Management (GEAM), a privately owned investment manager. • Mitsubishi UFJ Investor Services. Represented Mitsubishi UFJ Investors Services in its acquisition of UBS Global Asset Management’s Alternative Fund Services Business, a company that offers professional services for hedge funds, funds of hedge funds, private equity, and real estate structures. • Mitsubishi UFJ Fund Services Holdings Ltd. Represented Mitsubishi UFJ Fund Services Holdings Ltd., an asset administration company, in its acquisition of Meridian Fund Services Group. • Bain Capital. Represented the global credit affiliate of Bain Capital in its $1.6 billion acquisition of four portfolios of collateralized loan obligations (CLOs) from Regiment Capital. • Wellington Management Company. Represented Wellington Management Company, a privately owned investment manager, in its $85 million PIPE investment in ChinaCache International Holdings Ltd., a provider of content and application delivery services in the People’s Republic of China. • 3i Group. Represented 3i Group in its strategic transaction with Fraser Sullivan, a privately owned investment manager. • Special Committee of Cole Credit Property Trust II Inc. -

Fact Sheet:State Street Aggregate Bond Index Fund, Jun2021

State Street Aggregate Bond Index Fund - Class K Fixed Income 30 June 2021 Fund Objective Total Return The State Street Aggregate Bond Index Fund (the "Fund") seeks to provide Bloomberg Barclays investment results that, before fees and expenses, correspond generally U.S. Aggregate to the price and yield performance of an index that tracks the U.S. dollar Cumulative Fund at NAV Bond Index denominated investment grade bond market over the long term. QTD 1.80% 1.83% Process YTD -1.77 -1.60 The Fund seeks to achieve its investment objective by investing Annualized substantially all of its investable assets in the Aggregate Bond Index 1 Year -0.56 -0.33 Portfolio, which has substantially similar investment policies to the Fund 3 Year 5.31 5.34 when the Fund invests in this “master-feeder” structure, the Fund’s only 5 Year 2.88 3.03 investments are shares of the Portfolio and it participates in the investment returns achieved by the Portfolio. Under normal circumstances, at least Since Fund Inception 3.27 3.40 80% of the Fund's net assets will be invested (either on its own or as a part of a master/feeder structure) in securities comprising the Bloomberg Barclays U.S. Aggregate Bond Index (the "Index") or in securities that Gross Expense Ratio 0.215% SSGA Funds Management, Inc. (the “Adviser”) determines have economic Net Expense Ratio^ 0.025% characteristics that are comparable to the economic characteristics of 30 Day SEC Yield 2.04% securities that comprise the Index. The Fund is not managed according 30 Day SEC Yield (Unsubsidized) 1.94% to traditional methods of "active" investment management, which involve the buying and selling of securities based upon economic, financial Maximum Sales Charge - and market analysis and investment judgment. -

Stewardship Activity Report: Q2 2017

Stewardship Activity Report Q2 2017 Figure 1: Vote Summary H1 2017 This report provides an overview of the 2017 proxy seasons Number of Meetings Voted 12,608 in the US, UK and Japan markets and highlights SSGA’s stewardship activities, proxy voting and engagement, on Number of Countries 81 material environmental, social and governance (ESG) topics. Management Proposals 123,572 Votes For (%) 87.3 Votes Against (%) 12.7 Thematic Focus — Cross Shareholder Proposals 3,446 Regional Engagements 92.7 With Management (%) Gender Diversity — Fearless Girl 1 Against Management (%) 7.3 In March 2017, SSGA launched its Fearless Girl campaign that 1 Votes Against Management are calculated as For + Abstain. All proposal statistics was supported by our call to action on companies to improve exclude Do Not Vote instructions. board quality by enhancing diversity on boards. In Q2 2017, we sent letters to over 600 companies in the US, UK and Figure 2: Breakdown of Voting by Region H1 2017 Australia that we identified as lacking a single woman on the board. In the letter we informed companies of our expectations Australia with regards to diversity on boards and offered to engage with 1% RW 37% companies on this matter. We made clear that our preferred United Kingdom 4% approach to drive greater board diversity is through an active dialogue and engagement with companies. However, we Japan 12% clarified that in the event that companies fails to take action to increase the number of women on their boards, we will use Europe North America our proxy voting power to effect change — voting against the 13% 33% Chair of the board’s nominating and/or governance committee if necessary. -

Fall Forum 2018 September 16 – 18 Four Seasons Hotel Baltimore, MD

Fall Forum 2018 September 16 – 18 Four Seasons Hotel Baltimore, MD AGENDA AT A GLANCE DRESS CODE FOR SUNDAY IS CASUAL AND MONDAY AND TUESDAY IS BUSINESS CASUAL. ALL TIMES AND SESSIONS ARE TENTATIVE AND SUBJECT TO CHANGE. Sunday, September 16, 2018 Time Meeting Room Floor 2:00 – 5:00 PM Board of Directors Meeting Azure 2nd Limited to Board of Directors only. 3:45 – 4:45 PM Co-Chair Meeting Grand Ballroom B 2nd Limited to Co-Chairs only. 5:00 – 6:00 PM Board of Directors & Co-Chair Meeting Grand Ballroom B 2nd Limited to Board of Directors and Co-Chairs only. 6:00 – 7:00 PM Cocktail Reception Splash Terrace – 4th weather permitting Grand Ballroom A – 2nd alternate Monday, September 17, 2018 Time Meeting Room Floor 8:00 – 9:00 AM Breakfast & New Member/First Time Attendee Grand Ballroom B 2nd Orientation 9:00 – 11:00 AM General Session Grand Ballroom A 2nd • Update from the Chair Erica Borghi, Brown Brothers Harriman & Co. • Security Aspects for Digital Currencies: ISO Standards Edward Scheidt, ANSI X9 Financial Standards Today, many use digital platforms for payments and transactions. Standards offer an international compromise and acceptance. As the International Standards Organization (ISO) advance digital use cases with currencies, security becomes the differentiation among the world bodies. Security technologies, policies, and innovations are needed to ensure Trust. • Modernizing the U.S. Equity Post-Trade Infrastructure & Settlement Optimization John Abel, DTCC John Abel, Executive Director DTCC Settlement Services, will discuss how DTCC is exploring several ways to further shorten the trade settlement cycle beyond T+2 and introduce new operational and capital efficiencies to the NSCC and DTC transactional workflows. -

Gold: the Original Liquid Alternative

Gold: The Original Liquid Alternative In today’s market environment, it is increasingly important to balance the need for diversification with risk-adjusted performance. Interest in alternatives (private equity, hedge funds, real estate, and commodities) has significantly grown over the past decade for two main reasons: 1) investors seek positive risk-adjusted returns and 2) they want to improve the diversification of traditional stock/bond portfolios while mitigating risk. Gold has historically shown that it may improve both. GOLD AS AN ALTERNATIVE TO ENHANCE ALTERNATIVES promote buying (investing in) gold as a store of value.1 In turn, One of the foundations of modern asset allocation is this creates a balance that drives gold’s lack of correlation to that, over the long run, a well-balanced portfolio increases other assets.2 risk-adjusted returns. Hedge funds, private equity, real estate, liquid alternatives (managed futures, long/short equity) and GOLD: METAL BY DESIGN, CURRENCY BY NATURE even commodities can potentially help investors achieve While we believe that commodities are an important portfolio higher risk-adjusted returns when compared to stocks and diversifier that can help hedge against inflation, gold’s unique bonds alone. But gold may offer benefits that cannot be solely characteristics make it stand out. Gold has low correlation obtained by investing in bonds, stocks or other alternative to commodities (Figure 3) and, in general, we believe that strategies. In other words, whether an investor is considering investors should see gold as more than a line-item in a generic adding alternatives to their asset allocation, has already commodities basket allocation. -

FX Factors and Media

FX Factors and Media Media information can improve the performance of FX carry, momentum and valuation Currency management styles or factors are now firmly part of the active currency management Figure 1: G10 Value & Media, returns and information ratios landscape. Rule-based active currency factors such 35% Value + Media IR = 0.7 as Momentum, Valuation and Carry have been shown 30% to generate positive risk-adjusted returns over the 25% long term, though their performance can be sensitive 20% through time. 15% Value IR = 0.2 10% 5% Cumulative return Cumulative measures of media sentiment, intensity and 0% disagreement, which capture the tone, volume and -5% returns correlation = 0.7 dispersion of media coverage drawn from hundreds -10% of thousands of curated, unstructured online Mar'13 Mar'14 Mar'15 Mar'16 Mar'17 Mar'18 Mar'19 sources. Over the past six years, we have found that Value Value+Media this data can generate timely insights into the Source: State Street Global Markets. Notes: Results span 13 to . We performance of foreign currencies. These near real- measure factor performance from 2013 onwards to span the period for which we have media data. G10 currencies: AUD, CAD, CHF, EUR, GBP, JPY, NOK, NZD, time pulses of broad media coverage enable investors SEK, USD to evaluate the impact of online chatter and control for systematic biases. Combinining these measures of media with traditional FX factors such as Momentum, Valuation and Carry can help enhance returns, reduce risk, and improve risk-adjusted performance. Figure 1 shows the historical performance of the media-enhanced value factor (Value+Media) applied to the major G10 currencies. -

Fact Sheet:SPDR® Bloomberg Barclays Global Aggregate Bond

EMEA_ETFEQFI 31 July 2021 31 August 2021 SPDR® Bloomberg Barclays Global Aggregate Bond USD Hdg UCITS ETF (Dist) ISIN IE00BF1QPH33 Index Description The Bloomberg Barclays Global Aggregate Bond Index (USD Fund Objective Hedged) represents a close estimation of the performance that can The objective of the Fund is to track the performance of global be achieved by hedging the currency exposure of its parent index, markets for investment grade (high quality) fixed-rate debt the Bloomberg Barclays Global Aggregate Bond Index, to USD. The securities. index is 100% hedged to the USD by selling the forwards of all the currencies in the parent index at the one-month Forward rate. The parent index is composed of government, government-related and corporate bonds, as well as asset-backed, mortgage-backed and commercial mortgage-backed securities from both developed and emerging markets issuers. Index Ticker LEGATRUH Index Type Total Return Number of Constituents 27,340 Key Facts Inception Date Income Treatment Domicile ISA Eligible Currency Hedging 14-Feb-2018 Semi-Annually Distribution Ireland Yes Monthly Share Class Currency Replication Method Investment Manager SIPP Eligible USD Stratified Sampling State Street Global Advisors Yes Europe Limited Fund - Base Currency UCITS Compliant PEA Eligible USD Yes Fund Umbrella No SSGA SPDR ETFs Europe I plc TER Sub-Investment Man- 0.10% Share Class Assets (millions) ager US$994.03 State Street Global Advisors Limited Total Fund Assets (millions) US$2,012.08 TAX STATUS As standard, SSGA aims to meet all applicable tax reporting requirements for all of the SPDR ETFs in the following countries. -

Fourth Quarter & Full Year 2017 Financial Highlights

Fourth Quarter & Full Year 2017 Financial Highlights January 23, 2018 (NYSE: STT) Preface and forward-looking statements This presentation includes certain highlights of, and also material supplemental to, State Street Corporation’s news release announcing its fourth quarter and full year 2017 financial results. That news release contains a more detailed discussion of many of the matters described in this presentation and is accompanied by detailed financial tables. This presentation is designed to be reviewed together with that news release, which is available on State Street’s website, at www.statestreet.com/stockholder, and is incorporated herein by reference. This presentation (and the conference call accompanying it) contains forward-looking statements as defined by United States securities laws. These statements are not guarantees of future performance, are inherently uncertain, are based on assumptions that are difficult to predict and have a number of risks and uncertainties. The forward-looking statements in this presentation speak only as of January 23, 2018, and State Street does not undertake efforts to revise forward-looking statements. See “Forward-Looking Statements” in the Appendix for more information, including a description of certain factors that could affect future results and outcomes. Financial information in this presentation includes presentation on both an “operating” or otherwise adjusted basis, which represent non-GAAP presentations. Refer to the Appendix for explanations of our non-GAAP financial measures, -

INVESTED in DISRUPTION IQ Redefining Investment Performance

Q3 & 4 2017 INVESTED IN DISRUPTION IQ Redefining Investment Performance The New Alternatives Paradigm Disruption in Action Demography and Destiny Q3&4 2017 IQ magazine provides the most relevant thought IQ leadership from State Street Global Advisors. We live in an age of disruption, in which business models, industries and even our daily lives are being transformed. As the pace of disruption accelerates, we look at game-changing shifts that are redefining ideas around investment performance and value and how investors can navigate this new landscape. State Street Global Advisors 2 4 ALL CHANGE While macroeconomic conditions might suggest a return to “normal,” disruptions on all sides require investors to embrace change and look for the opportunities. 8 CHANGE THE GOAL, CHANGE THE GAME In our latest investment roundtable, we look at how institutional investors are redefining ideas of performance and value beyond traditional metrics. 14 THE NEW ALTERNATIVES PARADIGM Alternatives remain an important portfolio component, but liquidity lessons and factor approaches are transforming how investors build their exposures. 20 DISRUPTION IN ACTION Automobiles, healthcare and retail are in the front lines of creative destruction: we look at what those disruptions mean for investors. 32 DEMOGRAPHIC DISRUPTION Ageing populations around the world are challenging assumptions about saving and investing. State Street Global Advisors 3 RICK LACAILLE Global Chief Investment Officer ALL State Street Global Advisors CHANGEAs we move into the final stretch of 2017, the global economy continues to grind higher, with overall growth for the year slated to improve for the first time in three years. While the stimulus expected from the new Trump administration has languished, the equity bull market in the US nonetheless is charging into its ninth year. -

Echiquier Agressor A

ECHIQUIER AGRESSOR A AUGUST 2021 (data as of 08/31/2021) Echiquier Agressor in vests in European stocks using bottom up stock -picking. The “carte blanche” feature allows the manager to select stocks without constraint of style or size. Fund Manager comments 532 M € 1,770.44 € NAV Echiquier Agressor A turned in a positive monthly performance of 2.51% and of 14.92% year -to -date. Net assets The unwavering support of central banks is allowing equity markets to continue their upward trajectory. Characteristics However, performance drivers largely turned to the advantage of defensive and growth stocks during the month of August. Despite results for the second q uarter confirming a gradual return to normal, the resurgence Inception date 11/29/1991 of the virus among vaccinated populations is worrying the markets, which are taking refuge in companies with ISIN FR0010321802 the highest visibility. Against this backdrop, companies in the healthcare sector such as NOVO NORDISK and ASTRAZENECA allowed the fund to outperform its benchmark, as did those in the semiconductor sector, which Bloomberg code ECHAGRE FP benefited from price increases related to component shortages. The only shadow in August was Chinese president Xi Jinping’s stron g statements for more social justice, which were aimed at the wealthiest taxpayers. Base currency EUR As a result of these statements, luxury stocks such as KERING and MONCLER returned part of their gains made Income allocation Accumulation since the beginning of the year. Ref. Indic. MSCI EUROPE NR Fund Manager: Olivier de Berranger Financial information Evolution of the performance of the fund and its reference indicator since inception Subscription/ (base 100) 3% max. -

2003 - 2019 Top 200 Employers for CPT Students**

2003 - 2019 Top 200 Employers for CPT Students** **If a student is employed at the same Employer while in a different program, he/she will be counted multiple times for that employer. Top 200 Employer Names Number of Students Participating in CPT in 2003-2019 Amazon 9,302 Intel Corporation 6,453 Microsoft Corporation 6,340 Google 6,132 IBM 4,721 Deloitte 3,870 Facebook 3,810 Qualcomm Technologies, Inc 3,371 Ernst & Young 2,929 Goldman Sachs 2,867 Cummins 2,729 JP Morgan Chase 2,474 PricewaterhouseCoopers 2,295 Bank of America 2,241 Apple, Inc 2,229 Cisco System, Inc 2,133 Disney 2,041 Morgan Stanley 1,970 World Bank 1,956 Citigroup 1,904 Merrill Lynch 1,850 KPMG 1,464 Dell, Inc 1,448 Yahoo 1,403 Motorola 1,357 Tesla, Inc 1,314 eBay or PayPal 1,268 Kelly Services 1,195 EMC Corporation 1,119 NVIDIA Corporation 1,110 Walmart 1,108 Samsung Research America 1,102 Ericsson, Inc 1,100 Adobe Systems Incorporated 1,085 PRO Unlimited 1,042 Texas Instruments 1,022 Credit Suisse 1017 Barclays 970 Randstad 942 Sony 930 Schlumberger 928 McKinsey & Company 883 2003 - 2019 Top 200 Employers for CPT Students** **If a student is employed at the same Employer while in a different program, he/she will be counted multiple times for that employer. VMWare 868 Adecco 845 Philips 829 Deutsche Bank 797 Broadcom Corporation 791 HP, Inc 789 Oracle 789 Advanced Micro Devices, Inc 782 Micron Technology, Inc 775 Boston Consulting Group 755 CVS Pharmacy 741 Robert Bosch LLC 723 Bloomberg 711 State Street 705 Hewlett-Packard 702 Alcatel-Lucent 666 Oak Ridge Institute for Science and Education 662 Genentech 657 Symantec Corporation 657 Nokia 642 Aerotek, Inc 638 Los Alamos National Laboratory 638 LinkedIn 635 Tekmark Global Solutions LLC 634 Populus Group 624 Salesforce 623 SAP America, Inc 619 Juniper Network 609 Atrium 584 The Mathworks, Inc 582 Monsanto 581 Wayfair 580 Autodesk 571 Intuit 562 Wells Fargo 559 Synopsys, Inc 546 NEC Laboratories America, Inc.