2015 Annual Meeting of Shareholders and Proxy Statement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ken Parent Senior Advisor to CEO and Chairman, Pilot Travel Centers LLC

Ken Parent Senior Advisor to CEO and Chairman, Pilot Travel Centers LLC Pilot Travel Centers LLC PO BOX 10146 (865) 588-7487 p 692 stores 5508 Lonas Dr www.pilottravelcenters.com Knoxville, TN 37939-0146 (865) 297-1334 f ken.parent@pilottravelcenters. com Serving on: • Board of Directors, Vice Chairman, • Executive Committee, Vice • Strategic Communications Strategic Communications Chairman, Strategic Committee Communications Company: Pilot Travel Centers LLC, doing business as Pilot Flying J, is a chain of truck stops in the United States and Canada. The company is based in Knoxville, Tennessee, where Pilot Corporation, the majority owner, is based. The company is owned by Pilot, FJ Management Inc., and CVC Capital Partners. The company operates truck stops under the Pilot Travel Centers and Flying J Travel Plaza brands. Industry Activities/Interests: As chief operating officer, a role he has held since November 2014, Ken Parent oversees store and restaurant operations, including retail pricing, marketing and technology. He leads the direct sales team, supply and distribution, and the branding and customer experience team. In addition, he collaborates with human resources to advance the companys culture, values and communication to more than 23,000 team members. Ken joined Pilot Corporation in 1996 as a region manager and was promoted to West Division director in 1998. In 2001, he was promoted to senior vice president of operations, marketing and human resources, and, in 2013, was named executive vice president. Prior to joining Pilot Flying J, Ken worked for 11 years in field and staff management at Mobil Oil Corporation and worked for several years with PepsiCo. -

Class Actions in MDL 1720 47 West 55Th Restaurant Inc. V. Visa USA Inc

Case 1:05-md-01720-MKB-JO Document 7257-2 Filed 09/18/18 Page 95 of 284 PageID #: 106696 APPENDIX A – Class Actions in MDL 1720 47 West 55th Restaurant Inc. v. Visa U.S.A. Inc., et al. , No. 06-CV-01829-MKB-JO (E.D.N.Y.), formerly No. 05-CV-08057-SCR (S.D.N.Y). 518 Restaurant Corp. v. American Express Travel Related Services Co., Inc., et al. , No. 05-CV-05884-MKB-JO (E.D.N.Y.), formerly No. 05-CVG-04230-GP (E.D. Pa.). American Booksellers Association v. Visa U.S.A., Inc., et al. , No. 05-CV-05319-MKB-JO (E.D.N.Y.). Animal Land, Inc. v. Visa U.S.A., Inc., et al. , No. 05-CV-05074-MKB-JO (E.D.N.Y.), formerly No. 05-CV-01210-JOF (N.D. Ga.). Baltimore Avenue Foods, LLC v. Visa U.S.A., Inc., et al. , No. 05-CV-05080-MKB-JO (E.D.N.Y.), formerly No. 05-CV-06532-DAB (S.D.N.Y). Barry’s Cut Rate Stores, Inc., et al. v. Visa, Inc., et al. , No. 05-MD-01720-MKB-JO (E.D.N.Y.) Bishara v. Visa USA, Inc, et al. , No. 05-CV-05883-MKB-JO (E.D.N.Y.), formerly No. 05-CV-04147-GP (E.D. Pa.). BKS, Inc., et al. v. Visa, Inc, et al., No. 09-CV-02264-MKB-JO (E.D.N.Y.), formerly No. 09-CV-00066-KS-MTP (S.D. Miss.). Bonte Wafflerie, LLC, et al. v. Visa U.S.A., Inc., et al. -

March/April 2016

ELDER NEWS VIEWS MARCH/APRIL 2016 MARCH FORTH TO PANCAKE FEST! “We are so excited to have a new date, Friday, March 4, for the annual O’CONNOR CENTER O’ Connor Center fundraiser,” said PANCAKE FEST Center manager Sue Massingill of this Friday, March 4 longtime $5 event held from 7 a.m. 7:00 a.m. - 1:00 p.m. to 1 p.m. There will be an abundance 611 Winona Street of regular and gluten-free pancakes, Tickets: $5 sausage, orange juice, milk, and coffee. The chef and team from UT Medical Center’s Healthy Living Kitchen will once again be preparing the famous “Heart Healthy” pancakes that have been such a hit! Ticket price includes the “all you can eat” pancake menu and admission to other activities. Tickets can be purchased at the door. Pancakes To-Go will be ready at 7 a.m. and can be picked up on your way to work to share with your employees or co-workers. Just call 523-1135 to place your order. WATE-TV and WVLT-TV personalities will be on site at 5:00 a.m., The North Addition will be turned into a bargain hunter’s delight with inviting everyone to participate in the day’s activities. Other local media beautiful and affordably priced craft and specialty items. Center program personalities, both the city and county mayors, and other community leaders will also be on hand to promote a wide variety of activities. Knox County also has a wide variety of services for senior adults. Many of Pancake Fest is a great way to incorporate a meeting with a fun outing. -

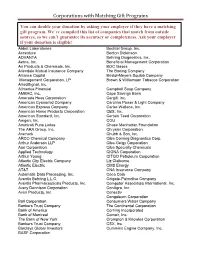

Corporations with Matching Gift Programs

Corporations with Matching Gift Programs You can double your donation by asking your employer if they have a matching gift program. We’ve compiled this list of companies that match from outside sources, so we can’t guarantee its accuracy or completeness. Ask your employer if your donation is eligible! Abbot Laboratories Bechtel Group, Inc. Accenture Becton Dickinson ADVANTA Behring Diagnostics, Inc. Aetna, Inc. Beneficial Management Corporation Air Products & Chemicals, Inc. BOC Gases Allendale Mutual Insurance Company The Boeing Company Alliance Capital Bristol-Meyers Squibb Company Management Corporation, LP Brown & Williamson Tobacco Corporation AlliedSignal, Inc. Allmerica Financial Campbell Soup Company AMBAC, Inc. Cape Savings Bank Amerada Hess Corporation Cargill, Inc. American Cyanamid Company Carolina Power & Light Company American Express Company Carter-Wallace, Inc. American Home Products Corporation CBS, Inc. American Standard, Inc. Certain Teed Corporation Amgen, Inc. CGU Ammirati Puris Lintas Chase Manhattan Foundation The ARA Group, Inc. Chrysler Corporation Aramark Chubb & Son, Inc. ARCO Chemical Company Ciba Corning Diagnostics Corp. Arthur Anderson LLP Ciba-Geigy Corporation Aon Corporation Ciba Specialty Chemicals Applied Technology CIGNA Corporation Arthur Young CITGO Petroleum Corporation Atlantic City Electric Company Liz Claiborne Atlantic Electric CMS Energy AT&T CNA Insurance Company Automatic Data Processing, Inc. Coca Cola Aventis Behring L.L.C. Colgate-Palmolive Company Aventis Pharmaceuticals Products, Inc. Computer Associates International, Inc. Avery Dennison Corporation ConAgra, Inc. Avon Products, Inc. Conectiv Congoleum Corporation Ball Corporation Consumers Water Company Bankers Trust Company The Continental Corporation Bank of America Corning Incorporated Bank of Montreal Comair, Inc. The Bank of New York Crompton & Knowles Corporation Bankers Trust Company CSX, Inc. -

Louisiana Sites Formatted 20090729.XLS

Fuel Part CD Merchant. Participant Merchant Name Address City ST ZIP COUNTY_NAME 028 40475707 CITGO PETROLEUM CORP LEE'S QUICK STOP 7009 CHURCH POINT HWY BRANCH LA 70516 ACADIA 313 1103108732001 BANK OF AMERICA CARQUEST 314 N. MAIN ST CHURCH POINT LA 70525 ACADIA 030 0308681 CHEVRONTEXACO INC EOC #677 1038 PEACH BLOOM HWY CHURCH POINT LA 70525 ACADIA 012 4238770 EXXONMOBIL EXPRESS #4 249 MAIN STREET CHURCH POINT LA 70525 ACADIA 028 43762008 CITGO PETROLEUM CORP KWICK STOP 8816 CHURCH POINT HWY CHURCH POINT LA 70525 ACADIA 030 0302072 CHEVRONTEXACO INC POINTE DE L'EGLISE 620 W CANAL ST CHURCH POINT LA 70525 ACADIA 002 57540914603 SHELL/EQUIVA SERVICE RAM OIL CORPORATION 507 EAST EBEY ST CHURCH POINT LA 70525 ACADIA 030 0209762 CHEVRONTEXACO INC SHORT STOP # 1 122 E PLAQUEMINE CHURCH POINT LA 70525 ACADIA 302 0990079907 PAYMENTECH WESTON'S GROCERY & M 1011 HWY 357 CHURCH POINT LA 70525 ACADIA 313 1103108728801 BANK OF AMERICA CARQUEST 919 N PARKERSON AVE CROWLEY LA 70526 ACADIA 030 0109125 CHEVRONTEXACO INC CHEVRON FOODMART # 20 2600 N PARKERSON CROWLEY LA 70526 ACADIA 040 09703940001 EFS NATIONAL BANK CIRCLE FOOD MART 1214 SECOND STREET CROWLEY LA 70526 ACADIA 027 6991495398 TOTAL/UDS DIAMOND 378 SHAMROCK 1764 N PARKERSON CROWLEY LA 70526 ACADIA 030 0208661 CHEVRONTEXACO INC DUAINE BELFOUR DBA 731 ODDFELLOW RD CROWLEY LA 70526 ACADIA 012 9603812 EXXONMOBIL ECONO MART # 7 703 S EASTERN AVE CROWLEY LA 70526 ACADIA 093 00839613 CONOCOPHILLIPS INC EXIT 80 TRAVEL CTR 2011 N CHEROKEE DR CROWLEY LA 70526 ACADIA 012 9978149 EXXONMOBIL EXPRESS -

Companies with Matching Gift Programs

Companies with Matching Gift Programs Many companies encourage charitable giving by matching gifts made by their employees. As a 501(c)(3) non-profit organization, CHCA is eligible for matching gifts. Below is a list of companies that have matching gift programs. Even if a company is not listed, they may still have a matching gift program. In addition, not all companies match PK-12 schools. To find out if your company matches gifts made to CHCA, please contact your HR representative. If you need additional assistance, please e-mail Paige Tomlin at [email protected]. A AK Steel 3Com Corporation Albemarle Corp. 3M Company Alco Standard AlliedSignal Inc. Alexander and Baldwin Inc. Allstate Alexander Hamilton Life Abacus Capital Investments Alexander Haas Martin and Partners Abbott Laboratories Al Neyer Altera Corp. Contributions Allegro Microsystems Inc. Accenture Alliance Bernstein Access Fund Alliance Capital Management L.P. ACE INA Foundation Alliance Coal LLC Adams Harkness and Hill Inc. Alliant Techsystems Altria Group Allegiance Corp. and Baxter International Adaptec Foundation Allendale Insurance Foundation AMBAC Indemnity American Natl Bank & Trust ADC Telecommunications American Intl Group, Inc. AMD Corporate Giving American Standard Found Adobe Systems Inc. Amgen Inc. ADP Foundation AMN Healthcare Services American Express Co. AmSouth BanCorp. A & E Television Networks American Stock Exchange AEGON TRANSAMERICA Ameriprise Financial AEP Ameritech Corp. AES Corporation AMETEK / Sealtron A.E. Staley Manufacturing Co. AMSTED Industries Inc. American Fidelity Corp. Amylin Pharmaceuticals Aetna Foundation, Inc. Anadarko Petroleum Corp. American General Corp. Analytics Operations Engineering AG Communications Systems Analog Devices Inc. American Honda Motor Co. Avon Products Foundation, Inc. -

Wikipedia List of Convenience Stores

List of convenience stores From Wikipedia, the free encyclopedia The following is a list of convenience stores organized by geographical location. Stores are grouped by the lowest heading that contains all locales in which the brands have significant presence. NOTE: These are not ALL the stores that exist, but a good list for potential investors to research which ones are publicly traded and can research stock charts back to 10 years on Nasdaq.com or other related websites. [edit ] Multinational • 7-Eleven • Circle K [edit ] North America Grouping is by country or united States Census Bureau regional division . [edit ] Canada • Alimentation Couche-Tard • Beckers Milk • Circle K • Couch-Tard • Max • Provi-Soir • Needs Convenience • Hasty Market , operates in Ontario, Canada • 7-Eleven • Quickie ( [1] ) [edit ] Mexico • Oxxo • 7-Eleven • Super City (store) • Extra • 7/24 • Farmacias Guadalajara [edit ] United States • 1st Stop at Phillips 66 gas stations • 7-Eleven • Acme Express gas stations/convenience stores • ampm at ARCO gas stations • Albertsons Express gas stations/convenience stores • Allsup's • AmeriStop Food Mart • A-Plus at Sunoco gas stations • A-Z Mart • Bill's Superette • BreakTime former oneer conoco]] gas stations • Cenex /NuWay • Circle K • CoGo's • Convenient Food Marts • Corner Store at Valero and Diamond Shamrock gas stations • Crunch Time • Cumberland Farms • Dari Mart , based in the Willamette Valley, Oregon Dion's Quik Marts (South Florida and the Florida Keys) • Express Mart • Exxon • Express Lane • ExtraMile at -

Company Match List 2020

Employer Matching Company List 3Com Corporation Alco Standard Fdn. 3M Company AlCOA Foundation Abacus Capital Investments Alexander and Baldwin Inc. Abbot Laboratories Alexander and Baldwin Foundation Alexander Haas Martin and Partners Alexander Hamilton Life Accenture Foundation, Inc. Allegro Microsystems Inc. Access Fund Allegiance Corp. and Baxter International Allendale Insurance Foundation Allendale Mutual Insurance Co. AllianceBernstein ACE INA Foundation Alliance Capital Management L.P. Alliance Coal LLC Adams Harkness and Hill Inc. Alliant Techsystems Adaptec Foundation AlliedSignal Inc. ADC Foundation Allstate Foundation, The Allstate Giving Campaign ADC Telecommunications Altera Corp. Contributions Program Adobe Systems Inc. Altria Employee Involvement ADP Foundation Programs A & E Television Networks Altria Group AMBAC Indemnity Corporation AEGON TRANSAMERICA AMD Corporate Giving Program AEP American Express Co AES Corporation American Fidelity Corp. A.E. Staley Manufacturing Co. American General Corp. Aetna Foundation, Inc. American Honda Motor Co. Inc. AG Communications Systems American National Bank and Trust Co. of Chicago Agilent Technologies American Standard Foundation Aid Association for Lutherans American Stock Exchange AIG Matching Grants Program Air Liquide America Corporation Aileen S. Andrew Foundation Air Products and Chemicals Inc. Albemarle Corp. AIM Foundation Ameriprise Financial Ameritech Corp. Amgen Center American Inter Group Amgen Foundation Amgen Inc. Employer Matching Company List American International Group, Inc. Aspect Telecommunications Associates Corp. of North America AMSTED Industries Inc. Astra Merck Inc. AMN Healthcare Services, Inc. AstraZeneca Pharmaceutical LP Atapco Amylin Pharmaceuticals, Inc. Corp. Giving ATK Foundation Program Anadarko Petroleum Corp. Analog Devices Atlantic Data Services Inc. Analytics Operations Engineering Analog Devices Atochem North America Foundation ATOFINA Inc. Chemicals, Inc. Anchor/Russell Capital Advisors Inc. -

(USPS 322-840) PUBLISHED WEEKLY by the Wilkes-Barre Law

Established 1872 (Cite(Cite Vol.Vol. 102109 Luz.Luz. Reg.Reg. Reports)Reports) VOL. 109102 Wilkes-Barre, Wilkes-Barre, PA,PA, Friday,Friday, NovemberFebruary 17, 15, 2012 2019 NO. NO. 467 COMMONWEALTHSABATOS v. SABATOS v. GUZMAN .............................................................. ..................................................56 1 POSTMASTER: SendSend addressaddress changeschanges to to THE THE LUZERNE LUZERNE LEGAL LEGAL REGISTER, REGISTER, 200Room N. River 23, CourtStreet, House, Room 23,Wilkes-Barre, Wilkes-Barre, PA 18711-1001 PA 18711-1001 PeriodicalPeriodical postagepostage paidpaid atat Wilkes-Barre,Wilkes-Barre, PA PA and and additional additional office. office. PricePrice $100.$40. Per Per Year Year SingleSingle Copies Copies $1.00 $2.00 Advertising MustMust BeBe ReceivedReceived ByBy 1212 O’ClockO’Clock Noon, Noon, Tuesday Tuesday In In The The Week Week of of Publication Publication (USPS 322-840) (USPS 322-840) PUBLISHED WEEKLY BY PUBLISHED WEEKLY BY The Wilkes-Barre Law and Library Association The Wilkes-Barre Law and Library Association Notice is hereby given to all persons concerned that accountants in the following es- tates have filed their accounts in the Office of the Register of Wills and Clerk of the Or- phans’ Court of Luzerne County and unless objections are filed thereto, said accounts will be audited and confirmed by the Orphans’ Court Division of the Court of Common Pleas of Luzerne County at 9:30 A.M. on December 3, 2019, in Courtroom C, Third Floor, Penn Place, 20 North Pennsylvania Avenue, Wilkes-Barre, PA. NO. NAME OF ESTATE ACCOUNTANT FIDUCIARY CAPACITY 1. Matthew Todd Herbert Joseph Schintz Administrator D.B.N.C.T.A. 2. Gertrude Schmitt a/k/a Mari P. -

Citizens National Bank Charter Number: 16076

O INTERMEDIATE SMALL BANK Comptroller of the Currency Administrator of National Banks Washington, DC 20219 PUBLIC DISCLOSURE April 05, 2010 COMMUNITY REINVESTMENT ACT PERFORMANCE EVALUATION Citizens National Bank Charter Number: 16076 200 Forks of River Parkway Sevierville, TN 37862-3419 Office of the Comptroller of the Currency NASHVILLE Field Office The Parklane Building 5200 Maryland Way, Suite 104 Brentwood, TN. 37027-5018 NOTE: This document is an evaluation of this institution’s record of meeting the credit needs of its entire community, including low- and moderate-income neighborhoods consistent with safe and sound operation of the institution. This evaluation is not, nor should it be construed as, an assessment of the financial condition of this institution. The rating assigned to this institution does not represent an analysis, conclusion, or opinion of the federal financial supervisory agency concerning the safety and soundness of this financial institution. Charter Number: 16076 INSTITUTION'S CRA RATING: This institution is rated “Outstanding.” The Lending Test is rated: “Outstanding.” The Community Development Test is rated: “Outstanding.” The bank’s average loan-to-ratio is more than reasonable at 94.70% during the evaluation period. CNB’s loan to deposit ratio ranged from a low of 86.77% September 2009 to a high of 104.12% in June 2008. A substantial majority of CNB loans are inside the bank’s Assessment Area. Approximately 89.89% of the number and 86.80% of the dollar volume of loans were to borrowers within the Assessment Area during this evaluation period. CNB’s distribution of loans to borrowers of different income (including low-and moderate-income) levels ranges from lower than ratio to near the ratio. -

Comdata Networks Litigation Third Consolidated Amended Complaint

Case 2:07-cv-01078-JKG Document 401 Filed 04/21/11 Page 1 of 58 IN THE UNITED STATES DISTRICT COURT FOR THE EASTERN DISTRICT OF PENNSYLVANIA _.... _-- MARCHBANKS TRUCK SERVICE, INC. d/b/a BEAR MOUNTAIN TRAVI~L STOP, MAHWAH FUEL STOP, GERALD F. KRACHEY d/b/a KRACHEY'S UP SOUTH, WALT WHITMAN TRUCK STOP, INC., on behalf of themselves and all others similarly situated, Plaintiffs, v. Civil Action No. 07-1078-.JKG COMDATA NETWORK, INC. d/b/a .JURY TRIAL DEMANDED COMDATA CORPORATION, CERIDlAN Consolidated Case CORPORATION, TRAVEL CENTERS OF AMERICA LLC, TA OPERATING LLC, TRAVELCENTERS OF AMERICA HOLDING COMPANY LLC,PETRO STOPPING CEN'fERS, L.P., PILOT TRAVEL CENTERS LLC, PILOT CORPORATION, and LOVE'S TRAVEL STOPS & COUNTRY STORES, INC., Defendants. THIRD CONSOLIDA'l'ED AMENDED COMPLAINT Plaintiffs allege as follows based upon personal knowledge as to matters relating to themselves, and upon information and belief as to all other matters: NATURE OF THE CASE 1. Plaintiffs, like the members of the class they seek to represent (defincd below), are independent truck stops, T'he majority of the approximately 3,000 truck stops in the United States are run by indepcndent operators ("Independent Truck Stops" or the "Independents"). 'rhe remaining truck stops are owned and/or operated by a small number of national and regional truck stop chains, which are each networks of multiple truck stops either owned by a single entity or lhmchisees of that entity ("Truck Stop Chains" or "Chains"). The Defendants, other Case 2:07-cv-01078-JKG Document 401 Filed 04/21/11 Page 2 of 58 than Comdata Network, Inc. -

Case 14-12092-KJC Doc 392 Filed 10/21/14 Page 1 of 483

Case 14-12092-KJC Doc 392 Filed 10/21/14 Page 1 of 483 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE In re: ) Chapter 11 ) AWI Delaware, Inc., et al.,1 ) Case No. 14-12092 (KJC) ) ) Jointly Administered Debtors. ) ) GLOBAL NOTES REGARDING DEBTORS’ SCHEDULES OF ASSETS AND LIABILITIES AND STATEMENT OF FINANCIAL AFFAIRS The Schedules of Assets and Liabilities (the “Schedules”) and Statement of Financial Affairs (the “SOFA” and, collectively with the Schedules, the “Schedules and Statements”) filed herewith by the debtors and debtors-in-possession in the above-captioned cases (collectively, the “Debtors”) were prepared pursuant to section 521 of title 11 of the United States Code (as amended, the “Bankruptcy Code”) and Rule 1007 of the Federal Rules of Bankruptcy Procedure (the “Bankruptcy Rules”) by management of the Debtors and have not been subject to audit, review or any similar financial analysis. While the Debtors’ management has made every reasonable effort to ensure that the Schedules and Statements are accurate and complete based upon information that was available to them at the time of preparation, the subsequent receipt of information may result in material changes to the financial data and other information contained therein. The Debtors have used their best efforts to present the information set forth in the Schedules and Statements from their books and records maintained in the ordinary course of their businesses. The Debtors reserve their right to amend their Schedules and Statements from time to time as may be necessary or appropriate. These Global Notes Regarding Debtors’ Schedules of Assets and Liabilities and Statement of Financial Affairs (the “Global Notes”) are incorporated by reference in, and comprise an integral part of, the Schedules and Statements, and should be referred to and reviewed in connection with any review of the Schedules and Statements.